- Bitcoin does not have a bullish sentiment in the short term, but a move toward $67k could be likely.

- Macro news events regarding September expectations may have dealt a bearish blow to BTC.

Bitcoin [BTC] is the king of crypto, not just because it has the largest market capitalization. It is the most robust and the earliest in the market, and has been a wind vane for the sentiment over the past decade.

Its price movements influence most of the crypto market and can help answer the question of why crypto is down today.

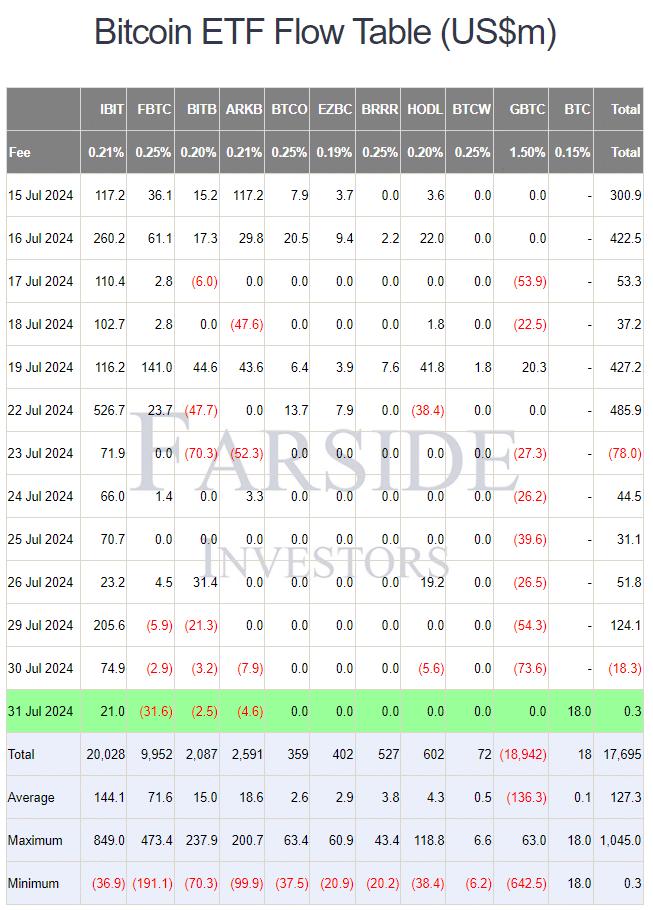

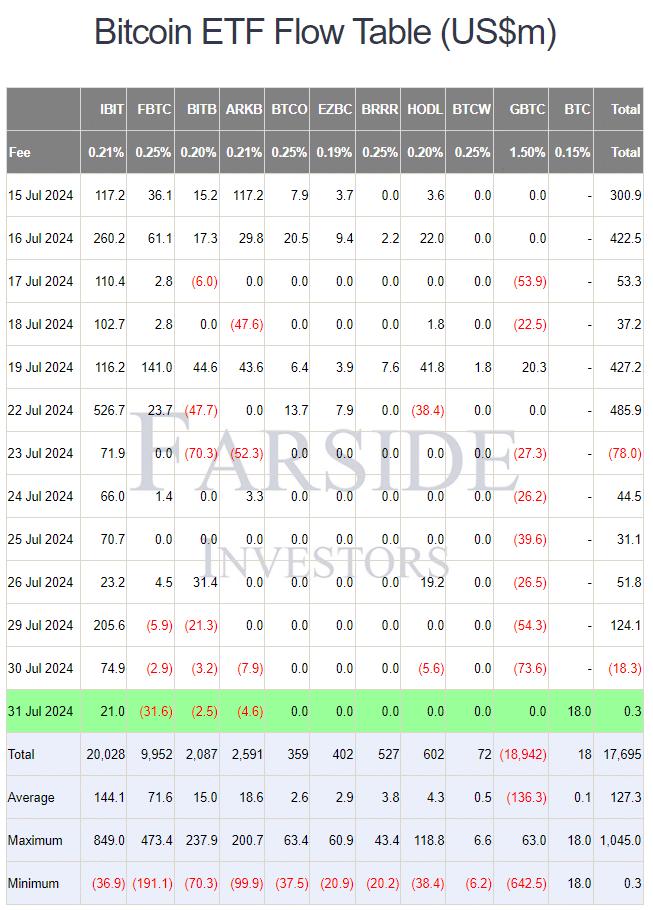

Source: Farside Investors

The ETF flows have been subdued over the past two days, a short-term sign of bearish sentiment. It likely will not dictate the long-term trend. That is due to liquidity and what the wider market expectations are.

The FOMC meeting threw a spanner in the works

The US Federal Reserve has not changed its benchmark fed funds rate from the 5.25%-5.5% range. While this was good news, it also did not give any positive indications about a September rate cut.

FOMC’s statement read,

“Inflation has eased over the past year but remains somewhat elevated.”

It continued,

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

Data from the CME FedWatch showed that the market does not expect a rate cut in mid-September. Before the FOMC meeting, this was not the case, and a 0.25% (25 basis point) rate reduction was anticipated in September.

This hawkish news might have led to Bitcoin’s prices tanking.

Clues from metrics and liquidation levels

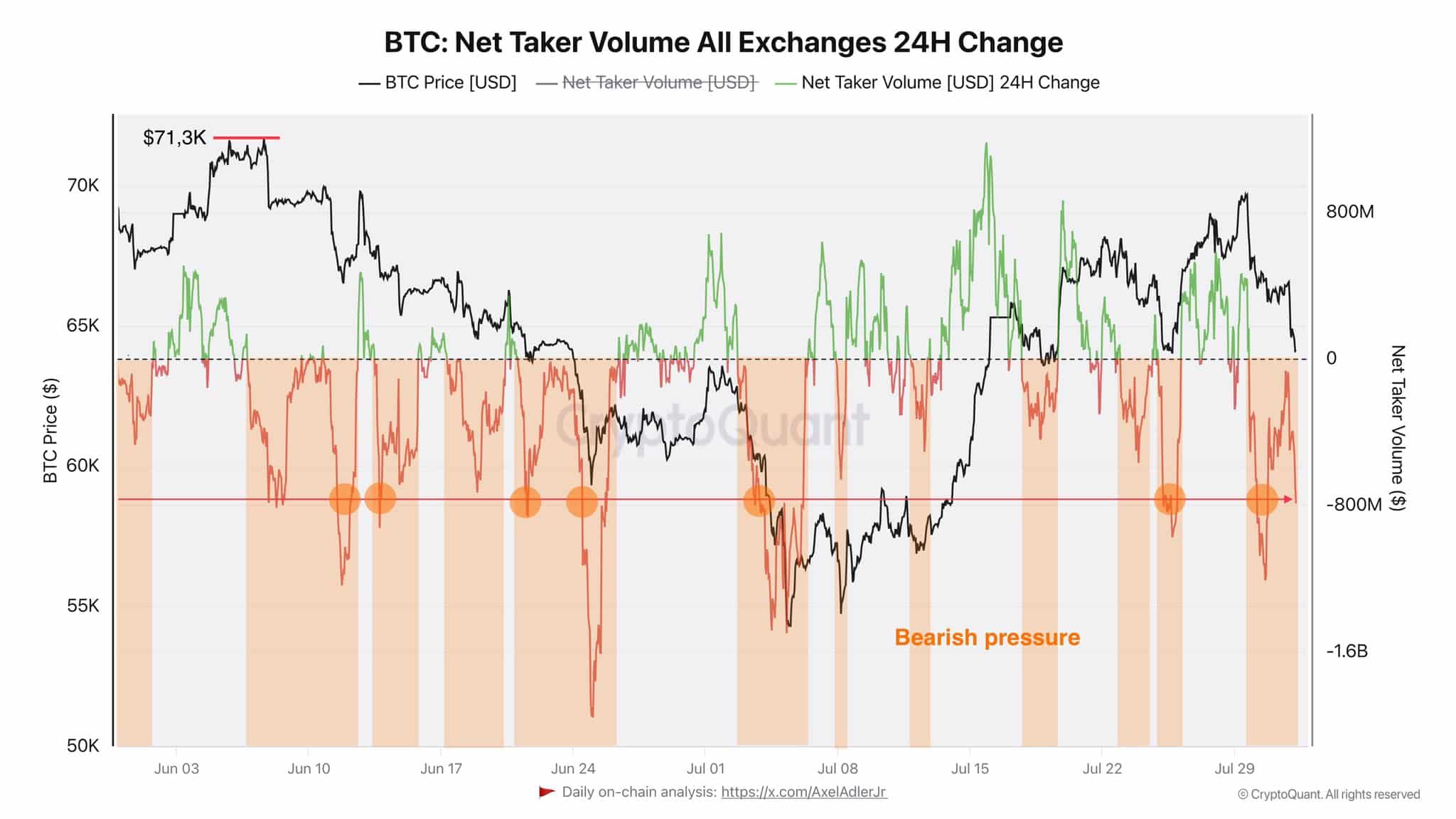

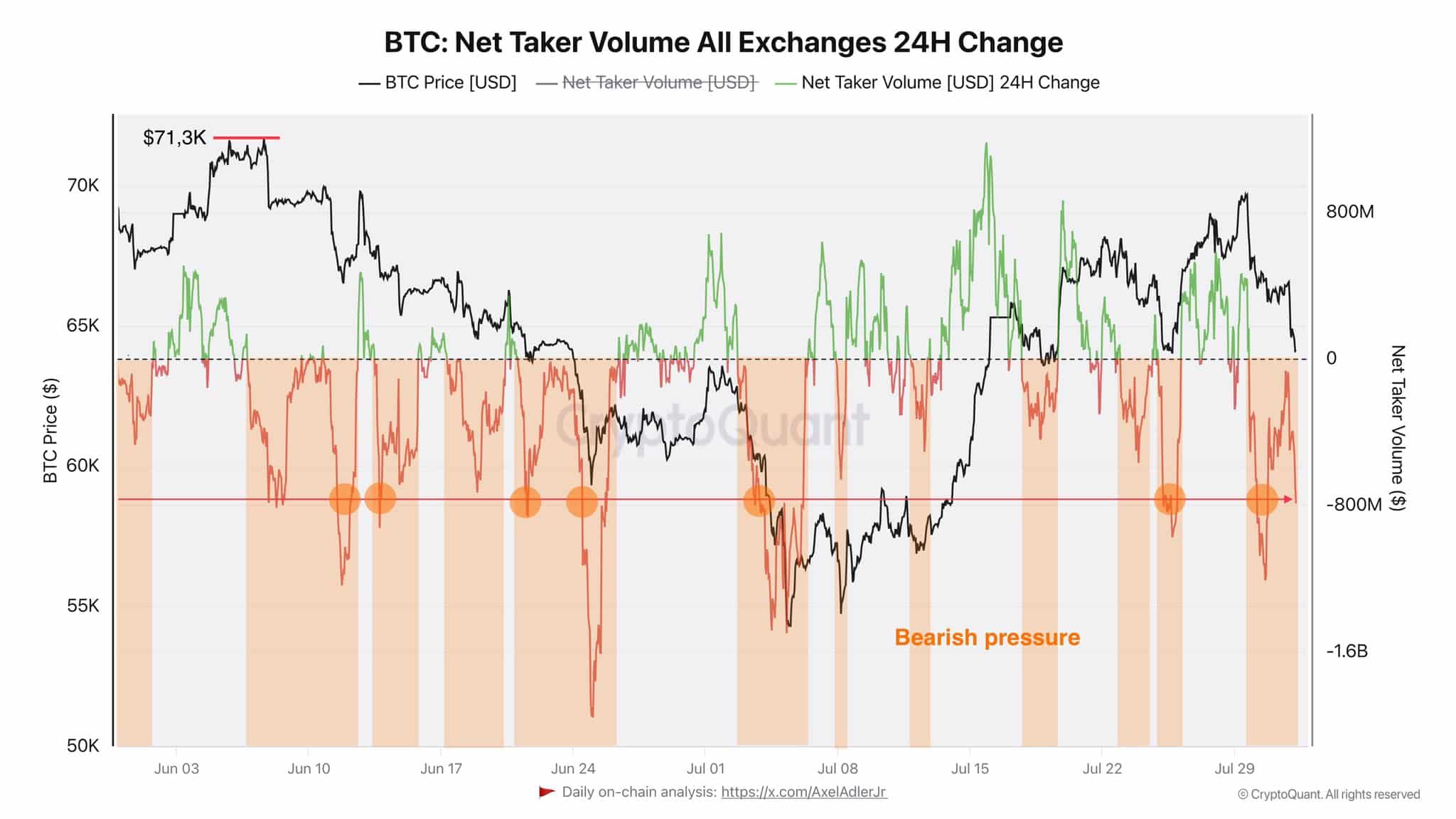

Source: Axel Adler on X

Crypto analyst Axel Adler posted on X (formerly Twitter) that the net taker volume has shown predominantly bearish pressure over the past two months.

Measuring the difference between taker buy and taker sell orders can give hints about the sentiment. For reference, taker indicates market orders and maker indicates limit orders.

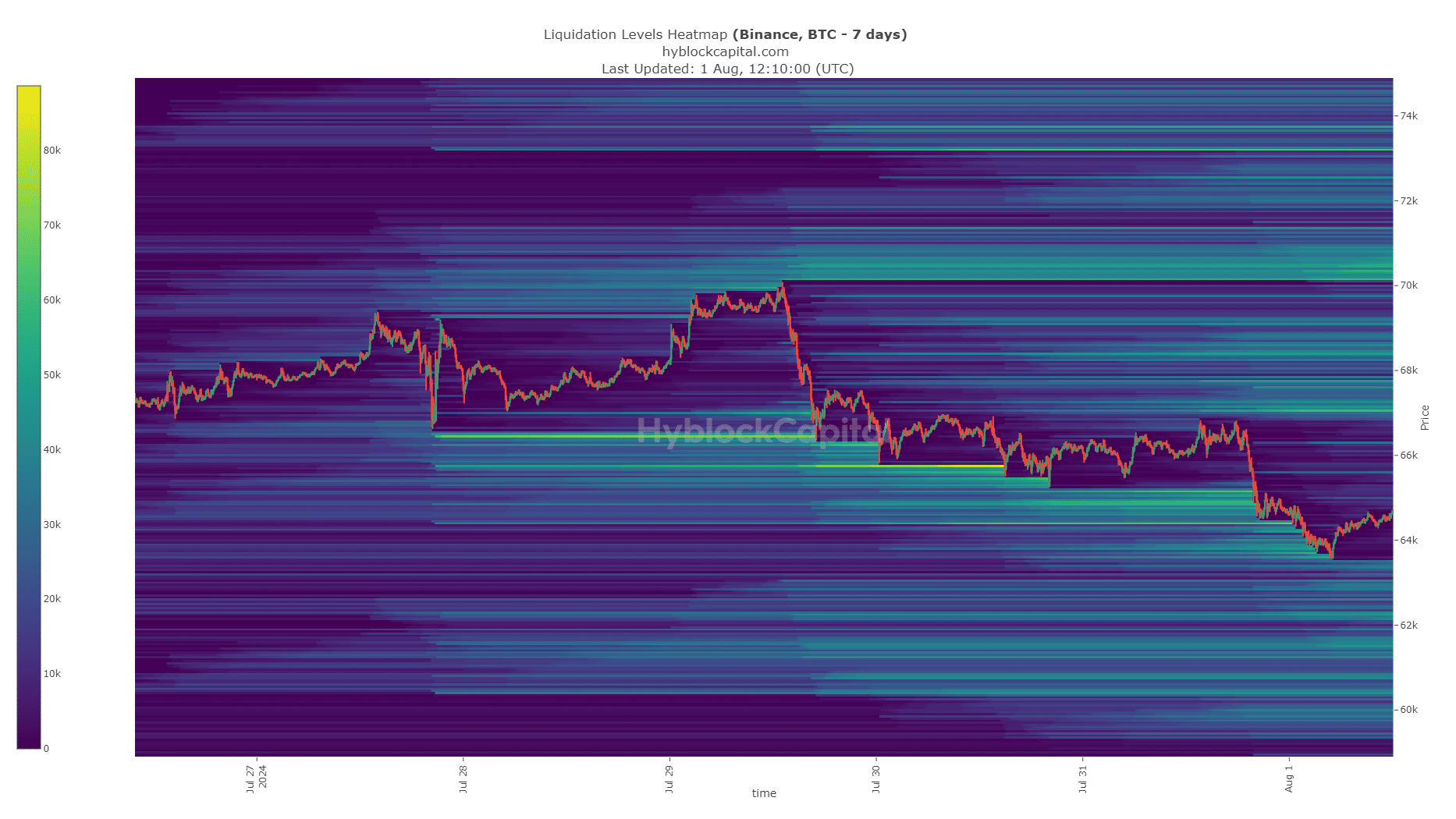

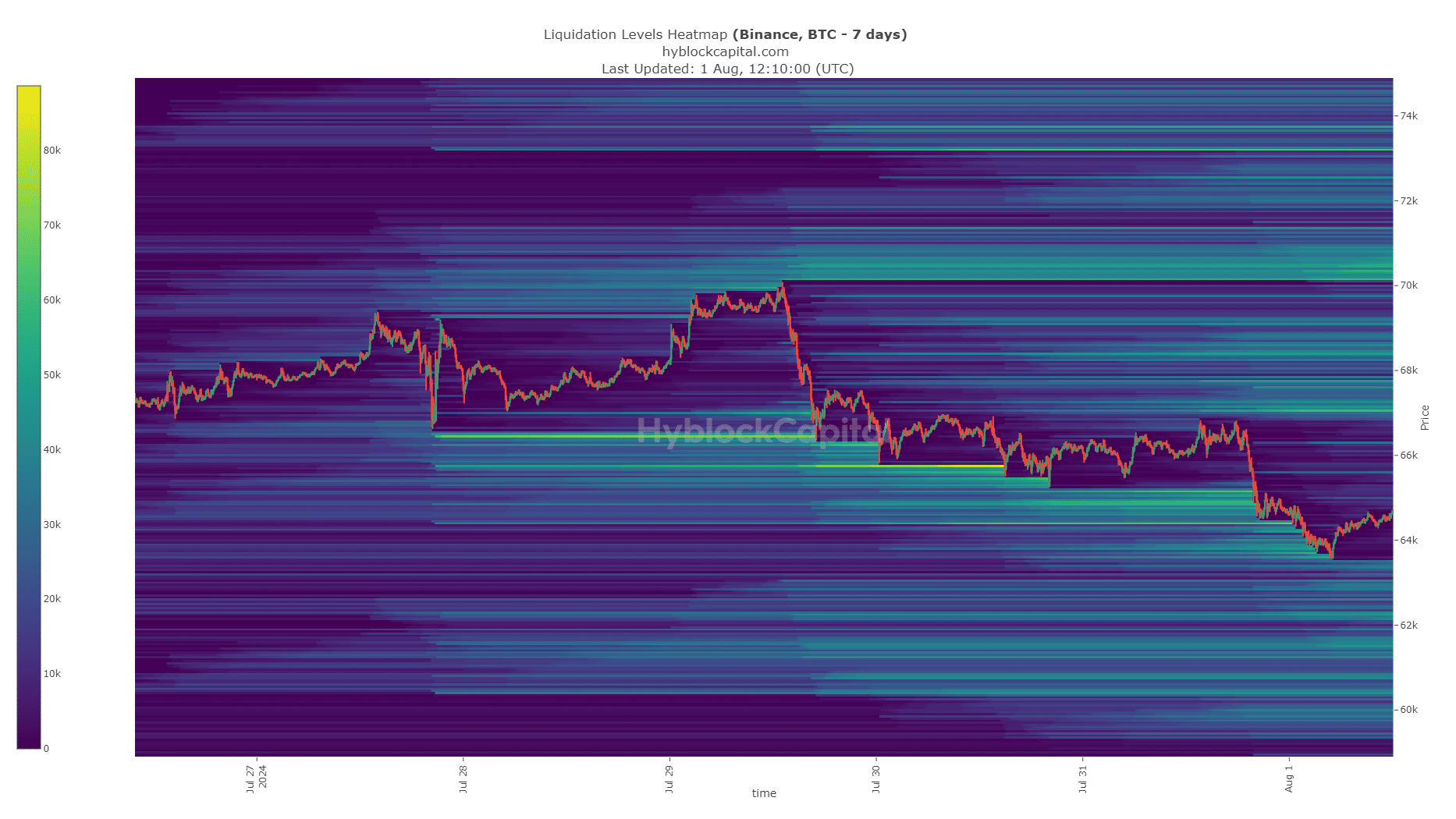

Source: Hyblock

Read Bitcoin’s [BTC] Price Prediction 2024-25

The liquidation cluster at $63.7k-$63.9k was reached, and the price has begun to move away from it. The short-term liquidation heatmap showed that $67k is the next target.

Overall, the market sentiment was bearish and the September expectations of a rate cut have been numbed. Together, they explained why the crypto market prices and sentiment were down in the past couple of days.

- Bitcoin does not have a bullish sentiment in the short term, but a move toward $67k could be likely.

- Macro news events regarding September expectations may have dealt a bearish blow to BTC.

Bitcoin [BTC] is the king of crypto, not just because it has the largest market capitalization. It is the most robust and the earliest in the market, and has been a wind vane for the sentiment over the past decade.

Its price movements influence most of the crypto market and can help answer the question of why crypto is down today.

Source: Farside Investors

The ETF flows have been subdued over the past two days, a short-term sign of bearish sentiment. It likely will not dictate the long-term trend. That is due to liquidity and what the wider market expectations are.

The FOMC meeting threw a spanner in the works

The US Federal Reserve has not changed its benchmark fed funds rate from the 5.25%-5.5% range. While this was good news, it also did not give any positive indications about a September rate cut.

FOMC’s statement read,

“Inflation has eased over the past year but remains somewhat elevated.”

It continued,

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run.”

Data from the CME FedWatch showed that the market does not expect a rate cut in mid-September. Before the FOMC meeting, this was not the case, and a 0.25% (25 basis point) rate reduction was anticipated in September.

This hawkish news might have led to Bitcoin’s prices tanking.

Clues from metrics and liquidation levels

Source: Axel Adler on X

Crypto analyst Axel Adler posted on X (formerly Twitter) that the net taker volume has shown predominantly bearish pressure over the past two months.

Measuring the difference between taker buy and taker sell orders can give hints about the sentiment. For reference, taker indicates market orders and maker indicates limit orders.

Source: Hyblock

Read Bitcoin’s [BTC] Price Prediction 2024-25

The liquidation cluster at $63.7k-$63.9k was reached, and the price has begun to move away from it. The short-term liquidation heatmap showed that $67k is the next target.

Overall, the market sentiment was bearish and the September expectations of a rate cut have been numbed. Together, they explained why the crypto market prices and sentiment were down in the past couple of days.

can i get generic clomiphene without a prescription order generic clomid without insurance clomid prices in south africa can you buy cheap clomid without insurance how to get generic clomid generic clomid walmart clomid risks

Greetings! Jolly serviceable advice within this article! It’s the crumb changes which will turn the largest changes. Thanks a a quantity in the direction of sharing!

This is the kind of enter I turn up helpful.

azithromycin over the counter – buy zithromax paypal buy generic metronidazole over the counter

semaglutide where to buy – cyproheptadine 4 mg generic oral cyproheptadine

domperidone canada – buy sumycin 500mg sale buy flexeril cheap

how to get propranolol without a prescription – buy methotrexate 2.5mg for sale order generic methotrexate 2.5mg

purchase amoxil without prescription – order valsartan 80mg sale buy combivent pill

cost azithromycin 500mg – order nebivolol 5mg for sale order bystolic 20mg online

augmentin 1000mg brand – https://atbioinfo.com/ buy ampicillin generic

order esomeprazole 20mg generic – https://anexamate.com/ oral esomeprazole

warfarin 5mg oral – https://coumamide.com/ purchase cozaar generic

mobic 7.5mg pills – https://moboxsin.com/ meloxicam 7.5mg for sale

order deltasone 20mg – https://apreplson.com/ purchase prednisone sale

buy ed pills for sale – ed pills that work quickly new ed pills

buy generic amoxicillin – combamoxi.com order generic amoxicillin

buy fluconazole paypal – https://gpdifluca.com/# purchase forcan online cheap

brand cenforce – https://cenforcers.com/ buy cenforce without prescription

cialis dapoxetine overnight shipment – on this site cialis no prescription overnight delivery

cialis available in walgreens over counter?? – https://strongtadafl.com/# where can i buy cialis online in australia

ranitidine 300mg without prescription – on this site ranitidine sale

viagra sale leeds – buy viagra at cvs cheap legal viagra

Thanks for putting this up. It’s okay done. this

Greetings! Utter productive par‘nesis within this article! It’s the scarcely changes which choice make the largest changes. Thanks a a quantity quest of sharing! amoxil where to buy

Thanks towards putting this up. It’s understandably done. doxycycline for sale online

More posts like this would make the online space more useful. https://prohnrg.com/product/orlistat-pills-di/

This is the stripe of content I enjoy reading. https://aranitidine.com/fr/ivermectine-en-france/

More posts like this would make the online space more useful. https://ondactone.com/simvastatin/

I couldn’t hold back commenting. Warmly written!

https://doxycyclinege.com/pro/spironolactone/

Thanks an eye to sharing. It’s acme quality. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4272498&do=profile

buy dapagliflozin 10mg – dapagliflozin 10mg price order dapagliflozin 10 mg for sale

xenical buy online – how to buy orlistat order xenical 120mg generic