- An increase in exchange withdrawal and a negative MVRV ratio suggested a potential UNI rally.

- The project’s TVL increased, indicating that traders had recovered from the earlier FUD.

If the recent action of a whale is anything to go by, Uniswap [UNI] could be set for a big rally in the coming weeks. According to Spot On Chain, a whale withdrew his UNI holdings from Binance for the first time.

The total tokens were 121,871, valued at $954,000. Withdrawing the tokens from the exchange implied that the participant does not plan to sell anytime soon.

For the price action, this was a bullish signal. A few weeks ago, UNI was subject to a massive nosedive after the U.S. SEC publicly revealed that it might sue Uniswap Labs, the firm behind the development of the token.

This news caused Fear, Uncertainty, and Doubt (FUD) around the token. Besides that, UNI’s price plunged to $5.86.

However, in the last seven days, the value of the cryptocurrency has increased by 8.31% while changing hands at $7.81.

DeFi’s time to shine?

But one other thing AMBCrypto noticed was that the whale also removed his Compound [COMP] tokens from Binance [BNB].

A scenario like this suggests that it could be possible that DeFi tokens, not UNI alone, might jump.

Unlike the last bull market, DeFi has not been one of the top narratives this cycle. Instead, meme coins, Real World Assets (RWAs), and AI tokens have been dominating.

Will the recent development change the state of things? Well, we checked the possibility by looking at the sentiment around UNI.

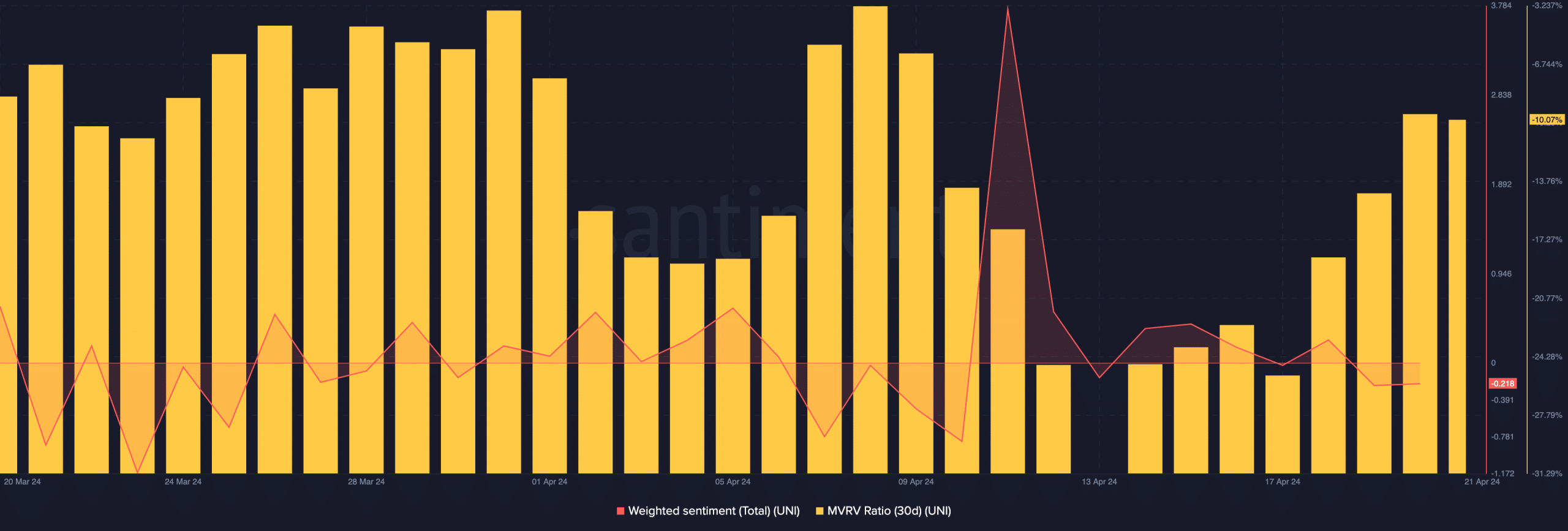

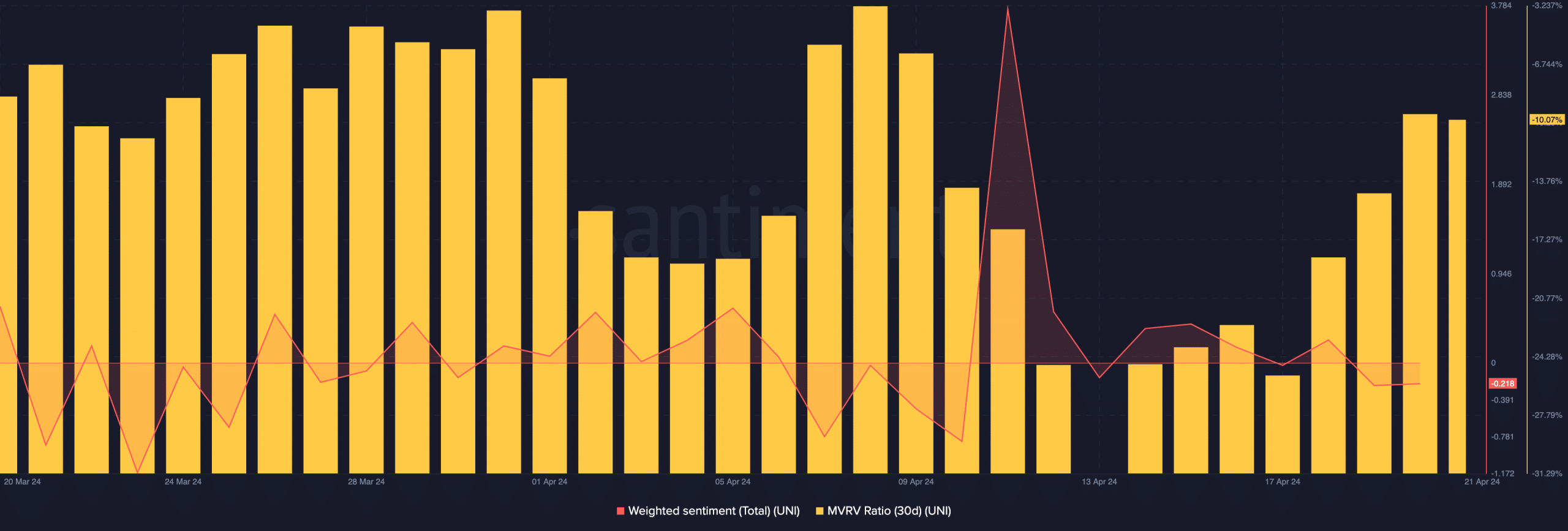

As of this writing, Uniswap’s Weighted Sentiment had dropped to the negative zone. This decline implied that most comments about the project were more gloomy than they were enthusiastic.

Typically, the state of the metric is supposed to imply that UNI might lack demand. But a look at the Market Value to Realized Value (MVRV) ratio suggested otherwise.

Source: Santiment

At press time, the 30-day MVRV ratio was -10.01%. This means that if every UNI holder sells at press time price, the average return would be a 10% loss.

UNI regains trust

But that is not something most holders would do. As such, a buying opportunity could exist between $6.50 and $8. If buying pressure increases, UNI’s price might rally back to double-digit numbers.

Furthermore, a forthcoming altcoin season might also help its prices, as targets between $15 and $20 could be possible.

AMBCrypto got further evidence that Uniswap was recovering from the FUD from its Total Value Locked (TVL).

Realistic to not, here’s UNI’s market cap in BTC’s terms

According to DeFiLlama, the TVL had increased by 138% in the last 30 days. This increase was a sign that participants perceived the protocol to be trustworthy.

Source: Santiment

Hence, the value of assets staked and locked in surged. Should this TVL continue to rise toward 2021 levels like it has shown in the last few weeks, UNI’s price might also get close to its all-time high.

- An increase in exchange withdrawal and a negative MVRV ratio suggested a potential UNI rally.

- The project’s TVL increased, indicating that traders had recovered from the earlier FUD.

If the recent action of a whale is anything to go by, Uniswap [UNI] could be set for a big rally in the coming weeks. According to Spot On Chain, a whale withdrew his UNI holdings from Binance for the first time.

The total tokens were 121,871, valued at $954,000. Withdrawing the tokens from the exchange implied that the participant does not plan to sell anytime soon.

For the price action, this was a bullish signal. A few weeks ago, UNI was subject to a massive nosedive after the U.S. SEC publicly revealed that it might sue Uniswap Labs, the firm behind the development of the token.

This news caused Fear, Uncertainty, and Doubt (FUD) around the token. Besides that, UNI’s price plunged to $5.86.

However, in the last seven days, the value of the cryptocurrency has increased by 8.31% while changing hands at $7.81.

DeFi’s time to shine?

But one other thing AMBCrypto noticed was that the whale also removed his Compound [COMP] tokens from Binance [BNB].

A scenario like this suggests that it could be possible that DeFi tokens, not UNI alone, might jump.

Unlike the last bull market, DeFi has not been one of the top narratives this cycle. Instead, meme coins, Real World Assets (RWAs), and AI tokens have been dominating.

Will the recent development change the state of things? Well, we checked the possibility by looking at the sentiment around UNI.

As of this writing, Uniswap’s Weighted Sentiment had dropped to the negative zone. This decline implied that most comments about the project were more gloomy than they were enthusiastic.

Typically, the state of the metric is supposed to imply that UNI might lack demand. But a look at the Market Value to Realized Value (MVRV) ratio suggested otherwise.

Source: Santiment

At press time, the 30-day MVRV ratio was -10.01%. This means that if every UNI holder sells at press time price, the average return would be a 10% loss.

UNI regains trust

But that is not something most holders would do. As such, a buying opportunity could exist between $6.50 and $8. If buying pressure increases, UNI’s price might rally back to double-digit numbers.

Furthermore, a forthcoming altcoin season might also help its prices, as targets between $15 and $20 could be possible.

AMBCrypto got further evidence that Uniswap was recovering from the FUD from its Total Value Locked (TVL).

Realistic to not, here’s UNI’s market cap in BTC’s terms

According to DeFiLlama, the TVL had increased by 138% in the last 30 days. This increase was a sign that participants perceived the protocol to be trustworthy.

Source: Santiment

Hence, the value of assets staked and locked in surged. Should this TVL continue to rise toward 2021 levels like it has shown in the last few weeks, UNI’s price might also get close to its all-time high.

![Will Uniswap [UNI] be a dark horse post-Bitcoin halving?](https://coininsights.com/wp-content/uploads/2024/04/uni-sentiment-and-mvrv-ratio-750x254.png)

cost cheap clomid without rx order generic clomid online cost of clomid for men clomid tablets uses in urdu order clomiphene prices cheap clomid without a prescription how to buy generic clomid without dr prescription

This website absolutely has all of the bumf and facts I needed there this case and didn’t comprehend who to ask.

This is the big-hearted of literature I truly appreciate.

purchase azithromycin pills – tinidazole 300mg canada buy metronidazole for sale

semaglutide 14mg cheap – order semaglutide online periactin 4 mg without prescription

brand inderal 10mg – inderal 10mg usa order methotrexate online

zithromax where to buy – buy tinidazole paypal where can i buy nebivolol

buy augmentin 1000mg for sale – atbioinfo how to buy acillin

buy nexium pills for sale – https://anexamate.com/ buy esomeprazole no prescription

purchase coumadin generic – anticoagulant oral losartan

order mobic 7.5mg generic – swelling buy meloxicam tablets

purchase prednisone pills – aprep lson deltasone 20mg cost

free ed pills – fastedtotake buy cheap generic ed pills

buy amoxil without a prescription – combamoxi.com cheap amoxil generic

diflucan 200mg oral – buy forcan medication buy diflucan 200mg online cheap

buy generic cenforce online – https://cenforcers.com/ buy cenforce paypal

where to buy generic cialis – https://ciltadgn.com/ buy cialis overnight shipping

when will cialis be over the counter – buy cialis no prescription australia cialis super active plus reviews

zantac pill – https://aranitidine.com/ ranitidine usa