- XRP saw a minor rally.

- Ripple has reclaimed the $0.5 price range, and has kept climbing.

After enduring consecutive significant declines, Ripple [XRP] appeared to experience a rally in the past week.

Despite these positive price movements, the road to recovery is far from complete, as the current price ranges posed significant hurdles.

Ripple sees mini rally

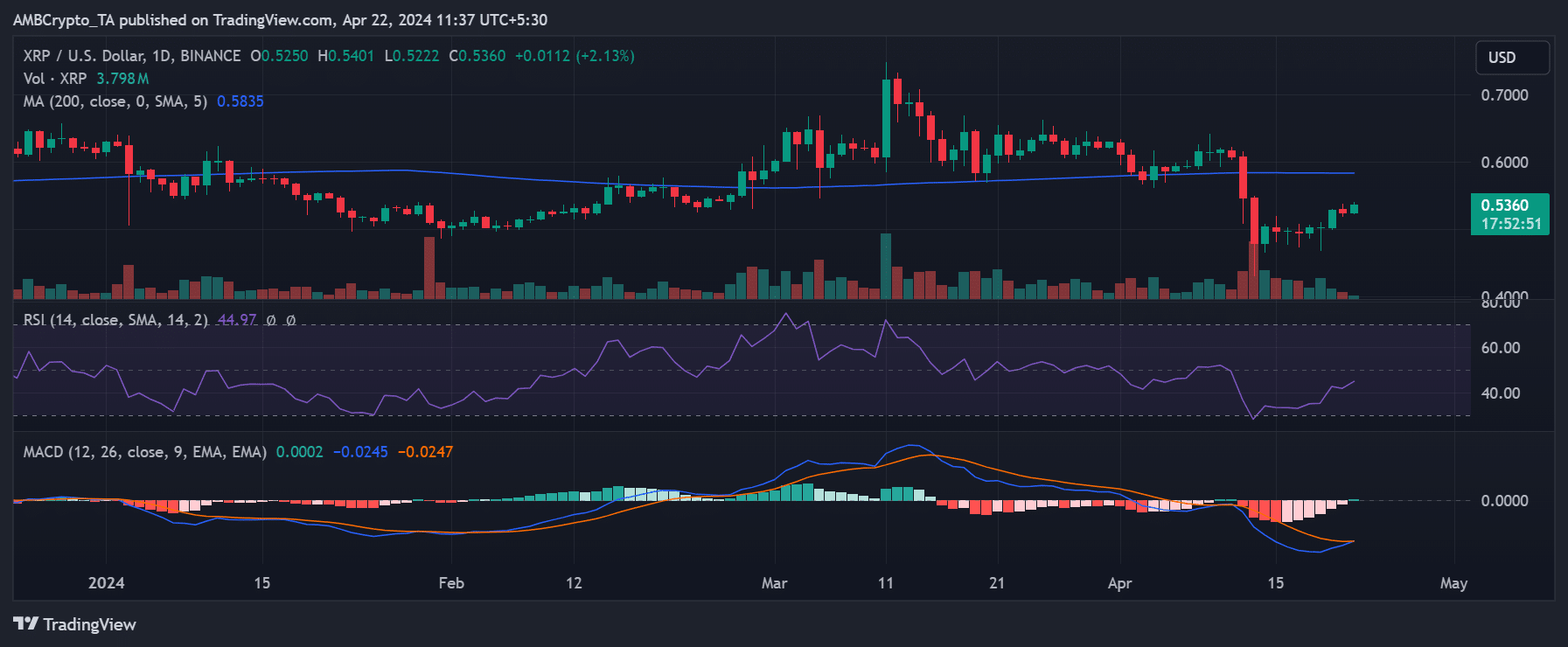

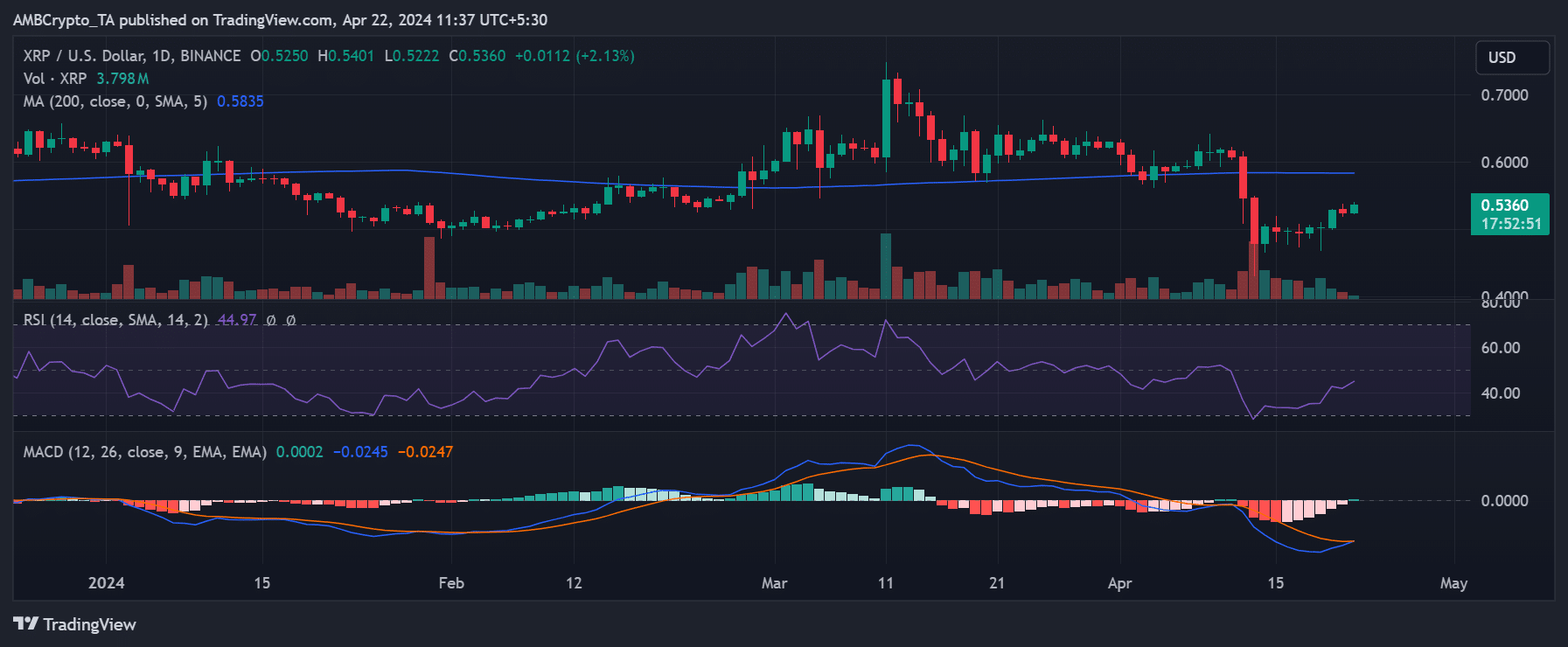

AMBCrypto’s look at XRP’s daily timeframe chart revealed that it concluded the trading session on the 20th of April with a notable increase in value, surpassing 5%.

This upward movement resulted in the price closing at around $0.52.

While this increase may not have garnered attention under normal circumstances, it followed a tumultuous previous week when XRP experienced a drastic 22% drop within 48 hours.

The decline dropped the XRP price from the $0.60 range to around $0.48.

At the time of this writing, XRP was trading at approximately $0.53, boasting an additional 1% increase. The chart indicated that the immediate resistance is posed by its long Moving Average (blue line), around $0.58.

A breakthrough above this line would signal a potential rally for XRP.

However, facing longer-term resistance around the $0.65 and $0.70 price range suggests that a new rally may be achievable only if XRP surpasses these levels.

Source: TradingView

Despite the recent price increase, the XRP price trend remained bearish. Its Relative Strength Index (RSI) indicated that XRP still resided below the neutral line at press time, showing ongoing downward pressure.

Traders’ sentiment remains low

Two weeks ago, it wasn’t just the price of Ripple that experienced a decline; the volume of funds flowing into the cryptocurrency also dropped.

Data from the Open Interest chart on Coinglass revealed a sharp decrease in volume coinciding with the drop in XRP’s price. The volume plunged from over $1 billion to around $500 million during that period.

As of the latest data available, Open Interest stood at around $522 million.

This decline in funds inflow indicated a significant reduction in investor sentiment toward XRP, reflecting low confidence among traders.

A more positive sentiment would likely facilitate the emergence of more uptrends in the price of XRP.

XRP in profit nears 78 billion

In addition to the price surge, another metric that experienced an increase was the Ripple supply in profit.

Realistic or not, here’s XRP market cap in BTC’s terms

Data indicated that with the recent rally in price, the supply in profit has surpassed 77%, representing almost 78 billion XRP in profit.

This trend is expected, as higher prices typically lead to a greater portion of the supply being in profit.

- XRP saw a minor rally.

- Ripple has reclaimed the $0.5 price range, and has kept climbing.

After enduring consecutive significant declines, Ripple [XRP] appeared to experience a rally in the past week.

Despite these positive price movements, the road to recovery is far from complete, as the current price ranges posed significant hurdles.

Ripple sees mini rally

AMBCrypto’s look at XRP’s daily timeframe chart revealed that it concluded the trading session on the 20th of April with a notable increase in value, surpassing 5%.

This upward movement resulted in the price closing at around $0.52.

While this increase may not have garnered attention under normal circumstances, it followed a tumultuous previous week when XRP experienced a drastic 22% drop within 48 hours.

The decline dropped the XRP price from the $0.60 range to around $0.48.

At the time of this writing, XRP was trading at approximately $0.53, boasting an additional 1% increase. The chart indicated that the immediate resistance is posed by its long Moving Average (blue line), around $0.58.

A breakthrough above this line would signal a potential rally for XRP.

However, facing longer-term resistance around the $0.65 and $0.70 price range suggests that a new rally may be achievable only if XRP surpasses these levels.

Source: TradingView

Despite the recent price increase, the XRP price trend remained bearish. Its Relative Strength Index (RSI) indicated that XRP still resided below the neutral line at press time, showing ongoing downward pressure.

Traders’ sentiment remains low

Two weeks ago, it wasn’t just the price of Ripple that experienced a decline; the volume of funds flowing into the cryptocurrency also dropped.

Data from the Open Interest chart on Coinglass revealed a sharp decrease in volume coinciding with the drop in XRP’s price. The volume plunged from over $1 billion to around $500 million during that period.

As of the latest data available, Open Interest stood at around $522 million.

This decline in funds inflow indicated a significant reduction in investor sentiment toward XRP, reflecting low confidence among traders.

A more positive sentiment would likely facilitate the emergence of more uptrends in the price of XRP.

XRP in profit nears 78 billion

In addition to the price surge, another metric that experienced an increase was the Ripple supply in profit.

Realistic or not, here’s XRP market cap in BTC’s terms

Data indicated that with the recent rally in price, the supply in profit has surpassed 77%, representing almost 78 billion XRP in profit.

This trend is expected, as higher prices typically lead to a greater portion of the supply being in profit.

how to get generic clomid price how to get cheap clomid pill buying generic clomiphene pill good rx clomid can i purchase generic clomiphene without a prescription clomid order generic clomiphene without insurance

Thanks for sharing. It’s acme quality.

Greetings! Very serviceable par‘nesis within this article! It’s the scarcely changes which choice obtain the largest changes. Thanks a a quantity for sharing!

zithromax 250mg price – tinidazole 500mg uk buy metronidazole 400mg pill

semaglutide 14 mg ca – cyproheptadine canada cyproheptadine 4 mg canada

buy domperidone 10mg for sale – how to get cyclobenzaprine without a prescription flexeril canada

augmentin 1000mg us – https://atbioinfo.com/ acillin cost

esomeprazole 20mg cheap – https://anexamate.com/ esomeprazole price

medex over the counter – cou mamide buy losartan 25mg

order mobic 7.5mg online – https://moboxsin.com/ order mobic 15mg online cheap

order deltasone 5mg generic – https://apreplson.com/ deltasone 20mg sale

buy ed pills medication – fastedtotake.com buy erection pills

amoxicillin oral – buy generic amoxil online buy amoxicillin medication

purchase fluconazole pills – https://gpdifluca.com/# order diflucan 100mg generic

order generic cenforce 100mg – cenforce 50mg pill buy cenforce 50mg online

what is cialis tadalafil used for – this cialis for prostate

buy ranitidine no prescription – order zantac 150mg sale ranitidine 300mg us

where to get the best price on cialis – https://strongtadafl.com/ canadian pharmacy online cialis

This website really has all of the information and facts I needed about this case and didn’t identify who to ask. https://gnolvade.com/es/comprar-kamagra-generico/

best mail order viagra – strong vpls sildenafil oral jelly 100mg

I’ll certainly carry back to be familiar with more. https://ursxdol.com/augmentin-amoxiclav-pill/

This is a topic which is near to my fundamentals… Diverse thanks! Faithfully where can I lay one’s hands on the connection details due to the fact that questions? https://buyfastonl.com/azithromycin.html

I couldn’t turn down commenting. Adequately written! https://prohnrg.com/product/acyclovir-pills/

More peace pieces like this would insinuate the web better. https://ondactone.com/product/domperidone/

I couldn’t hold back commenting. Adequately written!

celecoxib over the counter

This is the stripe of content I enjoy reading. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=488145

forxiga 10mg brand – order forxiga generic forxiga 10mg us

orlistat pills – https://asacostat.com/# xenical 120mg cheap

I’ll certainly carry back to be familiar with more. http://seafishzone.com/home.php?mod=space&uid=2331125