- DOGE’s price increased by double digits in the last week.

- Technical indicators hinted at the possibility of a price swing in either direction.

Leading meme coin Dogecoin [DOGE] may experience headwinds this week as volatility markers hinted at the possibility of significant short-term price swings.

At press time, DOGE was trading at $0.207. According to CoinMarketCap’s data, its price has increased by 20% in the last week.

However, with rising volatility in its market, the meme coin may shed some of these gains.

Price swings on the horizon

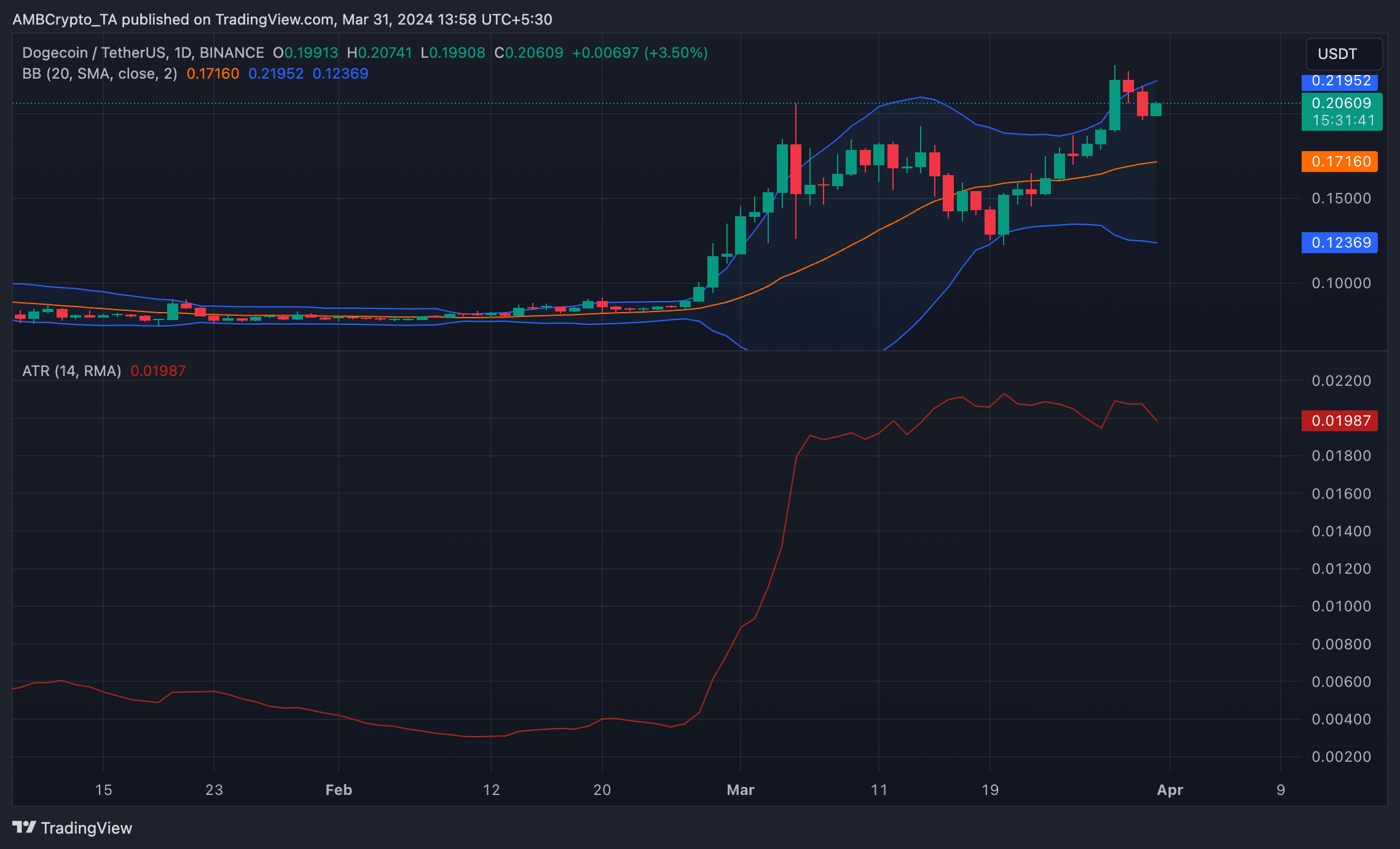

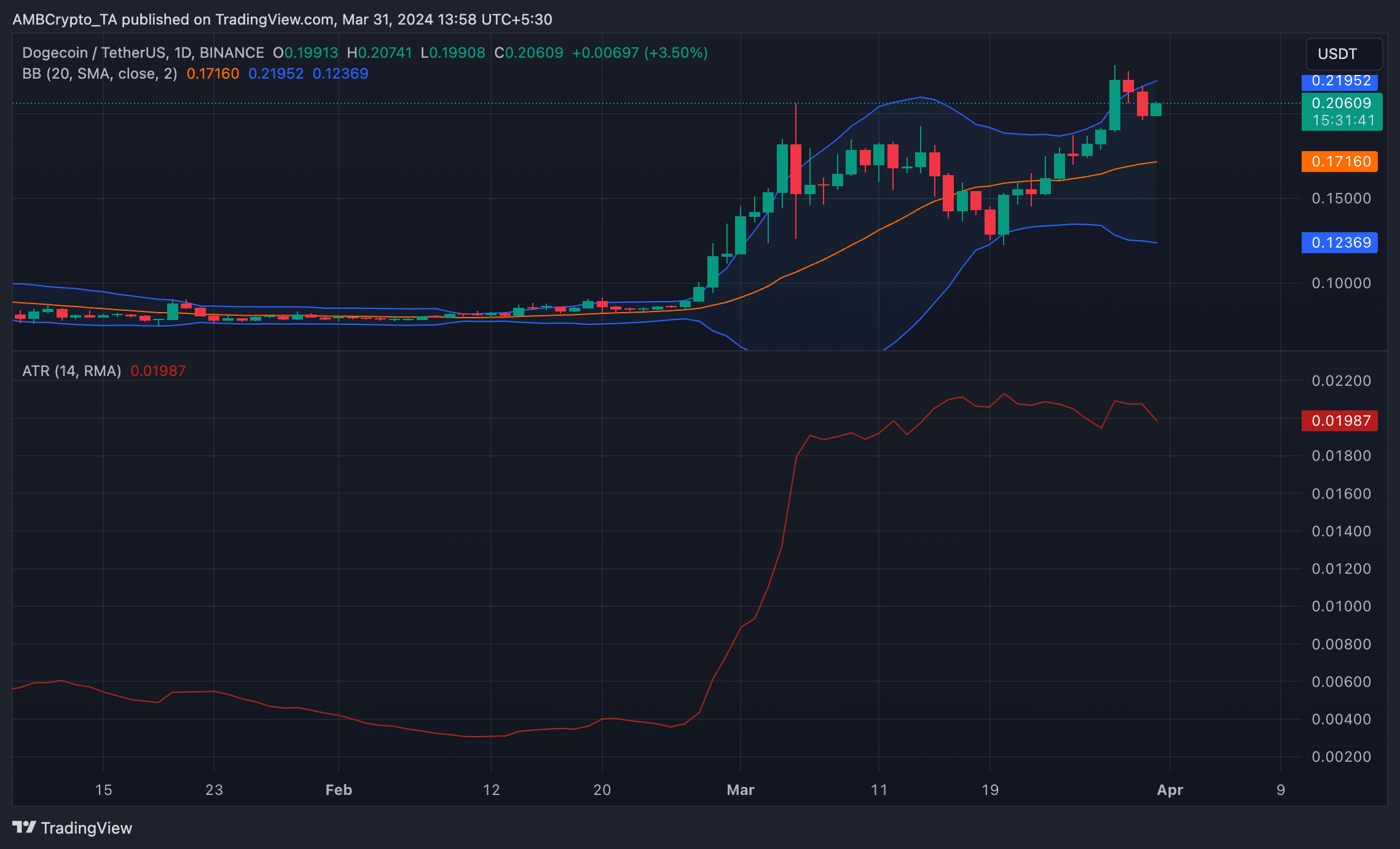

AMBCrypto assessed the coin’s Bollinger Bands (BB) on a one-day chart and found that the gap between the indicator’s upper and lower bands has steadily widened since the 27th of March.

This indicator gauges an asset’s market volatility and potential price movements. When the gap between its lower and upper bands widens, it indicates an increase in volatility.

The gap may widen for several reasons, one of which is increased trading volume. According to Santiment’s data, DOGE’s trading volume climbed to a weekly high of $7 billion on the 28th of March.

During periods of band expansion, traders are on the lookout for price breakouts in either direction.

Further confirming the possibility of a market swing, the value of DOGE’s Average True has risen by 5% in the past three days.

This indicator measures market volatility by calculating the average range between high and low prices over a specified number of periods.

When it rises in this manner, it suggests that the price swings are becoming more significant.

Source: DOGE/USDT on TradingView

The bulls remain in control

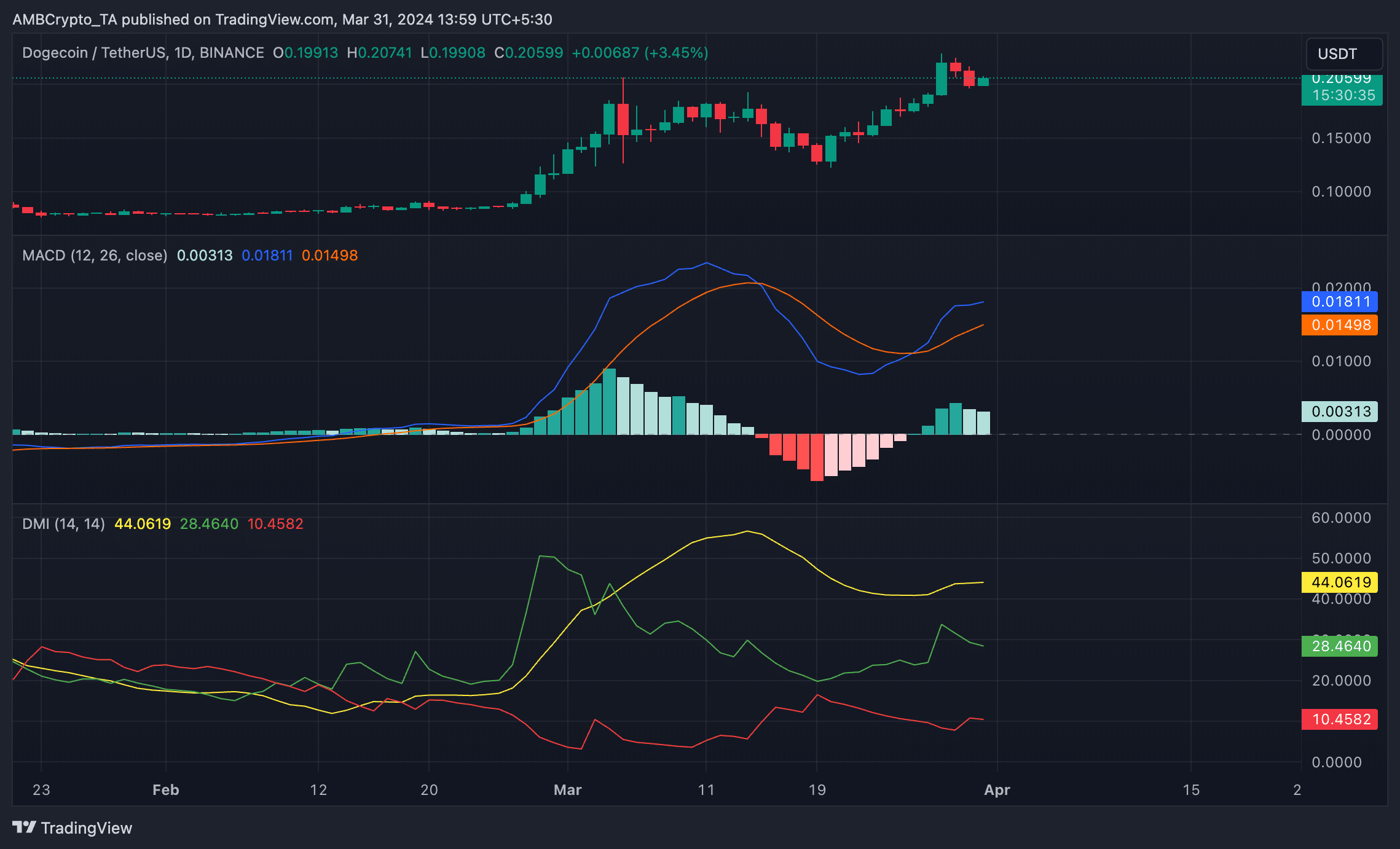

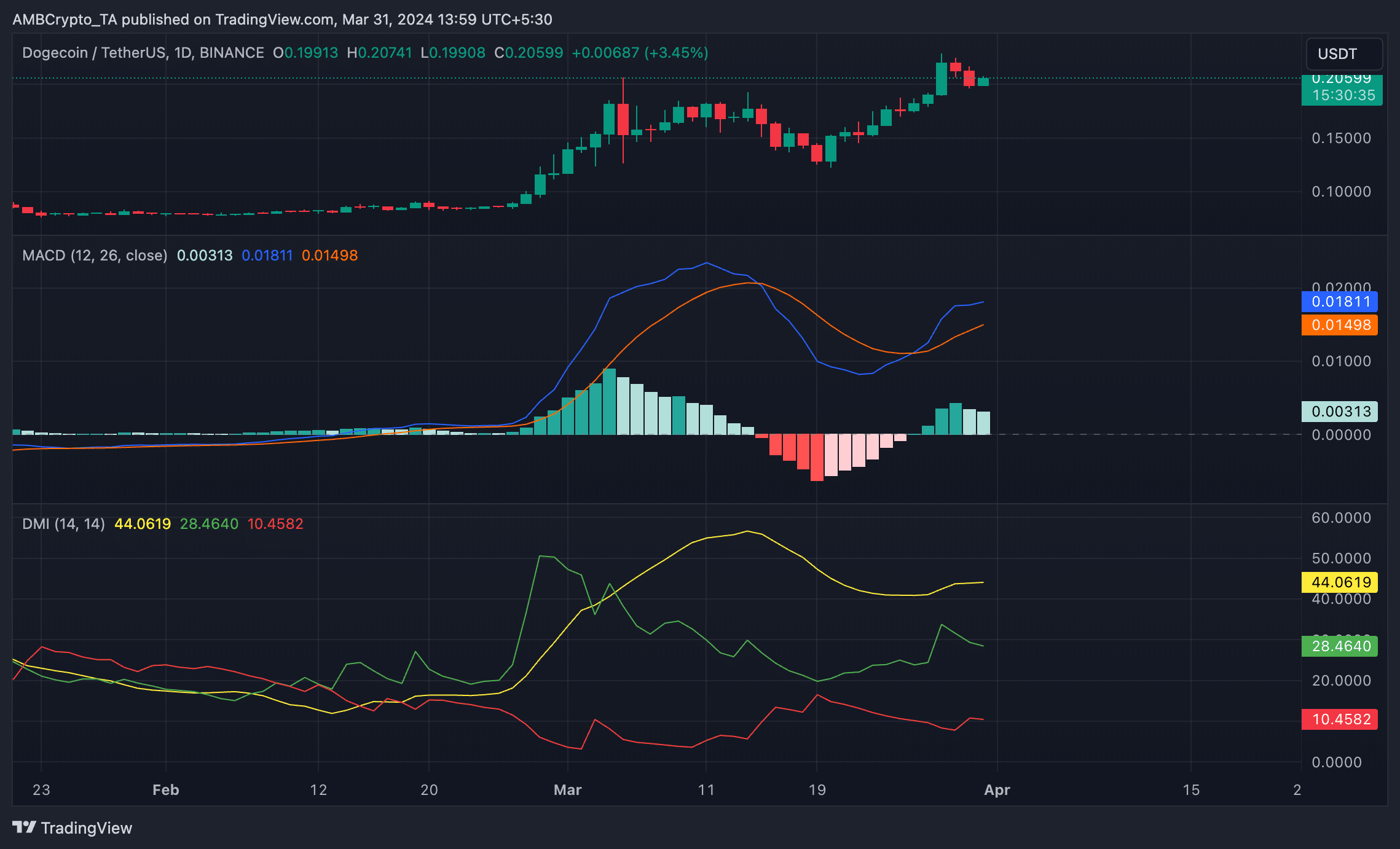

While volatility markers hint at the possibility of price swings in the coming days, DOGE’s Directional Movement Index (DMI) and Moving Average Convergence/Divergence indicators showed that bullish sentiments exceeded bearish activity.

Readings from the coin’s Directional Movement Index (DMI) showed the positive directional index above the negative index.

When these lines are positioned this way, it means that the strength of the prevailing bullish trend is higher than the strength of any potential downward price movement.

Source: DOGE/USDT on TradingView

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Likewise, DOGE’s MACD line crossed above the signal line on the 26th of March and has since been positioned this way.

An upward intersection of the MACD line with the signal line is a bullish sign, often indicating a rise in buying pressure.

- DOGE’s price increased by double digits in the last week.

- Technical indicators hinted at the possibility of a price swing in either direction.

Leading meme coin Dogecoin [DOGE] may experience headwinds this week as volatility markers hinted at the possibility of significant short-term price swings.

At press time, DOGE was trading at $0.207. According to CoinMarketCap’s data, its price has increased by 20% in the last week.

However, with rising volatility in its market, the meme coin may shed some of these gains.

Price swings on the horizon

AMBCrypto assessed the coin’s Bollinger Bands (BB) on a one-day chart and found that the gap between the indicator’s upper and lower bands has steadily widened since the 27th of March.

This indicator gauges an asset’s market volatility and potential price movements. When the gap between its lower and upper bands widens, it indicates an increase in volatility.

The gap may widen for several reasons, one of which is increased trading volume. According to Santiment’s data, DOGE’s trading volume climbed to a weekly high of $7 billion on the 28th of March.

During periods of band expansion, traders are on the lookout for price breakouts in either direction.

Further confirming the possibility of a market swing, the value of DOGE’s Average True has risen by 5% in the past three days.

This indicator measures market volatility by calculating the average range between high and low prices over a specified number of periods.

When it rises in this manner, it suggests that the price swings are becoming more significant.

Source: DOGE/USDT on TradingView

The bulls remain in control

While volatility markers hint at the possibility of price swings in the coming days, DOGE’s Directional Movement Index (DMI) and Moving Average Convergence/Divergence indicators showed that bullish sentiments exceeded bearish activity.

Readings from the coin’s Directional Movement Index (DMI) showed the positive directional index above the negative index.

When these lines are positioned this way, it means that the strength of the prevailing bullish trend is higher than the strength of any potential downward price movement.

Source: DOGE/USDT on TradingView

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Likewise, DOGE’s MACD line crossed above the signal line on the 26th of March and has since been positioned this way.

An upward intersection of the MACD line with the signal line is a bullish sign, often indicating a rise in buying pressure.

how to buy clomiphene pill can i buy cheap clomiphene without prescription can you get generic clomiphene online buying cheap clomiphene without dr prescription clomid prices in south africa how to buy generic clomiphene no prescription can i purchase generic clomid pills

More text pieces like this would urge the web better.

This is a theme which is in to my fundamentals… Many thanks! Quite where can I find the contact details an eye to questions?

zithromax online – order ciplox 500mg sale metronidazole medication

cheap semaglutide 14mg – purchase semaglutide without prescription buy cheap generic periactin

order motilium generic – tetracycline generic cyclobenzaprine 15mg generic

propranolol us – buy methotrexate 2.5mg sale methotrexate 10mg pills

buy augmentin 375mg without prescription – atbioinfo buy acillin tablets

nexium pill – anexa mate esomeprazole 40mg uk

buy warfarin 2mg for sale – anticoagulant losartan pills

purchase meloxicam generic – https://moboxsin.com/ how to buy mobic

buy prednisone 5mg sale – apreplson.com where to buy prednisone without a prescription

best drug for ed – https://fastedtotake.com/ buy ed pills canada

purchase amoxil without prescription – combamoxi amoxil online

buy generic fluconazole 200mg – https://gpdifluca.com/ fluconazole pills

buy cenforce without prescription – https://cenforcers.com/ order generic cenforce 50mg

cialis tadalafil tablets – this cialis manufacturer coupon free trial

brand ranitidine 300mg – aranitidine zantac tablet

what is the normal dose of cialis – this cheaper alternative to cialis

I am in truth happy to glance at this blog posts which consists of tons of profitable facts, thanks object of providing such data. sitio web

50mg of viagra – https://strongvpls.com/# sildenafil tabletas 100 mg

More posts like this would bring about the blogosphere more useful. https://ursxdol.com/get-metformin-pills/

Greetings! Extremely gainful advice within this article! It’s the crumb changes which choice obtain the largest changes. Thanks a lot towards sharing! https://buyfastonl.com/gabapentin.html

I’ll certainly bring to be familiar with more. https://prohnrg.com/

I am in truth thrilled to glitter at this blog posts which consists of tons of profitable facts, thanks representing providing such data. https://ondactone.com/simvastatin/

More text pieces like this would create the web better.

https://proisotrepl.com/product/methotrexate/

Greetings! Very useful advice within this article! It’s the little changes which will make the largest changes. Thanks a quantity in the direction of sharing! https://lzdsxxb.com/home.php?mod=space&uid=5057532

order generic forxiga 10 mg – https://janozin.com/# purchase dapagliflozin generic

purchase orlistat generic – cheap orlistat purchase orlistat without prescription