- While accumulation increased, BTC’s price was inching towards $70k.

- However, a few metrics and market indicators hinted at a price correction.

Bitcoin [BTC] price has once again gained bullish momentum as it was fast approaching $70k. The latest data suggested that investors have started to stockpile BTC.

Does this mean they expect BTC’s price to go up further, or will BTC fall victim to yet another price correction?

Bitcoin investors are accumulating

CoinMarketCap’s data revealed that BTC’s price had increased by over 3% last week. The bullish trend continued in the last 24 hours as the king of crypto witnessed an over 3% surge.

Thanks to that, at the time of writing, BTC was trading at $69,535.15 with a market capitalization of over $1.37 trillion.

AMBCrypto reported earlier that it was a good option to HODL Bitcoin as a few key indicators hinted at a buying opportunity.

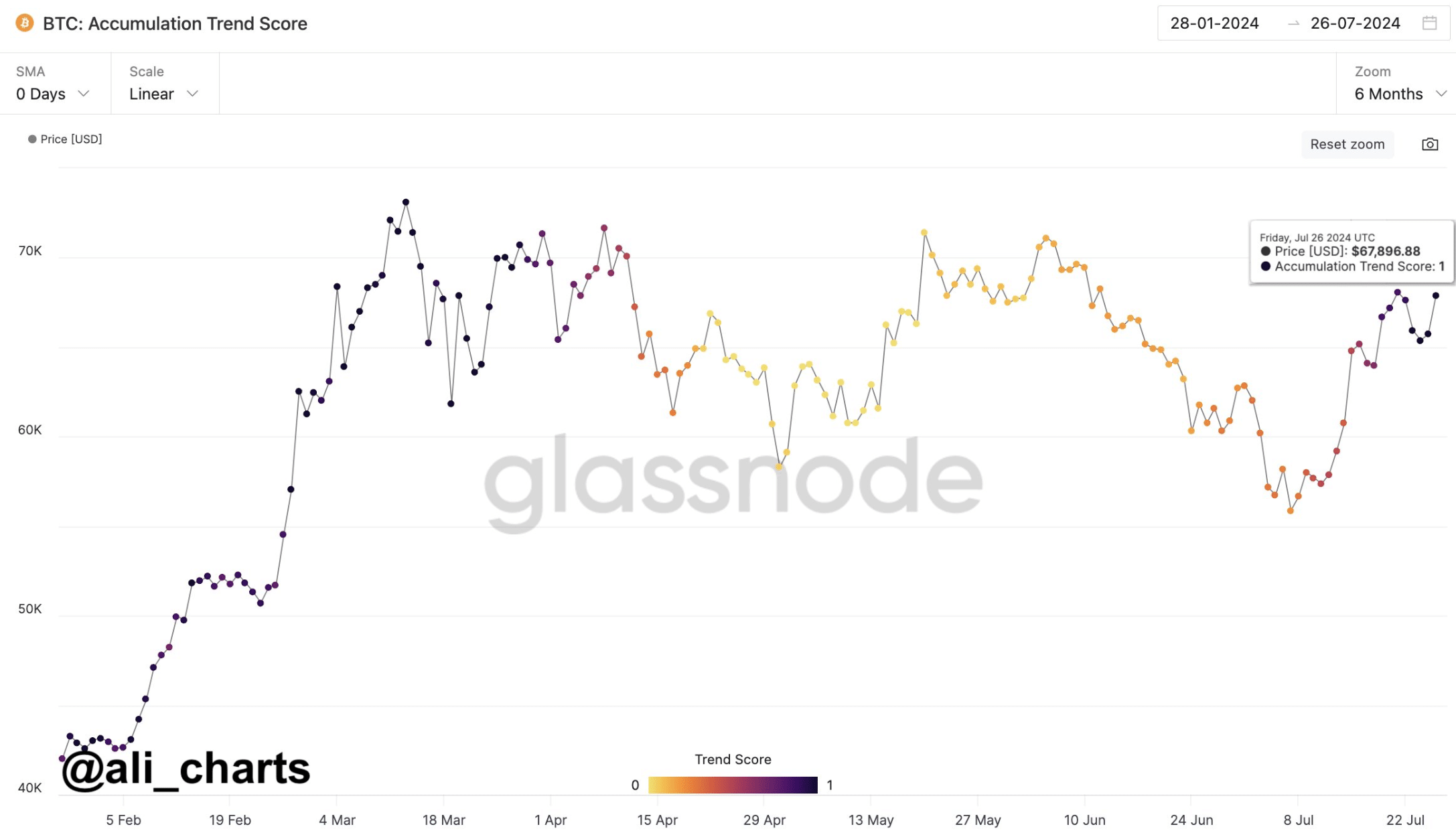

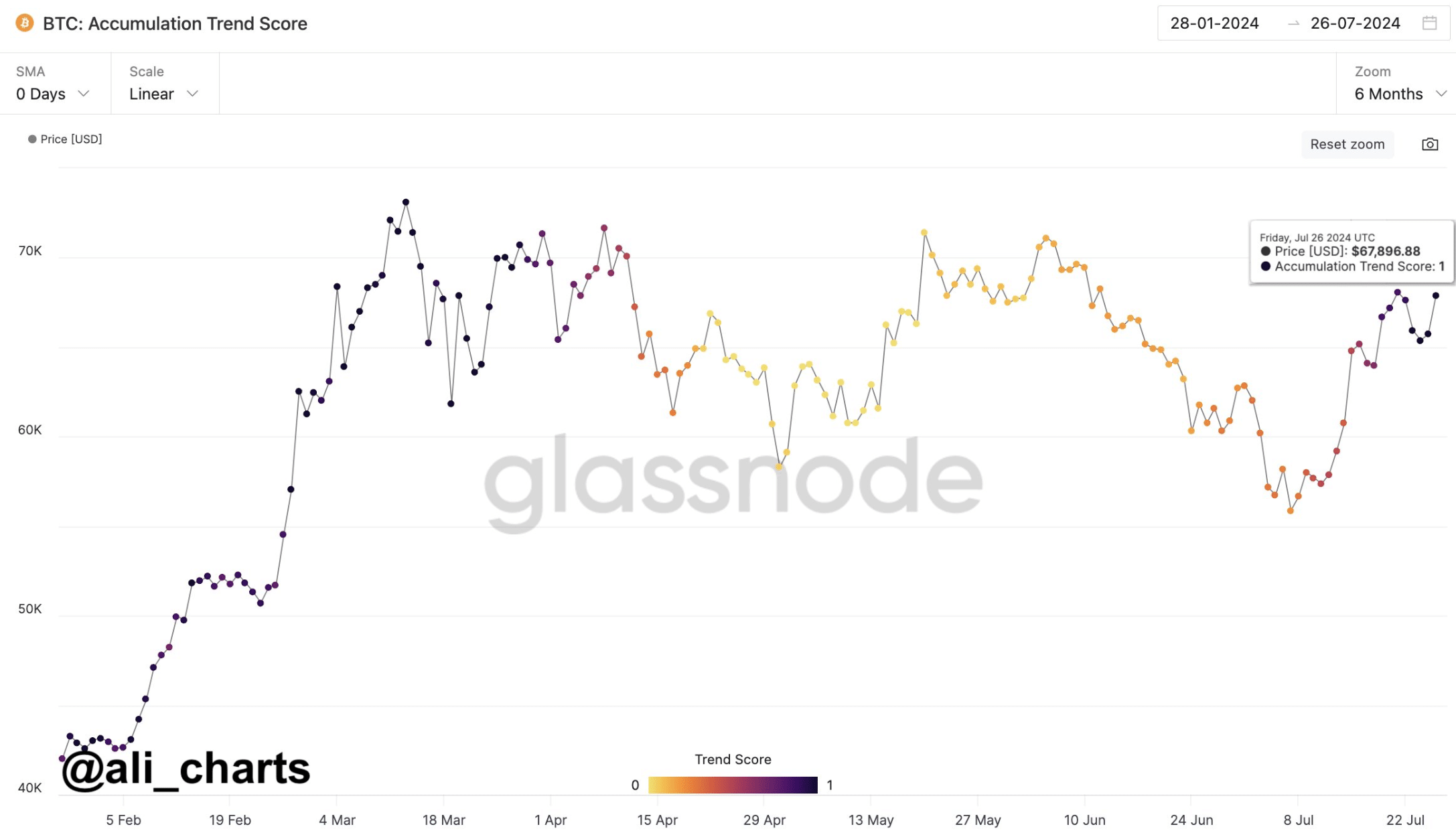

In the meantime, Ali, a popular crypto analyst, posted a tweet revealing yet another interesting development. As per the tweet, BTC’s accumulation trend score hit 1, suggesting that investors were buying substantial amounts of BTC.

For starters, the accumulation trend score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 1 indicates buying pressure was high.

Source: X

Will the king coin grow further?

Since buying sentiment was dominant in the market, AMBCrypto planned to have a closer look at BTC’s state to find out whether its latest bull rally would continue.

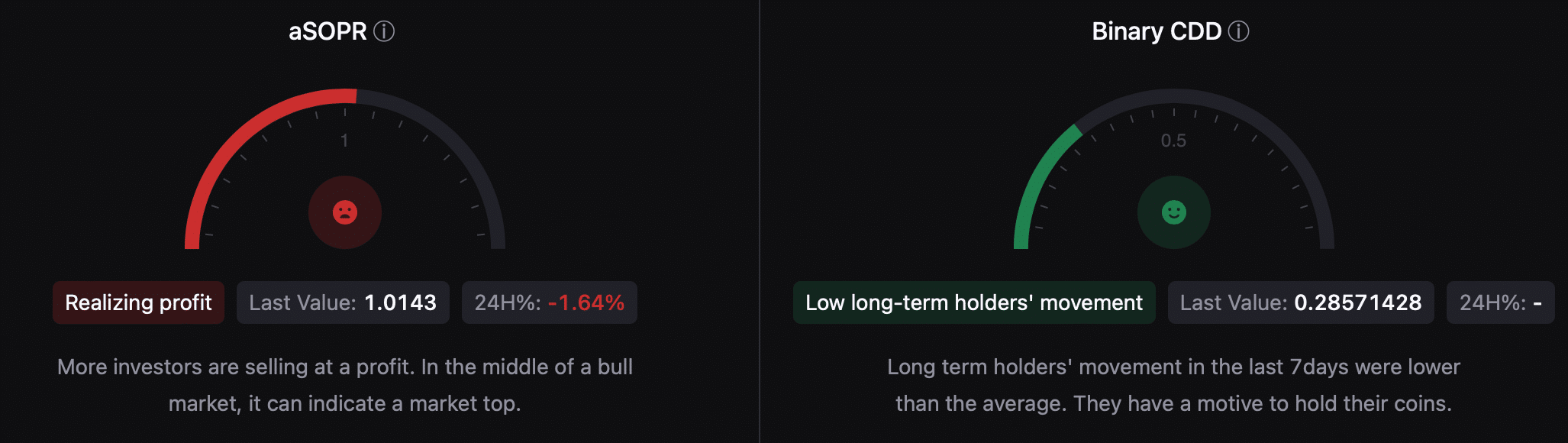

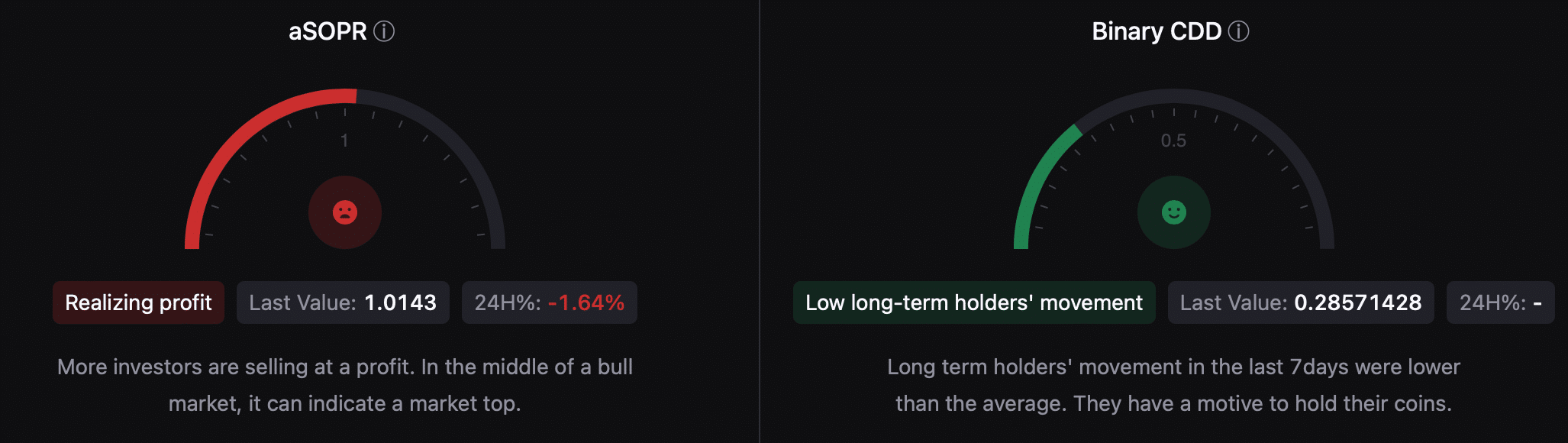

As per our analysis of CryptoQuant’s data, BTC’s binary CDD was green, meaning that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins.

However, its aSORP turned red, which suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Source: CryptoQuant

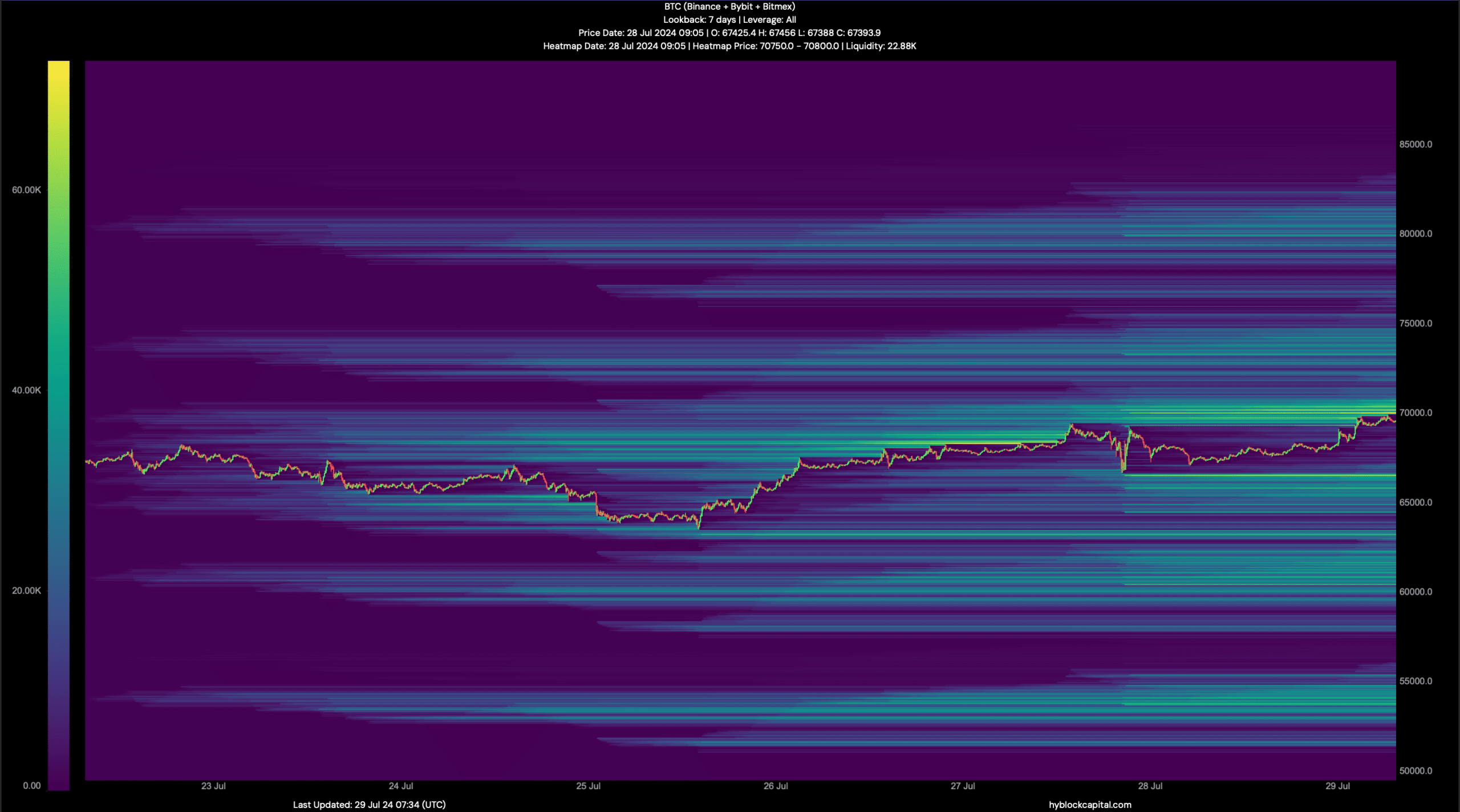

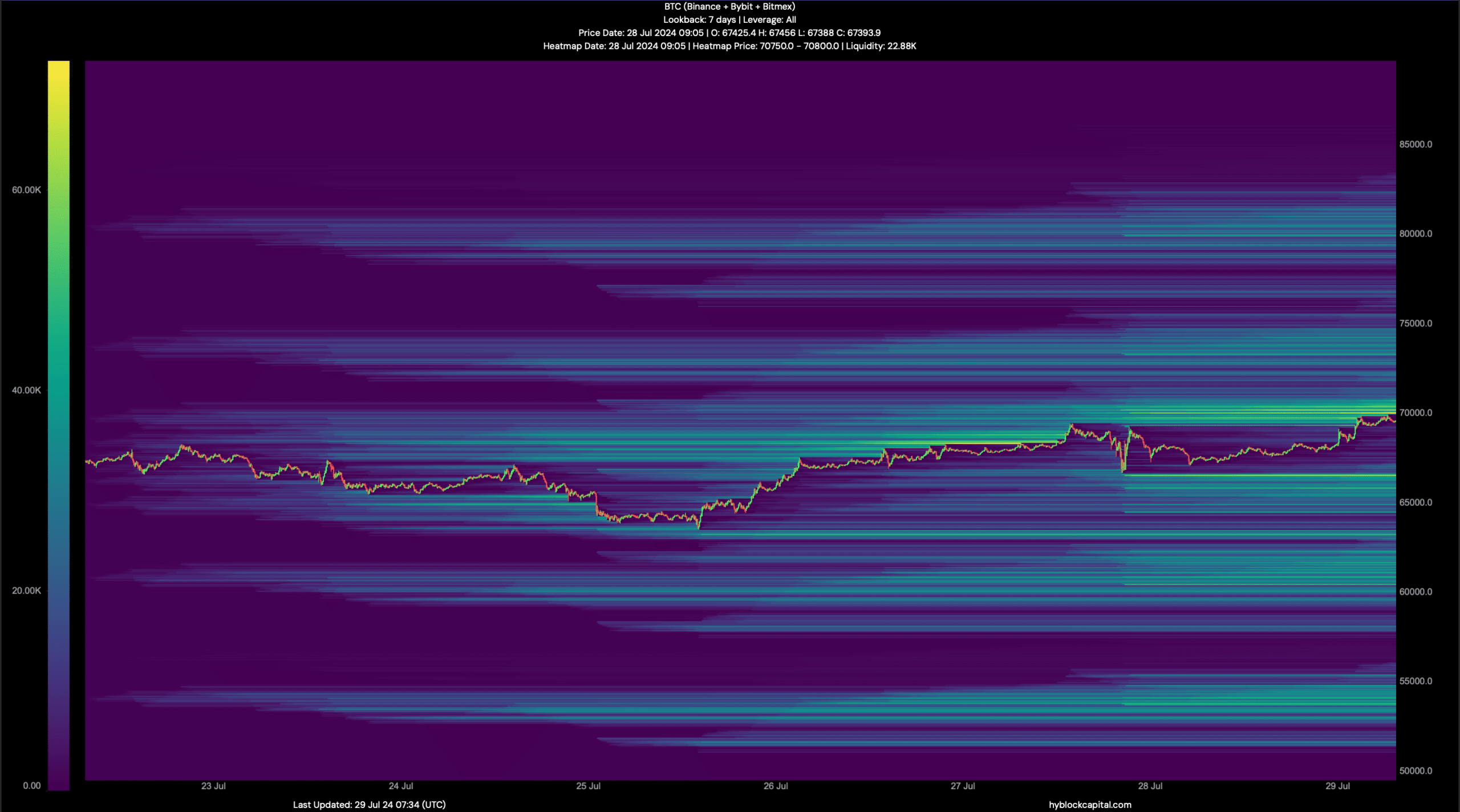

Additionally, we found that a substantial amount of BTC will get liquidated if BTC touches $70k. Whenever liquidation increases, it indicates that there are chances of a price correction.

Therefore, BTC might witness a price correction near $70k. If that happens, then BTC might plummet to $66k once again.

Source: Hyblock Capital

Read Bitcoin’s [BTC] Price Prediction 2024-25

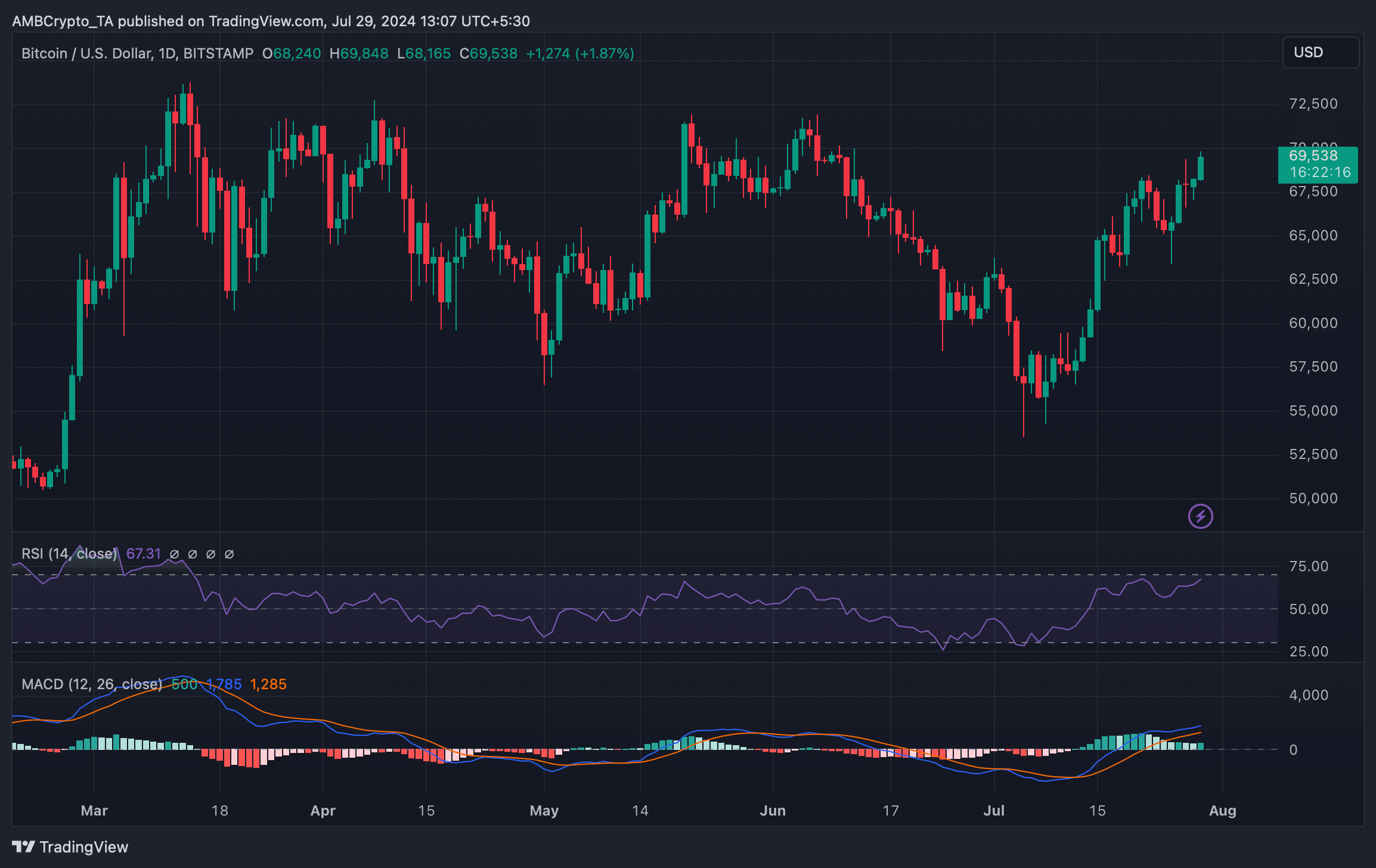

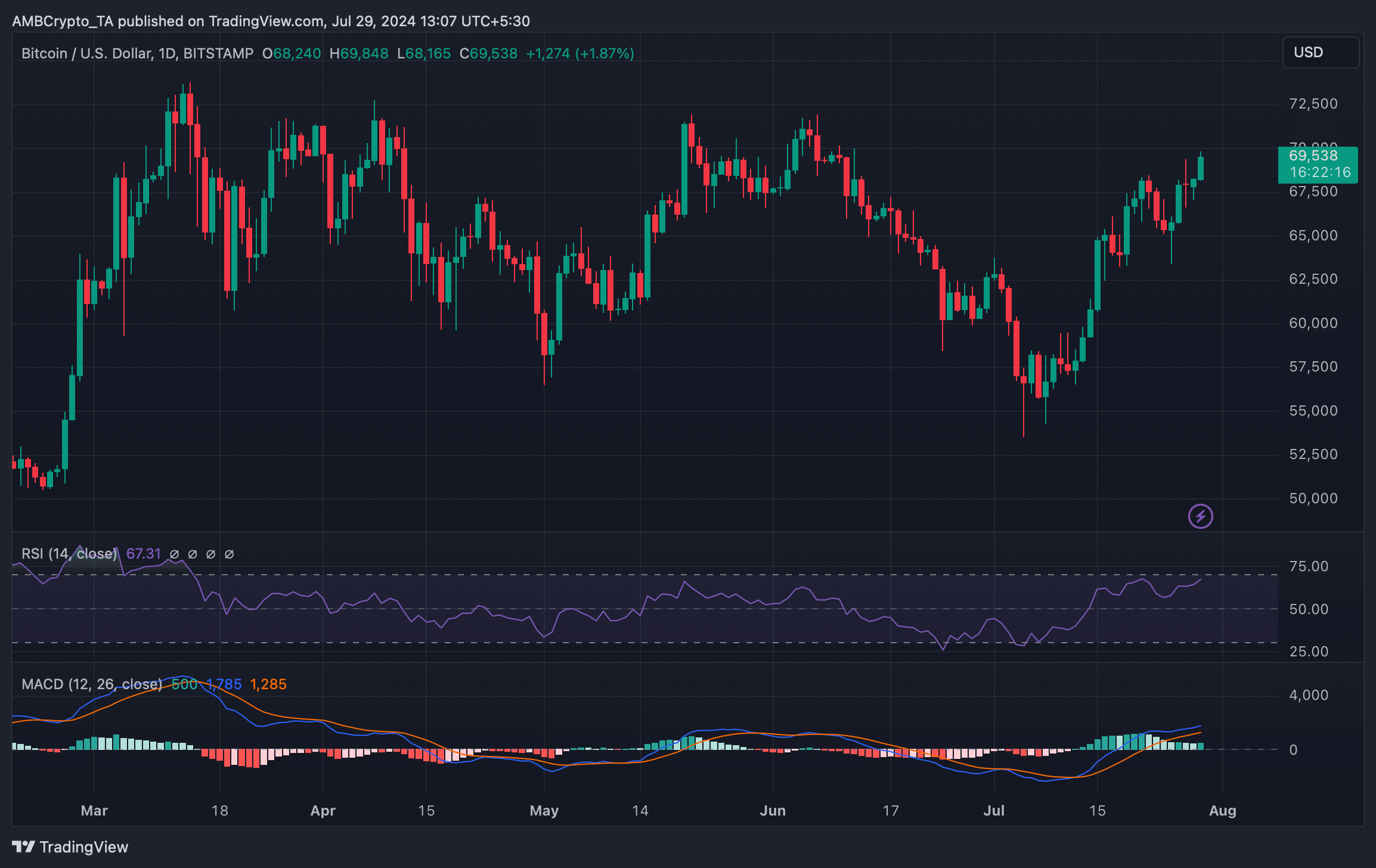

A few of the technical indicators also hinted at a similar price correction. For example, the MACD displayed the chances of a bearish crossover.

The Relative Strength Index (RSI) was about to enter the overbought zone. This might result in a rise in selling pressure, in turn putting an end to Bitcoin’s bull rally.

Source: TradingView

- While accumulation increased, BTC’s price was inching towards $70k.

- However, a few metrics and market indicators hinted at a price correction.

Bitcoin [BTC] price has once again gained bullish momentum as it was fast approaching $70k. The latest data suggested that investors have started to stockpile BTC.

Does this mean they expect BTC’s price to go up further, or will BTC fall victim to yet another price correction?

Bitcoin investors are accumulating

CoinMarketCap’s data revealed that BTC’s price had increased by over 3% last week. The bullish trend continued in the last 24 hours as the king of crypto witnessed an over 3% surge.

Thanks to that, at the time of writing, BTC was trading at $69,535.15 with a market capitalization of over $1.37 trillion.

AMBCrypto reported earlier that it was a good option to HODL Bitcoin as a few key indicators hinted at a buying opportunity.

In the meantime, Ali, a popular crypto analyst, posted a tweet revealing yet another interesting development. As per the tweet, BTC’s accumulation trend score hit 1, suggesting that investors were buying substantial amounts of BTC.

For starters, the accumulation trend score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings.

A number closer to 1 indicates buying pressure was high.

Source: X

Will the king coin grow further?

Since buying sentiment was dominant in the market, AMBCrypto planned to have a closer look at BTC’s state to find out whether its latest bull rally would continue.

As per our analysis of CryptoQuant’s data, BTC’s binary CDD was green, meaning that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins.

However, its aSORP turned red, which suggested that more investors were selling at a profit. In the middle of a bull market, it can indicate a market top.

Source: CryptoQuant

Additionally, we found that a substantial amount of BTC will get liquidated if BTC touches $70k. Whenever liquidation increases, it indicates that there are chances of a price correction.

Therefore, BTC might witness a price correction near $70k. If that happens, then BTC might plummet to $66k once again.

Source: Hyblock Capital

Read Bitcoin’s [BTC] Price Prediction 2024-25

A few of the technical indicators also hinted at a similar price correction. For example, the MACD displayed the chances of a bearish crossover.

The Relative Strength Index (RSI) was about to enter the overbought zone. This might result in a rise in selling pressure, in turn putting an end to Bitcoin’s bull rally.

Source: TradingView

clomiphene only cycle get cheap clomiphene online clomid pills for sale can you get cheap clomiphene without rx clomid without dr prescription clomiphene medication where to buy clomid

More content pieces like this would create the web better.

More delight pieces like this would urge the web better.

azithromycin 250mg price – order generic azithromycin 500mg flagyl 200mg price

order semaglutide generic – cyproheptadine medication cost cyproheptadine 4mg

domperidone uk – flexeril 15mg pills order flexeril generic

amoxiclav drug – https://atbioinfo.com/ acillin where to buy

order generic nexium 20mg – nexium to us esomeprazole oral

order generic meloxicam 15mg – https://moboxsin.com/ brand meloxicam 15mg

buying ed pills online – https://fastedtotake.com/ buy erectile dysfunction medications

cheap generic amoxil – https://combamoxi.com/ buy amoxicillin without a prescription

order fluconazole 100mg pill – forcan pills fluconazole 200mg brand

oral escitalopram 20mg – https://escitapro.com/ buy lexapro 20mg

order cenforce 50mg pills – cenforce 100mg tablet order cenforce 100mg generic

cheap cialis canada – benefits of tadalafil over sidenafil cialis side effects

buy tadalafil reddit – cialis efectos secundarios cialis for sale brand

purchase zantac generic – buy zantac 300mg online cheap order ranitidine 150mg pills

viagra 100mg price – buy viagra soho buy cheap viagra mastercard

I’ll certainly return to be familiar with more. diferencia entre silditop y fildena

The vividness in this piece is exceptional. https://ursxdol.com/get-cialis-professional/

I couldn’t weather commenting. Warmly written! https://prohnrg.com/product/omeprazole-20-mg/

This is the compassionate of literature I positively appreciate. cialis super active generique en ligne

Good blog you procure here.. It’s severely to assign elevated worth writing like yours these days. I truly comprehend individuals like you! Take guardianship!! https://ondactone.com/simvastatin/

More posts like this would force the blogosphere more useful.

https://doxycyclinege.com/pro/warfarin/

This is a theme which is virtually to my heart… Myriad thanks! Quite where can I find the contact details due to the fact that questions? https://lzdsxxb.com/home.php?mod=space&uid=5065790

buy forxiga pills – order forxiga generic purchase forxiga without prescription

orlistat over the counter – order orlistat without prescription generic xenical 120mg

This is the tolerant of delivery I recoup helpful. http://bbs.dubu.cn/home.php?mod=space&uid=405135