- Bearish sentiment around BTC was dominant in the market.

- Selling pressure on the coin was high.

Bitcoin’s [BTC] price action remained underwhelming, as it has failed to move above $64k in the last few days. In the meantime, a key BTC metric entered a zone of indecisive direction.

Does this mean investors have to wait longer to see BTC rise again?

What’s going on with Bitcoin?

CoinMarketCap’s data revealed that BTC was down by more than 2% in the last seven days.

This pushed BTC’s price under $64k, as at press time it was trading at $63,843.66 with a market capitalization of over $1.26 trillion.

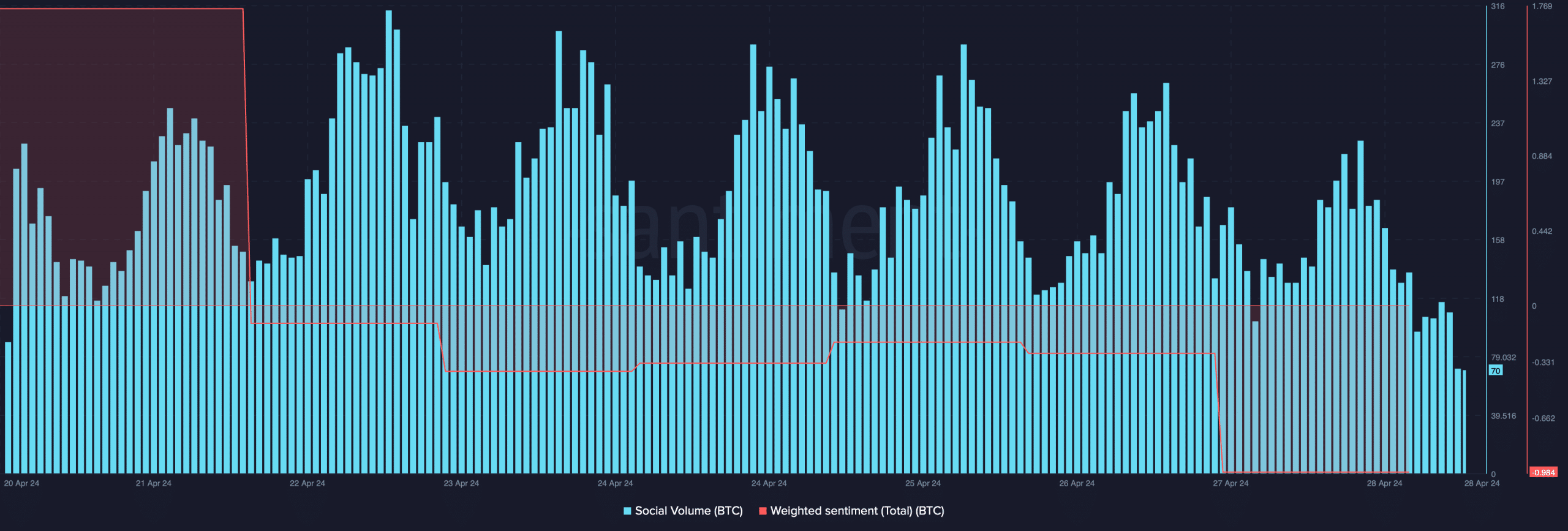

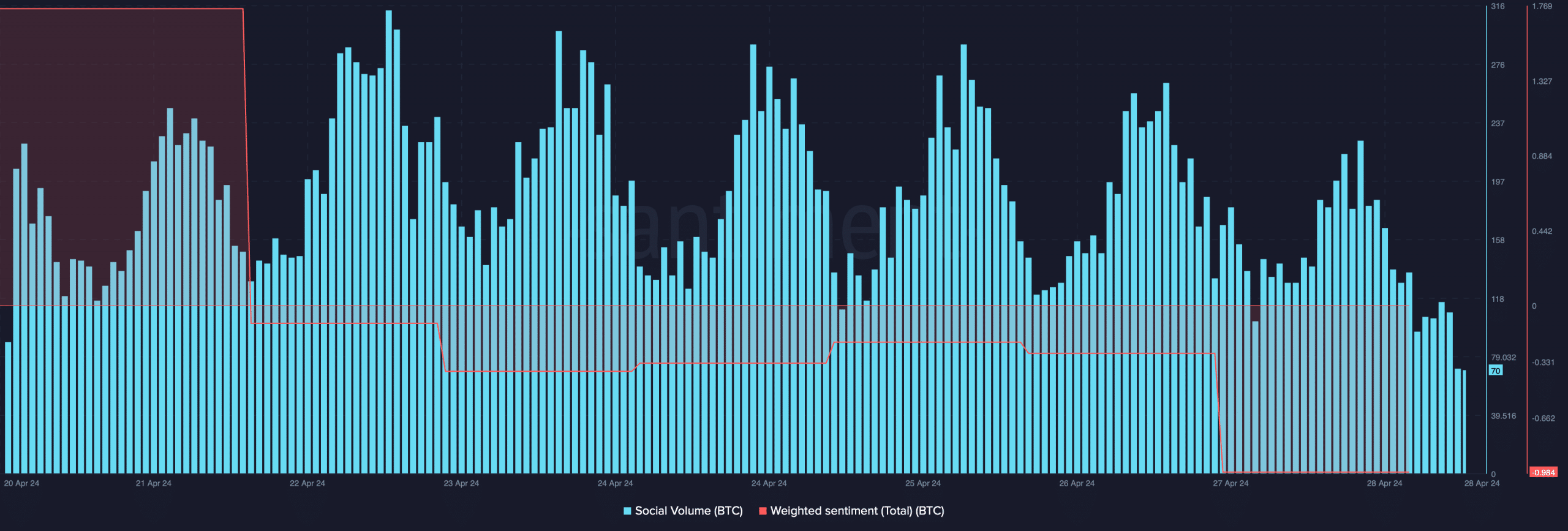

Because of the negative price action, Weighted Sentiment around the king of cryptos turned bearish on the 27th of April.

Its Social Volume also dropped slightly last week, reflecting a decline in BTC’s popularity in the crypto space.

Source: Santiment

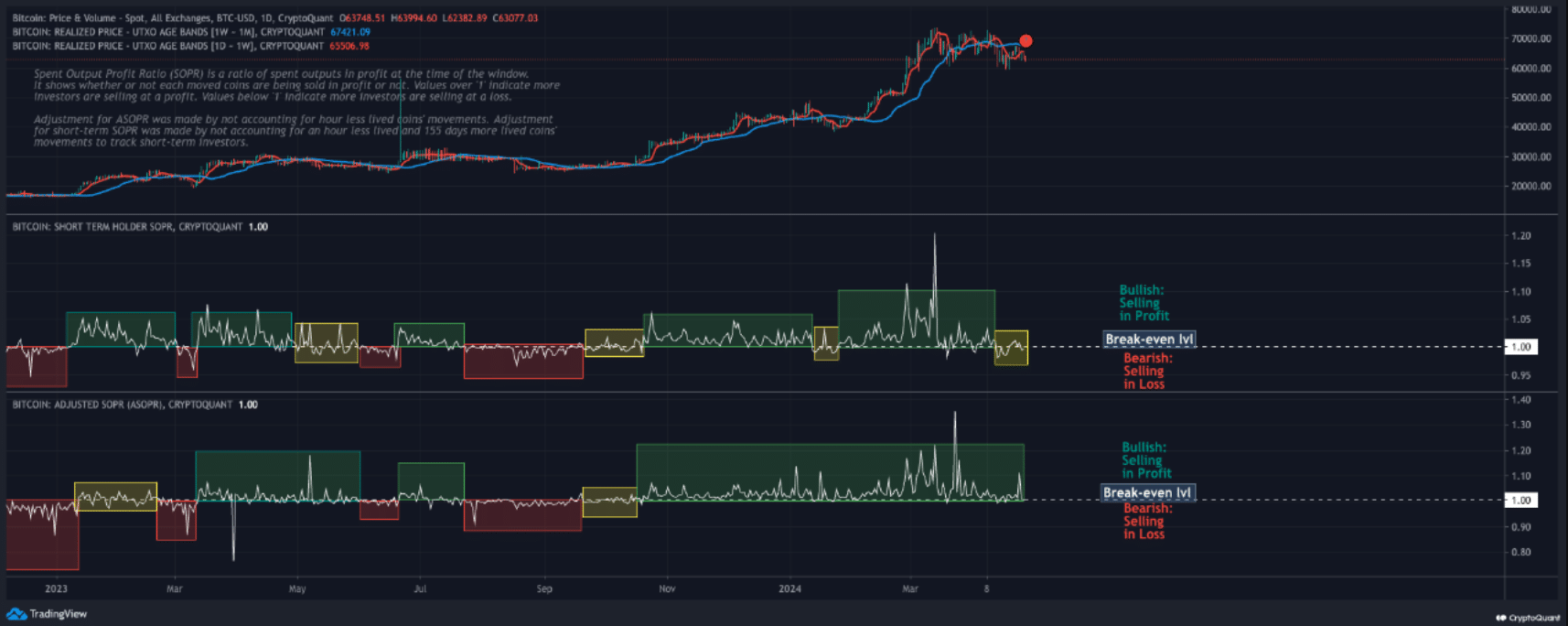

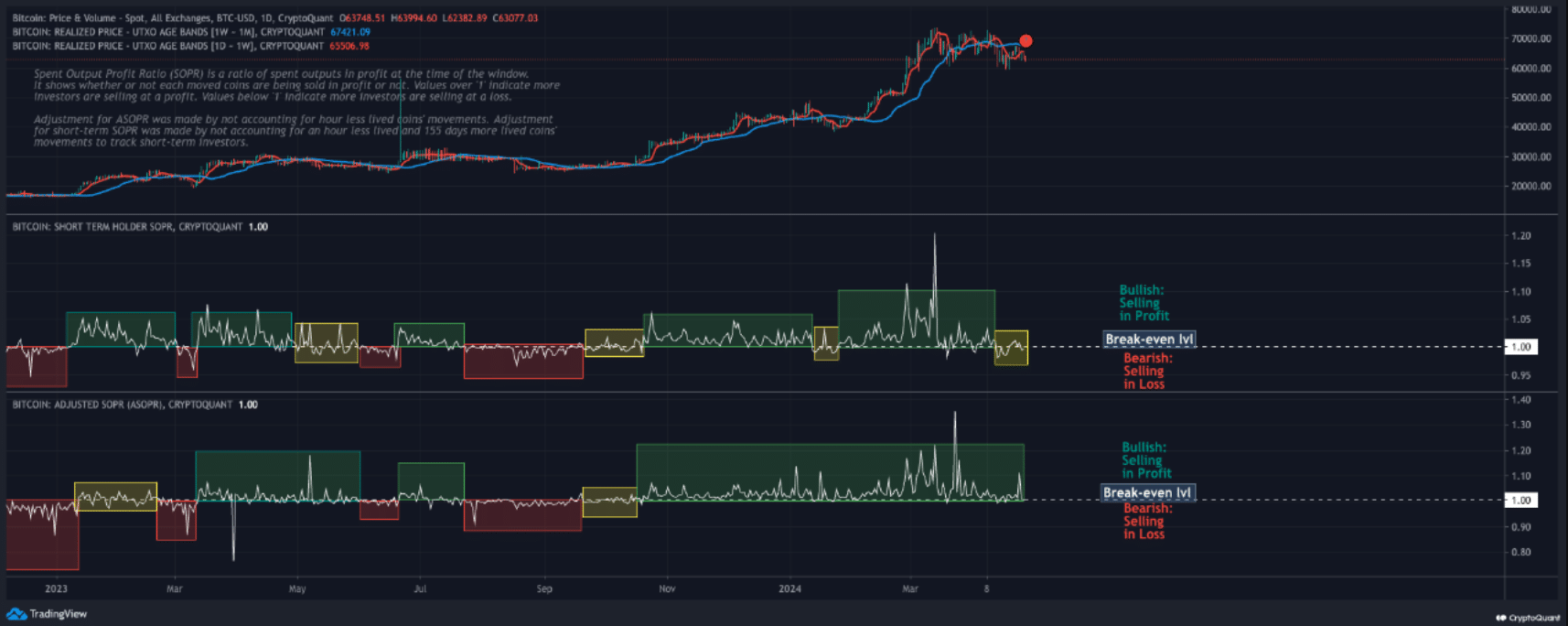

Meanwhile, Phi Deltalytics, an author and analyst at CryptoQuant, posted an analysis using a key BTC metric.

As per the analysis, the adjusted Spent Output Profit Ratio (SOPR) of Bitcoin continued to move in a bullish direction, while the short-term SOPR has entered a zone of uncertainty.

This discrepancy highlighted a complex environment where short-term investors faced losses.

Source: CryptoQuant

The analysis mentioned,

“While fluctuations of this nature are not uncommon, particularly during periods of price exploration toward new all-time highs, heightened vigilance is warranted.”

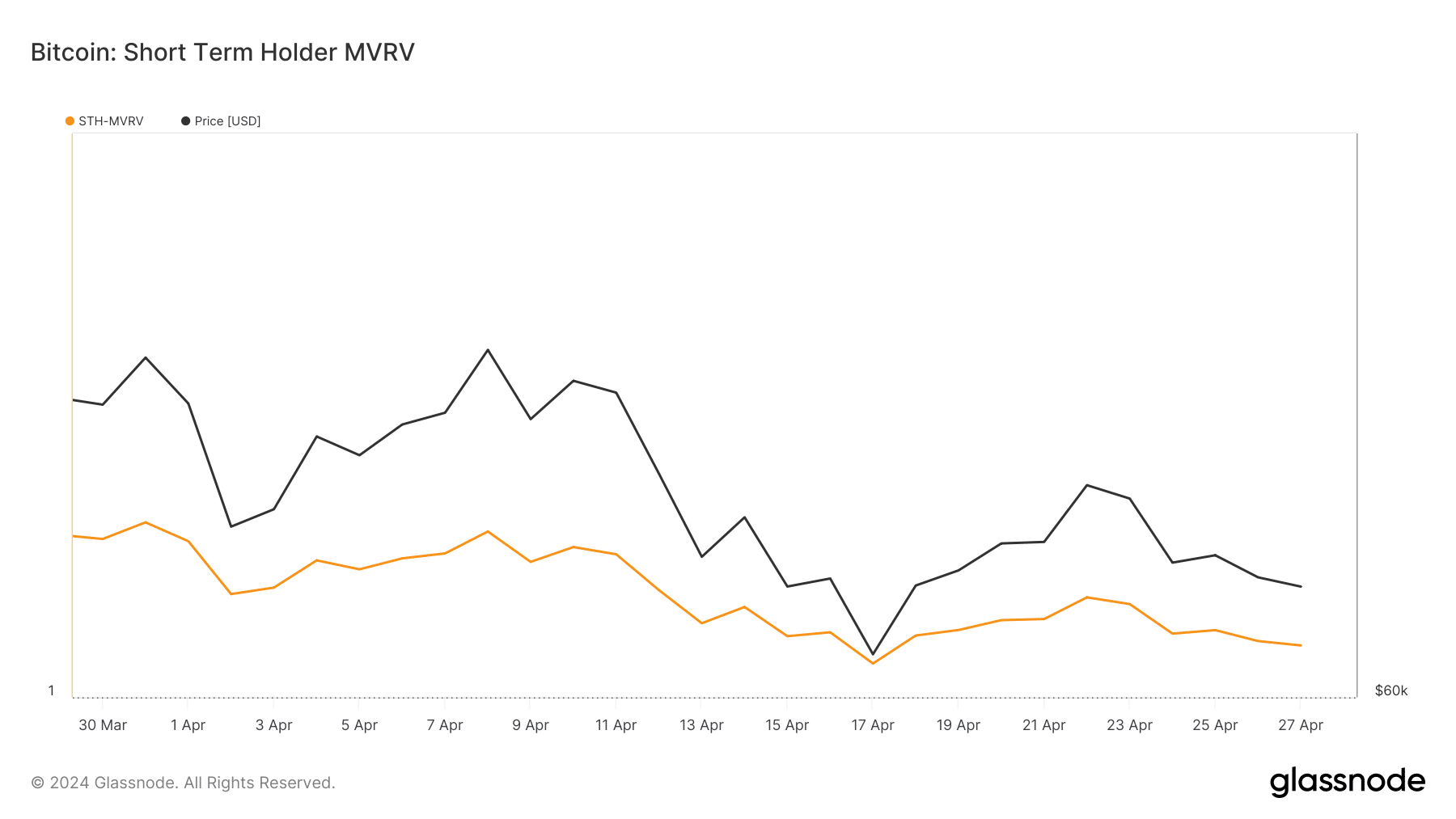

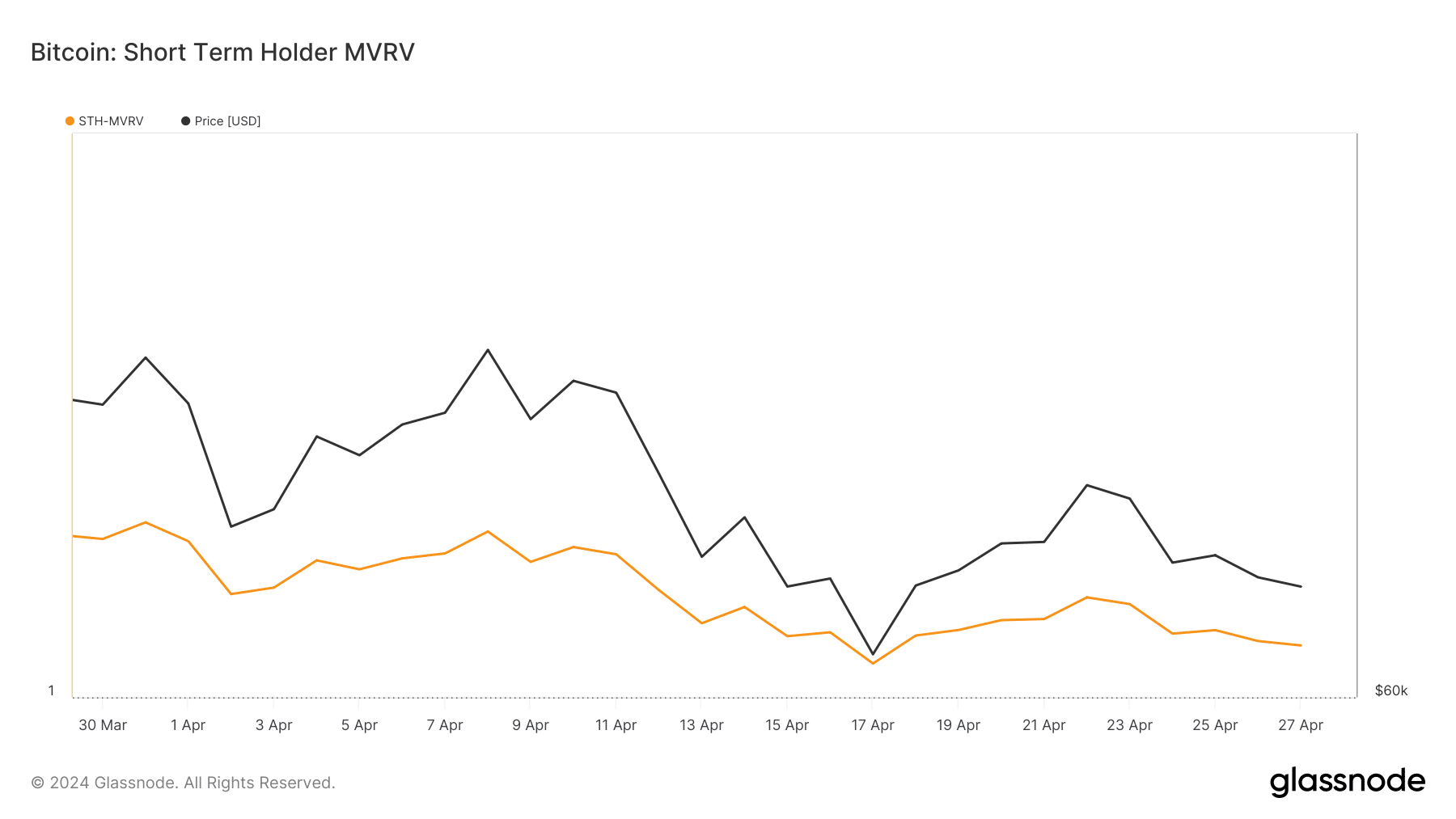

AMBCrypto’s analysis of Glassnode’s data also pointed out an interesting development related to short-term holders. We found that BTC’s STH MVRV dropped over the past few weeks.

For the uninitiated, a low MVRV suggests that the current price of Bitcoin is relatively lower compared to the last transaction prices.

Source: Glassnode

Does this hint at a price uptick?

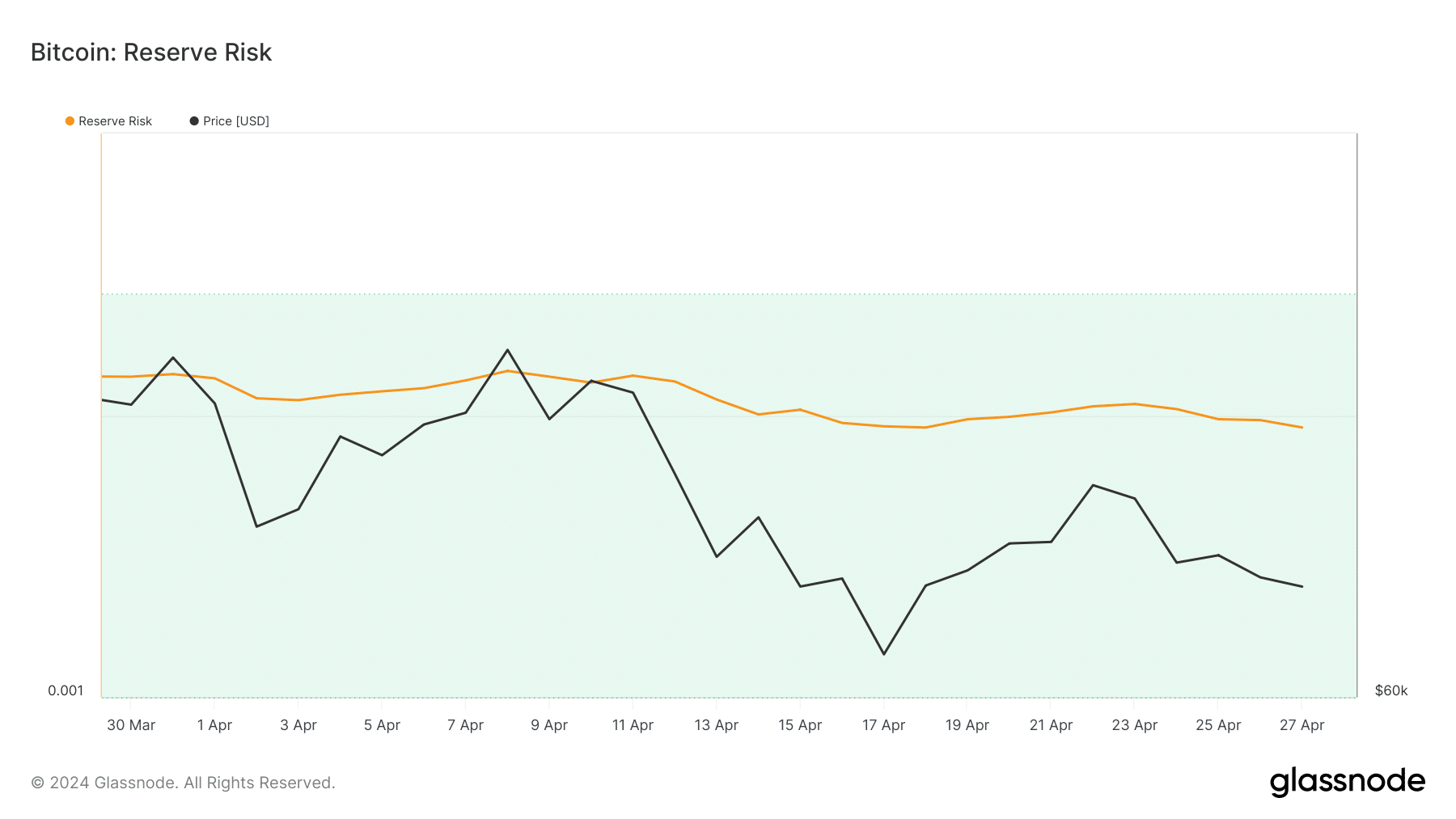

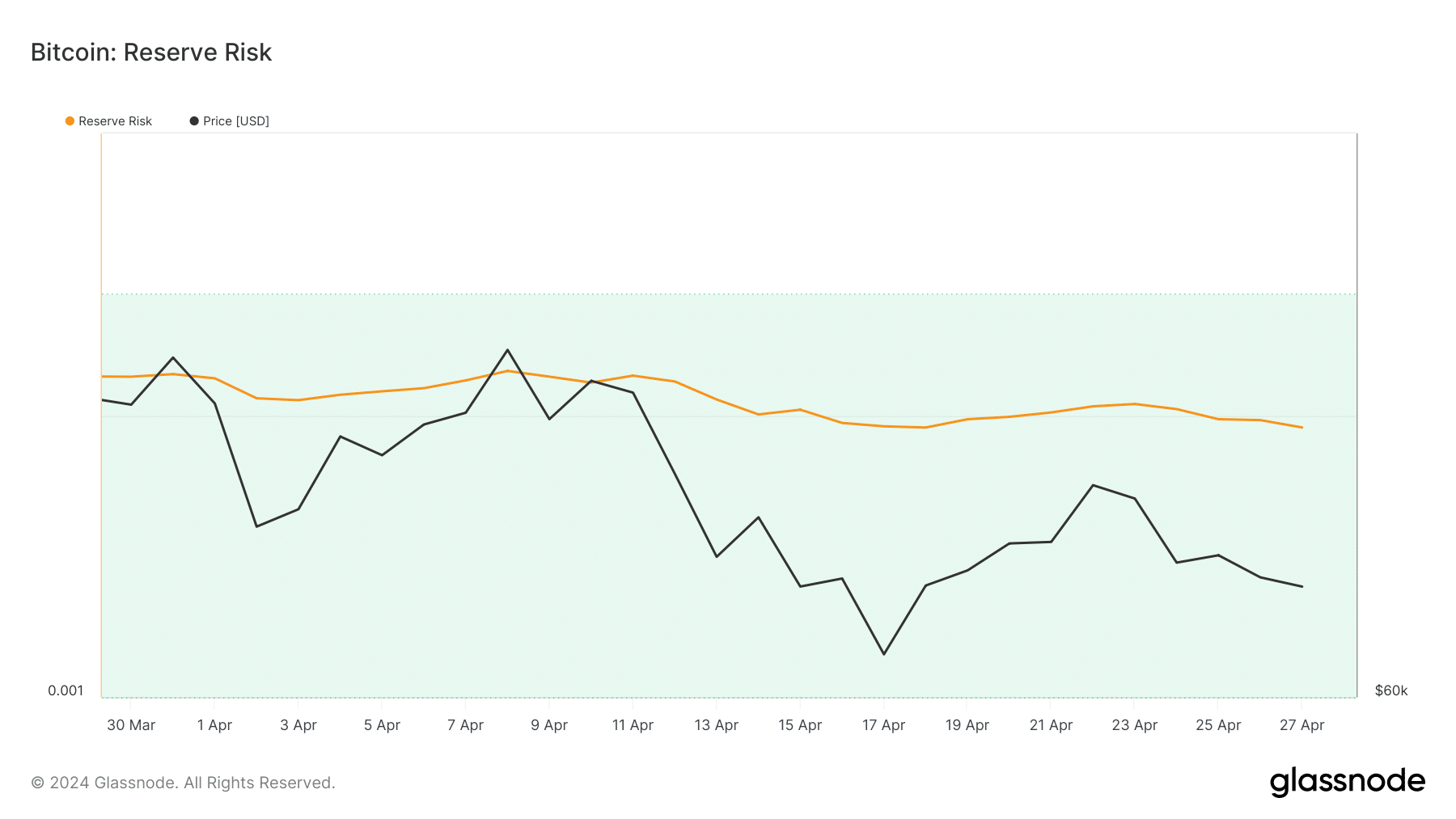

Since BTC seemed to be undervalued, AMBCrypto took a closer look at its state to better understand whether a price rise was around the corner. As per our analysis, BTC’s reserve risk was low.

This metric indicated that confidence in BTC was high. However, its price lay low at press time, which could be inferred as a bullish signal.

Source: Glassnode

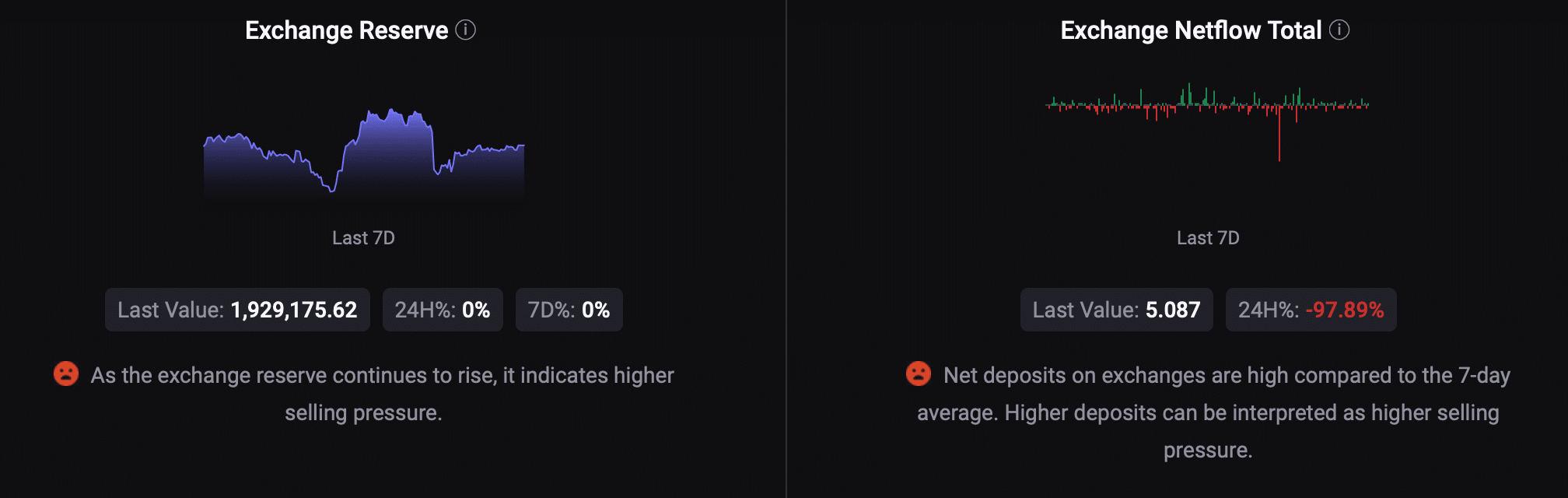

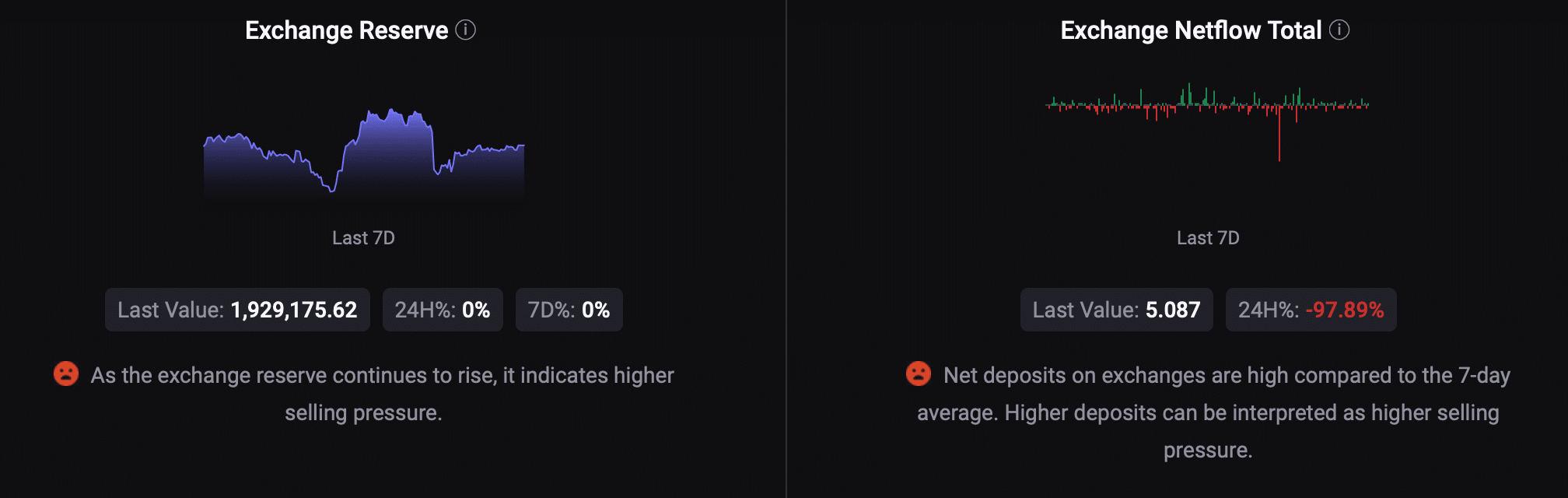

Not everything looked optimistic for BTC. For instance, AMBCrypto’s look at CryptoQuant’s data revealed that selling pressure on BTC was high as its exchange reserve was increasing.

Its net deposit on exchanges was also high compared to the last seven days’ average.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-2025

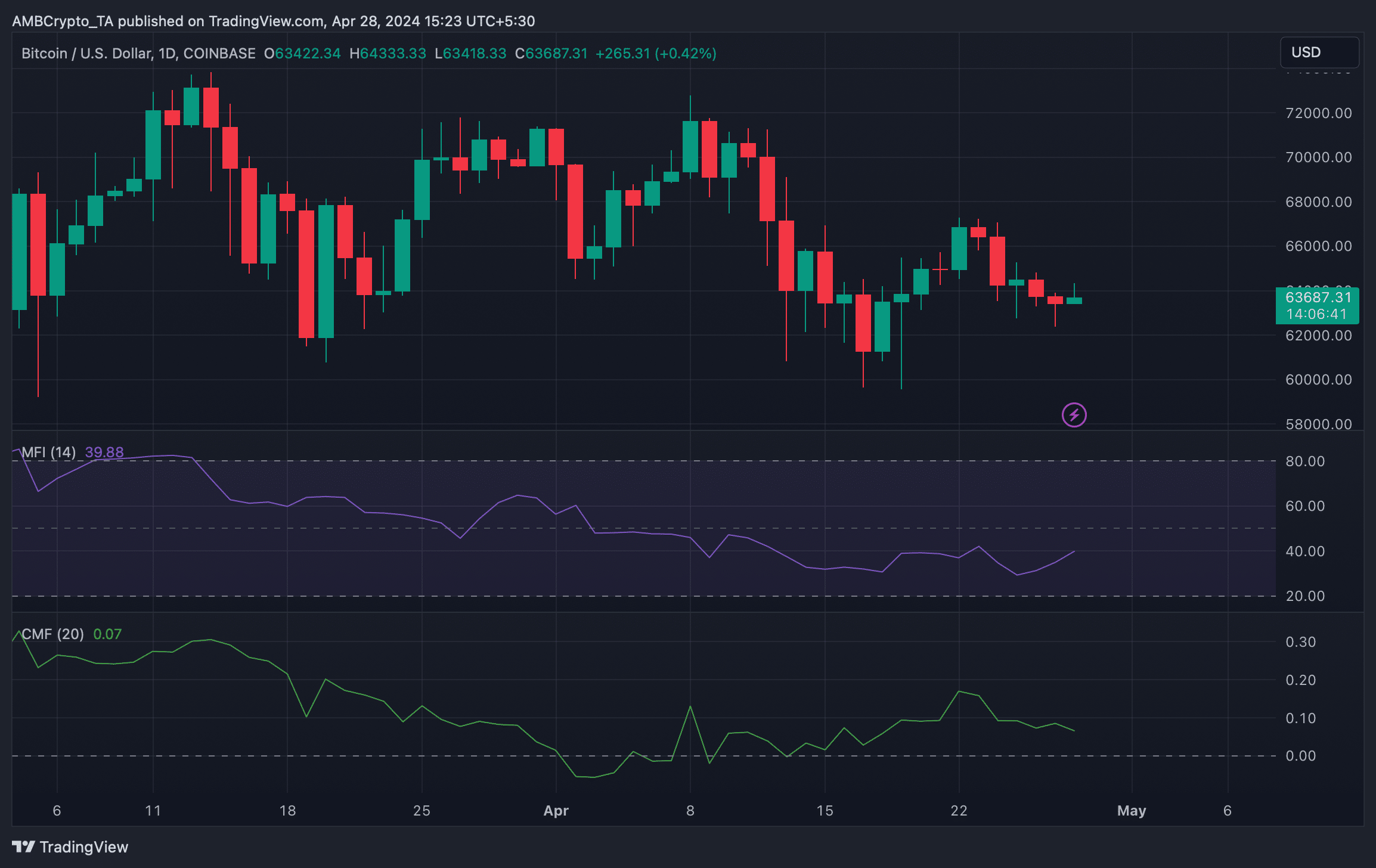

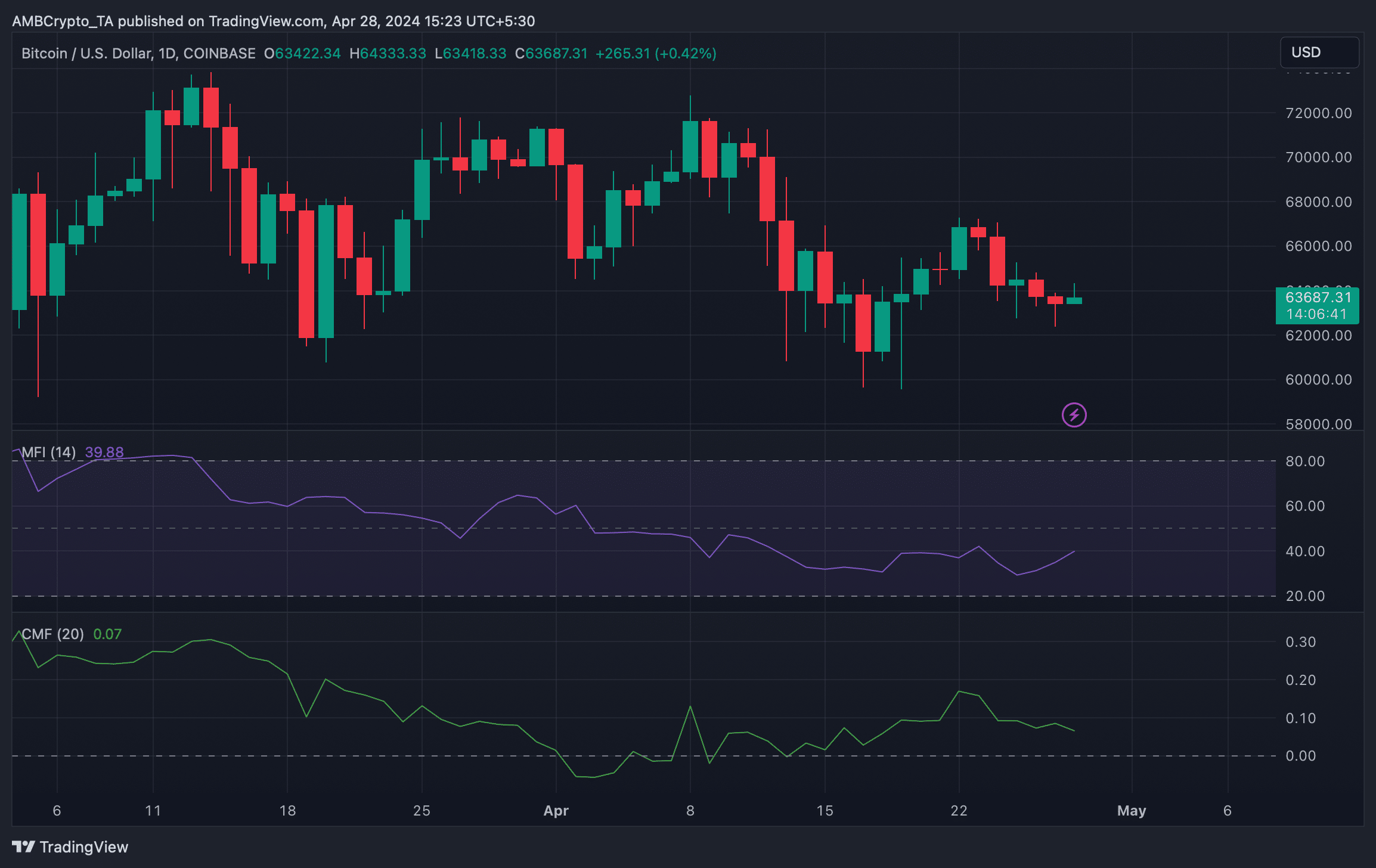

We then took a look at BTC’s daily chart to see what market indicators had to suggest regarding BTC’s upcoming price movement.

As per our analysis, the Money Flow Index (MFI) hinted at a price uptick as it moved upwards. However, the Chaikin Money Flow (CMF) remained bearish.

Source: TradingView

- Bearish sentiment around BTC was dominant in the market.

- Selling pressure on the coin was high.

Bitcoin’s [BTC] price action remained underwhelming, as it has failed to move above $64k in the last few days. In the meantime, a key BTC metric entered a zone of indecisive direction.

Does this mean investors have to wait longer to see BTC rise again?

What’s going on with Bitcoin?

CoinMarketCap’s data revealed that BTC was down by more than 2% in the last seven days.

This pushed BTC’s price under $64k, as at press time it was trading at $63,843.66 with a market capitalization of over $1.26 trillion.

Because of the negative price action, Weighted Sentiment around the king of cryptos turned bearish on the 27th of April.

Its Social Volume also dropped slightly last week, reflecting a decline in BTC’s popularity in the crypto space.

Source: Santiment

Meanwhile, Phi Deltalytics, an author and analyst at CryptoQuant, posted an analysis using a key BTC metric.

As per the analysis, the adjusted Spent Output Profit Ratio (SOPR) of Bitcoin continued to move in a bullish direction, while the short-term SOPR has entered a zone of uncertainty.

This discrepancy highlighted a complex environment where short-term investors faced losses.

Source: CryptoQuant

The analysis mentioned,

“While fluctuations of this nature are not uncommon, particularly during periods of price exploration toward new all-time highs, heightened vigilance is warranted.”

AMBCrypto’s analysis of Glassnode’s data also pointed out an interesting development related to short-term holders. We found that BTC’s STH MVRV dropped over the past few weeks.

For the uninitiated, a low MVRV suggests that the current price of Bitcoin is relatively lower compared to the last transaction prices.

Source: Glassnode

Does this hint at a price uptick?

Since BTC seemed to be undervalued, AMBCrypto took a closer look at its state to better understand whether a price rise was around the corner. As per our analysis, BTC’s reserve risk was low.

This metric indicated that confidence in BTC was high. However, its price lay low at press time, which could be inferred as a bullish signal.

Source: Glassnode

Not everything looked optimistic for BTC. For instance, AMBCrypto’s look at CryptoQuant’s data revealed that selling pressure on BTC was high as its exchange reserve was increasing.

Its net deposit on exchanges was also high compared to the last seven days’ average.

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-2025

We then took a look at BTC’s daily chart to see what market indicators had to suggest regarding BTC’s upcoming price movement.

As per our analysis, the Money Flow Index (MFI) hinted at a price uptick as it moved upwards. However, the Chaikin Money Flow (CMF) remained bearish.

Source: TradingView

order cheap clomid pill can i get cheap clomid no prescription order clomid without rx cost of clomiphene price can you buy cheap clomid without insurance can you buy cheap clomid online cost generic clomiphene online

More articles like this would pretence of the blogosphere richer.

With thanks. Loads of erudition!

zithromax pills – buy tindamax 500mg online order flagyl 400mg sale

order motilium 10mg without prescription – flexeril pill generic flexeril

inderal order online – methotrexate 10mg for sale order methotrexate 2.5mg online

augmentin 625mg oral – atbioinfo buy ampicillin antibiotic

nexium generic – https://anexamate.com/ buy nexium no prescription

order coumadin online cheap – cou mamide hyzaar pill

how to get mobic without a prescription – https://moboxsin.com/ buy mobic 7.5mg generic

prednisone 20mg pill – asthma prednisone 5mg without prescription

buy ed pills online – https://fastedtotake.com/ ed pills comparison

buy cheap amoxicillin – amoxil price amoxicillin medication