- The bullish triangle pattern could see ETH breakout toward $3,350

- Unenthusiastic demand could hurt the chances of a breakout

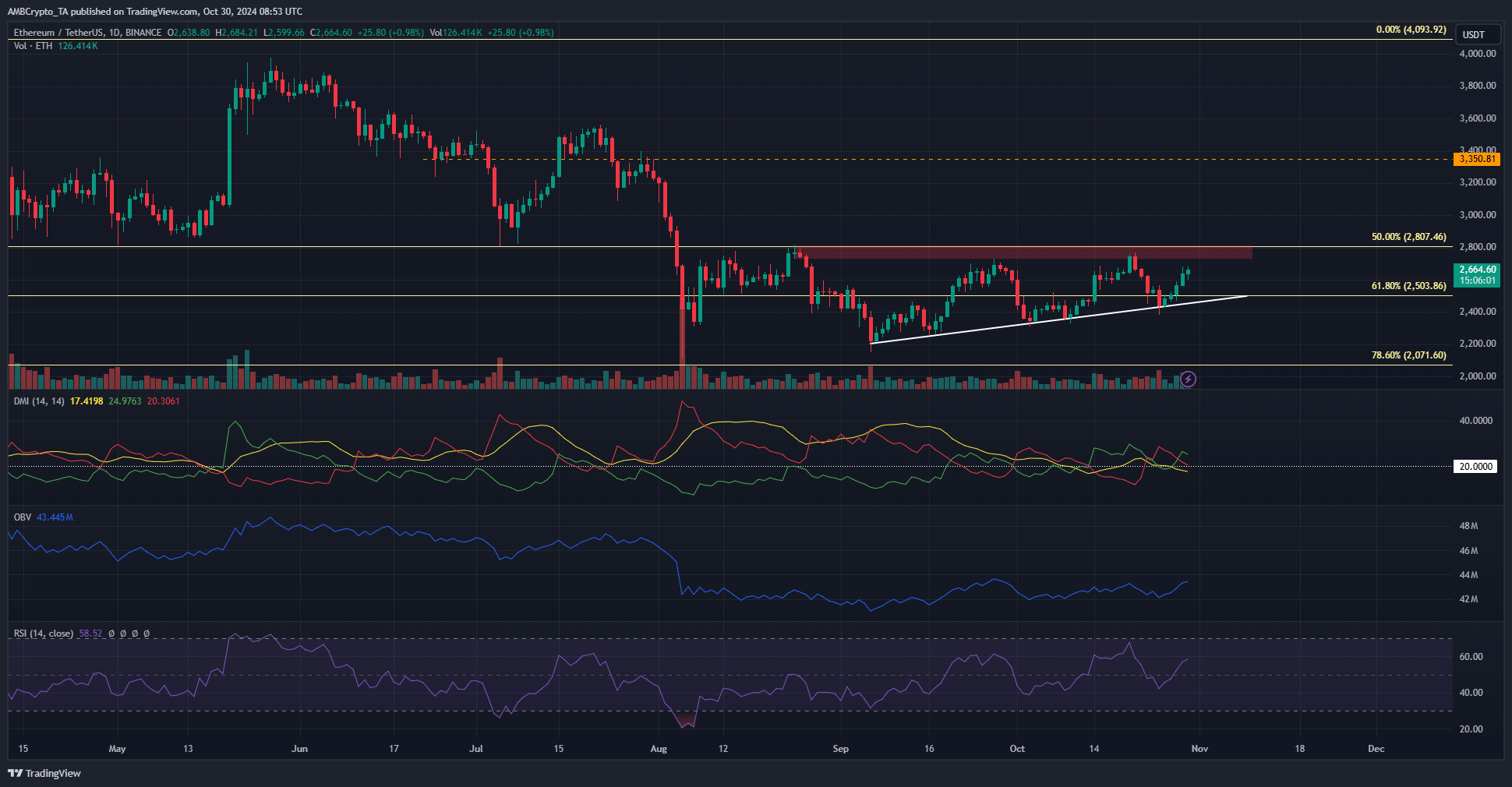

Ethereum [ETH] was trading beneath the resistance zone at $2.8k which was unbeaten since August. The recent move upward was slow and lacked explosive momentum, but has been gradually building up since September.

Negative exchange netflows showed that accumulation was in progress, but it was unclear if this was enough to push prices past the three-month highs.

Ascending triangle pattern promises $3.3k for ETH

Source: ETH/USDT on TradingView

Since September, Ethereum has been forming a series of higher lows. It was unable to climb past the $2.8k resistance zone, forming an ascending triangle pattern. The OBV has slowly trended higher over the past two months but was well below the levels it maintained in June and July.

This lukewarm demand could weaken the size of the breakout. As things stand, a daily session close above $2.8k would ideally reach the $3,350 level.

This breakout might not be imminent and could take a few days to materialize. A dip toward $2.5k was also a possibility. The RSI, though bullish, did not signal a clear trend in October. The DMI agreed with this, and at press time the ADX (yellow) was falling below 20.

More volume concerns on the lower timeframes

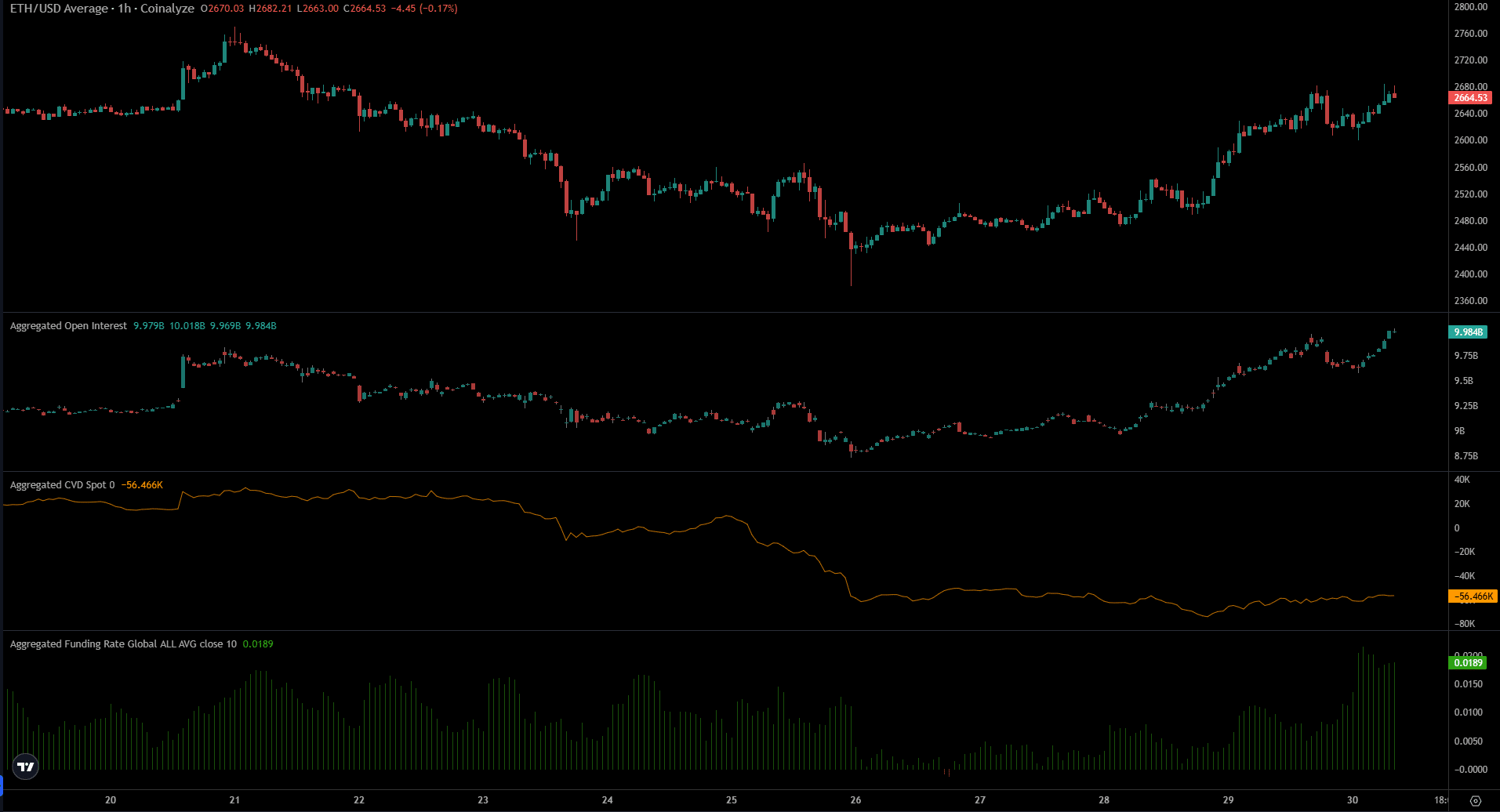

Source: Coinalyze

The Open Interest and the price have been strongly trending upward in the past three days. The funding rate also surged higher over the past 24 hours. Together they indicated firm bullish belief in the lower timeframes.

Is your portfolio green? Check the Ethereum Profit Calculator

Yet, the spot CVD failed to pick up even though ETH is up by 9.4% since the 26th of October. This lack of spot demand alongside the weakness the OBV exhibited raised questions about the bulls’ strength.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- The bullish triangle pattern could see ETH breakout toward $3,350

- Unenthusiastic demand could hurt the chances of a breakout

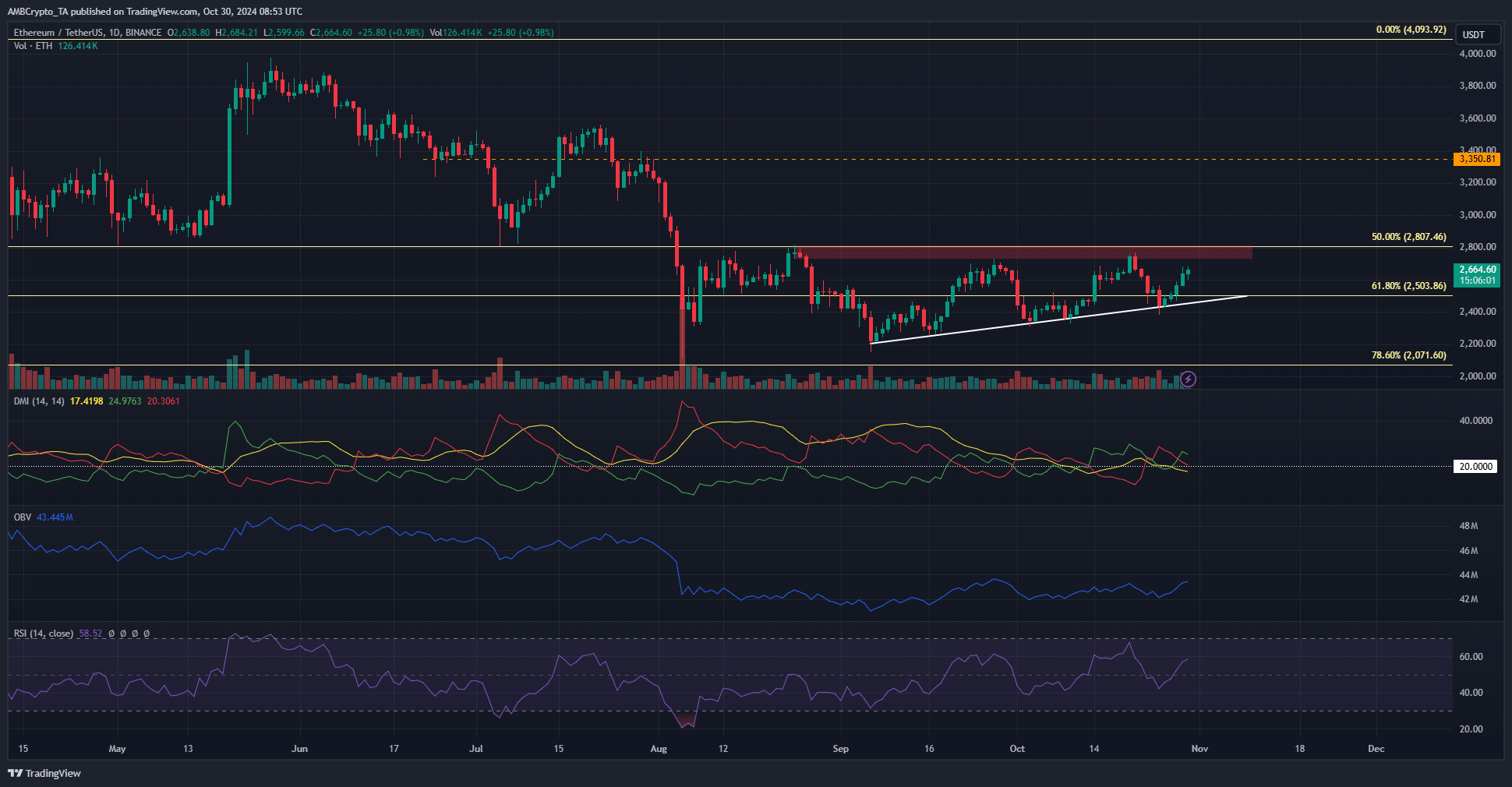

Ethereum [ETH] was trading beneath the resistance zone at $2.8k which was unbeaten since August. The recent move upward was slow and lacked explosive momentum, but has been gradually building up since September.

Negative exchange netflows showed that accumulation was in progress, but it was unclear if this was enough to push prices past the three-month highs.

Ascending triangle pattern promises $3.3k for ETH

Source: ETH/USDT on TradingView

Since September, Ethereum has been forming a series of higher lows. It was unable to climb past the $2.8k resistance zone, forming an ascending triangle pattern. The OBV has slowly trended higher over the past two months but was well below the levels it maintained in June and July.

This lukewarm demand could weaken the size of the breakout. As things stand, a daily session close above $2.8k would ideally reach the $3,350 level.

This breakout might not be imminent and could take a few days to materialize. A dip toward $2.5k was also a possibility. The RSI, though bullish, did not signal a clear trend in October. The DMI agreed with this, and at press time the ADX (yellow) was falling below 20.

More volume concerns on the lower timeframes

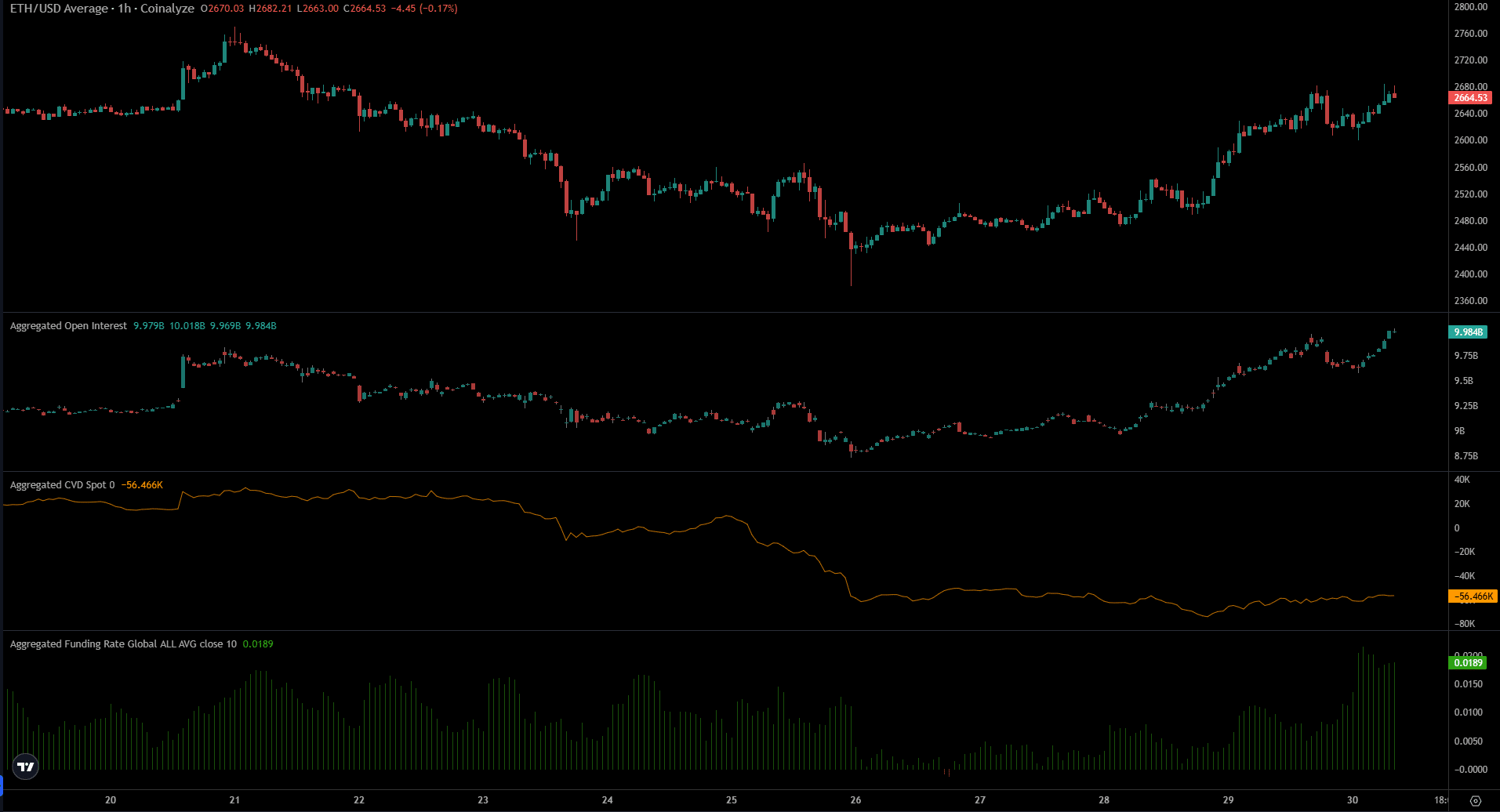

Source: Coinalyze

The Open Interest and the price have been strongly trending upward in the past three days. The funding rate also surged higher over the past 24 hours. Together they indicated firm bullish belief in the lower timeframes.

Is your portfolio green? Check the Ethereum Profit Calculator

Yet, the spot CVD failed to pick up even though ETH is up by 9.4% since the 26th of October. This lack of spot demand alongside the weakness the OBV exhibited raised questions about the bulls’ strength.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

can i buy cheap clomid pill can you buy clomiphene without insurance can i get generic clomid without insurance can i order clomiphene without a prescription order cheap clomid without dr prescription can i order generic clomid without a prescription how can i get generic clomiphene

I’ll certainly carry back to read more.

Thanks on putting this up. It’s well done.

zithromax usa – order sumycin online cheap order metronidazole 400mg generic

semaglutide 14 mg ca – buy periactin online periactin for sale

order motilium pills – domperidone generic purchase cyclobenzaprine pills

purchase augmentin without prescription – https://atbioinfo.com/ buy generic acillin for sale

esomeprazole where to buy – https://anexamate.com/ nexium 40mg sale

warfarin 2mg ca – cou mamide buy cheap generic cozaar

buy meloxicam 7.5mg generic – tenderness mobic 7.5mg pills

order deltasone 20mg generic – asthma order prednisone pills