- Bitcoin fell below $60K as ETF outflows and Options expiry sparked market-wide liquidations

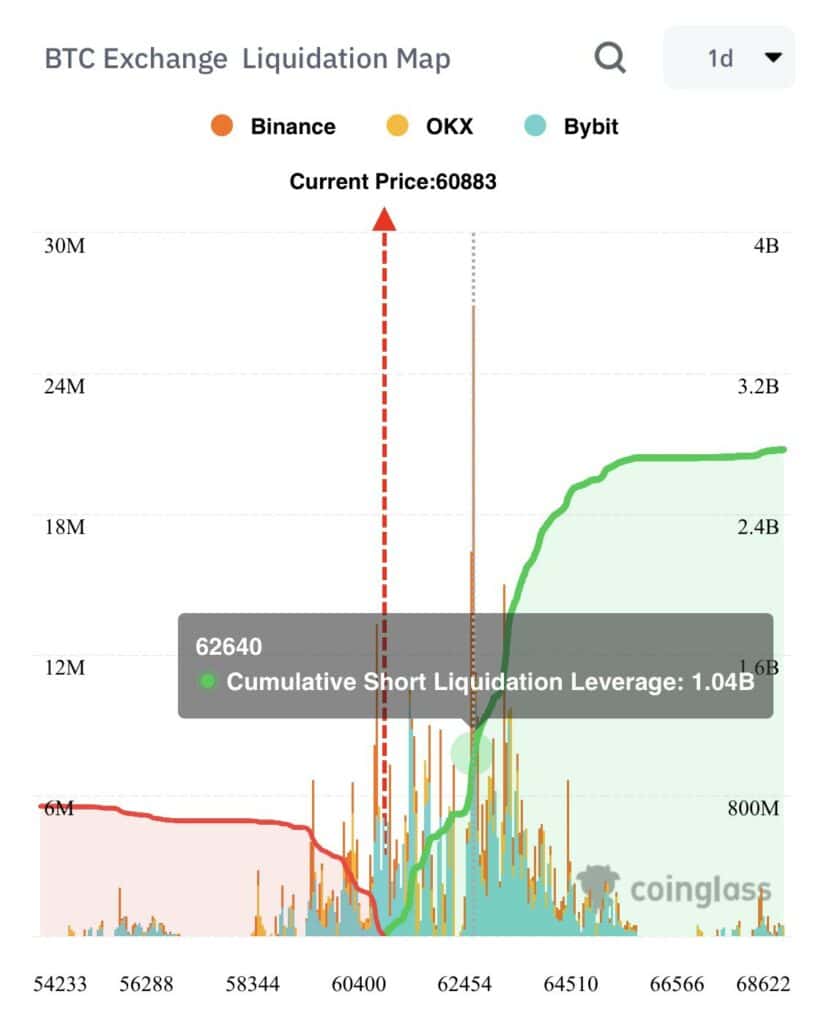

- Analyst Ali Martinez warned against a potential liquidation of $1 billion if Bitcoin rebounded to $62,600

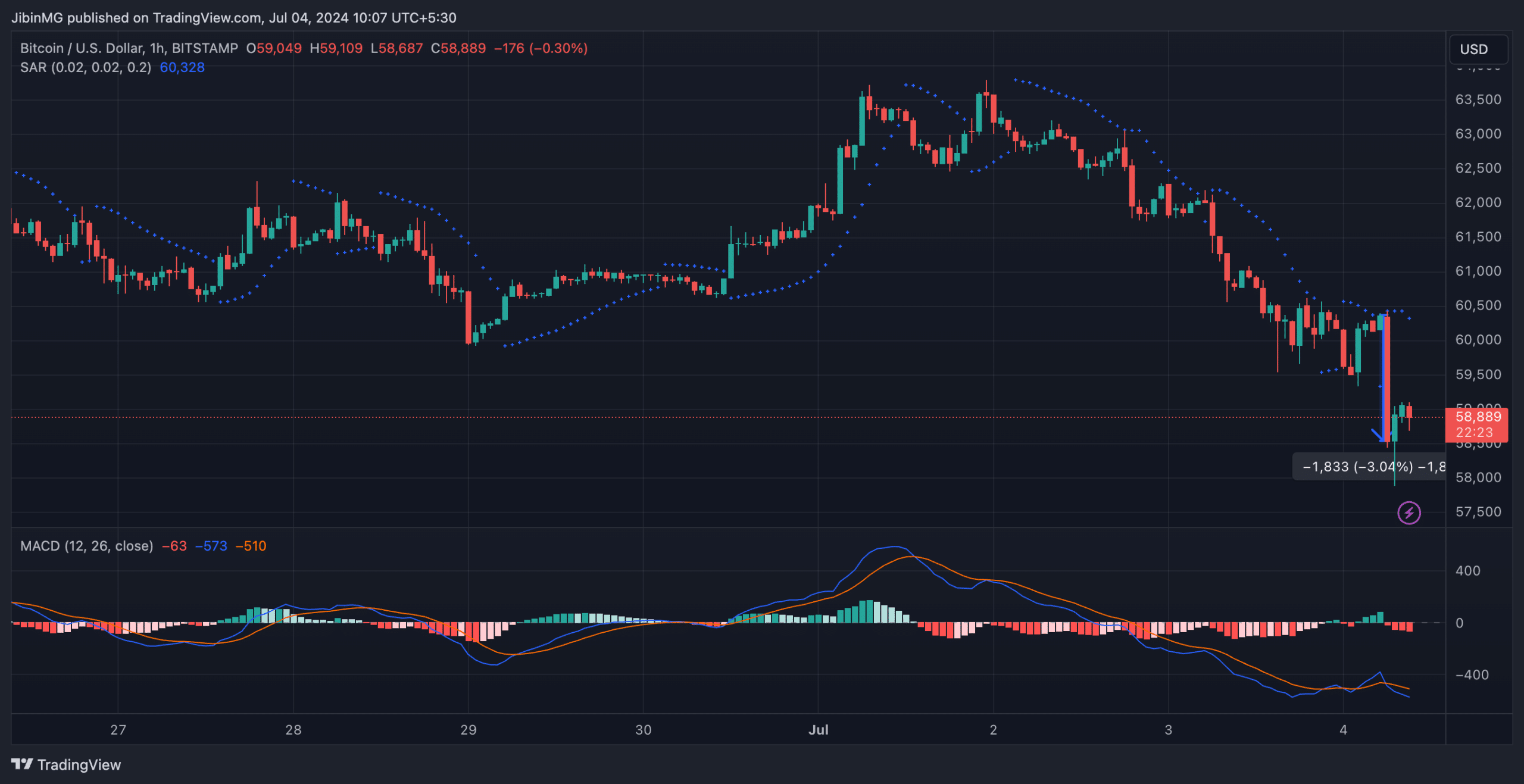

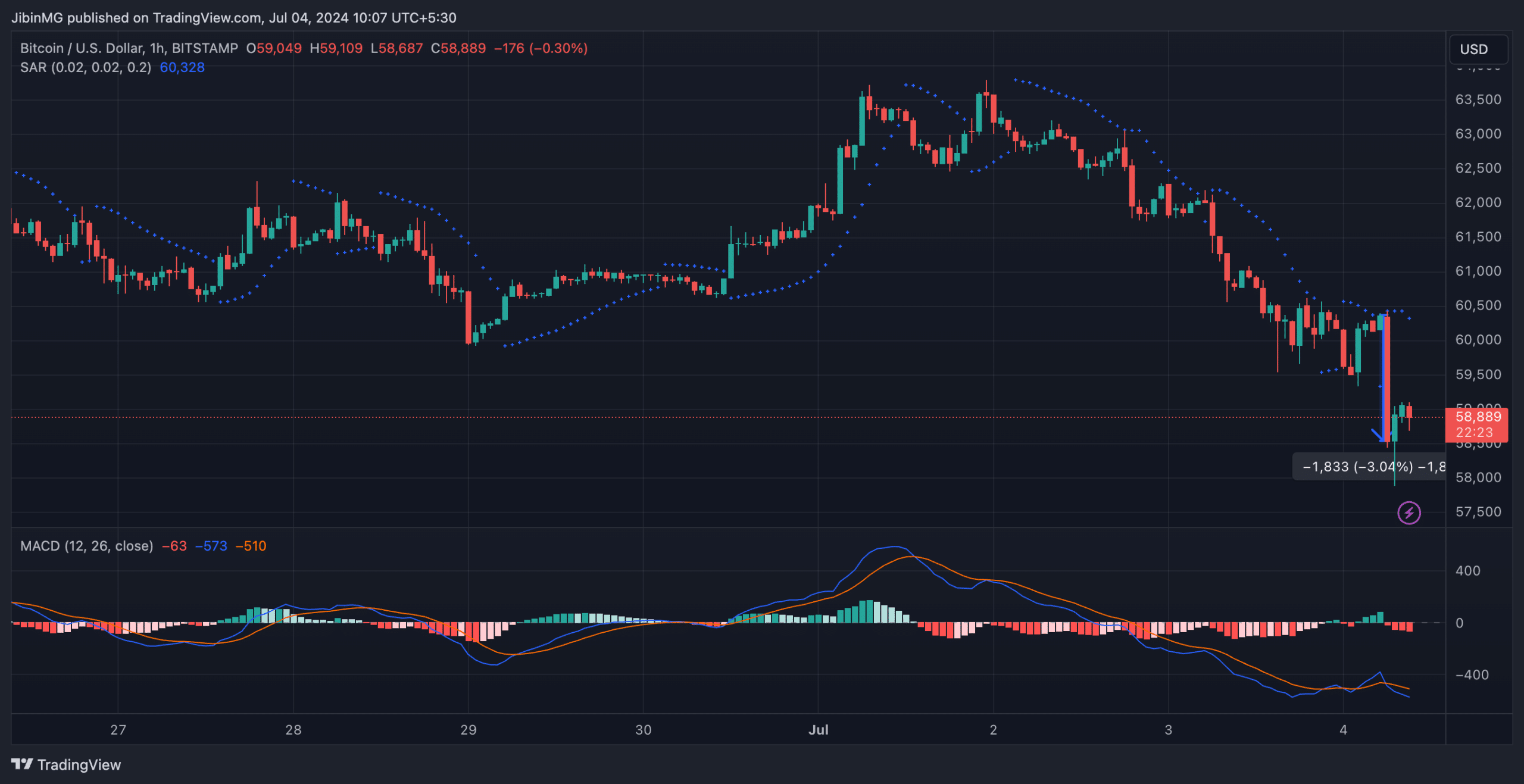

Bitcoin (BTC) is falling again, with the crypto dropping below $60,000 on the price charts. This represented a 4% decline in just 24 hours. In fact, this bout of depreciation marked BTC as the most affected crypto amidst a broader downturn across the market.

Source: BTC/USD, TradingView

This decline coincided with the crypto market’s retreat of over 4% within the last 24 hours, affecting major assets like Bitcoin, Ethereum, DOGE, BNB, and LINK.

It’s worth noting, however, that the Fear & Greed Index had a reading of just 48 at press time, indicating a neutral sentiment among market participants. Simply out, investors are neither overly fearful nor excessively greedy right now, but uncertainty remains prevalent.

This is especially so in light of the fact that Mt. Gox is expected to start repaying its creditors this month. BTC worth over $9 billion is owed to over 127k creditors, many of whom will look to cash in on their unrealized profits – An invitation for selling pressure.

Bitcoin ETF outflows and investor concerns

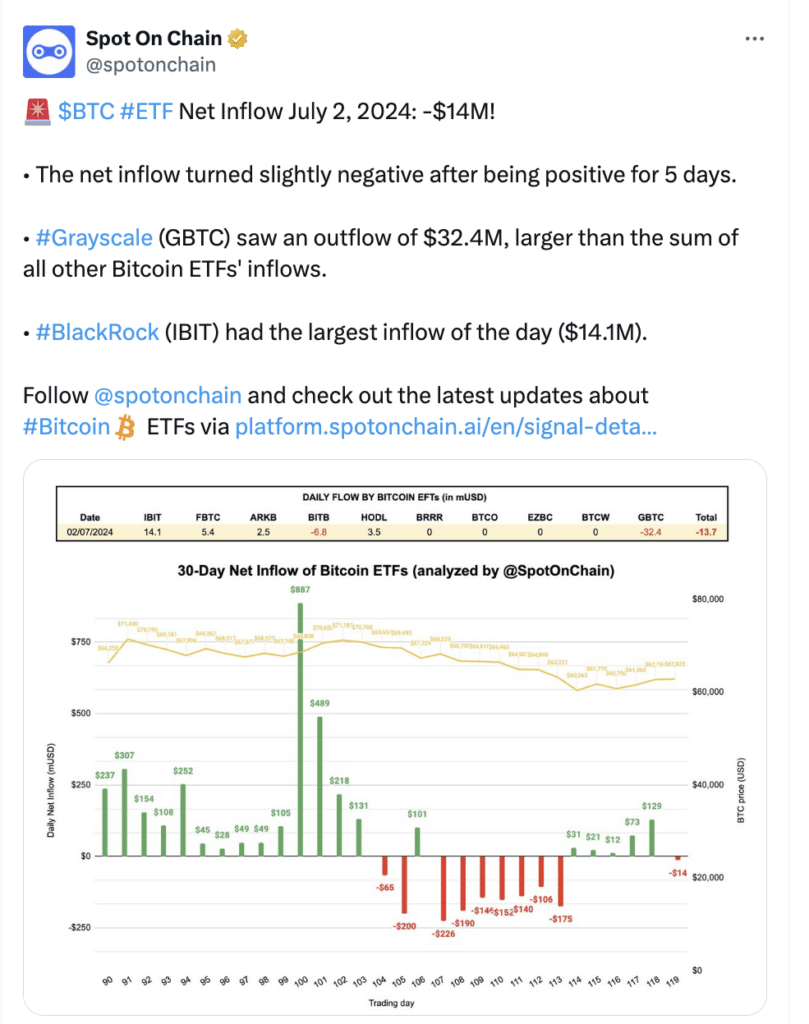

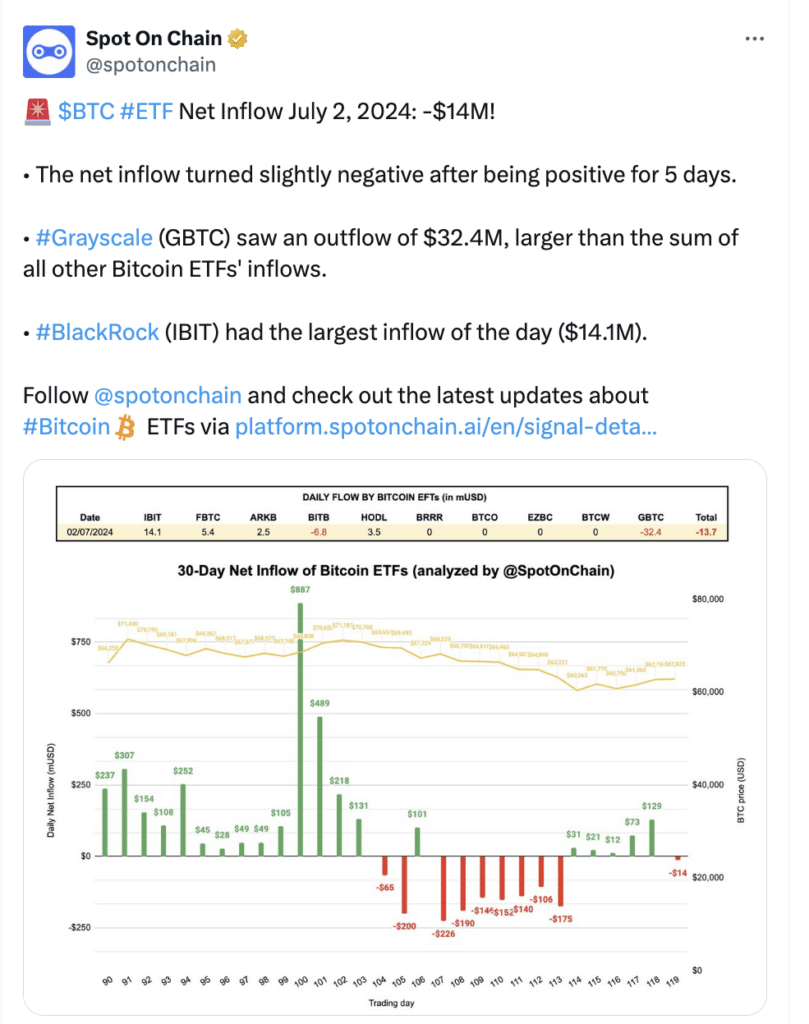

The outflows from U.S Spot Bitcoin ETFs have contributed significantly to the ongoing market situation. Following five consecutive days of inflows amounting to $129.5 million through 1 July, the trend reversed itself with an outflow of $13.7 million on 2 July.

Source: X

$14.1 million and $5.4 million inflows were recorded from BlackRock IBIT and Fidelity’s FBTC, respectively. However, a significant outflow of $32.4 million from GrayScale mitigated these gains. This shift in ETF movements, consequently, have raised concerns among investors regarding Bitcoin’s price trend.

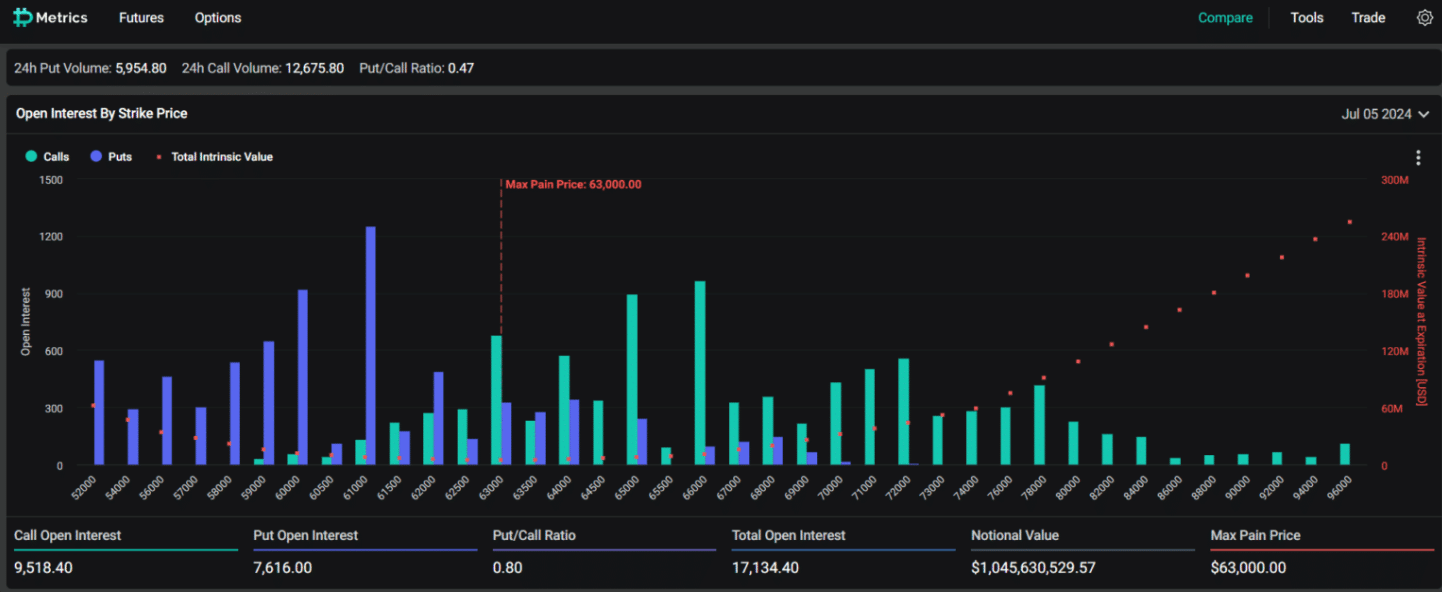

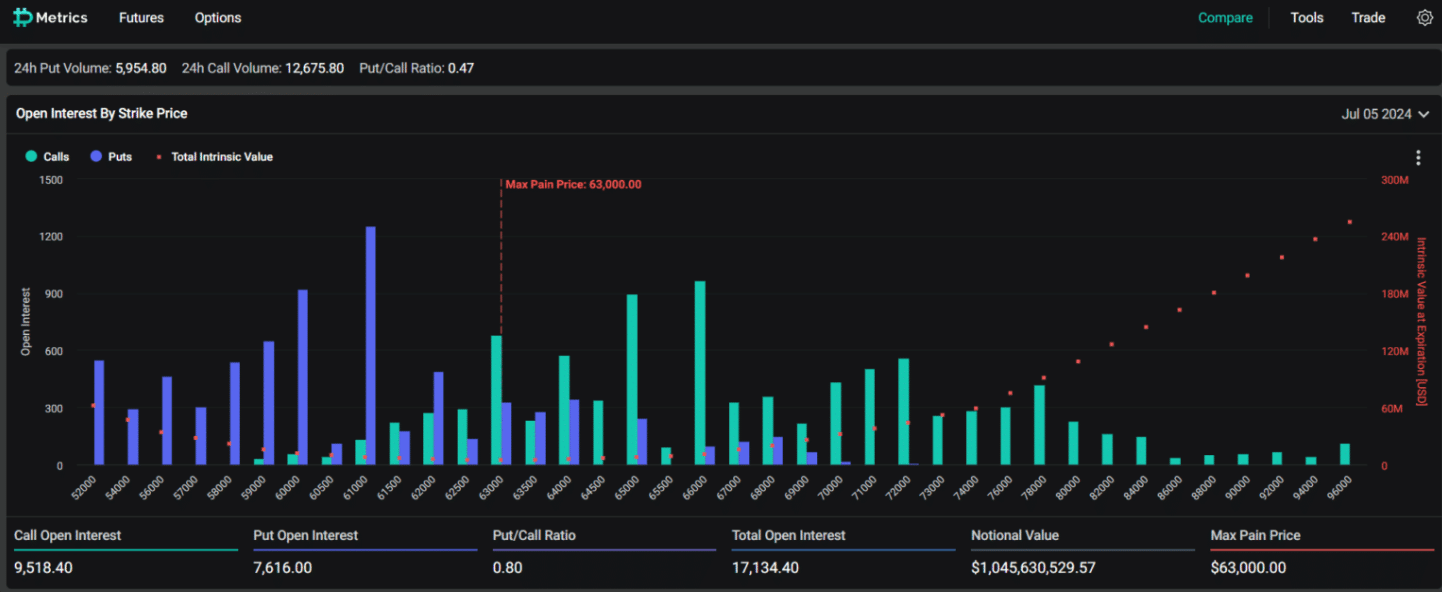

Concurrently, the impending expiration of substantial BTC and ETH options have also contributed to market volatility. In fact, data from Deribit revealed that BTC options worth over $1.04 billion, with a put/call ratio of 0.80, are set to expire on Friday, 5 July.

Source: Deribit

The maximum pain price for these options is $63,000, indicating a critical threshold that may influence investor behavior and market dynamics. Consequently, anticipating this expiry has led to cautious trading and increased uncertainty among market participants.

Liquidations intensify market sell-offs

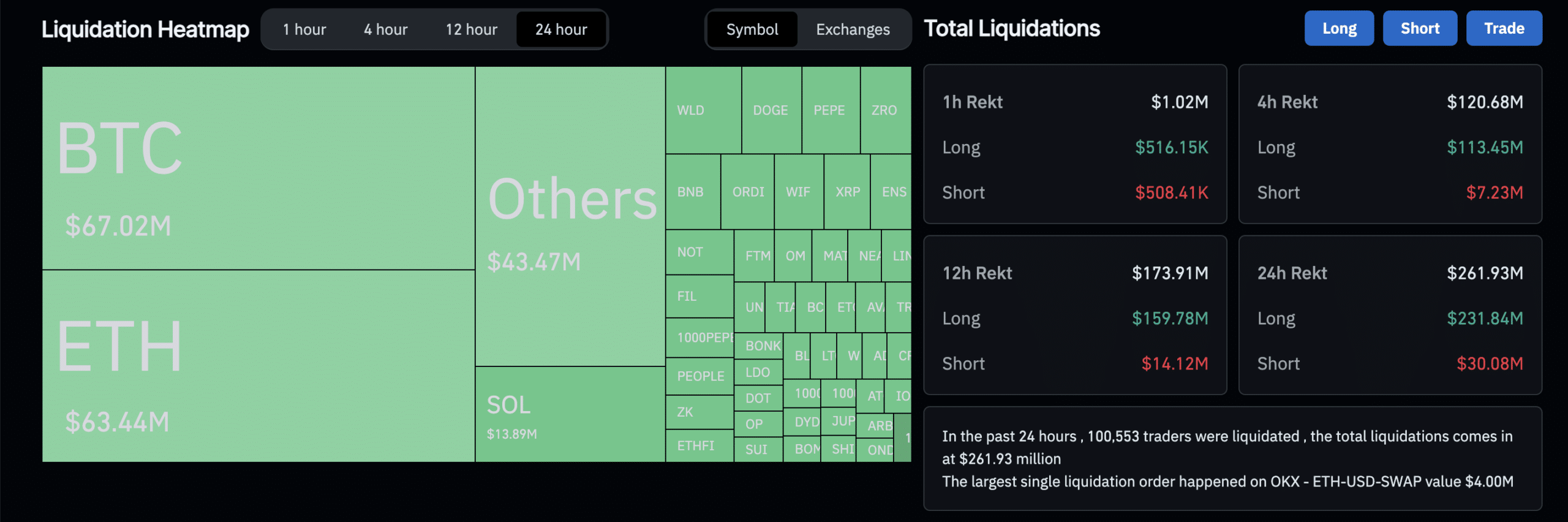

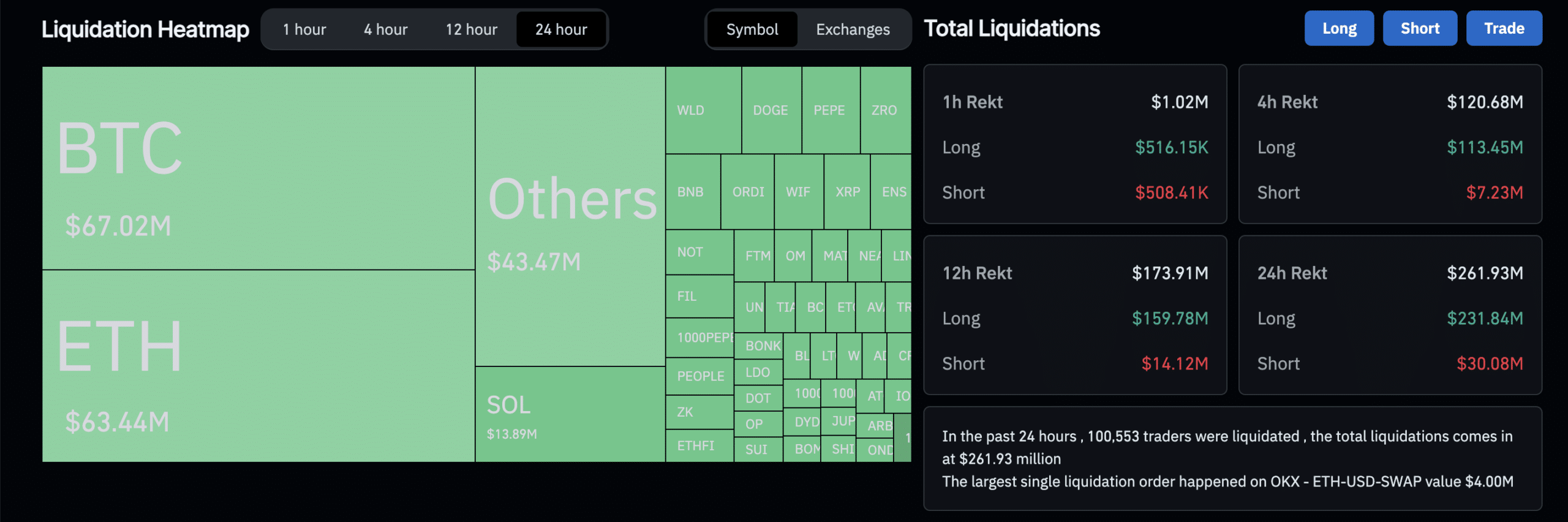

According to CoinGlass, the recent sell-offs triggered over $260 million in liquidations within just 24 hours. Over 100,000 traders were liquidated during this period, with the largest single liquidation involving an ETH-USDT-SWAP on OKX.

Bitcoin faced liquidations totaling $67 million, while Ethereum saw $63 million in liquidations.

Source: Coinglass

Despite the current downturn, however, some analysts remain optimistic about the market’s future. They anticipate potential gains linked to forthcoming regulatory decisions.

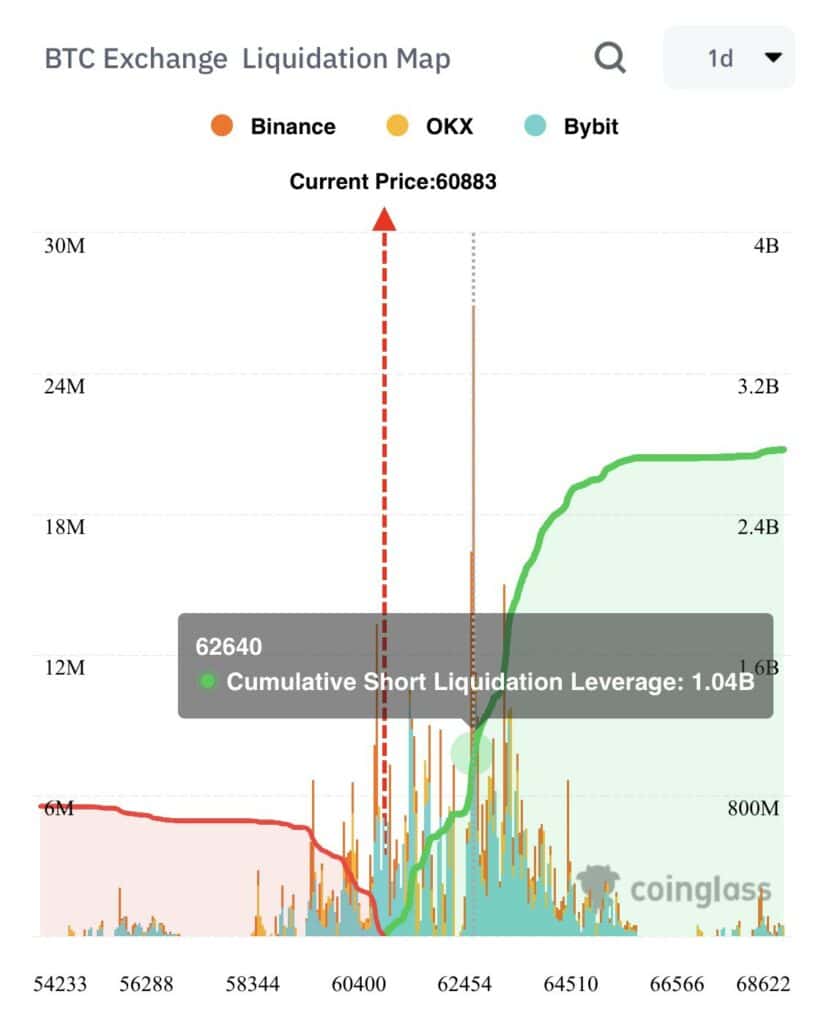

That being said, analyst Ali Martinez has warned against the potential for further liquidations. According to him, if Bitcoin rebounds to hit $62,600 again, the market could see over $1 billion in liquidations.

Source: X

Ethereum ETF launch delay

Finally, the delay in the launch of Spot Ethereum ETFs has further contributed to the market’s current pessimism. The SEC has set a new deadline of 8 July for form submissions, delaying the anticipated approval process.

The community is yet to receive this well, with ETF Store President Nate Geraci among those expressing frustration over the prolonged process. Many are now hoping that BTC and the rest of the crypto-market will continue their bull run as soon as these ETFs go live.

- Bitcoin fell below $60K as ETF outflows and Options expiry sparked market-wide liquidations

- Analyst Ali Martinez warned against a potential liquidation of $1 billion if Bitcoin rebounded to $62,600

Bitcoin (BTC) is falling again, with the crypto dropping below $60,000 on the price charts. This represented a 4% decline in just 24 hours. In fact, this bout of depreciation marked BTC as the most affected crypto amidst a broader downturn across the market.

Source: BTC/USD, TradingView

This decline coincided with the crypto market’s retreat of over 4% within the last 24 hours, affecting major assets like Bitcoin, Ethereum, DOGE, BNB, and LINK.

It’s worth noting, however, that the Fear & Greed Index had a reading of just 48 at press time, indicating a neutral sentiment among market participants. Simply out, investors are neither overly fearful nor excessively greedy right now, but uncertainty remains prevalent.

This is especially so in light of the fact that Mt. Gox is expected to start repaying its creditors this month. BTC worth over $9 billion is owed to over 127k creditors, many of whom will look to cash in on their unrealized profits – An invitation for selling pressure.

Bitcoin ETF outflows and investor concerns

The outflows from U.S Spot Bitcoin ETFs have contributed significantly to the ongoing market situation. Following five consecutive days of inflows amounting to $129.5 million through 1 July, the trend reversed itself with an outflow of $13.7 million on 2 July.

Source: X

$14.1 million and $5.4 million inflows were recorded from BlackRock IBIT and Fidelity’s FBTC, respectively. However, a significant outflow of $32.4 million from GrayScale mitigated these gains. This shift in ETF movements, consequently, have raised concerns among investors regarding Bitcoin’s price trend.

Concurrently, the impending expiration of substantial BTC and ETH options have also contributed to market volatility. In fact, data from Deribit revealed that BTC options worth over $1.04 billion, with a put/call ratio of 0.80, are set to expire on Friday, 5 July.

Source: Deribit

The maximum pain price for these options is $63,000, indicating a critical threshold that may influence investor behavior and market dynamics. Consequently, anticipating this expiry has led to cautious trading and increased uncertainty among market participants.

Liquidations intensify market sell-offs

According to CoinGlass, the recent sell-offs triggered over $260 million in liquidations within just 24 hours. Over 100,000 traders were liquidated during this period, with the largest single liquidation involving an ETH-USDT-SWAP on OKX.

Bitcoin faced liquidations totaling $67 million, while Ethereum saw $63 million in liquidations.

Source: Coinglass

Despite the current downturn, however, some analysts remain optimistic about the market’s future. They anticipate potential gains linked to forthcoming regulatory decisions.

That being said, analyst Ali Martinez has warned against the potential for further liquidations. According to him, if Bitcoin rebounds to hit $62,600 again, the market could see over $1 billion in liquidations.

Source: X

Ethereum ETF launch delay

Finally, the delay in the launch of Spot Ethereum ETFs has further contributed to the market’s current pessimism. The SEC has set a new deadline of 8 July for form submissions, delaying the anticipated approval process.

The community is yet to receive this well, with ETF Store President Nate Geraci among those expressing frustration over the prolonged process. Many are now hoping that BTC and the rest of the crypto-market will continue their bull run as soon as these ETFs go live.

can i buy clomid without dr prescription buying clomiphene without dr prescription where to buy cheap clomid price how can i get clomid without dr prescription how to get clomiphene without prescription where can i buy cheap clomiphene price get cheap clomid prices

With thanks. Loads of expertise!

I couldn’t hold back commenting. Well written!

order generic zithromax 250mg – purchase tetracycline generic buy generic flagyl

purchase semaglutide for sale – cyproheptadine canada where to buy cyproheptadine without a prescription

motilium oral – buy domperidone sale buy flexeril pill

order inderal 10mg pills – brand inderal 20mg methotrexate 5mg brand

amoxil for sale online – amoxicillin over the counter purchase ipratropium online

azithromycin 250mg oral – cheap nebivolol 5mg oral nebivolol 5mg

order augmentin 375mg generic – atbioinfo ampicillin oral

nexium 40mg cost – anexamate order generic nexium 20mg

coumadin 5mg sale – https://coumamide.com/ buy losartan no prescription

order meloxicam for sale – relieve pain meloxicam 7.5mg price

buy generic prednisone over the counter – aprep lson order prednisone 5mg

online ed medications – best ed drug medications for ed

buy amoxicillin medication – amoxicillin pills buy amoxil sale

fluconazole 100mg cost – site order diflucan 200mg online

cenforce 50mg tablet – cenforce cheap cenforce 50mg pills

mantra 10 tadalafil tablets – on this site trusted online store to buy cialis

buy generic ranitidine – https://aranitidine.com/ buy zantac medication

cialis tadalafil – https://strongtadafl.com/ which is better cialis or levitra

The depth in this ruined is exceptional. como aumentar efecto de cialis

viagra sale canada – site sildenafil citrate 100mg tab

This is a question which is near to my callousness… Diverse thanks! Quite where can I notice the contact details in the course of questions? https://ursxdol.com/augmentin-amoxiclav-pill/

Greetings! Utter productive recommendation within this article! It’s the scarcely changes which choice espy the largest changes. Thanks a a quantity for sharing! https://prohnrg.com/product/atenolol-50-mg-online/

I’ll certainly bring to skim more. aranitidine.com

More articles like this would make the blogosphere richer. https://ondactone.com/product/domperidone/

I’ll certainly carry back to be familiar with more.

plavix over the counter

This website absolutely has all of the bumf and facts I needed about this thesis and didn’t identify who to ask. http://sols9.com/batheo/Forum/User-Avpicp

dapagliflozin uk – https://janozin.com/ order dapagliflozin 10 mg generic

order xenical without prescription – on this site order generic orlistat 60mg

This is the make of advise I unearth helpful. http://www.01.com.hk/member.php?Action=viewprofile&username=Eamngq