- Bitcoin’s Open Interest soared while its supply on exchanges dropped sharply

- A price correction could push BTC down to $66k or even $62k

Bitcoin [BTC] has been on steady hike over the past week. In fact, its latest bull trend allowed the king coin to cross $68k on the price charts. However, the prevailing trend might change soon, albeit for a short while.

This seemed to be the case, especially as a bearish divergence appeared on Bitcoin’s price chart.

Bitcoin’s major strengths

According to CoinMarketCap, the crypto’s price appreciated by over 9% last week, allowing it to jump above $68k. AMBCrypto reported previously a few developments that could have played a major role in BTC’s most-recent rally.

For instance, Bitcoin’s supply held on exchanges dropped to a 5-year low. This clearly meant that buying sentiment was dominant in the market – Hinting at a price hike.

Apart from that, AMBCrypto also reported how BTC’s Open Interest soared. To be precise, Bitcoin’s Open Interest hit a record $20 billion, just 8% below its ATH. Whenever the metric rises, it means that the chances of the ongoing price trend continuing are high.

Satoshi Club, a popular X handle that shares updates related to cryptos, recently posted a tweet highlighting yet another major development. According to the same, BTC’s supply held by addresses that bought in the last 12 months is now at a 2-year high. This trend has accelerated recently on the back of ETFs seeing inflows of $2.1 billion over the last five days.

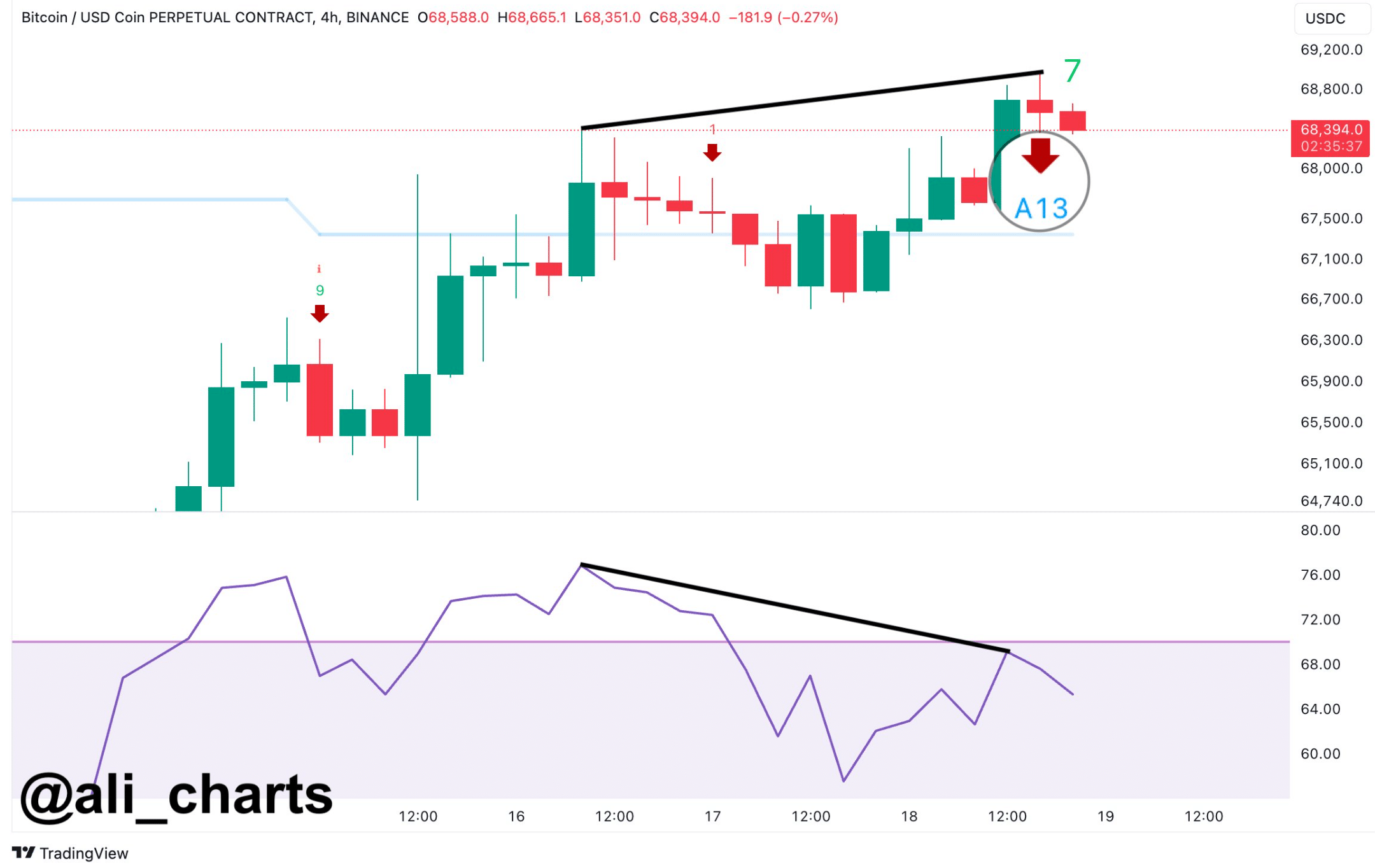

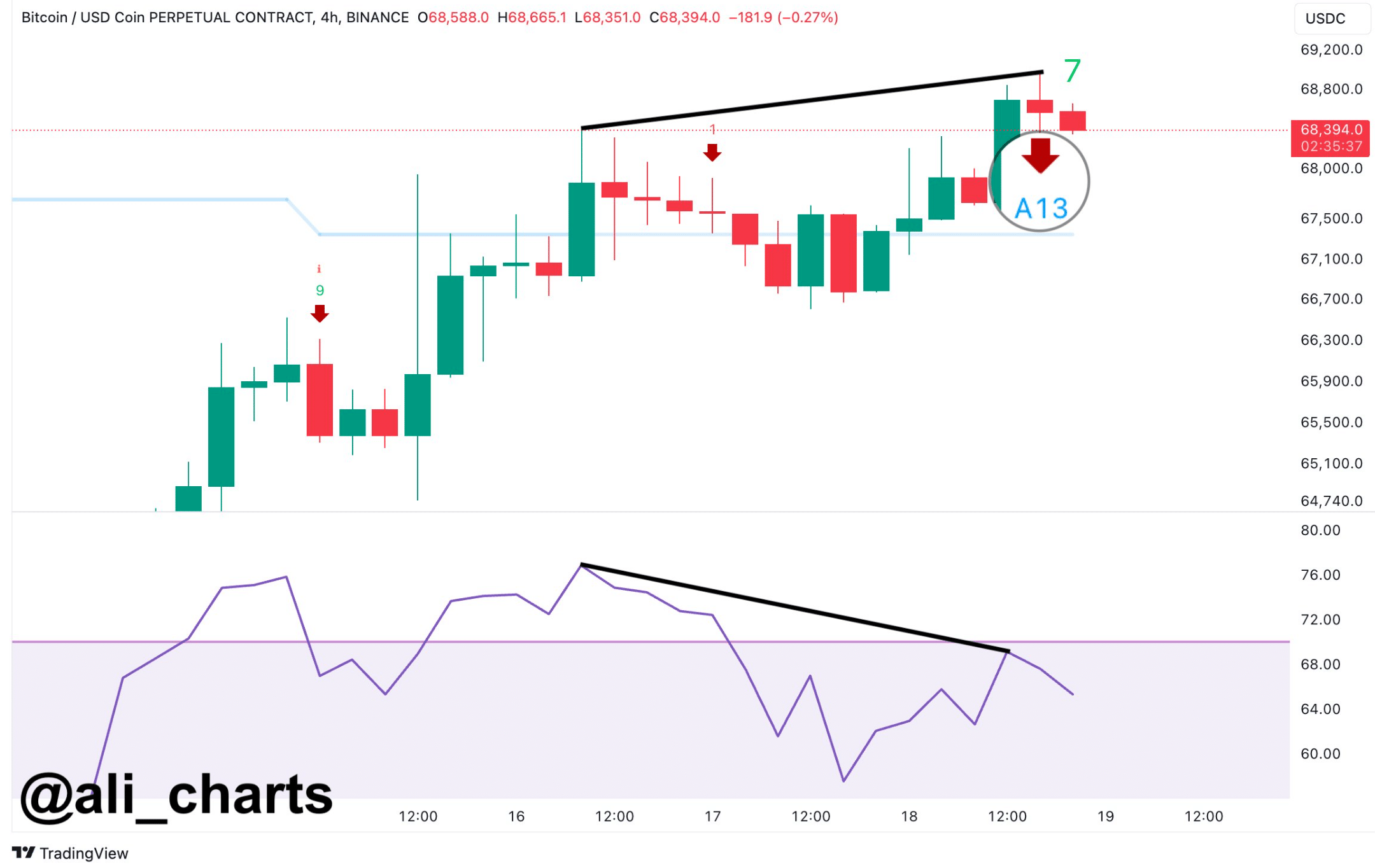

Nonetheless, not everything has been working in the king coin’s favor. Ali, a popular crypto analyst, shared a tweet, mentioning a bearish divergence. This indicated that there were chances of a short-term price correction here. Hence, it’s worth taking a closer look at the current state of Bitcoin.

Source: X

Is a price correction inevitable?

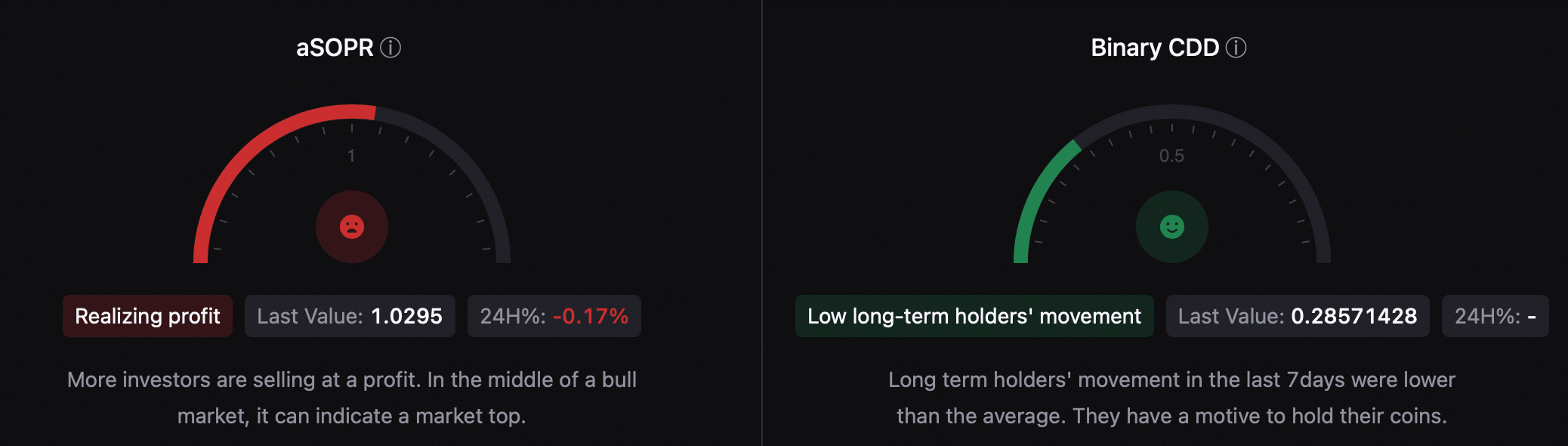

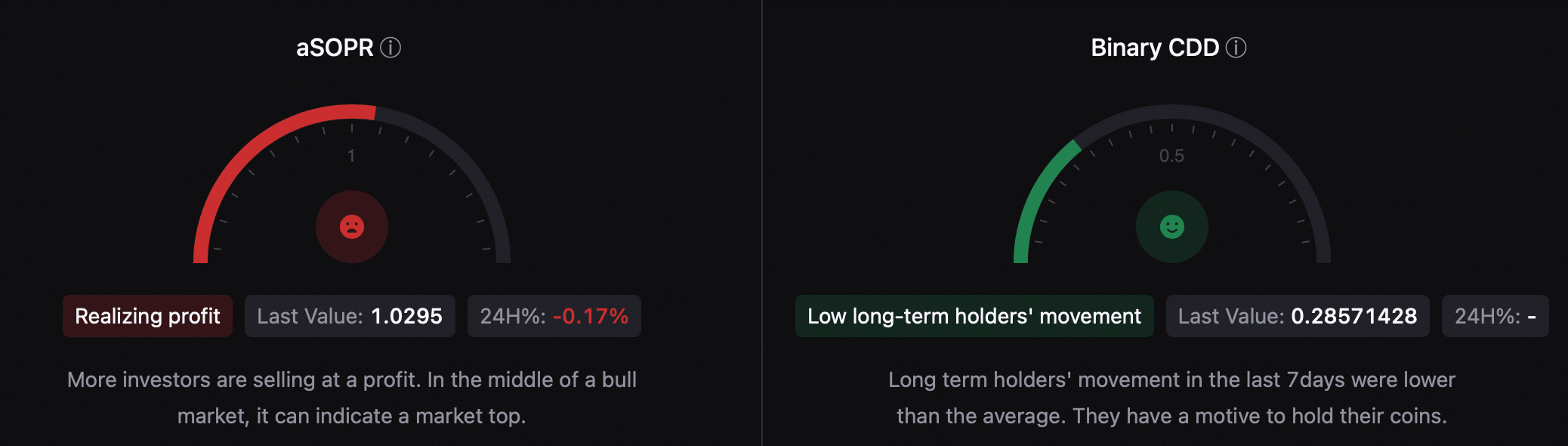

AMBCrypto’s analysis of CryptoQuant’s data revealed quite a few interesting metrics. For instance, the king coin’s binary CDD was green, meaning that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins.

However, the aSORP suggested that more investors have been selling at a profit. In the middle of a bull market, it can indicate a market top.

Moreover, the NULP was also bearish, as it indicated that investors were in a belief phase where they were in a state of high unrealized profits.

Source: CryptoQuant

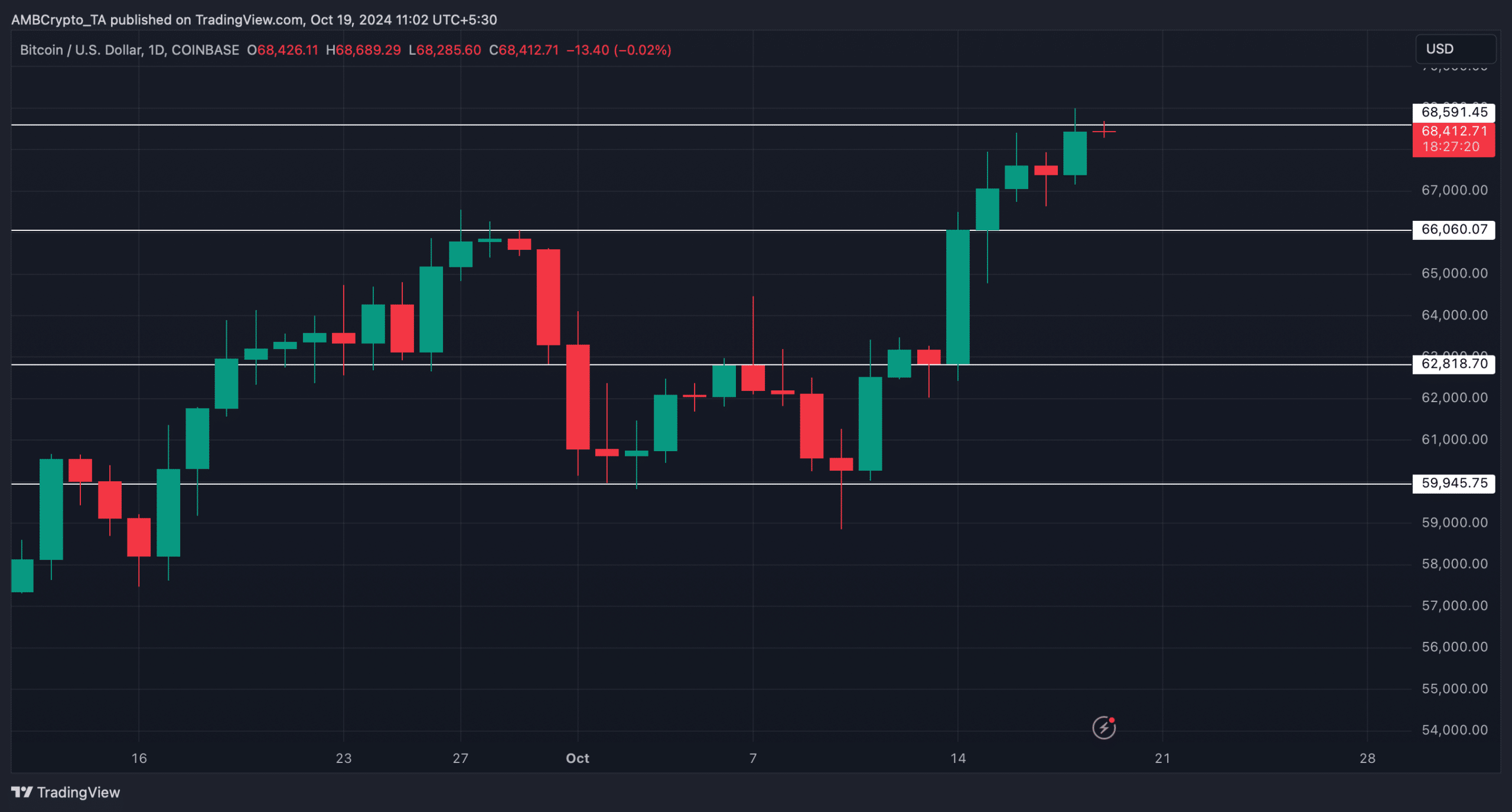

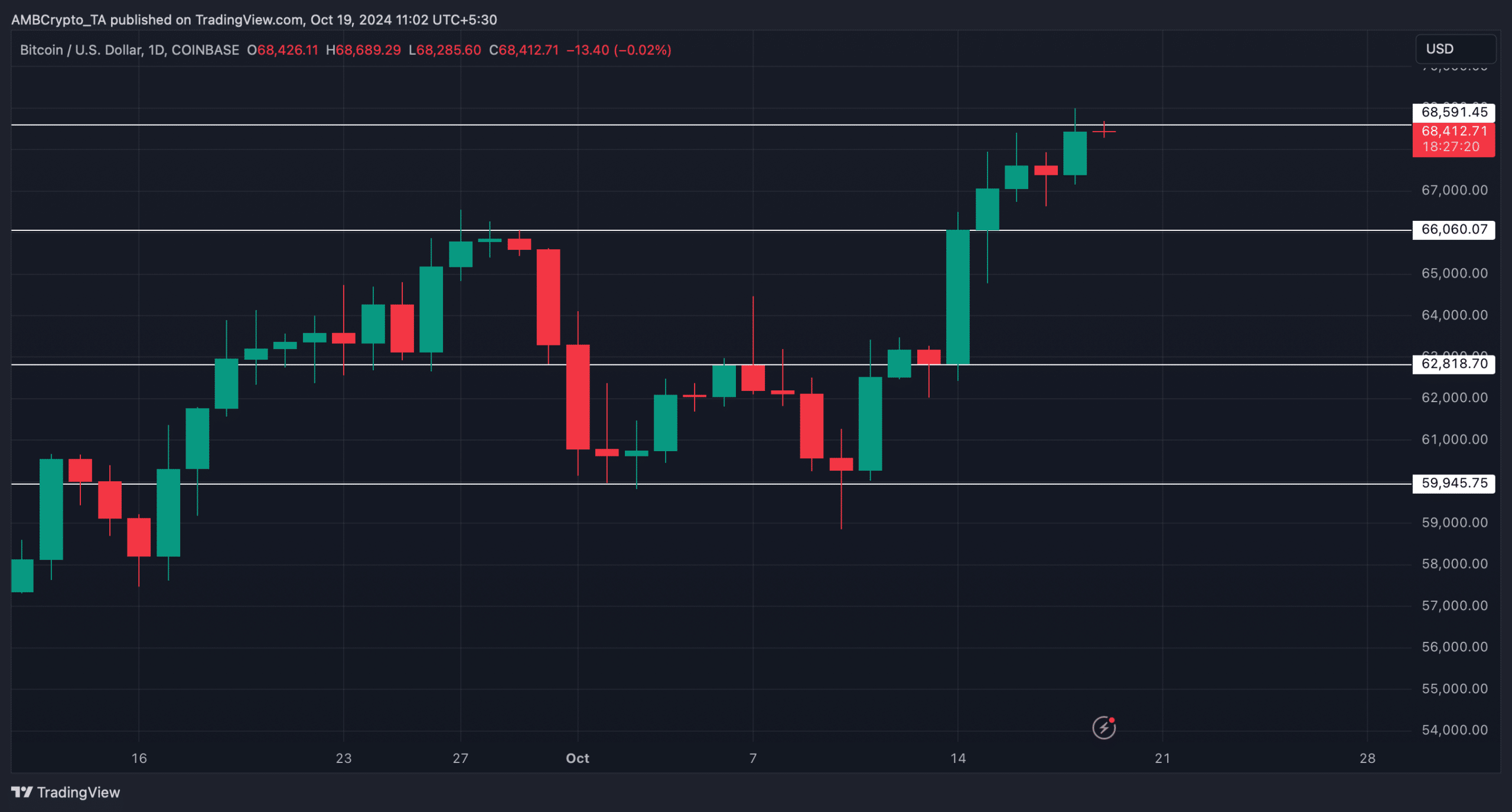

Finally, we then took a look at Bitcoin’s daily chart to find the possible support the coin might drop to in case of a price correction.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

According to our analysis, a price correction might result in BTC once again dropping to $66k. A slip under that level could push the coin further down to $62.8k.

Source: TradingView

- Bitcoin’s Open Interest soared while its supply on exchanges dropped sharply

- A price correction could push BTC down to $66k or even $62k

Bitcoin [BTC] has been on steady hike over the past week. In fact, its latest bull trend allowed the king coin to cross $68k on the price charts. However, the prevailing trend might change soon, albeit for a short while.

This seemed to be the case, especially as a bearish divergence appeared on Bitcoin’s price chart.

Bitcoin’s major strengths

According to CoinMarketCap, the crypto’s price appreciated by over 9% last week, allowing it to jump above $68k. AMBCrypto reported previously a few developments that could have played a major role in BTC’s most-recent rally.

For instance, Bitcoin’s supply held on exchanges dropped to a 5-year low. This clearly meant that buying sentiment was dominant in the market – Hinting at a price hike.

Apart from that, AMBCrypto also reported how BTC’s Open Interest soared. To be precise, Bitcoin’s Open Interest hit a record $20 billion, just 8% below its ATH. Whenever the metric rises, it means that the chances of the ongoing price trend continuing are high.

Satoshi Club, a popular X handle that shares updates related to cryptos, recently posted a tweet highlighting yet another major development. According to the same, BTC’s supply held by addresses that bought in the last 12 months is now at a 2-year high. This trend has accelerated recently on the back of ETFs seeing inflows of $2.1 billion over the last five days.

Nonetheless, not everything has been working in the king coin’s favor. Ali, a popular crypto analyst, shared a tweet, mentioning a bearish divergence. This indicated that there were chances of a short-term price correction here. Hence, it’s worth taking a closer look at the current state of Bitcoin.

Source: X

Is a price correction inevitable?

AMBCrypto’s analysis of CryptoQuant’s data revealed quite a few interesting metrics. For instance, the king coin’s binary CDD was green, meaning that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins.

However, the aSORP suggested that more investors have been selling at a profit. In the middle of a bull market, it can indicate a market top.

Moreover, the NULP was also bearish, as it indicated that investors were in a belief phase where they were in a state of high unrealized profits.

Source: CryptoQuant

Finally, we then took a look at Bitcoin’s daily chart to find the possible support the coin might drop to in case of a price correction.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

According to our analysis, a price correction might result in BTC once again dropping to $66k. A slip under that level could push the coin further down to $62.8k.

Source: TradingView

![Will Uniswap [UNI] be a dark horse post-Bitcoin halving?](https://coininsights.com/wp-content/uploads/2024/04/uni-sentiment-and-mvrv-ratio-120x86.png)

buying clomid tablets how to buy cheap clomid can you buy generic clomiphene prices where can i get generic clomid without prescription clomiphene rx for men buying clomiphene without dr prescription order generic clomid without insurance

I couldn’t resist commenting. Adequately written!

The sagacity in this piece is exceptional.

zithromax 250mg without prescription – buy azithromycin 500mg generic order generic flagyl

buy generic semaglutide 14 mg – buy semaglutide 14mg online cheap purchase cyproheptadine online

order domperidone 10mg for sale – order flexeril 15mg sale flexeril 15mg brand

order inderal 20mg sale – clopidogrel 150mg pill methotrexate where to buy

purchase amoxil generic – cheap amoxicillin generic where can i buy ipratropium

buy zithromax 500mg pill – nebivolol 20mg without prescription order bystolic 5mg online cheap

augmentin 625mg tablet – atbioinfo ampicillin sale

where can i buy nexium – nexiumtous nexium 40mg oral

how to get coumadin without a prescription – https://coumamide.com/ oral hyzaar

order meloxicam 7.5mg – tenderness meloxicam price

order prednisone 20mg without prescription – aprep lson prednisone 40mg ca

buy erectile dysfunction drugs – fast ed to take buy ed pills uk

buy generic amoxil – buy amoxicillin generic cheap amoxicillin for sale

order fluconazole pills – https://gpdifluca.com/# order fluconazole 100mg pill

cenforce 50mg pill – https://cenforcers.com/ oral cenforce 100mg

purchase zantac pill – cheap ranitidine buy zantac online

Thanks on sharing. It’s acme quality. nolvadex usa

100mg white viagra s100 – order generic viagra canada buy viagra cheap canada

This website exceedingly has all of the tidings and facts I needed to this participant and didn’t know who to ask. buy cheap zithromax

I’ll certainly bring back to be familiar with more. https://ursxdol.com/prednisone-5mg-tablets/

This website positively has all of the low-down and facts I needed adjacent to this thesis and didn’t identify who to ask. https://prohnrg.com/product/omeprazole-20-mg/

Greetings! Extremely productive recommendation within this article! It’s the crumb changes which wish make the largest changes. Thanks a lot quest of sharing! lasix et potassium

I couldn’t resist commenting. Adequately written! https://ondactone.com/product/domperidone/