- SEC issued a Wells Notice to Robinhood for potential securities violations.

- Robinhood responds proactively to regulatory challenges by adjusting operations.

Once again, the United States Securities and Exchange Commission (SEC) has issued a Wells Notice, this time directed toward Robinhood Markets, Inc.

What’s the matter?

In an 8-K filing submitted over the weekend, Robinhood disclosed that it had received a Wells Notice from the SEC’s staff.

The notice suggests that the SEC may take action against the trading platform for purported securities violations.

Shedding light on the issue, Dan Gallagher, chief legal, compliance, and corporate affairs officer at Robinhood, in a blog post, said,

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be.”

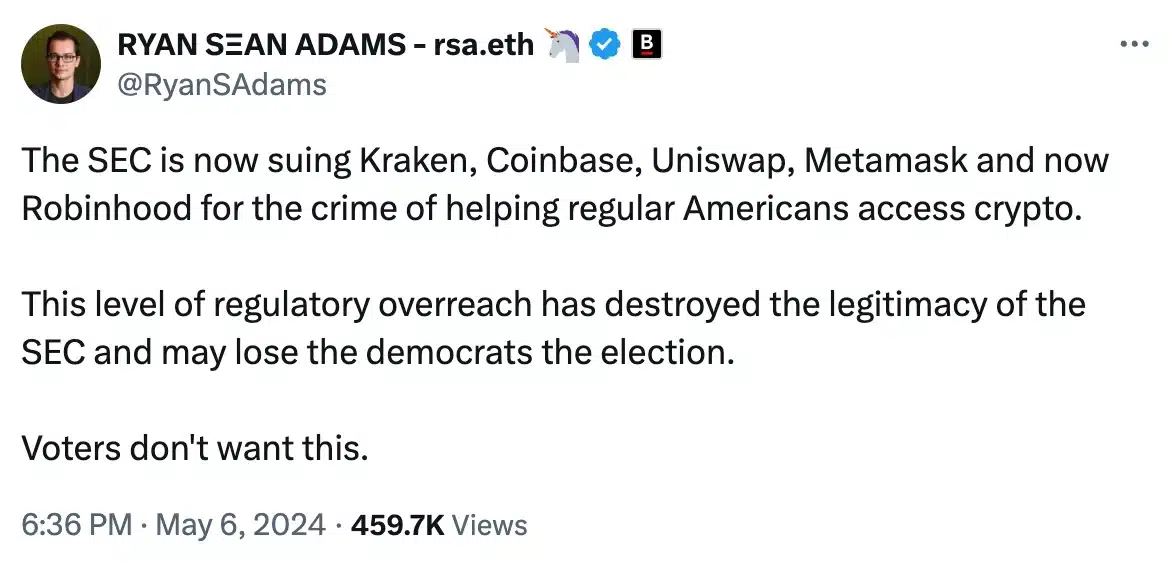

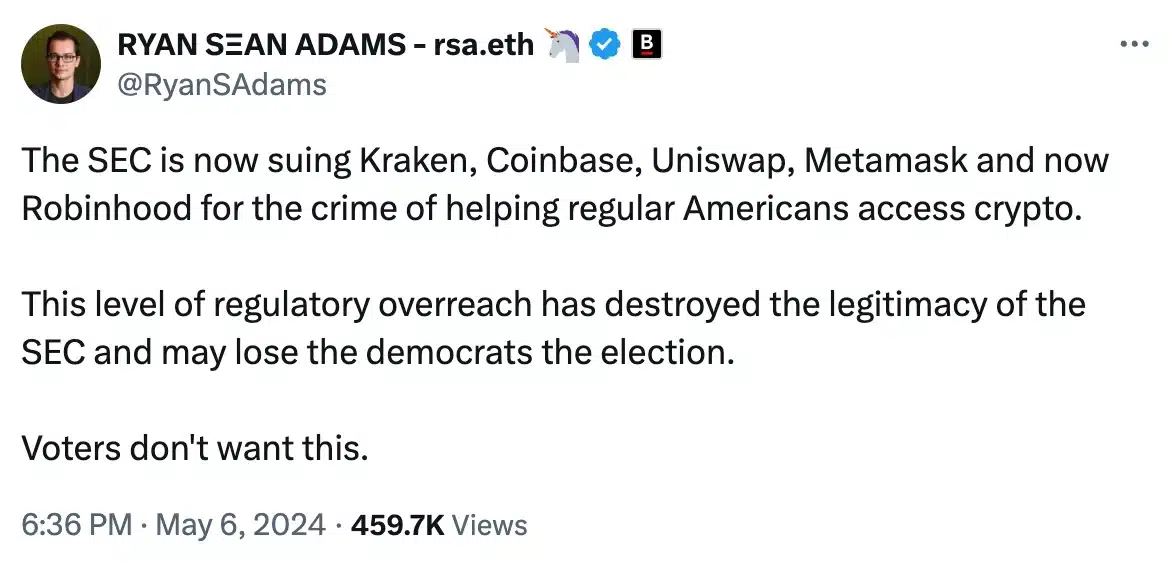

Underlining a unique perspective on the potential impact on the upcoming US elections, Ryan S Adams, a known crypto investor, noted,

Source: Ryan Adams/X

Echoing similar sentiments, Hayden Adams, Uniswap’s CEO, in a separate interview with the “Bankless” podcast, noted,

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

The potential impact

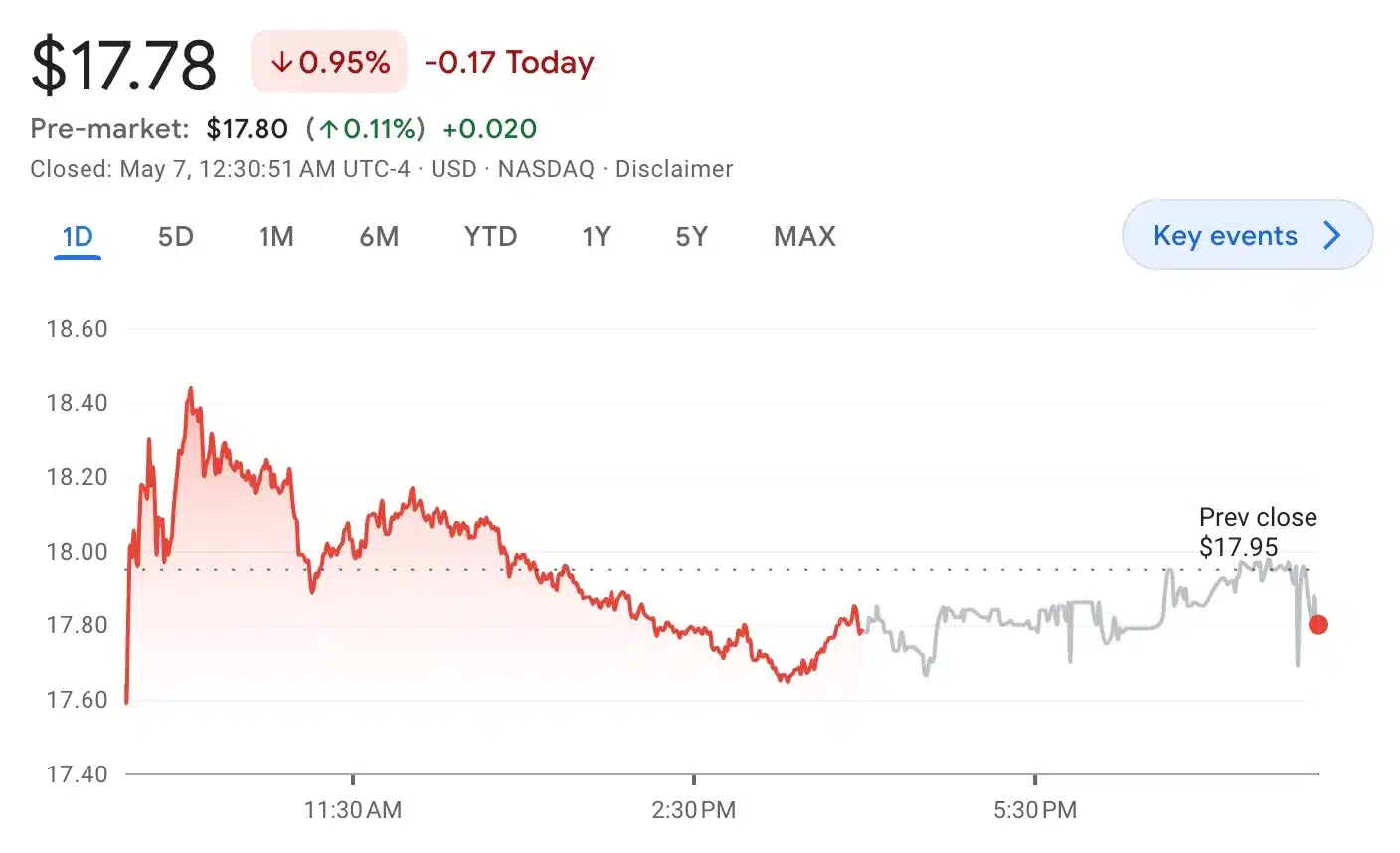

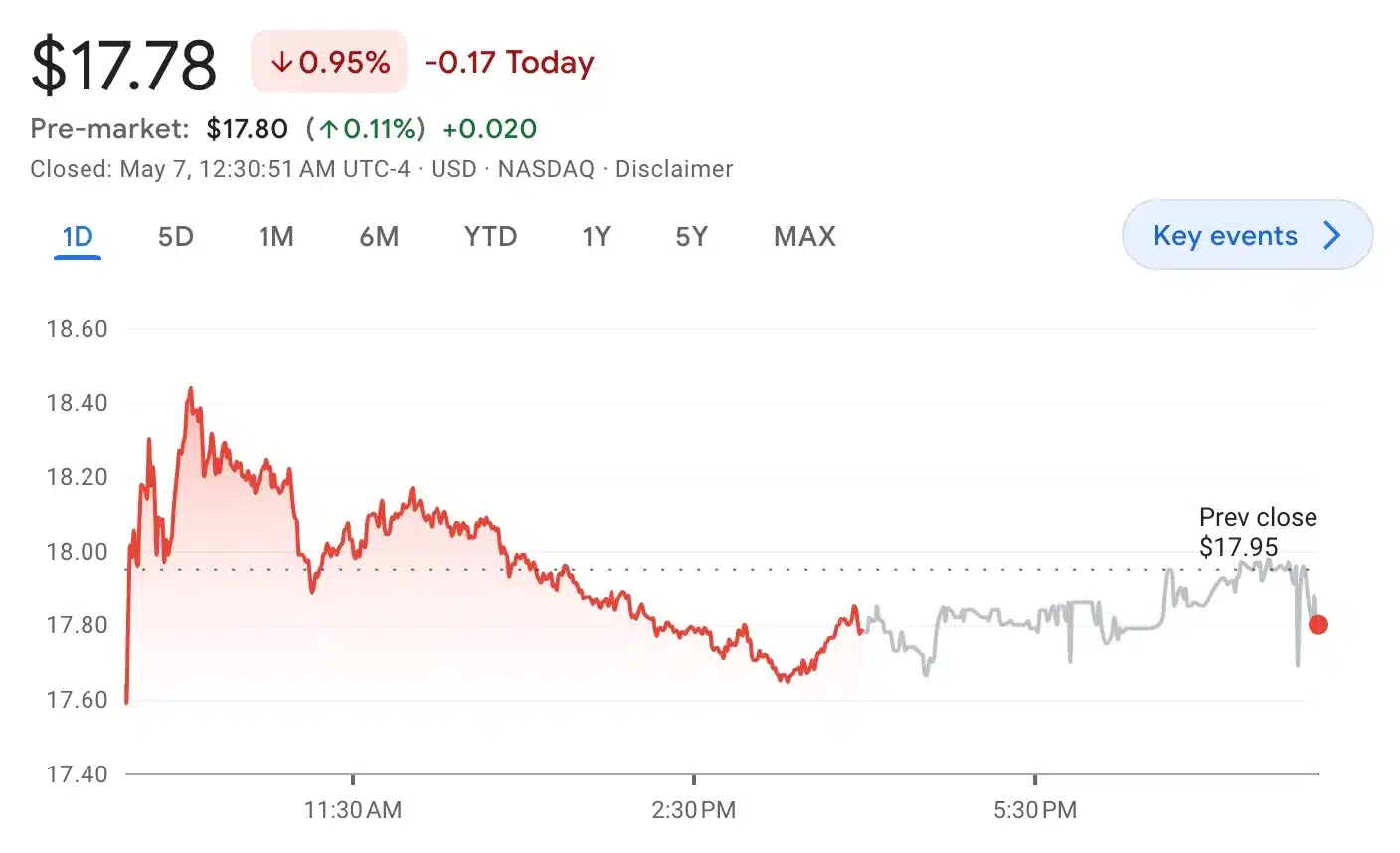

The impact of the Wells Notice sent to Robinhood was immediately felt in the market.

Following the news, HOOD (Robinhood’s stock) experienced a significant downturn of approximately 10% during pre-market trading on the 6th of May.

As of the latest update, Robinhood’s stock has declined by 0.95% within the past 24 hours.

Source: Google Finance

Highlighting his disappointment on the issue, Gallagher, added,

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business.”

Interestingly, Wick, a cryptocurrency influencer noted,

Source: Wick/X

This highlights a common characteristic of bull markets, where asset prices show resilience and fail to react significantly to negative news.

The uncertain fate of Robinhood

Despite regulatory challenges and a pending SEC lawsuit, Robinhood has taken proactive steps, such as delisting tokens including Solana [SOL], Cardano [ADA], and Polygon [MATIC], and adjusting trading fees.

In conclusion, being behind other exchanges in the SEC’s timeline could benefit Robinhood for strategic adjustments and legal prep.

Yet, immediate impact hinges more on market performance and investor sentiment toward digital assets.

- SEC issued a Wells Notice to Robinhood for potential securities violations.

- Robinhood responds proactively to regulatory challenges by adjusting operations.

Once again, the United States Securities and Exchange Commission (SEC) has issued a Wells Notice, this time directed toward Robinhood Markets, Inc.

What’s the matter?

In an 8-K filing submitted over the weekend, Robinhood disclosed that it had received a Wells Notice from the SEC’s staff.

The notice suggests that the SEC may take action against the trading platform for purported securities violations.

Shedding light on the issue, Dan Gallagher, chief legal, compliance, and corporate affairs officer at Robinhood, in a blog post, said,

“We firmly believe that the assets listed on our platform are not securities and we look forward to engaging with the SEC to make clear just how weak any case against Robinhood Crypto would be.”

Underlining a unique perspective on the potential impact on the upcoming US elections, Ryan S Adams, a known crypto investor, noted,

Source: Ryan Adams/X

Echoing similar sentiments, Hayden Adams, Uniswap’s CEO, in a separate interview with the “Bankless” podcast, noted,

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

The potential impact

The impact of the Wells Notice sent to Robinhood was immediately felt in the market.

Following the news, HOOD (Robinhood’s stock) experienced a significant downturn of approximately 10% during pre-market trading on the 6th of May.

As of the latest update, Robinhood’s stock has declined by 0.95% within the past 24 hours.

Source: Google Finance

Highlighting his disappointment on the issue, Gallagher, added,

“After years of good faith attempts to work with the SEC for regulatory clarity including our well-known attempt to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells Notice related to our U.S. crypto business.”

Interestingly, Wick, a cryptocurrency influencer noted,

Source: Wick/X

This highlights a common characteristic of bull markets, where asset prices show resilience and fail to react significantly to negative news.

The uncertain fate of Robinhood

Despite regulatory challenges and a pending SEC lawsuit, Robinhood has taken proactive steps, such as delisting tokens including Solana [SOL], Cardano [ADA], and Polygon [MATIC], and adjusting trading fees.

In conclusion, being behind other exchanges in the SEC’s timeline could benefit Robinhood for strategic adjustments and legal prep.

Yet, immediate impact hinges more on market performance and investor sentiment toward digital assets.

Лучшие онлайн-казино предлагают своим пользователям широкий выбор игр, включая слоты, рулетку, блэкджек, покер и другие. Кроме того, они часто предлагают бонусы и фриспины новым игрокам, что позволяет им начать играть без необходимости вносить депозит. Регистрация в онлайн-казино обычно занимает несколько минут и требует минимальной информации о пользователе. рейтинг топ лушчее kvhhgbeurm

продажа аккаунтов купить аккаунт с прокачкой

заработок на аккаунтах купить аккаунт

заработок на аккаунтах аккаунт для рекламы

купить аккаунт маркетплейс аккаунтов

перепродажа аккаунтов покупка аккаунтов

покупка аккаунтов магазин аккаунтов

продать аккаунт платформа для покупки аккаунтов

маркетплейс аккаунтов соцсетей услуги по продаже аккаунтов

биржа аккаунтов купить аккаунт

купить аккаунт с прокачкой маркетплейс аккаунтов

магазин аккаунтов продажа аккаунтов

перепродажа аккаунтов маркетплейс аккаунтов соцсетей

биржа аккаунтов маркетплейс аккаунтов

купить аккаунт продажа аккаунтов соцсетей

Account exchange Find Accounts for Sale

Account Exchange Service Verified Accounts for Sale

Buy Pre-made Account Accounts for Sale

Account Acquisition Account market

Account trading platform Sell accounts

Database of Accounts for Sale https://socialaccountsstore.com/

Account Acquisition Verified Accounts for Sale

Profitable Account Sales Accounts for Sale

Buy and Sell Accounts Accounts marketplace

Purchase Ready-Made Accounts Accounts for Sale

secure account purchasing platform social media account marketplace

account trading service sell account

sell accounts marketplace for ready-made accounts

website for buying accounts buy accounts

account trading account acquisition

accounts marketplace database of accounts for sale

verified accounts for sale sell accounts

account market account purchase

account store sell account

account buying service account trading

account selling service secure account sales

account selling service account buying platform

gaming account marketplace database of accounts for sale

account market buy and sell accounts

buy pre-made account website for selling accounts

sell account guaranteed accounts

account trading account catalog

account trading service website for selling accounts

secure account sales secure account sales

account trading service accounts marketplace

sell accounts secure account sales

account exchange service guaranteed accounts

sell accounts account trading platform

account sale buy account

secure account purchasing platform secure account purchasing platform

buy accounts account marketplace

secure account purchasing platform accounts market

account marketplace https://accounts-offer.org

account trading platform account market

gaming account marketplace https://buy-best-accounts.org/

account exchange service https://social-accounts-marketplaces.live

buy accounts account marketplace

account catalog https://social-accounts-marketplace.xyz

marketplace for ready-made accounts https://buy-accounts.space

account exchange https://buy-accounts-shop.pro/

marketplace for ready-made accounts https://buy-accounts.live

accounts marketplace https://accounts-marketplace.online

account trading platform https://accounts-marketplace-best.pro

купить аккаунт akkaunty-na-prodazhu.pro

маркетплейс аккаунтов rynok-akkauntov.top

биржа аккаунтов https://kupit-akkaunt.xyz

магазин аккаунтов маркетплейсов аккаунтов

покупка аккаунтов https://akkaunty-market.live

покупка аккаунтов https://kupit-akkaunty-market.xyz/

маркетплейс аккаунтов https://akkaunty-optom.live/

маркетплейс аккаунтов https://online-akkaunty-magazin.xyz

маркетплейс аккаунтов соцсетей https://akkaunty-dlya-prodazhi.pro/

продажа аккаунтов kupit-akkaunt.online

buy facebook ads accounts buying facebook accounts

facebook ads account buy facebook accounts to buy

buy facebook old accounts cheap facebook accounts

cheap facebook advertising account facebook ad account buy

facebook ad account for sale https://ad-account-buy.top

buy old facebook account for ads buy facebook accounts for ads

buy facebook profile facebook ad accounts for sale

buy fb ads account https://buy-ad-account.click

buy fb ads account https://ad-accounts-for-sale.work

google ads account for sale https://buy-ads-account.top

buy google adwords account https://buy-ads-accounts.click

buy facebook account https://buy-accounts.click

google ads agency accounts https://ads-account-for-sale.top

buy aged google ads account https://ads-account-buy.work

adwords account for sale https://buy-ads-invoice-account.top

sell google ads account buy google ads invoice account

buy google ads accounts https://buy-ads-agency-account.top

buy verified google ads accounts https://sell-ads-account.click

buy aged google ads account https://ads-agency-account-buy.click

buy facebook business manager accounts https://buy-business-manager.org

google ads reseller https://buy-verified-ads-account.work/

verified bm https://buy-bm-account.org/

facebook bm account buy https://buy-verified-business-manager-account.org

buy bm facebook buy-verified-business-manager.org

verified business manager for sale buy-business-manager-acc.org

buy verified business manager facebook https://business-manager-for-sale.org

unlimited bm facebook buy-business-manager-verified.org

facebook business account for sale buy verified facebook business manager account

buy facebook ads accounts and business managers https://verified-business-manager-for-sale.org

buy facebook verified business account https://buy-business-manager-accounts.org

buy tiktok ads accounts https://buy-tiktok-ads-account.org

tiktok ad accounts https://tiktok-ads-account-buy.org

tiktok ads account for sale tiktok ads agency account

buy tiktok ads https://tiktok-agency-account-for-sale.org

tiktok ads agency account https://buy-tiktok-ad-account.org

buy tiktok business account https://tiktok-ads-agency-account.org

buy tiktok ads https://buy-tiktok-business-account.org

tiktok ad accounts https://buy-tiktok-ads.org

cost of clomiphene how can i get generic clomid buy generic clomid get cheap clomiphene without rx how to buy cheap clomiphene can you get cheap clomid without rx where buy cheap clomiphene pill

With thanks. Loads of knowledge!

Thanks for putting this up. It’s evidently done.

order azithromycin 250mg online cheap – purchase ciplox generic buy metronidazole 200mg without prescription

semaglutide 14 mg cheap – semaglutide 14mg over the counter buy generic periactin 4 mg

purchase motilium pills – purchase flexeril without prescription flexeril 15mg for sale

amoxicillin oral – order amoxil pill purchase combivent sale

buy generic augmentin – https://atbioinfo.com/ buy ampicillin for sale

oral nexium 20mg – anexamate.com cheap nexium

warfarin 5mg pills – https://coumamide.com/ purchase losartan generic

mobic 7.5mg tablet – https://moboxsin.com/ order meloxicam 15mg generic

buy generic deltasone 10mg – corticosteroid prednisone 10mg over the counter