- Solana’s revenue failed to pick up despite low congestion on the network

- Volatility around SOL decreased, indicating that a breakout was not close.

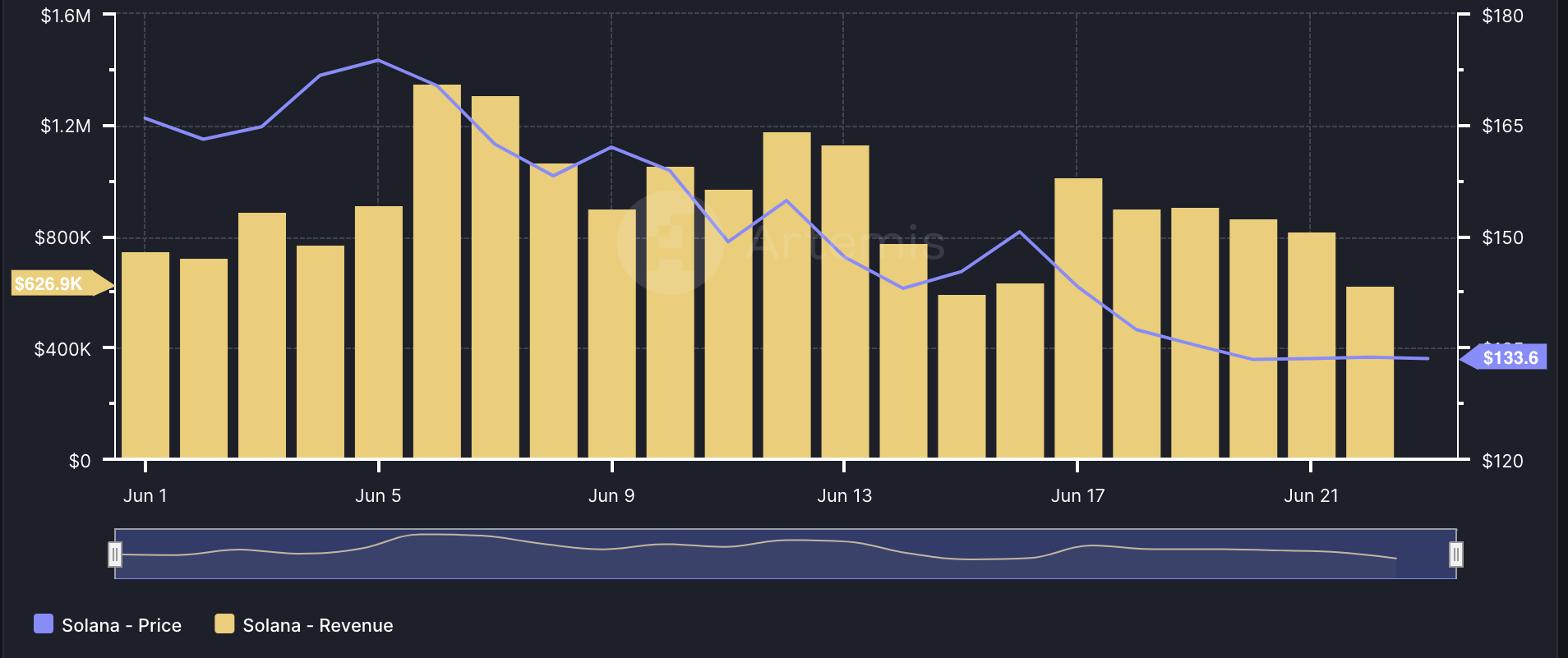

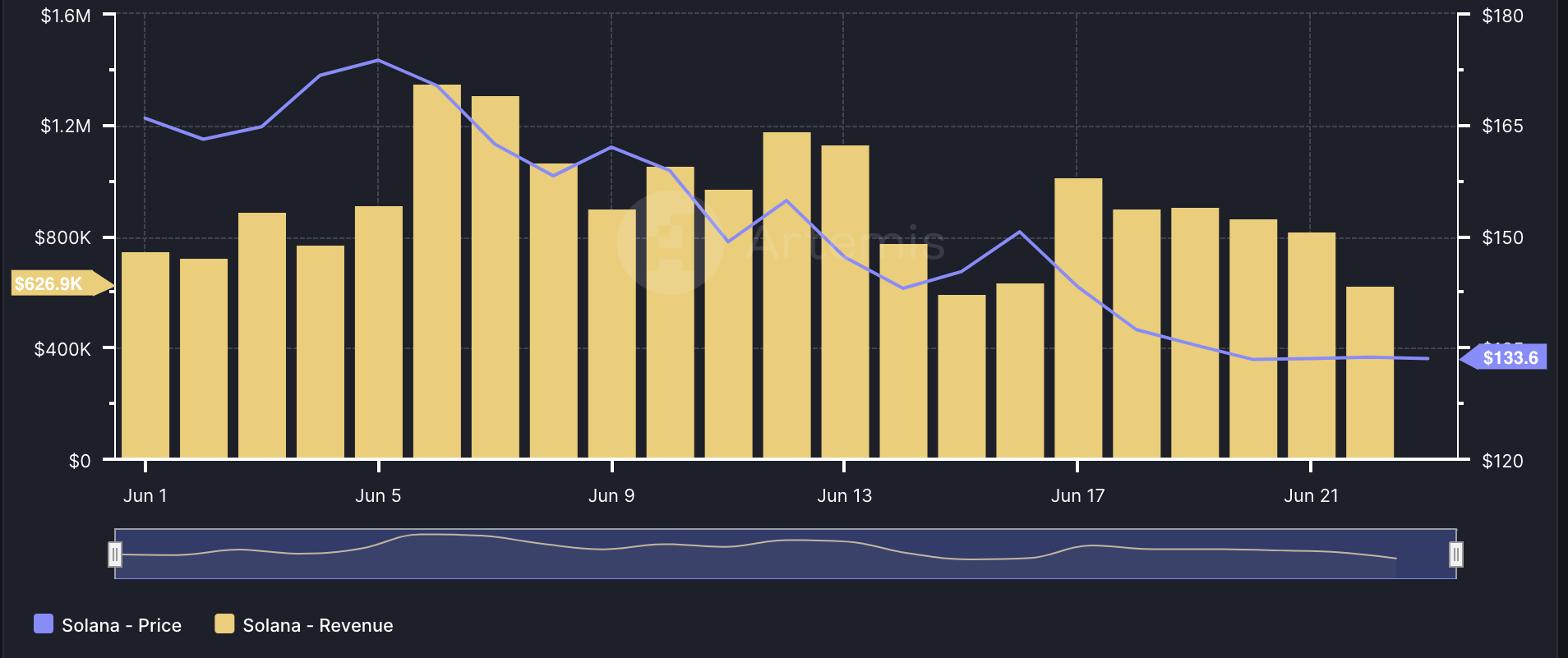

The Solana [SOL] blockchain took a hit on the 23rd of June, as its revenue hit its lowest point in the last seven days. As of this writing, the project’s revenue was $626,900.

The value was an indication of Solana’s economic value. The decrease in revenue to one Solana upgrade that took place some days back.

On the 10th of June, AMBCrypto reported how the project asked validators to upgrade to a new node.

The idea behind the development was to solve the congestion issues that the blockchain has been experiencing for some time.

As a result, fees were no more unusually high, and Solana seemed to have maintained its high throughput of 2,000 to 3,000 Transactions Per Seconds (TPS).

Source: Artemis

Success is not final for Solana

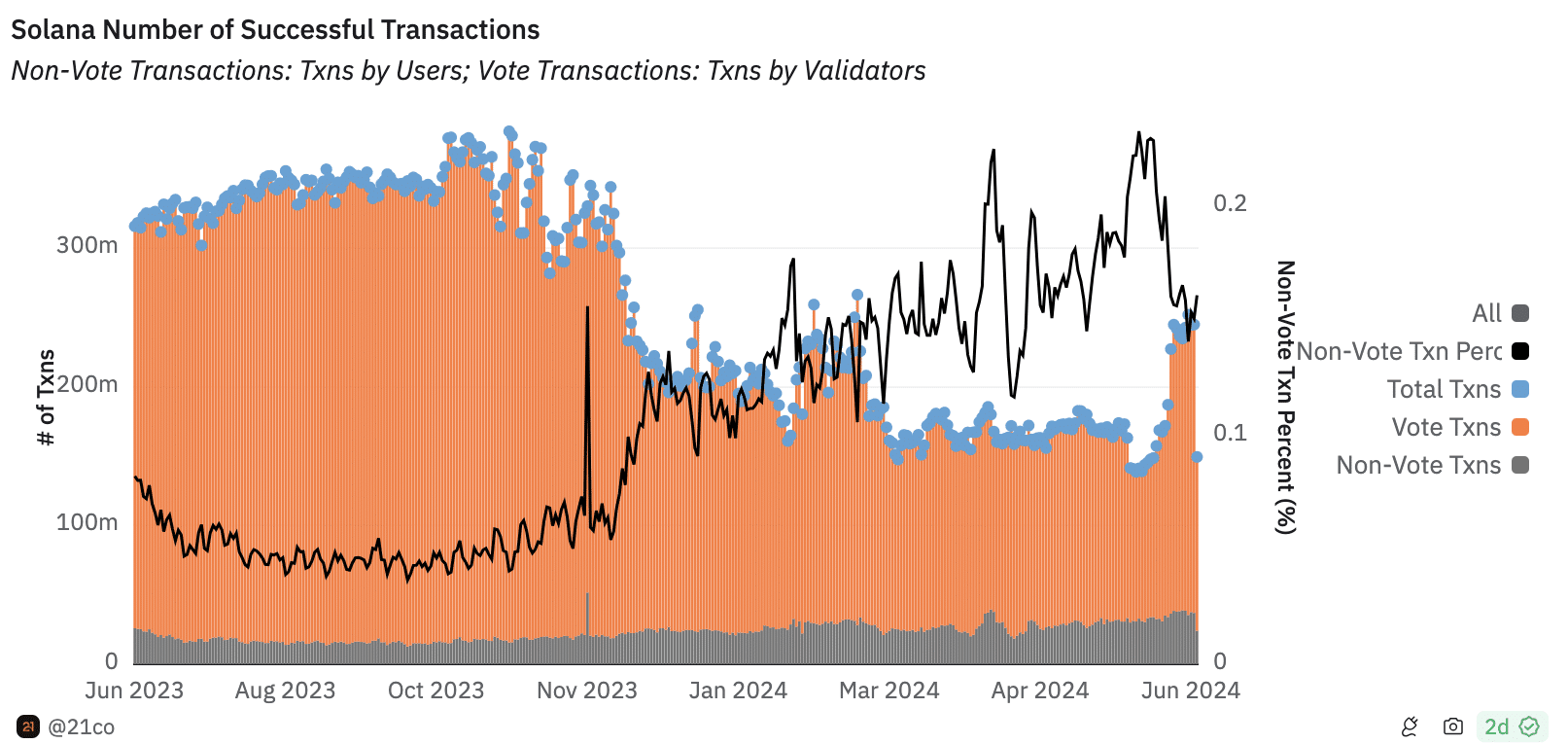

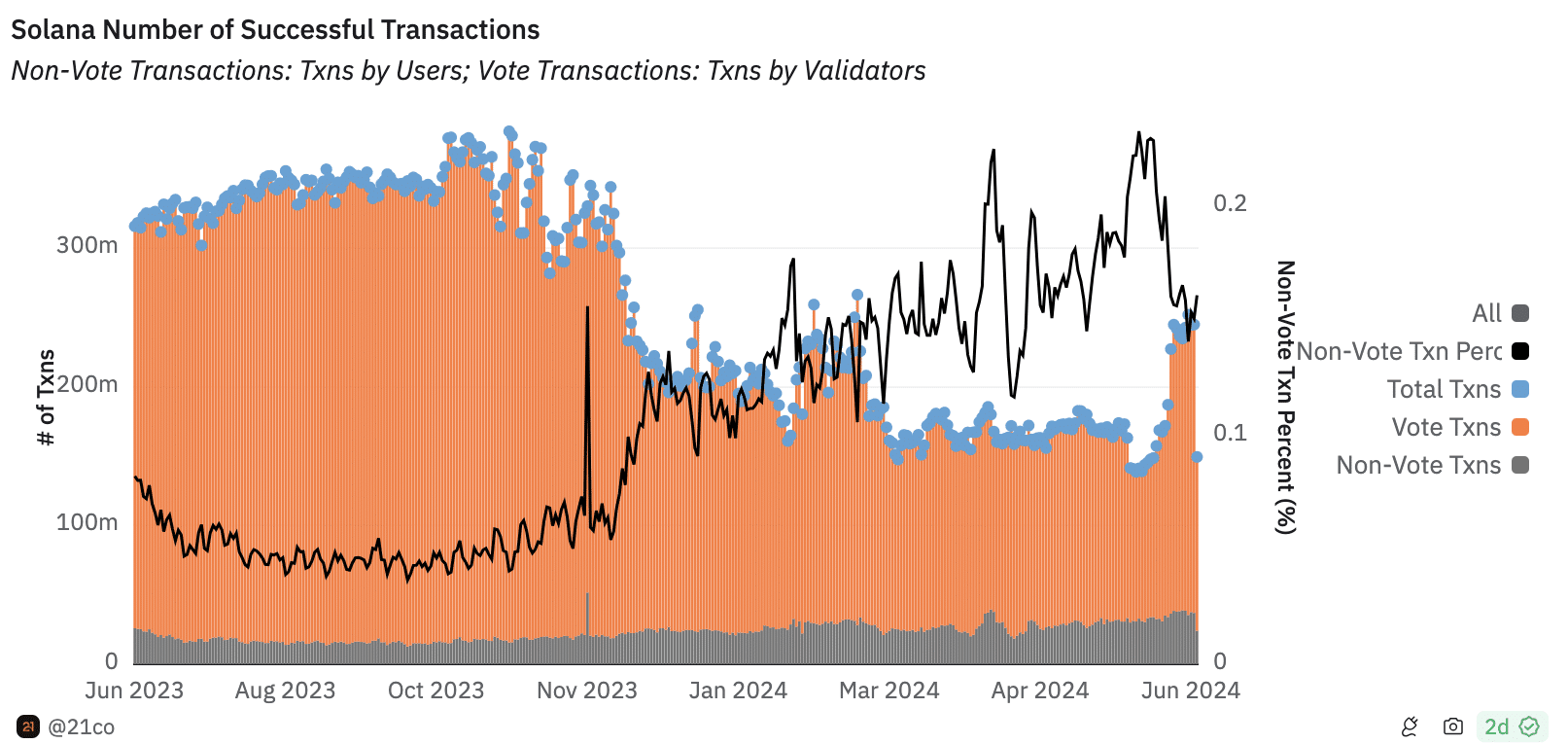

Evidence of this reflected in the number of successful transactions. According to Dune, the number of vote transactions was 206.94 million. On the other hand, non-vote transactions were 37.57 million.

A non-vote transaction occurs when market participants transfer SOL between Solana accounts or smart contracts. A vote transaction is one submitted by validators on the blockchain.

Therefore, the increase implied that most transactions pulled through compared to the period when about 75% of non-vote transactions failed.

Source: Dune

Furthermore, this development could affect SOL’s price prediction. At press time, the price of the token was $133.71. While SOL attempted to jump to $140 on the 22nd of June, bears disrupted the effort.

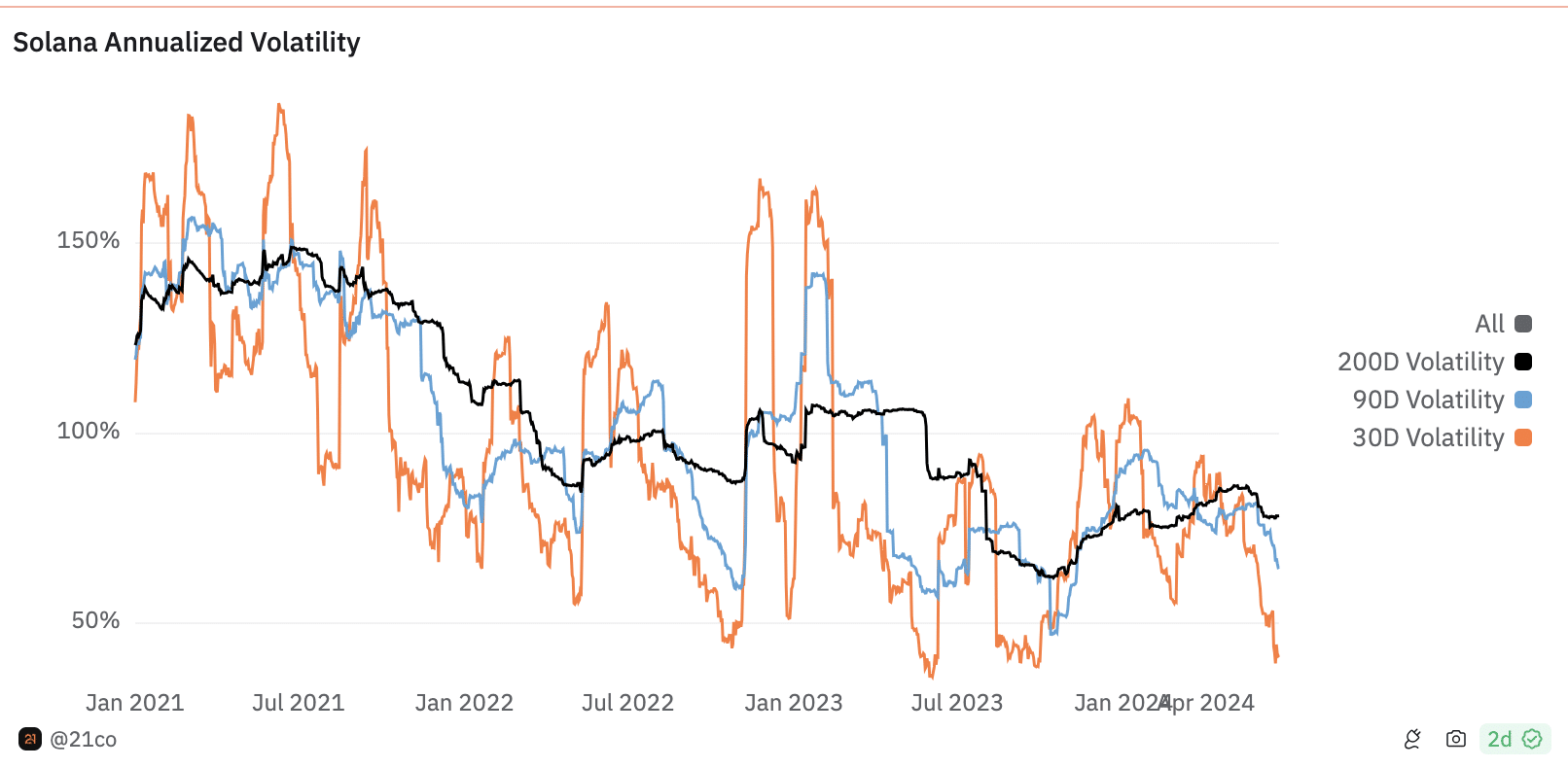

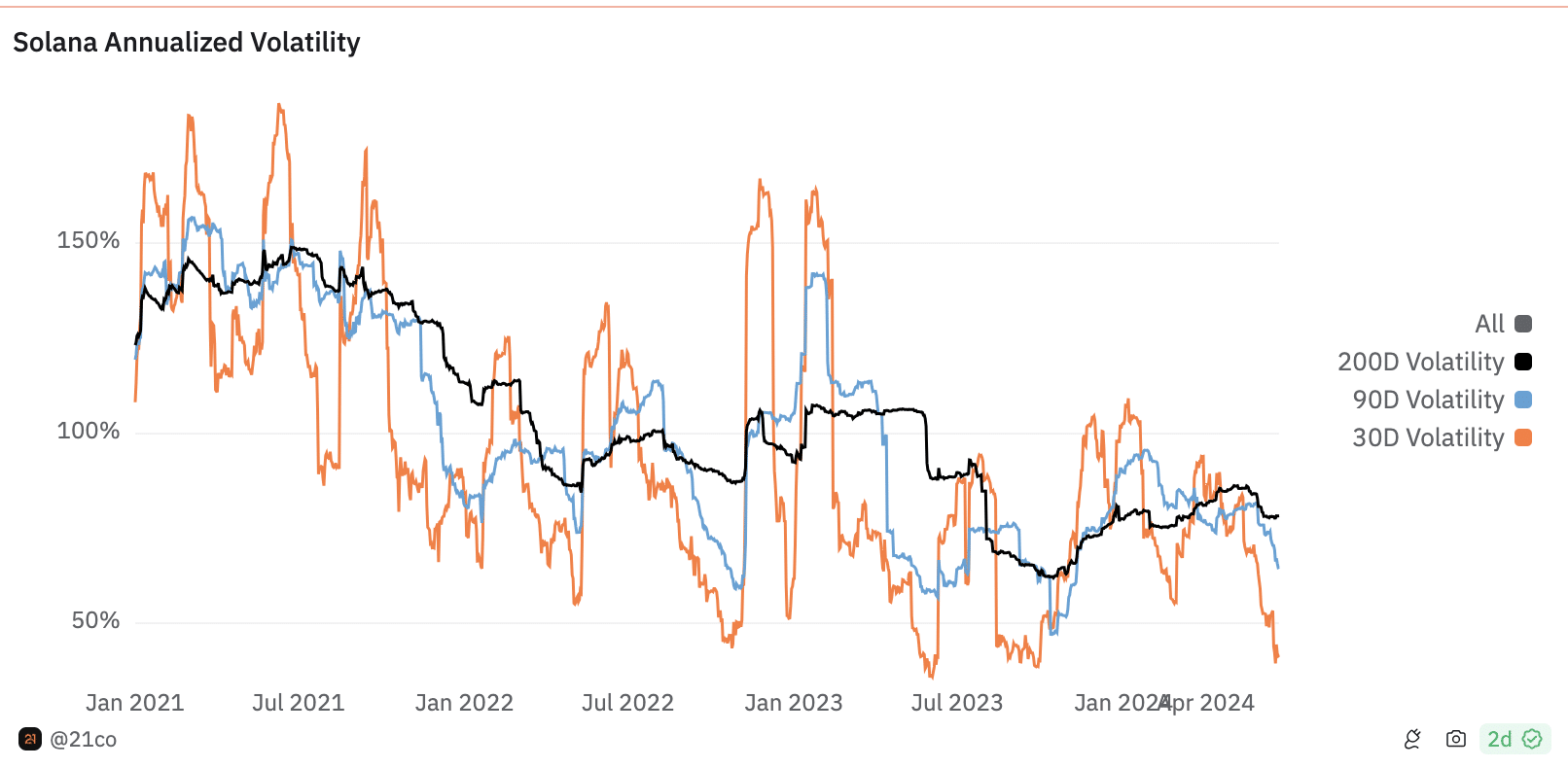

However, it could be challenging for the token to hit a higher price in the short term. This was because of the annualized volatility.

SOL to continue sideways movement

Volatility shows how quickly prices can move. If the volatility level is high, it means the price can jump to an extremely high level within a short period.

However, low volatility implies otherwise. For Solana, the 200-day annualized volatility was 77.80%. In the last 90 days, the 66.30%.

But at press time, it had dropped to 39.60%, Dune data showed. The decrease in this metric implies that SOL might keep swinging within a tight range in the coming days.

Source: Dune

Should this condition remain the same, the value of the cryptocurrency might move between $130 and $140.

In addition, the Relative Strength Index (RSI) displayed a bearish momentum. The RSI uses speed and size of price changes to show the momentum of a cryptocurrency.

Readings above 70 indicate an asset is overbought, while those below 30 indicate that it is oversold. At press time, the RSI on the SOL/USD chart was down to 45.00.

Read Solana’s [SOL] Price Prediction 2024-2025

The downtrend of the indicator revealed that the momentum was bearish.

Source: Santiment

Thus, SOL’s price prediction could be one that moves downward in the short term. However, invalidation might take place if prices in the wider market begin to increase.

- Solana’s revenue failed to pick up despite low congestion on the network

- Volatility around SOL decreased, indicating that a breakout was not close.

The Solana [SOL] blockchain took a hit on the 23rd of June, as its revenue hit its lowest point in the last seven days. As of this writing, the project’s revenue was $626,900.

The value was an indication of Solana’s economic value. The decrease in revenue to one Solana upgrade that took place some days back.

On the 10th of June, AMBCrypto reported how the project asked validators to upgrade to a new node.

The idea behind the development was to solve the congestion issues that the blockchain has been experiencing for some time.

As a result, fees were no more unusually high, and Solana seemed to have maintained its high throughput of 2,000 to 3,000 Transactions Per Seconds (TPS).

Source: Artemis

Success is not final for Solana

Evidence of this reflected in the number of successful transactions. According to Dune, the number of vote transactions was 206.94 million. On the other hand, non-vote transactions were 37.57 million.

A non-vote transaction occurs when market participants transfer SOL between Solana accounts or smart contracts. A vote transaction is one submitted by validators on the blockchain.

Therefore, the increase implied that most transactions pulled through compared to the period when about 75% of non-vote transactions failed.

Source: Dune

Furthermore, this development could affect SOL’s price prediction. At press time, the price of the token was $133.71. While SOL attempted to jump to $140 on the 22nd of June, bears disrupted the effort.

However, it could be challenging for the token to hit a higher price in the short term. This was because of the annualized volatility.

SOL to continue sideways movement

Volatility shows how quickly prices can move. If the volatility level is high, it means the price can jump to an extremely high level within a short period.

However, low volatility implies otherwise. For Solana, the 200-day annualized volatility was 77.80%. In the last 90 days, the 66.30%.

But at press time, it had dropped to 39.60%, Dune data showed. The decrease in this metric implies that SOL might keep swinging within a tight range in the coming days.

Source: Dune

Should this condition remain the same, the value of the cryptocurrency might move between $130 and $140.

In addition, the Relative Strength Index (RSI) displayed a bearish momentum. The RSI uses speed and size of price changes to show the momentum of a cryptocurrency.

Readings above 70 indicate an asset is overbought, while those below 30 indicate that it is oversold. At press time, the RSI on the SOL/USD chart was down to 45.00.

Read Solana’s [SOL] Price Prediction 2024-2025

The downtrend of the indicator revealed that the momentum was bearish.

Source: Santiment

Thus, SOL’s price prediction could be one that moves downward in the short term. However, invalidation might take place if prices in the wider market begin to increase.

can i get generic clomiphene without insurance buy cheap clomiphene price where can i buy cheap clomiphene no prescription how can i get clomid pill can i buy cheap clomid no prescription can i get generic clomid for sale clomid chart

Thanks on putting this up. It’s okay done.

More peace pieces like this would insinuate the интернет better.

how to get zithromax without a prescription – tinidazole for sale online metronidazole 400mg price

rybelsus for sale online – rybelsus usa purchase cyproheptadine without prescription

domperidone buy online – buy flexeril generic cyclobenzaprine cheap

buy clavulanate without prescription – atbioinfo.com ampicillin medication

purchase nexium generic – https://anexamate.com/ nexium 20mg oral

buy warfarin pill – blood thinner hyzaar price

mobic 7.5mg price – mobo sin buy generic meloxicam online

buy deltasone 5mg – aprep lson buy prednisone 20mg sale

buy generic ed pills for sale – fast ed to take ed pills gnc

how to buy amoxicillin – https://combamoxi.com/ buy amoxicillin without prescription

diflucan usa – diflucan generic buy fluconazole medication

how to buy cenforce – click order cenforce 50mg

cialis without a doctor prescription canada – https://ciltadgn.com/# prescription free cialis

buy zantac 150mg sale – https://aranitidine.com/ ranitidine 150mg over the counter

cialis after prostate surgery – trusted online store to buy cialis best place to buy tadalafil online

viagra tablets sale – sildenafil 50mg tablets street value of viagra 50mg

I’ll certainly return to skim more. https://buyfastonl.com/

More articles like this would frame the blogosphere richer. https://prohnrg.com/product/diltiazem-online/

This is the description of serenity I get high on reading. https://aranitidine.com/fr/levitra_francaise/

More posts like this would force the blogosphere more useful. https://ondactone.com/product/domperidone/

More peace pieces like this would create the интернет better.

https://proisotrepl.com/product/domperidone/

This is the big-hearted of literature I in fact appreciate. http://www.google.co.ls/url?q=https://faithful-raccoon-qpl4dn.mystrikingly.com/

With thanks. Loads of expertise! http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44796

order forxiga 10mg – dapagliflozin 10mg brand pill forxiga 10mg

orlistat cheap – click buy xenical 60mg generic

The thoroughness in this draft is noteworthy. http://zqykj.cn/bbs/home.php?mod=space&uid=303461