- Coinbase’s Q3 revenue dropped amid reduced trading but achieved a $75 million profit.

- The firm strengthened its crypto stance with a $1 billion buyback and Fairshake PAC support.

In an unexpected turn, on the 30th of October, Coinbase revealed a drop in quarterly revenue. This points to a decline in crypto trading activity among users over the summer months.

As per the report, the exchange’s revenue dipped to $1.2 billion in Q3 2024, down from $1.45 billion in the prior quarter. Despite this, Coinbase posted a notable turnaround with a $75 million profit.

This is a stark improvement from the $2 million loss reported last year.

Coinbase Q3 revenue sparks concerns

Coinbase experienced a 27% drop in transaction fees compared to the previous quarter due to declining trading volumes.

The company’s shareholder letter outlined ongoing market challenges. The letter highlighted that subscription and services revenue had decreased by 7%, bringing in $556.1 million for the quarter.

This revenue comes from products like stablecoins, staking, and leverage for Prime traders.

In its shareholder letter, the firm noted,

“We are working to drive revenue growth through products like derivatives, international expansion, custody, and deeper integration of USDC into the cryptoeconomy.”

However, Anil Gupta, Coinbase’s vice president of investor relations, seemed positive as highlighted in a conversation with a publication where he marked the company’s fourth consecutive profitable quarter.

“It was a solid quarter for the business across the three priorities we set forth early in the year: driving revenue, driving crypto utility, and driving regulatory clarity.”

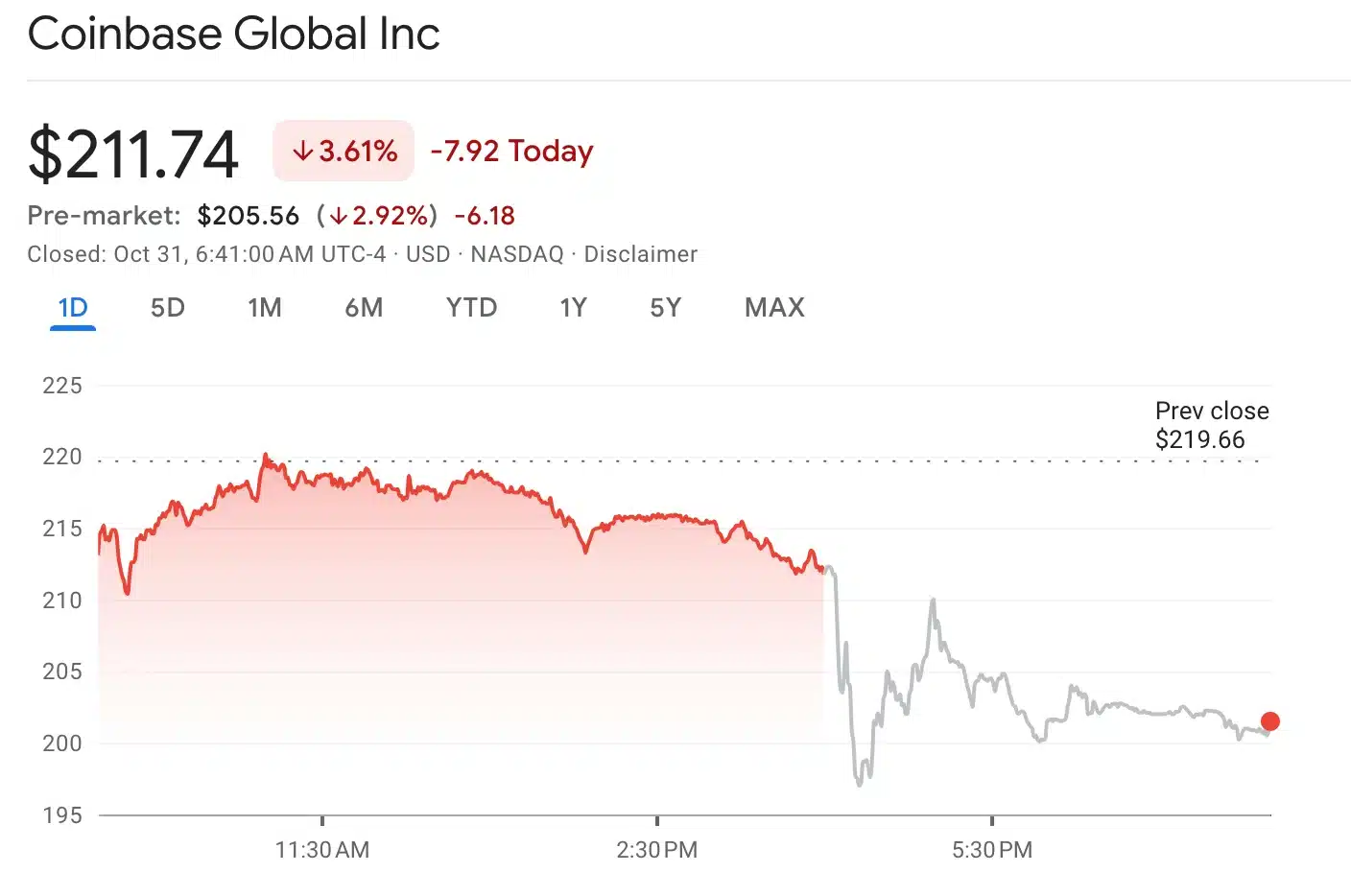

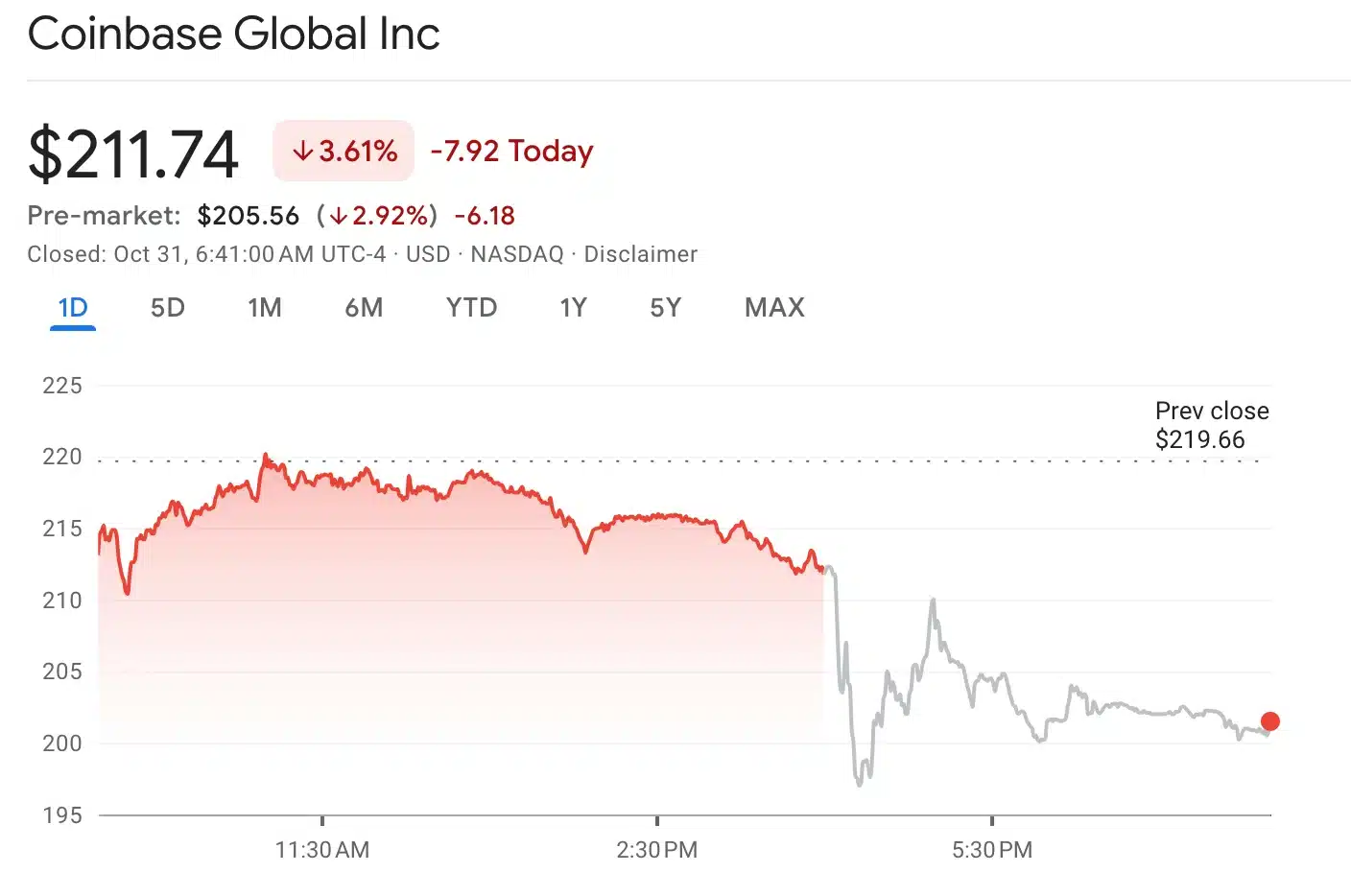

Coinbase stock price trend

In March, Coinbase’s stock price surged to a peak of $279, fueled by Bitcoin [BTC] reaching a record high of nearly $73,000.

Although shares have since dipped to $211 as of 30th October’s close, they remain up 35% year-to-date.

However, in after-hours trading, Coinbase’s stock saw a further decline, dropping to $202.

As of the latest update, Bitcoin’s price settled at $72,288.21 after a slight 0.37% decrease in the last 24 hours, while Coinbase shares traded at $211.74, down by 3.61% at press time.

Source: Google Finance

What lies ahead?

Oppenheimer analysts projected a dip in Coinbase’s trading volume due to a lack of strong market catalysts and election uncertainty.

Analysts remain cautiously optimistic, noting VP Kamala Harris’s endorsement of a digital asset regulatory framework.

This could drive Coinbase trading activity in Q4, potentially offsetting the slowdown.

The introduction of a $1 billion stock buyback program underscores the company’s optimistic long-term outlook, aimed at rewarding investors.

Additionally, Coinbase’s stablecoin revenue saw growth, particularly with USDC, supported by platform incentives and expanded product integration.

On the political front, Coinbase is reinforcing its commitment to pro-crypto policy by contributing $25 million to Fairshake PAC, a move intended to back crypto-friendly candidates in the 2026 elections.

This will solidify its role in shaping favorable regulatory outcomes for digital assets.

Source: Brian Armstrong/X

- Coinbase’s Q3 revenue dropped amid reduced trading but achieved a $75 million profit.

- The firm strengthened its crypto stance with a $1 billion buyback and Fairshake PAC support.

In an unexpected turn, on the 30th of October, Coinbase revealed a drop in quarterly revenue. This points to a decline in crypto trading activity among users over the summer months.

As per the report, the exchange’s revenue dipped to $1.2 billion in Q3 2024, down from $1.45 billion in the prior quarter. Despite this, Coinbase posted a notable turnaround with a $75 million profit.

This is a stark improvement from the $2 million loss reported last year.

Coinbase Q3 revenue sparks concerns

Coinbase experienced a 27% drop in transaction fees compared to the previous quarter due to declining trading volumes.

The company’s shareholder letter outlined ongoing market challenges. The letter highlighted that subscription and services revenue had decreased by 7%, bringing in $556.1 million for the quarter.

This revenue comes from products like stablecoins, staking, and leverage for Prime traders.

In its shareholder letter, the firm noted,

“We are working to drive revenue growth through products like derivatives, international expansion, custody, and deeper integration of USDC into the cryptoeconomy.”

However, Anil Gupta, Coinbase’s vice president of investor relations, seemed positive as highlighted in a conversation with a publication where he marked the company’s fourth consecutive profitable quarter.

“It was a solid quarter for the business across the three priorities we set forth early in the year: driving revenue, driving crypto utility, and driving regulatory clarity.”

Coinbase stock price trend

In March, Coinbase’s stock price surged to a peak of $279, fueled by Bitcoin [BTC] reaching a record high of nearly $73,000.

Although shares have since dipped to $211 as of 30th October’s close, they remain up 35% year-to-date.

However, in after-hours trading, Coinbase’s stock saw a further decline, dropping to $202.

As of the latest update, Bitcoin’s price settled at $72,288.21 after a slight 0.37% decrease in the last 24 hours, while Coinbase shares traded at $211.74, down by 3.61% at press time.

Source: Google Finance

What lies ahead?

Oppenheimer analysts projected a dip in Coinbase’s trading volume due to a lack of strong market catalysts and election uncertainty.

Analysts remain cautiously optimistic, noting VP Kamala Harris’s endorsement of a digital asset regulatory framework.

This could drive Coinbase trading activity in Q4, potentially offsetting the slowdown.

The introduction of a $1 billion stock buyback program underscores the company’s optimistic long-term outlook, aimed at rewarding investors.

Additionally, Coinbase’s stablecoin revenue saw growth, particularly with USDC, supported by platform incentives and expanded product integration.

On the political front, Coinbase is reinforcing its commitment to pro-crypto policy by contributing $25 million to Fairshake PAC, a move intended to back crypto-friendly candidates in the 2026 elections.

This will solidify its role in shaping favorable regulatory outcomes for digital assets.

Source: Brian Armstrong/X

where can i get cheap clomid tablets can i get cheap clomid price can i buy cheap clomid tablets generic clomiphene walmart can i get generic clomiphene prices clomid for sale australia how to get clomid pill

I couldn’t weather commenting. Well written!

I’ll certainly bring back to skim more.

zithromax 250mg canada – order azithromycin 250mg without prescription buy flagyl 400mg generic

semaglutide 14mg over the counter – buy periactin pill order periactin 4 mg

domperidone generic – buy cyclobenzaprine paypal cyclobenzaprine price

buy generic nexium 40mg – https://anexamate.com/ buy esomeprazole 20mg pill

buy warfarin tablets – anticoagulant cozaar 50mg tablet

mobic 7.5mg cost – https://moboxsin.com/ buy generic mobic online

buy prednisone 5mg online – inflammatory bowel diseases order deltasone 40mg without prescription

hims ed pills – buy erectile dysfunction medications generic ed pills

amoxicillin drug – https://combamoxi.com/ amoxil cheap

order fluconazole 100mg generic – fluconazole 100mg cost fluconazole online

purchase cenforce generic – on this site buy cenforce 100mg online cheap

safest and most reliable pharmacy to buy cialis – cialis high blood pressure cialis how long does it last

zantac where to buy – https://aranitidine.com/ zantac 150mg drug

cialis for sale toronto – https://strongtadafl.com/# cialis for sale toronto