- The German government transferred BTC worth millions of dollars.

- However, buying sentiment remained dominant in the market.

The last month of the second quarter of the year has been in the best interest of Bitcoin [BTC] investors. This was the case as BTC witnessed multiple price corrections.

Meanwhile, the German government made a move that might have a negative impact on the king of cryptos’ price.

Are investors selling Bitcoin?

CoinMarketCap’s data revealed that over the last 30 days, BTC witnessed a more than 11% price decline. In the last seven days alone, the coin’s value sipped by over 6%.

At the time of writing, BTC was trading at $61,043.62 with a market capitalization of over $1.2 trillion. Thanks to the price drop, over 12% of BTC investors were out of money, as per IntoTheBlock’s data.

While that happened, Lookonchain’s latest tweet revealed that the German government transferred BTC worth millions of dollars.

To be precise, the German government transferred 750 BTC, worth $46.35 million, out again, of which 250 BTC, worth $15.41 million, was transferred to Bitstamp and Kraken.

As a result, AMBCrypto planned to check the data to find out whether selling pressure on BTC was high.

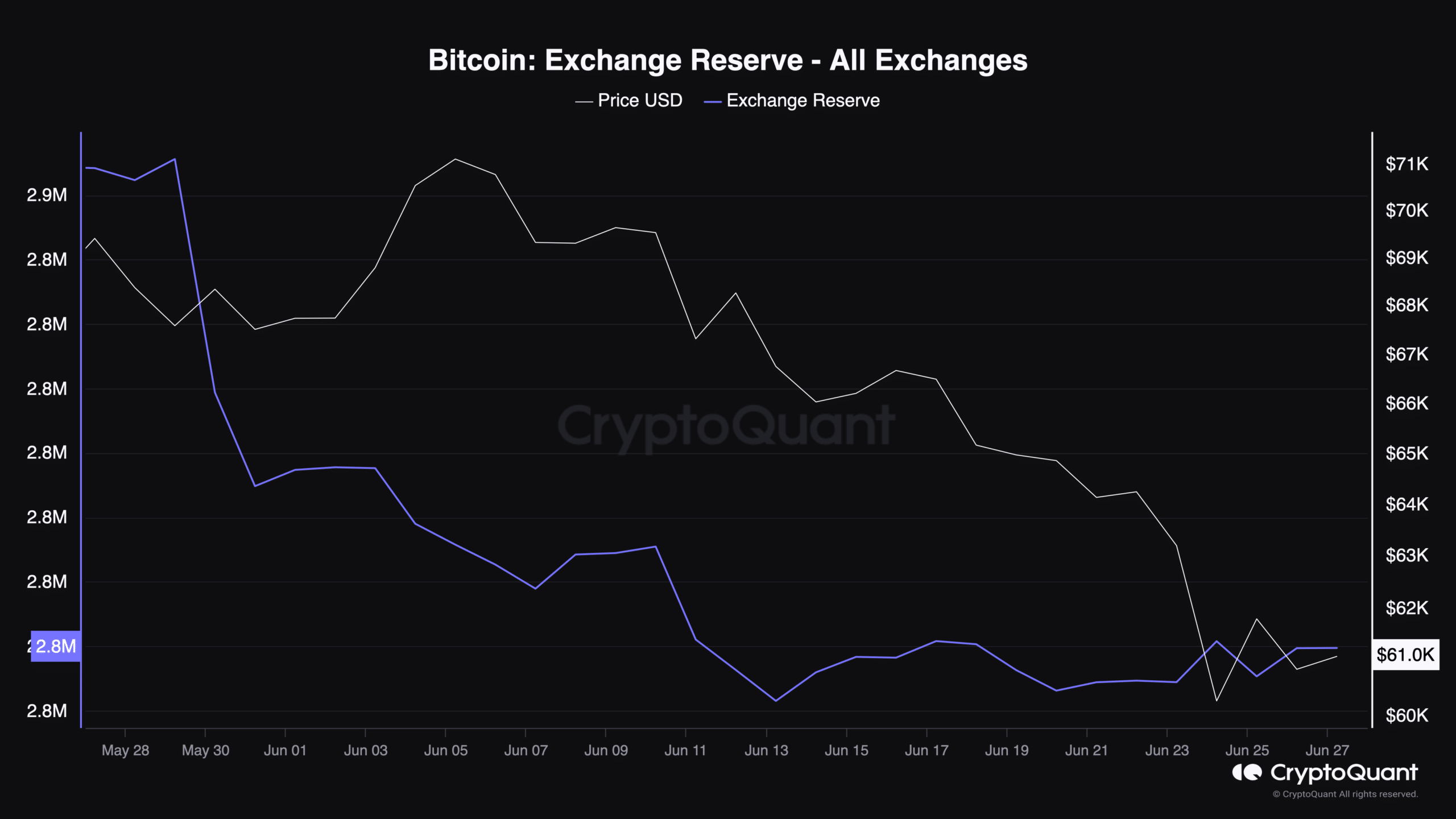

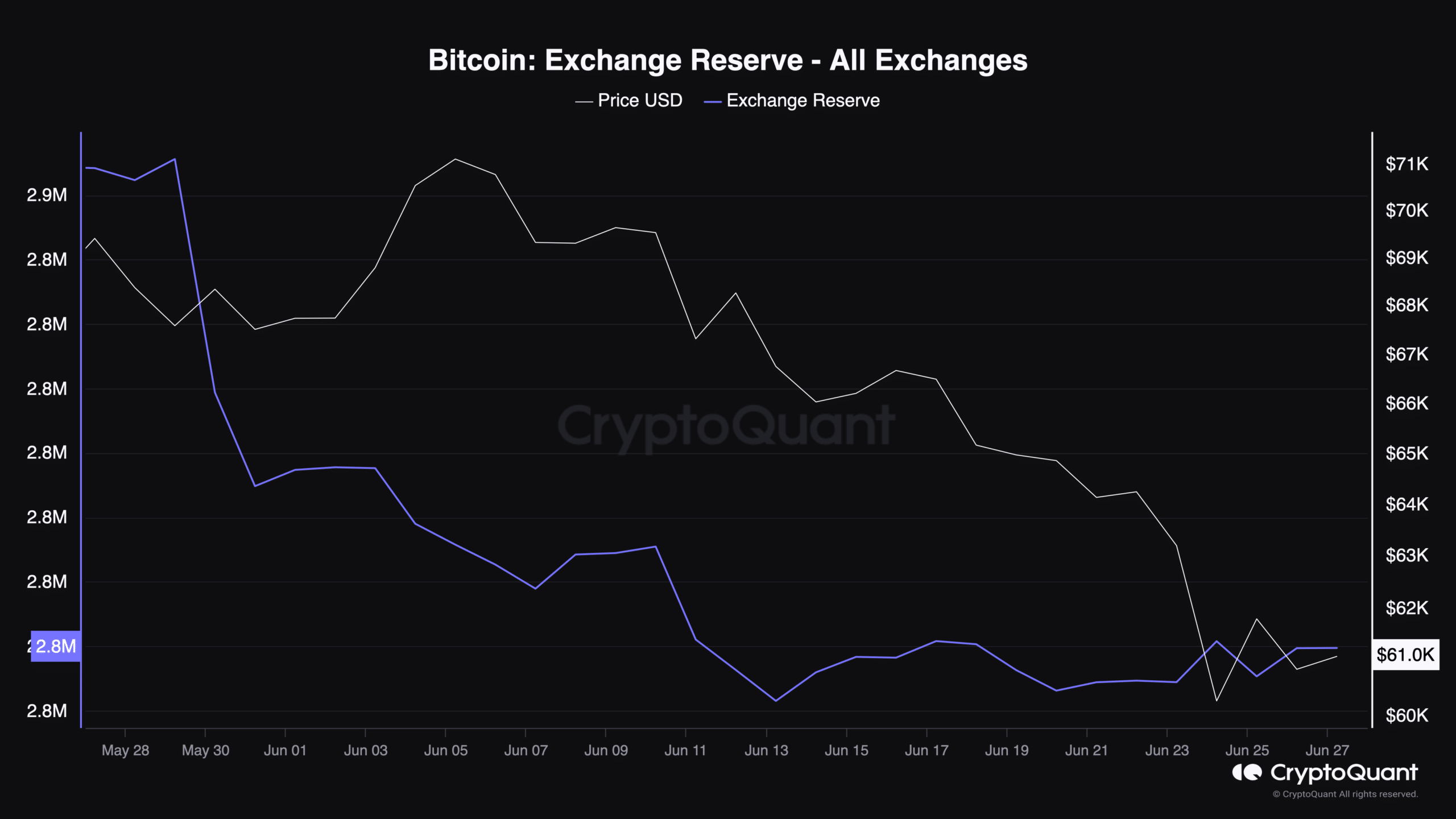

Our analysis of CryptoQuant’s data revealed that BTC’s net deposit on exchanges was high compared to the last seven days’ average, hinting at high buying pressure.

The king of cryptos’ exchange reserve also dropped sharply last month, further establishing the fact that investors were buying BTC while its price declined.

Nonetheless, selling sentiment was dominant among U.S. investors, as its Coinbase Premium was in the red at press time.

Source: CryptoQuant

What to expect from BTC

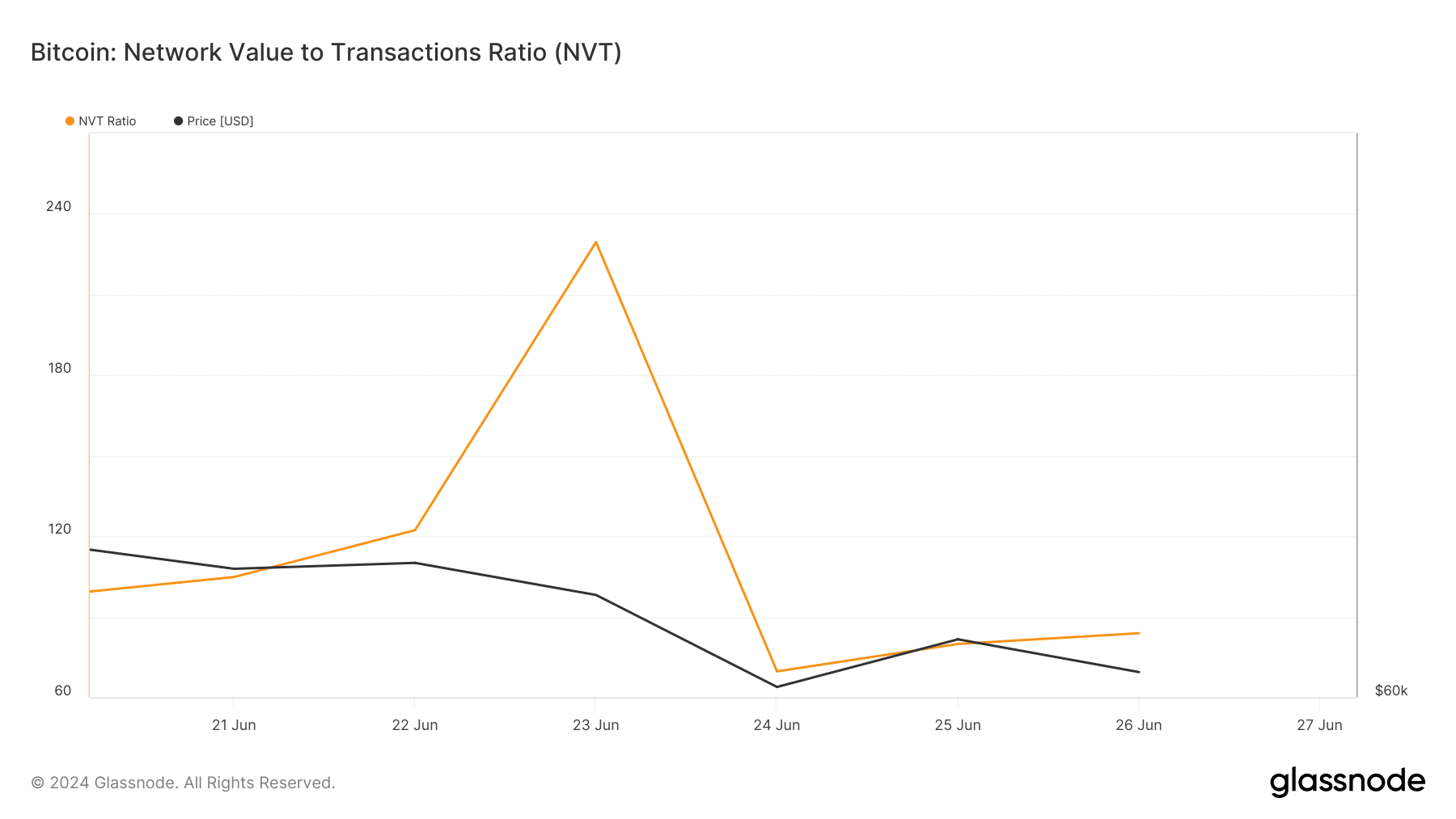

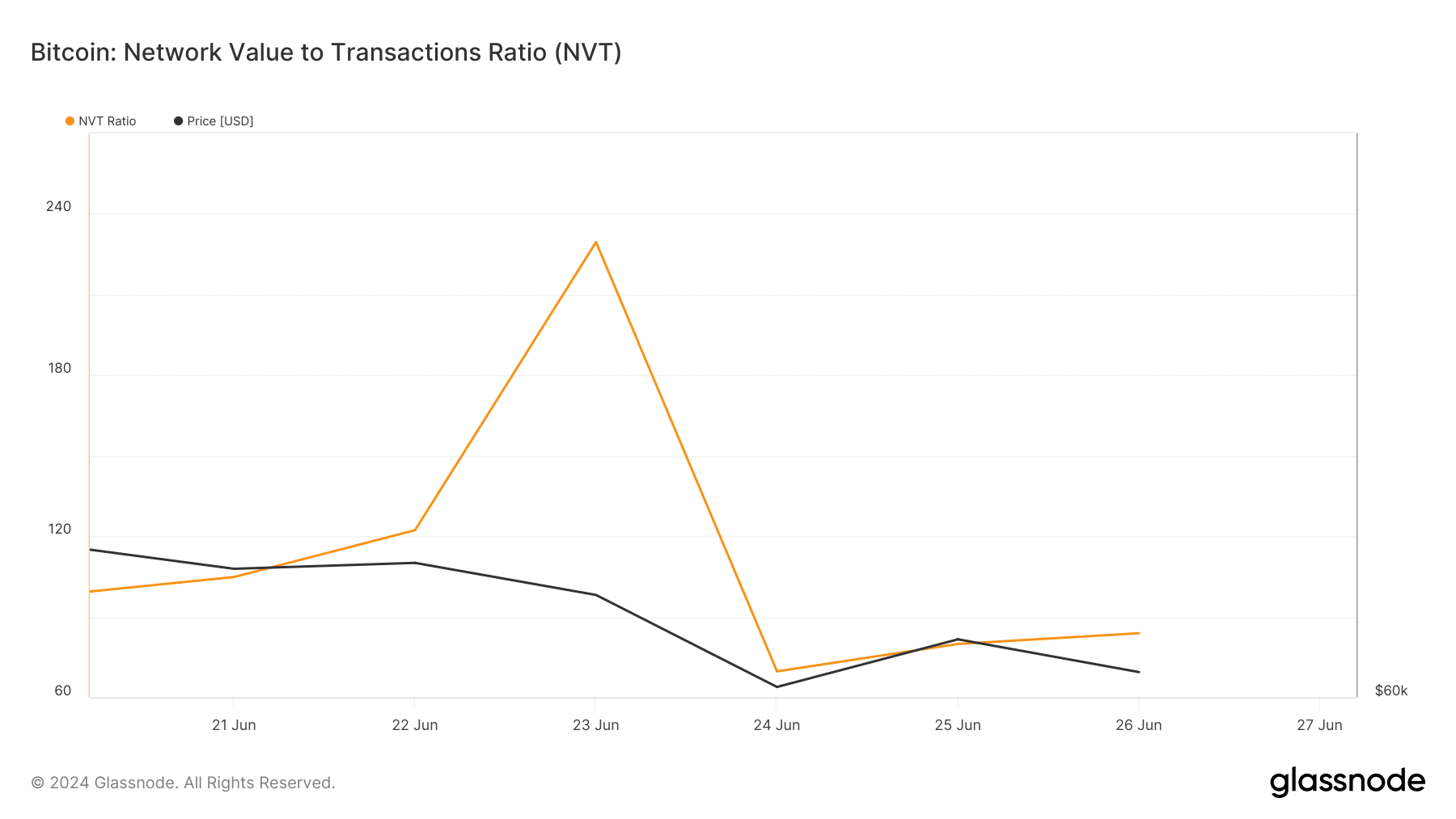

High buying pressure often results in price increases. Therefore, AMBCrypto checked Glassnode’s data and found a bullish metric.

As per our analysis, BTC’s NVT ratio dipped sharply in the last few days. Generally, a decline in the metric means that an asset is undervalued, which hints at a possible price rise in the days to follow.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

We then planned to analyze the coin’s daily chart to better understand whether it was awaiting a price hike. As per our analysis, BTC’s Relative Strength Index (RSI) was resting near the oversold zone.

This might exert more buying pressure on the coin and help lift its price. The Chaikin Money Flow (CMF) also registered a slight uptick, indicating a possible price rise. Nonetheless, the MACD remained in the bears’ favor.

Source: TradingView

- The German government transferred BTC worth millions of dollars.

- However, buying sentiment remained dominant in the market.

The last month of the second quarter of the year has been in the best interest of Bitcoin [BTC] investors. This was the case as BTC witnessed multiple price corrections.

Meanwhile, the German government made a move that might have a negative impact on the king of cryptos’ price.

Are investors selling Bitcoin?

CoinMarketCap’s data revealed that over the last 30 days, BTC witnessed a more than 11% price decline. In the last seven days alone, the coin’s value sipped by over 6%.

At the time of writing, BTC was trading at $61,043.62 with a market capitalization of over $1.2 trillion. Thanks to the price drop, over 12% of BTC investors were out of money, as per IntoTheBlock’s data.

While that happened, Lookonchain’s latest tweet revealed that the German government transferred BTC worth millions of dollars.

To be precise, the German government transferred 750 BTC, worth $46.35 million, out again, of which 250 BTC, worth $15.41 million, was transferred to Bitstamp and Kraken.

As a result, AMBCrypto planned to check the data to find out whether selling pressure on BTC was high.

Our analysis of CryptoQuant’s data revealed that BTC’s net deposit on exchanges was high compared to the last seven days’ average, hinting at high buying pressure.

The king of cryptos’ exchange reserve also dropped sharply last month, further establishing the fact that investors were buying BTC while its price declined.

Nonetheless, selling sentiment was dominant among U.S. investors, as its Coinbase Premium was in the red at press time.

Source: CryptoQuant

What to expect from BTC

High buying pressure often results in price increases. Therefore, AMBCrypto checked Glassnode’s data and found a bullish metric.

As per our analysis, BTC’s NVT ratio dipped sharply in the last few days. Generally, a decline in the metric means that an asset is undervalued, which hints at a possible price rise in the days to follow.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

We then planned to analyze the coin’s daily chart to better understand whether it was awaiting a price hike. As per our analysis, BTC’s Relative Strength Index (RSI) was resting near the oversold zone.

This might exert more buying pressure on the coin and help lift its price. The Chaikin Money Flow (CMF) also registered a slight uptick, indicating a possible price rise. Nonetheless, the MACD remained in the bears’ favor.

Source: TradingView

I am not sure where youre getting your info but good topic I needs to spend some time learning much more or understanding more Thanks for magnificent info I was looking for this information for my mission

buying cheap clomiphene tablets cost of cheap clomiphene for sale clomid usa where to get generic clomid clomid for sale uk can you buy generic clomid without insurance where to get clomiphene without dr prescription

This is the big-hearted of criticism I truly appreciate.

More content pieces like this would create the интернет better.

buy zithromax 250mg generic – zithromax 500mg cost flagyl 200mg price

cost rybelsus – semaglutide 14 mg pills cyproheptadine canada

buy domperidone 10mg generic – motilium cost purchase flexeril online

buy generic propranolol – how to get plavix without a prescription methotrexate online buy

buy azithromycin 250mg pill – bystolic over the counter order nebivolol 5mg generic

augmentin 625mg usa – atbioinfo purchase ampicillin pill

buy nexium capsules – anexa mate nexium 40mg sale

order warfarin – coumamide purchase hyzaar sale

buy meloxicam generic – relieve pain meloxicam 15mg usa

cost prednisone 10mg – aprep lson buy deltasone 20mg generic

medication for ed dysfunction – https://fastedtotake.com/ cheap erectile dysfunction pill

buy generic amoxicillin – https://combamoxi.com/ order amoxicillin sale

fluconazole 200mg brand – click buy diflucan 200mg sale

buy cenforce pill – cost cenforce order generic cenforce 100mg

cialis blood pressure – https://ciltadgn.com/ tadalafil without a doctor’s prescription

ranitidine 150mg pills – ranitidine sale zantac ca

This is the type of enter I unearth helpful. fildena comprar 100mg

buy viagra paypal accepted – https://strongvpls.com/# viagra sale walgreens

More delight pieces like this would create the интернет better. https://prohnrg.com/product/lisinopril-5-mg/