- Bitcoin surged past $68,000 for the first time since late July.

- Key metrics peaked at an ATH.

Bitcoin [BTC] bulls are having a field day as their Uptober dreams appear to be turning into reality. This week, the king coin made a remarkable comeback, breaching critical resistance levels.

On the 16th of October, the king coin climbed to $68,424, marking its highest price in nearly three months. MicroStrategy Co-Founder and Chairman Michael Saylor chimed in on the excitement, declaring,

“To the moon.”

His words captured the optimism among crypto enthusiasts, as Bitcoin’s surge fueled renewed confidence and excitement.

At the time of writing, the coin had slightly pulled back to $67,458 but remained up by 0.97% over the past day and 10% over the past week.

Is a Bitcoin supply shock coming?

Aside from the positive price movement, developments on the supply side have fueled traders’ expectations for further gains.

Firstly, Bitcoin miners produce only 450 BTC daily, which falls short of meeting the rising demand driven by ongoing accumulation from institutional investors.

For instance, BlackRock recently added $391.8 million worth of Bitcoin to its holdings.

Worth noting that spot Bitcoin ETFs hold total net assets of $64.46 billion, representing 4.82% of Bitcoin’s market capitalization, according to data from SoSo Value.

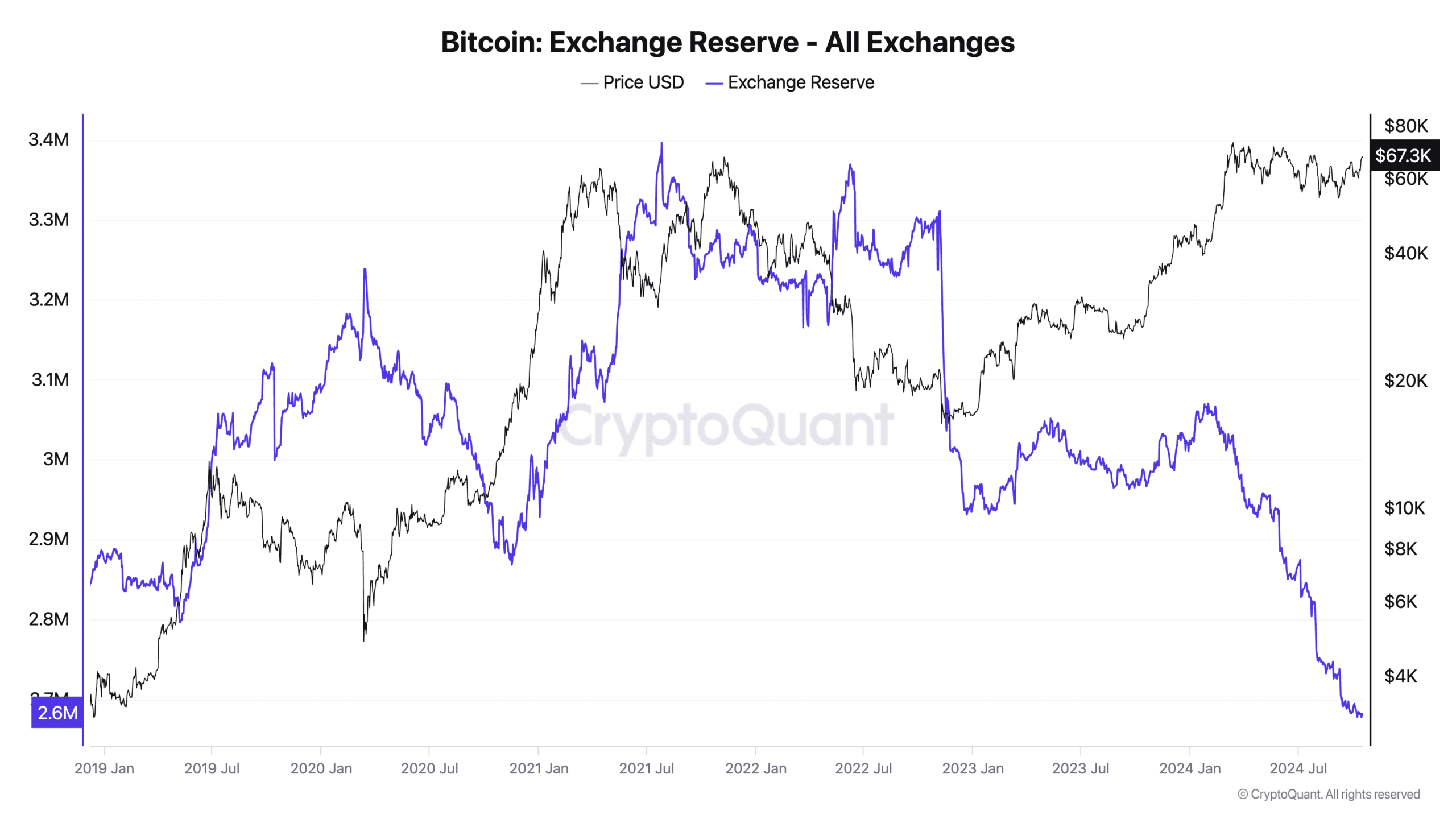

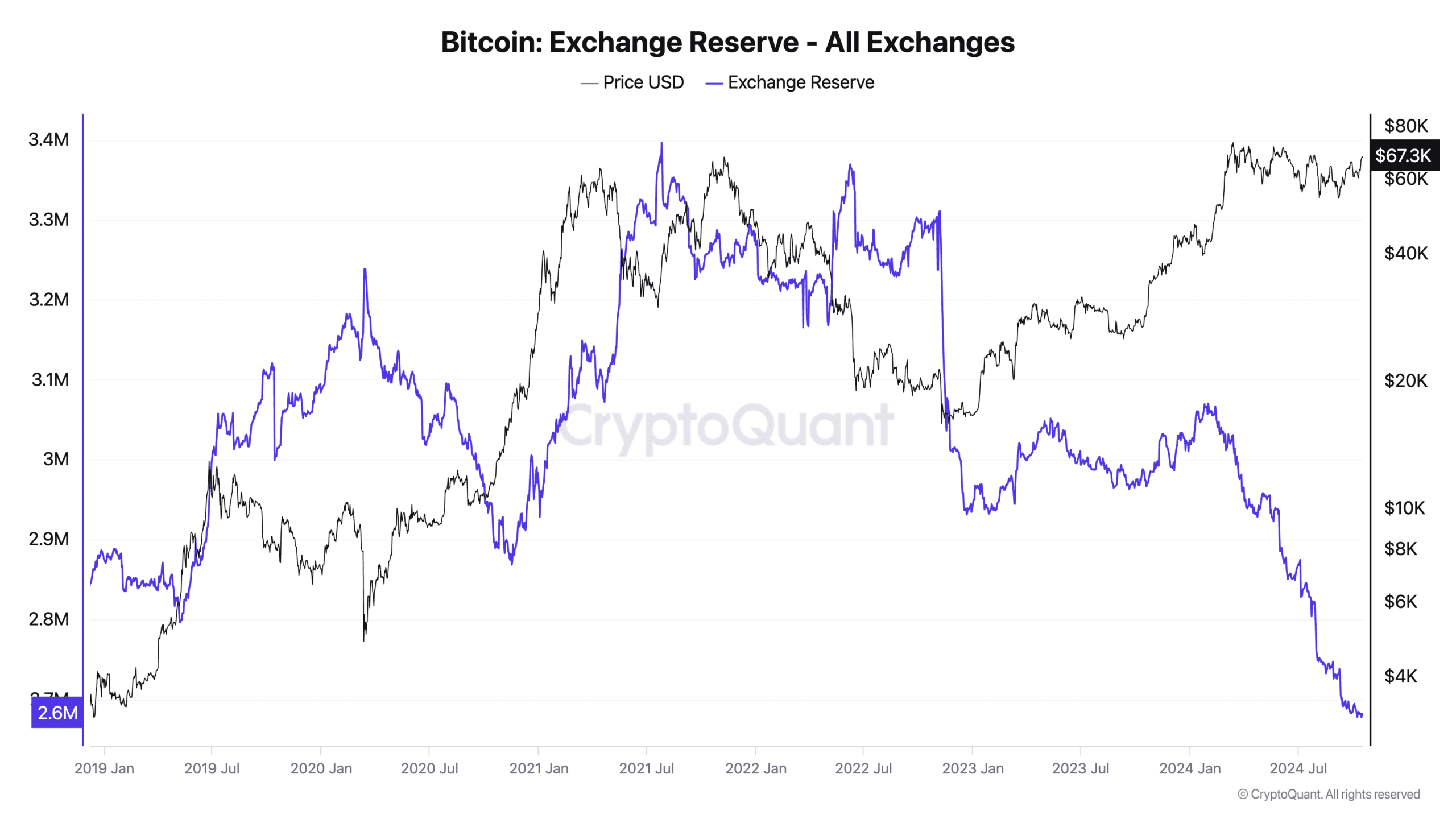

Additionally, the circulating supply of Bitcoin has reached 19.77 million, accounting for 94.14% of the total supply. Lastly, as per CryptoQuant, the Exchange Reserve has fallen to a five-year low of just 2.6 million BTC.

As a result of these factors, the likelihood of a supply shock appears increasingly imminent.

Source: CryptoQuant

What does the derivative data say?

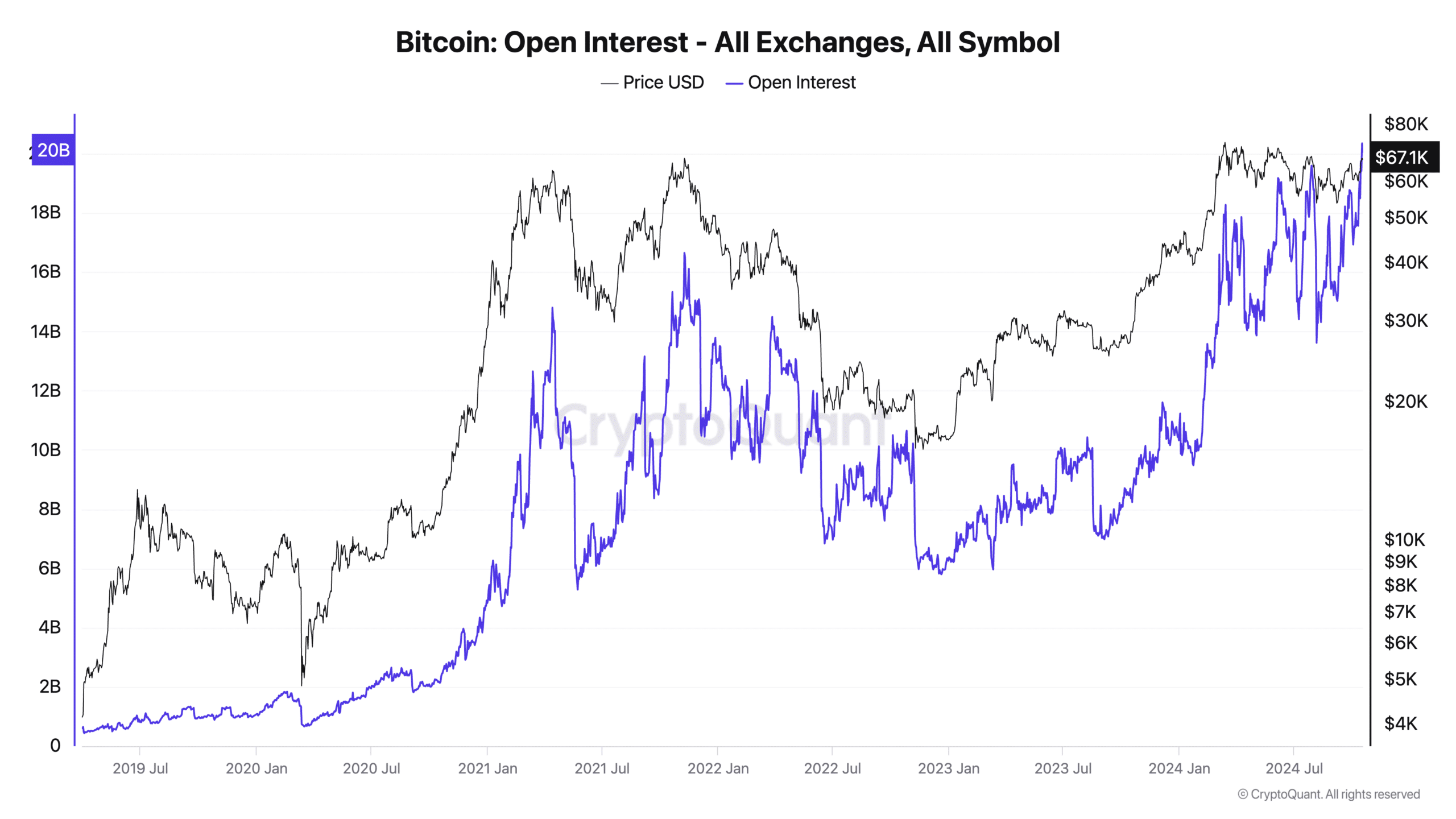

To gain deeper insights into market sentiment surrounding Bitcoin, AMBCrypto analyzed the derivative’s data.

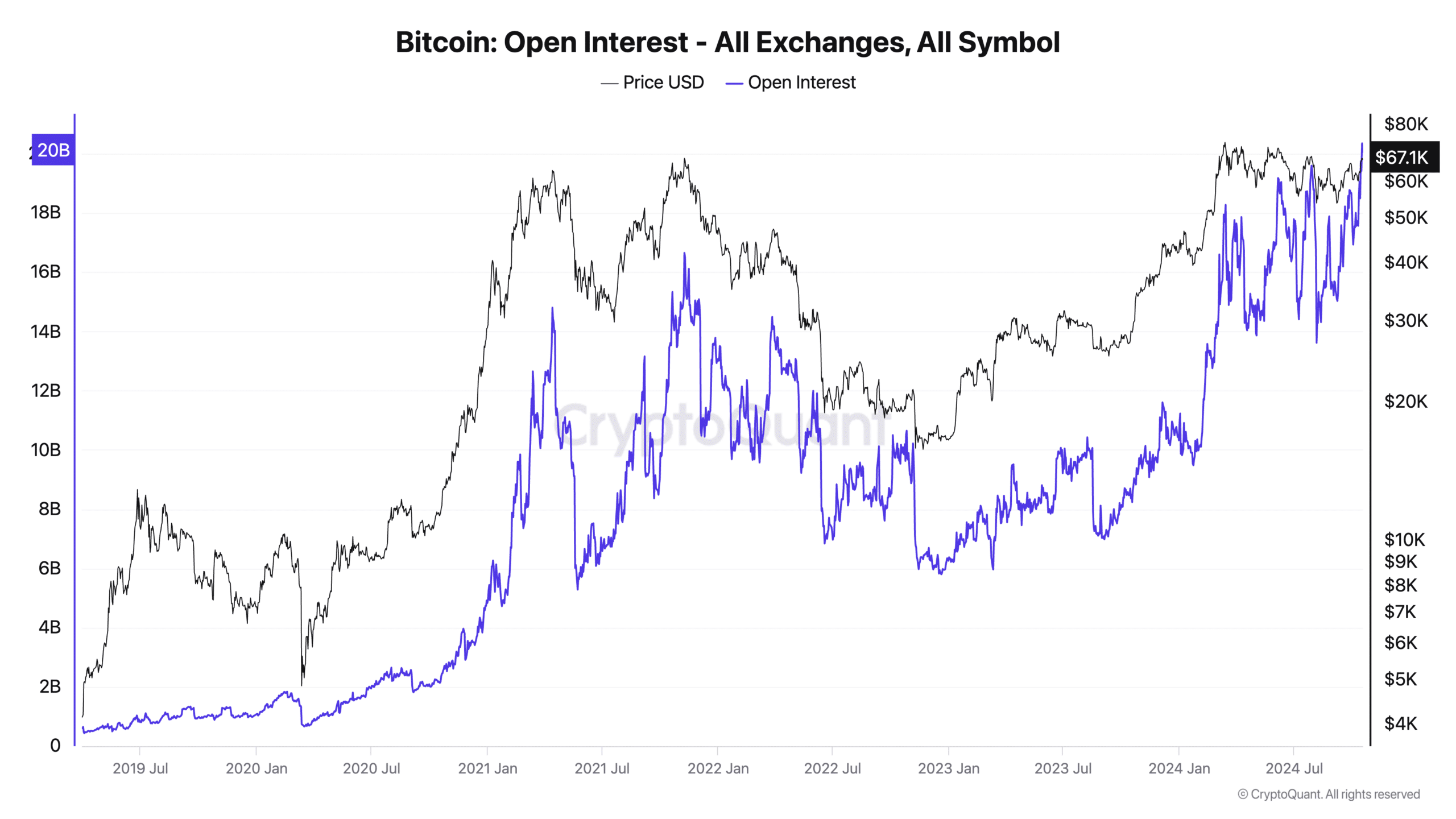

According to CryptoQuant, Bitcoin’s Open Interest (OI) recently reached an all-time high of $20 billion, signaling increased participation and interest.

Source: CryptoQuant

CME Bitcoin Futures OI also hit a record high, reflecting growing institutional involvement. Moreover, the funding rate was positive at press time.

Data from Coinglass showed a Long/Short Ratio of 1.02, indicating a slight preference for long positions. These metrics suggested overall optimism in the market.

BTC closing in on $70K

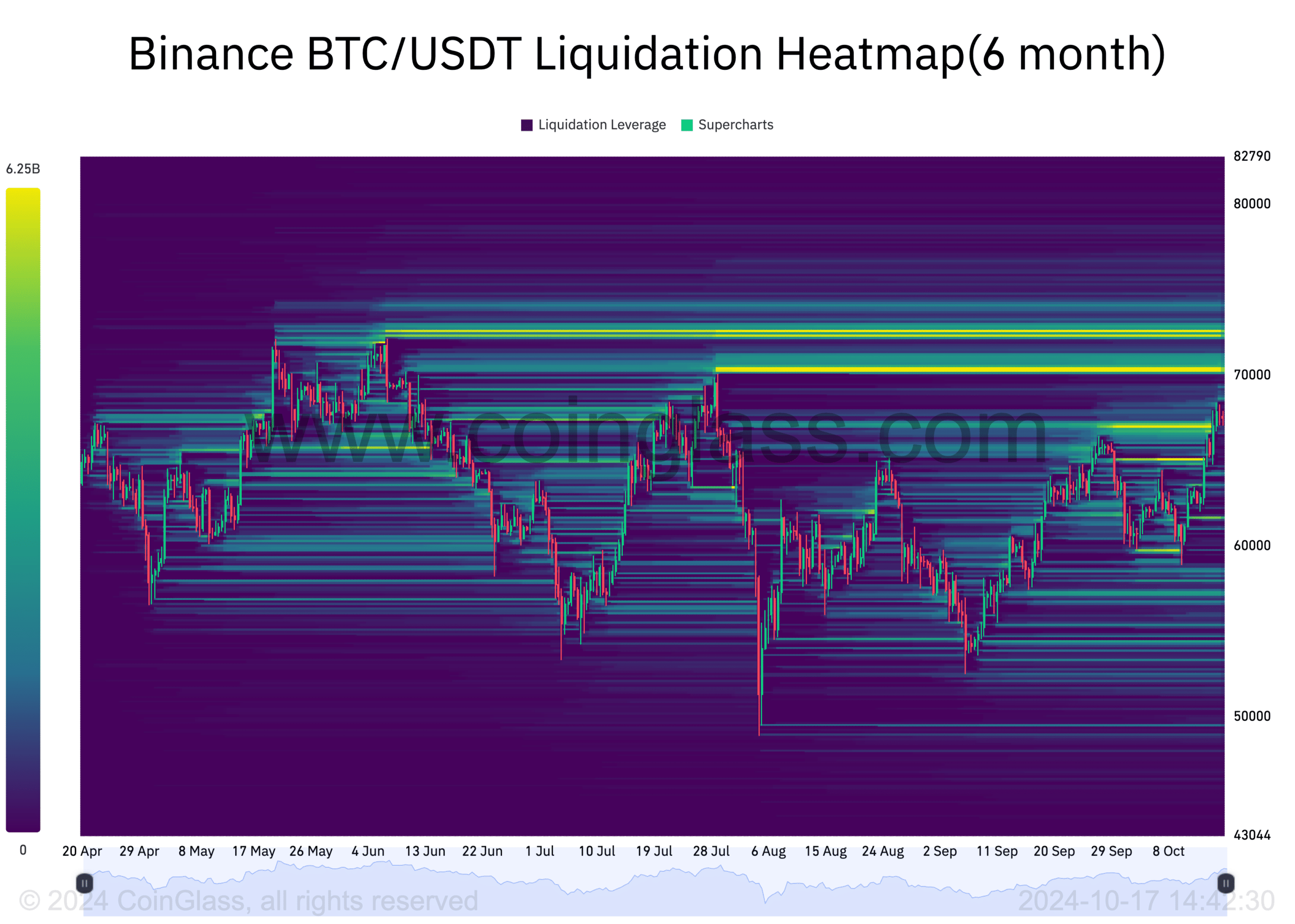

Amid the favorable market environment, with Saylor eyeing the moon, it seems that the moon might be around $70,000.

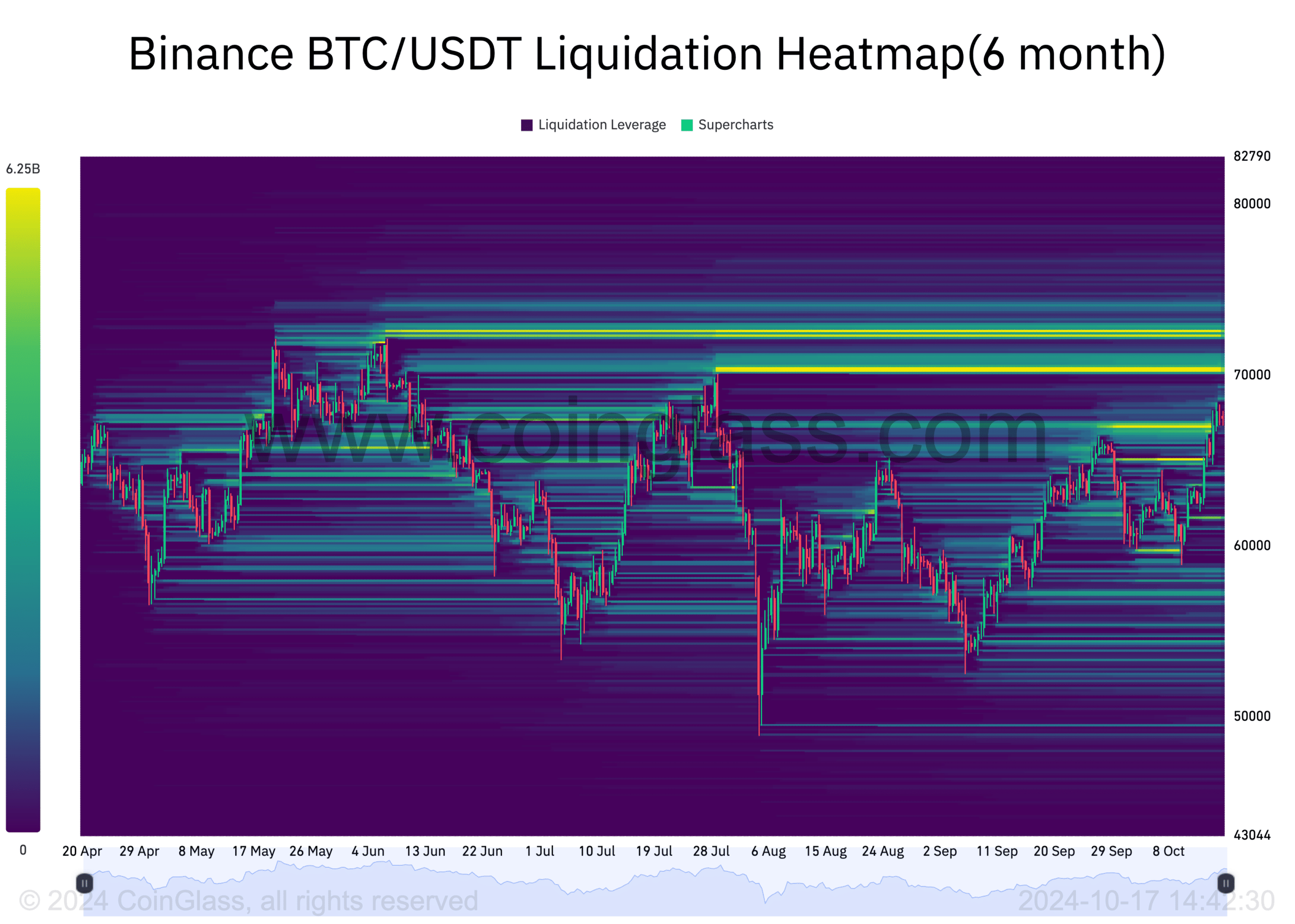

The 6-month liquidation heatmap from Coinglass revealed a substantial liquidity cluster at this level, with $72,300 and $72,600 emerging as the next magnetic zones likely to attract the price.

On the downside, significant liquidity was concentrated around $67,000 and $65,000. If BTC drops to sweep these levels, a rebound could follow.

Source: Coinglass

Thus, given Bitcoin’s trajectory, bulls remain hopeful of reclaiming the record highs set in March.

- Bitcoin surged past $68,000 for the first time since late July.

- Key metrics peaked at an ATH.

Bitcoin [BTC] bulls are having a field day as their Uptober dreams appear to be turning into reality. This week, the king coin made a remarkable comeback, breaching critical resistance levels.

On the 16th of October, the king coin climbed to $68,424, marking its highest price in nearly three months. MicroStrategy Co-Founder and Chairman Michael Saylor chimed in on the excitement, declaring,

“To the moon.”

His words captured the optimism among crypto enthusiasts, as Bitcoin’s surge fueled renewed confidence and excitement.

At the time of writing, the coin had slightly pulled back to $67,458 but remained up by 0.97% over the past day and 10% over the past week.

Is a Bitcoin supply shock coming?

Aside from the positive price movement, developments on the supply side have fueled traders’ expectations for further gains.

Firstly, Bitcoin miners produce only 450 BTC daily, which falls short of meeting the rising demand driven by ongoing accumulation from institutional investors.

For instance, BlackRock recently added $391.8 million worth of Bitcoin to its holdings.

Worth noting that spot Bitcoin ETFs hold total net assets of $64.46 billion, representing 4.82% of Bitcoin’s market capitalization, according to data from SoSo Value.

Additionally, the circulating supply of Bitcoin has reached 19.77 million, accounting for 94.14% of the total supply. Lastly, as per CryptoQuant, the Exchange Reserve has fallen to a five-year low of just 2.6 million BTC.

As a result of these factors, the likelihood of a supply shock appears increasingly imminent.

Source: CryptoQuant

What does the derivative data say?

To gain deeper insights into market sentiment surrounding Bitcoin, AMBCrypto analyzed the derivative’s data.

According to CryptoQuant, Bitcoin’s Open Interest (OI) recently reached an all-time high of $20 billion, signaling increased participation and interest.

Source: CryptoQuant

CME Bitcoin Futures OI also hit a record high, reflecting growing institutional involvement. Moreover, the funding rate was positive at press time.

Data from Coinglass showed a Long/Short Ratio of 1.02, indicating a slight preference for long positions. These metrics suggested overall optimism in the market.

BTC closing in on $70K

Amid the favorable market environment, with Saylor eyeing the moon, it seems that the moon might be around $70,000.

The 6-month liquidation heatmap from Coinglass revealed a substantial liquidity cluster at this level, with $72,300 and $72,600 emerging as the next magnetic zones likely to attract the price.

On the downside, significant liquidity was concentrated around $67,000 and $65,000. If BTC drops to sweep these levels, a rebound could follow.

Source: Coinglass

Thus, given Bitcoin’s trajectory, bulls remain hopeful of reclaiming the record highs set in March.

great articlebandar togel Terpercaya

clomiphene other name clomid generic cost get generic clomiphene without rx clomiphene sale clomiphene buy cost of clomid without prescription can i order cheap clomid prices

More peace pieces like this would urge the web better.

Thanks for sharing. It’s top quality.

where can i buy azithromycin – azithromycin 250mg ca metronidazole usa

where can i buy semaglutide – buy semaglutide sale buy cyproheptadine 4mg online cheap

purchase motilium online – order tetracycline 500mg generic oral cyclobenzaprine

buy inderal 10mg online – methotrexate 2.5mg drug methotrexate 5mg price

amoxicillin price – purchase diovan without prescription combivent price

order zithromax 250mg without prescription – buy azithromycin sale nebivolol 5mg cost

clavulanate uk – atbioinfo buy generic acillin over the counter

order nexium 20mg without prescription – https://anexamate.com/ order esomeprazole 20mg generic

order coumadin 2mg online cheap – https://coumamide.com/ buy losartan 25mg online cheap

buy meloxicam medication – mobo sin order mobic for sale

order prednisone generic – https://apreplson.com/ cheap deltasone 20mg

sexual dysfunction – fastedtotake the blue pill ed

how to buy amoxil – buy amoxil pills for sale buy amoxicillin paypal

cenforce 50mg pills – https://cenforcers.com/ cenforce 100mg cheap

side effects of cialis – https://ciltadgn.com/# cialis professional

zantac 150mg pill – https://aranitidine.com/# buy generic ranitidine for sale

cialis for daily use reviews – https://strongtadafl.com/ how to get cialis for free