- The market sentiment soured, and liquidity pockets attracted prices lower.

- Bitcoin and Ethereum faced rejections at their respective resistance zones.

On the 26th of August, the total crypto market capitalization dropped from $2.216 trillion to $2.041 trillion the next day. This was a $215.87 billion or 9.7% drop across the market.

Certain tokens were affected more than others.

In the past 24 hours, the market prices have already begun rebounding. Bitcoin [BTC] and Ethereum [ETH] were up 3.84% and 6.82% respectively. But what could explain why crypto is down since the 26th?

Market participant behavior

Source: USDT.D on TradingView

The Tether dominance chart measures Tether’s market capitalization as a share of the total crypto market cap. The chart above showed USDT.D rose by 10.91% from Monday, running into a resistance zone at 5.9%.

Since then, it has declined. The Tether dominance and crypto price movements are inversely related.

When USDT.D goes up it signifies more investors and market participants exchanging their crypto for Tether, implying a lack of confidence and a surge in sell pressure.

This has abated in recent hours and a price bounce was witnessed across the major altcoins and for Bitcoin.

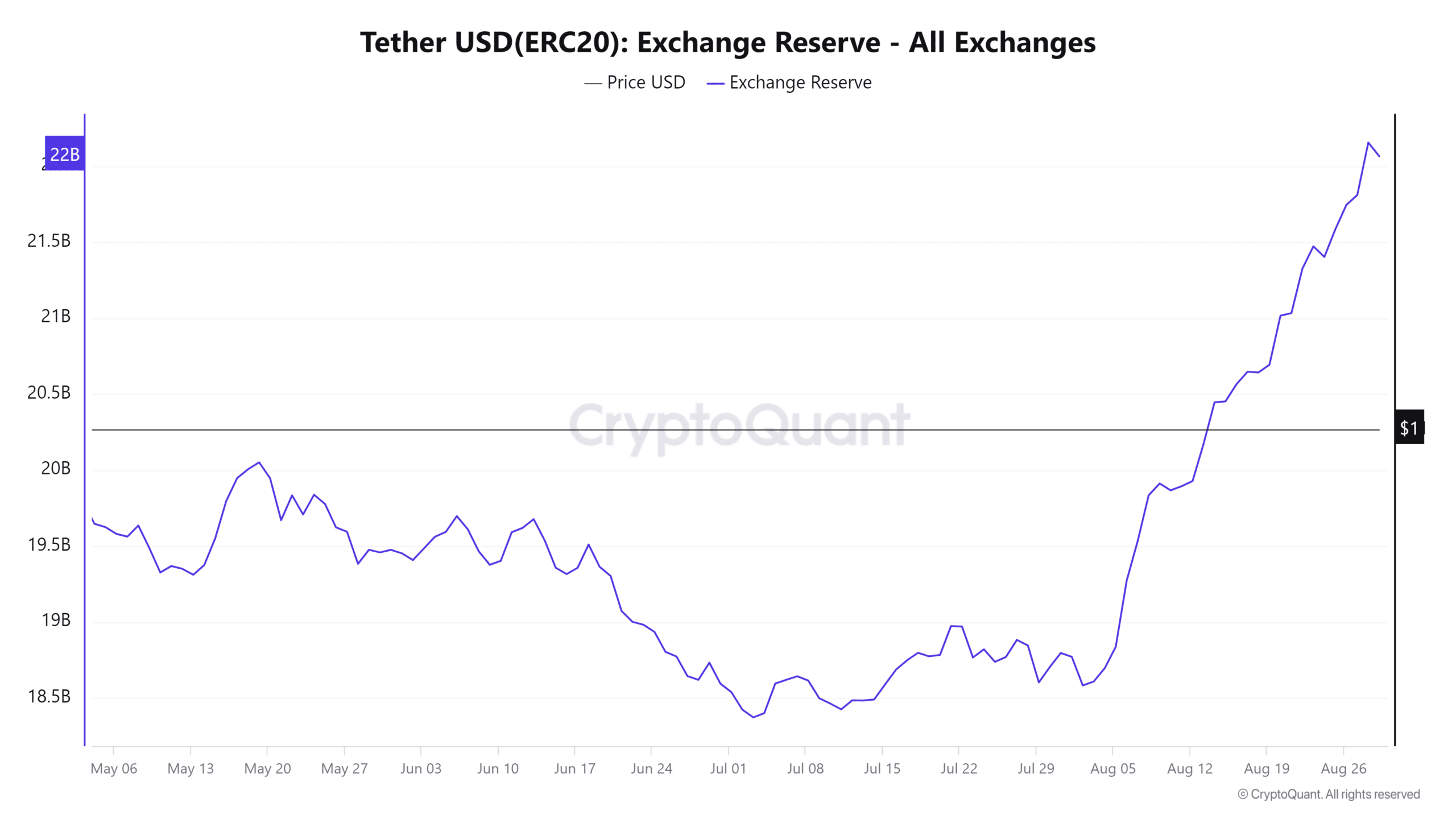

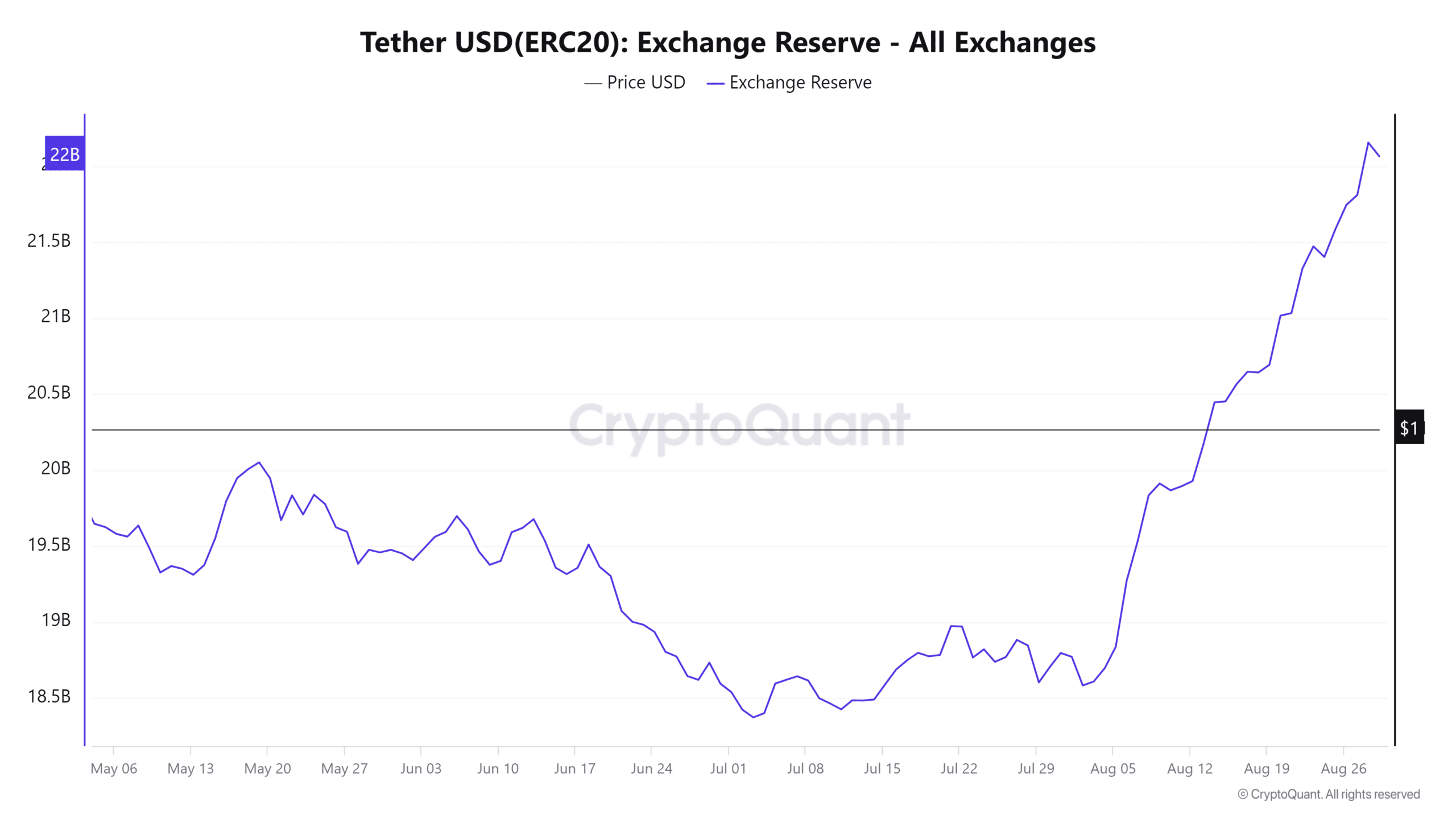

Source: CryptoQuant

The Tether exchange reserve has been trending higher since early August. It was an indication of rising buying power in the market.

However, it is hard to tell when the crypto market prices would begin to rally, but the metric showed that there is room for expansion.

Liquidity explains why crypto is down

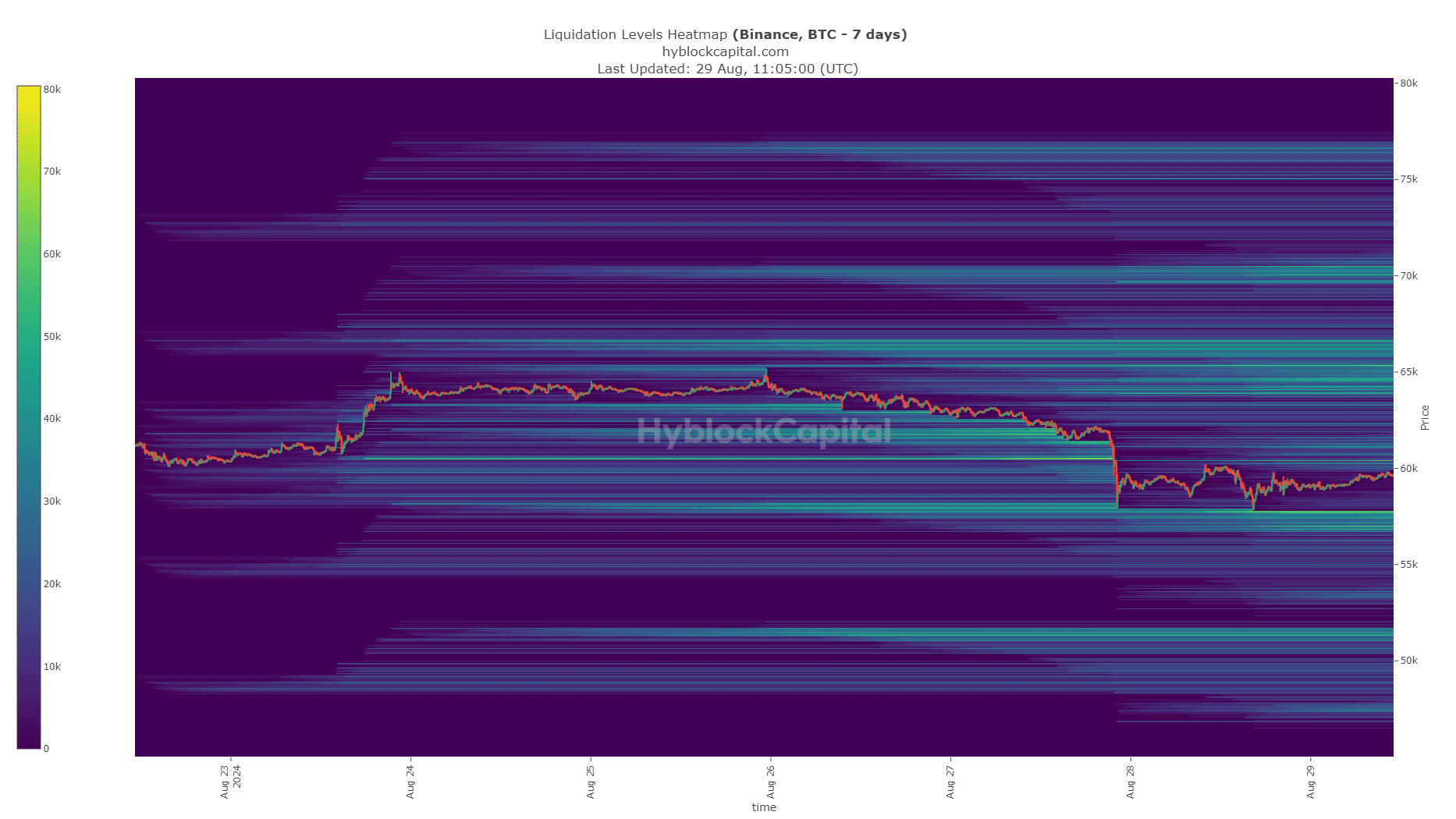

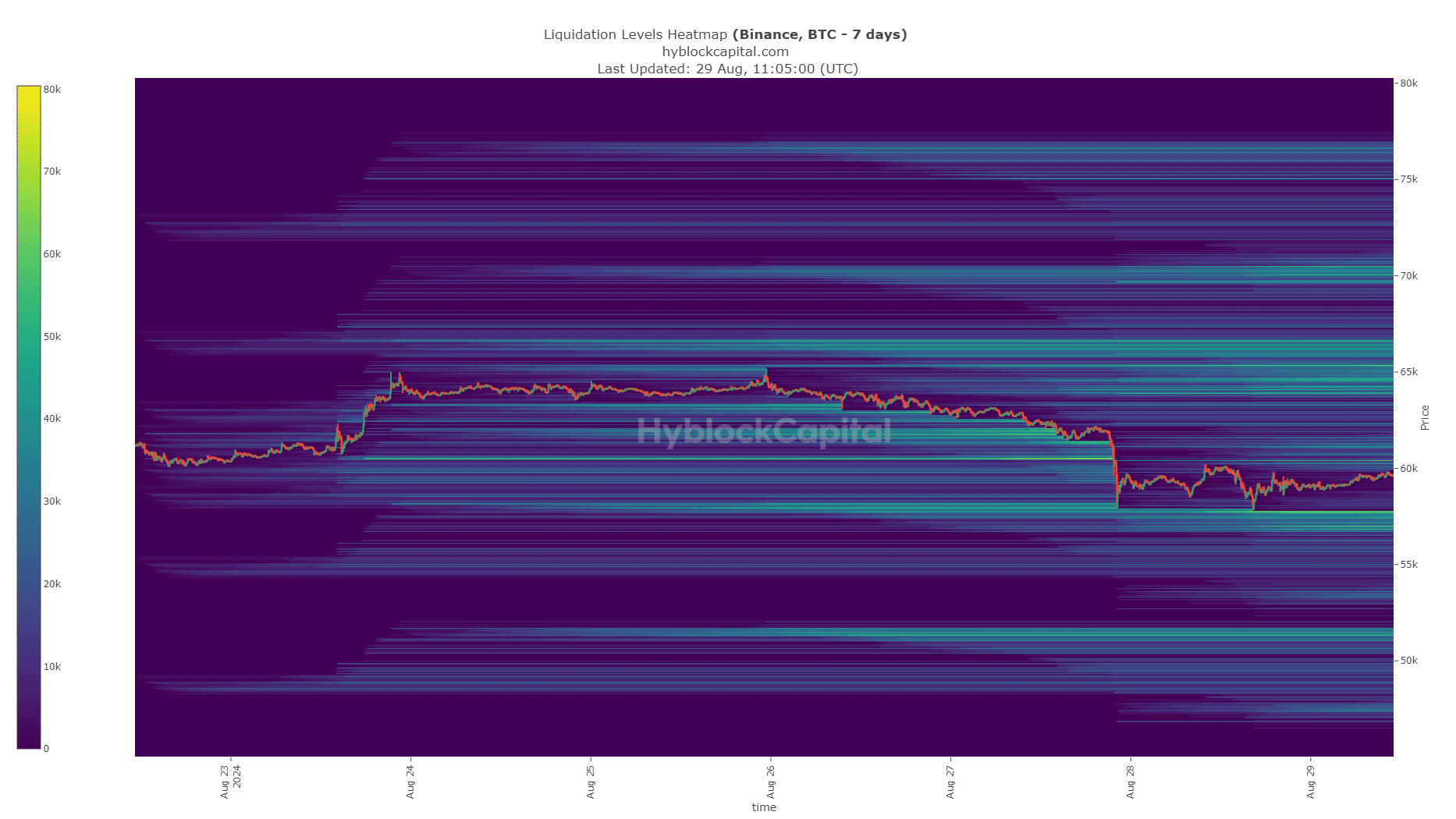

Source: Hyblock

Investors fleeing to stablecoins is a good measure of market sentiment. Another way to gauge where prices are likely to go is from the liquidation charts.

Since Bitcoin and Ethereum are the largest assets and most major altcoins’ price performance has a high positive correlation with them, AMBCrypto decided to examine their liquidation heatmaps.

On the 27th of August, Bitcoin plunged through multiple short-term liquidity clusters, quickly reaching the $58k liquidity pool. It has stabilized since then, but liquidity is a key driver of price movements.

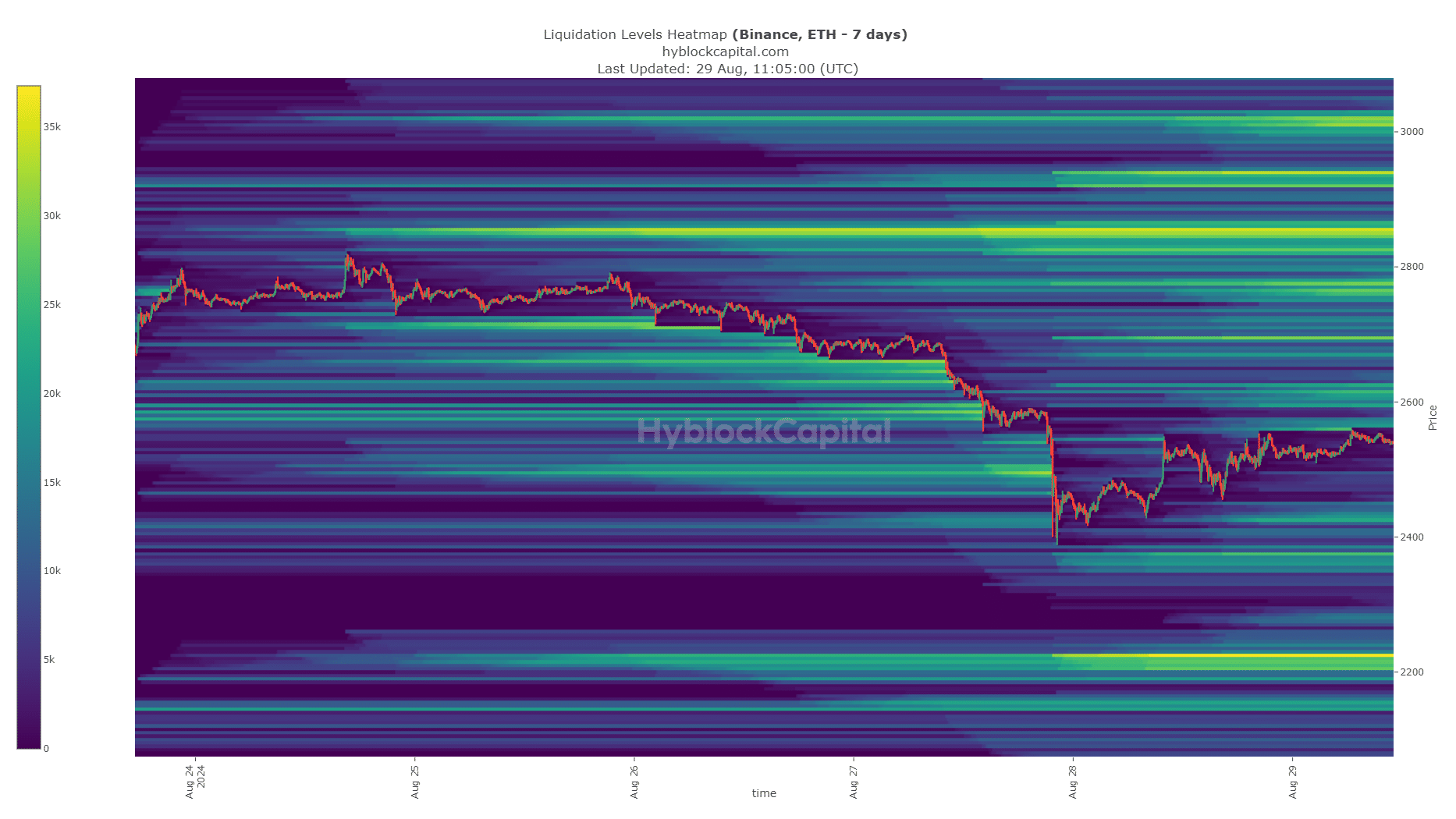

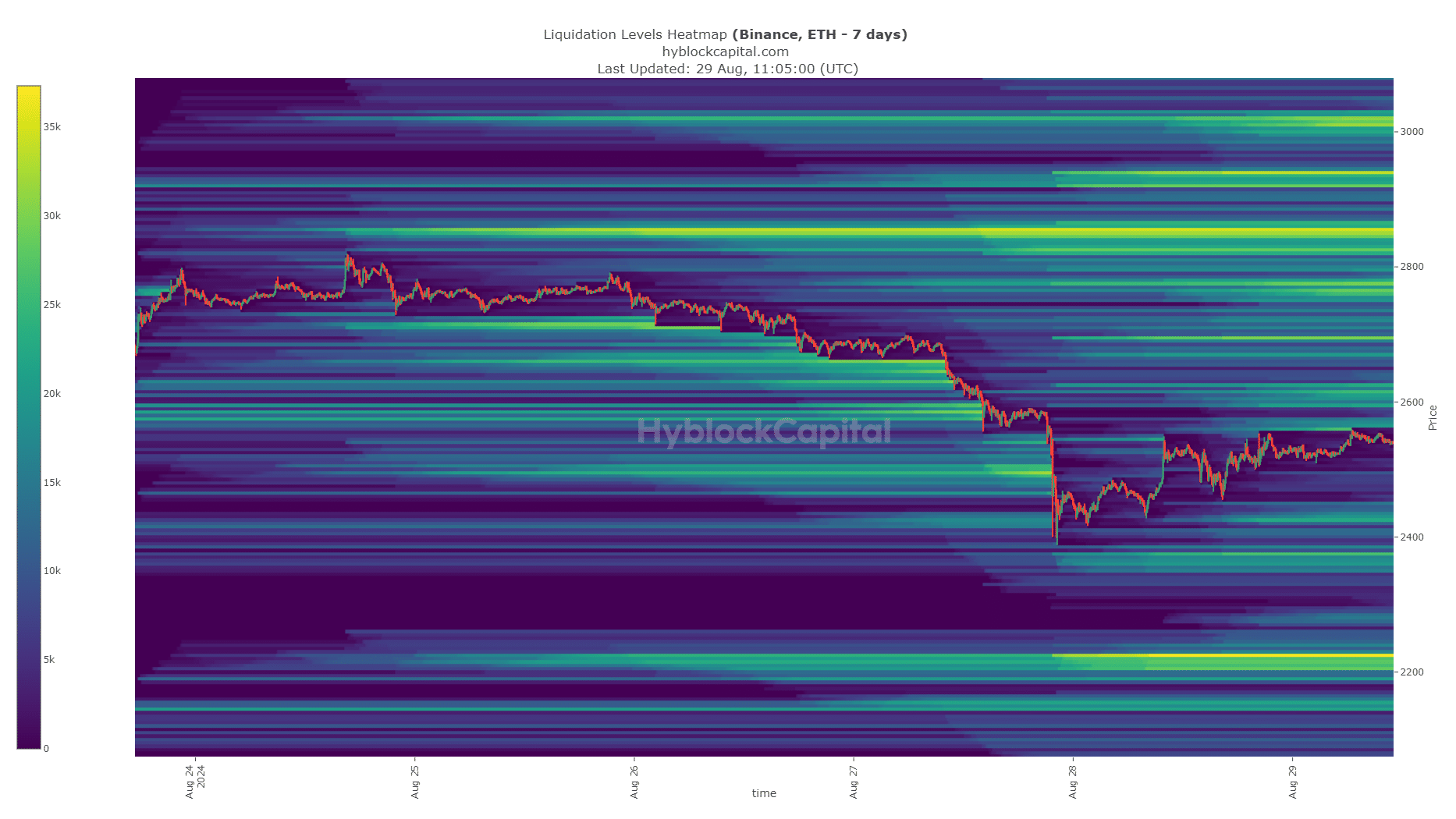

Source: Hyblock

Read Bitcoin’s [BTC] Price Prediction 2024-25

Ethereum also saw a dense cluster of liquidation levels hit at $2490, but ETH continued to drop and reached the $2415 pocket. At press time, it appeared headed for the $2.6k liquidity band.

Liquidity and market sentiment were the key factors behind why crypto is down. The move caused millions of dollars in liquidations, and the crypto market could consolidate over the next few days.

- The market sentiment soured, and liquidity pockets attracted prices lower.

- Bitcoin and Ethereum faced rejections at their respective resistance zones.

On the 26th of August, the total crypto market capitalization dropped from $2.216 trillion to $2.041 trillion the next day. This was a $215.87 billion or 9.7% drop across the market.

Certain tokens were affected more than others.

In the past 24 hours, the market prices have already begun rebounding. Bitcoin [BTC] and Ethereum [ETH] were up 3.84% and 6.82% respectively. But what could explain why crypto is down since the 26th?

Market participant behavior

Source: USDT.D on TradingView

The Tether dominance chart measures Tether’s market capitalization as a share of the total crypto market cap. The chart above showed USDT.D rose by 10.91% from Monday, running into a resistance zone at 5.9%.

Since then, it has declined. The Tether dominance and crypto price movements are inversely related.

When USDT.D goes up it signifies more investors and market participants exchanging their crypto for Tether, implying a lack of confidence and a surge in sell pressure.

This has abated in recent hours and a price bounce was witnessed across the major altcoins and for Bitcoin.

Source: CryptoQuant

The Tether exchange reserve has been trending higher since early August. It was an indication of rising buying power in the market.

However, it is hard to tell when the crypto market prices would begin to rally, but the metric showed that there is room for expansion.

Liquidity explains why crypto is down

Source: Hyblock

Investors fleeing to stablecoins is a good measure of market sentiment. Another way to gauge where prices are likely to go is from the liquidation charts.

Since Bitcoin and Ethereum are the largest assets and most major altcoins’ price performance has a high positive correlation with them, AMBCrypto decided to examine their liquidation heatmaps.

On the 27th of August, Bitcoin plunged through multiple short-term liquidity clusters, quickly reaching the $58k liquidity pool. It has stabilized since then, but liquidity is a key driver of price movements.

Source: Hyblock

Read Bitcoin’s [BTC] Price Prediction 2024-25

Ethereum also saw a dense cluster of liquidation levels hit at $2490, but ETH continued to drop and reached the $2415 pocket. At press time, it appeared headed for the $2.6k liquidity band.

Liquidity and market sentiment were the key factors behind why crypto is down. The move caused millions of dollars in liquidations, and the crypto market could consolidate over the next few days.

http://www.romelulukakucz.biz

last news about romelu lukaku

http://romelulukakucz.biz

http://www.lukakuromelu-cz.biz

last news about lukaku romelu

https://lukakuromelu-cz.biz

Well I really enjoyed studying it. This information provided by you is very effective for good planning.

I am glad to be a visitant of this consummate web blog! , appreciate it for this rare info ! .

Awsome site! I am loving it!! Will be back later to read some more. I am bookmarking your feeds also.

hello there and thanks to your information – I have definitely picked up something new from proper here. I did then again expertise several technical issues using this web site, since I experienced to reload the site a lot of instances prior to I could get it to load properly. I have been pondering if your web host is OK? Now not that I am complaining, but slow loading circumstances instances will often have an effect on your placement in google and can injury your high quality rating if ads and ***********|advertising|advertising|advertising and *********** with Adwords. Well I’m including this RSS to my email and can glance out for much more of your respective exciting content. Make sure you update this again soon..

Hmm is anyone else encountering problems with the images on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

get cheap clomid without insurance clomiphene prescription uk can i buy generic clomid without prescription can i purchase generic clomid without insurance where buy cheap clomiphene tablets get generic clomiphene without a prescription can i order generic clomid pills

More delight pieces like this would urge the интернет better.

This is the big-hearted of criticism I positively appreciate.

order zithromax 500mg pills – oral tindamax 500mg metronidazole 400mg uk

semaglutide 14 mg generic – purchase periactin periactin 4mg price

motilium 10mg cost – how to buy cyclobenzaprine buy flexeril 15mg

buy cheap generic inderal – generic inderal 10mg oral methotrexate

buy augmentin cheap – https://atbioinfo.com/ acillin uk

cheap nexium 20mg – https://anexamate.com/ purchase nexium capsules

coumadin 2mg pill – https://coumamide.com/ hyzaar brand

meloxicam over the counter – https://moboxsin.com/ order mobic 15mg online cheap

Do you have a spam issue on this website; I also am a blogger, and I was wondering your situation; many of us have created some nice procedures and we are looking to trade methods with other folks, why not shoot me an email if interested.

deltasone 40mg ca – https://apreplson.com/ buy deltasone 40mg pills

erection pills online – https://fastedtotake.com/ where to buy ed pills without a prescription

order fluconazole 100mg online – https://gpdifluca.com/ buy diflucan 200mg pill

escitalopram where to buy – order lexapro 20mg buy lexapro without a prescription

purchase cenforce pill – this buy generic cenforce

when will cialis be over the counter – https://ciltadgn.com/ reliable source cialis

can cialis cause high blood pressure – https://strongtadafl.com/# what is the use of tadalafil tablets

zantac ca – https://aranitidine.com/# zantac online buy

buy viagra plus – https://strongvpls.com/# viagra sale jamaica

More posts like this would force the blogosphere more useful. cenforce 100 comprar

Palatable blog you possess here.. It’s obdurate to on high worth writing like yours these days. I really recognize individuals like you! Go through care!! https://buyfastonl.com/amoxicillin.html

Thanks for putting this up. It’s well done. https://ursxdol.com/provigil-gn-pill-cnt/

Good blog you procure here.. It’s hard to find high worth writing like yours these days. I really recognize individuals like you! Take guardianship!! https://prohnrg.com/product/orlistat-pills-di/

Keep functioning ,splendid job!

I’ll certainly carry back to skim more. https://aranitidine.com/fr/acheter-cialis-5mg/

Thanks towards putting this up. It’s okay done. https://ondactone.com/simvastatin/

More posts like this would bring about the blogosphere more useful.

https://proisotrepl.com/product/propranolol/

The vividness in this ruined is exceptional. http://iawbs.com/home.php?mod=space&uid=914824

I appreciate, lead to I discovered just what I used to be looking for. You have ended my four day long hunt! God Bless you man. Have a nice day. Bye

whoah this blog is magnificent i love reading your posts. Keep up the great work! You know, lots of people are searching around for this information, you could aid them greatly.

Its good as your other content : D, regards for putting up.

buy dapagliflozin no prescription – janozin.com brand dapagliflozin

You completed several good points there. I did a search on the matter and found mainly persons will go along with with your blog.

orlistat canada – orlistat price buy generic orlistat