- ETH long-term holders were more bullish than their BTC colleagues.

- ETH/BTC was at a pivotal point, but a strong rebound was yet to be triggered.

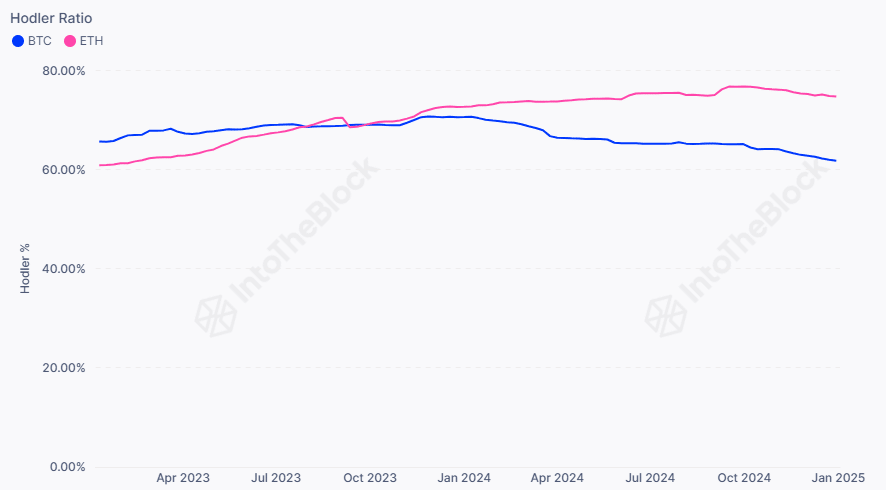

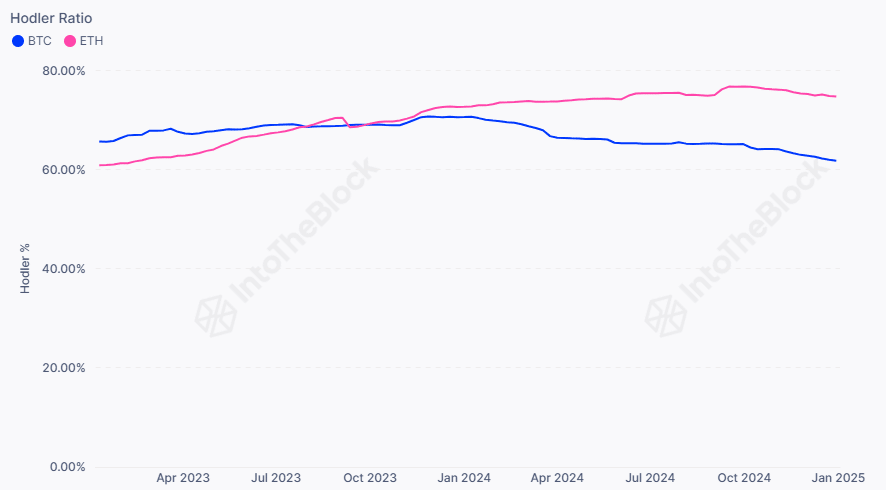

Ethereum’s [ETH] long-term holders (LTH) have shown more bullish conviction than their Bitcoin [BTC] counterparts.

Analytics firm IntoTheBock showed that the market shift began in early 2024 and intensified into 2025 as the ETH LTH cohort increased holdings and dominance to nearly 75%.

On the contrary, the BTC LTH cohort has been relentlessly liquidating their holdings, dragging their dominance below 60%. The firm stated,

“Currently, 74.7% of Ethereum addresses are long-term holders, significantly outpacing Bitcoin. This trend is likely to hold until Ethereum approaches its all-time high and holders start taking profits.”

Source: IntoTheBlock

Will ETH gain ground in Q1?

The update isn’t surprising because ETH price performance has lagged behind BTC since early 2024. BTC crossed its previous cycle high and topped $108K, making nearly every holder profitable.

ETH hasn’t achieved such a feat. So, most ETH bulls might be holding in anticipation of a future rally to make a profit or break even on their investments.

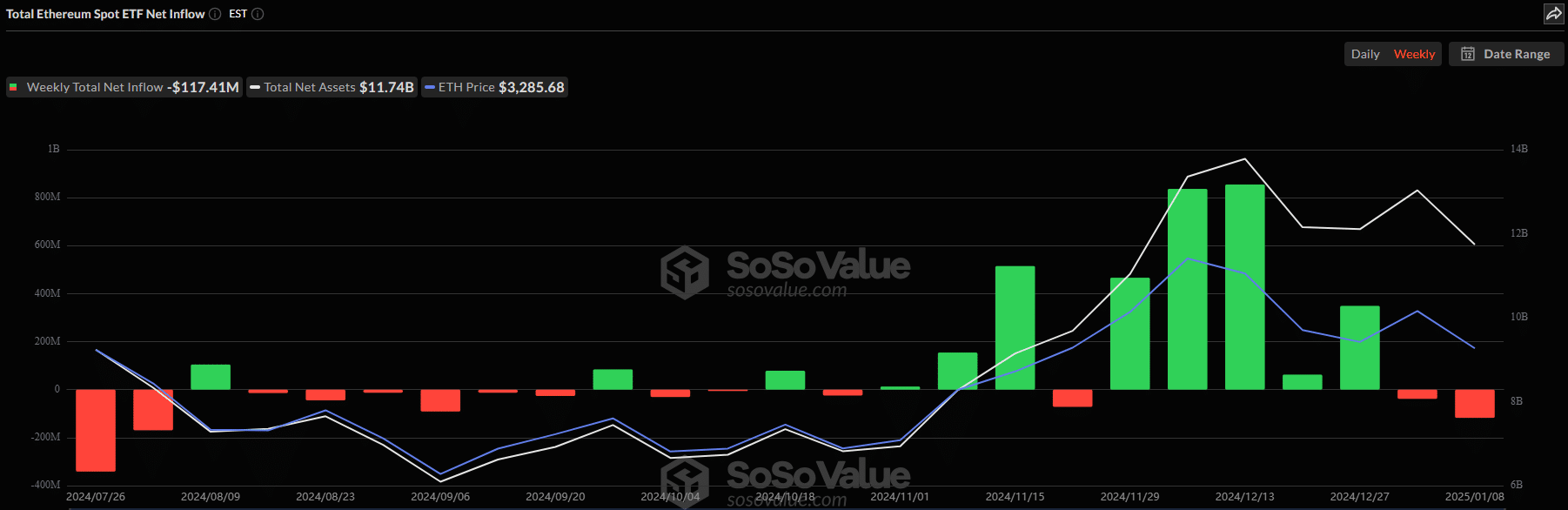

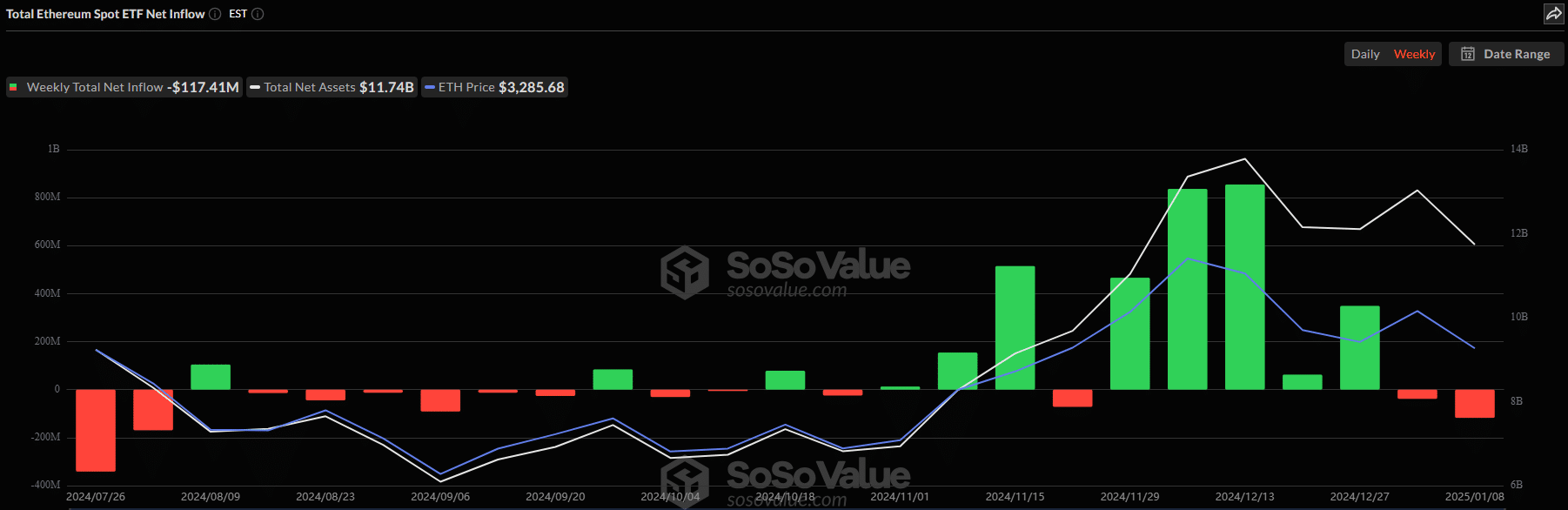

Institutional demand for ETH and BTC was slightly distorted into the new year. According to Soso Value data, ETH ETFs are on track to close the second week of outflows. This contrasts with the demand seen in November when the products logged five consecutive weeks of inflows.

Source: SoSo Value

In contrast, BTC saw net inflows in the past two weeks. If this institutional demand trend persists, BTC could outperform ETH on the price charts.

However, another indicator, the ETH/BTC ratio, showed a potential pivot for ETH. This indicator tracks ETH’s relative price performance against BTC. It dropped to a 4-year low of 0.30, underscoring ETH’s underperformance over that period.

Yet, it formed a double bottom pattern, indicating a potential rebound and likely market shift in favor of ETH.

Source: ETH/BTC ratio, TradingView

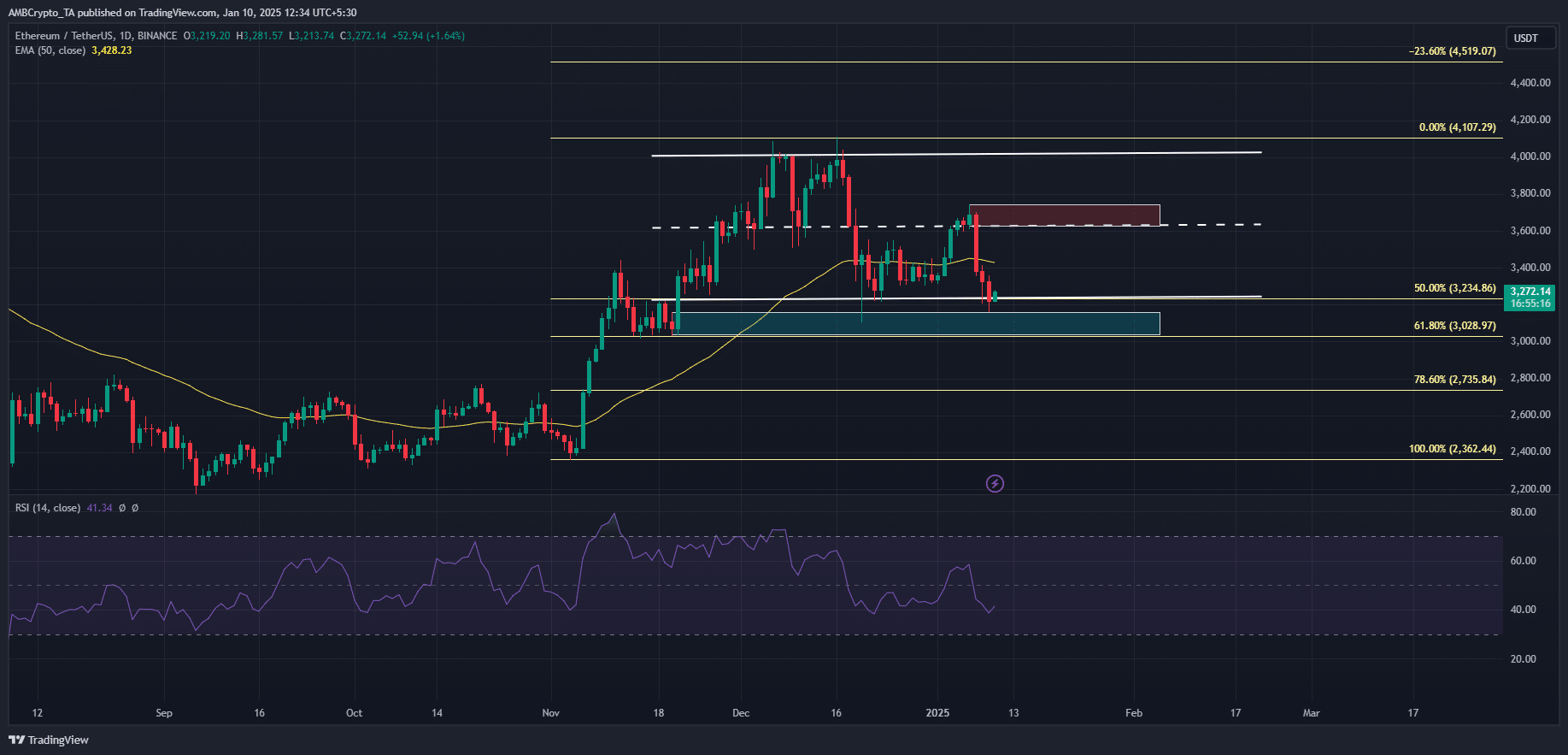

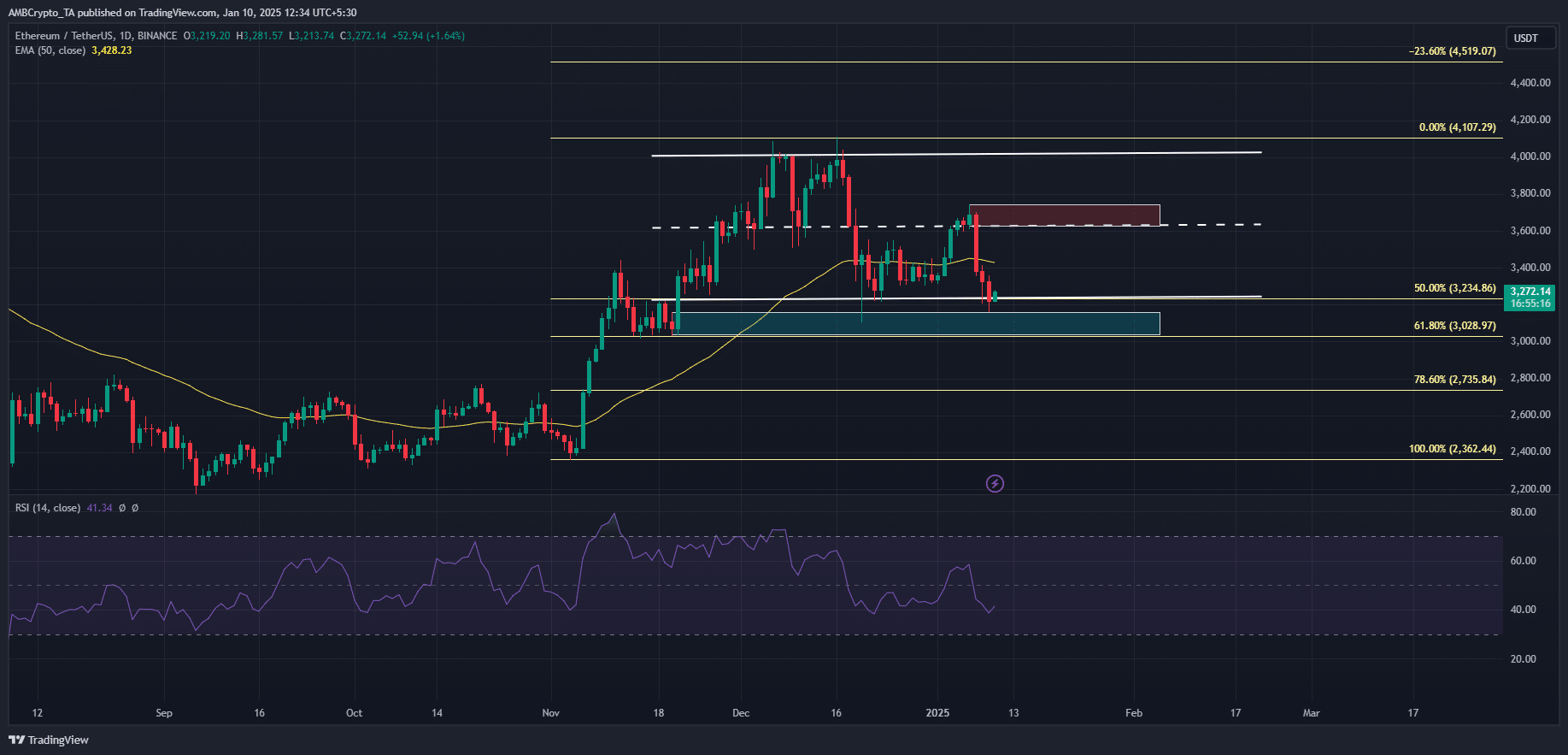

That said, the recent market crash dragged ETH to its December lows above $3K. ETH could attempt a rebound from the $3K-$3.3K support zone, with the immediate target at $3.6K. This was the same outlook shared by some ETH traders on X (formerly Twitter).

Read Ethereum’s [ETH] Price Prediction 2025–2026

However, ETH’s likely recovery could be further strengthened if it reclaimed the 50-day EMA.

Source: TradingView

- ETH long-term holders were more bullish than their BTC colleagues.

- ETH/BTC was at a pivotal point, but a strong rebound was yet to be triggered.

Ethereum’s [ETH] long-term holders (LTH) have shown more bullish conviction than their Bitcoin [BTC] counterparts.

Analytics firm IntoTheBock showed that the market shift began in early 2024 and intensified into 2025 as the ETH LTH cohort increased holdings and dominance to nearly 75%.

On the contrary, the BTC LTH cohort has been relentlessly liquidating their holdings, dragging their dominance below 60%. The firm stated,

“Currently, 74.7% of Ethereum addresses are long-term holders, significantly outpacing Bitcoin. This trend is likely to hold until Ethereum approaches its all-time high and holders start taking profits.”

Source: IntoTheBlock

Will ETH gain ground in Q1?

The update isn’t surprising because ETH price performance has lagged behind BTC since early 2024. BTC crossed its previous cycle high and topped $108K, making nearly every holder profitable.

ETH hasn’t achieved such a feat. So, most ETH bulls might be holding in anticipation of a future rally to make a profit or break even on their investments.

Institutional demand for ETH and BTC was slightly distorted into the new year. According to Soso Value data, ETH ETFs are on track to close the second week of outflows. This contrasts with the demand seen in November when the products logged five consecutive weeks of inflows.

Source: SoSo Value

In contrast, BTC saw net inflows in the past two weeks. If this institutional demand trend persists, BTC could outperform ETH on the price charts.

However, another indicator, the ETH/BTC ratio, showed a potential pivot for ETH. This indicator tracks ETH’s relative price performance against BTC. It dropped to a 4-year low of 0.30, underscoring ETH’s underperformance over that period.

Yet, it formed a double bottom pattern, indicating a potential rebound and likely market shift in favor of ETH.

Source: ETH/BTC ratio, TradingView

That said, the recent market crash dragged ETH to its December lows above $3K. ETH could attempt a rebound from the $3K-$3.3K support zone, with the immediate target at $3.6K. This was the same outlook shared by some ETH traders on X (formerly Twitter).

Read Ethereum’s [ETH] Price Prediction 2025–2026

However, ETH’s likely recovery could be further strengthened if it reclaimed the 50-day EMA.

Source: TradingView

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Nice read, I just passed this onto a friend who was doing a little research on that. And he just bought me lunch because I found it for him smile Therefore let me rephrase that: Thanks for lunch!

Wonderful beat ! I wish to apprentice while you amend your website, how can i subscribe for a blog website? The account aided me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear idea

Simply wish to say your article is as astonishing. The clearness in your post is just cool and i can assume you’re an expert on this subject. Well with your permission let me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please carry on the rewarding work.

Purdentix

Purdentix reviews

Purdentix review

Purdentix review

I’m really impressed by the speed and responsiveness.

The layout is visually appealing and very functional.

The layout is visually appealing and very functional.

I love how user-friendly and intuitive everything feels.

The content is well-organized and highly informative.

I’m really impressed by the speed and responsiveness.

The content is well-organized and highly informative.

The design and usability are top-notch, making everything flow smoothly.

This site truly stands out as a great example of quality web design and performance.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

The design and usability are top-notch, making everything flow smoothly.

I love how user-friendly and intuitive everything feels.

It provides an excellent user experience from start to finish.

It provides an excellent user experience from start to finish.

The content is engaging and well-structured, keeping visitors interested.

This website is amazing, with a clean design and easy navigation.

The layout is visually appealing and very functional.

This website is amazing, with a clean design and easy navigation.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The design and usability are top-notch, making everything flow smoothly.

This site truly stands out as a great example of quality web design and performance.

Nothing beats homemade pasta. The texture and flavor are just on another level compared to store-bought versions. Cooking from scratch is truly an art.

Open-world games are the best! Nothing beats the feeling of total freedom, exploring vast landscapes, and creating your own adventure.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

All knowledge, it is said, comes from experience, but does that not mean that the more we experience, the wiser we become? If wisdom is the understanding of life, then should we not chase every experience we can, taste every flavor, walk every path, and embrace every feeling? Perhaps the greatest tragedy is to live cautiously, never fully opening oneself to the richness of being.

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

Lift detox black funciona

Some really fantastic work on behalf of the owner of this website , perfectly great written content.

order clomiphene pill buying clomid clomiphene 50mg tablets can i order clomiphene pills can i get clomid without insurance buying generic clomiphene pill buy generic clomiphene pill

This is a keynote which is near to my heart… Numberless thanks! Faithfully where can I upon the phone details in the course of questions?

More articles like this would frame the blogosphere richer.

azithromycin online order – purchase ciprofloxacin flagyl order

order semaglutide sale – semaglutide drug periactin oral

buy domperidone generic – buy sumycin pills flexeril price