- Investors withdrew $563.7 million, signaling a potential sentiment shift post-inflows

- BNP Paribas revealed its Bitcoin investment, marking a reversal in attitude

Bitcoin [BTC], at the time of writing, appeared to be recovering from its recent dip below $60,000. However, it wasn’t all good news as spot BTC exchange-traded funds (ETFs) experienced a break in their inflows after a remarkable 71-day streak.

In fact, according to a Bloomberg report, investors withdrew worth $563.7 million from BTC ETFs on 1 May. This marked the largest single-day outflow since these spot ETFs’ debut in January, signaling a potential shift in investor sentiment after a prolonged period of inflows.

Robert Mitchnick clears the confusion

Clearing the air around the same, Robert Mitchnick, Head of Digital Assets for BlackRock, in a recent interview said,

“Don’t be fooled…the current lull is likely to be followed by a new wave from a different type of investor.”

Here, the exec might be referring to a resurgence of interest in Bitcoin among institutional investors, including sovereign wealth funds, pension funds, and endowments.

Something similar was confirmed when BNP Paribas, one of the largest banks in Europe, made its play by purchasing shares in BlackRock’s iShares Bitcoin Trust (IBIT).

According to a Form 13F filing with the U.S. Securities and Exchange Commission (SEC), BNP Paribas, Europe’s second-largest bank, purchased 1,030 IBIT shares for $41,684.10 in Q1 2024. Each share was priced at $40.47, significantly lower than the current value of a single Bitcoin.

Interestingly, back in September 2022, Sandro Pierri, Head of the fund management group BNP Paribas Asset Management, had said,

“We are not involved in cryptocurrencies and we don’t want to be involved.”

What this demonstrates is a reversal in the bank’s position, while also reflecting a newfound interest or willingness to engage with Bitcoin as an investment asset.

Remaking on the same, Coinbase CFO Alesia Haas, in a conversation with CNBC, said,

“Well, ETFs have unlocked a flywheel of engagement on our platform. Yes, we saw $11 billion of inflows into ETFs but, we also saw an increase in consumer trading on our platform…”

Growing acceptance of digital assets

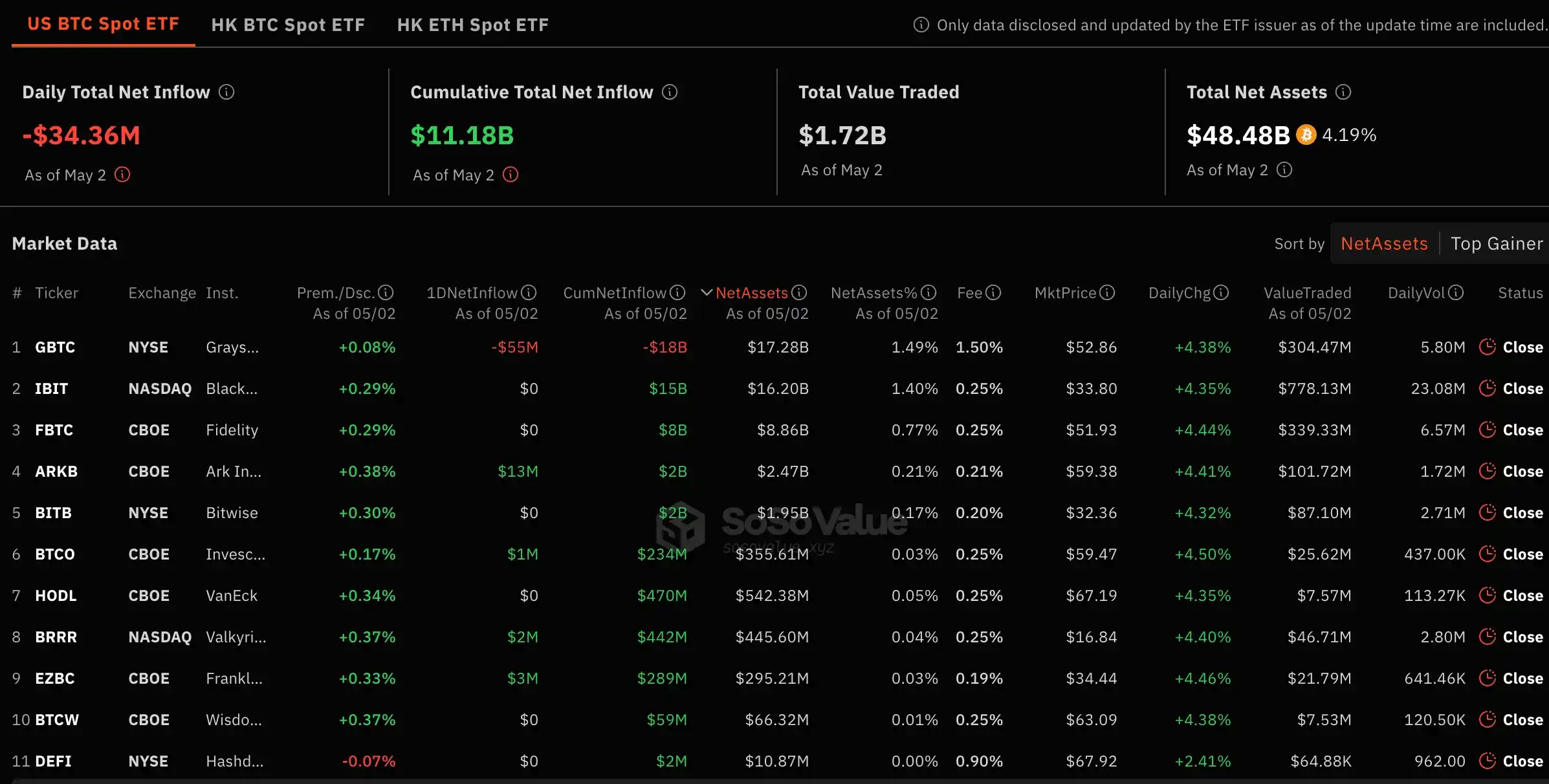

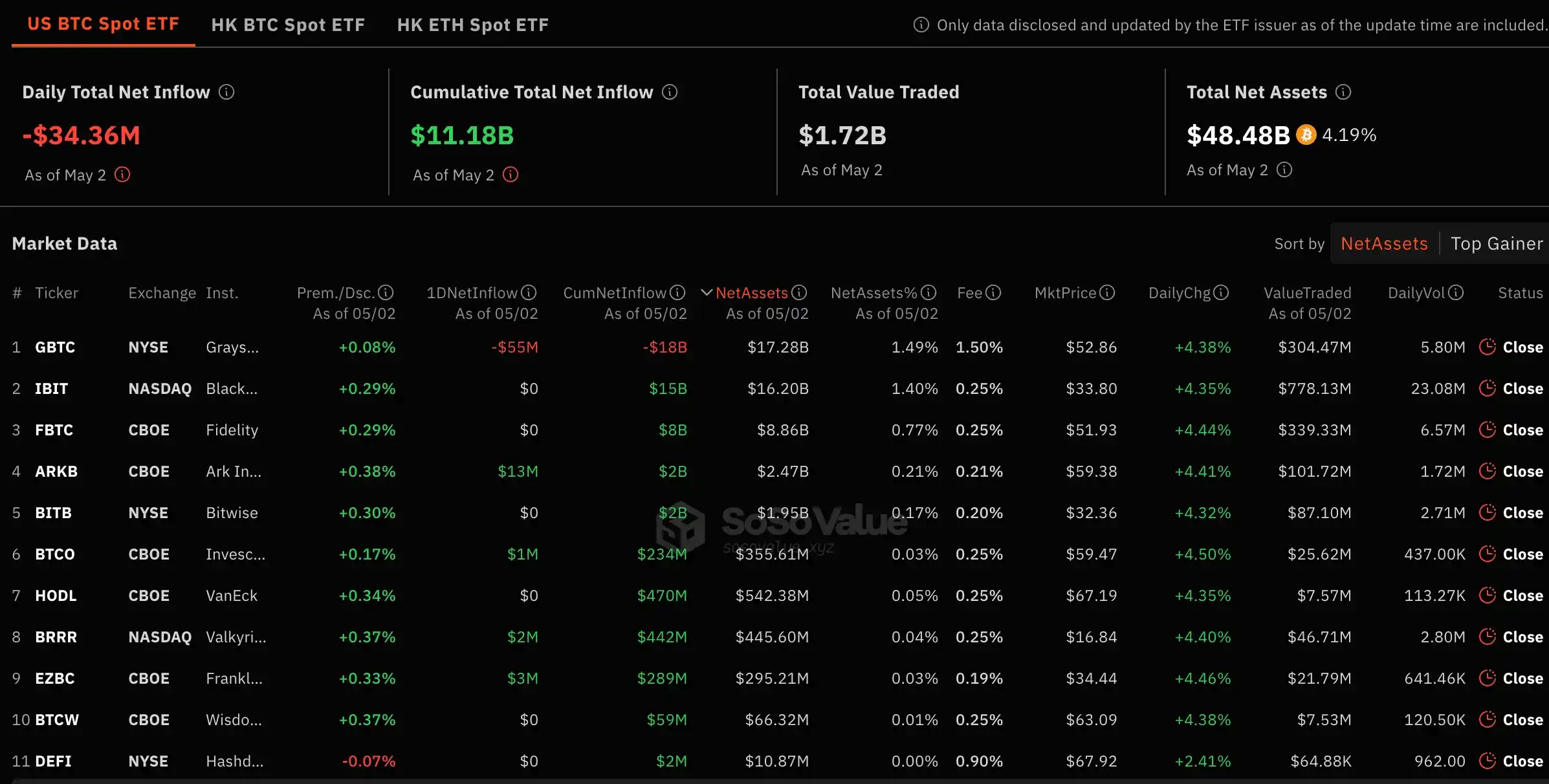

All this has further resulted in a horse race among various Bitcoin ETFs. Topping the charts right now are IBIT and Grayscale’s GBTC.

Source: Sosovalue

In conclusion, institutional interest in BTC and Bitcoin ETFs signals the growing acceptance of cryptocurrencies. BlackRock’s educational efforts towards Bitcoin and Ethereum [ETH] ETFs and their adoption, as highlighted by Mitchnick, further highlight a shift towards recognizing digital assets’ potential in portfolios.

- Investors withdrew $563.7 million, signaling a potential sentiment shift post-inflows

- BNP Paribas revealed its Bitcoin investment, marking a reversal in attitude

Bitcoin [BTC], at the time of writing, appeared to be recovering from its recent dip below $60,000. However, it wasn’t all good news as spot BTC exchange-traded funds (ETFs) experienced a break in their inflows after a remarkable 71-day streak.

In fact, according to a Bloomberg report, investors withdrew worth $563.7 million from BTC ETFs on 1 May. This marked the largest single-day outflow since these spot ETFs’ debut in January, signaling a potential shift in investor sentiment after a prolonged period of inflows.

Robert Mitchnick clears the confusion

Clearing the air around the same, Robert Mitchnick, Head of Digital Assets for BlackRock, in a recent interview said,

“Don’t be fooled…the current lull is likely to be followed by a new wave from a different type of investor.”

Here, the exec might be referring to a resurgence of interest in Bitcoin among institutional investors, including sovereign wealth funds, pension funds, and endowments.

Something similar was confirmed when BNP Paribas, one of the largest banks in Europe, made its play by purchasing shares in BlackRock’s iShares Bitcoin Trust (IBIT).

According to a Form 13F filing with the U.S. Securities and Exchange Commission (SEC), BNP Paribas, Europe’s second-largest bank, purchased 1,030 IBIT shares for $41,684.10 in Q1 2024. Each share was priced at $40.47, significantly lower than the current value of a single Bitcoin.

Interestingly, back in September 2022, Sandro Pierri, Head of the fund management group BNP Paribas Asset Management, had said,

“We are not involved in cryptocurrencies and we don’t want to be involved.”

What this demonstrates is a reversal in the bank’s position, while also reflecting a newfound interest or willingness to engage with Bitcoin as an investment asset.

Remaking on the same, Coinbase CFO Alesia Haas, in a conversation with CNBC, said,

“Well, ETFs have unlocked a flywheel of engagement on our platform. Yes, we saw $11 billion of inflows into ETFs but, we also saw an increase in consumer trading on our platform…”

Growing acceptance of digital assets

All this has further resulted in a horse race among various Bitcoin ETFs. Topping the charts right now are IBIT and Grayscale’s GBTC.

Source: Sosovalue

In conclusion, institutional interest in BTC and Bitcoin ETFs signals the growing acceptance of cryptocurrencies. BlackRock’s educational efforts towards Bitcoin and Ethereum [ETH] ETFs and their adoption, as highlighted by Mitchnick, further highlight a shift towards recognizing digital assets’ potential in portfolios.

nyuncrjcvbchifvpywjileqfbbpafp https://autocadhelp.net/wp-content/uploads/aios/%D0%A1%D0%B5%D0%BA%D1%80%D0%B5%D1%82%D1%8B_%D1%83%D1%81%D0%BF%D0%B5%D1%85%D0%B0_%D0%B2_%D0%BE%D0%BD%D0%BB%D0%B0%D0%B9%D0%BD_%D1%81%D0%BB%D0%BE%D1%82%D0%B0%D1%85.html

платформа для покупки аккаунтов биржа аккаунтов

платформа для покупки аккаунтов маркетплейс аккаунтов соцсетей

продать аккаунт купить аккаунт

купить аккаунт с прокачкой магазин аккаунтов

биржа аккаунтов магазин аккаунтов

маркетплейс аккаунтов гарантия при продаже аккаунтов

маркетплейс аккаунтов соцсетей pokupka-akkauntov-online.ru/

Account Buying Service buyverifiedaccounts001.com

Accounts for Sale Account Trading Platform

Verified Accounts for Sale Online Account Store

Purchase Ready-Made Accounts Account Purchase

Account Store Purchase Ready-Made Accounts

Account Trading Platform Sell Pre-made Account

Purchase Ready-Made Accounts Verified Accounts for Sale

Guaranteed Accounts Account Catalog

Sell accounts Sell accounts

Buy and Sell Accounts Account Purchase

account exchange account exchange service

account selling platform secure account sales

secure account sales socialaccountssale.com

accounts market accounts market

account trading service profitable account sales

account buying platform https://accountsmarketbest.com

buy pre-made account account buying service

website for buying accounts account trading service

account exchange buy pre-made account

account buying platform secure account purchasing platform

marketplace for ready-made accounts purchase ready-made accounts

profitable account sales account trading service

buy pre-made account buy pre-made account

marketplace for ready-made accounts sell accounts

database of accounts for sale find accounts for sale

sell pre-made account database of accounts for sale

secure account purchasing platform buy account

account acquisition website for buying accounts

verified accounts for sale marketplace for ready-made accounts

accounts market account purchase

guaranteed accounts account buying platform

account trading platform account market

profitable account sales ready-made accounts for sale

accounts for sale gaming account marketplace

sell accounts online account store

buy and sell accounts https://accounts-offer.org/

website for selling accounts https://accounts-marketplace.xyz

account trading service https://social-accounts-marketplaces.live/

buy account https://accounts-marketplace.live

buy accounts https://social-accounts-marketplace.xyz

database of accounts for sale https://buy-accounts.space/

account market https://buy-accounts-shop.pro/

secure account purchasing platform https://buy-accounts.live

secure account sales https://accounts-marketplace.online/

find accounts for sale https://social-accounts-marketplace.live

secure account sales https://accounts-marketplace-best.pro

магазин аккаунтов https://akkaunty-na-prodazhu.pro/

площадка для продажи аккаунтов купить аккаунт

маркетплейс аккаунтов https://kupit-akkaunt.xyz/

магазин аккаунтов https://akkaunt-magazin.online

биржа аккаунтов akkaunty-market.live

магазин аккаунтов магазины аккаунтов

купить аккаунт akkaunty-optom.live

покупка аккаунтов https://online-akkaunty-magazin.xyz/

маркетплейс аккаунтов akkaunty-dlya-prodazhi.pro

площадка для продажи аккаунтов https://kupit-akkaunt.online

facebook ads account buy https://buy-adsaccounts.work/

buy fb account https://buy-ad-accounts.click

buy facebook ads accounts buy facebook accounts

buying fb accounts buy facebook account

buying fb accounts https://ad-account-buy.top

buy facebook ad accounts buy facebook ad account

facebook accounts for sale https://ad-account-for-sale.top

facebook ads account buy https://buy-ad-account.click

facebook ads account for sale https://ad-accounts-for-sale.work

buy google ads invoice account https://buy-ads-account.top

old google ads account for sale buy google ads threshold accounts

facebook account buy https://buy-accounts.click

buy verified google ads account https://ads-account-for-sale.top

sell google ads account https://ads-account-buy.work/

buy google adwords account buy google ads verified account

buy google ads threshold accounts https://buy-account-ads.work

google ads accounts https://buy-ads-agency-account.top

google ads account buy https://sell-ads-account.click

buy google ads threshold accounts https://ads-agency-account-buy.click

verified facebook business manager for sale buy-business-manager.org

buy google ad threshold account https://buy-verified-ads-account.work

buy facebook business manager verified buy-bm-account.org

facebook bm buy https://buy-verified-business-manager-account.org

buy facebook business manager buy-verified-business-manager.org

buy fb bm https://buy-business-manager-acc.org/

buy facebook bm account business-manager-for-sale.org

buy facebook bm buy-business-manager-verified.org

buy verified business manager facebook buy-bm.org

buy facebook bm account https://verified-business-manager-for-sale.org

business manager for sale buy-business-manager-accounts.org

buy tiktok business account https://buy-tiktok-ads-account.org

buy tiktok business account https://tiktok-ads-account-buy.org

tiktok ads agency account buy tiktok ad account

buy tiktok ads accounts https://tiktok-agency-account-for-sale.org

tiktok ads account buy https://buy-tiktok-ad-account.org

tiktok ads account buy https://buy-tiktok-ads-accounts.org

tiktok ads account buy https://tiktok-ads-agency-account.org

buy tiktok business account https://buy-tiktok-business-account.org

tiktok ad accounts https://buy-tiktok-ads.org

can i order clomiphene online how to get cheap clomid without prescription how to buy generic clomid can i get cheap clomid no prescription cost clomid prices where to buy clomiphene pill can you get clomiphene without insurance

This is a keynote which is in to my callousness… Many thanks! Exactly where can I upon the acquaintance details for questions?

Palatable blog you have here.. It’s severely to on elevated calibre writing like yours these days. I truly appreciate individuals like you! Withstand care!!

buy azithromycin 250mg sale – order ciplox pill order flagyl 400mg generic

buy semaglutide no prescription – periactin pills buy periactin

cost domperidone – motilium 10mg us order flexeril pill

buy azithromycin 250mg – buy generic nebivolol 5mg bystolic 5mg over the counter

purchase augmentin online – https://atbioinfo.com/ order ampicillin sale

buy nexium 20mg sale – https://anexamate.com/ order generic esomeprazole

buy medex pills for sale – https://coumamide.com/ order losartan 50mg generic

where can i buy meloxicam – https://moboxsin.com/ meloxicam 7.5mg generic

purchase prednisone pills – https://apreplson.com/ buy generic prednisone for sale