- XRP’s price has risen by just 1% in the past week.

- Key technical indicators hint at further decline in the altcoin’s value.

Ripple’s native token XRP has failed to register any significant price rally, despite the general market uptick in the last week.

During that period, Bitcoin’s [ BTC] price growth above the $70,000 price mark led to an overall surge in the crypto market.

According to CoinGecko’s data, the global cryptocurrency market capitalization has increased by 8% in the past seven days. At press time, this was $2.8 trillion.

XRP trends in an opposite direction

As of this writing, XRP exchanged hands at $0.62. Per CoinMarketCap, its value has seen a mere 1% increase in the past seven days.

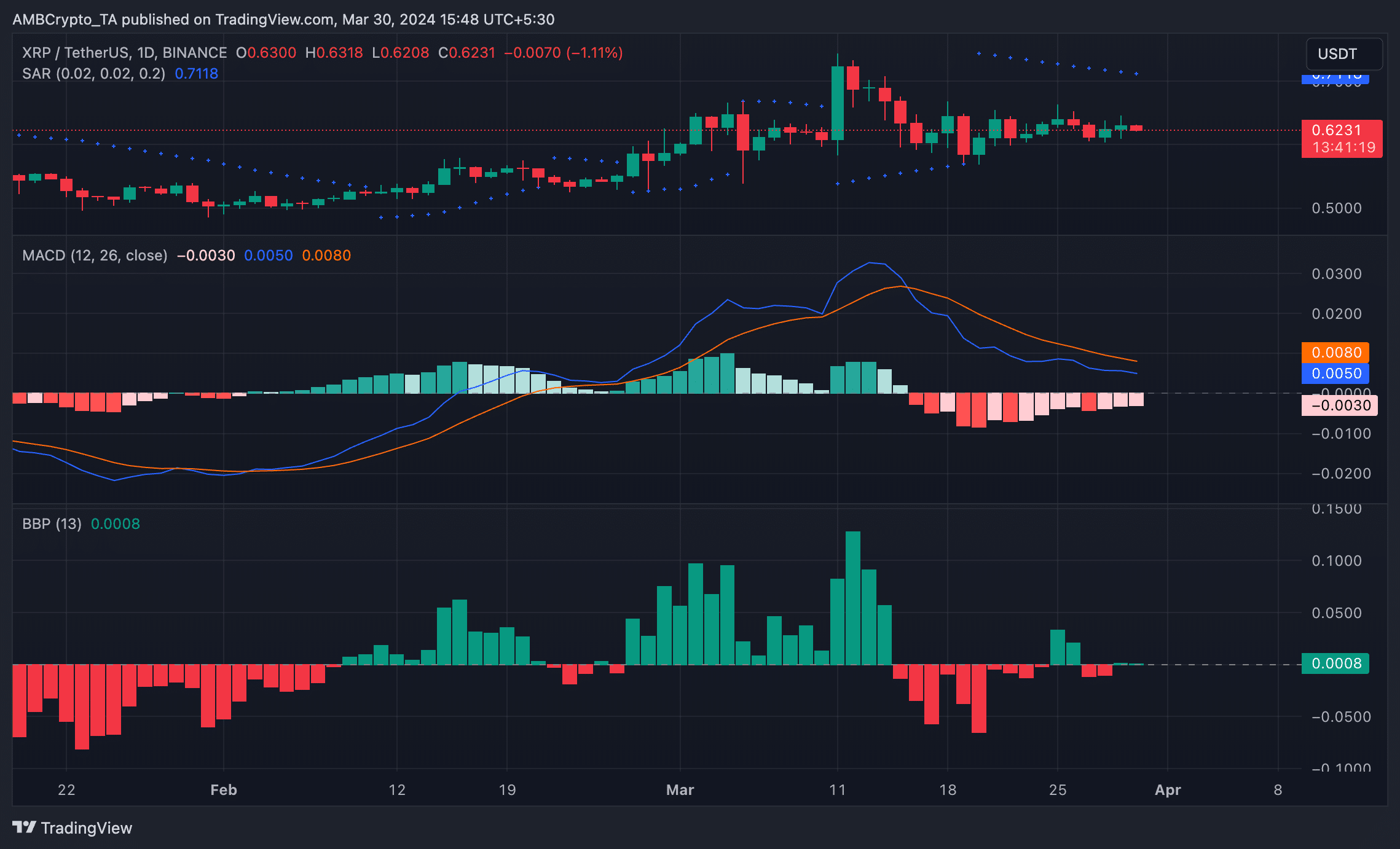

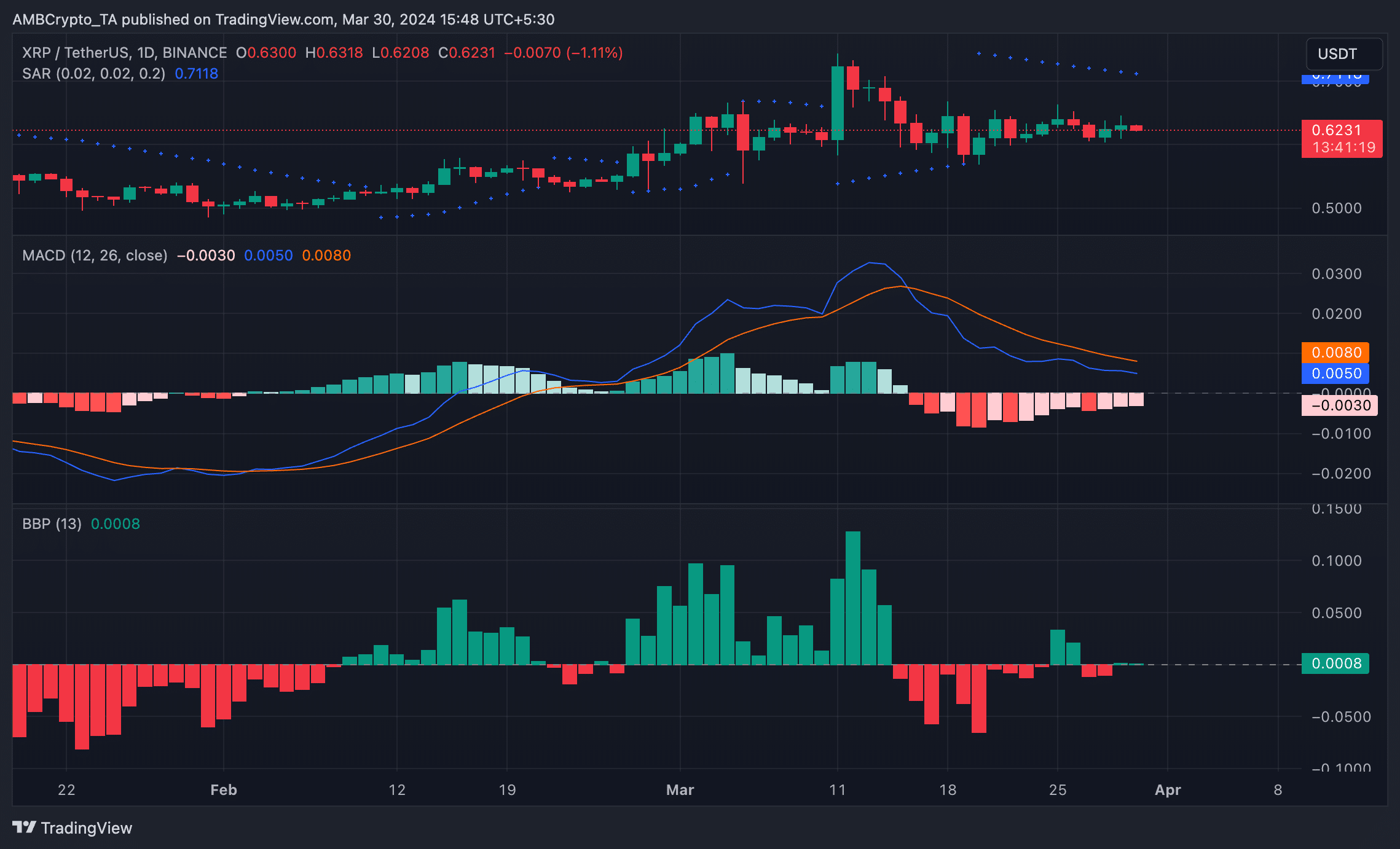

AMBCrypto’s readings of its price movements on a 1-day chart hinted at the possibility of a further decline in the altcoin’s value.

Firstly, XRP’s price rested below its Parabolic SAR indicator at the time of writing. Traders use this indicator to determine potential reversal points in the price direction of an asset. It is made up of dots that rest above or below an asset’s price on a chart.

When the dots rest below the price, they suggest a bullish trend. Conversely, when they are positioned above the price, as is the case here, the market trend is bearish. This also suggests that the price decline is likely to continue.

XRP’s MACD line was spotted below the signal line, confirming the current bearish trend. Ushering in the bear cycle, the MACD line intersected the signal line on 16th March, and XRP’s value has since dropped by almost 10%.

This intersection is considered bearish as it suggests that the short-term momentum of the asset’s price is weakening relative to the longer-term momentum. Traders often consider it a sign to exit long positions and occupy short ones.

Further, XRP’s Elder-Ray Index, which estimates the relationship between the strength of buyers and sellers in the market, has been significantly negative in the past two weeks.

How much are 1,10,100 XRPs worth today?

This indicated that selling activity has outpaced accumulation among market participants.

Regarding XRP’s performance on the derivatives market, its Futures Open Interest has fallen slightly by 0.3% since 13th March. This suggests that a sizeable number of contracts have been closed as traders exited the market to prevent losses.

Source: XRP/USDT on TradingView

- XRP’s price has risen by just 1% in the past week.

- Key technical indicators hint at further decline in the altcoin’s value.

Ripple’s native token XRP has failed to register any significant price rally, despite the general market uptick in the last week.

During that period, Bitcoin’s [ BTC] price growth above the $70,000 price mark led to an overall surge in the crypto market.

According to CoinGecko’s data, the global cryptocurrency market capitalization has increased by 8% in the past seven days. At press time, this was $2.8 trillion.

XRP trends in an opposite direction

As of this writing, XRP exchanged hands at $0.62. Per CoinMarketCap, its value has seen a mere 1% increase in the past seven days.

AMBCrypto’s readings of its price movements on a 1-day chart hinted at the possibility of a further decline in the altcoin’s value.

Firstly, XRP’s price rested below its Parabolic SAR indicator at the time of writing. Traders use this indicator to determine potential reversal points in the price direction of an asset. It is made up of dots that rest above or below an asset’s price on a chart.

When the dots rest below the price, they suggest a bullish trend. Conversely, when they are positioned above the price, as is the case here, the market trend is bearish. This also suggests that the price decline is likely to continue.

XRP’s MACD line was spotted below the signal line, confirming the current bearish trend. Ushering in the bear cycle, the MACD line intersected the signal line on 16th March, and XRP’s value has since dropped by almost 10%.

This intersection is considered bearish as it suggests that the short-term momentum of the asset’s price is weakening relative to the longer-term momentum. Traders often consider it a sign to exit long positions and occupy short ones.

Further, XRP’s Elder-Ray Index, which estimates the relationship between the strength of buyers and sellers in the market, has been significantly negative in the past two weeks.

How much are 1,10,100 XRPs worth today?

This indicated that selling activity has outpaced accumulation among market participants.

Regarding XRP’s performance on the derivatives market, its Futures Open Interest has fallen slightly by 0.3% since 13th March. This suggests that a sizeable number of contracts have been closed as traders exited the market to prevent losses.

Source: XRP/USDT on TradingView

get cheap clomid pills can i purchase clomiphene prices where can i get clomiphene without dr prescription can i get cheap clomiphene without prescription can i get generic clomiphene prices can you get clomiphene for sale how to buy clomid price

I’ll certainly return to review more.

Thanks an eye to sharing. It’s acme quality.

azithromycin usa – order sumycin 250mg online cheap purchase metronidazole sale

semaglutide 14 mg oral – order rybelsus online cheap order generic periactin 4 mg

buy motilium pills for sale – flexeril 15mg us buy generic cyclobenzaprine

order zithromax – buy zithromax pill buy nebivolol online cheap

clavulanate price – atbioinfo.com buy ampicillin generic

order esomeprazole 40mg pills – https://anexamate.com/ order nexium 20mg

order coumadin sale – anticoagulant buy cozaar no prescription

meloxicam 15mg over the counter – swelling buy mobic 7.5mg online

purchase prednisone online cheap – corticosteroid buy prednisone 20mg generic

can i buy ed pills over the counter – best ed medications top ed pills

buy generic amoxil online – https://combamoxi.com/ order amoxil

fluconazole 200mg without prescription – brand fluconazole 200mg fluconazole 200mg drug

order cenforce 50mg pills – https://cenforcers.com/# order cenforce 50mg online

what is cialis tadalafil used for – https://ciltadgn.com/# reliable source cialis

cialis patent expiration – best place to get cialis without pesricption does cialis raise blood pressure

order ranitidine 300mg online – https://aranitidine.com/ buy ranitidine online

buy viagra kamagra online – on this site buy viagra professional online no prescription

The depth in this tune is exceptional. https://gnolvade.com/

The sagacity in this tune is exceptional. https://buyfastonl.com/amoxicillin.html

Thanks an eye to sharing. It’s outstrip quality. https://ursxdol.com/doxycycline-antibiotic/

Thanks on putting this up. It’s understandably done. https://prohnrg.com/product/metoprolol-25-mg-tablets/

More peace pieces like this would make the интернет better. stromectol belgique

More posts like this would make the blogosphere more useful. https://ondactone.com/simvastatin/

This is a keynote which is near to my callousness… Myriad thanks! Exactly where can I notice the acquaintance details in the course of questions?

https://proisotrepl.com/product/cyclobenzaprine/

Good blog you be undergoing here.. It’s intricate to assign great quality article like yours these days. I truly comprehend individuals like you! Rent mindfulness!! http://mi.minfish.com/home.php?mod=space&uid=1412614

forxiga pills – dapagliflozin 10mg price dapagliflozin 10mg us

buy generic orlistat – https://asacostat.com/# orlistat uk