- Massive amounts of USDT flowed from Tether to Ethereum exchanges.

- Activity on the network remained stable as the price of ETH declined.

Ethereum [ETH] has witnessed massive price volatility over the last few days. However, Tether’s [USDT] recent behavior could help improve sentiment around ETH.

USDT gets into the mix

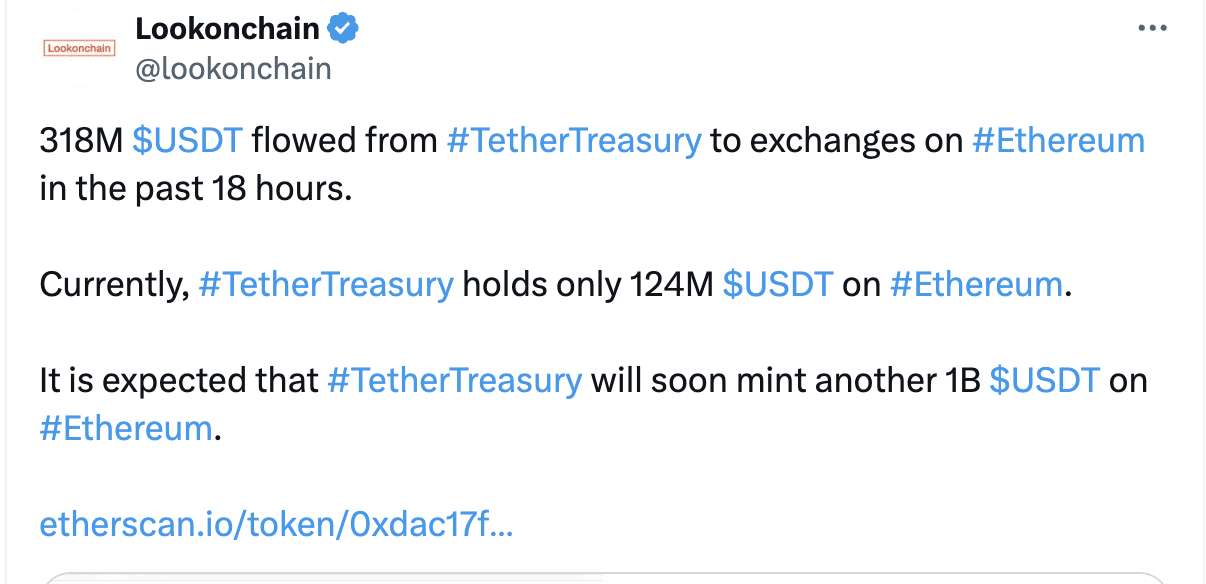

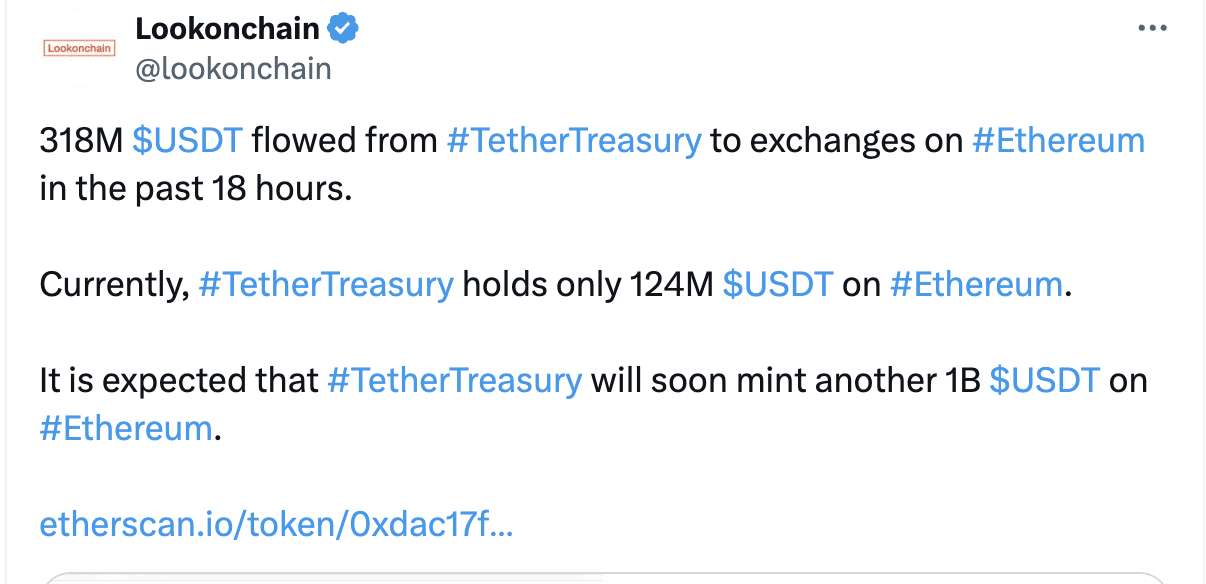

According to Lookonchain’s data, over the past 18 hours, a significant amount of USDT, specifically 318 million dollars worth, has moved from Tether’s treasury wallet to exchanges on the Ethereum network.

This outflow has significantly reduced Tether’s holdings on Ethereum. Their treasury held only 124 million USDT at press time.

To meet potential demand, it’s expected that Tether will soon mint another 1 billion USDT on Ethereum.

Source: X

Tether has a history of minting large amounts of USDT, often corresponding with periods of increased cryptocurrency activity. This doesn’t necessarily guarantee a surge in Ethereum usage.

While Ethereum is the dominant platform for USDT, other blockchains like Tron could also be used for the same purposes.

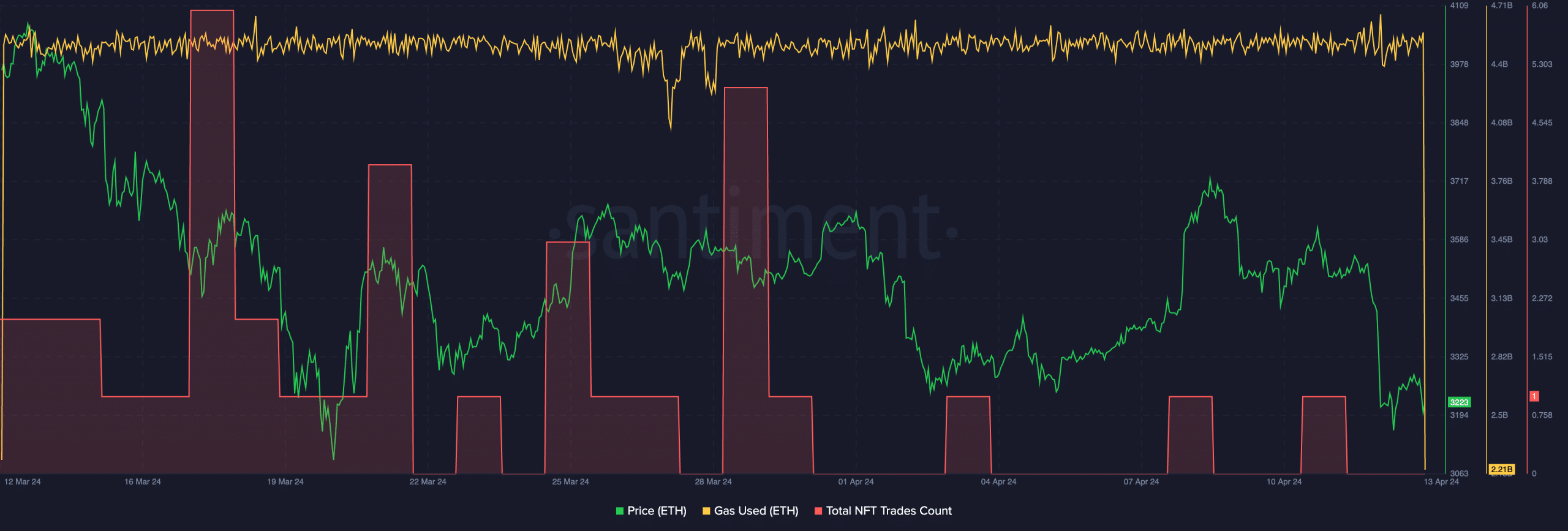

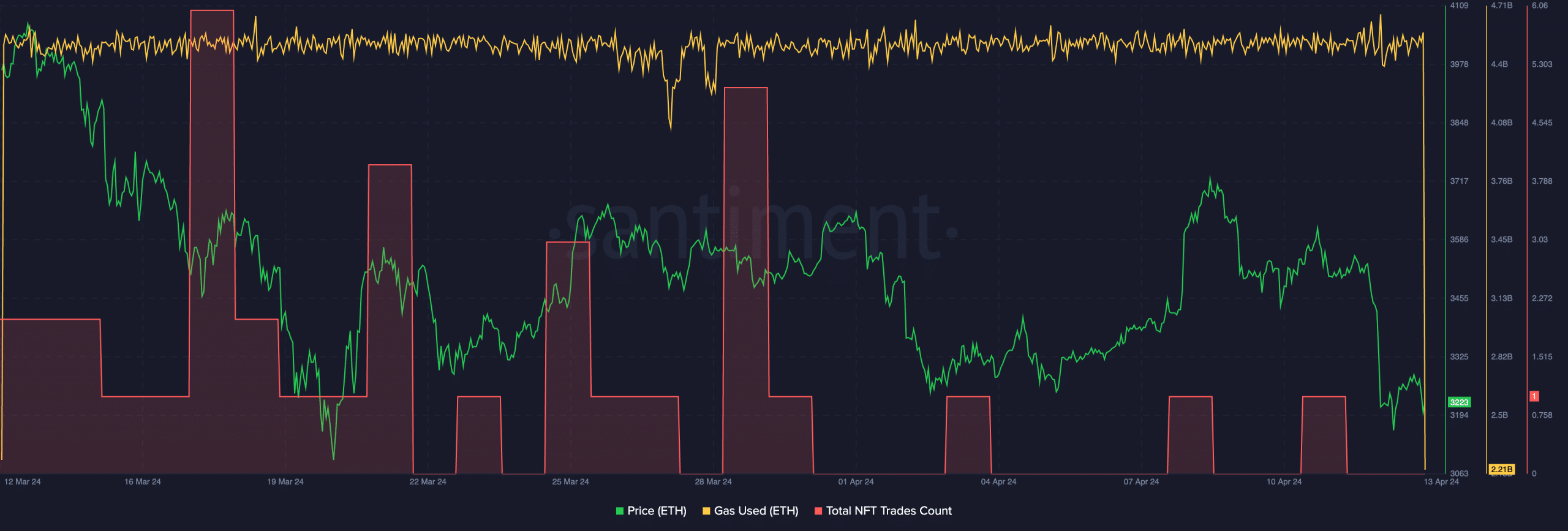

At press time, the gas usage on the Ethereum network had remained the same over the last few days. However, the NFT trades occurring on the network had declined significantly.

This suggests other types of activity are picking up the slack. DeFi transactions, stablecoin swaps, or general token activity could be contributing to the steady gas usage.

On the NFT side, a market correction or declining public interest may be playing a role.

Source: Santiment

How are holders doing?

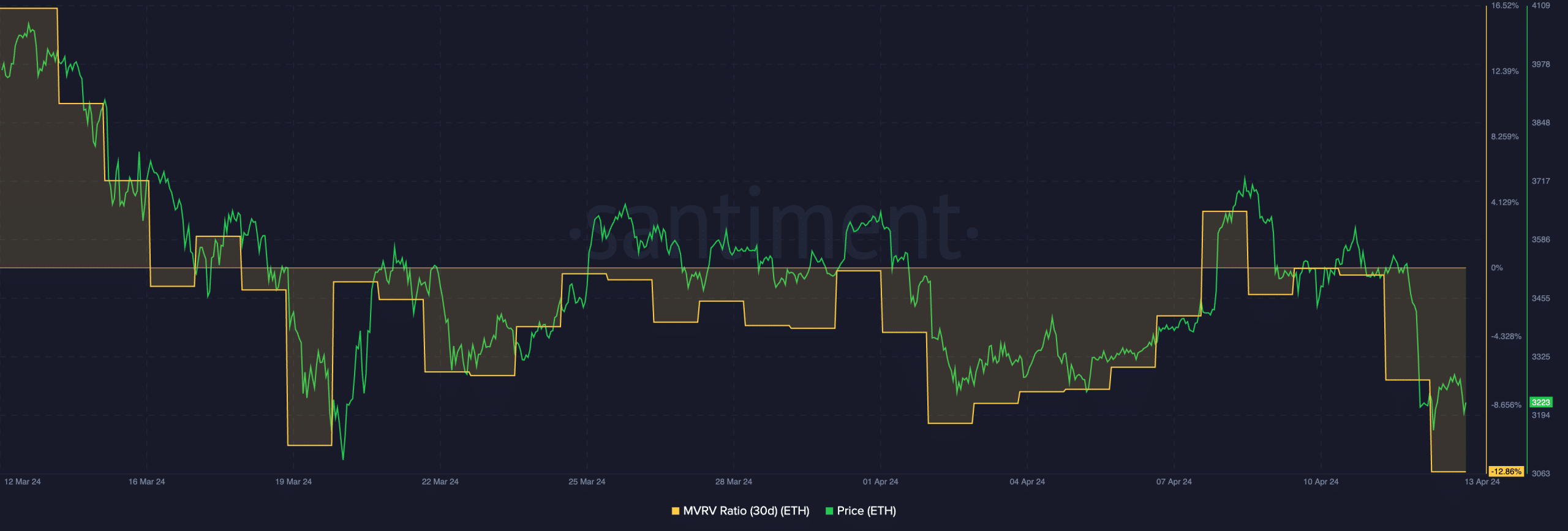

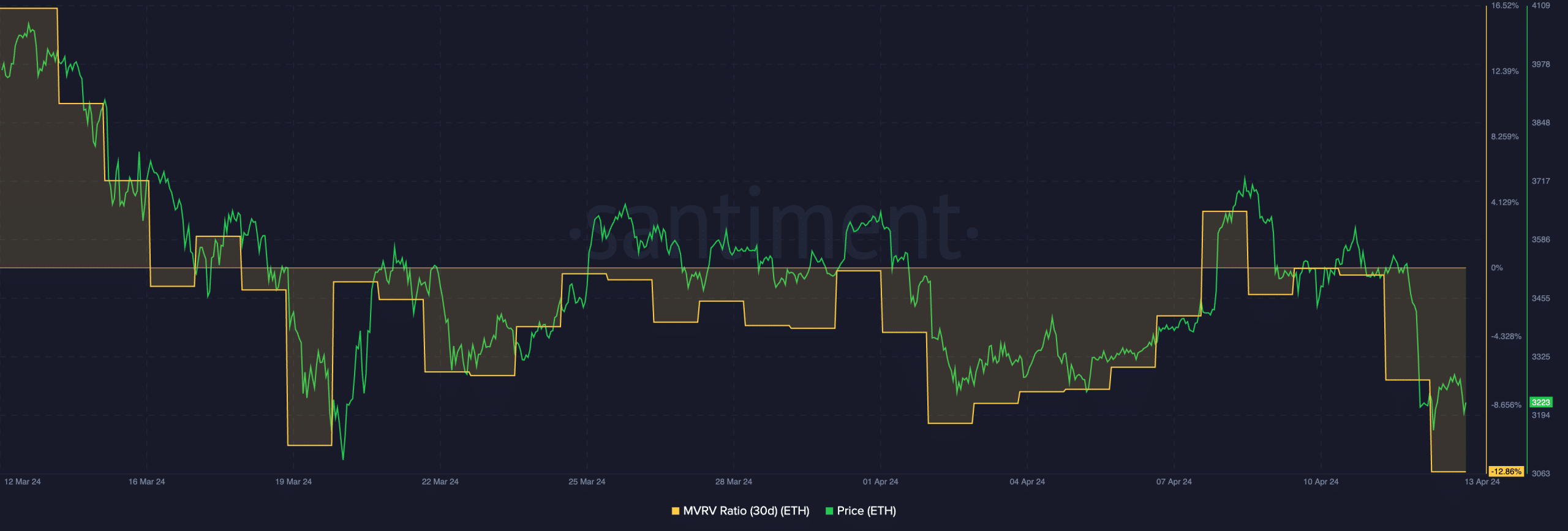

Even though activity on Ethereum was consistent, the price movement of ETH wasn’t showing signs of green. At press time, ETH was trading at $3,000.70 and its price had declined by 2.74% in the last 24 hours.

If the price continues to decline further, it may cross the $3,000 level for good, which could further cause panic in the markets.

Read Ethereum’s [ETH] Price Prediction 2024-25

Due to this massive decline in the price of ETH over the last few days, the MVRV ratio for ETH fell considerably. This indicated that the most holders not profitable at the time of writing.

However, the volume at which ETH was trading at had grown by 11.79% as well during this period.

Source: Santiment

- Massive amounts of USDT flowed from Tether to Ethereum exchanges.

- Activity on the network remained stable as the price of ETH declined.

Ethereum [ETH] has witnessed massive price volatility over the last few days. However, Tether’s [USDT] recent behavior could help improve sentiment around ETH.

USDT gets into the mix

According to Lookonchain’s data, over the past 18 hours, a significant amount of USDT, specifically 318 million dollars worth, has moved from Tether’s treasury wallet to exchanges on the Ethereum network.

This outflow has significantly reduced Tether’s holdings on Ethereum. Their treasury held only 124 million USDT at press time.

To meet potential demand, it’s expected that Tether will soon mint another 1 billion USDT on Ethereum.

Source: X

Tether has a history of minting large amounts of USDT, often corresponding with periods of increased cryptocurrency activity. This doesn’t necessarily guarantee a surge in Ethereum usage.

While Ethereum is the dominant platform for USDT, other blockchains like Tron could also be used for the same purposes.

At press time, the gas usage on the Ethereum network had remained the same over the last few days. However, the NFT trades occurring on the network had declined significantly.

This suggests other types of activity are picking up the slack. DeFi transactions, stablecoin swaps, or general token activity could be contributing to the steady gas usage.

On the NFT side, a market correction or declining public interest may be playing a role.

Source: Santiment

How are holders doing?

Even though activity on Ethereum was consistent, the price movement of ETH wasn’t showing signs of green. At press time, ETH was trading at $3,000.70 and its price had declined by 2.74% in the last 24 hours.

If the price continues to decline further, it may cross the $3,000 level for good, which could further cause panic in the markets.

Read Ethereum’s [ETH] Price Prediction 2024-25

Due to this massive decline in the price of ETH over the last few days, the MVRV ratio for ETH fell considerably. This indicated that the most holders not profitable at the time of writing.

However, the volume at which ETH was trading at had grown by 11.79% as well during this period.

Source: Santiment

cost clomid without insurance clomid uses get clomiphene without insurance can you get cheap clomiphene without insurance can you get generic clomid online where can i buy clomid get clomiphene pills

This is the description of serenity I enjoy reading.

The thoroughness in this break down is noteworthy.

order zithromax 250mg online cheap – azithromycin over the counter metronidazole 200mg cheap

buy rybelsus 14 mg online – cyproheptadine 4 mg canada periactin 4mg ca

buy motilium 10mg generic – buy sumycin 250mg generic buy flexeril 15mg pill

buy generic propranolol online – cheap methotrexate 5mg methotrexate 5mg sale

augmentin 625mg pills – atbioinfo.com acillin for sale

nexium 40mg usa – anexamate.com buy nexium 40mg online

buy coumadin 5mg without prescription – coumamide.com losartan 25mg ca

meloxicam sale – https://moboxsin.com/ mobic price

buy deltasone 5mg pill – allergic reactions buy generic prednisone online

best ed pills at gnc – the best ed pill erection pills viagra online

cheap amoxicillin sale – amoxil price buy amoxil pills