- Analysts claimed that the Alt season could lag amidst a possible BTC dominance surge.

- But other observers expected the alt season to be trigged by the US spot ETH ETF launch.

The altcoin market could hit an inflection point this week as US spot Ethereum [ETH] ETF begin to trade. As the largest altcoin, ETH performance could set the pace for the altcoin sector.

However, per renowned crypto analyst Benjamin Cowen, the altcoin season could lag amidst a potential surge in Bitcoin [BTC] dominance ahead of a likely Fed rate cut in September.

According to Cowen, the current BTC dominance mirrored the 2019 pattern, two months before the Fed cut rate happened and Alts failed to catch up.

‘BTC also had an explosive move back then too, and ALTs could just not keep up. Similar candle today, potentially 2 months before the 1st rate cut.’

Source: X/Benjamin Cowen

Will Ethereum ETF trigger Alt season?

This could be bad news for crypto investors who were expecting relief from the altcoin market, which saw massive drawdowns in June.

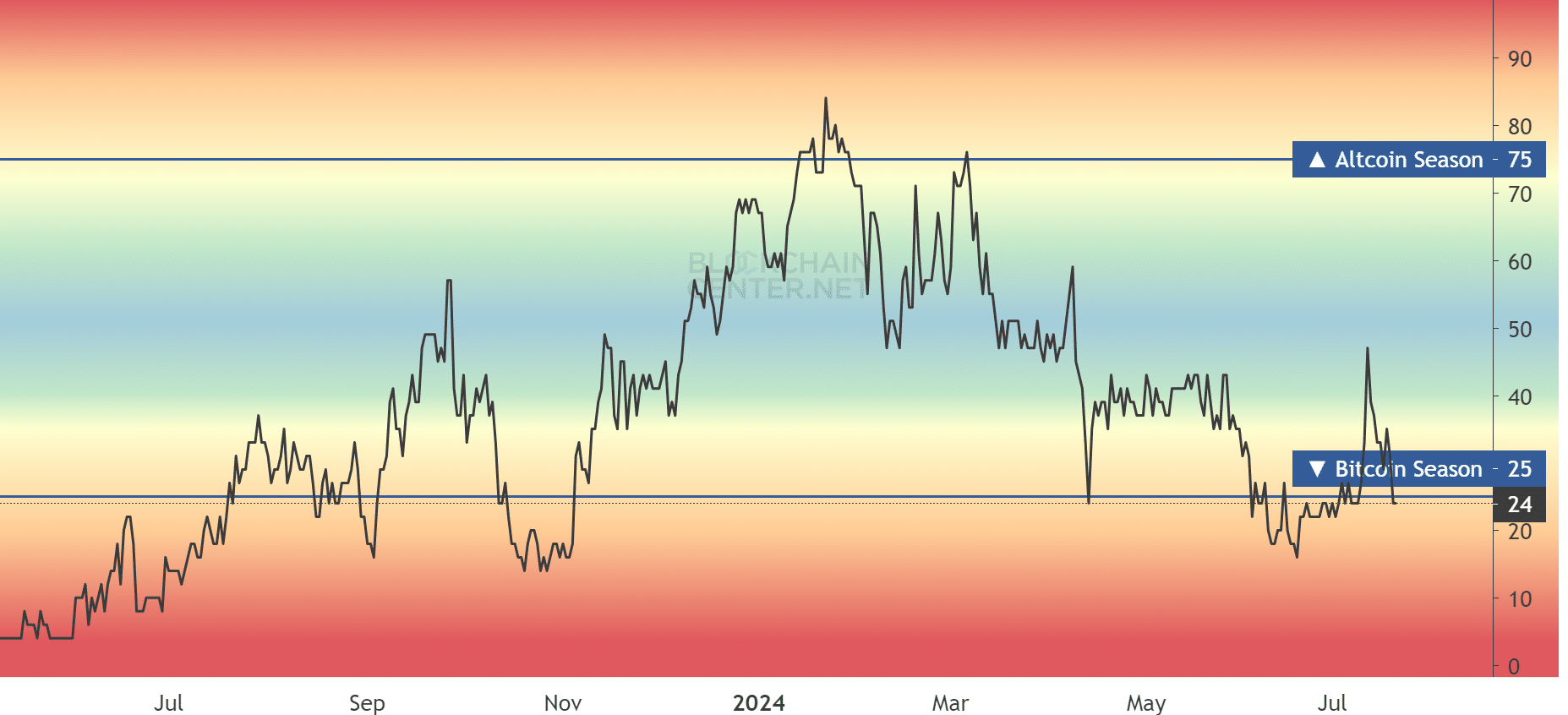

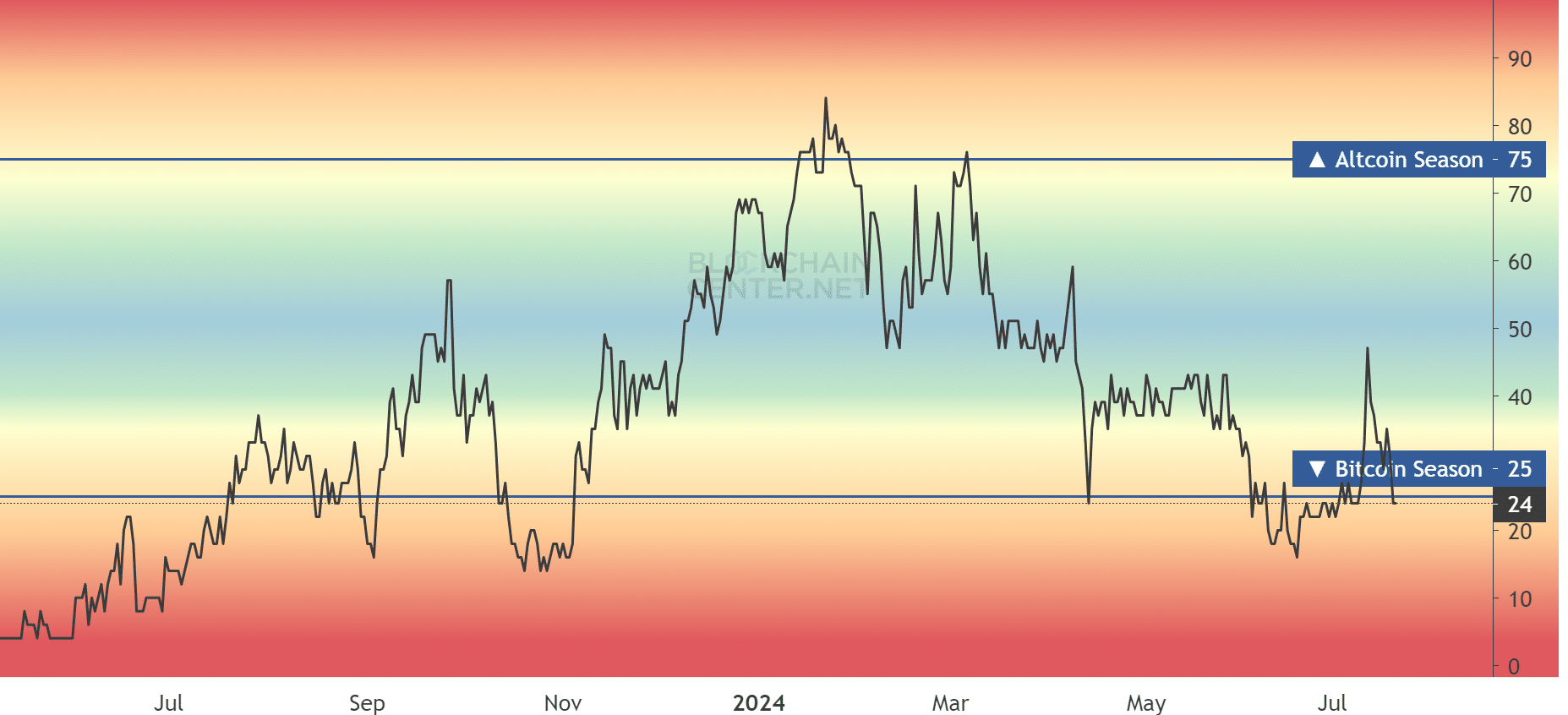

In addition, the Altcoin Season Index indicator revealed that the alt season was not in just yet, as of press time.

Source: Blockchain Center

According to the indicator, the first half of 2024 has been a Bitcoin season. And if Cowen’s projections are correct, this pattern could continue.

However, BTC Dominance is just one way to gauge the Altcoin season. According to some analysts, including Glassnode founders, the other is the ETH/BTC ratio.

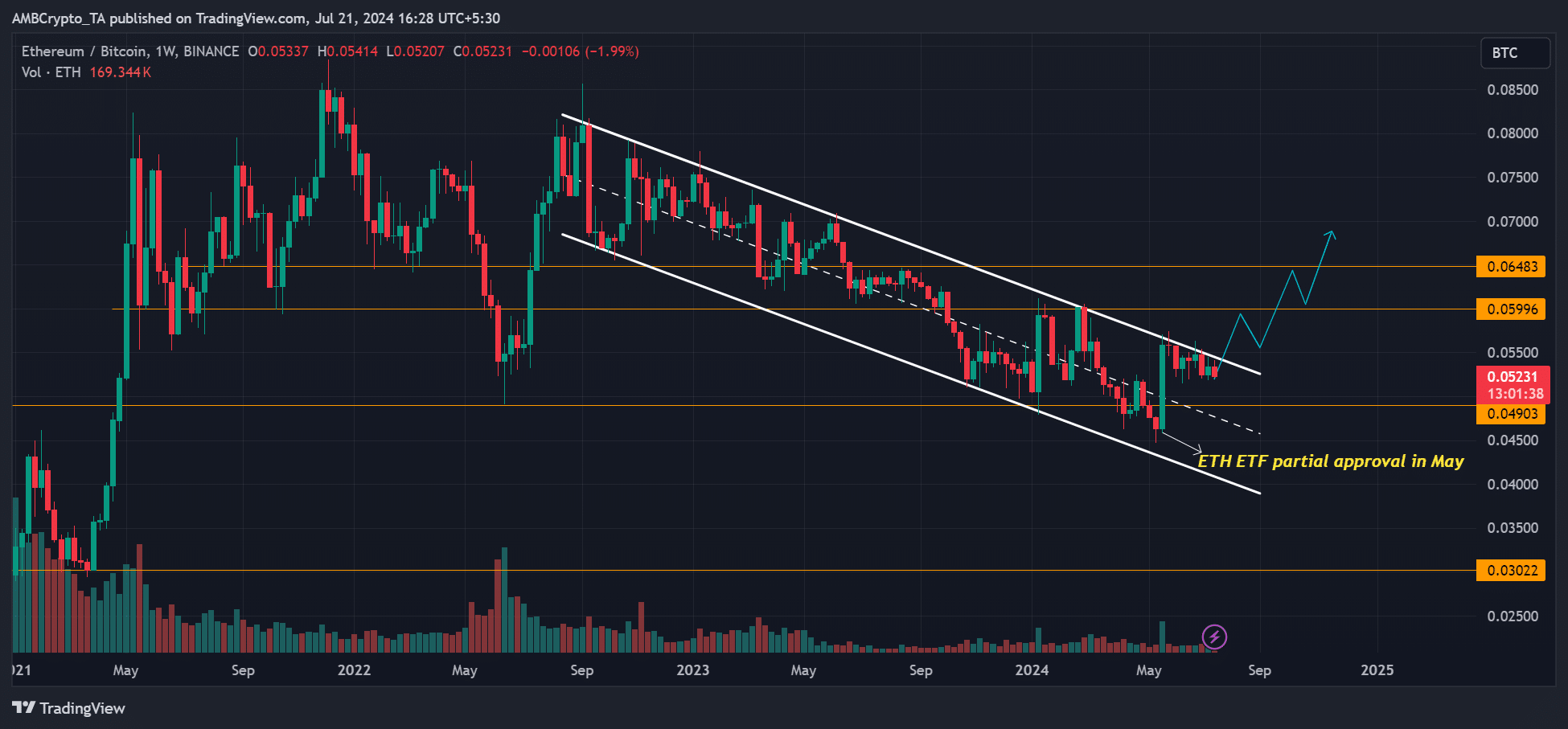

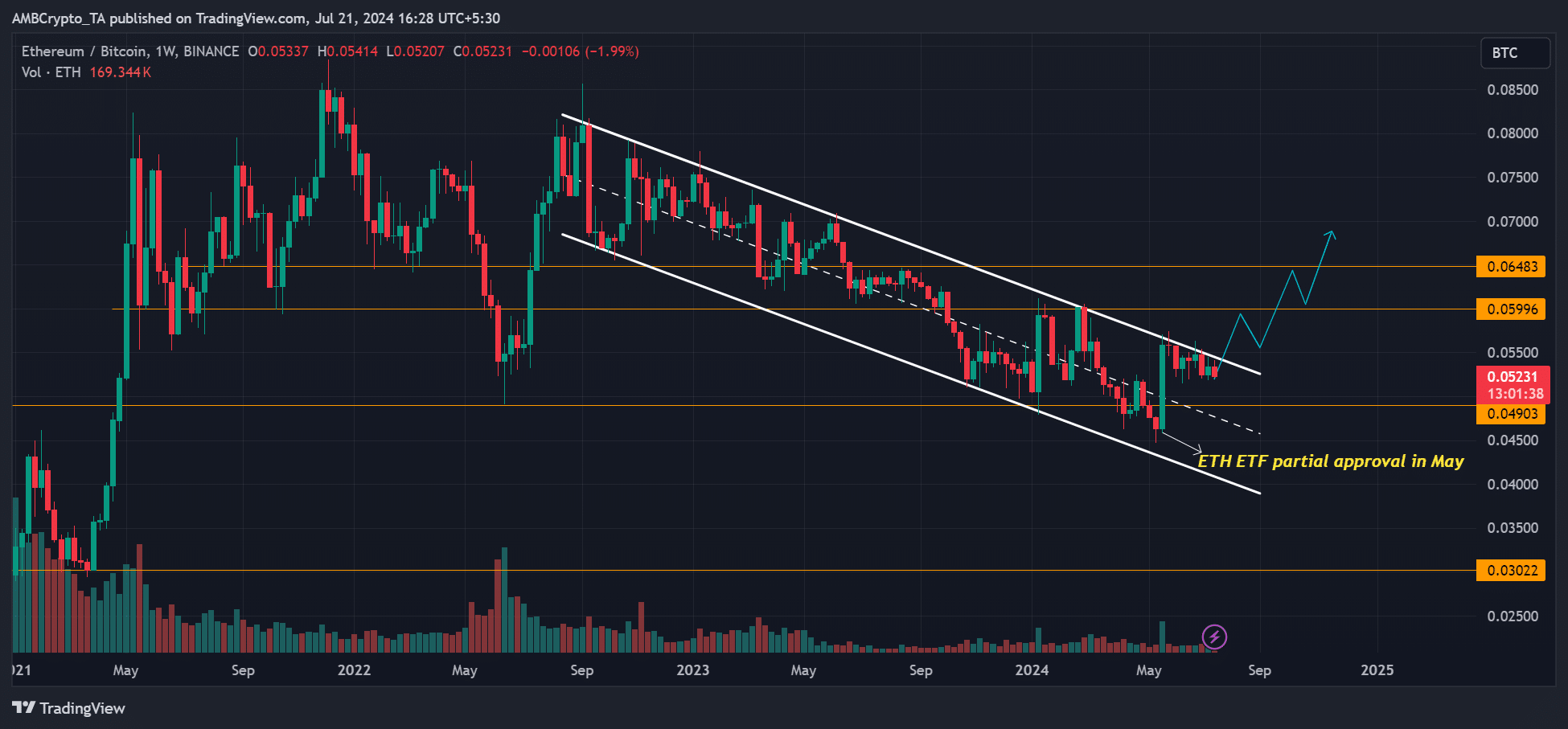

ETH/BTC tracks ETH performance relative to BTC. According to Glassnode founders, who go by the username Negentropic on X, the ratio was tipped to rip off and trigger altcoin season if the US spot ETH ETF begins trading.

The products are set to launch and start trading this week.

AMBCrypto’s evaluation of the ETH/BTC ratio showed that it surged after the partial approval of ETH ETF in May. However, the ratio was yet to break its downtrend, as denoted by the descending channel (white).

Source: ETH/BTC, TradingView

It remains to be seen how the ETH/BTC will react and whether it could trigger the altcoin season. So, the BTC Dominance and ETH/BTC ratio were key fronts to track and gauge the possible impact on altcoins.

- Analysts claimed that the Alt season could lag amidst a possible BTC dominance surge.

- But other observers expected the alt season to be trigged by the US spot ETH ETF launch.

The altcoin market could hit an inflection point this week as US spot Ethereum [ETH] ETF begin to trade. As the largest altcoin, ETH performance could set the pace for the altcoin sector.

However, per renowned crypto analyst Benjamin Cowen, the altcoin season could lag amidst a potential surge in Bitcoin [BTC] dominance ahead of a likely Fed rate cut in September.

According to Cowen, the current BTC dominance mirrored the 2019 pattern, two months before the Fed cut rate happened and Alts failed to catch up.

‘BTC also had an explosive move back then too, and ALTs could just not keep up. Similar candle today, potentially 2 months before the 1st rate cut.’

Source: X/Benjamin Cowen

Will Ethereum ETF trigger Alt season?

This could be bad news for crypto investors who were expecting relief from the altcoin market, which saw massive drawdowns in June.

In addition, the Altcoin Season Index indicator revealed that the alt season was not in just yet, as of press time.

Source: Blockchain Center

According to the indicator, the first half of 2024 has been a Bitcoin season. And if Cowen’s projections are correct, this pattern could continue.

However, BTC Dominance is just one way to gauge the Altcoin season. According to some analysts, including Glassnode founders, the other is the ETH/BTC ratio.

ETH/BTC tracks ETH performance relative to BTC. According to Glassnode founders, who go by the username Negentropic on X, the ratio was tipped to rip off and trigger altcoin season if the US spot ETH ETF begins trading.

The products are set to launch and start trading this week.

AMBCrypto’s evaluation of the ETH/BTC ratio showed that it surged after the partial approval of ETH ETF in May. However, the ratio was yet to break its downtrend, as denoted by the descending channel (white).

Source: ETH/BTC, TradingView

It remains to be seen how the ETH/BTC will react and whether it could trigger the altcoin season. So, the BTC Dominance and ETH/BTC ratio were key fronts to track and gauge the possible impact on altcoins.

buying clomid no prescription clomiphene prices clomid sale how to buy generic clomid without dr prescription where buy cheap clomiphene no prescription where to get generic clomid pill can you get clomiphene without a prescription

I am actually delighted to glance at this blog posts which consists of tons of of use facts, thanks representing providing such data.

This is the kind of content I take advantage of reading.

zithromax 500mg tablet – buy cheap generic tetracycline metronidazole 400mg over the counter

generic semaglutide 14 mg – order semaglutide generic buy cyproheptadine 4mg for sale

cost motilium – order cyclobenzaprine 15mg generic oral cyclobenzaprine 15mg

buy augmentin 625mg generic – https://atbioinfo.com/ buy generic ampicillin for sale

nexium 40mg uk – https://anexamate.com/ order esomeprazole 20mg online cheap

order coumadin 2mg generic – https://coumamide.com/ buy losartan medication

mobic 15mg usa – moboxsin.com order mobic 7.5mg generic

buy generic deltasone 10mg – aprep lson prednisone 5mg us

buy ed pills cheap – https://fastedtotake.com/ buy ed pills without a prescription

order generic amoxil – https://combamoxi.com/ buy generic amoxicillin

diflucan uk – https://gpdifluca.com/# generic fluconazole

generic cialis super active tadalafil 20mg – what possible side effect should a patient taking tadalafil report to a physician quizlet cialis for sale online in canada

buy zantac 300mg pills – https://aranitidine.com/# zantac online order

buy generic cialiss – on this site tadalafil 5mg generic from us

sildenafil 100 mg blue pill – https://strongvpls.com/ 100mg viagra street price

More articles like this would make the blogosphere richer. https://buyfastonl.com/azithromycin.html