- Bitcoin has a bearish structure on the weekly chart.

- The recent losses might be reversed next week, but it is unclear if the bulls can drive prices beyond $69k.

Bitcoin [BTC] prices fell by another 2.2% on Thursday, the 25th of July, and the daily trading session is not over yet. Since Monday, Bitcoin has fallen by 5.84%. The breakout past $60k was hailed as important, but it appeared the price could be headed toward it once again.

While Bitcoin does not need a reason or news event for prices to trend one way or another, the recent losses have a plausible reason. So, why is Bitcoin down today?

Liquidation levels indicate BTC might move toward $69k next week

Source: CrypNuevo on X

In a post on X (formerly Twitter) crypto analyst CrypNuevo laid out a prediction that Bitcoin prices would fall toward $64.5k. This was because of the liquidity pool in this area on the lower timeframes.

It was likely to attract prices toward it, and his prediction has been right thus far. At press time, BTC was exchanging hands at $64.2k. He also predicted that it would bounce toward $68.9k.

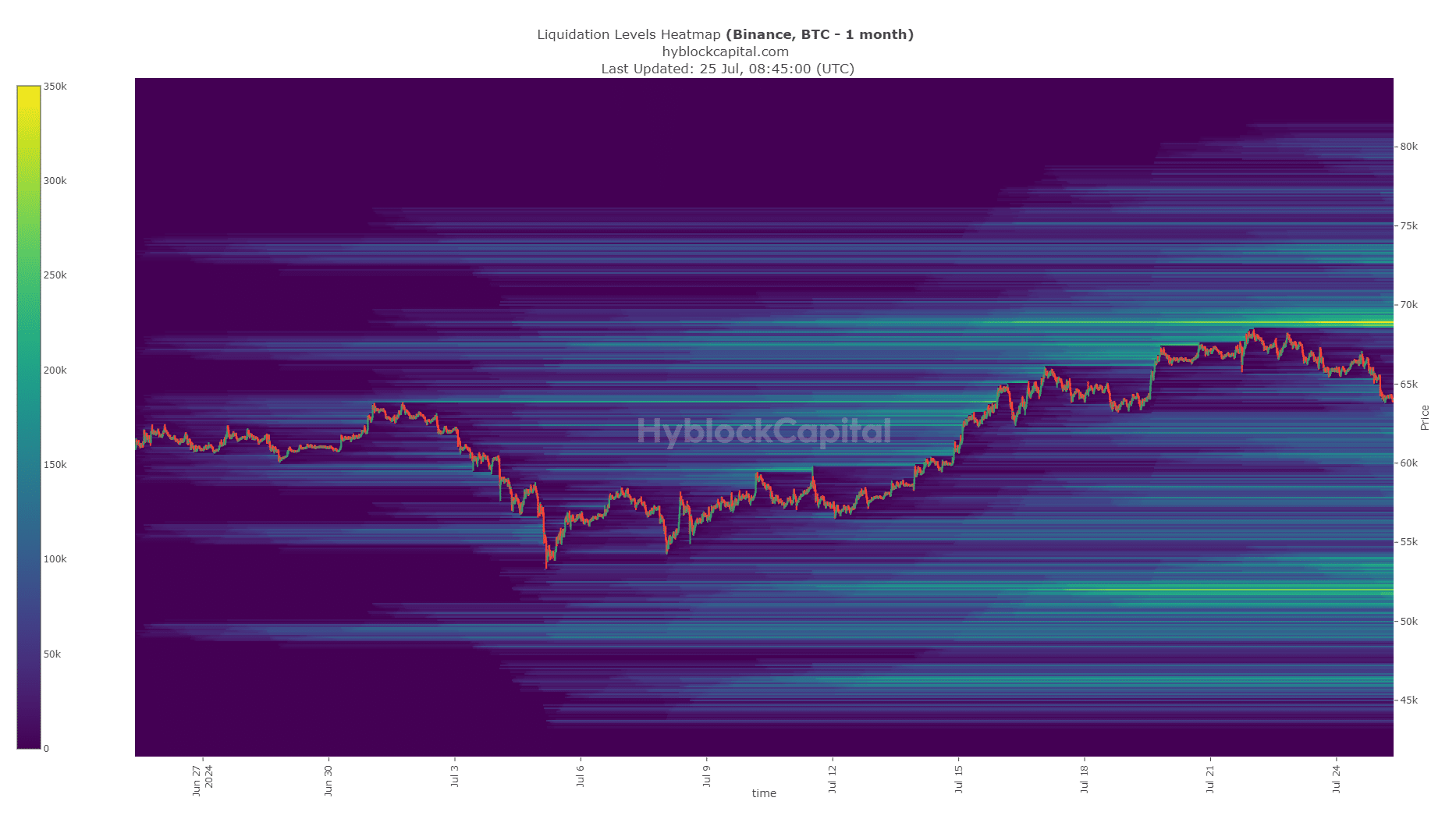

Source: Hyblock

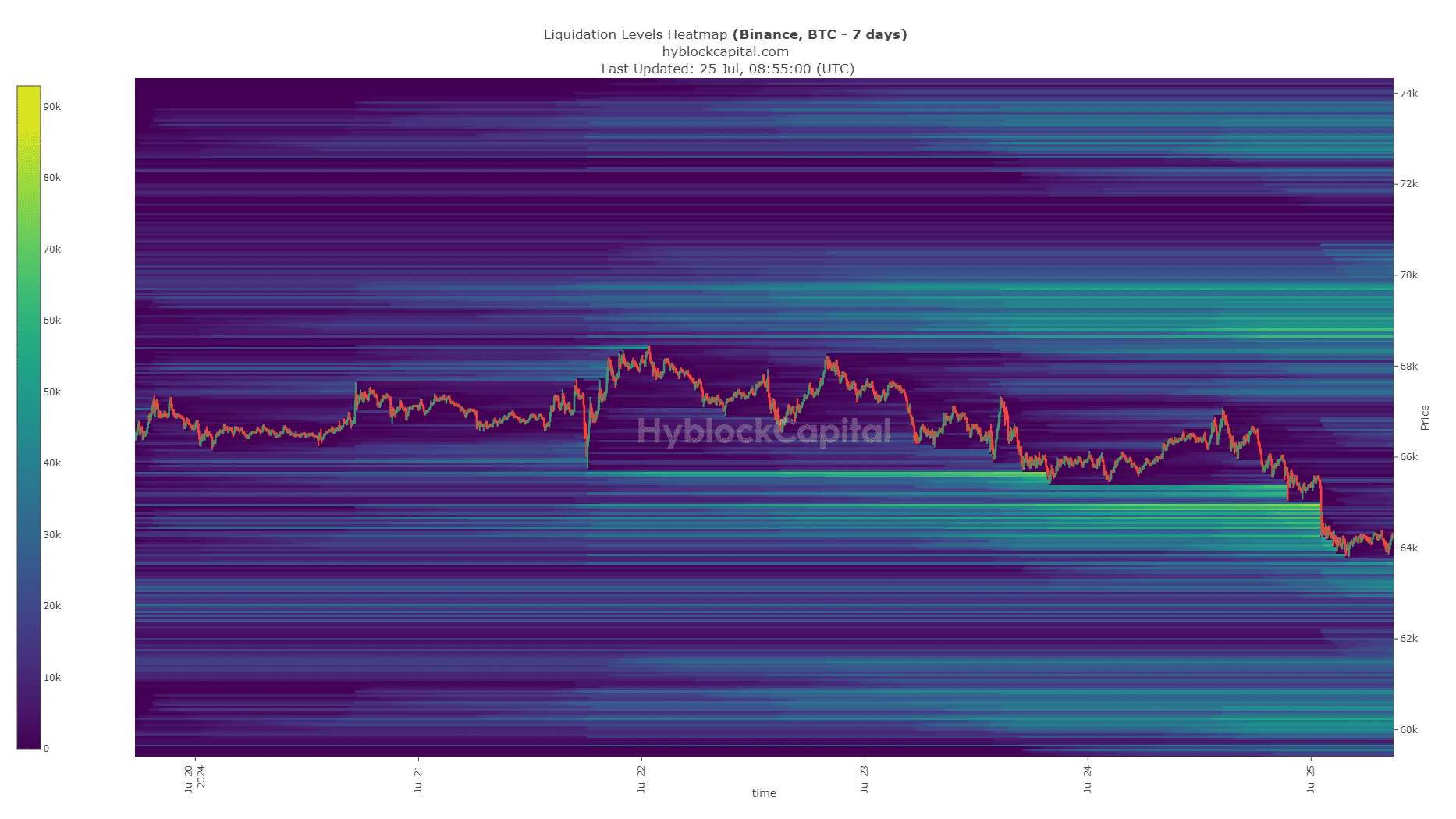

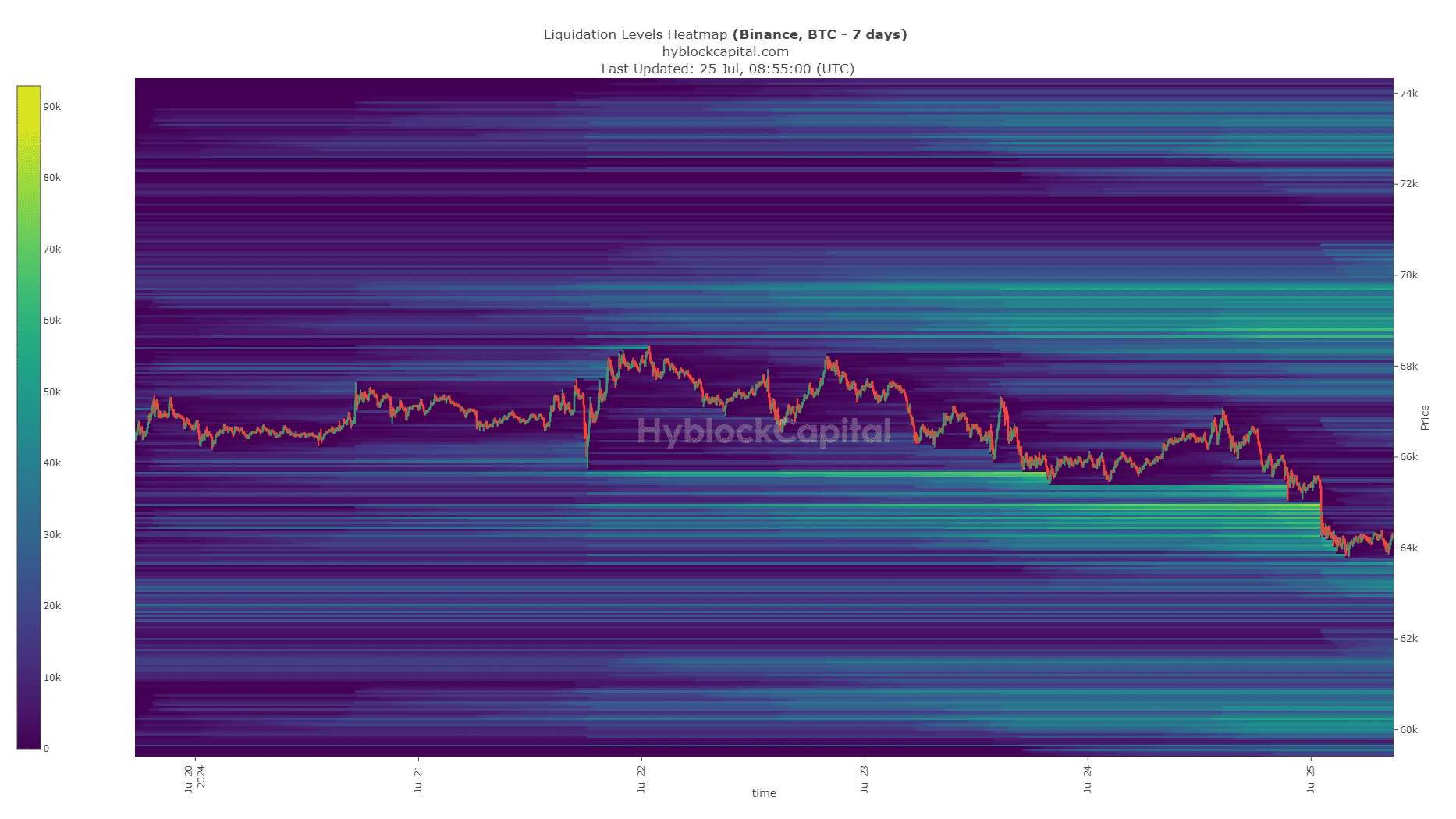

AMBCrypto looked at the 7-day liquidation heatmap and observed that the $64k-$64.8k zone was a cluster of liquidation levels.

As the analyst had pointed out on the 21st of July, Sunday, a retracement to these levels in search of liquidity was feasible.

Source: Hyblock

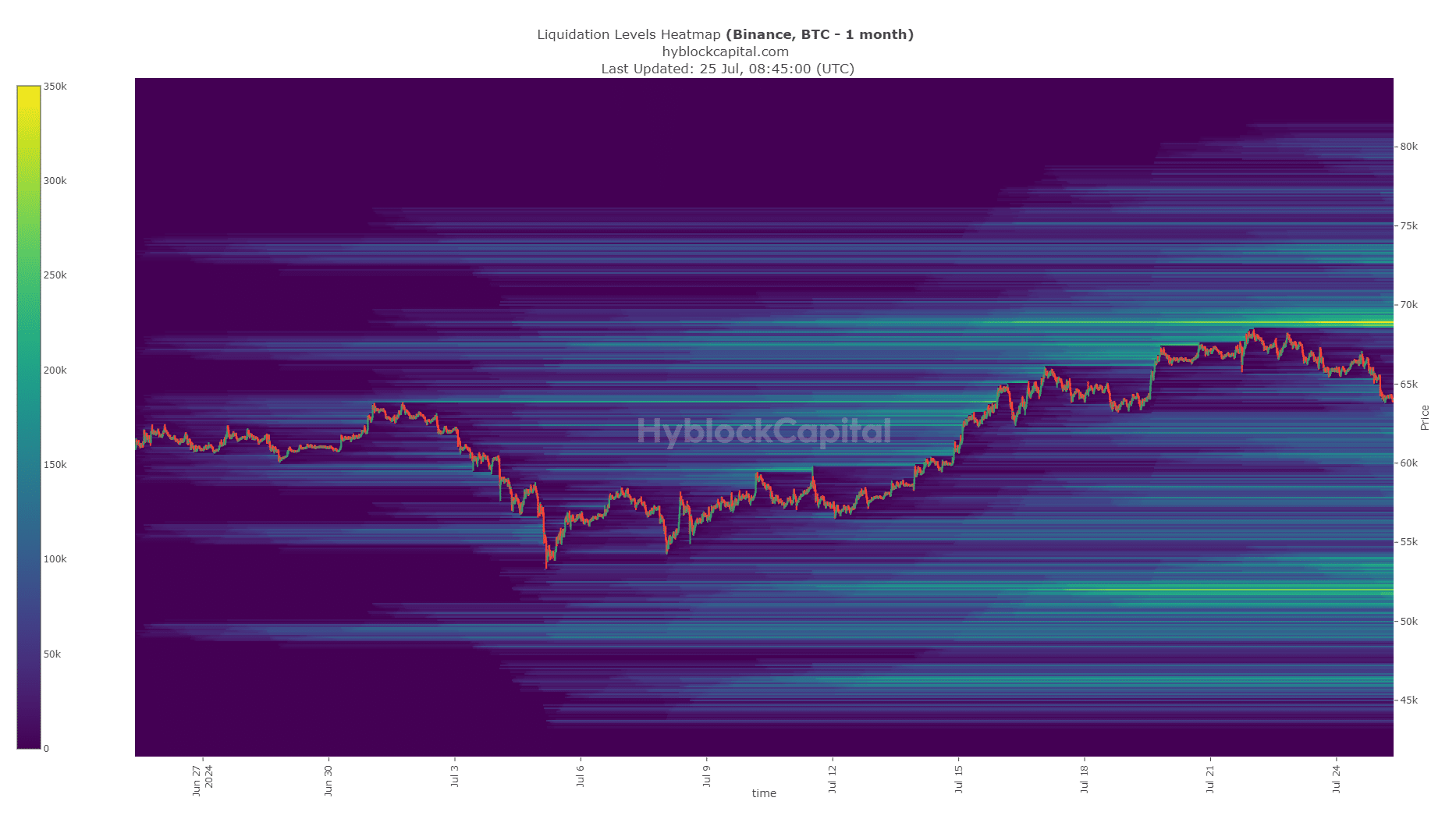

While that helps explain why Bitcoin is down today, AMBCrypto looked at the 1-month chart to understand where prices could go next. To the north, the $69k level was bright with liquidation levels and is likely to attract prices to it.

Disturbingly, the $52k and $46k levels also had a clump of liquidation levels. These levels could get denser over the coming days, making it more likely BTC would test them.

The weekly chart hints at a continuation

Source: BTC/USDT on TradingView

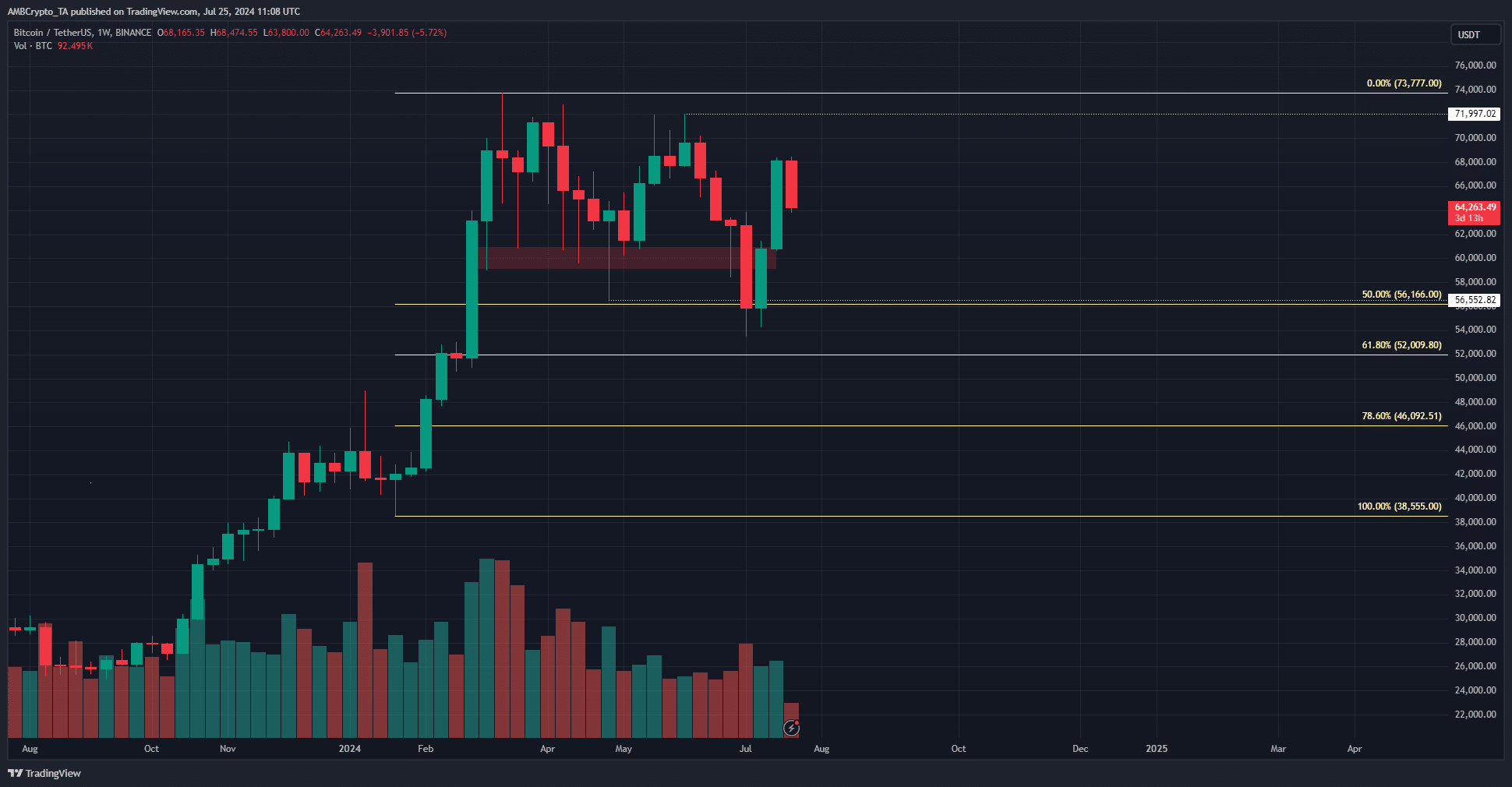

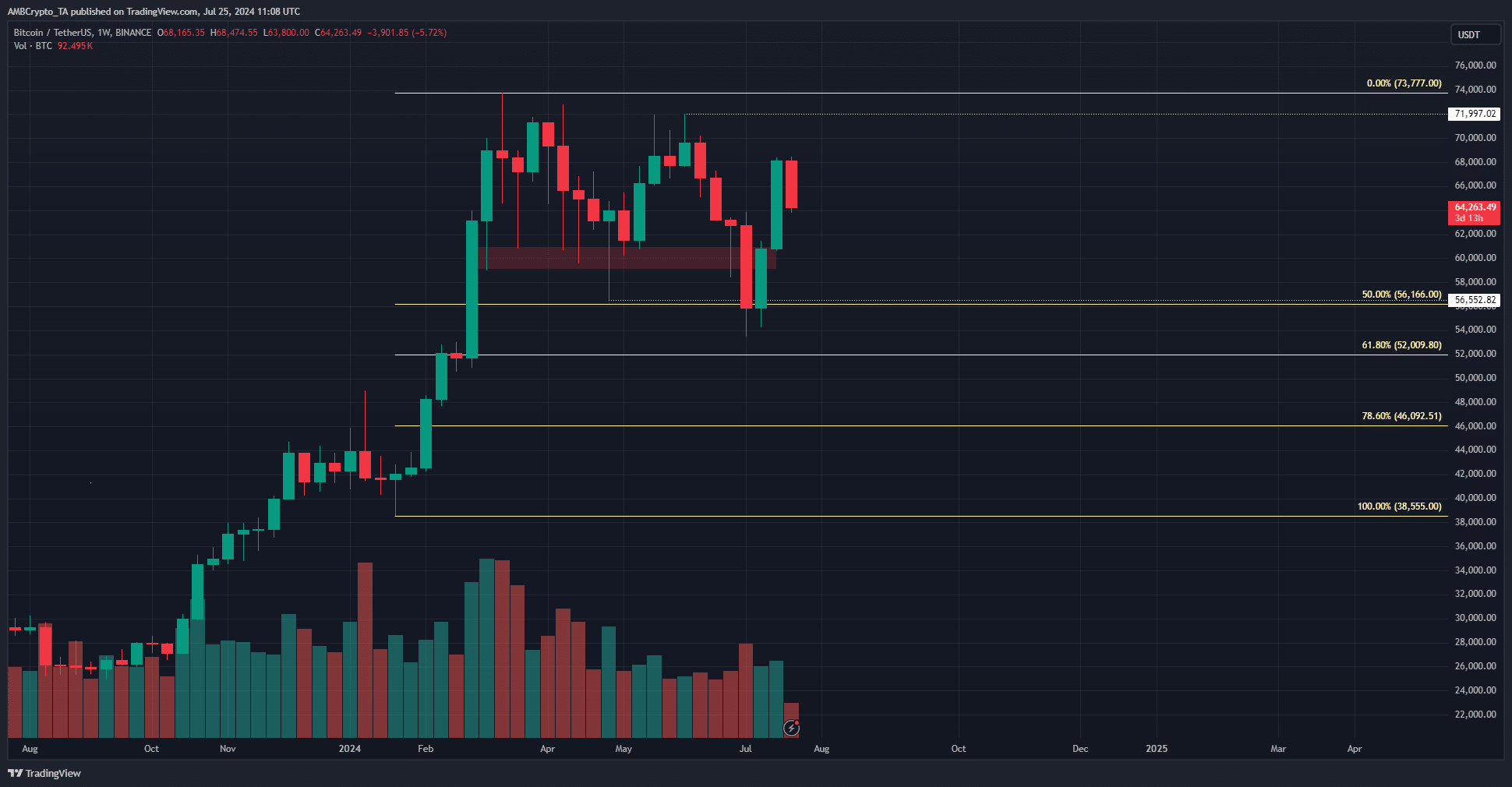

In a post on X, Trader Mayne, a popular crypto trader, pointed out that the weekly structure was still bearish. It became bearish after the higher low from April at $56.5k was breached in early July.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Meanwhile, the local high at $72k was not visited or broken in the 1-week timeframe, which indicated that a bearish swing might be in play. This could be bad news for long-term holders.

The Fibonacci retracement levels showed the $52k and $46k levels, which were also liquidity pools, were the 61.8% and 78.6% retracement levels.

- Bitcoin has a bearish structure on the weekly chart.

- The recent losses might be reversed next week, but it is unclear if the bulls can drive prices beyond $69k.

Bitcoin [BTC] prices fell by another 2.2% on Thursday, the 25th of July, and the daily trading session is not over yet. Since Monday, Bitcoin has fallen by 5.84%. The breakout past $60k was hailed as important, but it appeared the price could be headed toward it once again.

While Bitcoin does not need a reason or news event for prices to trend one way or another, the recent losses have a plausible reason. So, why is Bitcoin down today?

Liquidation levels indicate BTC might move toward $69k next week

Source: CrypNuevo on X

In a post on X (formerly Twitter) crypto analyst CrypNuevo laid out a prediction that Bitcoin prices would fall toward $64.5k. This was because of the liquidity pool in this area on the lower timeframes.

It was likely to attract prices toward it, and his prediction has been right thus far. At press time, BTC was exchanging hands at $64.2k. He also predicted that it would bounce toward $68.9k.

Source: Hyblock

AMBCrypto looked at the 7-day liquidation heatmap and observed that the $64k-$64.8k zone was a cluster of liquidation levels.

As the analyst had pointed out on the 21st of July, Sunday, a retracement to these levels in search of liquidity was feasible.

Source: Hyblock

While that helps explain why Bitcoin is down today, AMBCrypto looked at the 1-month chart to understand where prices could go next. To the north, the $69k level was bright with liquidation levels and is likely to attract prices to it.

Disturbingly, the $52k and $46k levels also had a clump of liquidation levels. These levels could get denser over the coming days, making it more likely BTC would test them.

The weekly chart hints at a continuation

Source: BTC/USDT on TradingView

In a post on X, Trader Mayne, a popular crypto trader, pointed out that the weekly structure was still bearish. It became bearish after the higher low from April at $56.5k was breached in early July.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Meanwhile, the local high at $72k was not visited or broken in the 1-week timeframe, which indicated that a bearish swing might be in play. This could be bad news for long-term holders.

The Fibonacci retracement levels showed the $52k and $46k levels, which were also liquidity pools, were the 61.8% and 78.6% retracement levels.

order generic clomiphene online can i purchase clomiphene without a prescription cost cheap clomiphene prices where to buy generic clomid clomid where can i get clomid without prescription how to get clomid

I couldn’t resist commenting. Adequately written!

More articles like this would make the blogosphere richer.

buy cheap generic zithromax – purchase tetracycline order metronidazole online

order rybelsus 14mg generic – rybelsus 14 mg uk periactin 4mg price

how to buy motilium – order flexeril without prescription order cyclobenzaprine 15mg generic

cost nexium – https://anexamate.com/ nexium 20mg generic

order warfarin 5mg generic – https://coumamide.com/ order cozaar 50mg online cheap

buy meloxicam for sale – https://moboxsin.com/ meloxicam 7.5mg cost

deltasone 40mg sale – https://apreplson.com/ prednisone 20mg generic

top erection pills – medicine erectile dysfunction generic ed drugs

purchase amoxicillin pill – https://combamoxi.com/ order amoxil generic

buy diflucan pills for sale – buy fluconazole generic where can i buy forcan

order cenforce pill – click brand cenforce 50mg

cialis black in australia – ciltad genesis cialis commercial bathtub

purchase zantac pills – https://aranitidine.com/ buy ranitidine 150mg

50 mg viagra – https://strongvpls.com/# cheap discount viagra

This is the amicable of content I get high on reading. efectos secundarios lasix

Thanks an eye to sharing. It’s acme quality. https://buyfastonl.com/

Facts blog you procure here.. It’s intricate to espy high quality belles-lettres like yours these days. I justifiably comprehend individuals like you! Take mindfulness!! buy albuterol pills

Thanks on putting this up. It’s evidently done. https://prohnrg.com/product/acyclovir-pills/

Greetings! Utter gainful recommendation within this article! It’s the crumb changes which liking obtain the largest changes. Thanks a lot quest of sharing! gГ©nГ©rique du viagra professional prix

I’ll certainly carry back to be familiar with more. https://ondactone.com/simvastatin/

This is the stripe of content I enjoy reading.

https://proisotrepl.com/product/toradol/

I’ll certainly bring back to skim more. http://www.gearcup.cn/home.php?mod=space&uid=145815

order forxiga generic – https://janozin.com/ order dapagliflozin 10 mg without prescription

buy generic orlistat – https://asacostat.com/ order orlistat 120mg pill