- Bitcoin has reached a fork in the road- recovery, or an extended accumulation phase.

- The long-term holders were slow in buying BTC despite the recent drops, a reticence that could spell trouble.

Bitcoin [BTC] continued to cling to the $61k support. News of BTC miners moving to Kaspa [KAS] might trigger more fear in the market, a recent AMBCrypto report revealed.

An analyst claimed that miners selling their assets to upgrade their hardware after the halving or for cash needs might not impact the market as heavily as anticipated.

So, are BTC holders ready for prices to rally? Or will the selling pressure continue from elsewhere?

Lack of demand combined with long-term holder behavior caused worries

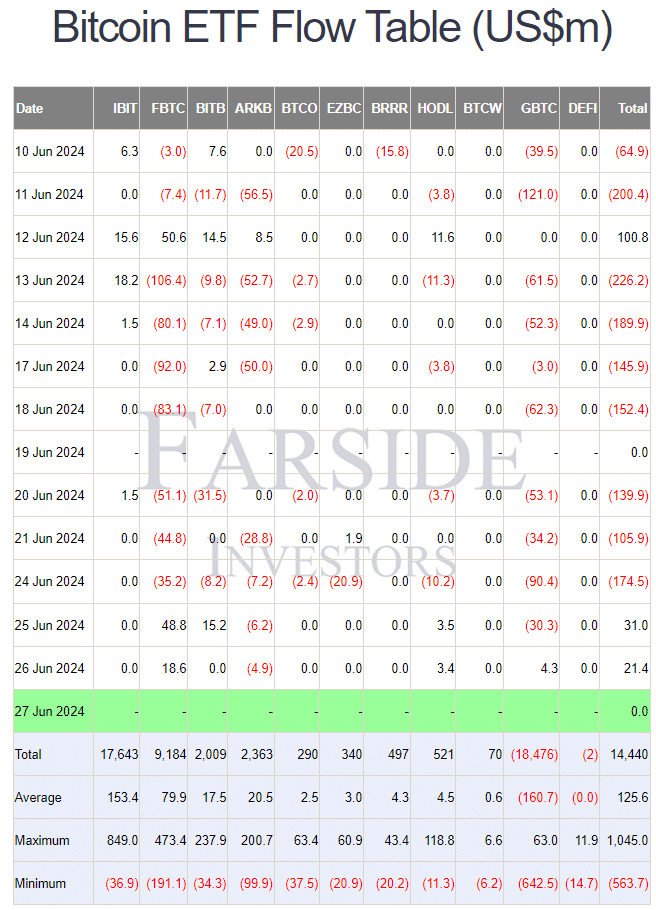

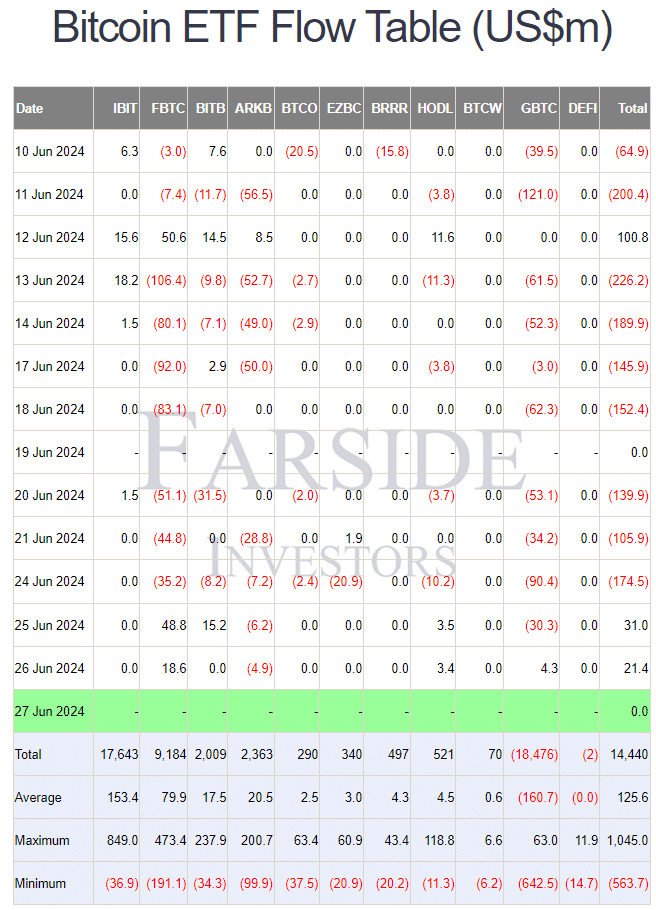

Source: Farside Investors

The ETF flows have been primarily negative in two weeks, with only the previous two days bringing some relief from the selling pressure.

This hinted at bearish sentiment for BTC from investors, but it is not yet clear whether that sentiment has begun to swing the other way or if this is a temporary respite before another wave of selling.

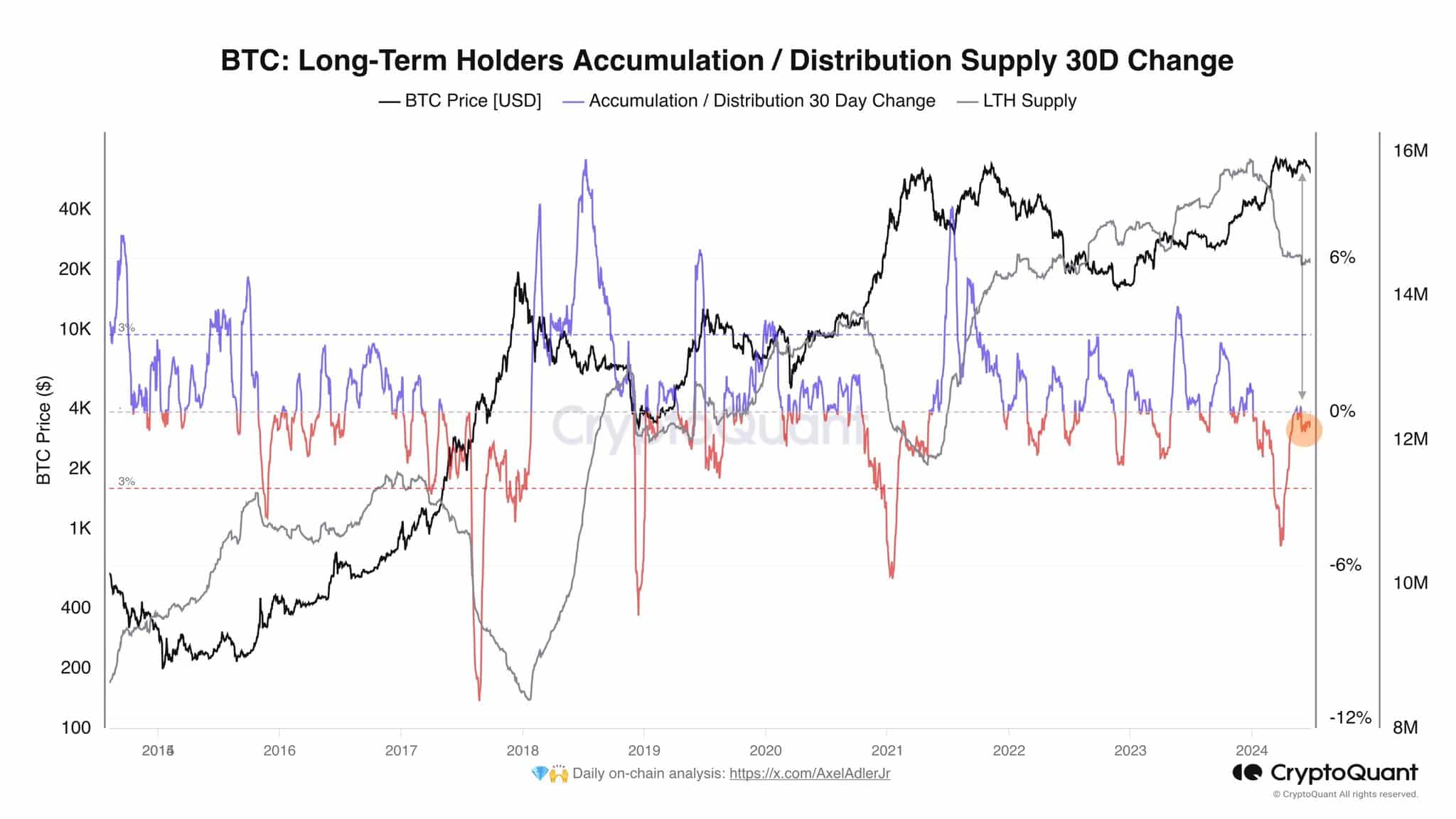

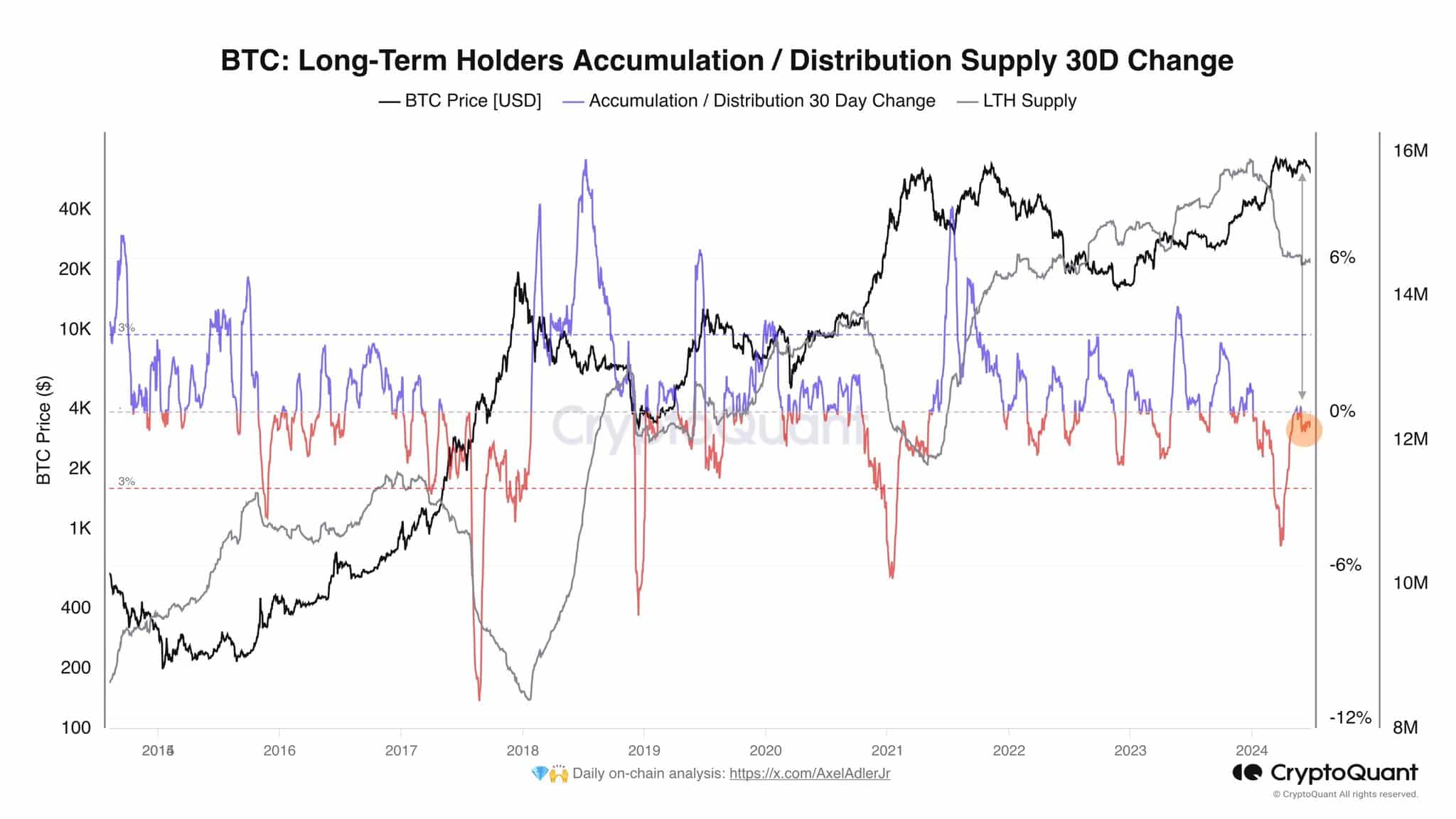

Source: Axel Adler on X

Crypto analyst Axel Adler observed on X (formerly Twitter) that the long-term holders’ supply change was minimal in recent weeks. This lack of LTH growth was a sign of pessimism across the market.

Supply in profit turns back from overheated zone

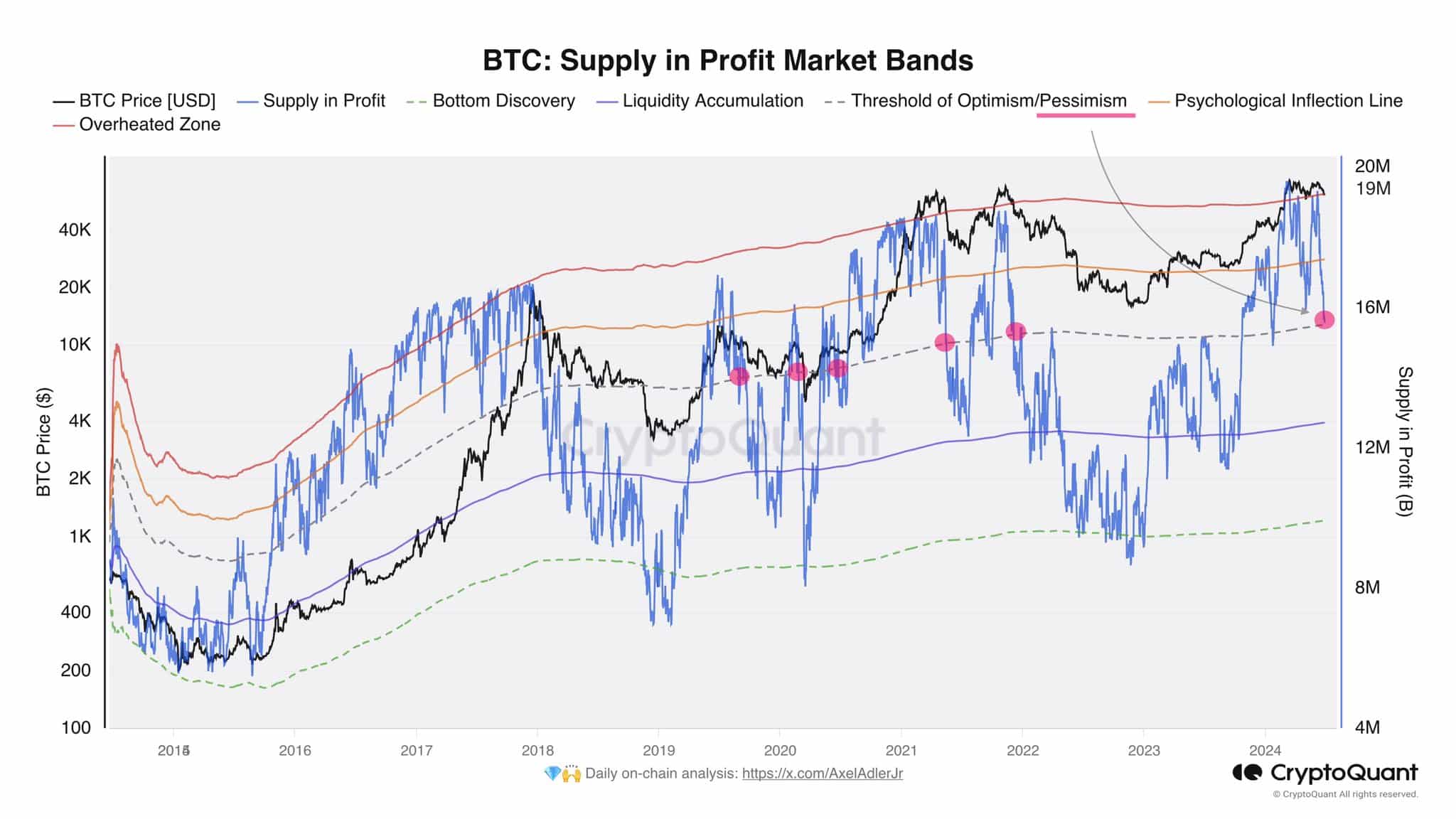

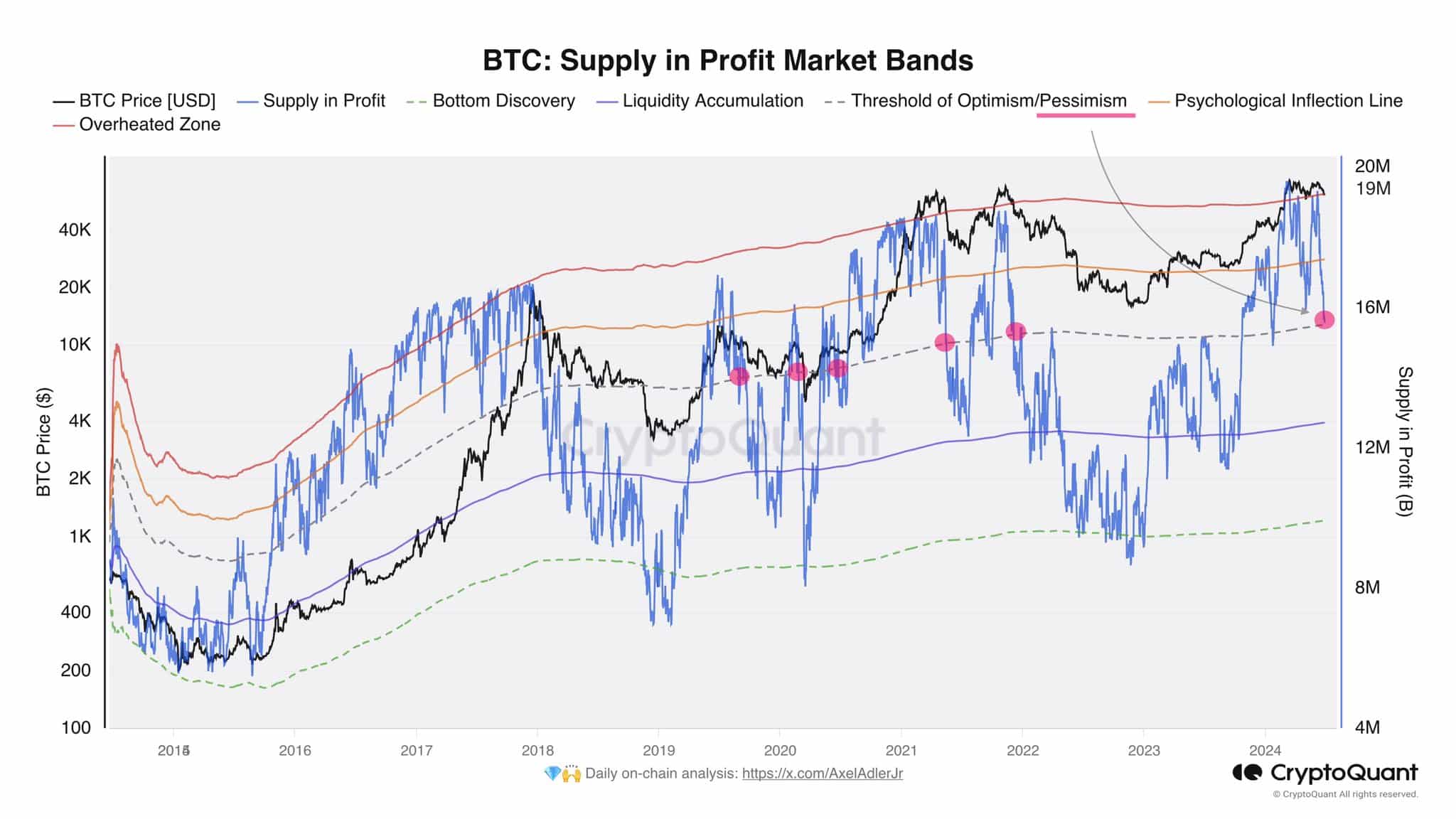

Source: Axel Adler on X

The analyst also pointed out that the supply in profit was at an inflection point. The threshold of optimism/pessimism had been reached.

In the past four years, whenever the supply in profit line crossed below this point, the market would likely go toward an extended accumulation phase.

This would be accompanied by a price drop and could dampen the bullish expectations that the market has for BTC after the halving in May.

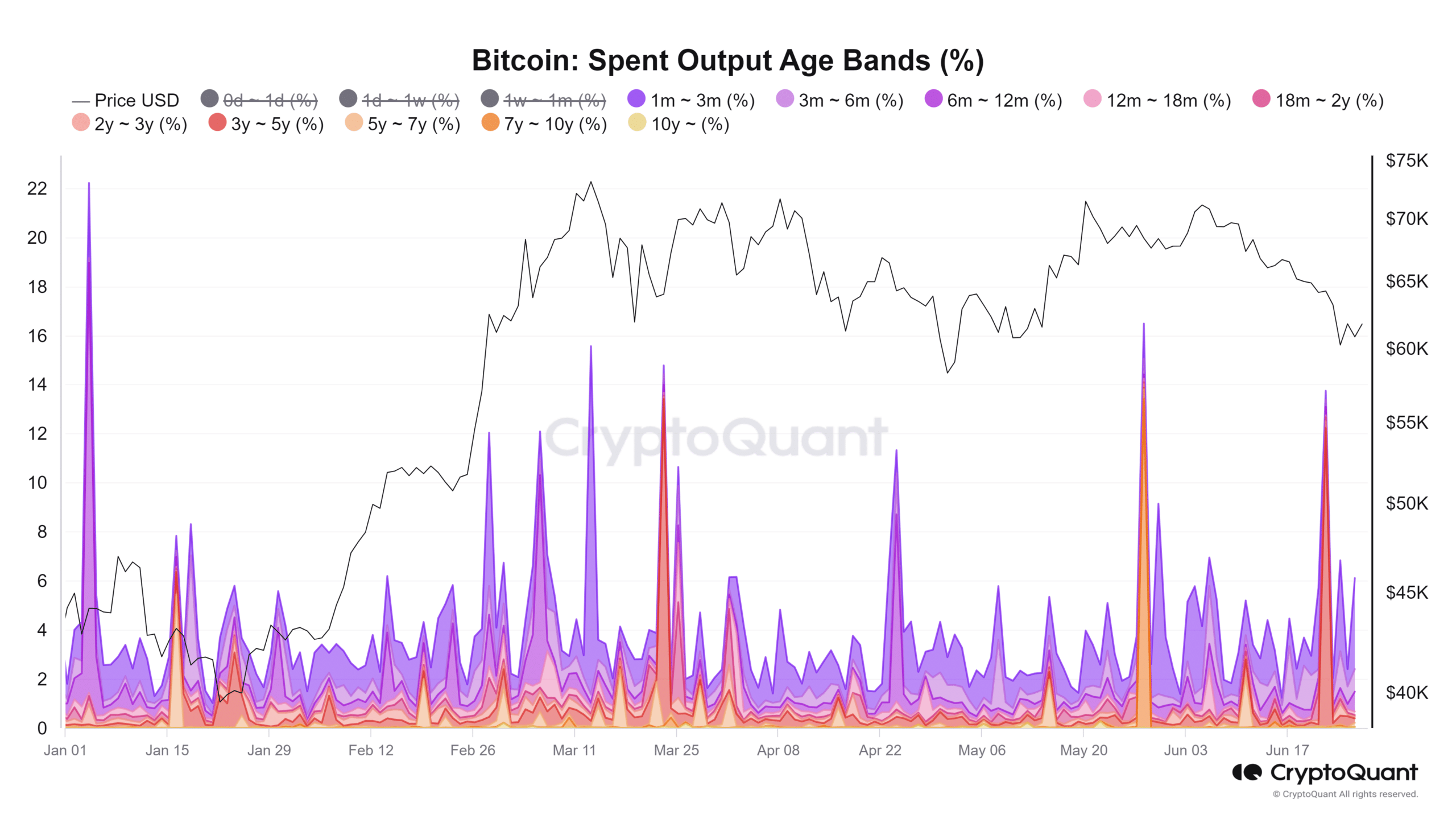

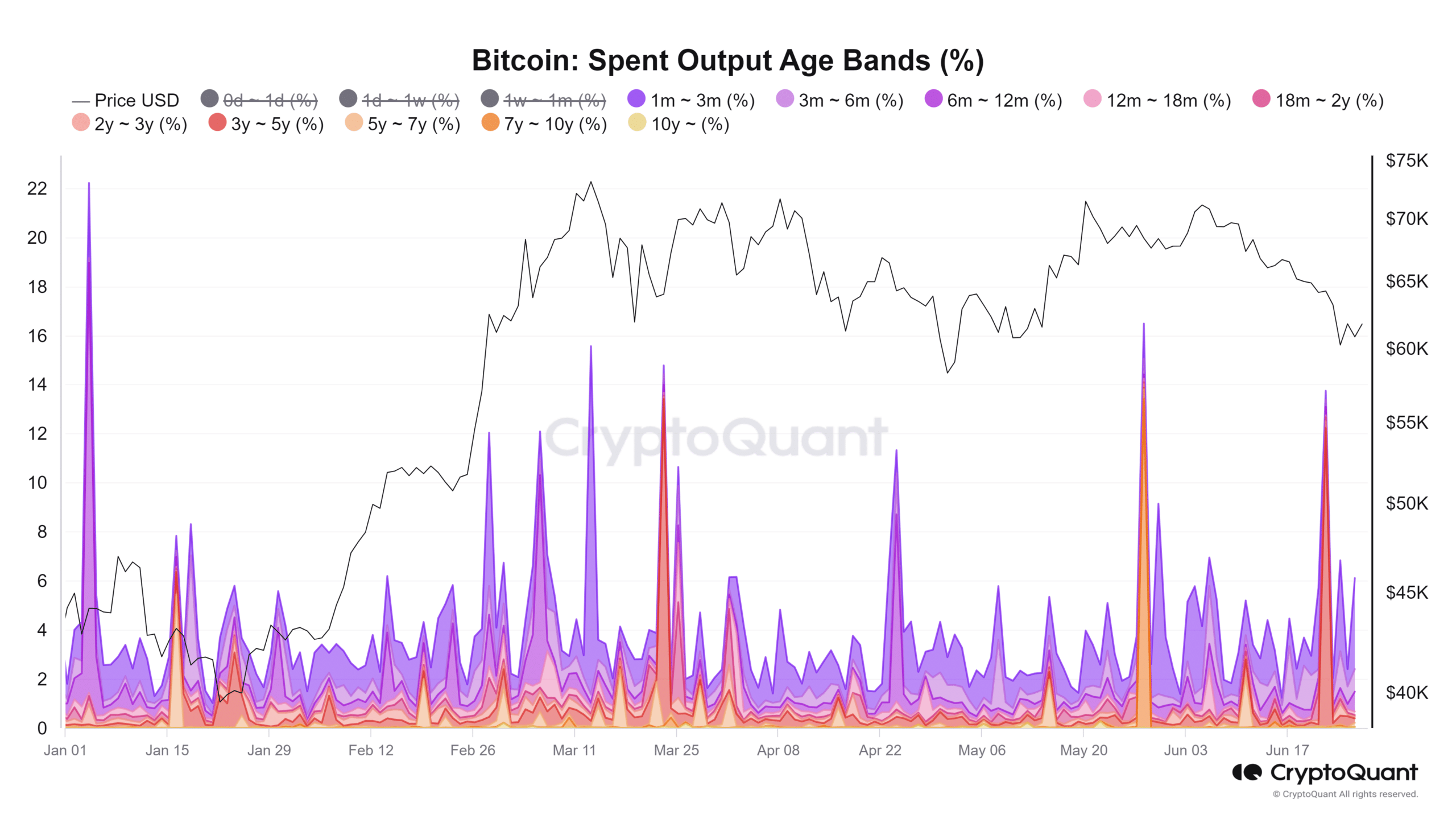

Source: CryptoQuant

The spent output age bands showed that late May and mid-June saw large coin movements from the 7-10-year holders and 3-5-year holders respectively.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This suggested that long-term holders were likely selling and was a sign of a lack of conviction.

It does not guarantee further price downturns but it is a sign that the selling pressure has not receded yet.

- Bitcoin has reached a fork in the road- recovery, or an extended accumulation phase.

- The long-term holders were slow in buying BTC despite the recent drops, a reticence that could spell trouble.

Bitcoin [BTC] continued to cling to the $61k support. News of BTC miners moving to Kaspa [KAS] might trigger more fear in the market, a recent AMBCrypto report revealed.

An analyst claimed that miners selling their assets to upgrade their hardware after the halving or for cash needs might not impact the market as heavily as anticipated.

So, are BTC holders ready for prices to rally? Or will the selling pressure continue from elsewhere?

Lack of demand combined with long-term holder behavior caused worries

Source: Farside Investors

The ETF flows have been primarily negative in two weeks, with only the previous two days bringing some relief from the selling pressure.

This hinted at bearish sentiment for BTC from investors, but it is not yet clear whether that sentiment has begun to swing the other way or if this is a temporary respite before another wave of selling.

Source: Axel Adler on X

Crypto analyst Axel Adler observed on X (formerly Twitter) that the long-term holders’ supply change was minimal in recent weeks. This lack of LTH growth was a sign of pessimism across the market.

Supply in profit turns back from overheated zone

Source: Axel Adler on X

The analyst also pointed out that the supply in profit was at an inflection point. The threshold of optimism/pessimism had been reached.

In the past four years, whenever the supply in profit line crossed below this point, the market would likely go toward an extended accumulation phase.

This would be accompanied by a price drop and could dampen the bullish expectations that the market has for BTC after the halving in May.

Source: CryptoQuant

The spent output age bands showed that late May and mid-June saw large coin movements from the 7-10-year holders and 3-5-year holders respectively.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This suggested that long-term holders were likely selling and was a sign of a lack of conviction.

It does not guarantee further price downturns but it is a sign that the selling pressure has not receded yet.

clomid pill where buy generic clomid without dr prescription can i purchase generic clomiphene for sale where to get clomiphene where to get generic clomid without prescription cost of clomid at cvs where buy clomiphene without prescription

I’ll certainly carry back to read more.

This website positively has all of the bumf and facts I needed about this thesis and didn’t identify who to ask.

purchase azithromycin for sale – tetracycline 250mg sale order metronidazole 400mg generic

buy semaglutide 14 mg for sale – order periactin pill order cyproheptadine online

order domperidone generic – domperidone online buy buy generic cyclobenzaprine

augmentin 1000mg price – atbioinfo buy cheap ampicillin

esomeprazole 40mg pills – anexa mate order nexium without prescription

order coumadin generic – https://coumamide.com/ losartan 50mg for sale

buy generic mobic for sale – swelling buy meloxicam 15mg without prescription

prednisone without prescription – allergic reactions cheap prednisone

male ed drugs – non prescription ed pills top ed pills

amoxicillin canada – purchase amoxicillin pills buy amoxil generic

order fluconazole 100mg – https://gpdifluca.com/# fluconazole pill

buy generic escitalopram online – https://escitapro.com/ order escitalopram 10mg pill

cheap cenforce 50mg – buy cenforce 50mg for sale brand cenforce