- Riot Platforms reported 65% revenue growth, but faces challenges in U.S facility expansions

- RIOT stock dropped by 32% YTD, reflecting market volatility despite strong operational performance

Riot Platforms, a major player in Bitcoin [BTC] mining, reported a significant 65% hike in year-over-year revenue. These findings underlined its resilience and growth momentum in the wake of BTC’s latest halving event.

Despite the strong financial performance, however, the firm has faced obstacles in its hashrate expansion efforts, citing challenges within its U.S facilities.

Riot Platforms Q3 revenue report

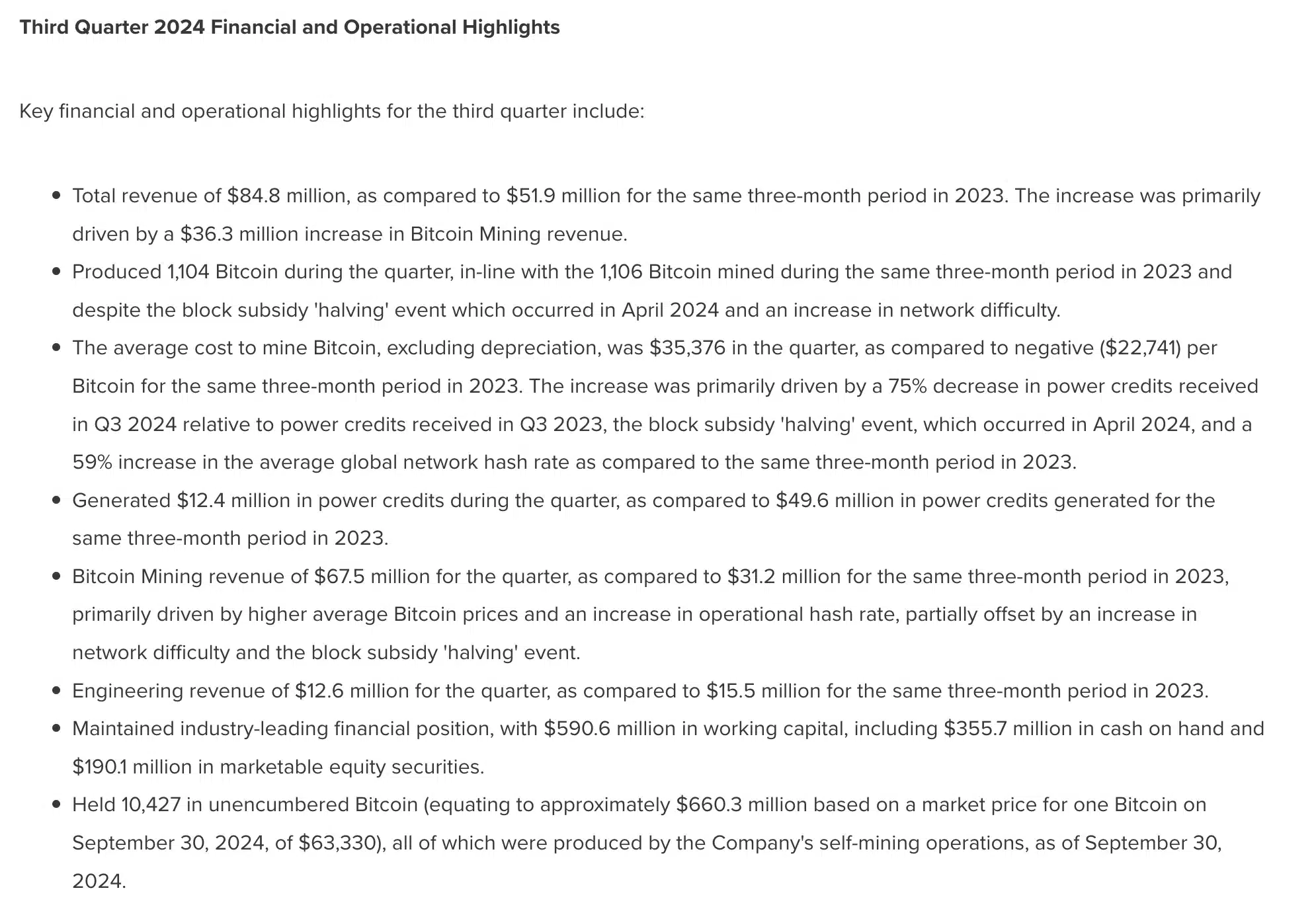

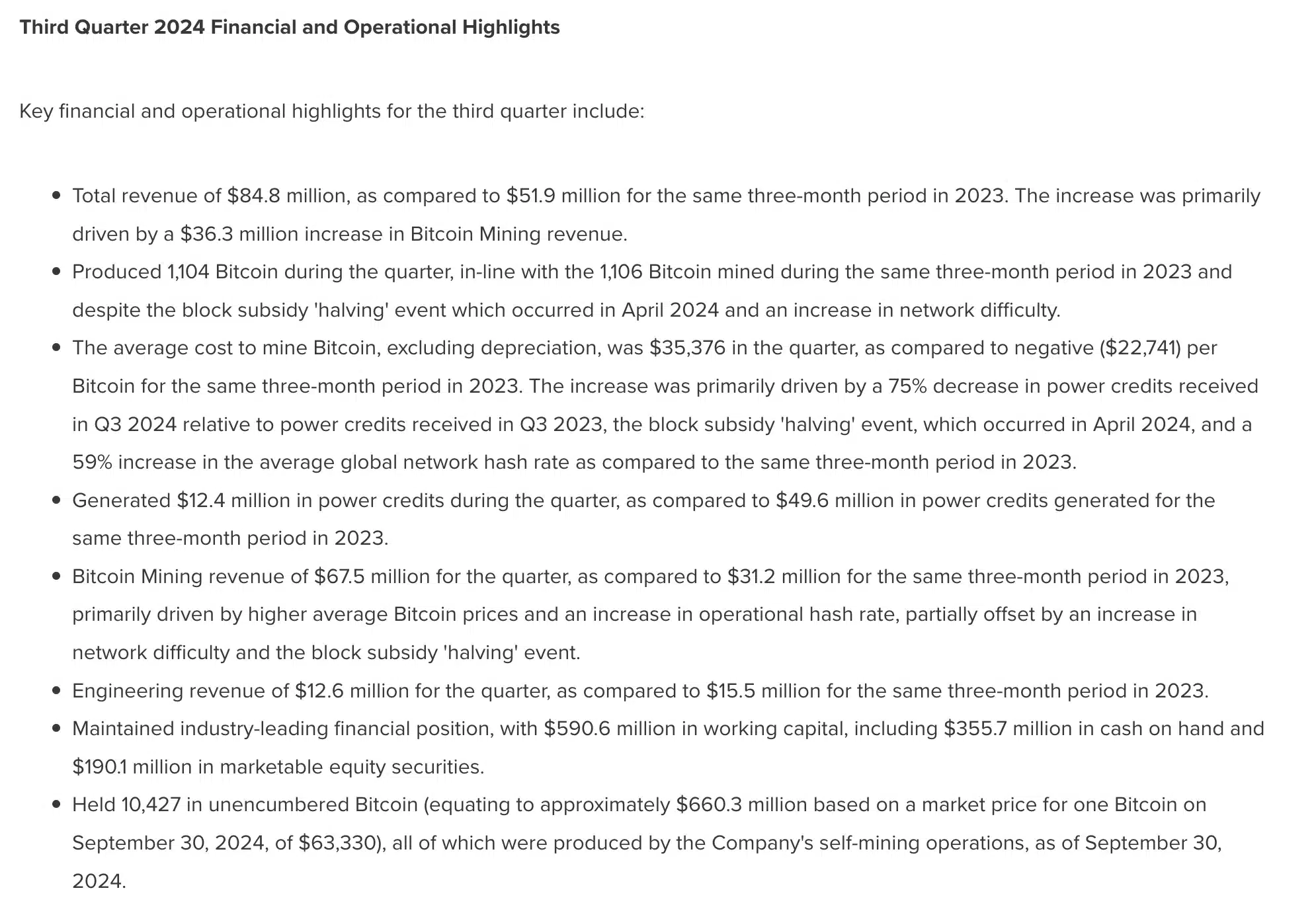

While detailing its Q3 2024 results, the company highlighted sustained growth alongside highly competitive and low power costs.

Commenting on the results, CEO Jason Les stated,

“Riot recorded $84.8 million in revenue this quarter, representing a 65% increase over the same quarter in 2023, driven by a 159% year-over-year increase in deployed hash rate to 28 EH/s at the end of the quarter.

He added,

“This significant increase in deployed hash rate allowed us to produce 1,104 Bitcoin this quarter, in-line with our Bitcoin production in the third quarter of 2023, despite the ‘halving’.”

Riot platforms’ Bitcoin mining difficulty

Riot Platforms reported a quarterly net loss of $154 million, or $0.54 per share, marking a 92% hike from its losses in Q3 2023. This decline was attributed to reduced power credits, heightened operational expenses, and the effects of Bitcoin’s halving event.

However, despite these challenges, the firm maintained impressive energy efficiency, with an average mining cost of $35,376 per BTC – Nearly half the current market price of around $72,000.

Additionally, CEO Jason Les noted that the company’s industry-leading energy rates, averaging 3.1 cents per kilowatt-hour, played a key role in achieving this cost efficiency.

That being said, Riot Platforms closed the quarter with a strong balance sheet, holding approximately $1.3 billion across cash, restricted cash, marketable equity securities, and reserves of 10,427 Bitcoin.

To know more, here are some key highlights from the report –

Source: www.prnewswire.com

What’s next?

As expected, CEO Jason Les shared optimism for the firm’s future, emphasizing efforts to boost power capacity and hash rate in Texas and Kentucky.

These steps would help support its goal of reaching 100 EH/s in self-mining capacity, underscoring its commitment to growth in U.S BTC mining.

Meanwhile, the company’s stock (RIOT) has struggled this year, dropping by 3.6% after hours on 30 October to $9.86 and down 32% year-to-date. At the time of writing, with a value of $10.48, RIOT remained 85% below its February 2021 high of over $70.

Source: Google Finance

Thus, despite operational growth and higher hashrates, the stock’s decline can be seen as evidence of the challenges of a volatile market.

- Riot Platforms reported 65% revenue growth, but faces challenges in U.S facility expansions

- RIOT stock dropped by 32% YTD, reflecting market volatility despite strong operational performance

Riot Platforms, a major player in Bitcoin [BTC] mining, reported a significant 65% hike in year-over-year revenue. These findings underlined its resilience and growth momentum in the wake of BTC’s latest halving event.

Despite the strong financial performance, however, the firm has faced obstacles in its hashrate expansion efforts, citing challenges within its U.S facilities.

Riot Platforms Q3 revenue report

While detailing its Q3 2024 results, the company highlighted sustained growth alongside highly competitive and low power costs.

Commenting on the results, CEO Jason Les stated,

“Riot recorded $84.8 million in revenue this quarter, representing a 65% increase over the same quarter in 2023, driven by a 159% year-over-year increase in deployed hash rate to 28 EH/s at the end of the quarter.

He added,

“This significant increase in deployed hash rate allowed us to produce 1,104 Bitcoin this quarter, in-line with our Bitcoin production in the third quarter of 2023, despite the ‘halving’.”

Riot platforms’ Bitcoin mining difficulty

Riot Platforms reported a quarterly net loss of $154 million, or $0.54 per share, marking a 92% hike from its losses in Q3 2023. This decline was attributed to reduced power credits, heightened operational expenses, and the effects of Bitcoin’s halving event.

However, despite these challenges, the firm maintained impressive energy efficiency, with an average mining cost of $35,376 per BTC – Nearly half the current market price of around $72,000.

Additionally, CEO Jason Les noted that the company’s industry-leading energy rates, averaging 3.1 cents per kilowatt-hour, played a key role in achieving this cost efficiency.

That being said, Riot Platforms closed the quarter with a strong balance sheet, holding approximately $1.3 billion across cash, restricted cash, marketable equity securities, and reserves of 10,427 Bitcoin.

To know more, here are some key highlights from the report –

Source: www.prnewswire.com

What’s next?

As expected, CEO Jason Les shared optimism for the firm’s future, emphasizing efforts to boost power capacity and hash rate in Texas and Kentucky.

These steps would help support its goal of reaching 100 EH/s in self-mining capacity, underscoring its commitment to growth in U.S BTC mining.

Meanwhile, the company’s stock (RIOT) has struggled this year, dropping by 3.6% after hours on 30 October to $9.86 and down 32% year-to-date. At the time of writing, with a value of $10.48, RIOT remained 85% below its February 2021 high of over $70.

Source: Google Finance

Thus, despite operational growth and higher hashrates, the stock’s decline can be seen as evidence of the challenges of a volatile market.

can i get clomid without rx can i purchase generic clomid prices clomiphene without insurance how to buy generic clomid without prescription how to buy clomid can you get cheap clomiphene online can you get generic clomid online

Greetings! Extremely productive par‘nesis within this article! It’s the little changes which wish turn the largest changes. Thanks a portion towards sharing!

The vividness in this tune is exceptional.

zithromax price – flagyl over the counter metronidazole drug

rybelsus 14mg usa – buy semaglutide 14 mg order periactin online cheap

buy generic domperidone – order sumycin 250mg online buy cheap generic flexeril

inderal 20mg cost – inderal order methotrexate drug

order amoxil online – combivent cheap order combivent 100 mcg pill

order azithromycin 250mg pill – buy azithromycin 250mg generic bystolic 20mg generic

augmentin 375mg drug – https://atbioinfo.com/ cheap ampicillin

buy cheap generic nexium – https://anexamate.com/ purchase nexium

buy cheap generic coumadin – https://coumamide.com/ cozaar 50mg canada

cost meloxicam 15mg – relieve pain oral mobic 7.5mg

ed pills no prescription – free samples of ed pills buy pills for erectile dysfunction

purchase amoxil sale – cost amoxil buy amoxicillin without prescription