- LINK’s market cap outpaced the volume, suggesting that the network was overvalued.

- The difference in XRP’s exchange inflow and outflow indicated that the price might climb.

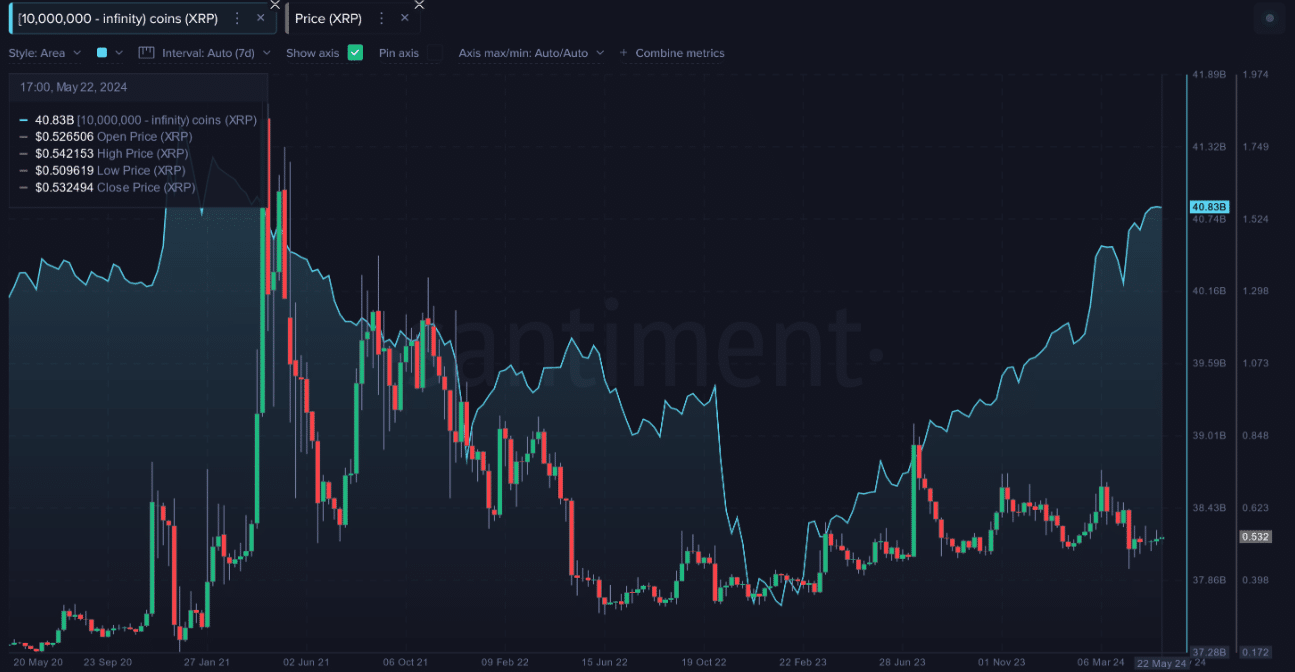

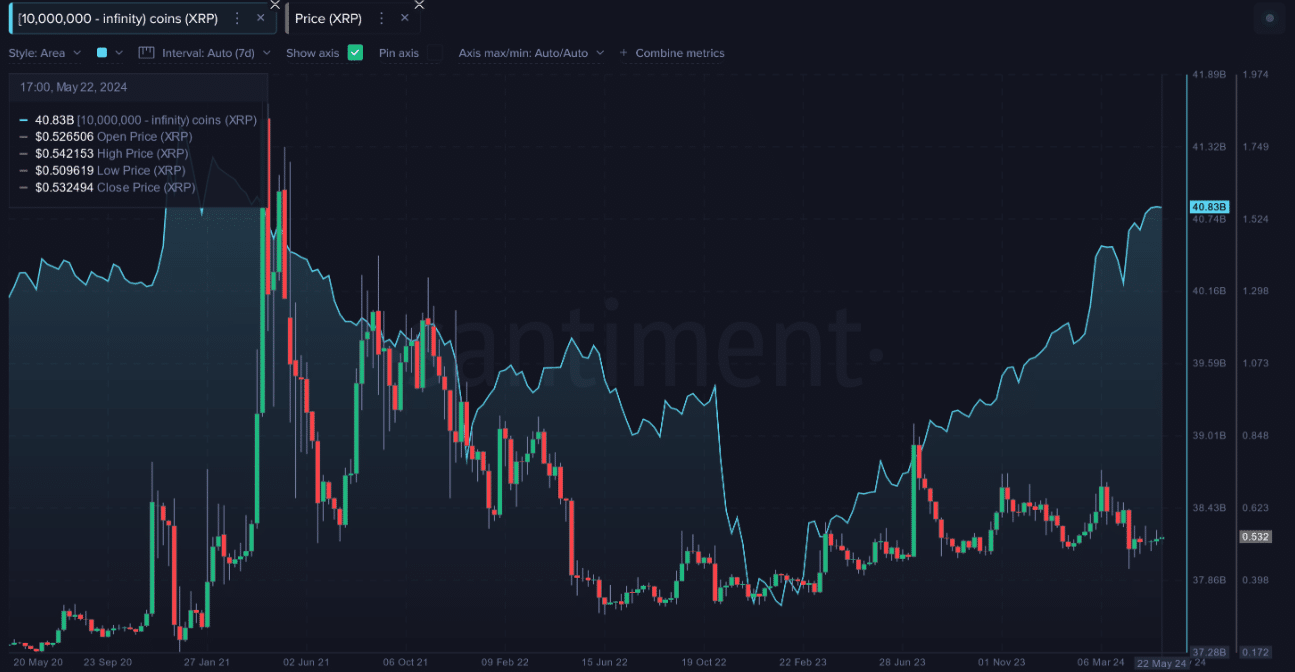

In the last 16 months, Ripple [XRP] whales have accumulated more tokens far above that of Chainlink [LINK], AMBCrypto confirmed.

Within the mentioned period, wallets holding 10 million XRP or more have purchased 3.17 billion tokens, valued at $5.1 million.

Such an increase is supposed to boost the price of the cryptocurrency. But for XRP, that has not been the case due to some factors outside of the occurrences on-chain.

The whales go different ways

At press time, XRP’s price was $0.52— an 11.28% increase within the last 365 days. Compared to the way other altcoins have performed, this was underwhelming.

Source: Santiment

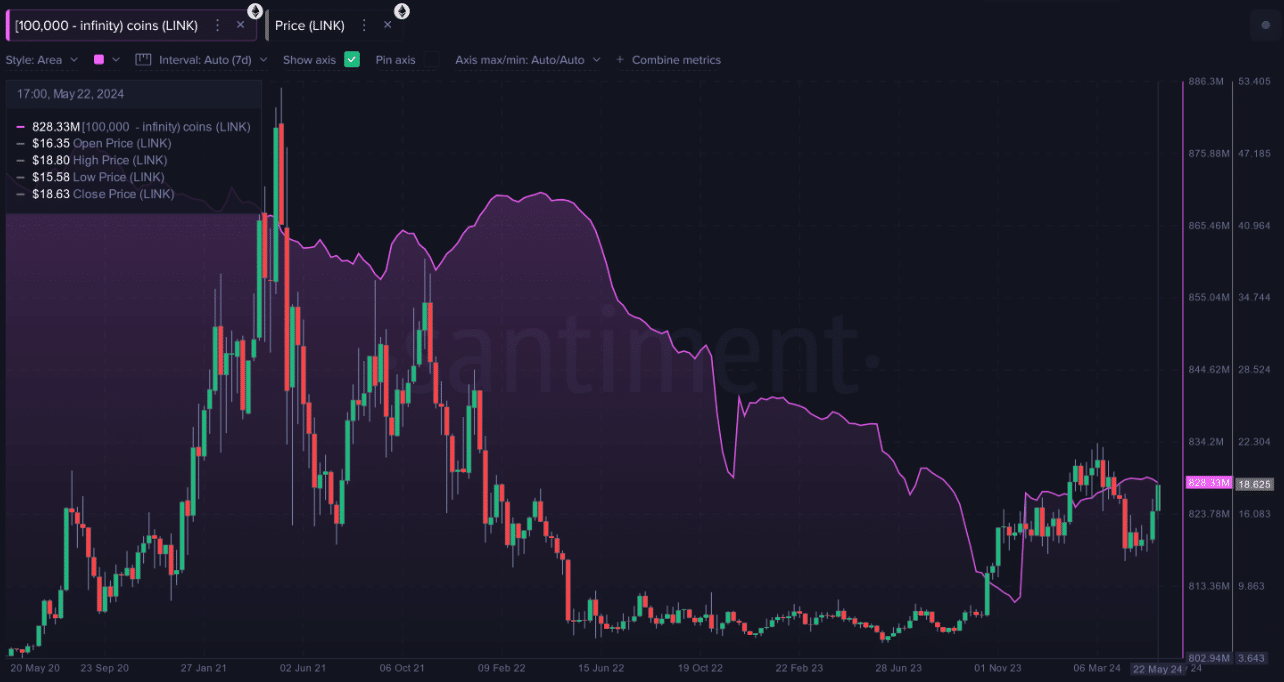

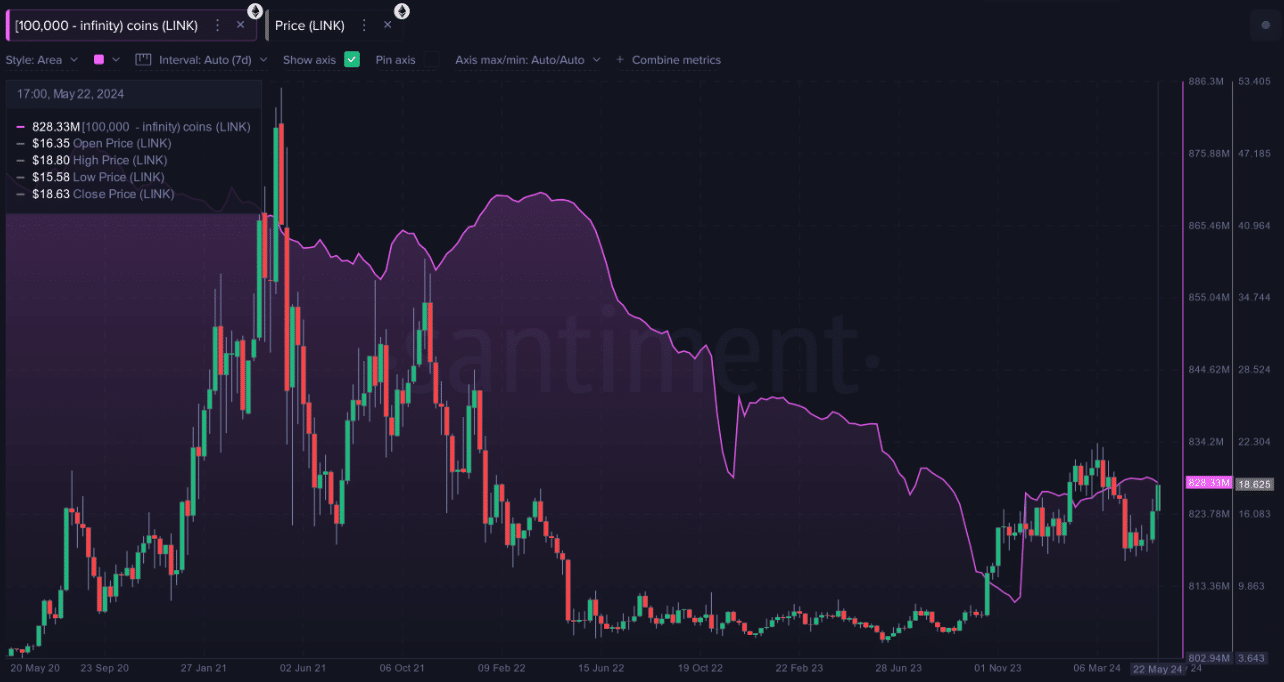

Now to Chainlink, the price was $18.11 at press time. This value represents a 178.21% increase within the same period, XRP registered the aforementioned increase.

Surprisingly, LINK whales did not amass as many tokens as their XRP counterparts.

On-chain analytic platform Santiment, in a recent analysis, mentioned that the number declined for most of the past four years.

However, things seemed to have changed in the last six months with the insight explaining that,

“There has been a bit of an accumulation rebound from them in the past six months (+17.27M LINK), but we’d like to see a bit more of a bode of confidence from these key stakeholders to justify continued rises.”

Source: Santiment

Going by the analysis above, it seemed that LINK whales’ impact on the price action was more significant than how XRP has reacted to the long-term accumulation.

LINK eyes a decline but XRP wants its high

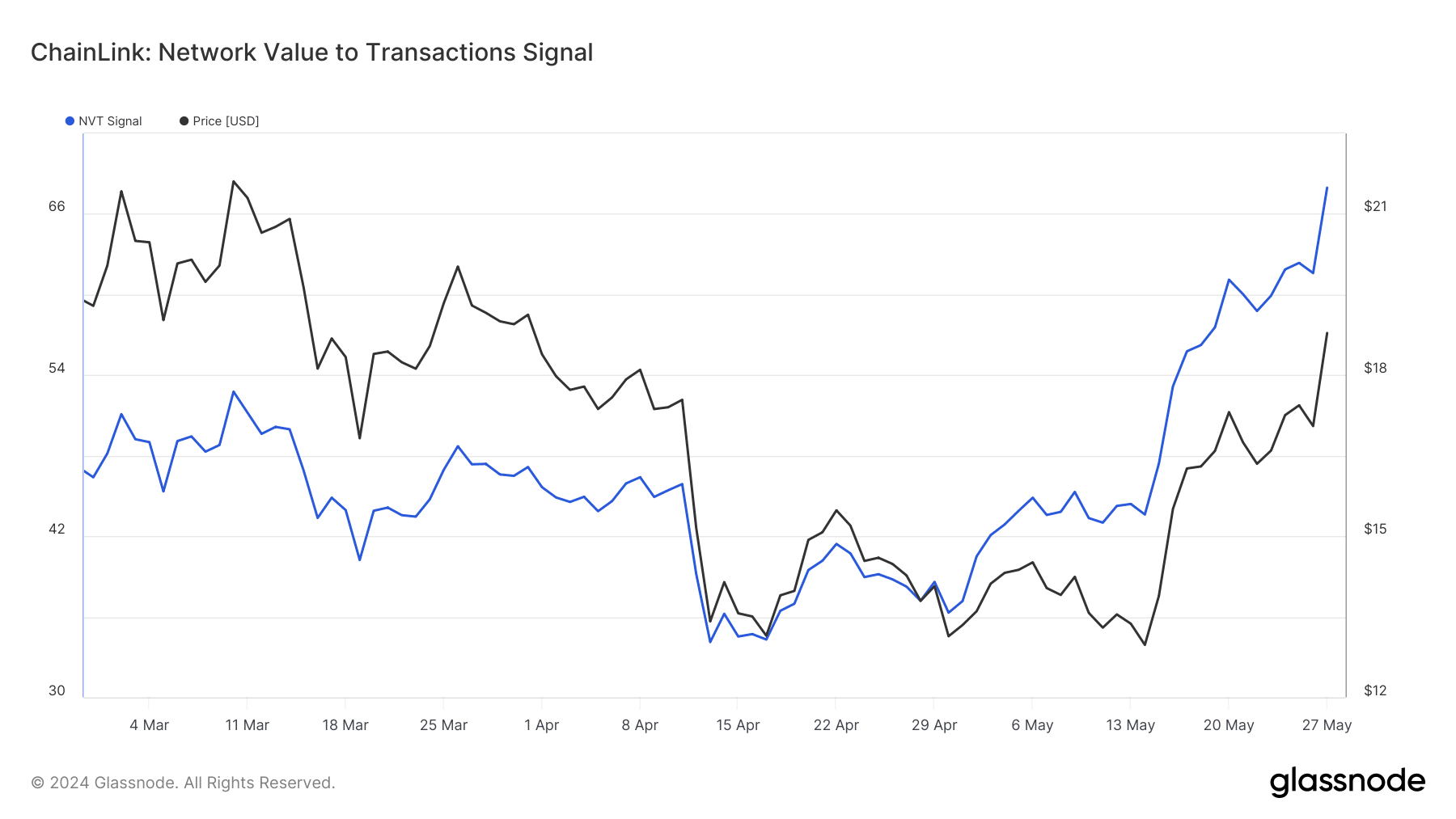

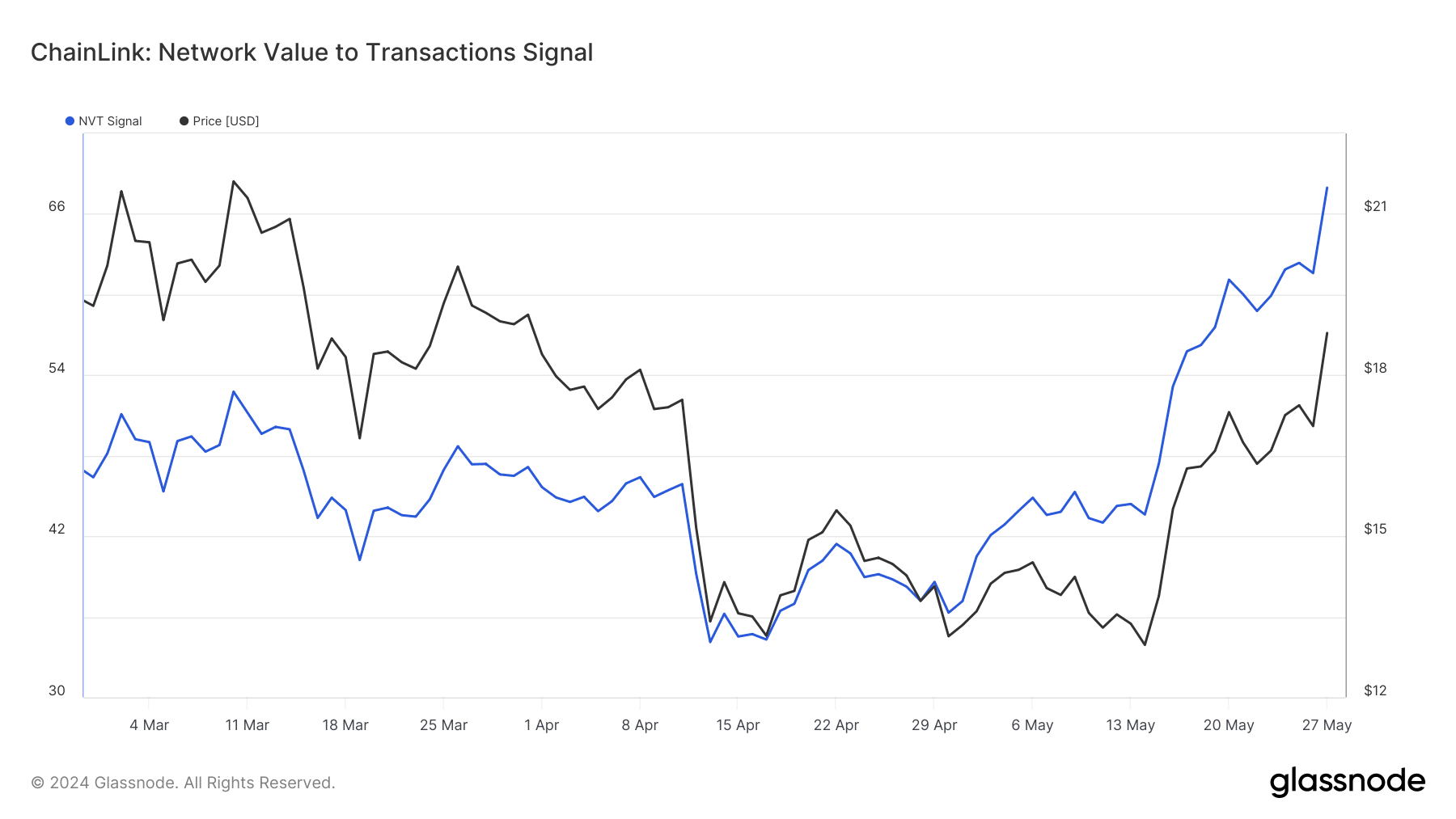

However, LINK’s recent uptrend might soon hit the stop button according to indications AMBCrypto obtained from Glassnode.

At press time, the Network Value to Transaction (NVT) signal had hit a ceiling of 67.95.

A low NVT signal often coincides with the period transaction value outpaces the market cap.

If this were the case, Chainlink would have been said to be priced at a discount, and this would have been bullish for the price.

However, the high reading of the NVT suggests that the network was overvalued. Hence, this was bearish for LINK and a decline toward $13 or $14 could be next.

Source: Glassnode

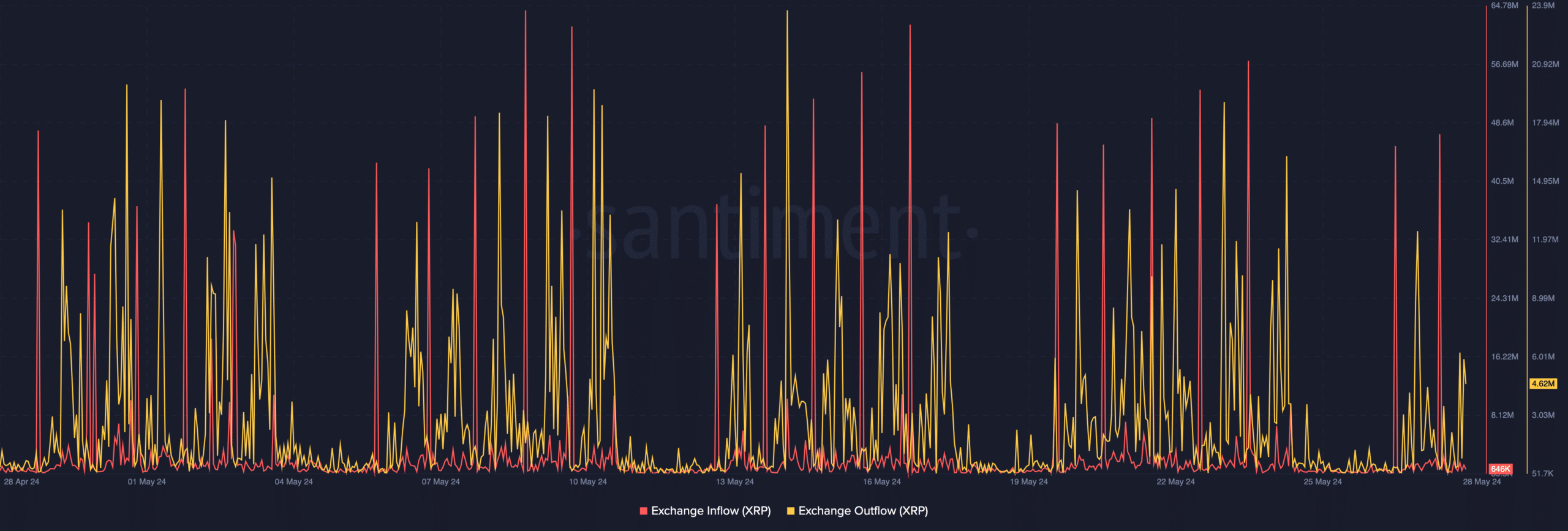

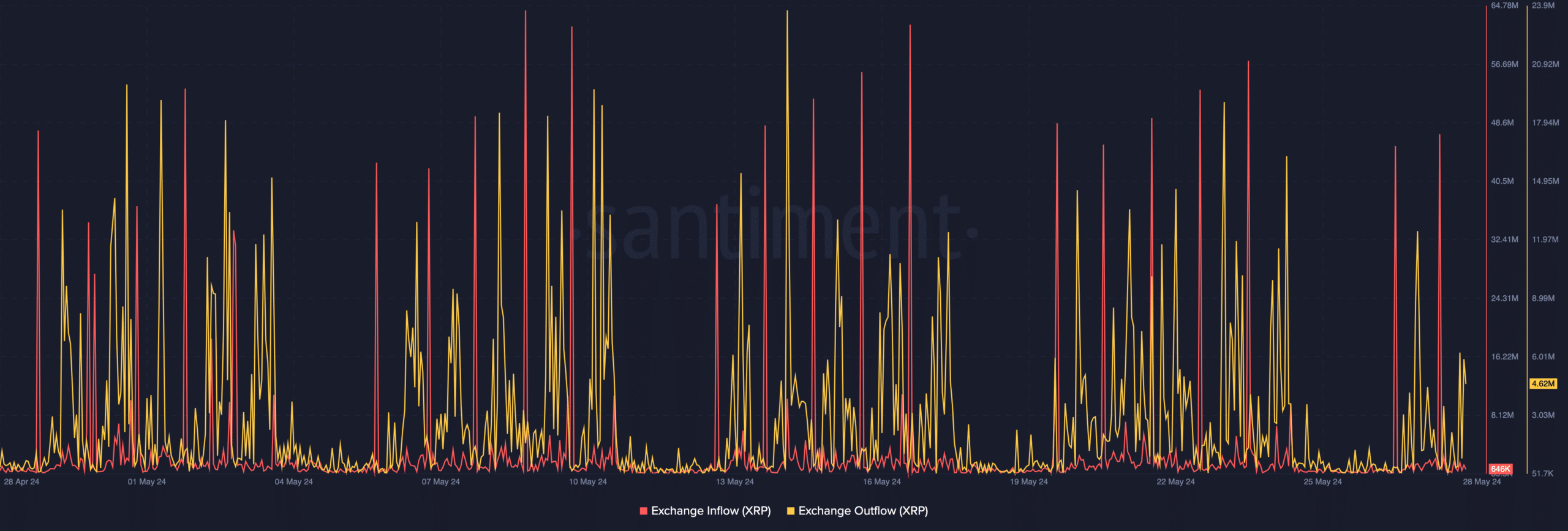

To check out XRP’s potential price movement, AMBCrypto looked at the exchange flow.

At press time, XRP’s exchange inflow was 646,000. This number represents the number of tokens sent into exchanges.

On the other hand, the exchange outflow was higher at 4.62 million. This means that there were tons of XRP heading for non-custodial wallets than those lined up for possible sale.

Source: Santiment

Realistic or not, here’s LINK’s market cap in XRP terms

This difference implies that there are more holders with a strong conviction in the bullish potential of XRP.

Should this position stay the same in the coming weeks, XRP’s price might increase, and a rise to $0.60 could be an option.

- LINK’s market cap outpaced the volume, suggesting that the network was overvalued.

- The difference in XRP’s exchange inflow and outflow indicated that the price might climb.

In the last 16 months, Ripple [XRP] whales have accumulated more tokens far above that of Chainlink [LINK], AMBCrypto confirmed.

Within the mentioned period, wallets holding 10 million XRP or more have purchased 3.17 billion tokens, valued at $5.1 million.

Such an increase is supposed to boost the price of the cryptocurrency. But for XRP, that has not been the case due to some factors outside of the occurrences on-chain.

The whales go different ways

At press time, XRP’s price was $0.52— an 11.28% increase within the last 365 days. Compared to the way other altcoins have performed, this was underwhelming.

Source: Santiment

Now to Chainlink, the price was $18.11 at press time. This value represents a 178.21% increase within the same period, XRP registered the aforementioned increase.

Surprisingly, LINK whales did not amass as many tokens as their XRP counterparts.

On-chain analytic platform Santiment, in a recent analysis, mentioned that the number declined for most of the past four years.

However, things seemed to have changed in the last six months with the insight explaining that,

“There has been a bit of an accumulation rebound from them in the past six months (+17.27M LINK), but we’d like to see a bit more of a bode of confidence from these key stakeholders to justify continued rises.”

Source: Santiment

Going by the analysis above, it seemed that LINK whales’ impact on the price action was more significant than how XRP has reacted to the long-term accumulation.

LINK eyes a decline but XRP wants its high

However, LINK’s recent uptrend might soon hit the stop button according to indications AMBCrypto obtained from Glassnode.

At press time, the Network Value to Transaction (NVT) signal had hit a ceiling of 67.95.

A low NVT signal often coincides with the period transaction value outpaces the market cap.

If this were the case, Chainlink would have been said to be priced at a discount, and this would have been bullish for the price.

However, the high reading of the NVT suggests that the network was overvalued. Hence, this was bearish for LINK and a decline toward $13 or $14 could be next.

Source: Glassnode

To check out XRP’s potential price movement, AMBCrypto looked at the exchange flow.

At press time, XRP’s exchange inflow was 646,000. This number represents the number of tokens sent into exchanges.

On the other hand, the exchange outflow was higher at 4.62 million. This means that there were tons of XRP heading for non-custodial wallets than those lined up for possible sale.

Source: Santiment

Realistic or not, here’s LINK’s market cap in XRP terms

This difference implies that there are more holders with a strong conviction in the bullish potential of XRP.

Should this position stay the same in the coming weeks, XRP’s price might increase, and a rise to $0.60 could be an option.

cost clomid for sale can i purchase generic clomiphene pills order generic clomid prices can i order clomiphene without a prescription how to get cheap clomiphene tablets where buy generic clomid without prescription cost of generic clomiphene pills

This is a topic which is virtually to my heart… Diverse thanks! Exactly where can I lay one’s hands on the connection details an eye to questions?

More delight pieces like this would create the интернет better.

azithromycin online order – buy azithromycin 500mg pills buy flagyl

semaglutide 14 mg pill – buy semaglutide 14mg generic cyproheptadine tablet

domperidone ca – order tetracycline 250mg without prescription buy flexeril 15mg for sale

purchase amoxiclav generic – atbioinfo acillin for sale

buy esomeprazole without prescription – https://anexamate.com/ buy nexium generic

buy medex – https://coumamide.com/ losartan pills

order meloxicam 15mg online cheap – tenderness order mobic 15mg without prescription

buy prednisone 10mg generic – https://apreplson.com/ prednisone 20mg brand

ed pills cheap – https://fastedtotake.com/ best drug for ed

order amoxil – https://combamoxi.com/ order amoxil without prescription

diflucan 200mg over the counter – site order fluconazole online

buy cenforce 100mg generic – cenforcers.com buy generic cenforce 50mg

buy cialis no prescription overnight – cialis soft tabs canadian pharmacy cialis canada over the counter

ranitidine 150mg us – ranitidine 300mg us buy generic ranitidine for sale

pharmacy 365 cialis – https://strongtadafl.com/ what does cialis do

where can i buy female pink viagra in the u.k – cheap viagra for women sildenafil citrato 100 mg

The thoroughness in this section is noteworthy. https://ursxdol.com/cialis-tadalafil-20/

This is a topic which is in to my verve… Myriad thanks! Quite where can I lay one’s hands on the acquaintance details in the course of questions? buy amoxicillin without a prescription

I am in point of fact thrilled to coup d’oeil at this blog posts which consists of tons of of use facts, thanks for providing such data. https://prohnrg.com/product/cytotec-online/

More posts like this would add up to the online play more useful. https://aranitidine.com/fr/acheter-fildena/

With thanks. Loads of knowledge! https://ondactone.com/simvastatin/

I couldn’t turn down commenting. Adequately written!

https://proisotrepl.com/product/tetracycline/

The thoroughness in this draft is noteworthy. http://www.01.com.hk/member.php?Action=viewprofile&username=Epqxeu

buy dapagliflozin medication – forxiga pill dapagliflozin 10 mg generic