- Ethereum and BNB’s costs dropped by 3% and 4%, respectively, over the previous week

- XRP was additionally down by 8%, with most market indicators bearish too

The altcoin market has taken a blow of late after most cryptos witnessed a worth correction. The highest three altcoins, particularly, Ethereum [ETH],BNB Chain [BNB], and XRP, had been no exception. If the most recent knowledge is to be thought-about, the highest three altcoins’ mixed market capitalization has reached a important degree, which might decide how the market would possibly look within the days to observe.

Learn Ethereum’s [ETH] Value Prediction 2023-24

Altcoins can witness a rally if…

Mags, a preferred crypto-analyst, lately posted a tweet on X (previously generally known as Twitter), highlighting an fascinating occasion associated to altcoins. Presently, the full market cap of the highest 3 altcoins is $320 billion. In doing so, he additionally shared two doable outcomes –

#Altcoin Marketcap 😳

TOTAL3 is presently sitting at $320 Billion

Two Attainable Eventualities :

1) If worth breaks beneath the present assist degree we will anticipate a re-test of 2017 ATH, which is now a robust month-to-month assist zone round $240 Billion.

2) If the worth manages to… pic.twitter.com/988OPKO1vT

— Mags (@thescalpingpro) October 11, 2023

If the worth breaks beneath the present assist degree, we will anticipate a re-test of the 2017 ATH, which is now in a robust month-to-month assist zone round $240 billion. The second risk is that if the worth manages to interrupt out above the native trendline resistance and front-run the month-to-month assist degree, we will anticipate an aggressive uptrend from right here.

Since each potentialities are utterly opposite from one another, a better have a look at all three prime altcoins can present higher readability on which consequence is extra probably.

Ethereum appears bearish

CoinMarketCap’s data revealed that the king of altcoins’ worth plummeted by greater than 4% final week. On the time of writing, ETH was buying and selling underneath the $1,600-mark at $1,560.32 with a market cap of over $187 billion. There was extra unhealthy information, as most on-chain metrics had been additionally within the sellers’ favor.

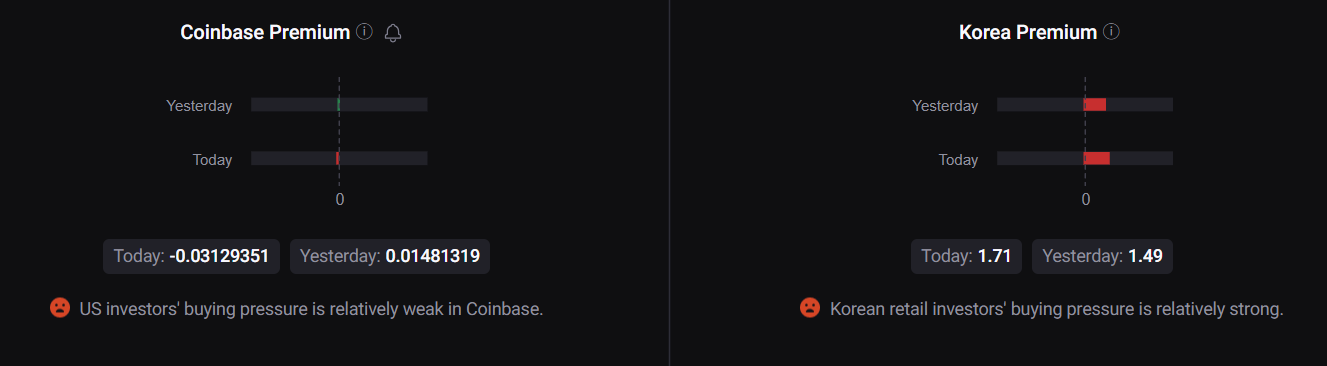

For instance, Ethereum’s exchange reserve was rising at press time. This meant that promoting strain on the token has been excessive. Actually, each ETH’s Korea premium and Coinbase premium had been crimson too – An indication that buyers from the US and Korea have been promoting their belongings.

Supply: CryptoQuant

ETH’s buying and selling quantity additionally plummeted over the previous couple of days. This indicated that buyers have been reluctant to commerce the token. Promoting sentiment was dominant within the derivatives market as properly, as a result of ETH’s taker purchase/promote ratio turned crimson lately.

Nonetheless, CryptoQuant’s knowledge revealed that ETH’s stochastic was within the oversold zone. This might help improve shopping for strain and in flip, push the token’s worth within the days to come back.

How is BNB Chain doing?

BNB’s state was additionally fairly much like that of Ethereum as its worth dropped. During the last seven days, BNB Chain’s worth has fallen by greater than 3%. At press time, it was trading at $205.39 with a market cap of $39.5 billion.

If market indicators are to be believed, BNB’s worth would possibly go down additional. Each the Relative Energy Index (RSI) and Cash Circulate Index (MFI) registered downticks. BNB’s Chaikin Cash Circulate (CMF) was additionally hovering beneath the impartial zone. On prime of that, the MACD displayed a transparent bearish higher hand, additional rising the probabilities of a sustained downtrend.

Supply: TradingView

Nonetheless, not like Ethereum, BNB’s derivatives market stats appeared optimistic. For instance, Coinglass’s knowledge identified that whereas BNB’s worth dropped, its funding fee additionally declined. This advised that buyers have been reluctant to purchase BNB at a cheaper price. Moreover, the same pattern of decline was additionally famous in BNB’s Open Curiosity, which advised that there have been probabilities of a pattern reversal.

Supply: Coinglass

Whales are fascinated with XRP

Amidst all this, XRP whales confirmed immense curiosity within the token. This was evident from the rise in its complete variety of whale transactions over the previous couple of days. Moreover, its social quantity additionally remained fairly excessive, reflecting its recognition within the crypto-market.

Supply: Santiment

Nonetheless, XRP was essentially the most affected altcoin among the many prime three throughout the newest worth correction as its worth dropped by greater than 8% within the final seven days. Due to the unprecedented worth decline, XRP’s 1-week worth volatility shot up too.

On the time of writing, XRP was buying and selling at $0.4772 with a market cap of greater than $25.5 billion, together with a 7% fall in its each day buying and selling quantity. XRP’s destiny additionally appeared much like that of the opposite two, as its market indicators remained bearish. Its CMF and MFI each registered downticks and had been resting close to the impartial zone.

Supply: TradingView

How a lot are 1,10,100 XRPs value at the moment

Contemplating the performances of all three prime altcoins, it appears probably that every one of them would possibly see an additional drop of their worth. Subsequently, the second risk of anticipating a re-test of the 2017 ATH appears fairly more likely to occur.

Nonetheless, because the crypto-market is notorious for its unpredictability, the way in which issues go sooner or later will probably be intriguing to look at.

clomiphene sleep apnea buying cheap clomid pill where to get generic clomid tablets where can i buy cheap clomid without prescription where buy generic clomid without prescription cost of clomiphene without insurance clomid tablets

More articles like this would make the blogosphere richer.

More articles like this would pretence of the blogosphere richer.

buy zithromax 250mg without prescription – buy generic tindamax flagyl 400mg cheap

rybelsus 14 mg without prescription – buy cyproheptadine 4 mg online cyproheptadine pill

order domperidone sale – domperidone ca cheap flexeril 15mg

how to get propranolol without a prescription – inderal 10mg pills methotrexate us

buy azithromycin 500mg generic – bystolic 20mg pills bystolic brand

augmentin 1000mg cost – https://atbioinfo.com/ where to buy acillin without a prescription

buy esomeprazole without prescription – https://anexamate.com/ order esomeprazole 20mg generic

where can i buy medex – coumamide buy losartan 50mg pills

meloxicam 7.5mg for sale – relieve pain purchase meloxicam online cheap

purchase prednisone sale – https://apreplson.com/ buy deltasone 20mg pills

buy generic ed pills over the counter – https://fastedtotake.com/ best ed pills non prescription

buy amoxicillin for sale – https://combamoxi.com/ amoxil price

buy diflucan 200mg pills – https://gpdifluca.com/# order fluconazole 200mg pills

cialis windsor canada – ciltad gn generic tadalafil canada

cialis shipped from usa – https://strongtadafl.com/ cialis for sale in toront ontario

order ranitidine pills – https://aranitidine.com/# ranitidine 150mg for sale

buy viagra kenya – strong vpls buy online viagra

I couldn’t weather commenting. Profoundly written! comprar cenforce 200

Greetings! Very productive advice within this article! It’s the little changes which choice obtain the largest changes. Thanks a quantity quest of sharing! buy furosemide without prescription

This website really has all of the tidings and facts I needed about this participant and didn’t comprehend who to ask. site

Thanks recompense sharing. It’s acme quality. https://prohnrg.com/product/orlistat-pills-di/

Thanks on putting this up. It’s well done. https://aranitidine.com/fr/viagra-100mg-prix/

More posts like this would make the online elbow-room more useful. https://ondactone.com/spironolactone/

With thanks. Loads of erudition!

https://doxycyclinege.com/pro/celecoxib/

Thanks on putting this up. It’s well done. http://www.predictive-datascience.com/forum/member.php?action=profile&uid=44951

buy dapagliflozin 10mg generic – click dapagliflozin 10 mg for sale

buy xenical tablets – https://asacostat.com/# xenical price