- Miners might have been selling BTC because of their reduced revenue.

- However, long-term investors were confident in BTC.

Bitcoin [BTC] has managed to push its price in the last 24 hours, but it has still been struggling under the $60k mark. The recent price uptick couldn’t help change the sentiment of Bitcoin miners as they continued to sell their holdings.

Will miners’ latest sell-off push BTC down towards $54k again?

Bitcoin miners are selling BTC

The bulls took control in the last 24 hours as they pushed BTC’s price up by over 3%. At the time of writing, BTC was trading at $56,675.42 with a market capitalization of over $1.11 trillion.

However, the miners still chose to sell BTC while its price gained bullish momentum.

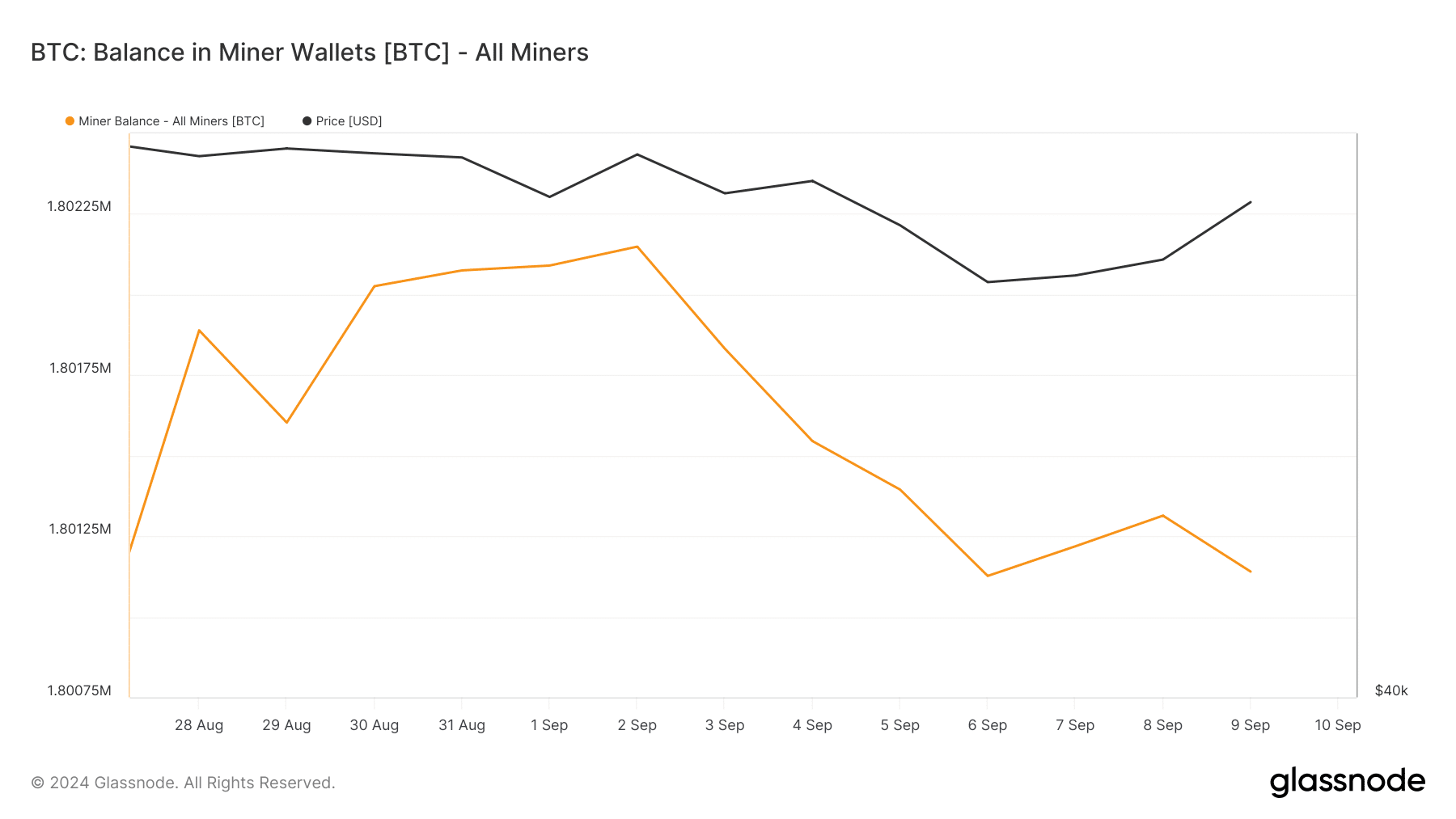

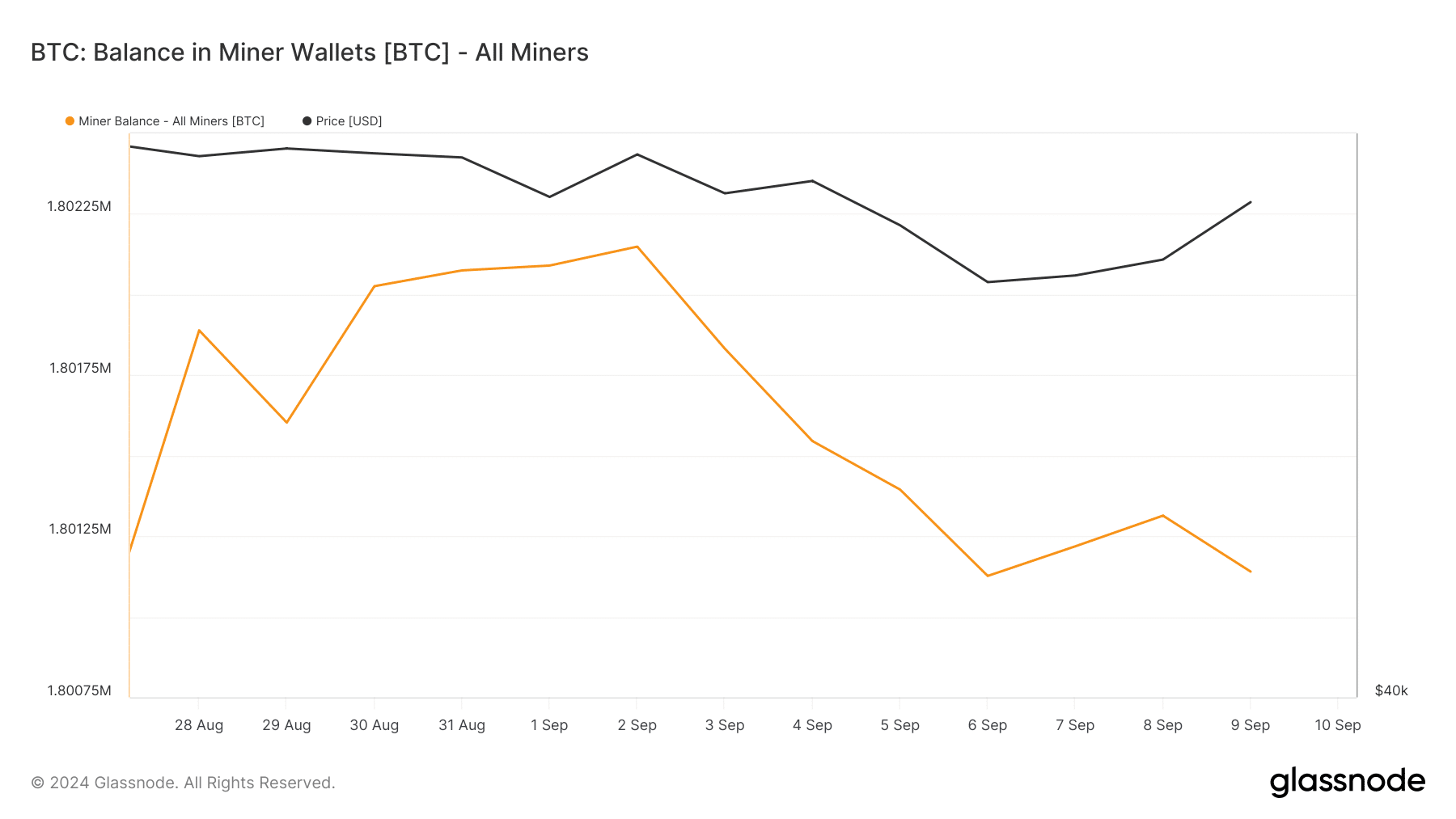

As per AMBCrypto’s look at Glassnode’s data, balance in miner wallets fell to 1.8 million BTC. This suggested that miners were not expecting the king coin’s price to rise further.

Source: Glassnode

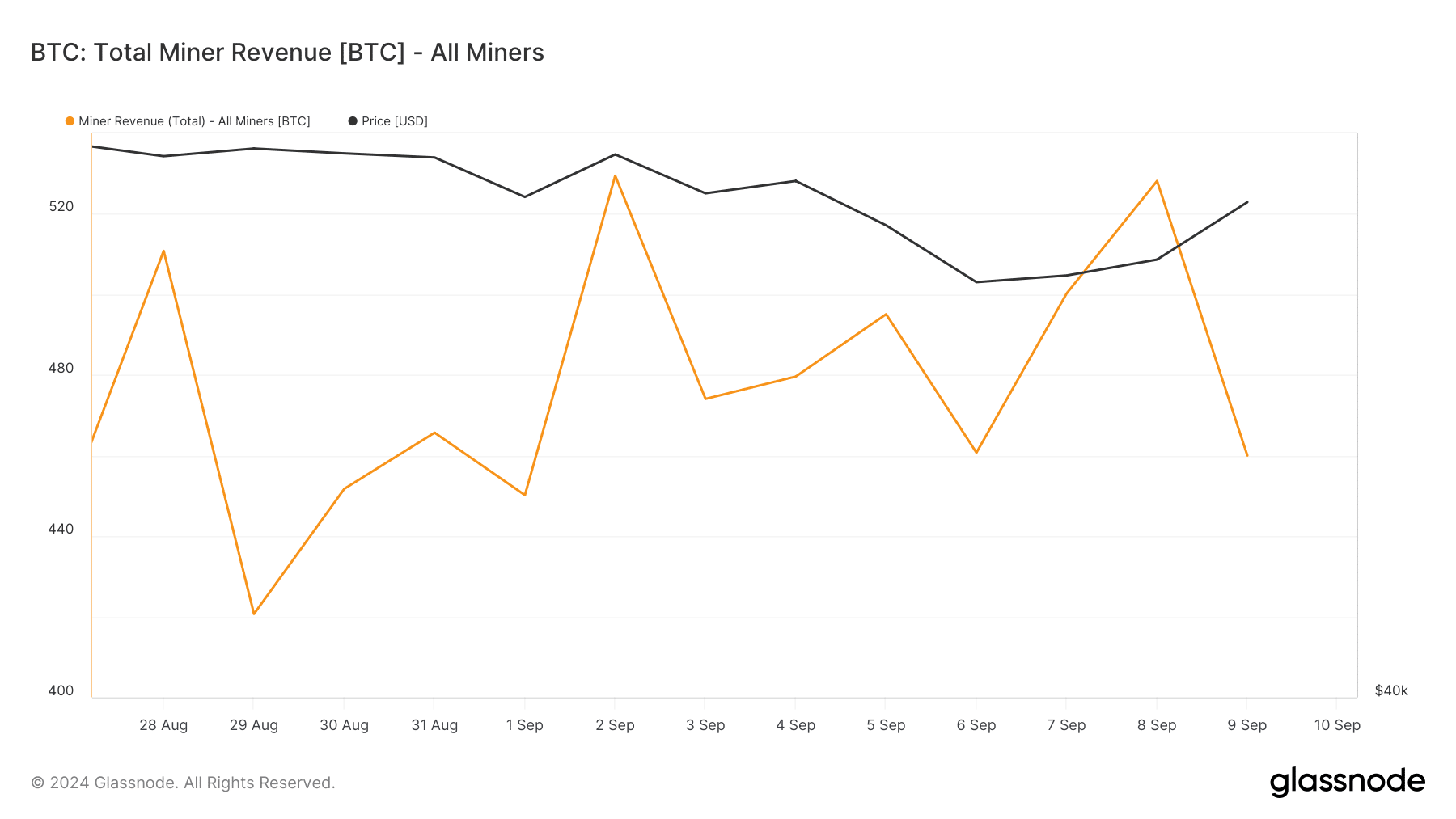

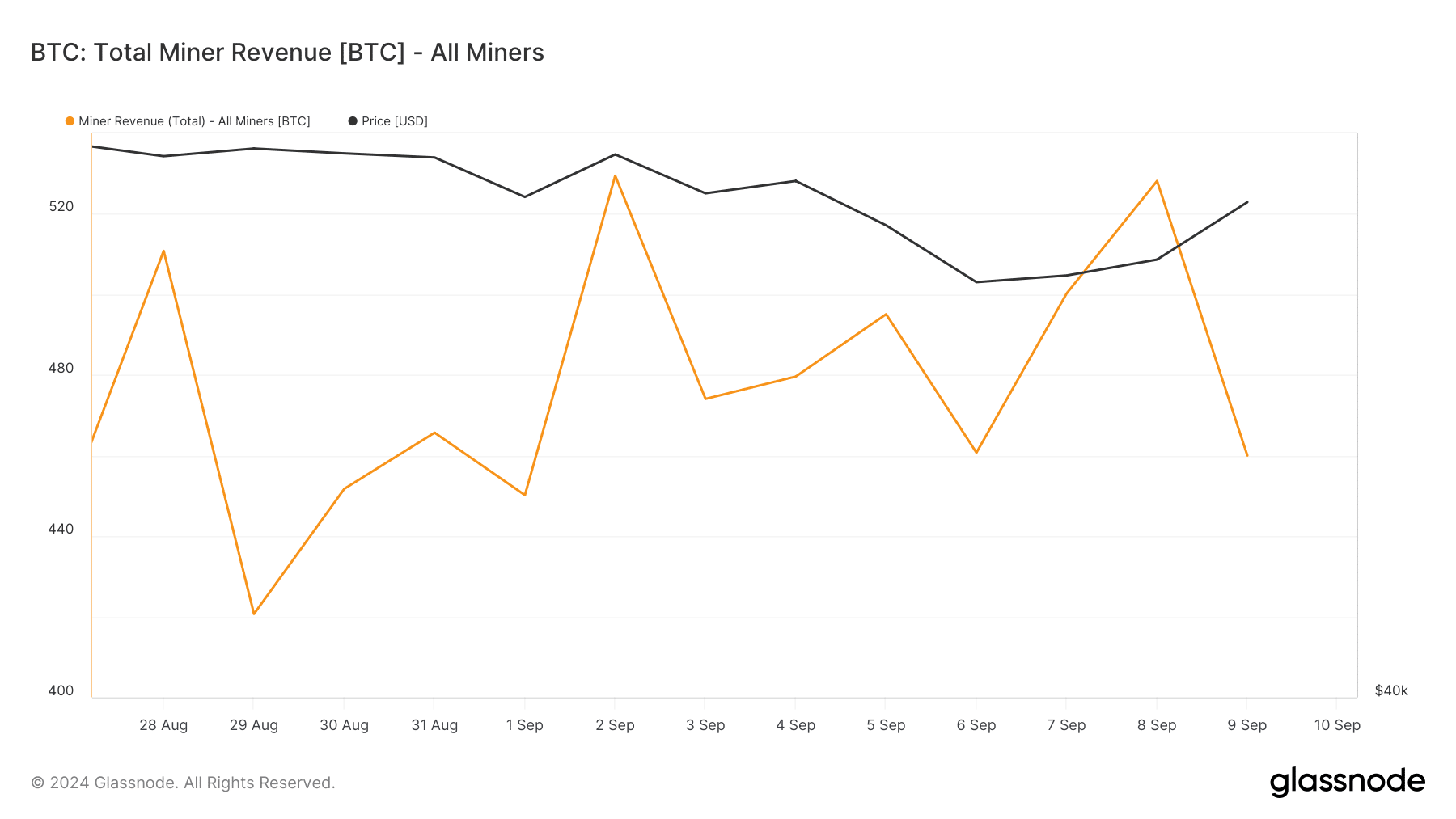

We then checked miners’ revenue to find out what motivated them to sell. Interestingly, their revenue also registered a decline in the recent past.

Source: Glassnode

The drop in miners balance and revenue also affected the blockchain’s hashrate. As per Coinwarz’s data, BTC’s hashrate dropped in the last few days. At press time, the number stood at 712.57 EH/s.

Will BTC’s price be affected?

There is a chance that this behavior of miners will affect BTC’s price as sell pressure generally results in price corrections.

In fact, Ali, a popular crypto analyst, recently posted a tweet revealing that if BTC drops to $54.2k, then it will face a liquidation worth $24 million.

Therefore, AMBCrypto checked more data sets to find other red flags.

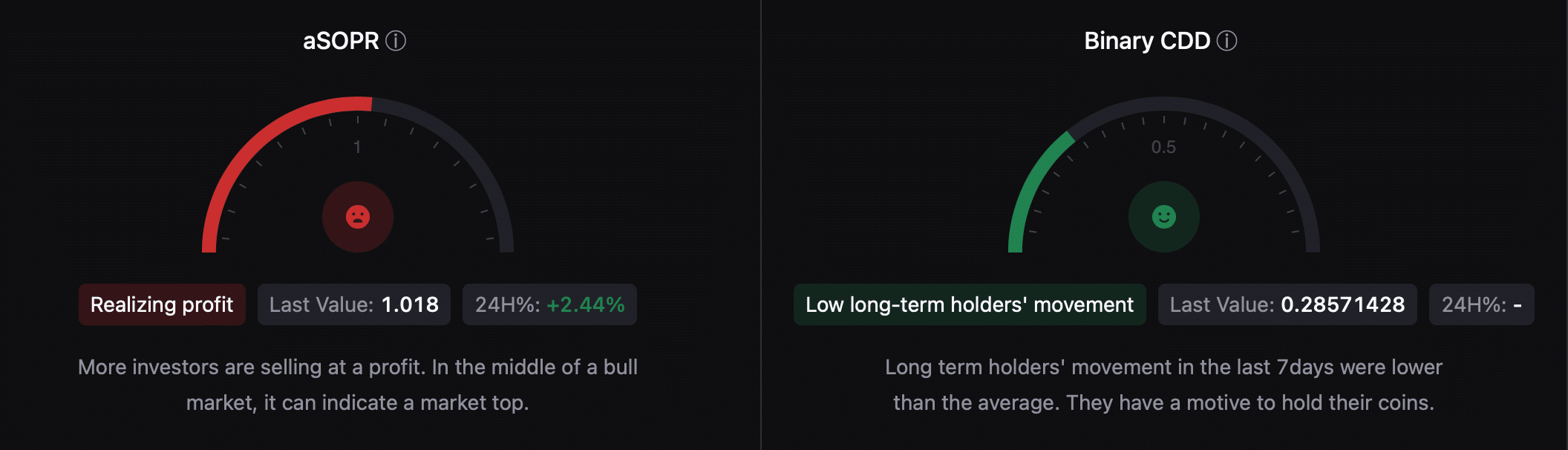

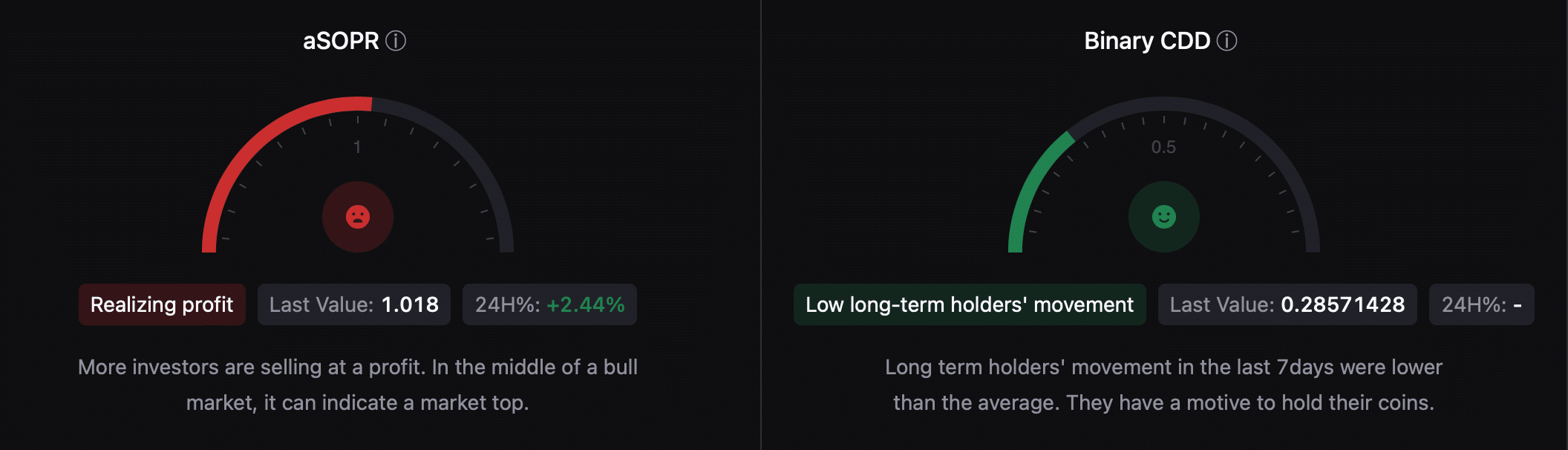

As per our analysis of CryptoQuant’s data, BTS’s aSORP was red, meaning that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, the rest of the metrics looked bullish. For instance, Bitcoin’s Binary CDD revealed that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

Source: CryptoQuant

Apart from that, things in the derivatives market also looked pretty optimistic, as the coin’s taker’s buy/sell ratio was green. This indicated that buying sentiment was dominant among futures investors.

- Miners might have been selling BTC because of their reduced revenue.

- However, long-term investors were confident in BTC.

Bitcoin [BTC] has managed to push its price in the last 24 hours, but it has still been struggling under the $60k mark. The recent price uptick couldn’t help change the sentiment of Bitcoin miners as they continued to sell their holdings.

Will miners’ latest sell-off push BTC down towards $54k again?

Bitcoin miners are selling BTC

The bulls took control in the last 24 hours as they pushed BTC’s price up by over 3%. At the time of writing, BTC was trading at $56,675.42 with a market capitalization of over $1.11 trillion.

However, the miners still chose to sell BTC while its price gained bullish momentum.

As per AMBCrypto’s look at Glassnode’s data, balance in miner wallets fell to 1.8 million BTC. This suggested that miners were not expecting the king coin’s price to rise further.

Source: Glassnode

We then checked miners’ revenue to find out what motivated them to sell. Interestingly, their revenue also registered a decline in the recent past.

Source: Glassnode

The drop in miners balance and revenue also affected the blockchain’s hashrate. As per Coinwarz’s data, BTC’s hashrate dropped in the last few days. At press time, the number stood at 712.57 EH/s.

Will BTC’s price be affected?

There is a chance that this behavior of miners will affect BTC’s price as sell pressure generally results in price corrections.

In fact, Ali, a popular crypto analyst, recently posted a tweet revealing that if BTC drops to $54.2k, then it will face a liquidation worth $24 million.

Therefore, AMBCrypto checked more data sets to find other red flags.

As per our analysis of CryptoQuant’s data, BTS’s aSORP was red, meaning that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, the rest of the metrics looked bullish. For instance, Bitcoin’s Binary CDD revealed that long-term holders’ movement in the last seven days was lower than the average. They have a motive to hold their coins.

Source: CryptoQuant

Apart from that, things in the derivatives market also looked pretty optimistic, as the coin’s taker’s buy/sell ratio was green. This indicated that buying sentiment was dominant among futures investors.

Tech to Force I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Techarp There is definately a lot to find out about this subject. I like all the points you made

Hey there! Do you know if they make any plugins to help with Search Engine

Optimization? I’m trying to get my website to

rank for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Thank you!

You can read similar article here: Eco wool

Good day! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for

some targeted keywords but I’m not seeing very good results.

If you know of any please share. Appreciate it!

I saw similar art here: Change your life

I am really impressed together with your writing abilities as neatly as with the layout in your weblog.

Is this a paid subject or did you modify it your self?

Either way stay up the excellent high quality writing, it is

uncommon to see a nice weblog like this one today. Blaze AI!

Oh my goodness! Amazing article dude! Many thanks, However I am encountering

problems with your RSS. I don’t understand

the reason why I can’t join it. Is there anybody getting

identical RSS issues? Anyone that knows the answer will you kindly

respond? Thanks!!

Hello everyone, it’s my first pay a visit at this website, and post is really fruitful designed for me, keep

up posting these types of articles.

I think that everything posted made a great deal of sense.

But, consider this, what if you composed a catchier title?

I ain’t saying your information isn’t solid, however suppose you added a post title that makes people want

more? I mean Why Bitcoin miners might drag down BTC's price to $54K again –

Coin Insights is a little plain. You should glance at Yahoo’s home page and see how they write post titles to grab viewers to click.

You might try adding a video or a related pic or two to grab people interested about

what you’ve got to say. In my opinion, it would

make your website a little bit more interesting.

Hello, just wanted to tell you, I liked this post. It was practical.

Keep on posting!

It’s amazing to go to see this web page and reading the views of all friends on the topic of this piece of writing,

while I am also eager of getting familiarity.

Wow, this piece of writing is nice, my younger sister is analyzing these things, thus

I am going to let know her.

I believe this is one of the so much vital info for me.

And i’m satisfied studying your article. But should remark on few general things, The site style

is great, the articles is in point of fact excellent : D.

Just right task, cheers

This site was… how do you say it? Relevant!!

Finally I’ve found something that helped me. Thank you!

I am extremely impressed together with your writing abilities and also with the format to your weblog.

Is that this a paid topic or did you customize it your self?

Anyway stay up the nice quality writing, it is uncommon to peer a great blog like

this one today. Madgicx!

I’m really inspired together with your writing skills and also with the layout to your blog. Is this a paid subject matter or did you customize it your self? Either way keep up the nice high quality writing, it’s rare to see a nice weblog like this one nowadays. I like coininsights.com ! I made: Blaze AI

Unquestionably consider that that you stated.

Your favourite justification appeared to be on the web the easiest

thing to have in mind of. I say to you, I certainly get irked even as people consider issues that they just

don’t recognise about. You controlled to hit the nail upon the top and also outlined out the

whole thing with no need side-effects , other folks

could take a signal. Will probably be again to get more.

Thank you

I’ll right away take hold of your rss feed as I can’t to find your email subscription hyperlink or e-newsletter service.

Do you have any? Please permit me realize so that I may subscribe.

Thanks.

Just desire to say your article is as astounding.

The clearness for your post is just great and that i can assume you’re an expert on this subject.

Well along with your permission let me to seize your feed to keep updated with forthcoming post.

Thanks 1,000,000 and please keep up the gratifying work.

Whats up this is kinda of off topic but I was wanting to know

if blogs use WYSIWYG editors or if you have to manually code with

HTML. I’m starting a blog soon but have no coding skills so I wanted to

get advice from someone with experience. Any help would be greatly appreciated!

Very soon this web page will be famous amid all blogging and site-building visitors, due

to it’s nice content

Very good post. I’m dealing with a few of these issues as well..

hi!,I really like your writing very so much! proportion we

keep in touch extra about your post on AOL?

I require a specialist in this area to solve my problem.

Maybe that’s you! Looking ahead to peer you.

What i do not realize is in truth how you are now not really a lot more smartly-liked than you might be right now.

You are very intelligent. You recognize thus significantly in terms of this subject, made me personally believe it from so many numerous angles.

Its like women and men are not interested except it’s something to do with Girl gaga!

Your own stuffs nice. All the time deal with it up!

Wow that was odd. I just wrote an really long comment but after I clicked submit my comment

didn’t show up. Grrrr… well I’m not writing all that

over again. Anyway, just wanted to say wonderful blog!

Thanks for some other great article. Where else may anyone get that type of information in such

an ideal way of writing? I have a presentation subsequent week, and I am

on the look for such info.

Hello i am kavin, its my first time to commenting anywhere, when i read this

piece of writing i thought i could also create comment due to this sensible article.

Ссылка на Кракен активна сейчас:

https://krac29.my/

Зеркало сайта Кракен указано ниже: https://krac29.my/

Вход на Кракен здесь: https://krac29.my/

Актуальная ссылка на Кракен в даркнете:

https://krac29.my/

Рабочее зеркало Кракен найдено:

https://krac29.my/

Для того чтобы войти в kraken darknet market, необходимо использовать кракен ссылка 2025.

Все резервные зеркала регулярно поддерживаются

на форумных ветках.

Кракен Telegram канал актуальные новости помогут оставаться на связи с платформой и использовать ресурсы

максимально эффективно.

Kraken сайт доступ обеспечивают актуальный доступ для всех, кто хочет купить в анонимно.

На платформе Kraken доступна обновлённая витрина — от

товаров darknet до редких позиций.

Оплата производится в анонимных транзакциях.

На платформе Kraken доступна обновлённая

витрина — от информационных материалов до необычных предложений.

Оплата производится в криптовалюте.

Для того чтобы получить

доступ в кракен сайт, необходимо

использовать кракен зеркало.

Все зеркала регулярно поддерживаются на специализированных сайтах.

На платформе Kraken доступна разнообразие продуктов — от инструментов до нишевых товаров.

Оплата производится в безналично.

Kraken Market отзывы помогут оставаться

в безопасности и находить доступ максимально эффективно.

актуальные ссылки на сайт Кракен помогут оставаться в тренде и получать информацию максимально эффективно.

Kraken площадка — это надежная платформ в даркнете для работы с криптовалютой.

Использование анонимного подключения позволяет гарантировать безопасность при

входе платформы.

Для того чтобы получить доступ

в официальное зеркало Кракен, необходимо использовать кракен ссылка 2025.

Все резервные зеркала регулярно обновляются на каналах Telegram.

Kraken darknet market — это популярная платформ в даркнете для работы с криптовалютой.

Использование VPN позволяет обеспечить доступ при

входе платформы.

Для того чтобы использовать в кракен сайт, необходимо использовать кракен

ссылка. Все обновленные адреса регулярно публикуются на форумных ветках.

Кракен доступ через VPN обеспечивают стабильный

вход для всех, кто хочет совершить покупку в сейчас.

Для того чтобы получить доступ в kraken darknet market, необходимо использовать кракен ссылка.

Все зеркала регулярно обновляются на

форумных ветках.

Для того чтобы войти в официальное зеркало

Кракен, необходимо использовать кракен ссылка.

Все резервные зеркала регулярно размещаются на каналах Telegram.

На платформе Kraken доступна обновлённая витрина — от электроники до необычных предложений.

Оплата производится в криптовалюте.

Kraken darknet market — это популярная платформ в даркнете для покупки с конфиденциальностью.

Использование безопасных каналов позволяет гарантировать приватность при входе платформы.

Не забывайте про правила доступа к площадке.

Для сохранения полной анонимности рекомендуем использовать приватные настройки браузера.

Не забывайте про Kraken безопасность и конфиденциальность.

Для сохранения полной анонимности рекомендуем использовать приватные настройки браузера.

Wonderful site. Lots of helpful information here.

I am sending it to some buddies ans also sharing in delicious.

And naturally, thank you to your effort!

At this moment I am going to do my breakfast, after having my breakfast coming again to read more news.

Hmm is anyone else experiencing problems with the pictures on this blog loading?

I’m trying to find out if its a problem on my end or if it’s the blog.

Any suggestions would be greatly appreciated.

Wow, incredible blog layout! How long have you been blogging for?

you made blogging look easy. The overall look of your website is wonderful, as

well as the content!

I am really impressed together with your writing abilities and also with the layout for your blog.

Is this a paid subject matter or did you customize it your

self? Either way keep up the excellent high

quality writing, it is uncommon to see a nice blog like this one

these days. Stan Store!

Tremendous things here. I am very glad to peer your article.

Thanks a lot and I am having a look ahead to contact you.

Will you please drop me a mail?

Very good info. Lucky me I came across your blog by chance (stumbleupon).

I have book-marked it for later!

Hello, i think that i saw you visited my blog so i came to “return the favor”.I’m attempting to find things

to enhance my site!I suppose its ok to use a few of your ideas!!

I am sure this paragraph has touched all the internet users, its really really

pleasant piece of writing on building up new website.

It is appropriate time to make some plans for the longer

term and it’s time to be happy. I’ve learn this publish and if I may just

I wish to suggest you some attention-grabbing issues or advice.

Perhaps you can write subsequent articles regarding this article.

I want to read even more things about it!

Good information. Lucky me I found your blog by accident (stumbleupon).

I have saved it for later!

Hello, I enjoy reading all of your article post. I like to write a little

comment to support you.

Oh my goodness! Awesome article dude! Thank you, However

I am having difficulties with your RSS. I don’t know why I

can’t join it. Is there anybody having the same RSS issues?

Anyone who knows the solution can you kindly respond?

Thanks!!

Heya i am for the primary time here. I found this board and I in finding It really helpful & it helped me out much.

I’m hoping to present one thing again and aid others such as you helped me.

We are a group of volunteers and opening a brand new scheme in our community.

Your website offered us with valuable information to work on. You

have done a formidable task and our entire group will

likely be grateful to you.

wonderful post, very informative. I ponder why the other specialists

of this sector don’t notice this. You should proceed your writing.

I’m sure, you’ve a great readers’ base already!

Howdy! This post couldn’t be written any better!

Reading through this post reminds me of my previous room mate!

He always kept chatting about this. I will forward this page to him.

Fairly certain he will have a good read. Many thanks for sharing!

If some one needs to be updated with latest technologies

then he must be visit this web page and be up to date every day.

I am really inspired together with your writing talents as neatly as with the structure for your blog.

Is that this a paid topic or did you customize it yourself?

Anyway keep up the nice high quality writing, it is uncommon to peer a nice weblog like this one these days..

Hello There. I found your blog the use of

msn. That is a really well written article. I will make sure to bookmark it and come

back to read extra of your useful information. Thank you for the post.

I will certainly comeback.

It’s not my first time to pay a visit this web site,

i am visiting this web site dailly and take nice data from here all the time.

Hey There. I found your blog using msn. This is a very well written article.

I will be sure to bookmark it and return to read more of your useful

information. Thanks for the post. I will definitely comeback.

Hello there, I found your web site by means of Google whilst looking

for a similar matter, your site came up, it seems to be great.

I’ve bookmarked it in my google bookmarks.

Hello there, simply become alert to your weblog through Google, and

located that it is truly informative. I’m going to watch out for brussels.

I will appreciate if you continue this in future. Lots of other folks shall be

benefited out of your writing. Cheers!

Howdy are using WordPress for your blog platform?

I’m new to the blog world but I’m trying to get started and

set up my own. Do you require any coding knowledge to make your own blog?

Any help would be greatly appreciated!

Wow! This blog looks exactly like my old one! It’s on a entirely different topic but

it has pretty much the same layout and design. Wonderful choice of colors!

Hi, I do believe this is a great web site. I stumbledupon it 😉 I’m going to revisit yet again since I book marked it.

Money and freedom is the greatest way to change, may you

be rich and continue to help others.

Awesome blog! Is your theme custom made or did you download

it from somewhere? A design like yours with a few simple

tweeks would really make my blog stand out. Please let me know where you got your theme.

Bless you

Keep on working, great job!

Heya! I just wanted to ask if you ever have any issues with hackers?

My last blog (wordpress) was hacked and I ended up

losing many months of hard work due to no data backup.

Do you have any methods to stop hackers?

It’s going to be finish of mine day, however before ending I am reading this fantastic article to increase my know-how.

I know this web page presents quality depending posts and other information, is

there any other web page which provides such information in quality?

Simply want to say your article is as astounding.

The clearness to your put up is just great and i could assume you are knowledgeable in this subject.

Fine along with your permission allow me to clutch your

RSS feed to stay up to date with coming near near

post. Thank you a million and please keep up the rewarding work.

Hello my family member! I want to say that this article

is awesome, nice written and include approximately all vital infos.

I’d like to see more posts like this .

My family members all the time say that I am wasting my time here

at net, however I know I am getting experience daily by reading thes pleasant

content.

Thanks for any other informative website. The place else could I am getting that kind of info written in such a perfect manner?

I have a project that I am just now working

on, and I’ve been at the look out for such information.

I’m very happy to find this page. I want to to thank you for your time

due to this wonderful read!! I definitely liked every bit of it and

i also have you saved to fav to see new information on your site.

Hello, this weekend is nice designed for me, since this occasion i am reading this enormous educational article here at my house.

hello there and thank you for your info – I’ve definitely

picked up anything new from right here. I did

however expertise several technical points using this website, as

I experienced to reload the web site lots of times

previous to I could get it to load correctly.

I had been wondering if your hosting is OK?

Not that I am complaining, but slow loading instances times will often affect your placement in google and could damage

your quality score if ads and marketing with Adwords.

Anyway I’m adding this RSS to my e-mail and can look out for a lot more of your respective exciting content.

Ensure that you update this again very soon.

Great article! This is the type of info that should be shared across the internet.

Shame on the search engines for now not positioning this submit upper!

Come on over and visit my site . Thank you =)

Hi there! Quick question that’s entirely off topic.

Do you know how to make your site mobile friendly?

My web site looks weird when viewing from my apple iphone.

I’m trying to find a template or plugin that

might be able to correct this issue. If you have any suggestions,

please share. Cheers!

where can i buy cheap clomiphene how to get generic clomiphene no prescription where can i buy generic clomiphene tablets can i purchase generic clomid pills cost cheap clomiphene online can i purchase cheap clomiphene pills buy clomid no prescription

Hello, just wanted to tell you, I loved this article. It was practical.

Keep on posting!

Spot on with this write-up, I honestly feel this website needs far more attention. I’ll probably be back

again to read more, thanks for the info!

Your style is very unique compared to other people I have read stuff from.

I appreciate you for posting when you’ve got the opportunity,

Guess I will just bookmark this blog.

Heya i am for the first time here. I found this board and I find It really useful & it helped me out much.

I hope to give something back and aid others like you aided me.

This website positively has all of the bumf and facts I needed about this case and didn’t identify who to ask.

Simply desire to say your article is as astonishing.

The clarity in your post is just nice and i could assume you

are an expert on this subject. Fine with your permission allow me to grab your feed to

keep updated with forthcoming post. Thanks a million and please continue the enjoyable work.

This website really has all of the bumf and facts I needed there this case and didn’t positive who to ask.

It’s really a great and helpful piece of information.

I’m glad that you just shared this useful information with

us. Please keep us up to date like this. Thanks for sharing.

Excellent post. I will be facing many of these issues as well..

My partner and I absolutely love your blog and find a lot of your

post’s to be precisely what I’m looking for. Does one

offer guest writers to write content for you personally? I wouldn’t

mind writing a post or elaborating on a few of the subjects you write with regards to here.

Again, awesome web site!

Do you have a spam problem on this website; I also am a

blogger, and I was wondering your situation; many of us have developed some nice methods and

we are looking to trade methods with others, why not shoot me an e-mail if interested.

cost azithromycin 250mg – order ofloxacin 200mg generic generic flagyl 400mg

Howdy! I’m at work browsing your blog from my new iphone 3gs!

Just wanted to say I love reading your blog and

look forward to all your posts! Carry on the fantastic

work!

buy rybelsus 14 mg generic – semaglutide 14 mg over the counter buy cyproheptadine cheap

Excellent post. I was checking constantly this blog and I am impressed!

Extremely useful info specially the last part 🙂

I care for such information much. I was seeking this particular info for a long time.

Thank you and good luck.

order motilium 10mg online cheap – buy cheap generic tetracycline cyclobenzaprine 15mg cost

buy propranolol sale – buy methotrexate pills for sale buy methotrexate 2.5mg online cheap

What’s up friends, good paragraph and good urging commented at this place, I am really enjoying by these.

Hello are using WordPress for your site platform?

I’m new to the blog world but I’m trying to get started

and set up my own. Do you require any coding knowledge to make your own blog?

Any help would be really appreciated!

augmentin 625mg over the counter – atbioinfo ampicillin uk

I visited many blogs except the audio quality for

audio songs current at this site is actually marvelous.

Thanks a bunch for sharing this with all people you really

recognise what you are speaking approximately! Bookmarked.

Kindly additionally discuss with my web site =).

We could have a link trade contract among us

esomeprazole 40mg oral – https://anexamate.com/ esomeprazole 20mg cheap

I read this paragraph fully about the comparison of most recent and previous technologies, it’s remarkable article.

Hurrah! After all I got a web site from where I know how to in fact

get useful information concerning my study and knowledge.

medex uk – anticoagulant purchase hyzaar generic

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something.

I think that you can do with some pics to drive the message home a bit, but

other than that, this is great blog. An excellent read.

I’ll definitely be back.

Fantastic beat ! I would like to apprentice while you amend your web site,

how could i subscribe for a blog site? The account aided me a acceptable deal.

I had been a little bit acquainted of this your broadcast offered bright clear idea

buy mobic 7.5mg for sale – swelling brand meloxicam 7.5mg

I know this if off topic but I’m looking into starting my own blog and

was curious what all is needed to get setup? I’m assuming having a blog like yours

would cost a pretty penny? I’m not very internet savvy so I’m not 100% positive.

Any suggestions or advice would be greatly

appreciated. Many thanks

Unquestionably believe that which you said. Your favorite

reason appeared to be on the web the simplest thing

to be aware of. I say to you, I definitely get annoyed while people

consider worries that they plainly do not know about.

You managed to hit the nail upon the top as well as defined out the

whole thing without having side-effects , people can take a

signal. Will probably be back to get more. Thanks

I think the admin of this web site is genuinely working hard for his web page, since here

every data is quality based data.

deltasone 40mg over the counter – https://apreplson.com/ order prednisone 20mg generic

ed solutions – fastedtotake.com best pills for ed

Hi, I do believe this is an excellent site.

I stumbledupon it 😉 I may return once again since I

book-marked it. Money and freedom is the best way to change, may

you be rich and continue to guide other people.

My programmer is trying to persuade me to move to .net

from PHP. I have always disliked the idea because of the costs.

But he’s tryiong none the less. I’ve been using WordPress

on a number of websites for about a year and am concerned about

switching to another platform. I have heard good things about blogengine.net.

Is there a way I can transfer all my wordpress content into it?

Any kind of help would be really appreciated!

Way cool! Some extremely valid points! I appreciate

you penning this article and also the rest of the website is also really

good.

I am regular reader, how are you everybody? This paragraph posted at this

web site is truly pleasant.

where to buy amoxil without a prescription – https://combamoxi.com/ how to buy amoxil

Hello there! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted

keywords but I’m not seeing very good results.

If you know of any please share. Cheers!

Thank you for the auspicious writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you! However, how

could we communicate?

This website really has all the information and facts I needed about this

subject and didn’t know who to ask.

There’s definately a great deal to learn about this issue.

I love all of the points you have made.

Hello! Do you know if they make any plugins to help

with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good success.

If you know of any please share. Appreciate it!

Good day! I know this is kinda off topic however , I’d figured I’d ask.

Would you be interested in exchanging links or maybe guest writing

a blog post or vice-versa? My blog goes over a lot of the same topics as

yours and I think we could greatly benefit from each

other. If you happen to be interested feel free to send me an e-mail.

I look forward to hearing from you! Great blog by the way!

Paragraph writing is also a excitement, if you know afterward you can write if not it is complicated to write.

order diflucan 100mg without prescription – https://gpdifluca.com/# diflucan cost