- BTC might hike to $67,269 in the first phase of the projected upswing

- The liquidation levels showed a bearish bias that may soon be invalidated

Things might have changed for Bitcoin [BTC] after the completion of its 4th halving. However, in terms of its price, the more things change, more they remain the same. AMBCrypto came to this conclusion after tracking its coin transfers to derivative exchanges. According to data from CryptoQuant, the number of BTC sent to derivative exchanges has increased significantly.

Specifically, we observed that this has been the handwork of whales. Historically, when this happens at a fast rate, it implies that whales are preparing to open long Bitcoin positions.

Source: CryptoQuant

Big guns are becoming aggressive

Pseudonymous on-chain analyst datascope also commented on the activity. According to datascope who shares his thoughts on CryptoQuant,

“The increase in transfer rates of Bitcoin from exchanges to derivative exchanges is considered an important indicator. Recent data indicates that these types of transfers have been a significant factor in the rise of Bitcoin prices.”

Bitcoin’s price, at press time, was $63,572, Here, it’s worth noting that before the halving, AMBCrypto had argued that the number one cryptocurrency could already be priced in.

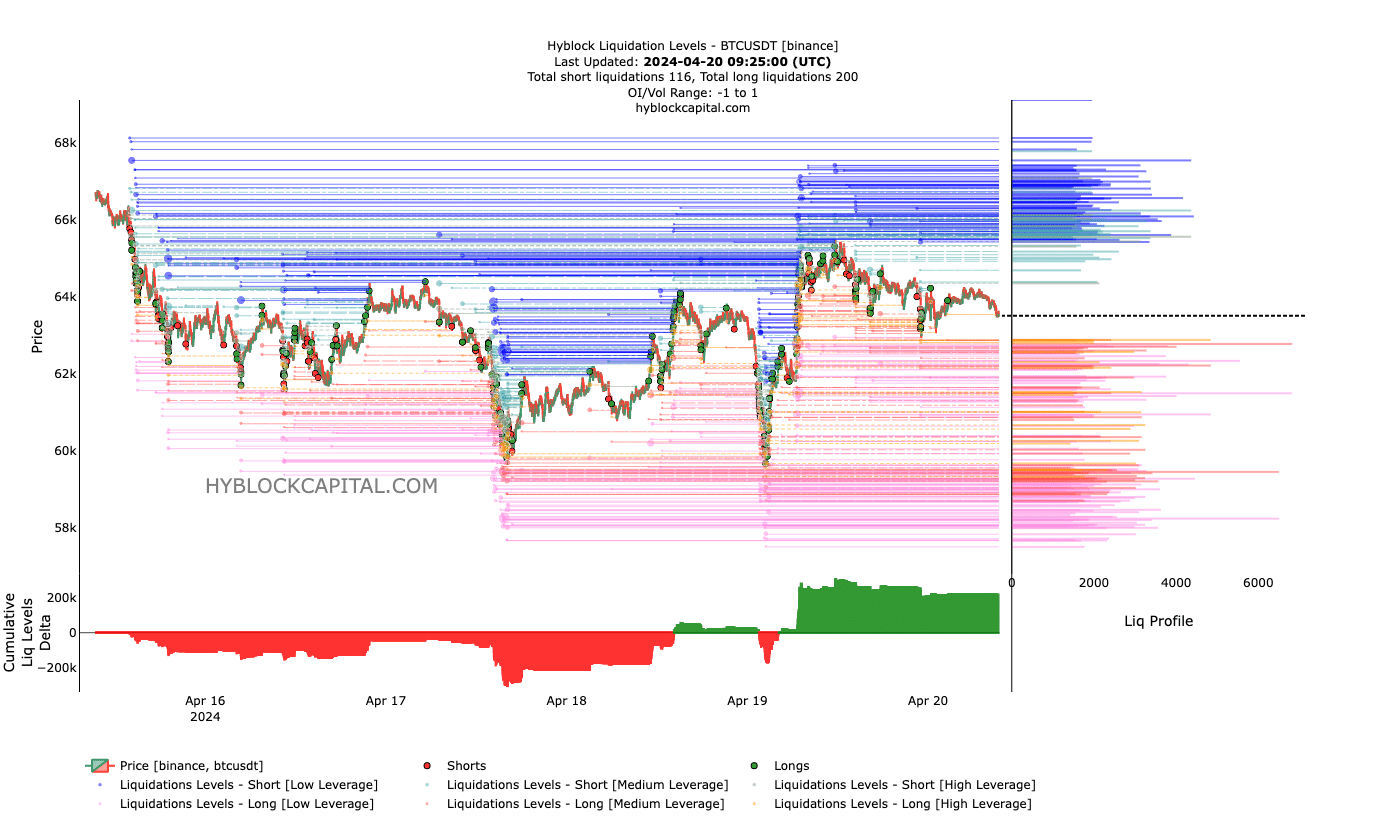

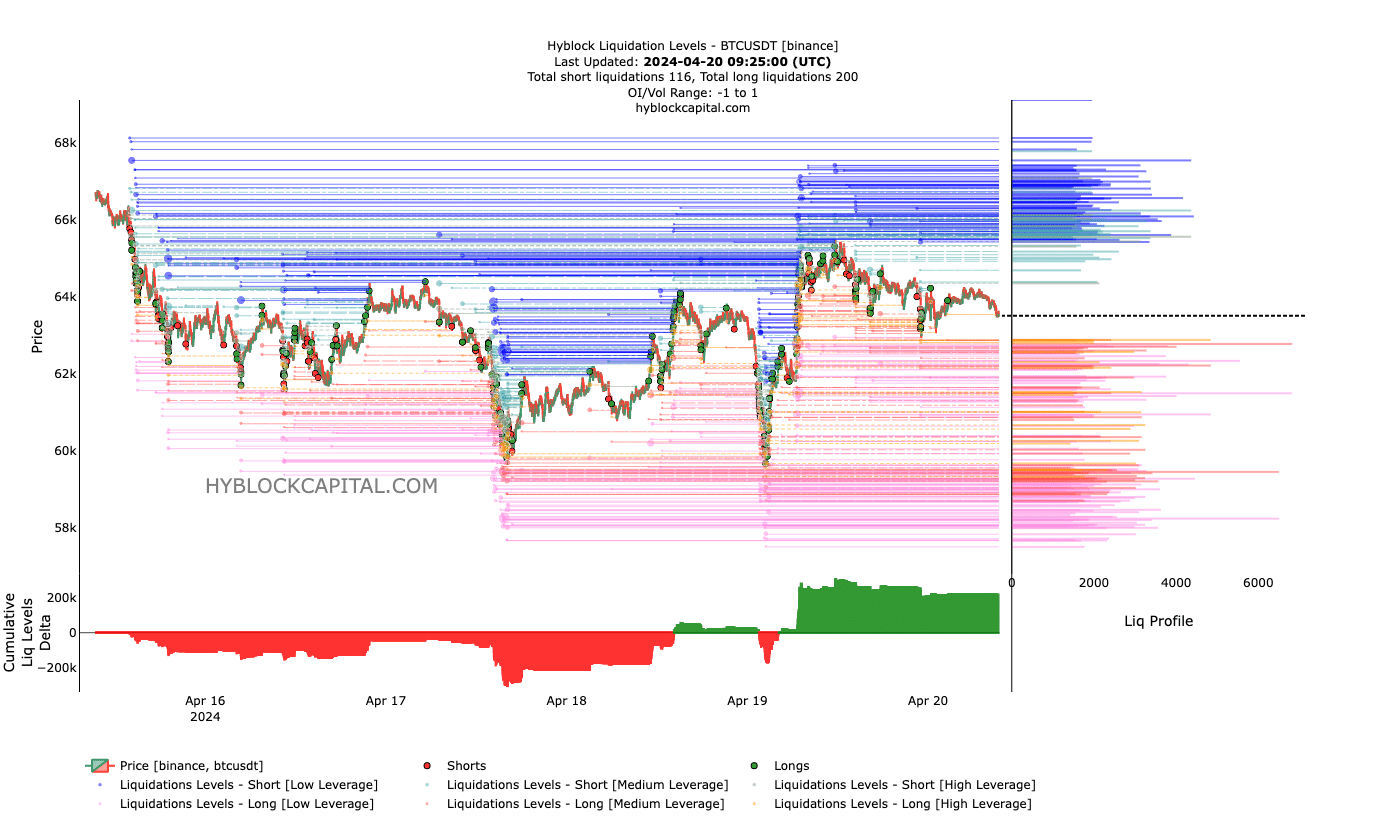

However, the stalemate might switch to the upside based on our latest analysis. The liquidation levels are one indicator fueling this prediction.

Liquidation levels revealed estimated price levels where a liquidation event might occur. For context, liquidation happens when an exchange forcefully closes a trader’s position. This is either due to an insufficient margin balance or a high-leveraged bet that went in the opposite direction.

At press time, a cluster of liquidity appeared from $65,434 to $67,269, suggesting that Bitcoin’s price might target those levels in the short term.

Another thing we noticed was that there has been aggressive buying since the drop below $64,000. If the buying pressure increases, longs with low leverage might be rewarded soon.

Bears won’t survive what’s coming

Finally, we considered the Cumulative Liquidation Levels Delta (CLLD). At the time of writing, the CLLD was positive. Negative values of the CLLD indicate more short liquidations.

On the contrary, a positive reading implies that there have been more long liquidations. However, this indicator also has some effect on the price.

Source: Hyblock

From the indications above, it can be seen that the CLLD revealed a bearish bias. However, whales’ entering their orders with the current liquidity might reverse the signal.

In this situation, the price might fall and trigger some stop losses. And yet, once a part of the liquidity has been flushed out, the price might begin to make its way back up.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Should this be the case moving on, Bitcoin might rally, and hitting $75,000 could be an option in the mid-term. In the short term, however, BTC could drop lower than $63,000 before the pump begins much later.

- BTC might hike to $67,269 in the first phase of the projected upswing

- The liquidation levels showed a bearish bias that may soon be invalidated

Things might have changed for Bitcoin [BTC] after the completion of its 4th halving. However, in terms of its price, the more things change, more they remain the same. AMBCrypto came to this conclusion after tracking its coin transfers to derivative exchanges. According to data from CryptoQuant, the number of BTC sent to derivative exchanges has increased significantly.

Specifically, we observed that this has been the handwork of whales. Historically, when this happens at a fast rate, it implies that whales are preparing to open long Bitcoin positions.

Source: CryptoQuant

Big guns are becoming aggressive

Pseudonymous on-chain analyst datascope also commented on the activity. According to datascope who shares his thoughts on CryptoQuant,

“The increase in transfer rates of Bitcoin from exchanges to derivative exchanges is considered an important indicator. Recent data indicates that these types of transfers have been a significant factor in the rise of Bitcoin prices.”

Bitcoin’s price, at press time, was $63,572, Here, it’s worth noting that before the halving, AMBCrypto had argued that the number one cryptocurrency could already be priced in.

However, the stalemate might switch to the upside based on our latest analysis. The liquidation levels are one indicator fueling this prediction.

Liquidation levels revealed estimated price levels where a liquidation event might occur. For context, liquidation happens when an exchange forcefully closes a trader’s position. This is either due to an insufficient margin balance or a high-leveraged bet that went in the opposite direction.

At press time, a cluster of liquidity appeared from $65,434 to $67,269, suggesting that Bitcoin’s price might target those levels in the short term.

Another thing we noticed was that there has been aggressive buying since the drop below $64,000. If the buying pressure increases, longs with low leverage might be rewarded soon.

Bears won’t survive what’s coming

Finally, we considered the Cumulative Liquidation Levels Delta (CLLD). At the time of writing, the CLLD was positive. Negative values of the CLLD indicate more short liquidations.

On the contrary, a positive reading implies that there have been more long liquidations. However, this indicator also has some effect on the price.

Source: Hyblock

From the indications above, it can be seen that the CLLD revealed a bearish bias. However, whales’ entering their orders with the current liquidity might reverse the signal.

In this situation, the price might fall and trigger some stop losses. And yet, once a part of the liquidity has been flushed out, the price might begin to make its way back up.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Should this be the case moving on, Bitcoin might rally, and hitting $75,000 could be an option in the mid-term. In the short term, however, BTC could drop lower than $63,000 before the pump begins much later.

can you get cheap clomiphene without insurance can i order generic clomiphene online can i order generic clomiphene without rx how to buy cheap clomiphene withou where can i get clomiphene no prescription get generic clomiphene for sale buying cheap clomid without dr prescription

More posts like this would bring about the blogosphere more useful.

This is the stripe of topic I have reading.

buy azithromycin generic – metronidazole 400mg cost metronidazole over the counter

buy semaglutide 14 mg generic – order semaglutide 14mg pill buy cyproheptadine 4 mg for sale

buy motilium 10mg generic – buy sumycin pills flexeril where to buy

buy augmentin 625mg online cheap – https://atbioinfo.com/ ampicillin over the counter

oral esomeprazole 20mg – anexamate buy nexium 20mg pill

how to get coumadin without a prescription – anticoagulant order cozaar online

order meloxicam 15mg for sale – mobo sin meloxicam 15mg cheap

buy deltasone sale – https://apreplson.com/ deltasone 40mg without prescription

home remedies for ed erectile dysfunction – buy ed pills cheap gnc ed pills

buy amoxicillin online – amoxicillin uk purchase amoxil pill

order fluconazole for sale – https://gpdifluca.com/ fluconazole 100mg drug

cenforce brand – cenforce pill order cenforce online

what possible side effect should a patient taking tadalafil report to a physician quizlet – how long does cialis take to work 10mg generic tadalafil tablet or pill photo or shape

generic cialis tadalafil 20mg reviews – https://strongtadafl.com/# cialis covered by insurance

order ranitidine sale – online order zantac generic