- Nearly $3 billion in BTC and ETH options expire, with traders bracing for major volatility and key price action.

- Market makers reposition amid holiday trading lull as $98K BTC and $3,700 ETH levels dominate attention.

Bitcoin [BTC] and Ethereum [ETH] options contracts worth $3 billion were set to expire on the 13th of December. These expirations often lead to increased market activity, with traders closely watching potential price movements.

At press time, Bitcoin was priced at $100,073, while Ethereum was trading at $3,881.12, according to Coingecko data.

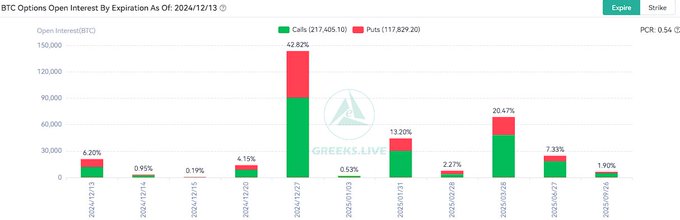

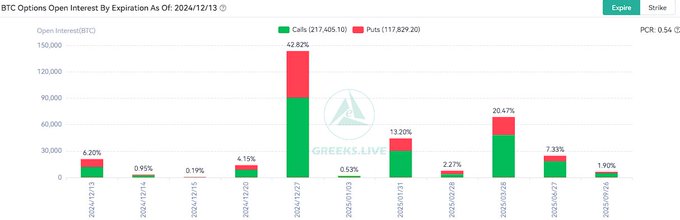

Bitcoin options worth $2.1 billion near expiry

Bitcoin has $2.1 billion in options contracts expiring. The put-call ratio stands at 0.83, indicating more call options (bullish bets) than puts (bearish bets).

The max pain point—the price level where most options will expire worthless—is $98,000.

Source: X

With Bitcoin’s market cap at $1.98 trillion and a circulating supply of 20 million coins, traders are monitoring its next moves.

The 24-hour trading volume for BTC has reached $94.48 billion, suggesting heightened activity as the expiration approaches.

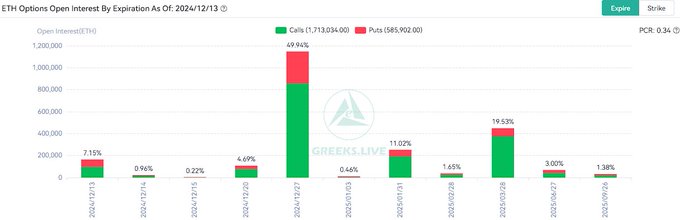

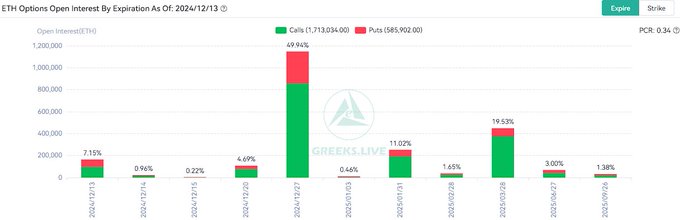

Ethereum options see $640M expire

Ethereum has $640 million in options expiring, with a put-call ratio of 0.68, showing even stronger bullish sentiment than Bitcoin. The max pain point for ETH is $3,700, a critical level that traders are watching closely.

Source: X

Ethereum’s trading volume over the past 24 hours stands at $44.47 billion, with a market cap of $467.65 billion and a circulating supply of 120 million ETH.

Though ETH has seen a slight 0.63% price decline in the last 24 hours, its week-to-week performance remains flat, reflecting a wait-and-see attitude among traders.

Market makers reposition as liquidity declines

According to Greeks.live, market makers are shifting their positions during this period of expirations, which coincides with reduced trading volumes during the holiday season.

Analysts have noted rising Implied Volatility (IV), indicating that markets are preparing for sharper price movements. “Lower liquidity during the holidays often magnifies market volatility,” said analysts at Greeks.live.

They also highlighted the growing correlation between crypto prices and U.S. stock markets, suggesting that equities’ price swings may influence cryptocurrency movements.

Economic data adds complexity

The expiration of these options comes after a week of economic developments in the U.S. November’s inflation rate increased to 2.7%, with core CPI at 0.3%, signaling ongoing inflationary challenges.

Read Bitcoin’s [BTC] Price Prediction 2024-25

While a Federal Reserve rate cut is expected, concerns remain about whether inflation will delay easing.

These factors, combined with the expiration of billions in crypto options, could create heightened market activity.

- Nearly $3 billion in BTC and ETH options expire, with traders bracing for major volatility and key price action.

- Market makers reposition amid holiday trading lull as $98K BTC and $3,700 ETH levels dominate attention.

Bitcoin [BTC] and Ethereum [ETH] options contracts worth $3 billion were set to expire on the 13th of December. These expirations often lead to increased market activity, with traders closely watching potential price movements.

At press time, Bitcoin was priced at $100,073, while Ethereum was trading at $3,881.12, according to Coingecko data.

Bitcoin options worth $2.1 billion near expiry

Bitcoin has $2.1 billion in options contracts expiring. The put-call ratio stands at 0.83, indicating more call options (bullish bets) than puts (bearish bets).

The max pain point—the price level where most options will expire worthless—is $98,000.

Source: X

With Bitcoin’s market cap at $1.98 trillion and a circulating supply of 20 million coins, traders are monitoring its next moves.

The 24-hour trading volume for BTC has reached $94.48 billion, suggesting heightened activity as the expiration approaches.

Ethereum options see $640M expire

Ethereum has $640 million in options expiring, with a put-call ratio of 0.68, showing even stronger bullish sentiment than Bitcoin. The max pain point for ETH is $3,700, a critical level that traders are watching closely.

Source: X

Ethereum’s trading volume over the past 24 hours stands at $44.47 billion, with a market cap of $467.65 billion and a circulating supply of 120 million ETH.

Though ETH has seen a slight 0.63% price decline in the last 24 hours, its week-to-week performance remains flat, reflecting a wait-and-see attitude among traders.

Market makers reposition as liquidity declines

According to Greeks.live, market makers are shifting their positions during this period of expirations, which coincides with reduced trading volumes during the holiday season.

Analysts have noted rising Implied Volatility (IV), indicating that markets are preparing for sharper price movements. “Lower liquidity during the holidays often magnifies market volatility,” said analysts at Greeks.live.

They also highlighted the growing correlation between crypto prices and U.S. stock markets, suggesting that equities’ price swings may influence cryptocurrency movements.

Economic data adds complexity

The expiration of these options comes after a week of economic developments in the U.S. November’s inflation rate increased to 2.7%, with core CPI at 0.3%, signaling ongoing inflationary challenges.

Read Bitcoin’s [BTC] Price Prediction 2024-25

While a Federal Reserve rate cut is expected, concerns remain about whether inflation will delay easing.

These factors, combined with the expiration of billions in crypto options, could create heightened market activity.

BWER Company provides Iraq’s leading-edge weighbridge solutions, designed to withstand harsh environments while delivering top-tier performance and accuracy.

how to buy cheap clomiphene price where to buy clomid price can you buy generic clomiphene without a prescription where to get cheap clomiphene without prescription where can i buy generic clomid price clomid 50mg tablets can i buy cheap clomid price

This website absolutely has all of the tidings and facts I needed adjacent to this subject and didn’t comprehend who to ask.

I am in point of fact delighted to glance at this blog posts which consists of tons of of use facts, thanks for providing such data.

buy zithromax 500mg online cheap – zithromax 250mg pill flagyl 400mg brand

semaglutide order – rybelsus without prescription brand cyproheptadine 4mg

buy motilium 10mg online – sumycin 500mg for sale buy cyclobenzaprine generic

buy inderal generic – order generic methotrexate 2.5mg buy methotrexate 5mg generic

amoxicillin price – amoxicillin where to buy order ipratropium online cheap

azithromycin ca – bystolic 20mg pills nebivolol ca

augmentin ca – https://atbioinfo.com/ buy acillin generic

buy nexium paypal – https://anexamate.com/ order esomeprazole 40mg

buy coumadin 5mg online cheap – anticoagulant buy hyzaar generic

buy mobic 15mg online – https://moboxsin.com/ cost mobic 7.5mg

buy prednisone 20mg sale – https://apreplson.com/ order deltasone 10mg pill

cheap erectile dysfunction – https://fastedtotake.com/ home remedies for ed erectile dysfunction

buy amoxil generic – https://combamoxi.com/ purchase amoxil generic

cheap fluconazole 200mg – https://gpdifluca.com/# fluconazole for sale

buy cenforce 50mg online – https://cenforcers.com/ cenforce 50mg drug

what is the generic name for cialis – canadian no prescription pharmacy cialis cialis super active real online store

order ranitidine generic – on this site ranitidine over the counter

tadalafil buy online canada – click best research tadalafil 2017

More posts like this would make the online space more useful. https://gnolvade.com/

order viagra by mail – https://strongvpls.com/# buy priligy viagra online

Greetings! Utter gainful suggestion within this article! It’s the scarcely changes which wish espy the largest changes. Thanks a lot towards sharing! https://ursxdol.com/clomid-for-sale-50-mg/

Thanks towards putting this up. It’s well done. https://buyfastonl.com/azithromycin.html

Thanks for sharing. It’s outstrip quality. https://prohnrg.com/product/metoprolol-25-mg-tablets/