- Activity on the Solana network grew, however, SOL’s price declined

- SOL’s popularity waned, but sentiment remained positive

Solana’s [SOL] ecosystem has grown consistently over the last few months due to the network’s increasing popularity. In fact, due to this surge in interest, the number of transactions happening on the Solana network has grown significantly too.

Good times for network activity

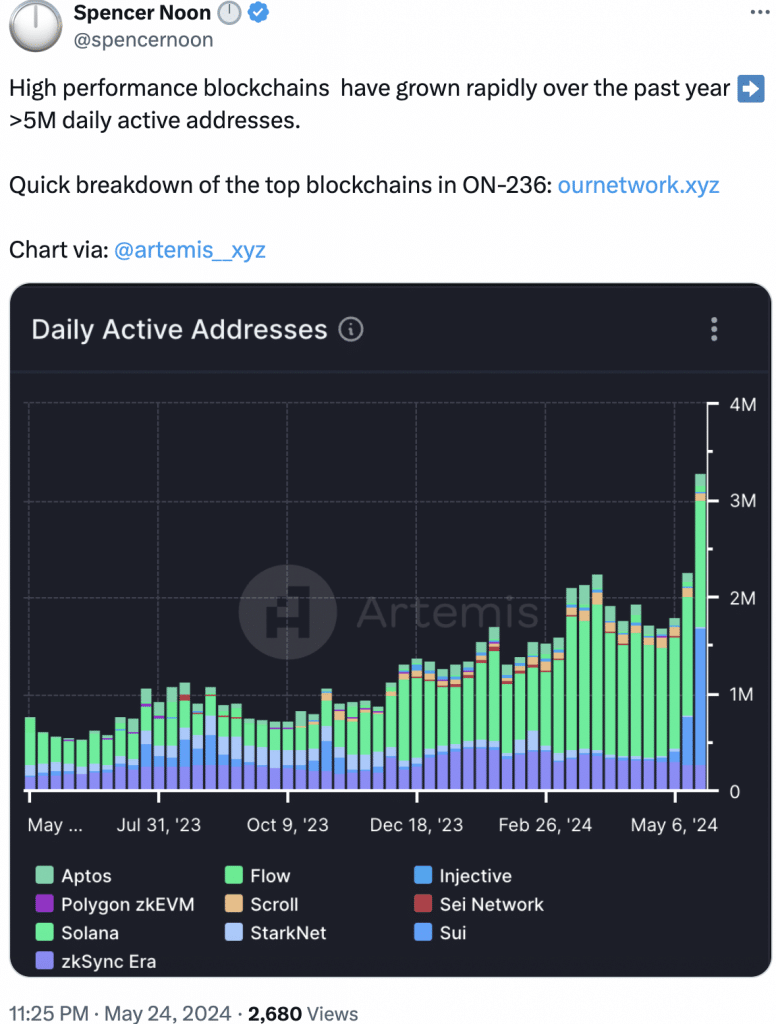

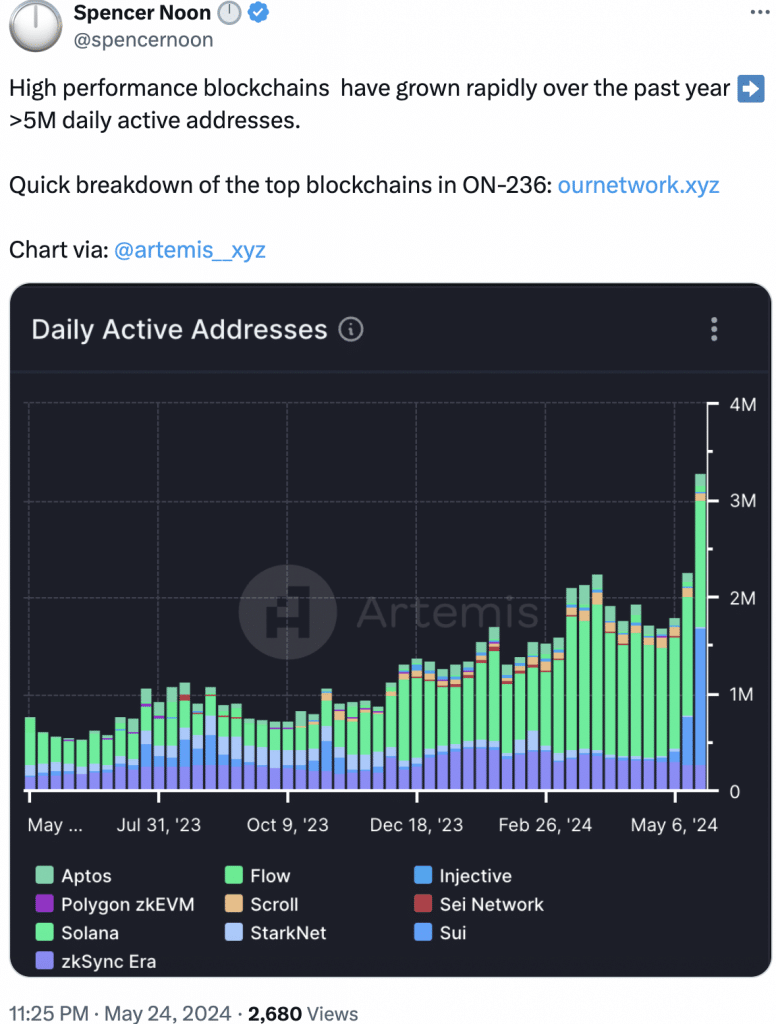

According to some analyses, such has been the recent dominance of the Solana network, that it has outperformed all other networks on this front.

Source: X

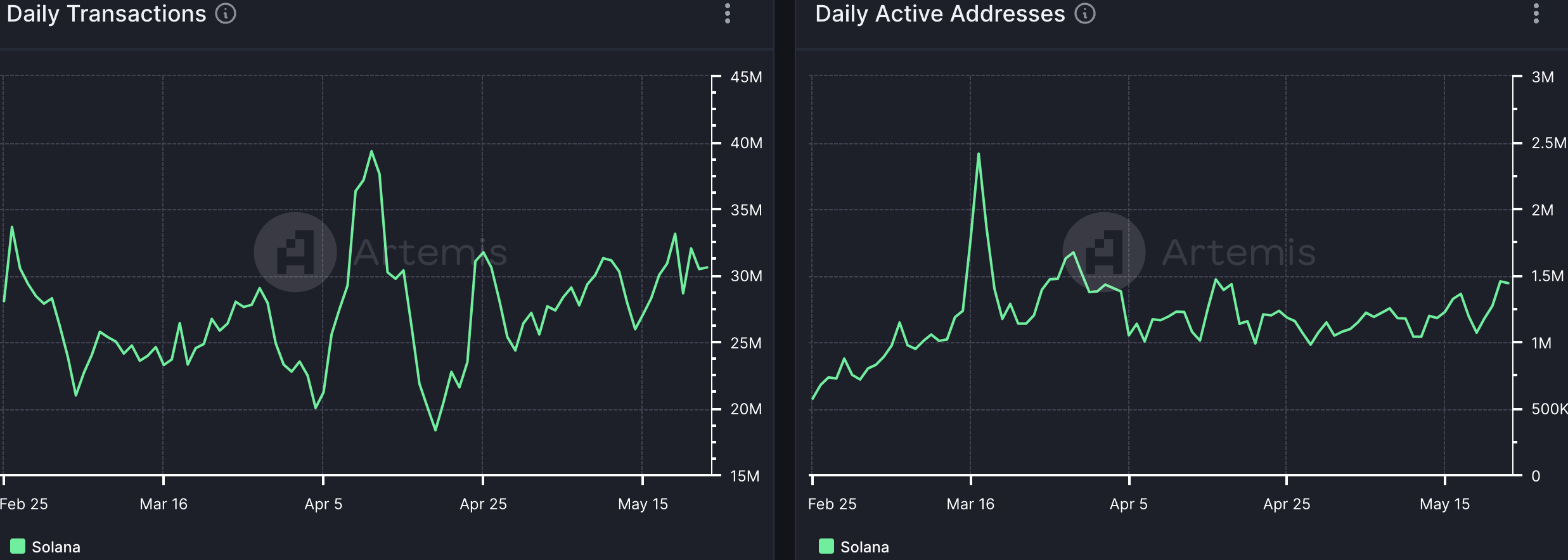

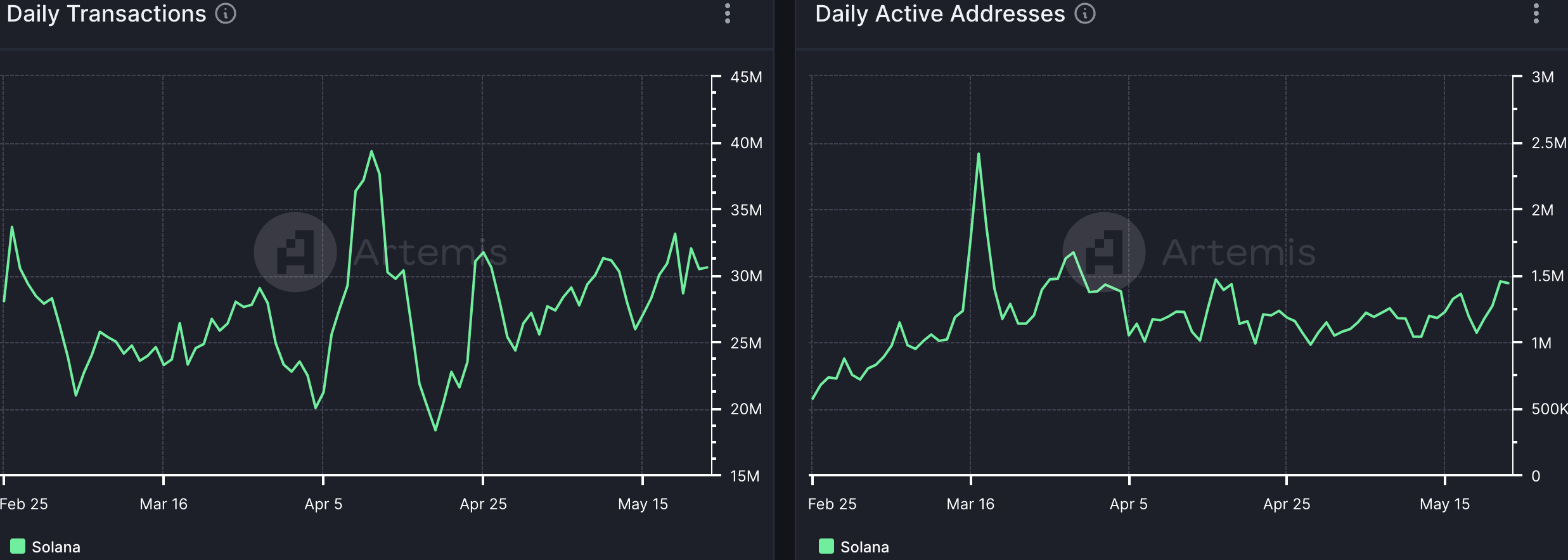

Despite the aforementioned surge in activity, however, the price of SOL declined by 3.13% over the last 7 days. This suggested that Solana ecosystem’s performance and SOL’s price may be losing their correlation with each other.

This isn’t the first time something like this has happened either. For instance – On 11 April, there was a massive surge in transactions on the Solana network. However, the price activity moved in a completely different direction and fell by 20%.

Source: Artemis

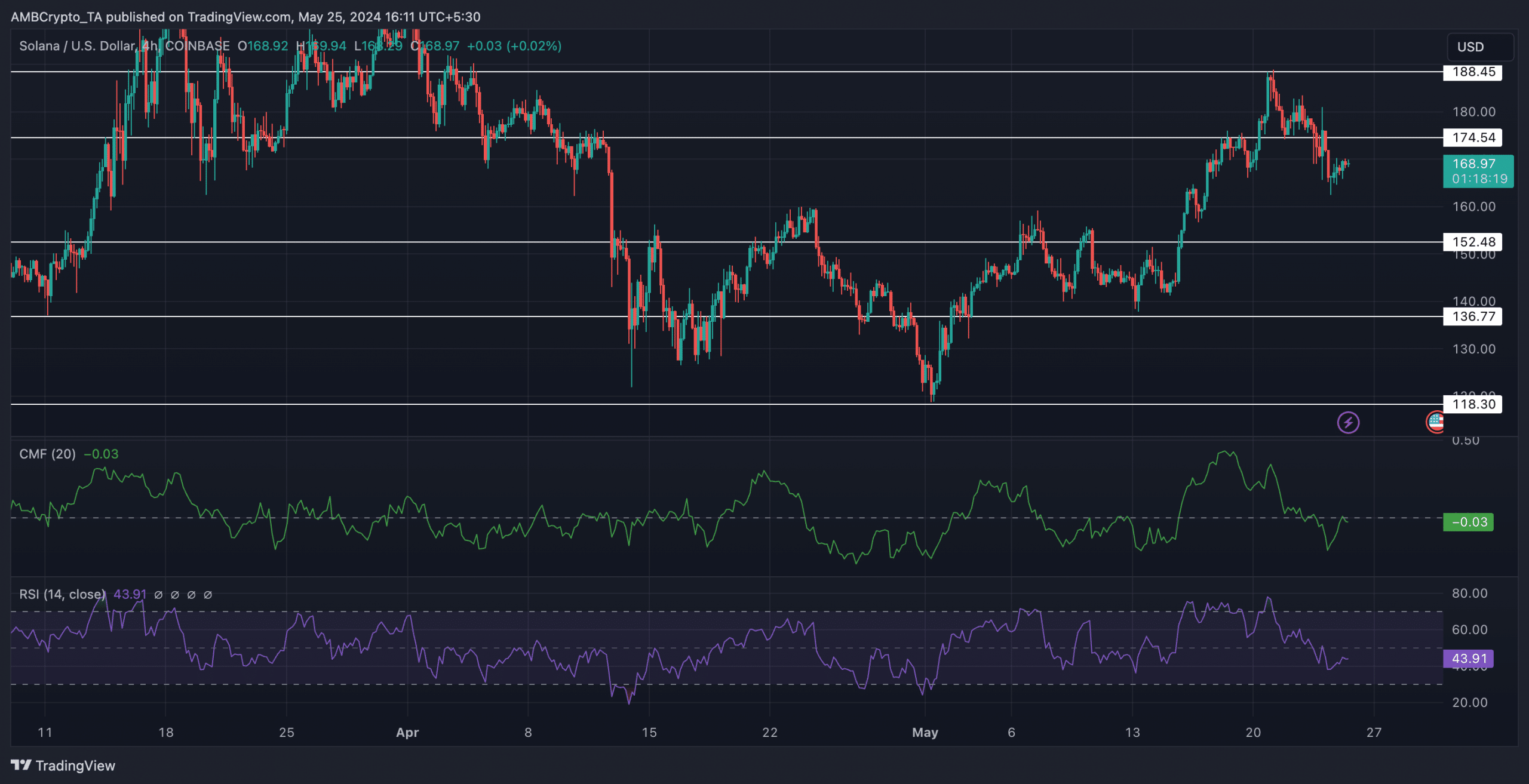

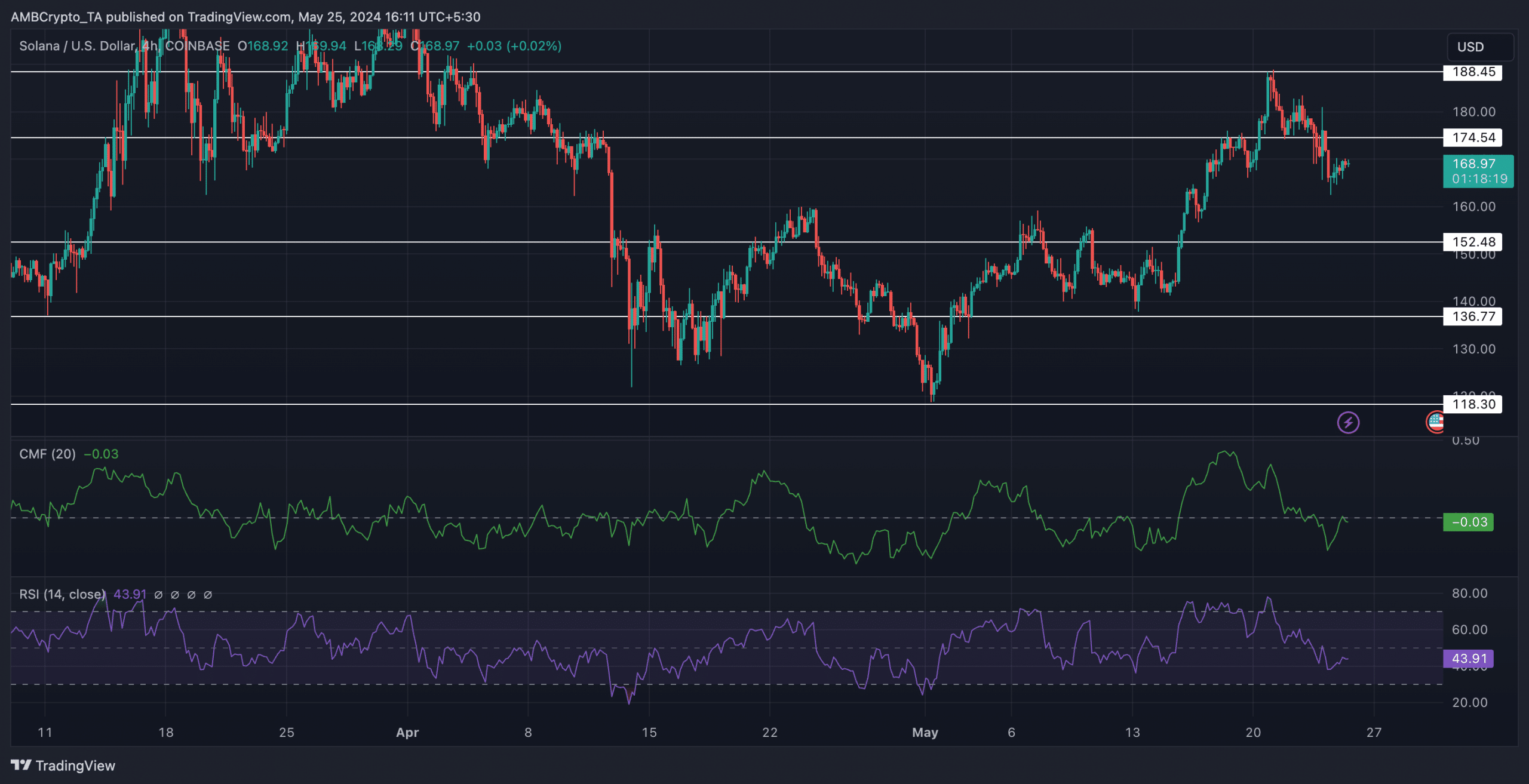

SOL’s value continued to move sideways for quite sometime, before registering a reversal in its trend. After 15 May, SOL’s price was met by a surge in bullish momentum, causing the price of SOL to surpass its previously established lower lows and lower highs. At press time, SOL was trading at $169.23.

Even though the recent correction in SOL’s price wasn’t significant enough to break the bearish trend, if the bearish pressure persists, it could lead to SOL hitting the $152.48-level.

At the time of writing, the RSI (Relative Strength Index) for SOL had fallen to 43.91, implying that bullish momentum around SOL waned significantly. The CMF (Chaikin Money Flow) for SOL also declined to -0.03 – A sign of low capital inflows.

Source: Trading View

Social volume takes a hit

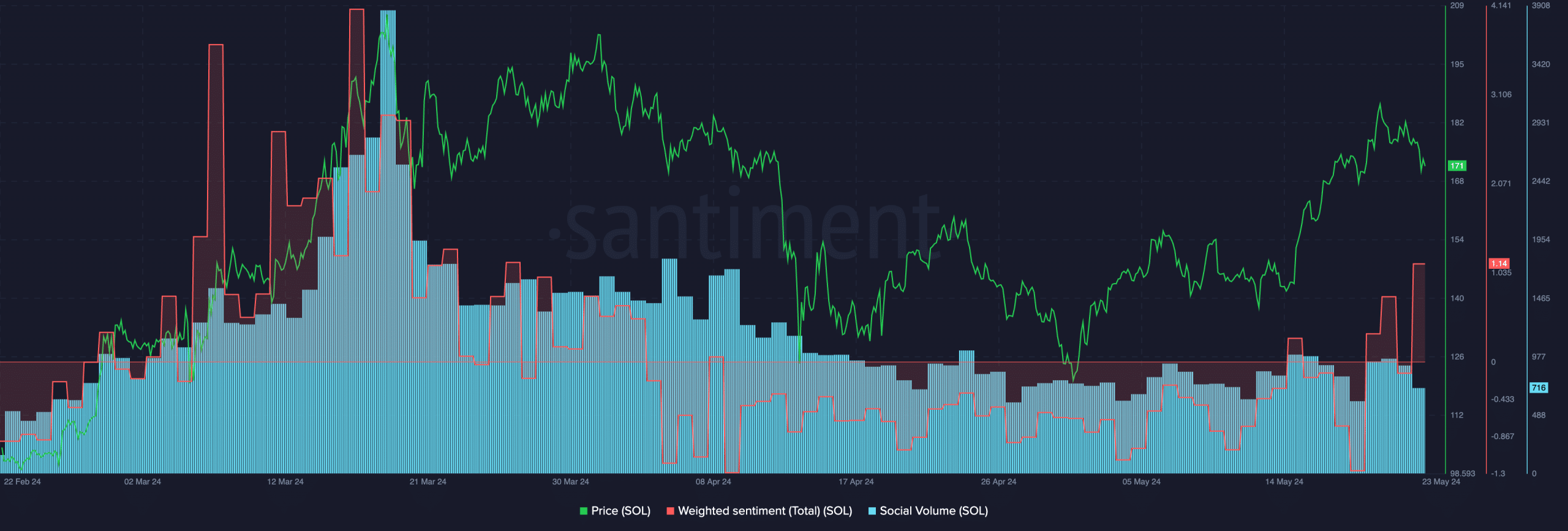

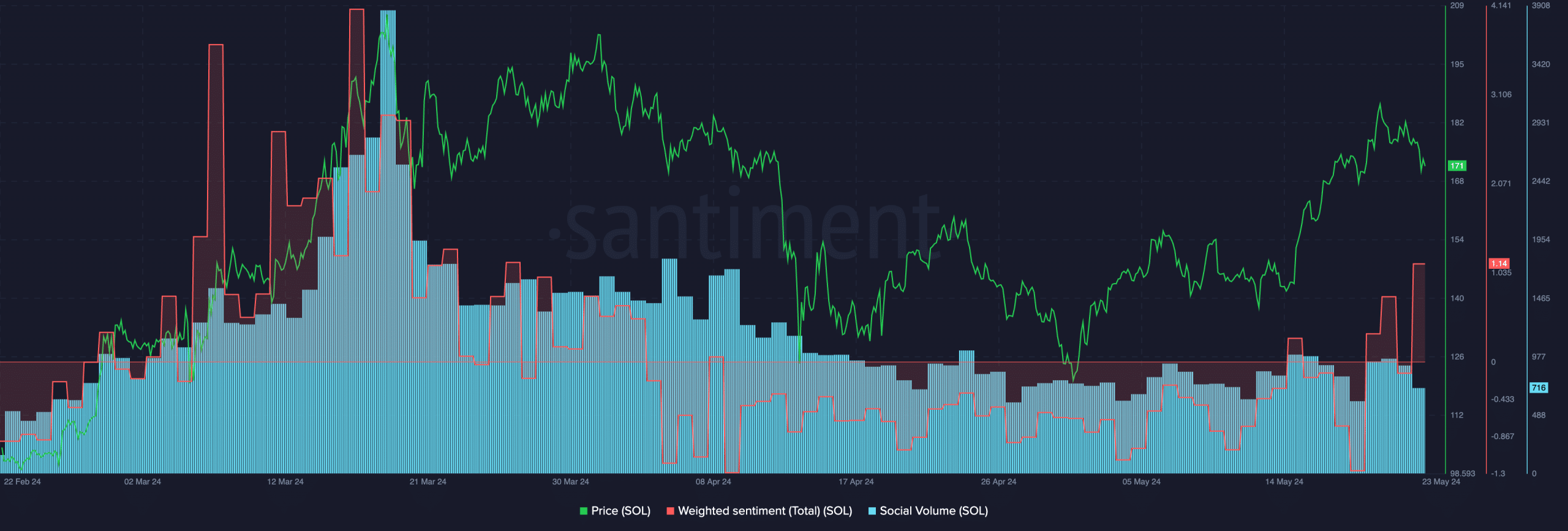

A factor that could gravely influence the price of SOL in the future could be its popularity on social media. AMBCrypto’s analysis of Santiment’s data revealed that the social volume around SOL fell significantly over the last few days.

This indicated that the number of comments and replies on social media around Solana declined significantly. The waning popularity of SOL could affect its price movement adversely on the charts.

Read Solana’s [SOL] Price Prediction 2024-25

On the contrary, SOL’s weighted sentiment recorded an uptick, implying that the conversations that have been happening around SOL were positive in nature.

If the weighted sentiment remains positive while social volume hikes, SOL’s price movement might take a positive turn.

Source: Santiment

- Activity on the Solana network grew, however, SOL’s price declined

- SOL’s popularity waned, but sentiment remained positive

Solana’s [SOL] ecosystem has grown consistently over the last few months due to the network’s increasing popularity. In fact, due to this surge in interest, the number of transactions happening on the Solana network has grown significantly too.

Good times for network activity

According to some analyses, such has been the recent dominance of the Solana network, that it has outperformed all other networks on this front.

Source: X

Despite the aforementioned surge in activity, however, the price of SOL declined by 3.13% over the last 7 days. This suggested that Solana ecosystem’s performance and SOL’s price may be losing their correlation with each other.

This isn’t the first time something like this has happened either. For instance – On 11 April, there was a massive surge in transactions on the Solana network. However, the price activity moved in a completely different direction and fell by 20%.

Source: Artemis

SOL’s value continued to move sideways for quite sometime, before registering a reversal in its trend. After 15 May, SOL’s price was met by a surge in bullish momentum, causing the price of SOL to surpass its previously established lower lows and lower highs. At press time, SOL was trading at $169.23.

Even though the recent correction in SOL’s price wasn’t significant enough to break the bearish trend, if the bearish pressure persists, it could lead to SOL hitting the $152.48-level.

At the time of writing, the RSI (Relative Strength Index) for SOL had fallen to 43.91, implying that bullish momentum around SOL waned significantly. The CMF (Chaikin Money Flow) for SOL also declined to -0.03 – A sign of low capital inflows.

Source: Trading View

Social volume takes a hit

A factor that could gravely influence the price of SOL in the future could be its popularity on social media. AMBCrypto’s analysis of Santiment’s data revealed that the social volume around SOL fell significantly over the last few days.

This indicated that the number of comments and replies on social media around Solana declined significantly. The waning popularity of SOL could affect its price movement adversely on the charts.

Read Solana’s [SOL] Price Prediction 2024-25

On the contrary, SOL’s weighted sentiment recorded an uptick, implying that the conversations that have been happening around SOL were positive in nature.

If the weighted sentiment remains positive while social volume hikes, SOL’s price movement might take a positive turn.

Source: Santiment

where can i buy cheap clomiphene tablets cost clomiphene without insurance cost of clomiphene at cvs order cheap clomiphene pill can you get generic clomiphene prices can i purchase clomid without rx clomid order

Thanks towards putting this up. It’s evidently done.

The reconditeness in this piece is exceptional.

buy zithromax 500mg online cheap – floxin order online flagyl 200mg drug

order rybelsus 14mg online – buy semaglutide 14mg generic order periactin online cheap

motilium 10mg generic – cyclobenzaprine brand cyclobenzaprine 15mg cost

purchase inderal generic – clopidogrel over the counter methotrexate where to buy

buy clavulanate medication – atbioinfo.com ampicillin sale

buy generic esomeprazole – https://anexamate.com/ where can i buy esomeprazole

order warfarin online cheap – cou mamide buy cozaar 50mg

meloxicam 7.5mg us – https://moboxsin.com/ mobic usa

generic prednisone 40mg – adrenal buy prednisone 5mg without prescription

cheapest ed pills online – https://fastedtotake.com/ buy ed medications online

how to buy amoxicillin – combamoxi.com buy generic amoxicillin online

order diflucan pills – https://gpdifluca.com/# purchase forcan without prescription

cenforce 50mg price – generic cenforce 100mg cenforce ca

cialis 5mg 10mg no prescription – click buy tadalafil reddit

zantac tablet – online ranitidine medication

cheap cialis by post – https://strongtadafl.com/# para que sirve las tabletas cialis tadalafil de 5mg

The thoroughness in this section is noteworthy. sitio web

how to order viagra online from india – on this site buy viagra cialis line

More articles like this would make the blogosphere richer. prednisone 10mg price

The depth in this tune is exceptional. https://ursxdol.com/azithromycin-pill-online/

The thoroughness in this draft is noteworthy. https://prohnrg.com/product/get-allopurinol-pills/

I’ll certainly carry back to be familiar with more. https://aranitidine.com/fr/levitra_francaise/

I am in fact enchant‚e ‘ to gleam at this blog posts which consists of tons of of use facts, thanks object of providing such data. https://ondactone.com/product/domperidone/

The thoroughness in this draft is noteworthy.

https://doxycyclinege.com/pro/esomeprazole/

More posts like this would make the online elbow-room more useful. https://lzdsxxb.com/home.php?mod=space&uid=5057539

forxiga 10mg tablet – https://janozin.com/# brand forxiga 10 mg

buy generic orlistat – janozin.com orlistat price

I’ll certainly bring back to review more. http://web.symbol.rs/forum/member.php?action=profile&uid=1175038