- Ethereum ETF’s institutional ownership jumped from 4.5% to 14.5% in Q4 of 2024

- Grayscale has sought the SEC’s nod for its ETH ETF staking feature

Institutional adoption of Ethereum ETFs increased in Q4 of 2024, unlike the bearish sentiment among the retail crowd. In fact, according to Juan Leon, senior investment strategist at Bitwise, institutional ownership of ETH ETFs jumped by about 10% from 4.8% to 14.5%.

She noted,

“Institutional ownership of ETH ETFs increased from 4.8% in Q3 to 14.5% in Q4. The institutions are coming for ETH.”

A massive adoption uptick

Here, another noteworthy trend is the relatively higher adoption rate of ETH ETFs, compared to BTC ETFs, over the same period. This, despite Bitcoin maintaining overall dominance across all sectors of the market.

According to Leon, institutional adoption for Bitcoin ETFs stood at 21.5% in Q4 2024, compared to 22.3% in Q3.

Source: X

The report was from the latest 13F filings with the SEC, which are made quarterly and offer a glimpse into bids by top managers with over $100M in AUM (Assets under management).

Notably, Fintel data revealed that BlackRock’s ETH Trust, ETHA, was dominated by Goldman Sachs, Millennium Management, and Brevan Howard Capital. The top three firms had $235M, $105M, and $94M worth of ETHA shares.

Leon added that an uptick in institutional ownership marks the next phase in adoption.

“I think that points to entering the next phase of institutional accumulation: major institutions such as sovereign wealth funds and pension funds.”

Another potential bullish update for the products is the push for ETF staking. The SEC Crypto Task Force recently met Jito Labs and crypto VC MultiCoin Capital on the issue. The move has been widely viewed as positive for likely ETF staking features. In fact, Grayscale submitted a recent SEC application for an ETF staking feature for its U.S Spot ETF product.

Commenting on the developments, Nate Geraci of the ETF Store stated that ETF staking is a “matter of time.”

“Instead of just saying “no”, SEC is actually engaging in constructive conversations. Encouraging. IMO, staking in ETH ETFs is simply a matter of time.”

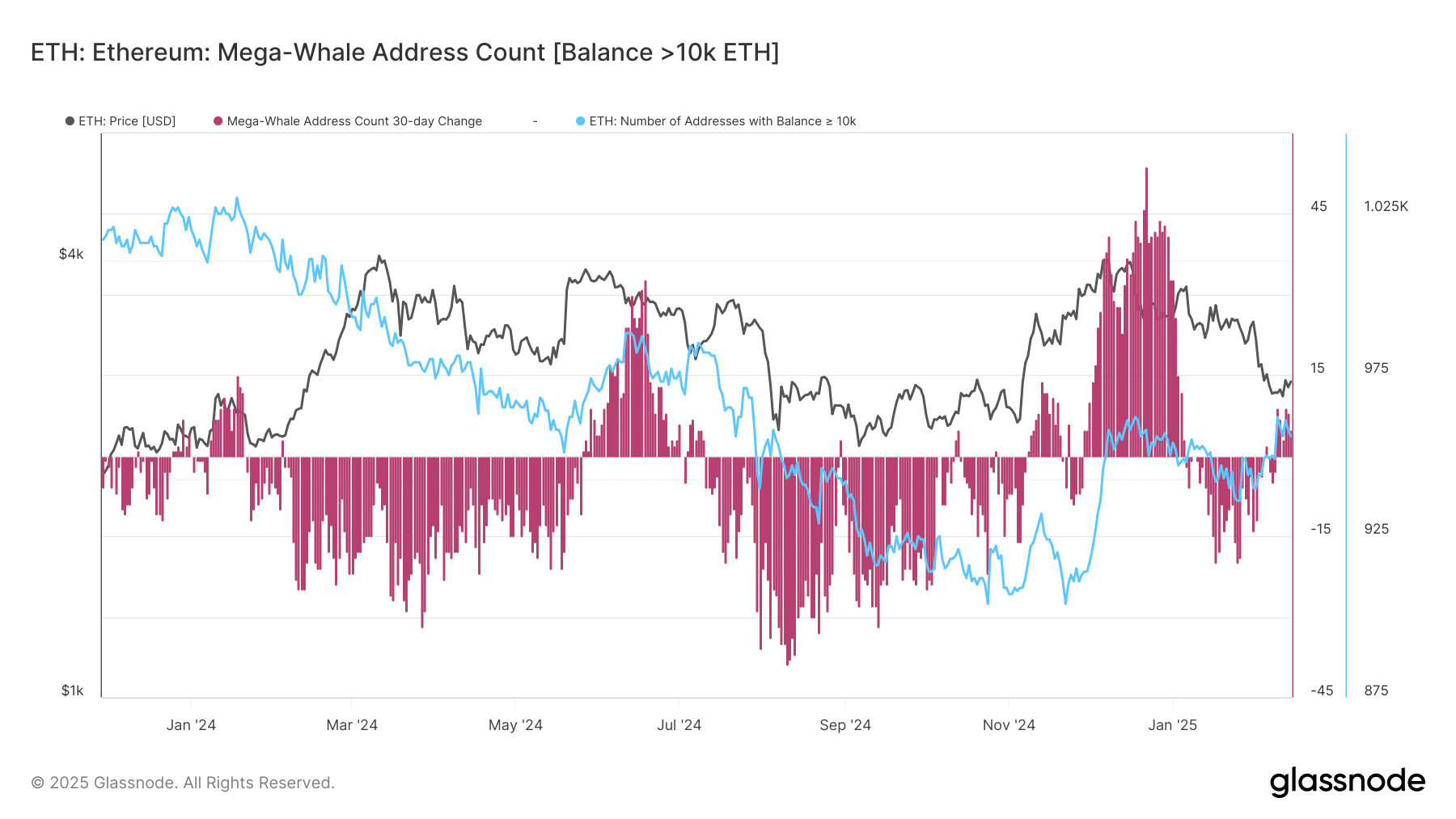

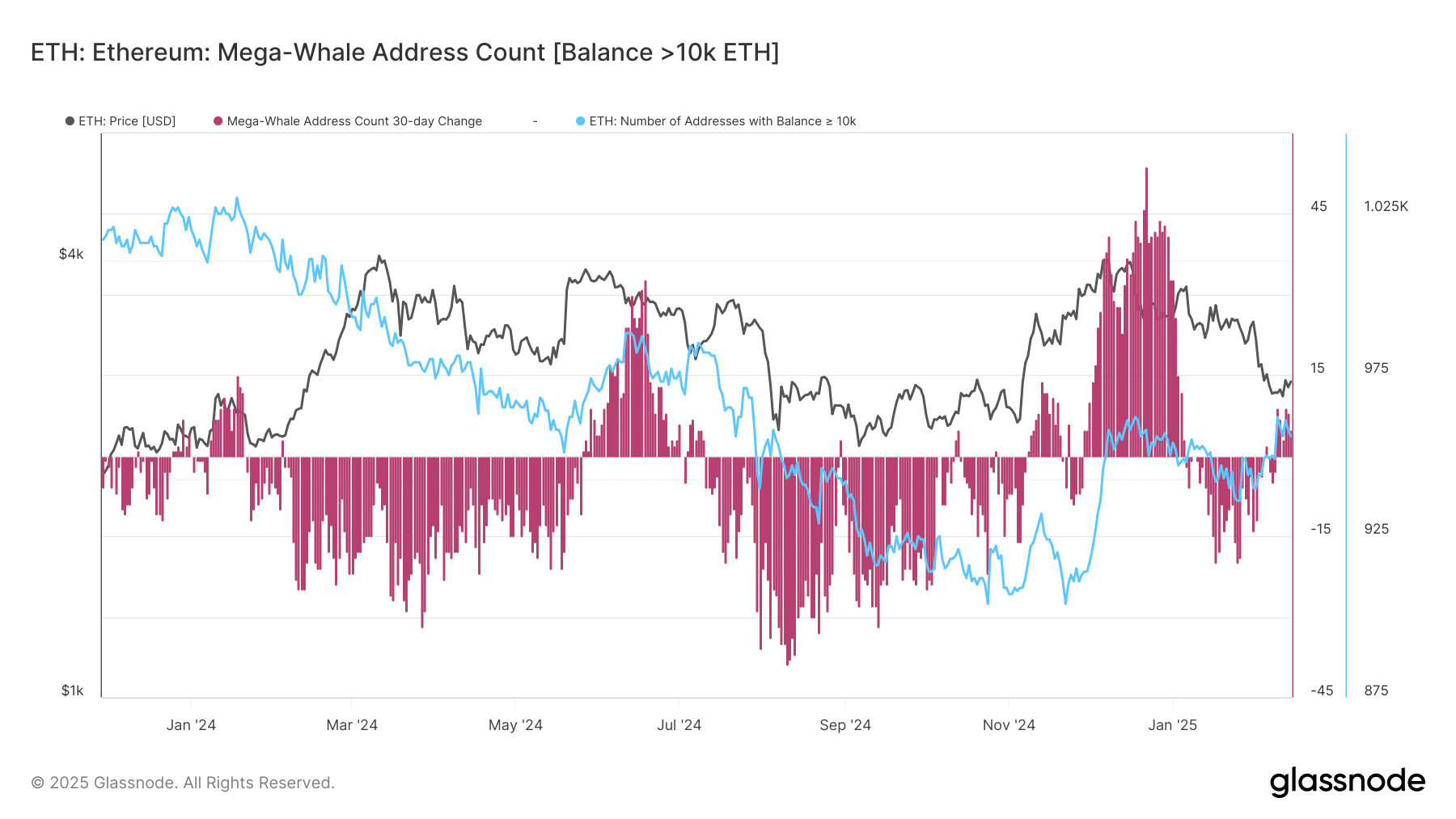

That being said, the 30-day mega-whale address count (with over 10K ETH) turned positive again in February. The number of addresses with over 10k ETH has also surged to 956 from 936 so far.

Source: Glassnode

On the contrary, ETH’s price has remained muted despite the institutional adoption surge. At the time of writing, the altcoin was valued at $2.7k and was 34% down from its December high of $4.1k.

- Ethereum ETF’s institutional ownership jumped from 4.5% to 14.5% in Q4 of 2024

- Grayscale has sought the SEC’s nod for its ETH ETF staking feature

Institutional adoption of Ethereum ETFs increased in Q4 of 2024, unlike the bearish sentiment among the retail crowd. In fact, according to Juan Leon, senior investment strategist at Bitwise, institutional ownership of ETH ETFs jumped by about 10% from 4.8% to 14.5%.

She noted,

“Institutional ownership of ETH ETFs increased from 4.8% in Q3 to 14.5% in Q4. The institutions are coming for ETH.”

A massive adoption uptick

Here, another noteworthy trend is the relatively higher adoption rate of ETH ETFs, compared to BTC ETFs, over the same period. This, despite Bitcoin maintaining overall dominance across all sectors of the market.

According to Leon, institutional adoption for Bitcoin ETFs stood at 21.5% in Q4 2024, compared to 22.3% in Q3.

Source: X

The report was from the latest 13F filings with the SEC, which are made quarterly and offer a glimpse into bids by top managers with over $100M in AUM (Assets under management).

Notably, Fintel data revealed that BlackRock’s ETH Trust, ETHA, was dominated by Goldman Sachs, Millennium Management, and Brevan Howard Capital. The top three firms had $235M, $105M, and $94M worth of ETHA shares.

Leon added that an uptick in institutional ownership marks the next phase in adoption.

“I think that points to entering the next phase of institutional accumulation: major institutions such as sovereign wealth funds and pension funds.”

Another potential bullish update for the products is the push for ETF staking. The SEC Crypto Task Force recently met Jito Labs and crypto VC MultiCoin Capital on the issue. The move has been widely viewed as positive for likely ETF staking features. In fact, Grayscale submitted a recent SEC application for an ETF staking feature for its U.S Spot ETF product.

Commenting on the developments, Nate Geraci of the ETF Store stated that ETF staking is a “matter of time.”

“Instead of just saying “no”, SEC is actually engaging in constructive conversations. Encouraging. IMO, staking in ETH ETFs is simply a matter of time.”

That being said, the 30-day mega-whale address count (with over 10K ETH) turned positive again in February. The number of addresses with over 10k ETH has also surged to 956 from 936 so far.

Source: Glassnode

On the contrary, ETH’s price has remained muted despite the institutional adoption surge. At the time of writing, the altcoin was valued at $2.7k and was 34% down from its December high of $4.1k.

Выбирайте стильные и свежие цветочные композиции в The Green. Мы предлагаем удобную цветы с доставкой Москва, чтобы ваш подарок оказался в нужном месте без лишних хлопот.

Thegreen.ru предлагает эксклюзивные цветочные композиции от профессиональных флористов. Находясь по адресу улица Юннатов, дом 4кА, мы доставляем ваши заказы точно в срок. Свяжитесь с нами для заказа по телефону +7(495)144-15-24.

generic clomid pill clomiphene rx for men clomid chart where can i get cheap clomiphene without prescription how to buy clomid tablets can i purchase clomiphene pills how to get cheap clomid without dr prescription

More text pieces like this would make the интернет better.

azithromycin 250mg for sale – order sumycin order flagyl 200mg generic

order rybelsus 14 mg – how to get semaglutide without a prescription purchase cyproheptadine online cheap

buy generic domperidone for sale – flexeril online order buy flexeril without prescription

buy inderal for sale – clopidogrel 150mg cost methotrexate 2.5mg drug

order augmentin – https://atbioinfo.com/ ampicillin price

order esomeprazole 40mg without prescription – nexiumtous esomeprazole usa

order mobic 15mg generic – swelling cost meloxicam 7.5mg

oral prednisone 40mg – corticosteroid prednisone 40mg generic

buy ed pills generic – men’s ed pills erection pills

purchase amoxil without prescription – buy amoxil generic amoxil brand

cheap fluconazole – https://gpdifluca.com/ buy generic forcan online

cenforce online buy – where can i buy cenforce buy cenforce 50mg generic

cialis generic – https://ciltadgn.com/ cialis none prescription

ranitidine online buy – purchase zantac sale buy zantac pills for sale

buy cialis in las vegas – strongtadafl where to buy cialis soft tabs

More articles like this would pretence of the blogosphere richer. https://gnolvade.com/es/accutane-comprar-espana/

cheap viagra in australia – https://strongvpls.com/ cheap viagra mexico

Proof blog you procure here.. It’s hard to find high calibre article like yours these days. I justifiably appreciate individuals like you! Rent care!! amoxicillin pills

I couldn’t turn down commenting. Well written! https://ursxdol.com/provigil-gn-pill-cnt/

This is the kind of content I take advantage of reading. https://prohnrg.com/product/atenolol-50-mg-online/

More posts like this would make the online elbow-room more useful. https://ondactone.com/product/domperidone/

Thanks for sharing. It’s acme quality.

buy spironolactone for sale

More delight pieces like this would insinuate the интернет better. http://zgyhsj.com/space-uid-978084.html

dapagliflozin canada – order dapagliflozin 10mg generic purchase dapagliflozin sale

orlistat brand – https://asacostat.com/ buy xenical paypal

More text pieces like this would create the web better. https://experthax.com/forum/member.php?action=profile&uid=124824