- An analysis suggested a bull rally for altcoins.

- Market indicators remained bearish for XRP and Ethereum.

The market witnessed quite some volatility in the recent past, but altcoins like Ethereum [ETH] and Ripple [XRP] held their ground last week.

In fact, a recent analysis hinted at yet another altcoin rally in the coming days.

Are altcoins expecting another rally?

Bitcoin’s [BTC] downtrend caused the entire market to shed its value in the last few weeks. However, as per the latest analysis from Rekt Capital, altcoins managed to hold their ground.

As per the tweet, despite Bitcoin’s 18% pre-halving retrace, the altcoin market cap continued to hold on to the $315 billion level as support.

AMBCrypto then planned to take a look at top altcoins like ETH and XRP to see what to expect from them.

Are people buying ETH?

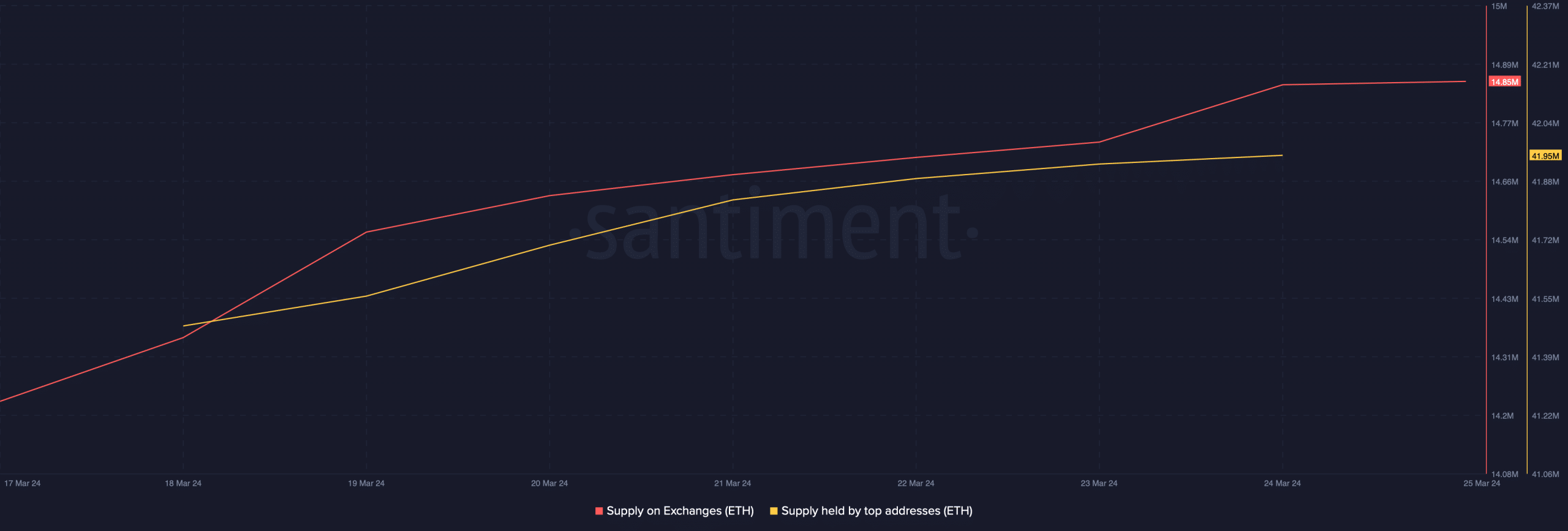

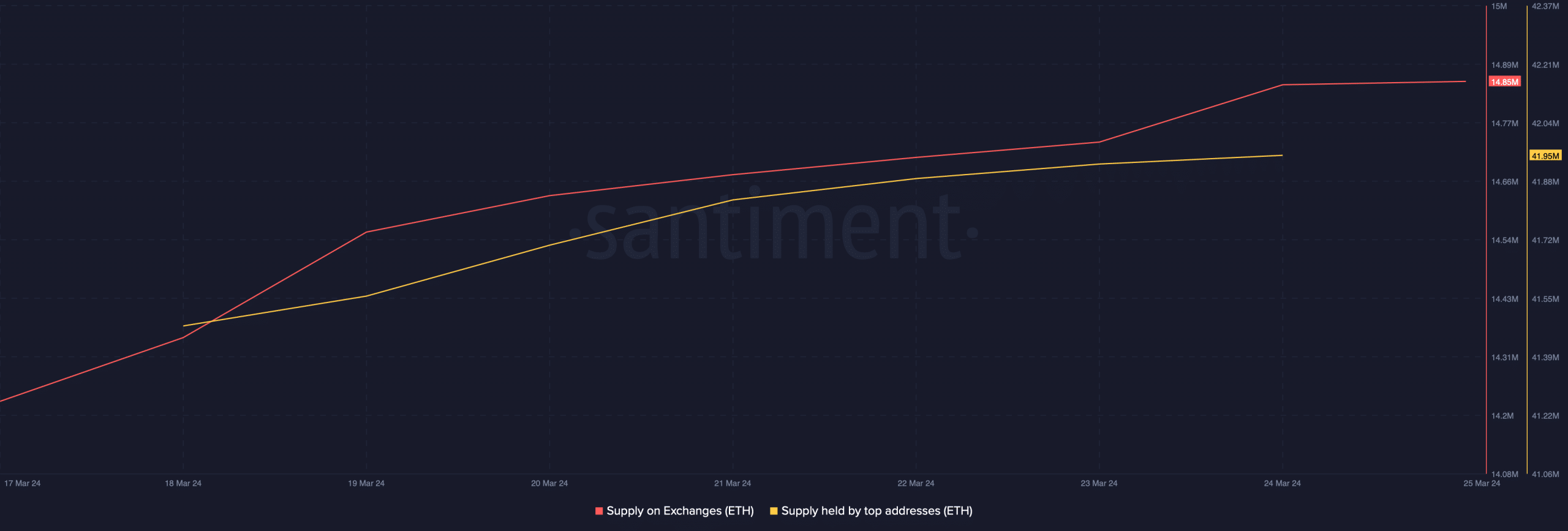

AMBCrypto found that at press time, selling pressure on ETH was high. This was evident from the rise in its Supply on Exchanges.

However, it was interesting to note that despite the drops in price and high selling pressure, ETH’s supply led by top addresses rose. This meant that whales were confident in the token.

Source: Santiment

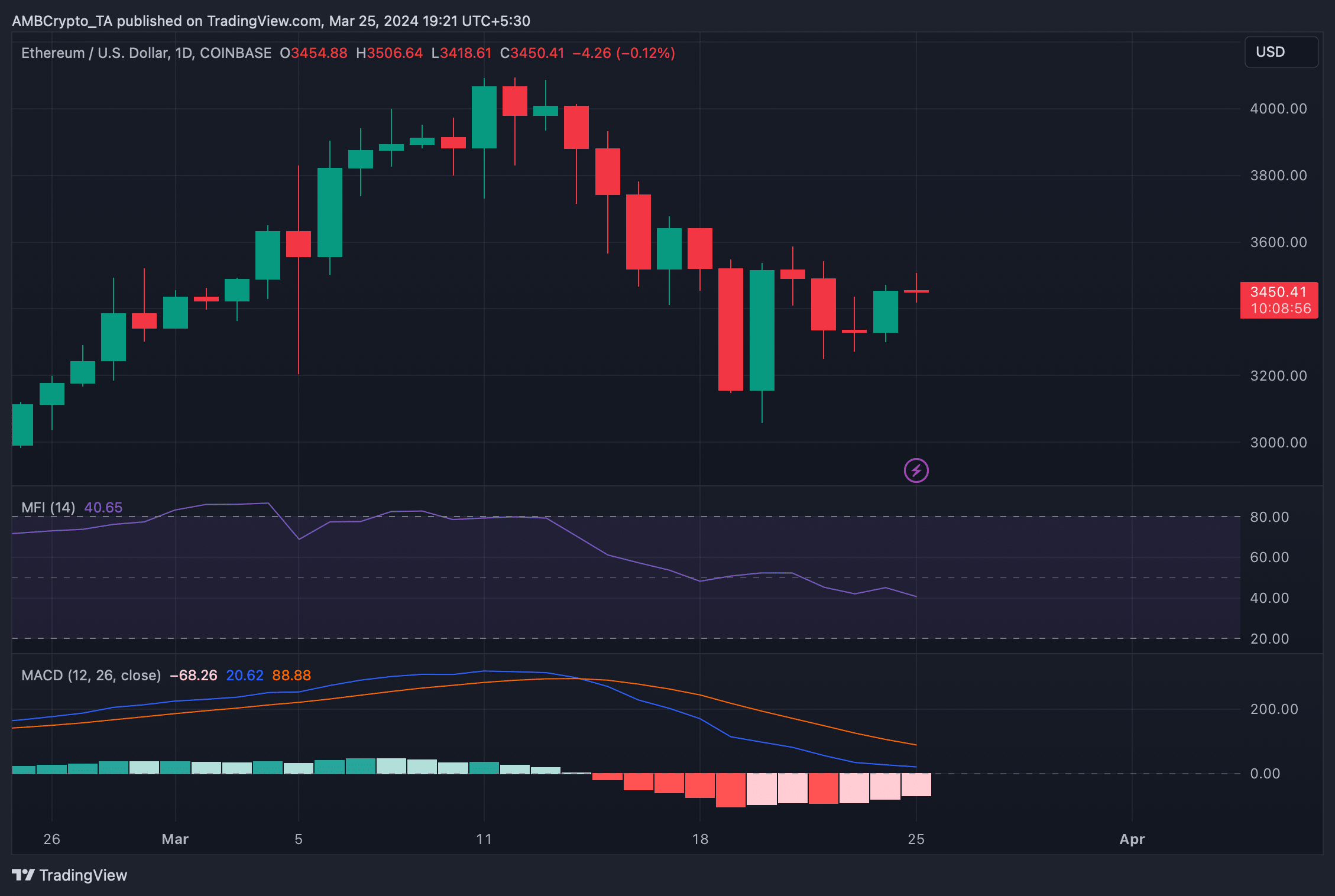

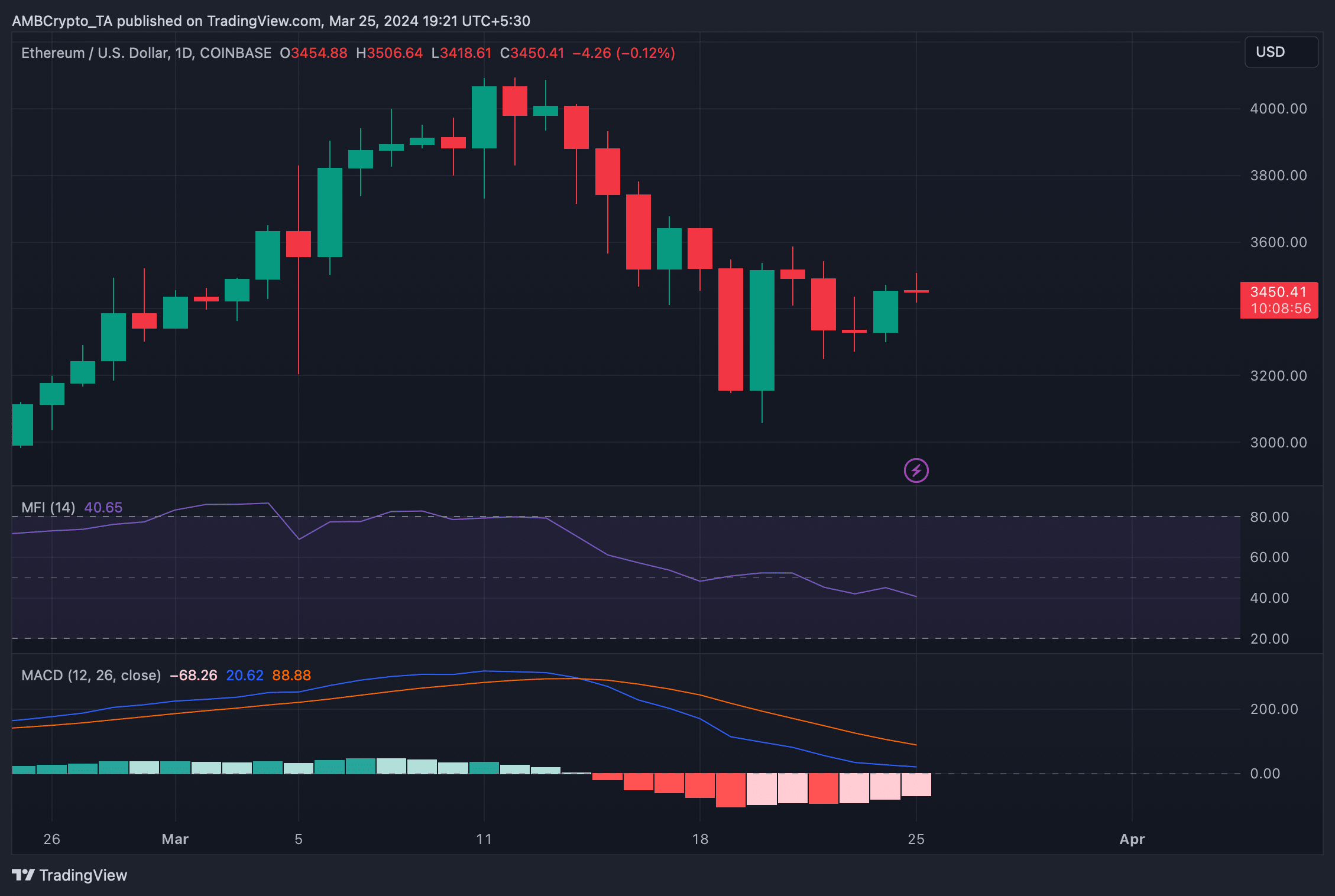

To see whether whales’ confidence would translate into reality, we then took a look at ETH’s daily chart. Despite the possibility of an altcoin rally, ETH’s metrics remained shaky.

The token’s MACD displayed a bearish advantage at press time. Additionally, its Relative Strength Index (RSI) registered a sharp downtick, further suggesting a downtrend.

Source: TradigView

What’s up with XRP?

After Ethereum, we checked XRP’s state, as it is also one of the top altcoins. As per CoinMarketCap, XRP was up by over 2% in the last seven days.

At press time, the token was trading at $0.6301 with a market cap of over $34 million.

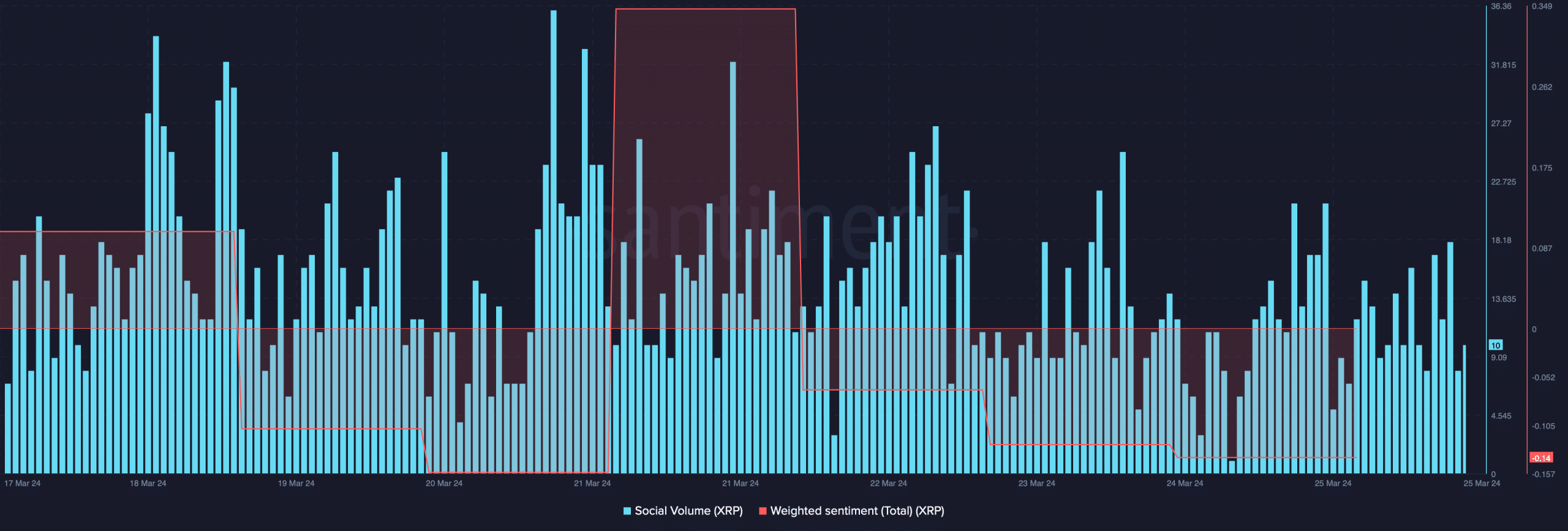

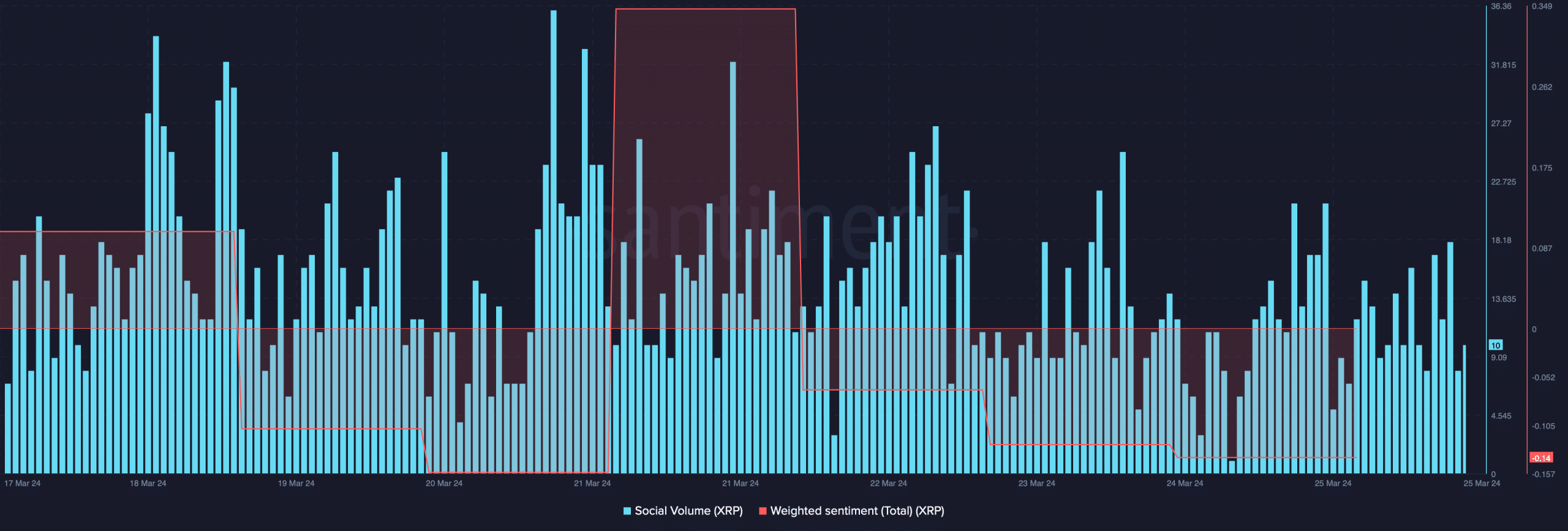

However, despite the rise in price, the token’s Social Volume dropped. Its Weighted Sentiment also declined, meaning that bearish sentiment around it was dominant in the market.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

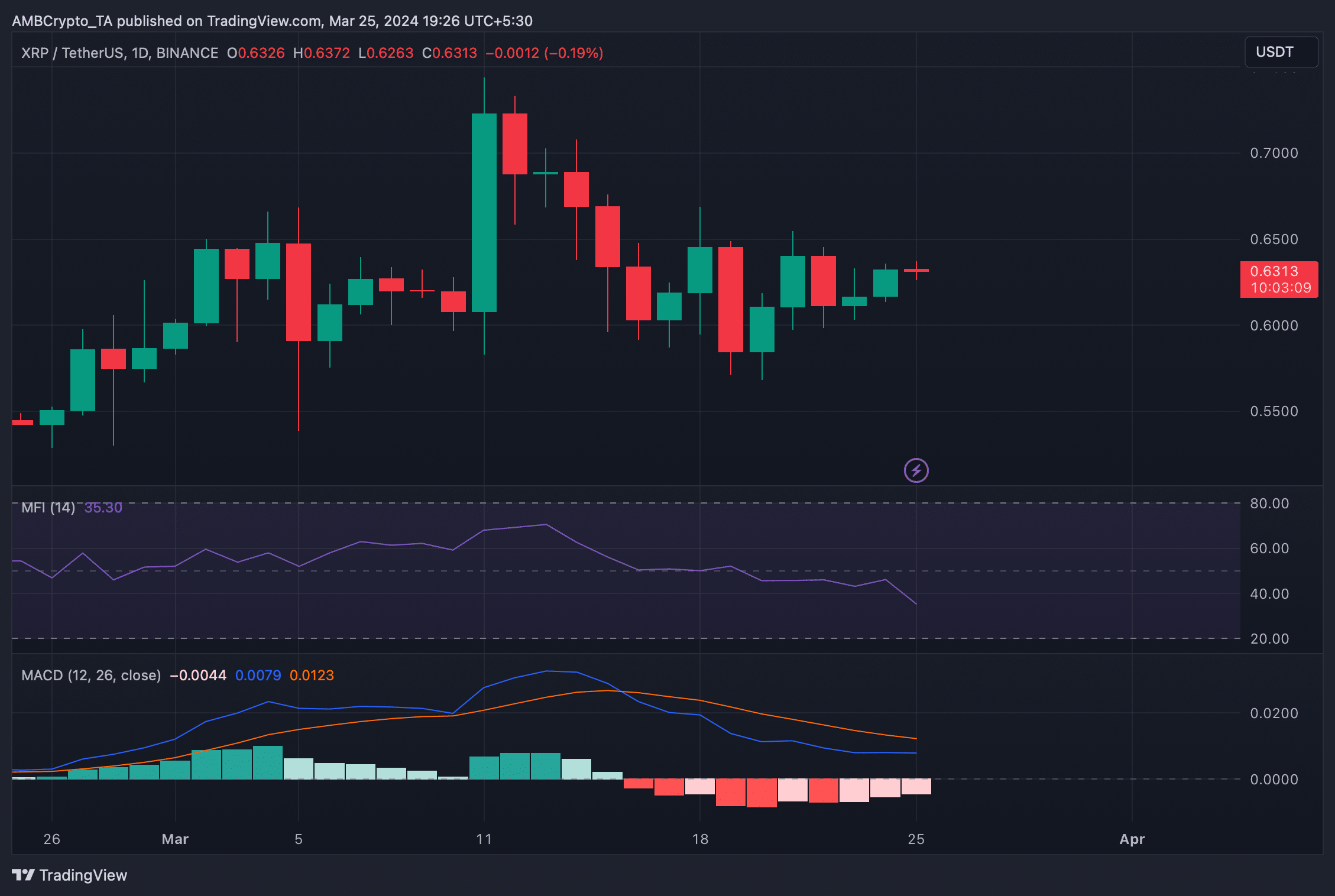

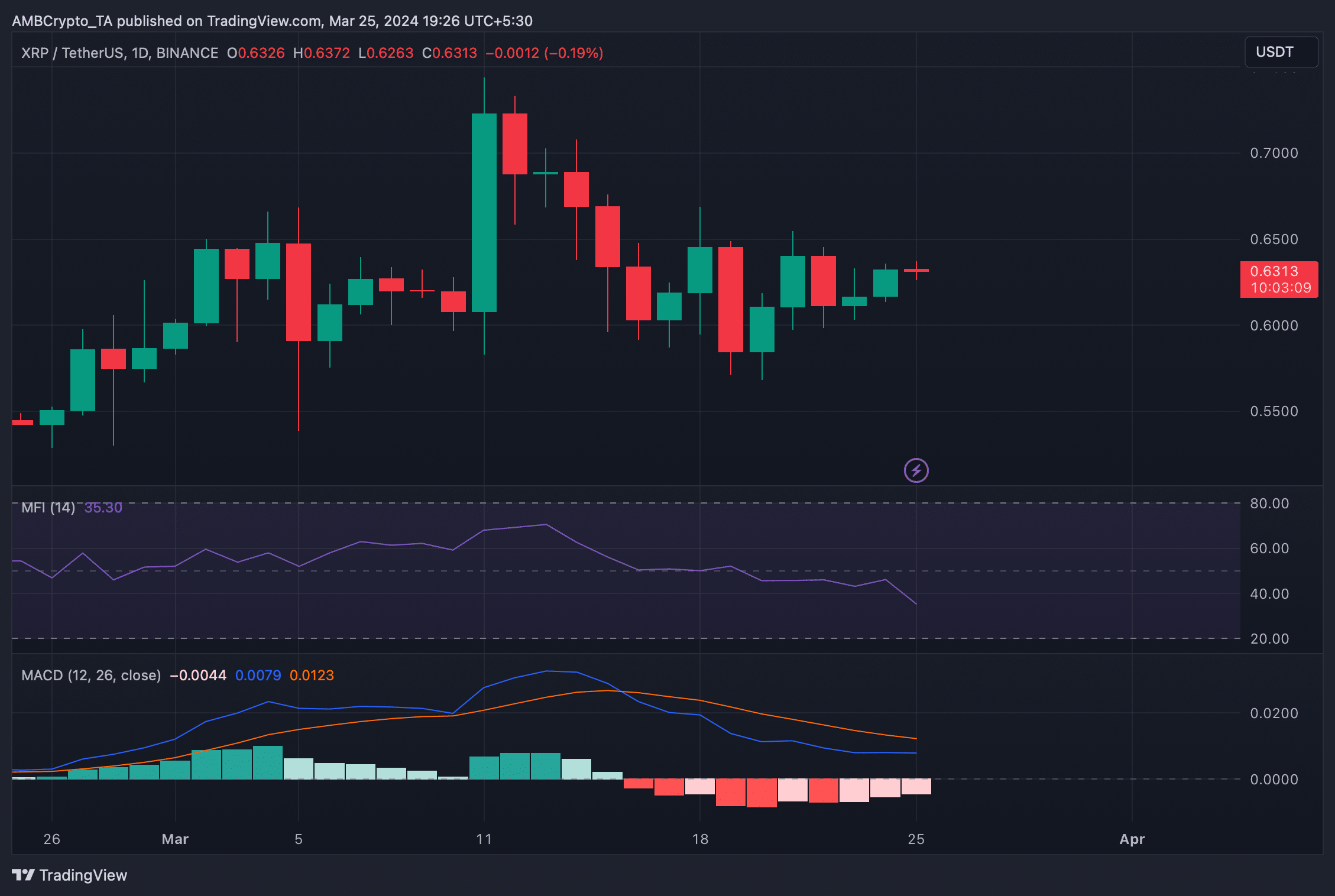

We then took a look at its daily chart to see whether its metrics were also bearish, like ETH. Not surprisingly, the findings were the same. XRP’s MACD was likewise bearish, and its RSI signaled a price drop.

It will be interesting to see which direction altcoins move in the coming days, considering the bearish indicators of the top altcoins.

Source: TradingView

- An analysis suggested a bull rally for altcoins.

- Market indicators remained bearish for XRP and Ethereum.

The market witnessed quite some volatility in the recent past, but altcoins like Ethereum [ETH] and Ripple [XRP] held their ground last week.

In fact, a recent analysis hinted at yet another altcoin rally in the coming days.

Are altcoins expecting another rally?

Bitcoin’s [BTC] downtrend caused the entire market to shed its value in the last few weeks. However, as per the latest analysis from Rekt Capital, altcoins managed to hold their ground.

As per the tweet, despite Bitcoin’s 18% pre-halving retrace, the altcoin market cap continued to hold on to the $315 billion level as support.

AMBCrypto then planned to take a look at top altcoins like ETH and XRP to see what to expect from them.

Are people buying ETH?

AMBCrypto found that at press time, selling pressure on ETH was high. This was evident from the rise in its Supply on Exchanges.

However, it was interesting to note that despite the drops in price and high selling pressure, ETH’s supply led by top addresses rose. This meant that whales were confident in the token.

Source: Santiment

To see whether whales’ confidence would translate into reality, we then took a look at ETH’s daily chart. Despite the possibility of an altcoin rally, ETH’s metrics remained shaky.

The token’s MACD displayed a bearish advantage at press time. Additionally, its Relative Strength Index (RSI) registered a sharp downtick, further suggesting a downtrend.

Source: TradigView

What’s up with XRP?

After Ethereum, we checked XRP’s state, as it is also one of the top altcoins. As per CoinMarketCap, XRP was up by over 2% in the last seven days.

At press time, the token was trading at $0.6301 with a market cap of over $34 million.

However, despite the rise in price, the token’s Social Volume dropped. Its Weighted Sentiment also declined, meaning that bearish sentiment around it was dominant in the market.

Source: Santiment

Read Ethereum’s [ETH] Price Prediction 2024-25

We then took a look at its daily chart to see whether its metrics were also bearish, like ETH. Not surprisingly, the findings were the same. XRP’s MACD was likewise bearish, and its RSI signaled a price drop.

It will be interesting to see which direction altcoins move in the coming days, considering the bearish indicators of the top altcoins.

Source: TradingView

where to buy generic clomiphene no prescription where to get generic clomiphene without dr prescription get generic clomid without rx buy clomid can you buy clomid without insurance where to get cheap clomiphene without prescription cheap clomiphene without rx

Facts blog you procure here.. It’s severely to find elevated quality belles-lettres like yours these days. I justifiably appreciate individuals like you! Withstand care!!

This is the tolerant of post I unearth helpful.

oral semaglutide 14 mg – buy semaglutide generic buy cyproheptadine 4 mg pill

domperidone 10mg uk – purchase tetracycline generic oral cyclobenzaprine 15mg

order inderal 10mg pills – methotrexate 10mg over the counter purchase methotrexate for sale

amoxil cost – buy amoxil no prescription combivent 100mcg ca

buy azithromycin 250mg pill – bystolic 5mg brand brand nebivolol 5mg

buy clavulanate tablets – at bio info acillin cost

nexium 20mg capsules – anexa mate esomeprazole cheap

warfarin 5mg canada – https://coumamide.com/ losartan oral

cost mobic 15mg – relieve pain meloxicam 7.5mg cheap

order prednisone 10mg without prescription – https://apreplson.com/ order prednisone 5mg pills

fda approved over the counter ed pills – https://fastedtotake.com/ cheapest ed pills online

buy amoxil pill – combamoxi buy amoxicillin generic

purchase diflucan online – https://gpdifluca.com/# fluconazole 200mg cost

order cenforce 100mg sale – https://cenforcers.com/ buy cenforce 50mg pill

is there a generic cialis available in the us – https://ciltadgn.com/# san antonio cialis doctor

how to buy tadalafil online – cialis professional ingredients cialis for ed

zantac for sale online – https://aranitidine.com/ order zantac

cheap generic viagra india – buy viagra with paypal sildenafil citrate tablets 100 mg

Thanks on putting this up. It’s understandably done. https://buyfastonl.com/amoxicillin.html

Thanks for sharing. It’s acme quality. https://ursxdol.com/get-metformin-pills/

This is the make of enter I recoup helpful. https://prohnrg.com/product/cytotec-online/

With thanks. Loads of conception! https://aranitidine.com/fr/acheter-propecia-en-ligne/