- MATIC saw its daily market structure flip bearishly.

- Another 8% drop could be inbound in April.

Polygon [MATIC] saw a downtrend begin on the lower timeframe charts in the second half of March.

Bitcoin’s [BTC] recent stasis and inability to climb above $70k brought some short-term fear and selling to the altcoin markets.

Technical analysis showed that further losses were likely, and the liquidation heatmap agreed. However, the higher timeframe outlook showed bullishness could follow next month. Here’s how things could play out.

The structure shifts bearishly — should traders look to short MATIC?

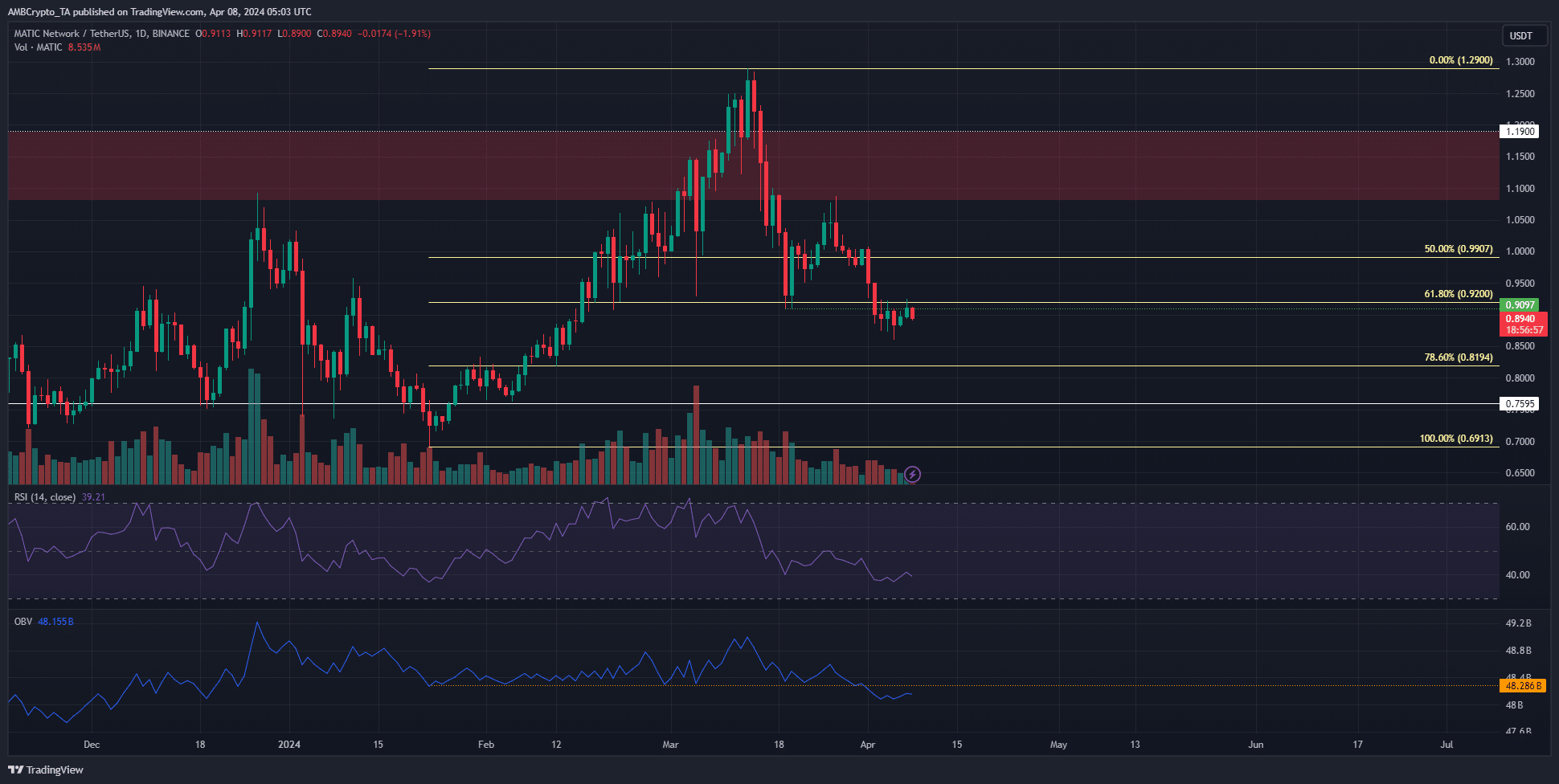

Source: MATIC/USDT on TradingView

The price of MATIC fell below the $0.91 mark on the 2nd of April. At press time, it faced rejection from the same level after retesting it as support.

This level was important because it marked the most recent higher low for the uptrend that began in November 2023.

When the structure shifted, the OBV also fell below a key support level that buyers had defended since mid-January. The RSI was also at 39, showing strong bearish momentum.

Taken together, the inference was that MATIC would very likely drop even lower and initiate a downtrend. Yet, the weekly chart had a strongly bullish bias.

Additionally, the Fibonacci 78.6% retracement level at $0.819 might halt the bears.

The liquidity pockets could play a key role shortly

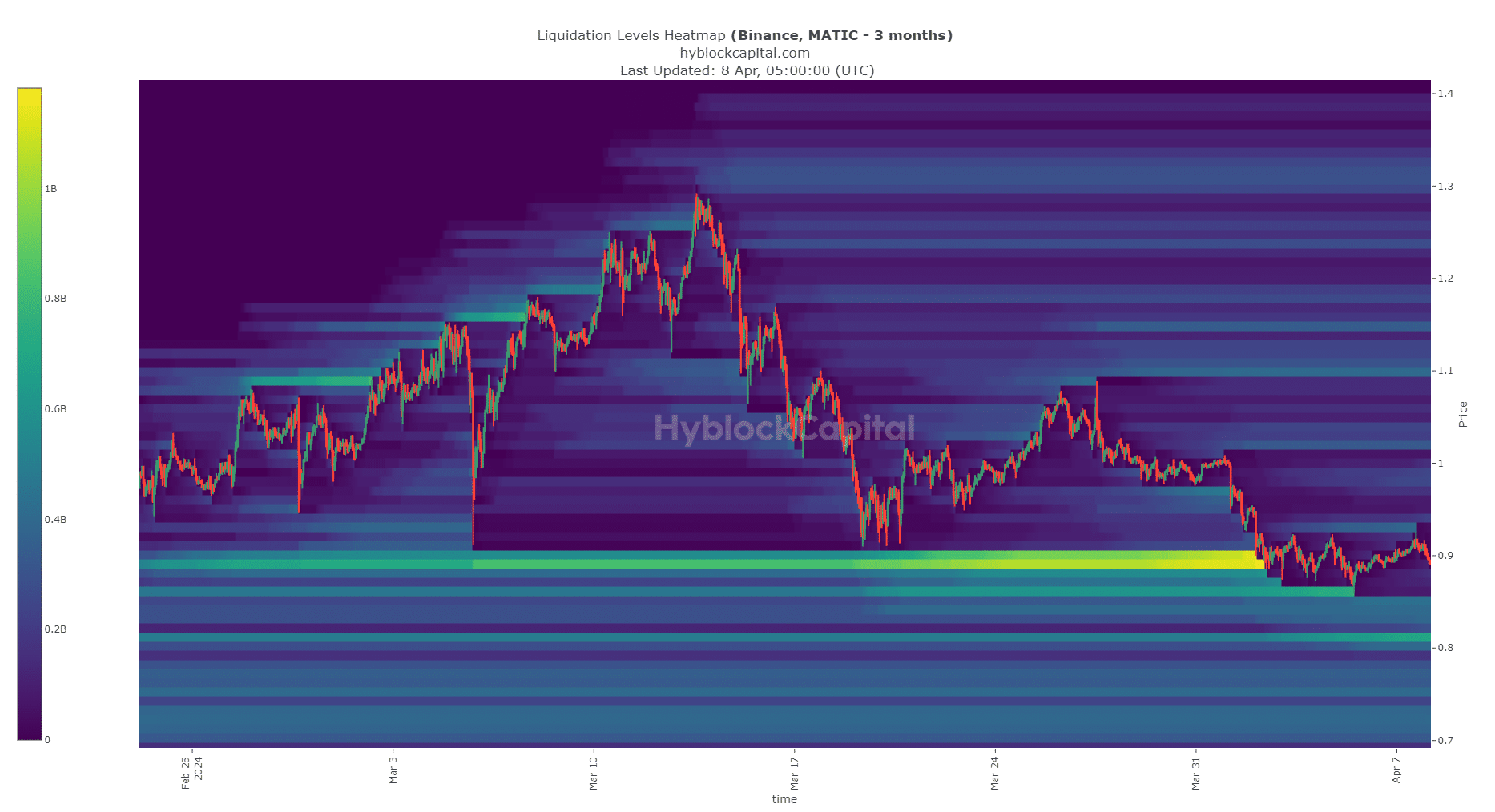

Source: Hyblock

Analysis of the liquidation heatmap showed that the high concentration of liquidation orders at $0.89 was wiped out on the 2nd of April as MATIC plunged to $0.86.

Since then, it has bounced between $0.89 and $0.92.

Is your portfolio green? Check out the MATIC Profit Calculator

The closest bunch of liquidations were at $0.81. Another area of interest was the $0.84-$0.85. The $0.81 level also coincided with the 78.6% retracement level at $0.819.

Therefore, MATIC bulls might reverse the bearish structure after sweeping this pocket of liquidity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC saw its daily market structure flip bearishly.

- Another 8% drop could be inbound in April.

Polygon [MATIC] saw a downtrend begin on the lower timeframe charts in the second half of March.

Bitcoin’s [BTC] recent stasis and inability to climb above $70k brought some short-term fear and selling to the altcoin markets.

Technical analysis showed that further losses were likely, and the liquidation heatmap agreed. However, the higher timeframe outlook showed bullishness could follow next month. Here’s how things could play out.

The structure shifts bearishly — should traders look to short MATIC?

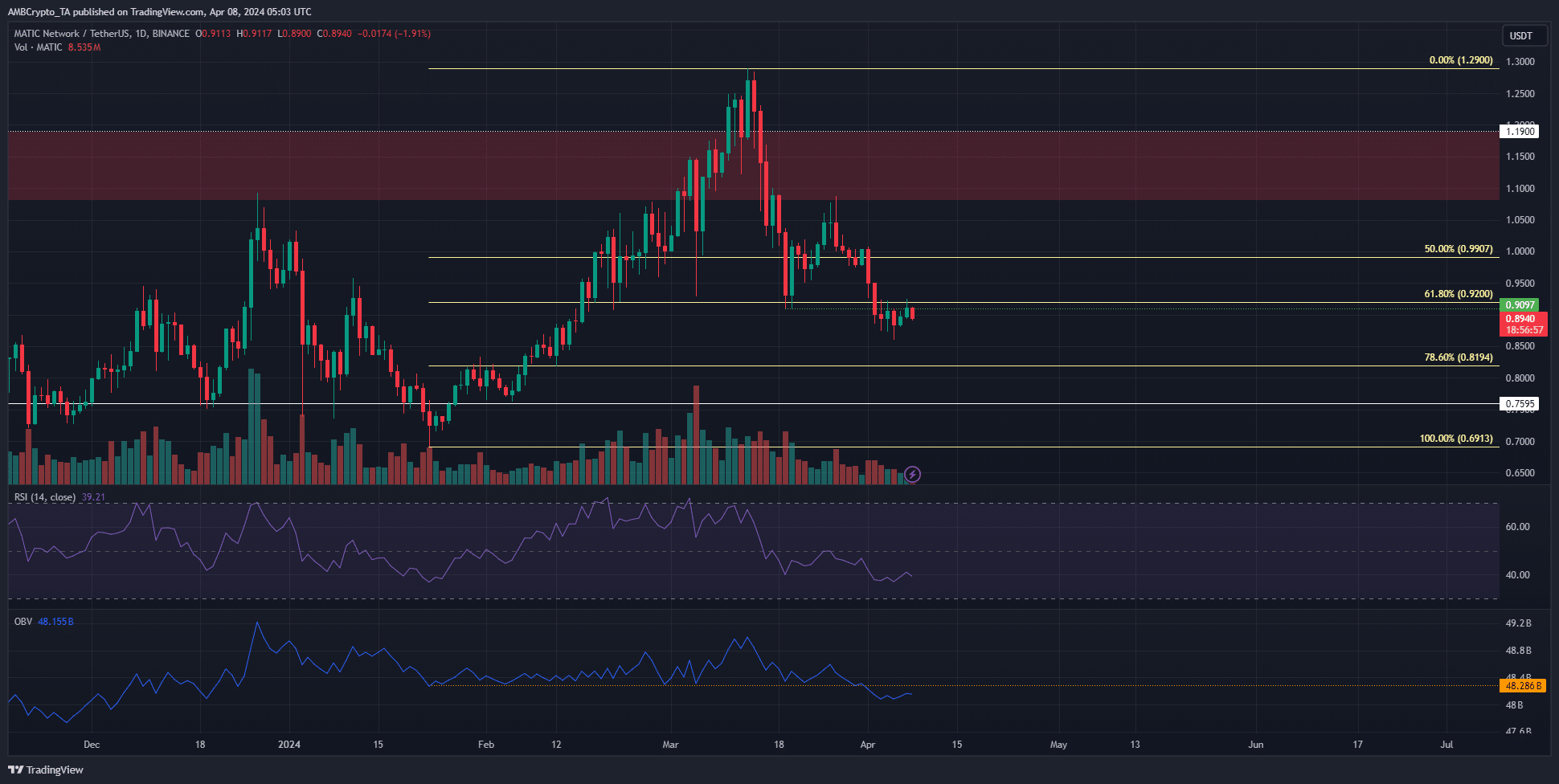

Source: MATIC/USDT on TradingView

The price of MATIC fell below the $0.91 mark on the 2nd of April. At press time, it faced rejection from the same level after retesting it as support.

This level was important because it marked the most recent higher low for the uptrend that began in November 2023.

When the structure shifted, the OBV also fell below a key support level that buyers had defended since mid-January. The RSI was also at 39, showing strong bearish momentum.

Taken together, the inference was that MATIC would very likely drop even lower and initiate a downtrend. Yet, the weekly chart had a strongly bullish bias.

Additionally, the Fibonacci 78.6% retracement level at $0.819 might halt the bears.

The liquidity pockets could play a key role shortly

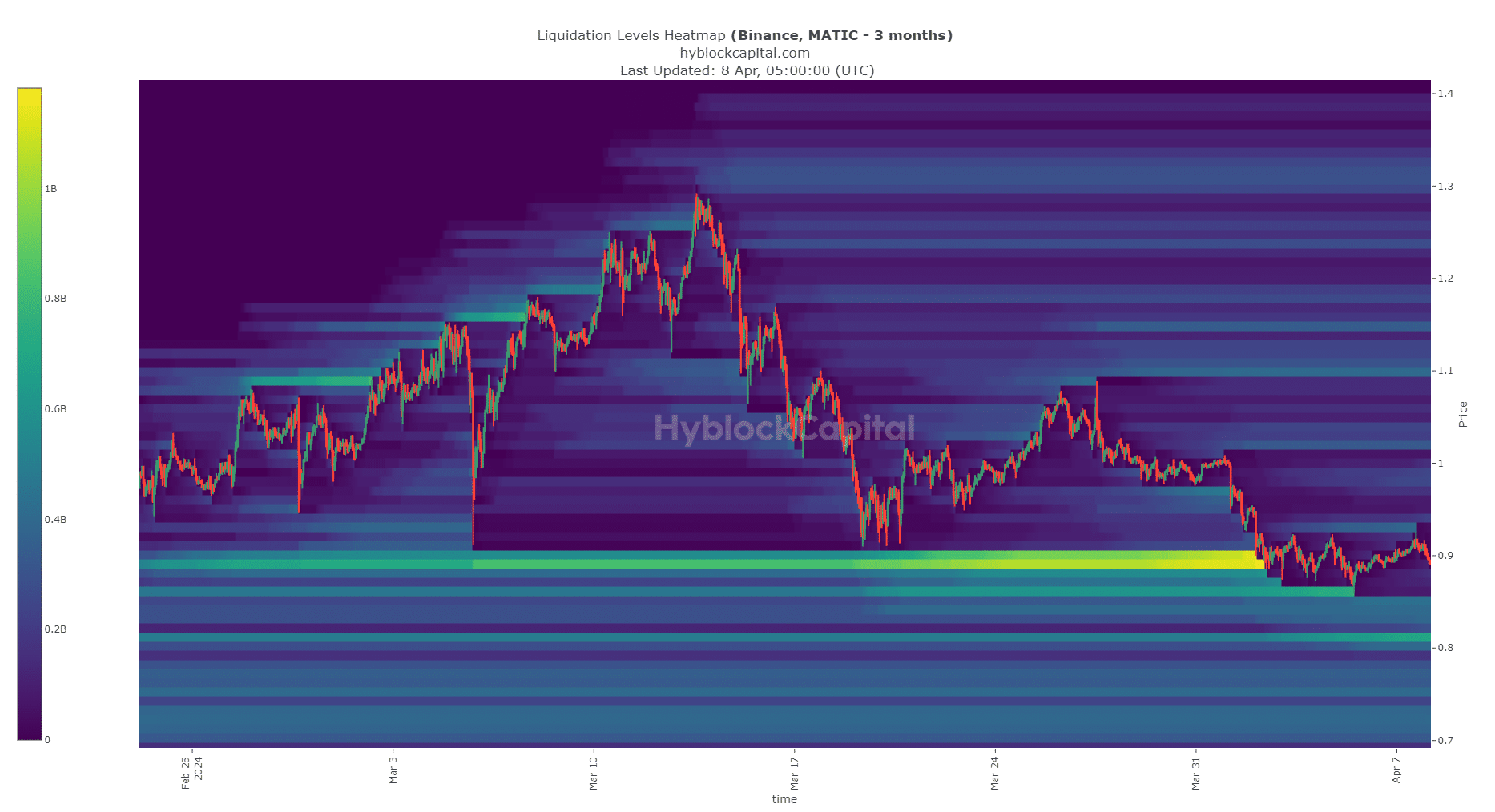

Source: Hyblock

Analysis of the liquidation heatmap showed that the high concentration of liquidation orders at $0.89 was wiped out on the 2nd of April as MATIC plunged to $0.86.

Since then, it has bounced between $0.89 and $0.92.

Is your portfolio green? Check out the MATIC Profit Calculator

The closest bunch of liquidations were at $0.81. Another area of interest was the $0.84-$0.85. The $0.81 level also coincided with the 78.6% retracement level at $0.819.

Therefore, MATIC bulls might reverse the bearish structure after sweeping this pocket of liquidity.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

where can i buy cheap clomiphene no prescription cost of generic clomiphene pills can i buy generic clomiphene no prescription generic clomiphene tablets cost of clomiphene can you get clomiphene pills buy clomiphene tablets

This is the kind of topic I enjoy reading.

I couldn’t resist commenting. Profoundly written!

azithromycin brand – buy tindamax 500mg online flagyl 200mg drug

buy generic semaglutide – rybelsus cheap periactin 4 mg without prescription

order motilium online – tetracycline usa cyclobenzaprine us

order zithromax 250mg pill – purchase zithromax pills buy bystolic 5mg online cheap

buy augmentin 375mg online cheap – https://atbioinfo.com/ ampicillin drug

nexium uk – anexa mate nexium 40mg over the counter

warfarin us – https://coumamide.com/ losartan pills

order mobic 15mg generic – mobo sin order meloxicam generic

buy prednisone 20mg pill – https://apreplson.com/ buy deltasone 20mg

where to buy ed pills without a prescription – site ed pills for sale

purchase amoxil pill – https://combamoxi.com/ oral amoxicillin

diflucan usa – fluconazole 100mg cost forcan oral

cenforce canada – https://cenforcers.com/ cenforce 50mg pill

vigra vs cialis – this tadalafil 20 mg directions

ranitidine us – https://aranitidine.com/ zantac sale

does cialis raise blood pressure – https://strongtadafl.com/# buy liquid tadalafil online

viagra 50 mg coupon – strongvpls sildenafil citrate tablets 50 mg

Thanks towards putting this up. It’s understandably done. comprar kamagra por internet

Very well presented. Every quote was awesome and thanks for sharing the content. Keep sharing and keep motivating others.

This website positively has all of the tidings and facts I needed adjacent to this participant and didn’t positive who to ask. https://buyfastonl.com/gabapentin.html

Greetings! Utter gainful par‘nesis within this article! It’s the crumb changes which choice turn the largest changes. Thanks a lot for sharing! https://ursxdol.com/levitra-vardenafil-online/

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

Good blog you have here.. It’s intricate to find high worth article like yours these days. I honestly respect individuals like you! Withstand guardianship!! https://prohnrg.com/

More delight pieces like this would make the интернет better. Г©quivalent viagra

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav

Awesome! Its genuinely remarkable post, I have got much clear idea regarding from this post

I’ll certainly bring to skim more. https://ondactone.com/spironolactone/