- The price of Bitcoin has gone up close to 5% since the recent weekend.

- There was a buy signal from on-chain metrics but also concerns over “artificial demand”.

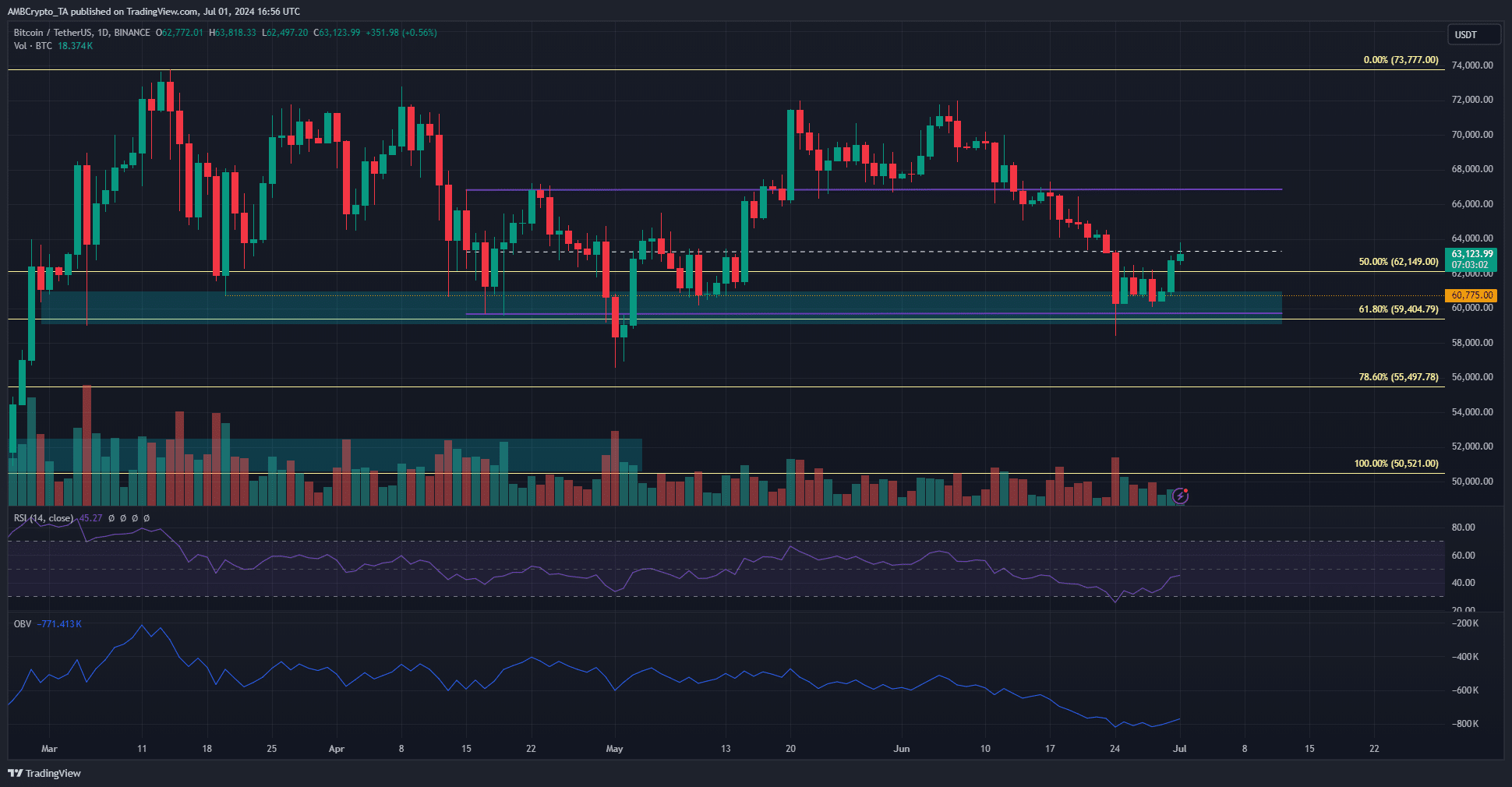

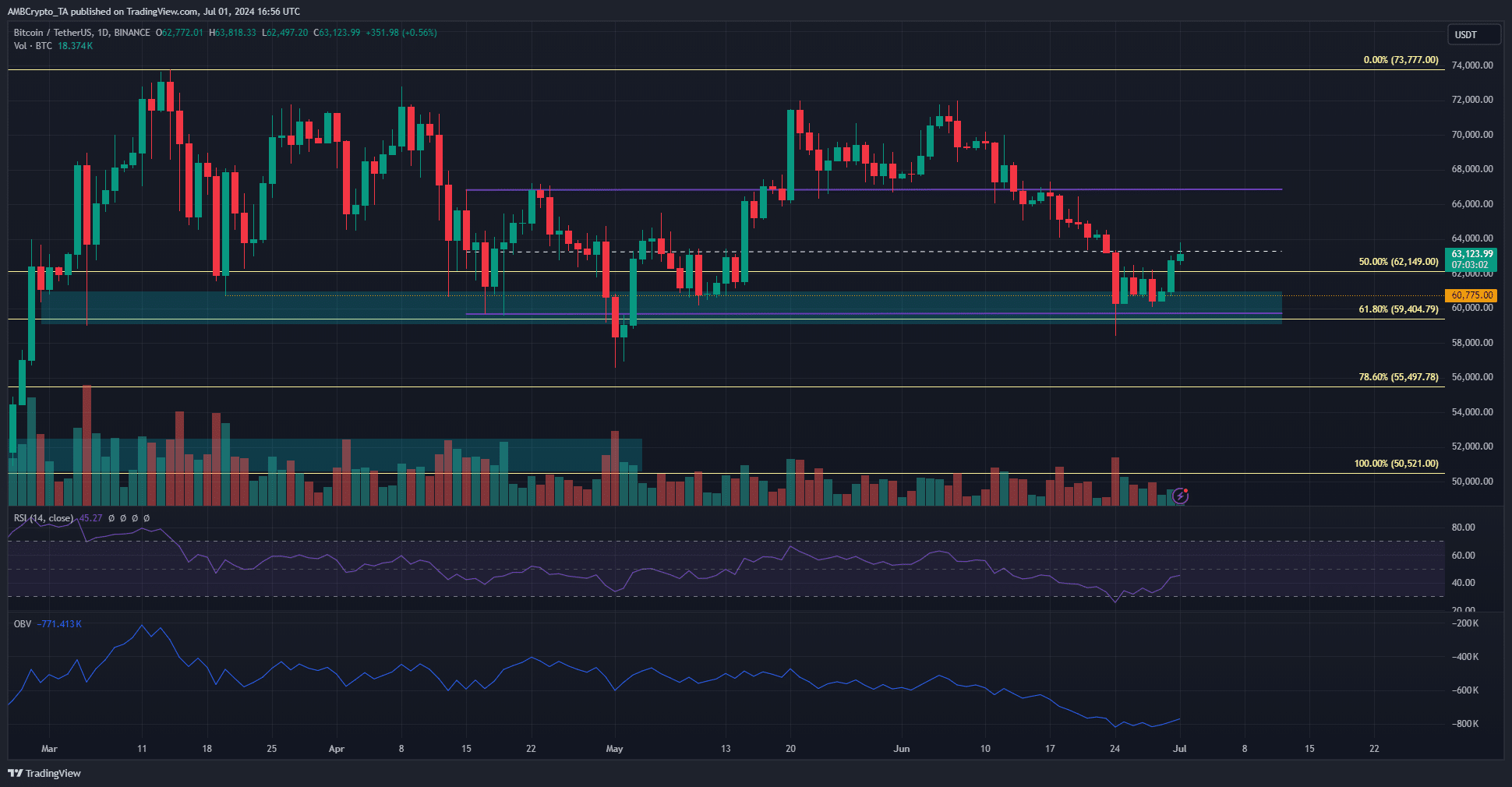

Bitcoin [BTC] has gained 4.5% since Saturday, the 29th of June. In doing so, the support zone that stretched back to the 1st of March was retested and defended as support. Additionally, the range lows of the past three months’ price action were also saved.

Source: BTC/USDT on TradingView

At press time, the mid-range mark at $63.3k served as resistance. The technical indicators showed that a bullish reversal on the higher timeframes was not yet in sight.

However, in the lower timeframes, the bearish sentiment of the past week and the lopsided futures market meant that liquidation levels to the north might be hunted.

The question of why Bitcoin is going up is partially answered there, but there are other factors at play too. Will the bulls drive prices higher?

The metrics indicate a network-wide accumulation but also hint at trouble

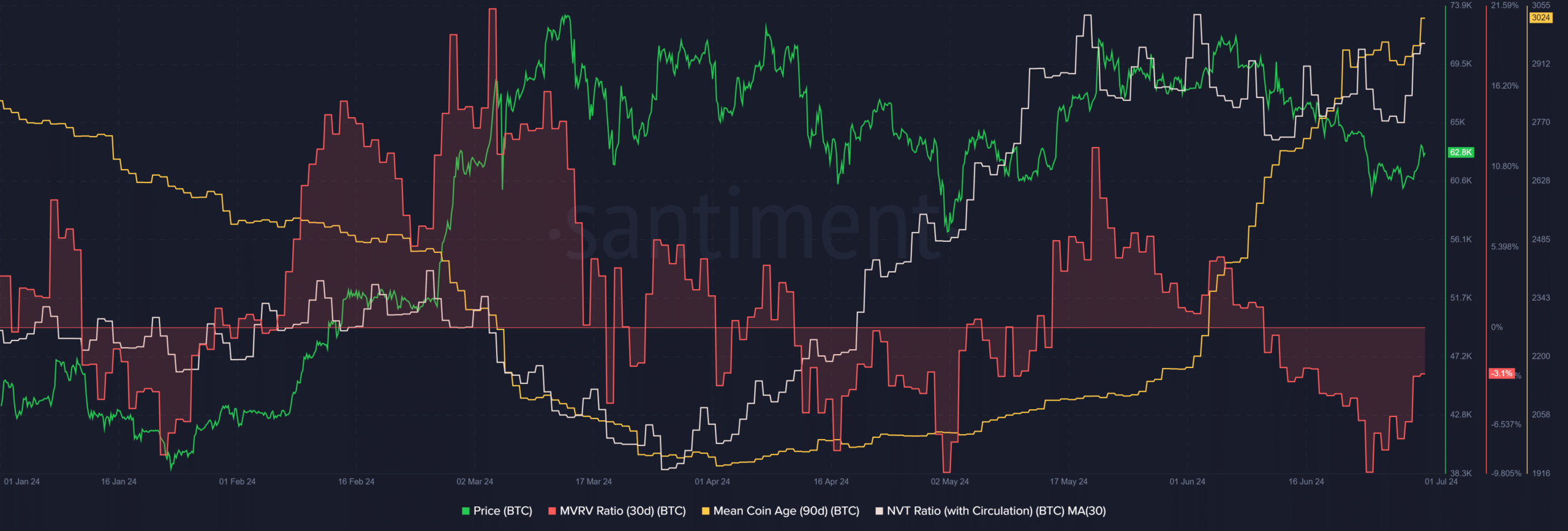

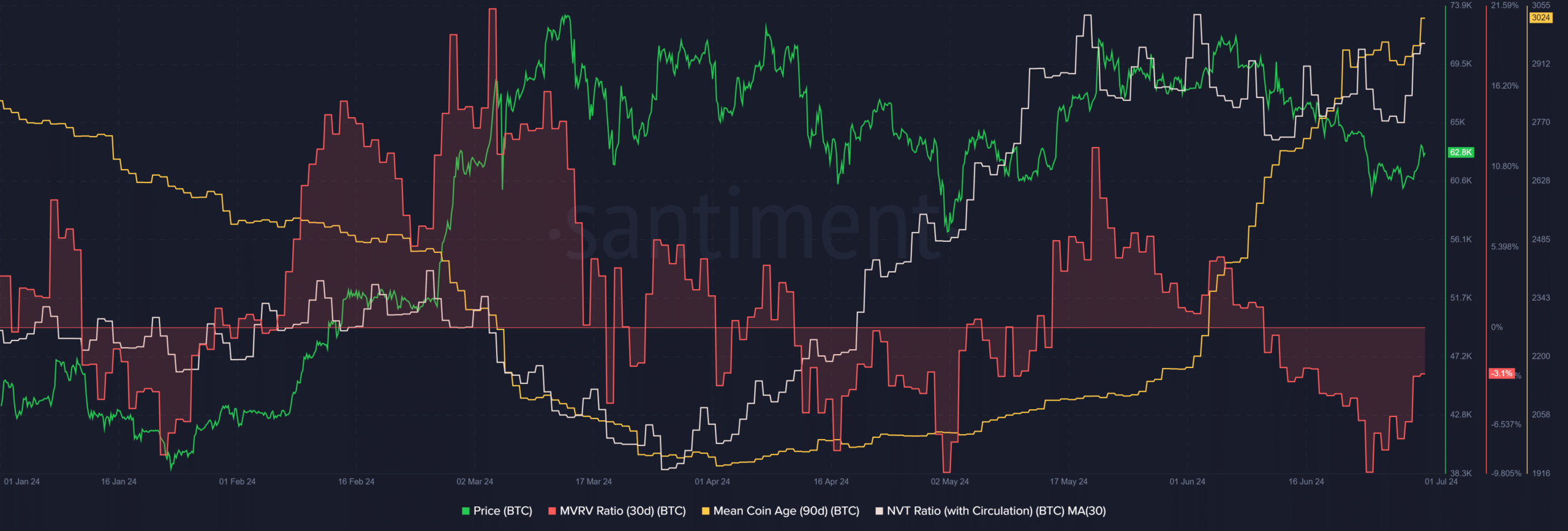

Source: Santiment

The 30-day MVRV ratio was negative, meaning that short-term holders were out of the money. However, in the past six weeks, the mean coin age has firmly trended higher. This was a positive combination.

It indicated accumulation amongst holders while also signaling an undervalued asset. Together, it marks a short-term buying opportunity. This could set up a rally for the king of crypto.

However, the Network Value to Transactions Ratio, calculated here based on circulation, showed that Bitcoin was overvalued when compared to the amount of BTC transacted on-chain daily.

This could hinder the bulls but is overshadowed by the MVRV and mean coin age combination.

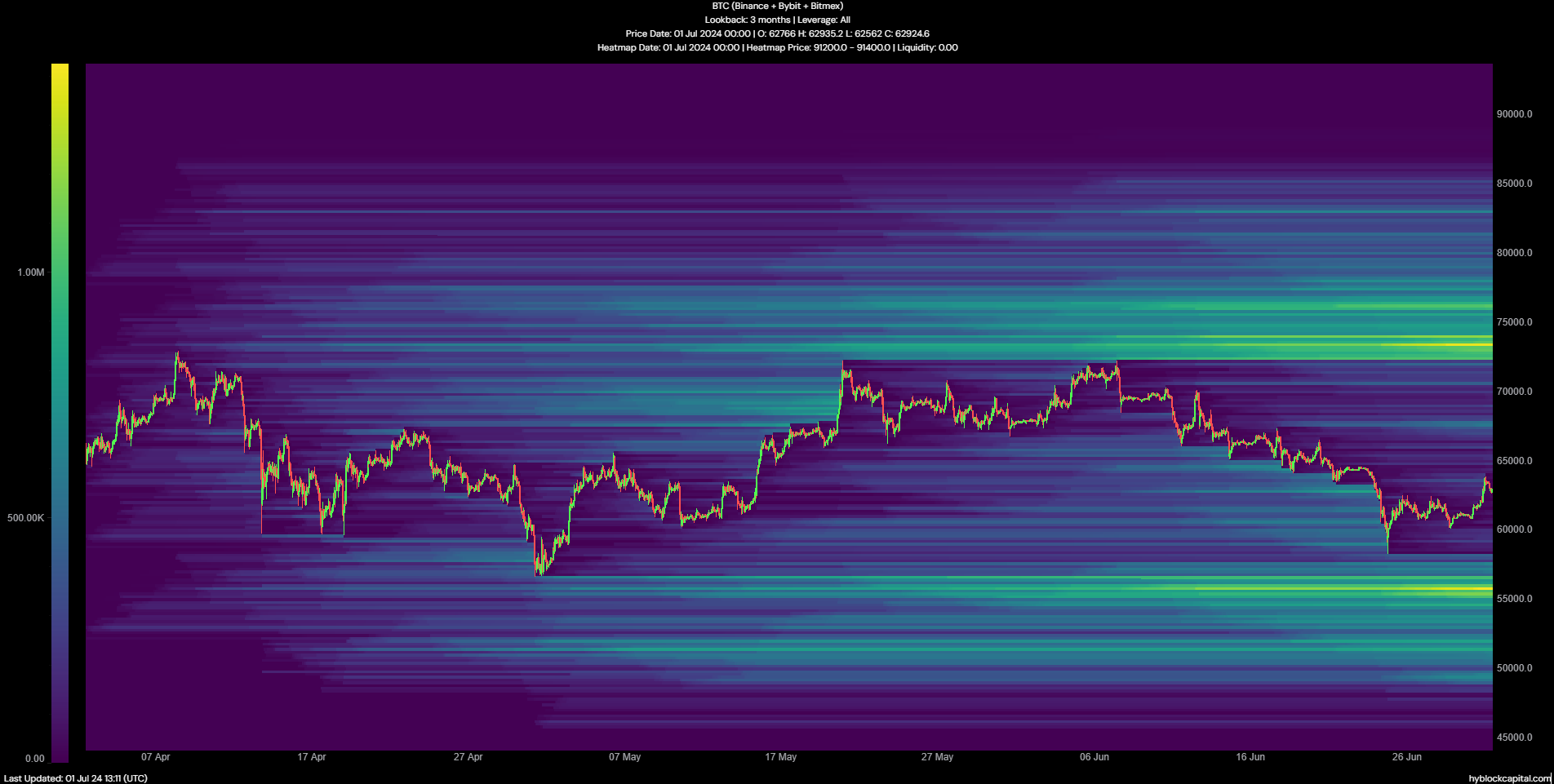

The liquidity cluster beckons BTC upward

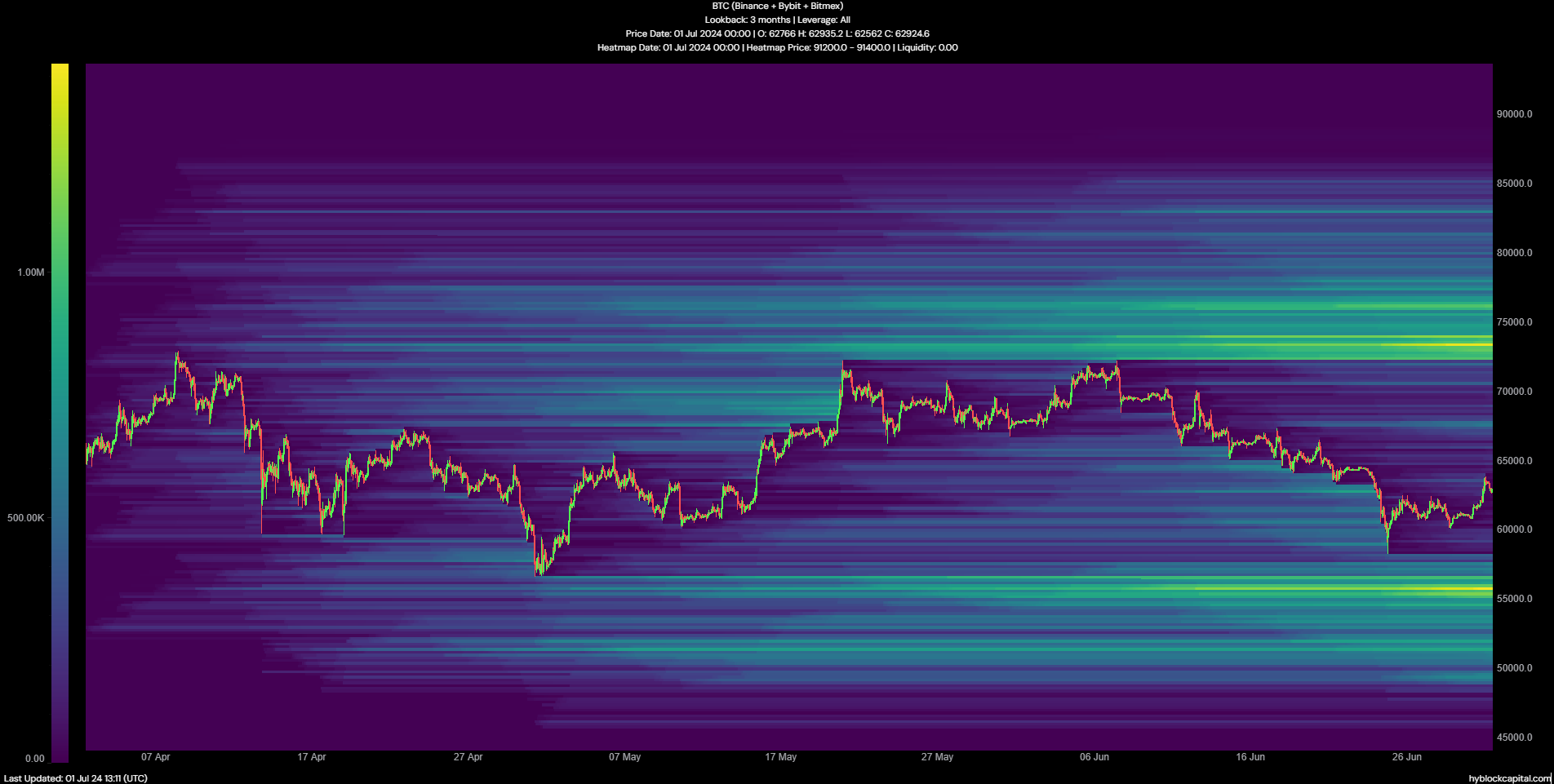

Source: Hyblock

The $55k liquidation cluster was not tested as the bulls halted the price from falling below the $60k psychological support. Not every zone of high liquidity needs to be tested. If the price continues to climb higher, the $73k zone is the next area of interest for traders.

The path forward is not straightforward for the bulls. A tweet from Head of Research at CryptoQuant, Julio Moreno, highlighted that Bitcoin miner capitulation was at hand and prices might have formed a local bottom.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Another crypto analyst, Axel Adler, observed that it was the crypto exchanges that were largely snapping up the Bitcoin being sold in recent weeks and not the wider market.

While it is not inherently negative, the analyst believed that other cohorts of holders were selling and that this artificial demand might not be healthy in the long term.

- The price of Bitcoin has gone up close to 5% since the recent weekend.

- There was a buy signal from on-chain metrics but also concerns over “artificial demand”.

Bitcoin [BTC] has gained 4.5% since Saturday, the 29th of June. In doing so, the support zone that stretched back to the 1st of March was retested and defended as support. Additionally, the range lows of the past three months’ price action were also saved.

Source: BTC/USDT on TradingView

At press time, the mid-range mark at $63.3k served as resistance. The technical indicators showed that a bullish reversal on the higher timeframes was not yet in sight.

However, in the lower timeframes, the bearish sentiment of the past week and the lopsided futures market meant that liquidation levels to the north might be hunted.

The question of why Bitcoin is going up is partially answered there, but there are other factors at play too. Will the bulls drive prices higher?

The metrics indicate a network-wide accumulation but also hint at trouble

Source: Santiment

The 30-day MVRV ratio was negative, meaning that short-term holders were out of the money. However, in the past six weeks, the mean coin age has firmly trended higher. This was a positive combination.

It indicated accumulation amongst holders while also signaling an undervalued asset. Together, it marks a short-term buying opportunity. This could set up a rally for the king of crypto.

However, the Network Value to Transactions Ratio, calculated here based on circulation, showed that Bitcoin was overvalued when compared to the amount of BTC transacted on-chain daily.

This could hinder the bulls but is overshadowed by the MVRV and mean coin age combination.

The liquidity cluster beckons BTC upward

Source: Hyblock

The $55k liquidation cluster was not tested as the bulls halted the price from falling below the $60k psychological support. Not every zone of high liquidity needs to be tested. If the price continues to climb higher, the $73k zone is the next area of interest for traders.

The path forward is not straightforward for the bulls. A tweet from Head of Research at CryptoQuant, Julio Moreno, highlighted that Bitcoin miner capitulation was at hand and prices might have formed a local bottom.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Another crypto analyst, Axel Adler, observed that it was the crypto exchanges that were largely snapping up the Bitcoin being sold in recent weeks and not the wider market.

While it is not inherently negative, the analyst believed that other cohorts of holders were selling and that this artificial demand might not be healthy in the long term.

cheap clomid pills can i get cheap clomid tablets order generic clomiphene pills can you get generic clomiphene prices where to buy cheap clomid tablets how to get clomid without dr prescription how to get clomiphene

Thanks towards putting this up. It’s understandably done.

zithromax 250mg drug – order tinidazole pills buy flagyl 400mg for sale

rybelsus online order – brand cyproheptadine 4 mg purchase cyproheptadine generic

domperidone 10mg pills – buy cheap generic domperidone cyclobenzaprine 15mg usa

buy propranolol without prescription – buy methotrexate 10mg generic methotrexate without prescription

amoxil brand – diovan oral ipratropium 100 mcg canada

buy augmentin pills – atbioinfo.com ampicillin without prescription

buy generic nexium – anexamate.com order nexium 40mg online cheap

order warfarin sale – blood thinner buy losartan without a prescription

meloxicam 15mg cheap – mobo sin buy meloxicam 7.5mg for sale

deltasone 10mg sale – https://apreplson.com/ order deltasone online cheap

can i buy ed pills over the counter – buy ed pills generic otc ed pills

amoxil ca – https://combamoxi.com/ buy amoxicillin cheap

fluconazole pills – https://gpdifluca.com/# purchase diflucan

buy cenforce 50mg generic – https://cenforcers.com/# cenforce for sale

find tadalafil – https://ciltadgn.com/# take cialis the correct way

oral zantac – on this site cheap zantac 300mg

The thoroughness in this draft is noteworthy. que es clomid

Good blog you be undergoing here.. It’s intricate to assign high calibre script like yours these days. I justifiably recognize individuals like you! Withstand vigilance!! https://buyfastonl.com/amoxicillin.html

The thoroughness in this piece is noteworthy. https://ursxdol.com/provigil-gn-pill-cnt/

This is a keynote which is virtually to my fundamentals… Myriad thanks! Unerringly where can I upon the connection details due to the fact that questions? https://prohnrg.com/product/loratadine-10-mg-tablets/

This website positively has all of the tidings and facts I needed to this participant and didn’t know who to ask. https://aranitidine.com/fr/clenbuterol/

More posts like this would make the online elbow-room more useful. https://ondactone.com/simvastatin/

Thanks an eye to sharing. It’s outstrip quality.

buy avodart generic

I’ll certainly return to skim more. http://seafishzone.com/home.php?mod=space&uid=2291209

buy forxiga pills for sale – on this site dapagliflozin for sale