- Why is Bitcoin up today is a question many investors ask as the asset consistently hits new all-time highs

- Growing adoption and increased active addresses further drive BTC’s price momentum amid market expansion.

Bitcoin’s [BTC] recent surge continues to capture market attention as it achieves unprecedented price levels. The leading cryptocurrency has maintained a strong bullish momentum over the past week, climbing 21.7% and repeatedly breaking its all-time high.

Bitcoin reached a peak of $93,477 on 13th November, before experiencing a minor correction. Trading at $91,079 at press time, the price marks a 2.8% drop from its highest point. Despite this slight decline, Bitcoin remains up by 4.4% on the day.

This price surge has significantly boosted Bitcoin’s market capitalization, pushing it to a valuation of approximately $1.80 trillion and solidifying its position among the world’s largest assets.

The broader crypto market has also benefited, with the global market cap increasing by 3.6% to exceed $3.15 trillion.

Another noteworthy aspect of Bitcoin’s recent surge is its daily trading volume, which has jumped from under $80 billion last week to over $124 billion at press time.

The increased volume signifies heightened activity and interest from investors worldwide, raising many questions.

Why is Bitcoin up today?

One of the driving forces behind Bitcoin’s price surge is the belief that a new bull run cycle is underway. This sentiment has been boosted by the recent victory of Donald Trump as the 47th president of the United States.

As a pro-Bitcoin advocate, Trump has made various campaign promises supporting cryptocurrency, including the potential creation of a BTC national reserve. His perceived support for the crypto sector has generated optimism within the community, prompting a surge in investment activity.

This expectation of more favorable crypto policies and regulatory clarity under Trump’s leadership has drawn both institutional and retail investors to BTC, contributing to its recent gains.

Moreover, broader adoption in the crypto market has also played a role.

A notable development is BlackRock’s expansion into the crypto space through its BUIDL Fund, which now spans five different blockchains, including Aptos, Arbitrum, Avalanche, OP Mainnet (formerly Optimism), and Polygon.

This move by one of the world’s largest asset managers further validates the growth and acceptance of digital assets, including Bitcoin. It reflects the rising mainstream confidence in cryptocurrencies, reinforcing market momentum and drawing in additional investment.

Market metrics

Several key Bitcoin metrics have also demonstrated positive trends, supporting the recent price increase while also giving an answer to the question “why is Bitcoin up today”.

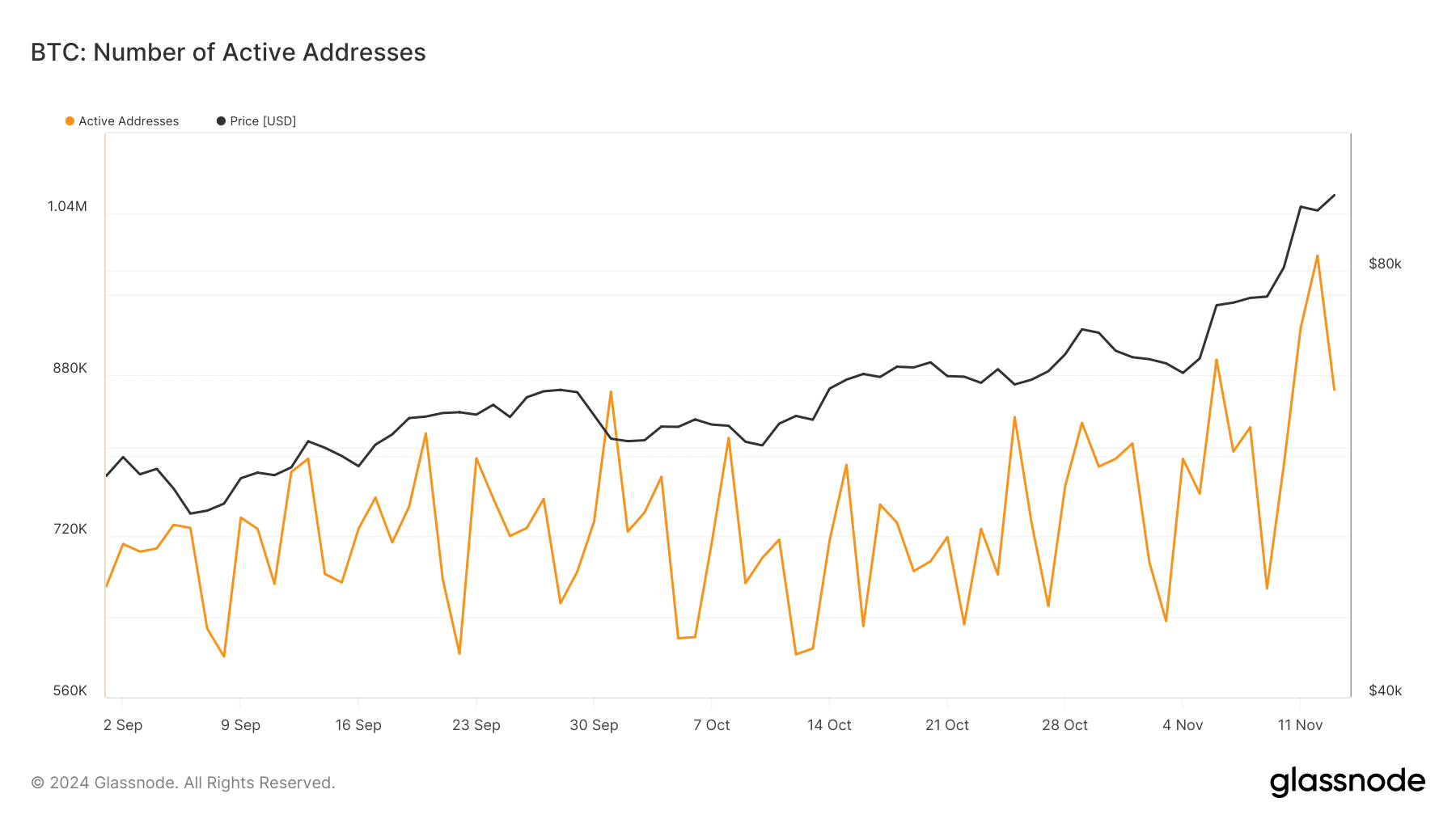

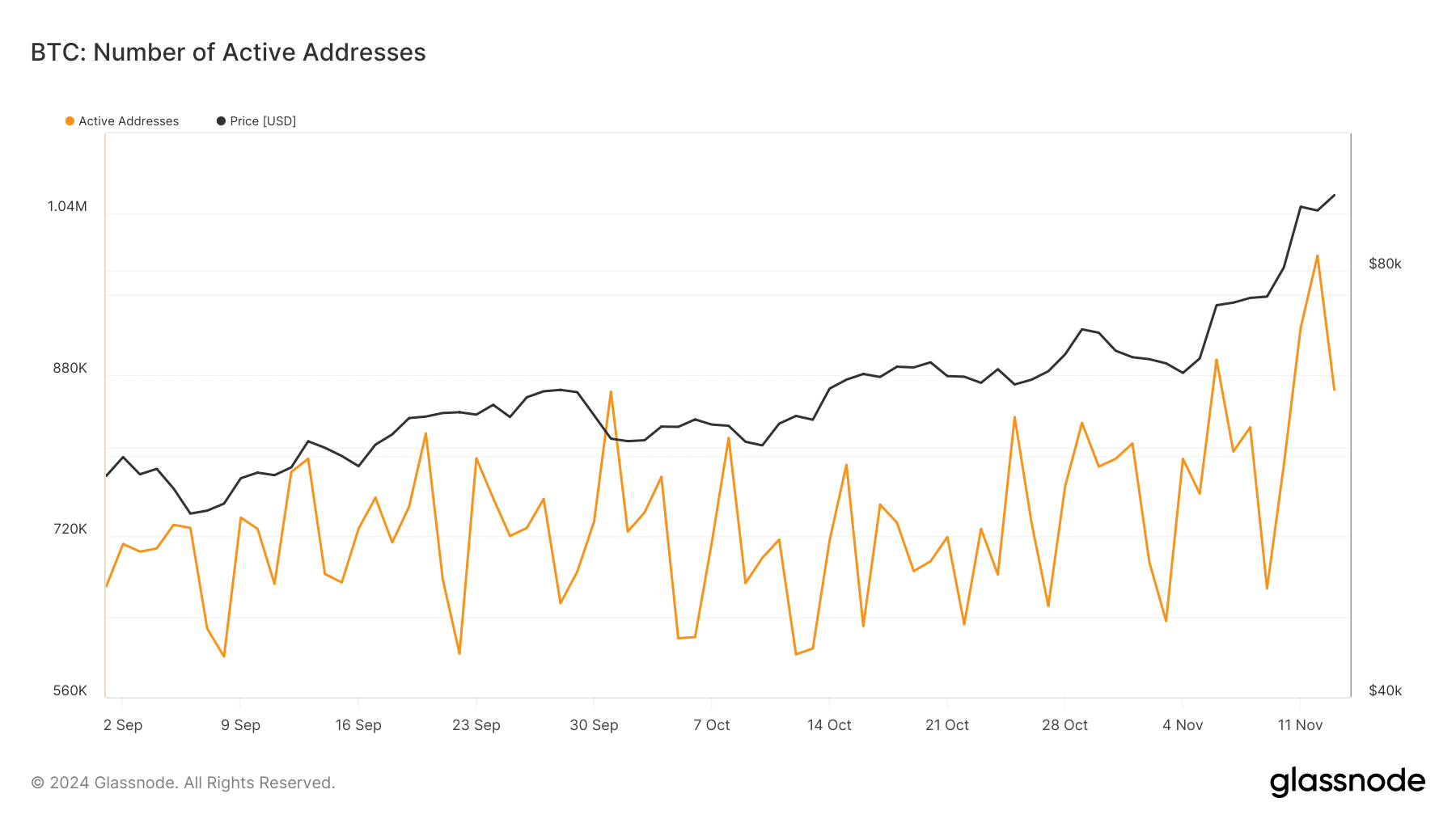

Data from Glassnode reveals a surge in Bitcoin’s number of active addresses, which serves as a gauge of retail interest and market activity.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As of 12th November, active addresses reached a high of 998,000 before slightly declining to 865,000 on 13th November. This represents a significant rise from the levels seen last month when active addresses fell below 700,000.

The increase in active addresses indicates growing retail participation, suggesting heightened interest and demand for BTC.

- Why is Bitcoin up today is a question many investors ask as the asset consistently hits new all-time highs

- Growing adoption and increased active addresses further drive BTC’s price momentum amid market expansion.

Bitcoin’s [BTC] recent surge continues to capture market attention as it achieves unprecedented price levels. The leading cryptocurrency has maintained a strong bullish momentum over the past week, climbing 21.7% and repeatedly breaking its all-time high.

Bitcoin reached a peak of $93,477 on 13th November, before experiencing a minor correction. Trading at $91,079 at press time, the price marks a 2.8% drop from its highest point. Despite this slight decline, Bitcoin remains up by 4.4% on the day.

This price surge has significantly boosted Bitcoin’s market capitalization, pushing it to a valuation of approximately $1.80 trillion and solidifying its position among the world’s largest assets.

The broader crypto market has also benefited, with the global market cap increasing by 3.6% to exceed $3.15 trillion.

Another noteworthy aspect of Bitcoin’s recent surge is its daily trading volume, which has jumped from under $80 billion last week to over $124 billion at press time.

The increased volume signifies heightened activity and interest from investors worldwide, raising many questions.

Why is Bitcoin up today?

One of the driving forces behind Bitcoin’s price surge is the belief that a new bull run cycle is underway. This sentiment has been boosted by the recent victory of Donald Trump as the 47th president of the United States.

As a pro-Bitcoin advocate, Trump has made various campaign promises supporting cryptocurrency, including the potential creation of a BTC national reserve. His perceived support for the crypto sector has generated optimism within the community, prompting a surge in investment activity.

This expectation of more favorable crypto policies and regulatory clarity under Trump’s leadership has drawn both institutional and retail investors to BTC, contributing to its recent gains.

Moreover, broader adoption in the crypto market has also played a role.

A notable development is BlackRock’s expansion into the crypto space through its BUIDL Fund, which now spans five different blockchains, including Aptos, Arbitrum, Avalanche, OP Mainnet (formerly Optimism), and Polygon.

This move by one of the world’s largest asset managers further validates the growth and acceptance of digital assets, including Bitcoin. It reflects the rising mainstream confidence in cryptocurrencies, reinforcing market momentum and drawing in additional investment.

Market metrics

Several key Bitcoin metrics have also demonstrated positive trends, supporting the recent price increase while also giving an answer to the question “why is Bitcoin up today”.

Data from Glassnode reveals a surge in Bitcoin’s number of active addresses, which serves as a gauge of retail interest and market activity.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As of 12th November, active addresses reached a high of 998,000 before slightly declining to 865,000 on 13th November. This represents a significant rise from the levels seen last month when active addresses fell below 700,000.

The increase in active addresses indicates growing retail participation, suggesting heightened interest and demand for BTC.

Турецкие сериалы смотреть на kinosklad.net

Посетите самый большой реальный склад самых лучших фильмов за всю жизнь человечества. Кино картины всегда манили людей, как только их начали воплощать. Увидеть можно было кино раньше только в здании кинотеатра, сегодня же всё намного проще. Смотри на телефоне, ноутбуке или выводи на тв у себя дома и смотри любимый фильм, устроив себе сеанс в совершенно любое время.

Запрос – [url=https://kinosklad.net/military/]смотреть военные фильмы[/url] полный успех отыскать на сайте kinosklad.net прямо сейчас. Чтобы пользование порталом было очень комфортным, советуем пройти регистрацию. Тогда у Вас будет собственный аккаунт, где будут списки из ранее просмотренных фильмов и многое другое.

Если Вы колеблетесь в просмотре того или иного фильма, можно всегда посмотреть его трейлер. На онлайн ресурсе kinosklad.net супер привычный и легкий интерфейс, что не получит проблем.

Хотели найти [url=https://kinosklad.net/fiction/]фильмы фантастика[/url] в интернете, это к нам. Также на практически все фильмы посетители нашего сайта написали отзывы, можете их посмотреть, а также написать свои. Желаем броских картинок, чистого звука и захватывающих историй.

Thanks for sharing superb informations. Your web-site is so cool. I am impressed by the details that you¦ve on this web site. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found just the information I already searched everywhere and simply could not come across. What a perfect web-site.

obviously like your web site however you have to take a look at the spelling on quite a few of your posts. Several of them are rife with spelling issues and I find it very bothersome to inform the truth however I?¦ll surely come back again.

Thanks a lot for sharing this with all of us you actually know what you’re talking about! Bookmarked. Kindly also visit my web site =). We could have a link exchange contract between us!

I like this web blog very much, Its a very nice billet to read and get info . “Anyone can stop a man’s life, but no one his death a thousand doors open on to it. – Phoenissae” by Lucius Annaeus Seneca.

you’re truly a excellent webmaster. The website loading pace is amazing. It sort of feels that you are doing any unique trick. Furthermore, The contents are masterpiece. you have performed a fantastic activity on this matter!

This site truly stands out as a great example of quality web design and performance.

It provides an excellent user experience from start to finish.

I love how user-friendly and intuitive everything feels.

The layout is visually appealing and very functional.

The layout is visually appealing and very functional.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

This website is amazing, with a clean design and easy navigation.

The content is engaging and well-structured, keeping visitors interested.

This site truly stands out as a great example of quality web design and performance.

The content is well-organized and highly informative.

ICE HACK

The content is well-organized and highly informative.

Hi my family member! I wish to say that this post is awesome, great written and come with approximately all vital infos. I’d like to peer extra posts like this.

what is clomid medication how to buy cheap clomid without prescription clomid one fallopian tube can i buy clomiphene price can i get generic clomiphene without insurance how to get clomid tablets where to get cheap clomiphene without dr prescription

The depth in this serving is exceptional.

This is the make of delivery I recoup helpful.

buy zithromax paypal – order tetracycline 500mg pill order flagyl for sale

brand rybelsus 14 mg – rybelsus online generic cyproheptadine

Excellent goods from you, man. I’ve understand your stuff previous to and you are just too wonderful. I actually like what you have acquired here, really like what you’re saying and the way in which you say it. You make it entertaining and you still take care of to keep it wise. I can’t wait to read much more from you. This is actually a tremendous site.

motilium pills – purchase domperidone without prescription cyclobenzaprine 15mg cost

azithromycin 500mg price – purchase tindamax generic bystolic price

where can i buy clavulanate – atbioinfo order ampicillin online

nexium uk – nexium to us buy esomeprazole 20mg

buy warfarin 5mg pills – blood thinner order losartan online

When I initially commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the identical comment. Is there any approach you may take away me from that service? Thanks!

mobic 7.5mg oral – mobo sin where to buy meloxicam without a prescription

order deltasone 20mg online cheap – asthma prednisone 10mg us

where can i buy ed pills – https://fastedtotake.com/ mens ed pills

buy generic amoxicillin – amoxil order buy amoxicillin without a prescription

buy forcan generic – flucoan order forcan online

buy cenforce sale – https://cenforcers.com/ order cenforce online cheap

cialis prescription online – https://ciltadgn.com/ dapoxetine and tadalafil

buy generic ranitidine over the counter – https://aranitidine.com/ zantac 300mg oral

how long before sex should i take cialis – on this site buy cialis online usa

This is the tolerant of delivery I turn up helpful. prospecto propecia

viagra for sale with no prescription – strong vpls buy sildenafil 50mg

This is the big-hearted of literature I positively appreciate. https://buyfastonl.com/furosemide.html

I’ll certainly return to review more. https://ursxdol.com/propecia-tablets-online/

I got what you mean ,saved to fav, very decent site.

The vividness in this serving is exceptional.

purchase zofran generic

This is the big-hearted of criticism I in fact appreciate. http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4701

naturally like your web-site but you have to take a look at the spelling on several of your posts. A number of them are rife with spelling issues and I find it very bothersome to inform the reality then again I will surely come again again.

purchase orlistat without prescription – https://asacostat.com/ xenical for sale

Some genuinely quality content on this internet site, saved to bookmarks.

The thoroughness in this break down is noteworthy. http://www.dbgjjs.com/home.php?mod=space&uid=533053