- At press time, ETH was caught in a 4-hour symmetrical triangle, showing no clear directional trend.

- On-chain data suggested that a potential rally could be on the horizon.

Market activity for Ethereum [ETH] has been subdued, showing only a slight increase of 2.45% in price, now trading around the $2,600 level.

This kind of price behavior is typical when an asset is trading within a symmetrical triangle—a pattern characterized by converging diagonal upper and lower lines.

Previous instances of such trading patterns have often led to significant price movements, either upwards or downwards.

Analyst forecast for ETH

In a recent tweet, crypto analyst Carl Runefelt highlighted that ETH was at a crossroads, facing a decision that could either trigger a drop to new lows.

It could potentially wipe out bullish momentum or propel ETH it to a new monthly high.

Runefelt shared a 4-hour chart to outline potential price targets, depending on the direction ETH takes:

“Potential bullish target: $2,800

Potential bearish target: $2,350.”

At such a critical point, it’s important to identify additional confluences. To this end, AMBCrypto has embarked on further analysis.

‘In the money’ traders can drive ETH higher

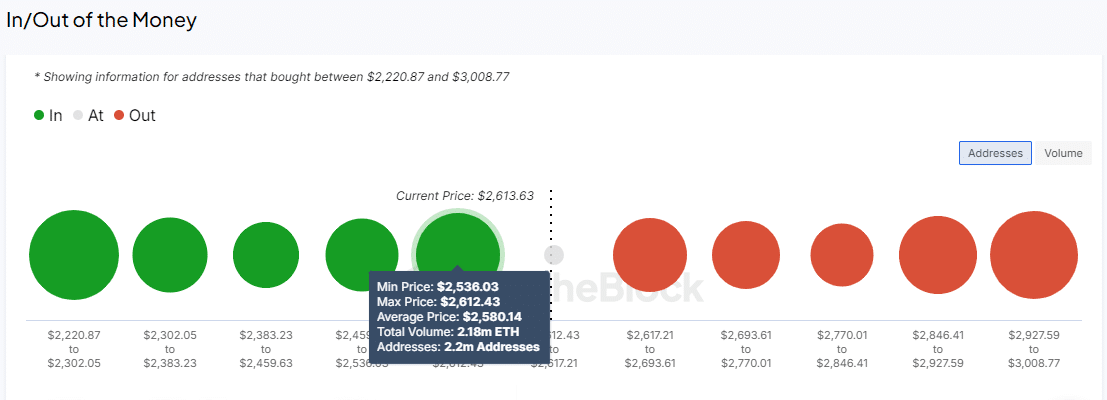

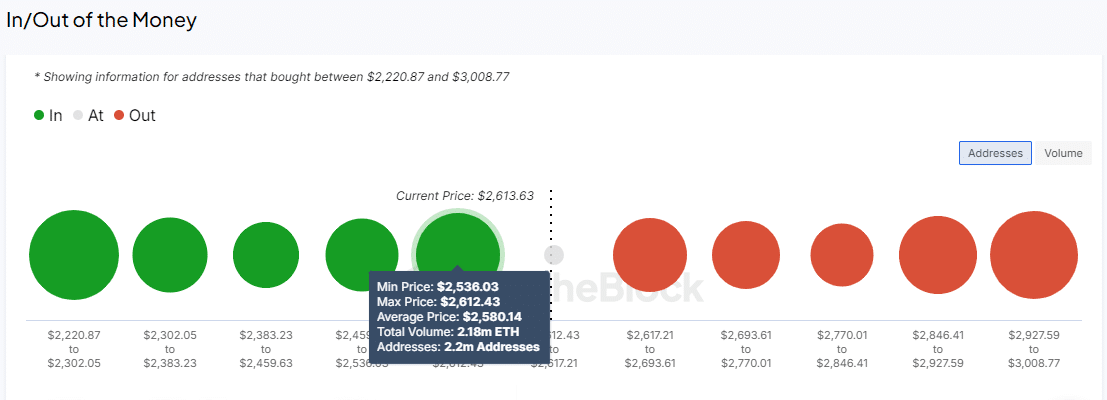

Using the In and Out of Money Around Price (IOMAP) indicator, AMBCrypto analyzed whether traders in profit (in the money) or at a loss (out of the money) could influence Ethereum’s price direction.

“In the money” indicates that trades are currently profitable and act as a support zone, while “out of the money” denotes unprofitable trades, serving as resistance.

According to IntoTheBlock, ETH has rebounded from the $2,597.37 support, with transactions involving 2.39 million addresses holding over $8 billion in ETH.

Source: IntoTheBlock

This level is essential for potentially propelling the price upward. However, significant resistance from traders that are out of the money is anticipated at $2,677.33, $2,760.00, and $2,831.77.

Although these resistance levels pose challenges, the press time bullish momentum, which outweighed selling pressure, suggested ETH may trend toward or exceed $2,800.

Buyers are interested in ETH

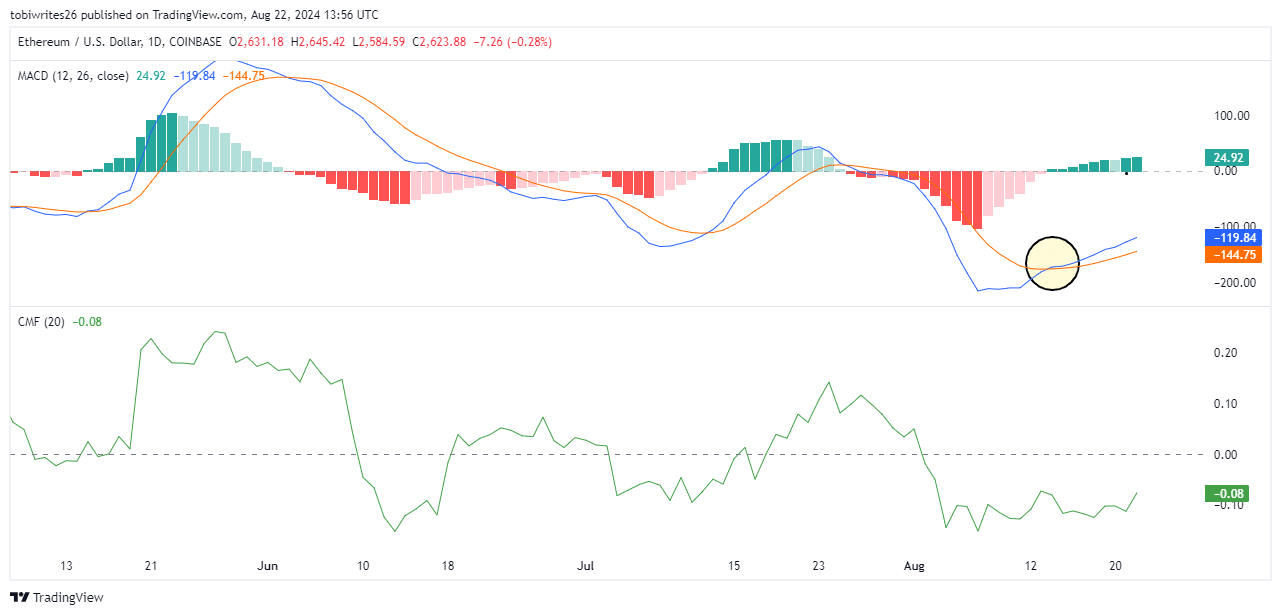

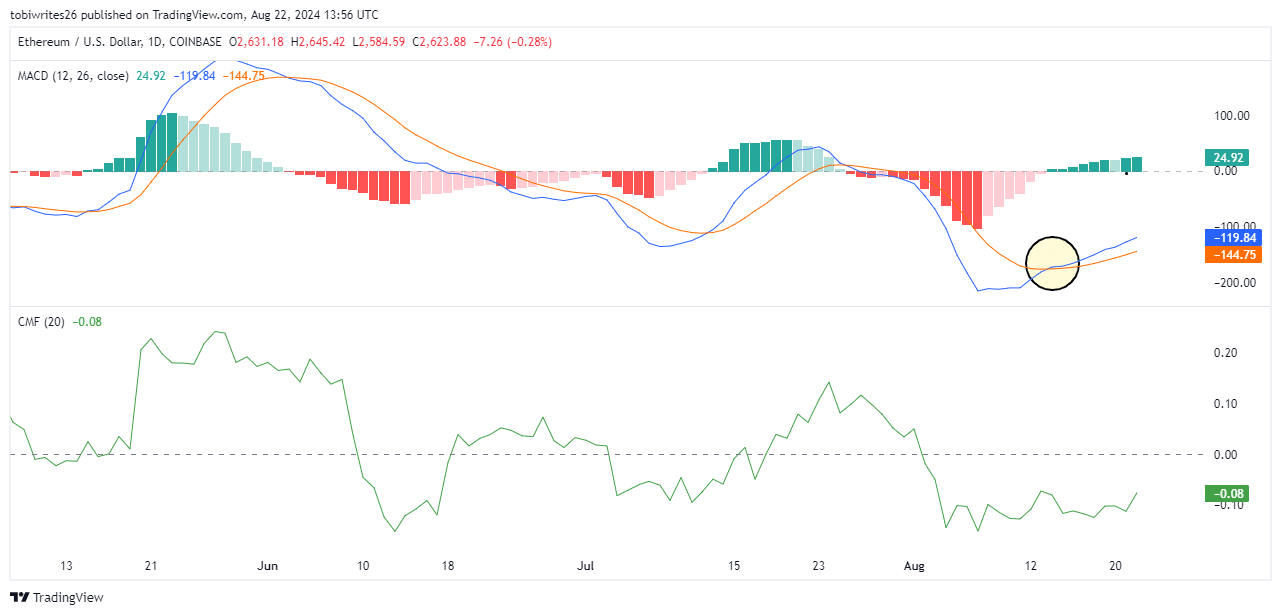

Momentum among Ethereum traders is increasing, as indicated by the Moving Average Convergence and Divergence (MACD).

This tool tracks the relationship between two moving averages of ETH’s price, helping to spot changes in momentum and direction.

Recently, the MACD signaled a bullish crossover, suggesting that buyers are actively entering the market and may continue to push the price upward.

Additionally, Ethereum’s momentum has been on the rise, with the MACD trending toward positive territory. This suggests a strong likelihood of continued price increases.

Source: TradingView

Is your portfolio green? Check out the ETH Profit Calculator

The Chaikin Money Flow (CMF) also supports this bullish outlook. It has been rising since the 18th of August, indicating that buying pressure was mounting.

If this trend persists, it could further propel ETH’s price higher to the $2,800 target.

- At press time, ETH was caught in a 4-hour symmetrical triangle, showing no clear directional trend.

- On-chain data suggested that a potential rally could be on the horizon.

Market activity for Ethereum [ETH] has been subdued, showing only a slight increase of 2.45% in price, now trading around the $2,600 level.

This kind of price behavior is typical when an asset is trading within a symmetrical triangle—a pattern characterized by converging diagonal upper and lower lines.

Previous instances of such trading patterns have often led to significant price movements, either upwards or downwards.

Analyst forecast for ETH

In a recent tweet, crypto analyst Carl Runefelt highlighted that ETH was at a crossroads, facing a decision that could either trigger a drop to new lows.

It could potentially wipe out bullish momentum or propel ETH it to a new monthly high.

Runefelt shared a 4-hour chart to outline potential price targets, depending on the direction ETH takes:

“Potential bullish target: $2,800

Potential bearish target: $2,350.”

At such a critical point, it’s important to identify additional confluences. To this end, AMBCrypto has embarked on further analysis.

‘In the money’ traders can drive ETH higher

Using the In and Out of Money Around Price (IOMAP) indicator, AMBCrypto analyzed whether traders in profit (in the money) or at a loss (out of the money) could influence Ethereum’s price direction.

“In the money” indicates that trades are currently profitable and act as a support zone, while “out of the money” denotes unprofitable trades, serving as resistance.

According to IntoTheBlock, ETH has rebounded from the $2,597.37 support, with transactions involving 2.39 million addresses holding over $8 billion in ETH.

Source: IntoTheBlock

This level is essential for potentially propelling the price upward. However, significant resistance from traders that are out of the money is anticipated at $2,677.33, $2,760.00, and $2,831.77.

Although these resistance levels pose challenges, the press time bullish momentum, which outweighed selling pressure, suggested ETH may trend toward or exceed $2,800.

Buyers are interested in ETH

Momentum among Ethereum traders is increasing, as indicated by the Moving Average Convergence and Divergence (MACD).

This tool tracks the relationship between two moving averages of ETH’s price, helping to spot changes in momentum and direction.

Recently, the MACD signaled a bullish crossover, suggesting that buyers are actively entering the market and may continue to push the price upward.

Additionally, Ethereum’s momentum has been on the rise, with the MACD trending toward positive territory. This suggests a strong likelihood of continued price increases.

Source: TradingView

Is your portfolio green? Check out the ETH Profit Calculator

The Chaikin Money Flow (CMF) also supports this bullish outlook. It has been rising since the 18th of August, indicating that buying pressure was mounting.

If this trend persists, it could further propel ETH’s price higher to the $2,800 target.

where to get clomid without dr prescription can i get clomiphene without a prescription how to buy generic clomid no prescription clomid pills at dischem price can you buy clomiphene prices how to get clomid without dr prescription clomid without insurance

This website absolutely has all of the tidings and facts I needed about this case and didn’t comprehend who to ask.

Greetings! Very productive par‘nesis within this article! It’s the scarcely changes which wish make the largest changes. Thanks a lot towards sharing!

where to buy azithromycin without a prescription – order tinidazole sale metronidazole 200mg for sale

semaglutide 14 mg sale – buy generic rybelsus for sale generic cyproheptadine 4 mg

motilium brand – tetracycline 250mg uk purchase flexeril sale

amoxiclav for sale online – atbioinfo buy ampicillin tablets

nexium ca – anexamate order nexium

buy cheap generic coumadin – anticoagulant order cozaar pills

mobic 7.5mg brand – mobo sin buy meloxicam generic

purchase deltasone pills – corticosteroid prednisone 5mg drug

erection pills – buy ed pills cheap buy best erectile dysfunction pills

amoxil tablets – comba moxi purchase amoxicillin pill

buy diflucan for sale – https://gpdifluca.com/ buy diflucan 200mg online

cheap escitalopram – escitalopram 20mg over the counter lexapro buy online

buy generic cenforce – order cenforce 100mg generic buy cenforce without a prescription

cialis tablet – on this site when will cialis be over the counter

tadalafil 5mg once a day – https://strongtadafl.com/ tadalafil (exilar-sava healthcare) version of cialis] (rx) lowest price

brand zantac – https://aranitidine.com/# buy cheap zantac