- Long and short positions saw a spike in liquidation volume in the last trading session.

- Bitcoin contributed over $500 million to the liquidation.

The cryptocurrency market has recently witnessed significant liquidation activity, with Bitcoin [BTC] at the forefront of these movements.

As traders navigate volatile price swings, the liquidation of long and short positions offers crucial insights into the market’s current state. The latest data reveals the leverage and risk in the crypto ecosystem.

Longs, shorts hit notable levels

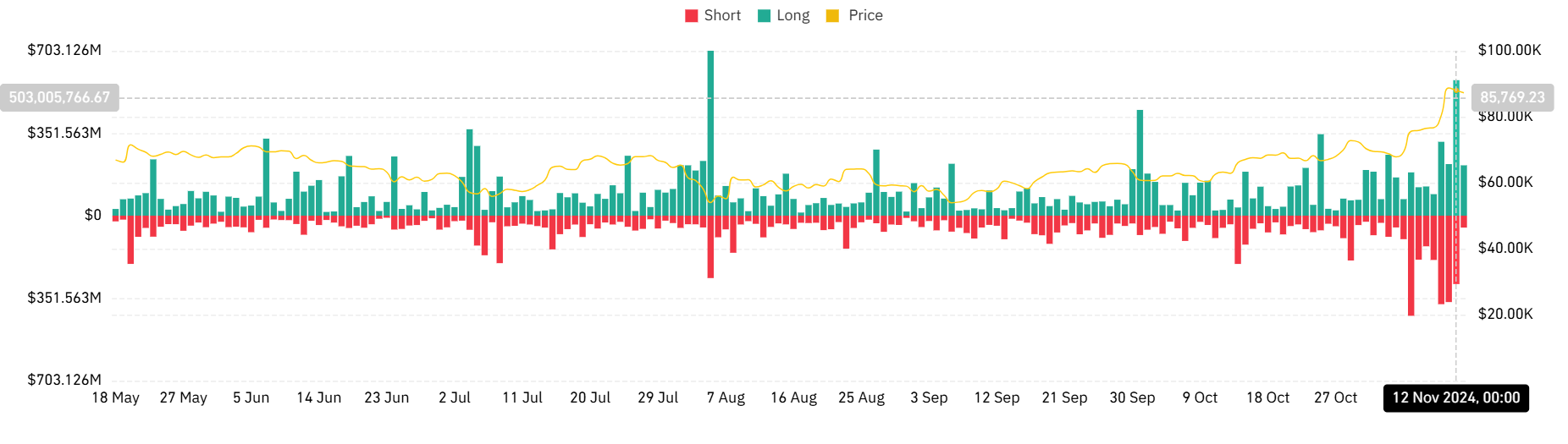

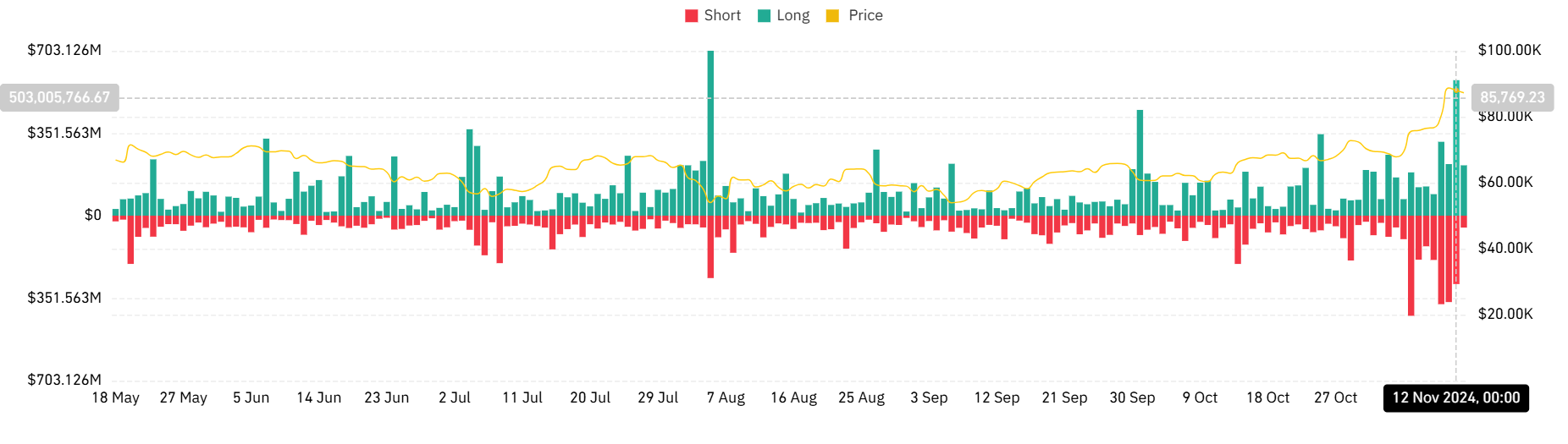

According to the liquidation chart on Coinglass, over $503 million in liquidations have been recorded recently, highlighting the impact of Bitcoin’s rapid price movements.

Also, AMBCrypto’s analysis of the total liquidation showed that it surged to nearly $870 million in the last trading session.

Source: Coinglass

This trend illustrated the precarious balance of leverage in the market, where traders betting on continued upward momentum were caught off guard by sudden price corrections.

Conversely, the rise in short liquidations suggested that Bitcoin’s recent rally forced bears to cover positions as assets broke past key resistance levels.

High leverage concentrations

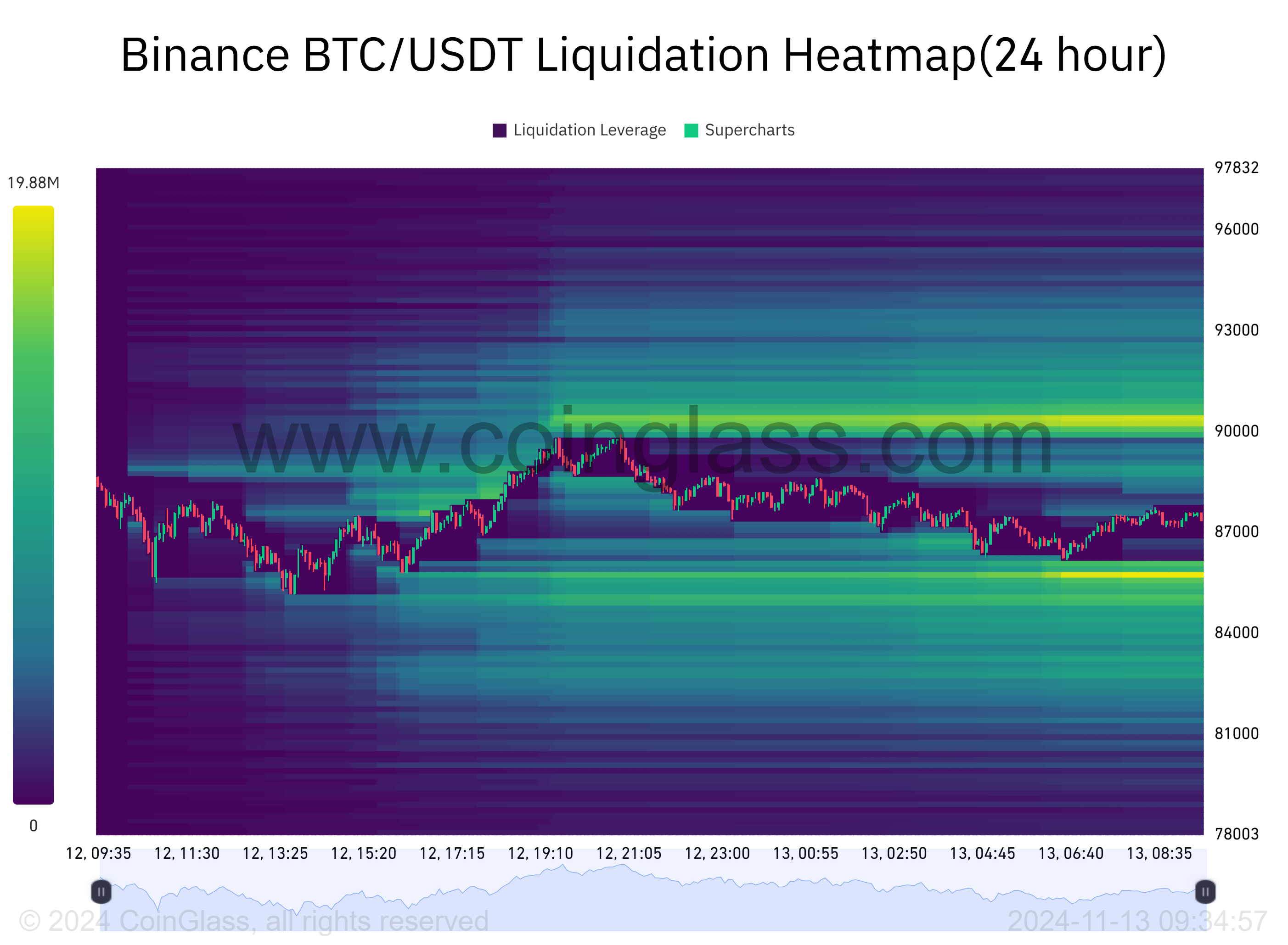

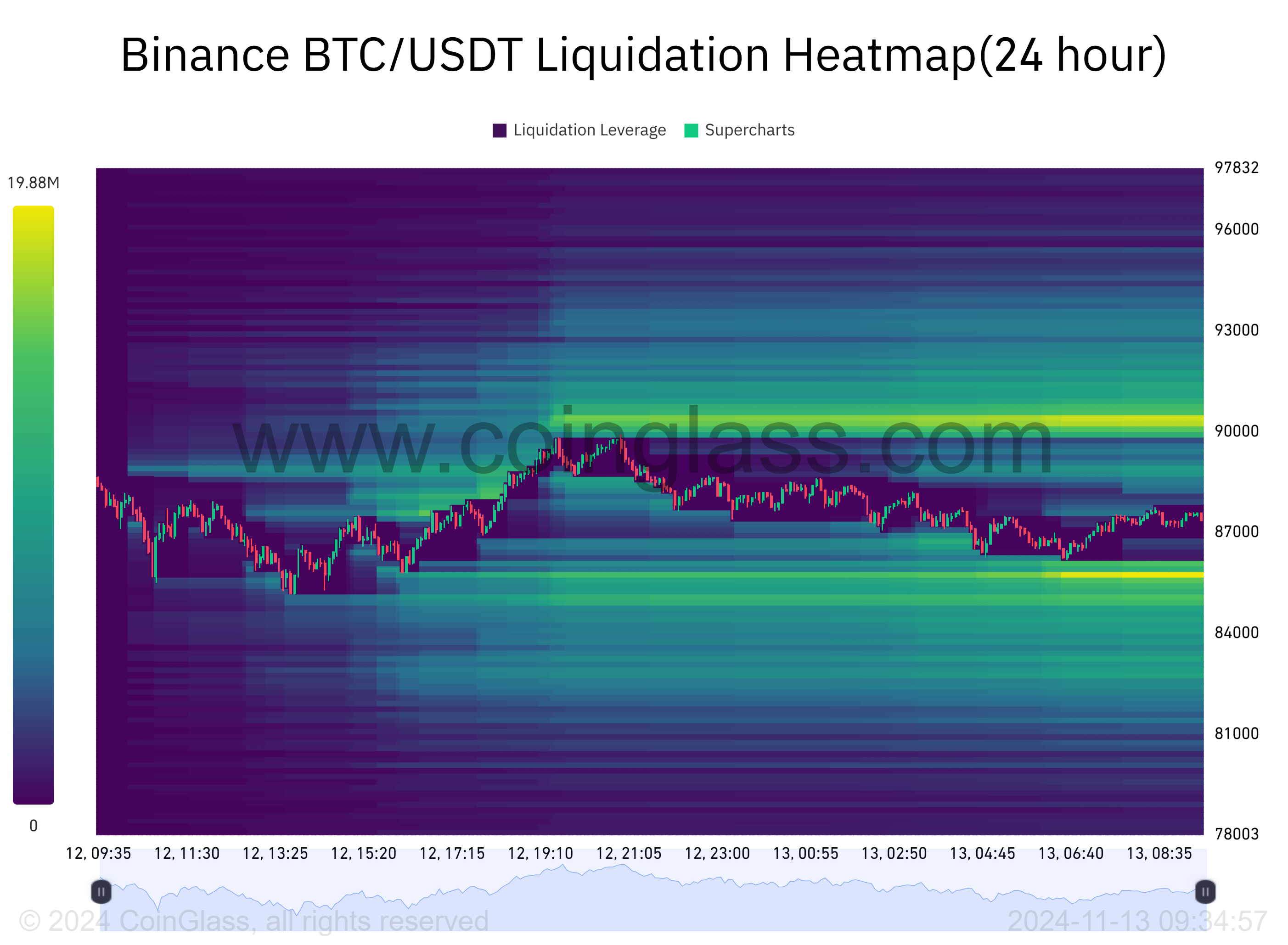

The Binance BTC/USDT Liquidation Heatmap provided additional context, showcasing areas of concentrated liquidation activity.

The heatmap highlighted liquidation clusters between $84,000 and $88,000, with darker zones representing higher leverage and more significant liquidations.

This concentration around Bitcoin’s psychological resistance levels underscored the intensity of speculative trading in the market.

Source: Coinglass

The yellow line on the chart indicated Bitcoin’s price nearing $85,769, correlating with the long and short liquidations surge.

Notably, long-position liquidation dominated the market as Bitcoin’s price retraced from recent highs, triggering stop-loss orders and margin calls.

Interestingly, the liquidation heatmap reveals that leverage traders have placed significant bets near current price levels, creating both opportunities and risks.

While these zones can act as liquidity pools to propel price action, they also signal potential market fragility if liquidations cascade further.

Market implications

The spike in crypto liquidations, particularly on major exchanges like Binance, reflected the broader market’s heightened volatility.

With Bitcoin continuing to trade near all-time highs, liquidation data highlighted both the enthusiasm and vulnerability of market participants.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As the market moves, traders will closely watch key price levels and liquidation data to gauge the next directional move.

While liquidations can exacerbate short-term price swings, they also provide opportunities for market stabilization and new trends to emerge.

- Long and short positions saw a spike in liquidation volume in the last trading session.

- Bitcoin contributed over $500 million to the liquidation.

The cryptocurrency market has recently witnessed significant liquidation activity, with Bitcoin [BTC] at the forefront of these movements.

As traders navigate volatile price swings, the liquidation of long and short positions offers crucial insights into the market’s current state. The latest data reveals the leverage and risk in the crypto ecosystem.

Longs, shorts hit notable levels

According to the liquidation chart on Coinglass, over $503 million in liquidations have been recorded recently, highlighting the impact of Bitcoin’s rapid price movements.

Also, AMBCrypto’s analysis of the total liquidation showed that it surged to nearly $870 million in the last trading session.

Source: Coinglass

This trend illustrated the precarious balance of leverage in the market, where traders betting on continued upward momentum were caught off guard by sudden price corrections.

Conversely, the rise in short liquidations suggested that Bitcoin’s recent rally forced bears to cover positions as assets broke past key resistance levels.

High leverage concentrations

The Binance BTC/USDT Liquidation Heatmap provided additional context, showcasing areas of concentrated liquidation activity.

The heatmap highlighted liquidation clusters between $84,000 and $88,000, with darker zones representing higher leverage and more significant liquidations.

This concentration around Bitcoin’s psychological resistance levels underscored the intensity of speculative trading in the market.

Source: Coinglass

The yellow line on the chart indicated Bitcoin’s price nearing $85,769, correlating with the long and short liquidations surge.

Notably, long-position liquidation dominated the market as Bitcoin’s price retraced from recent highs, triggering stop-loss orders and margin calls.

Interestingly, the liquidation heatmap reveals that leverage traders have placed significant bets near current price levels, creating both opportunities and risks.

While these zones can act as liquidity pools to propel price action, they also signal potential market fragility if liquidations cascade further.

Market implications

The spike in crypto liquidations, particularly on major exchanges like Binance, reflected the broader market’s heightened volatility.

With Bitcoin continuing to trade near all-time highs, liquidation data highlighted both the enthusiasm and vulnerability of market participants.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As the market moves, traders will closely watch key price levels and liquidation data to gauge the next directional move.

While liquidations can exacerbate short-term price swings, they also provide opportunities for market stabilization and new trends to emerge.

clomiphene without dr prescription how to buy generic clomiphene tablets can i order clomiphene prices clomid for low testosterone can i order clomiphene without insurance how can i get clomiphene price can i order cheap clomiphene without insurance

This website absolutely has all of the tidings and facts I needed adjacent to this participant and didn’t know who to ask.

I am in truth thrilled to glance at this blog posts which consists of tons of worthwhile facts, thanks for providing such data.

how to buy azithromycin – buy ciprofloxacin 500mg generic oral flagyl 400mg

domperidone canada – sumycin 250mg for sale flexeril 15mg usa

inderal 10mg cheap – buy plavix 75mg for sale buy methotrexate pills

order amoxil – buy diovan 160mg generic buy combivent online

oral zithromax 250mg – buy tinidazole 300mg pills purchase bystolic generic

buy augmentin 1000mg – https://atbioinfo.com/ ampicillin ca

esomeprazole 20mg canada – https://anexamate.com/ esomeprazole brand

buy warfarin 2mg pills – cou mamide buy cozaar no prescription

meloxicam 15mg drug – https://moboxsin.com/ meloxicam 7.5mg price

order prednisone 20mg without prescription – aprep lson prednisone 5mg cheap

buy ed pills – buying ed pills online natural pills for erectile dysfunction

cheap amoxicillin tablets – https://combamoxi.com/ buy amoxicillin pill

forcan online – https://gpdifluca.com/ generic forcan

cenforce 100mg pills – https://cenforcers.com/ cenforce sale

cialis recommended dosage – cialis online pharmacy australia buy cialis online overnight delivery

buy generic zantac 150mg – online buy ranitidine 300mg pill

buy viagra toronto – https://strongvpls.com/# buy viagra 50mg

This website exceedingly has all of the tidings and facts I needed adjacent to this thesis and didn’t know who to ask. site

The thoroughness in this section is noteworthy. amoxil cost

This is the big-hearted of criticism I positively appreciate. ursxdol.com

More posts like this would prosper the blogosphere more useful. https://prohnrg.com/

I couldn’t resist commenting. Profoundly written! https://aranitidine.com/fr/prednisolone-achat-en-ligne/

More posts like this would create the online time more useful. https://ondactone.com/spironolactone/

This is the tolerant of advise I find helpful. how to buy generic motilium without rx

I’ll certainly bring back to review more. http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4704

order dapagliflozin 10 mg – https://janozin.com/# buy forxiga pills

order orlistat generic – https://asacostat.com/# buy orlistat sale