- Ethereum accumulating address holdings have surged by 60% since August 2024

- Volatility took charge of Ethereum’s price action over the last 48 -72 hours

Since hitting a recent high of $4,109, Ethereum’s [ETH] price chart has seen a strong market correction. In fact, prior to its press time recovery that saw it gain by over 7% in 24 hours, the altcoin dropped to as low as $3,095.

This market correction left many key stakeholders talking. According to CryptoQuant’s analyst Mac D, this correction may have been driven by macroeconomic factors.

And yet, at press time, some recovery was in order, with the altcoin’s investors still accumulating the altcoin.

ETH accumulation address holdings surge

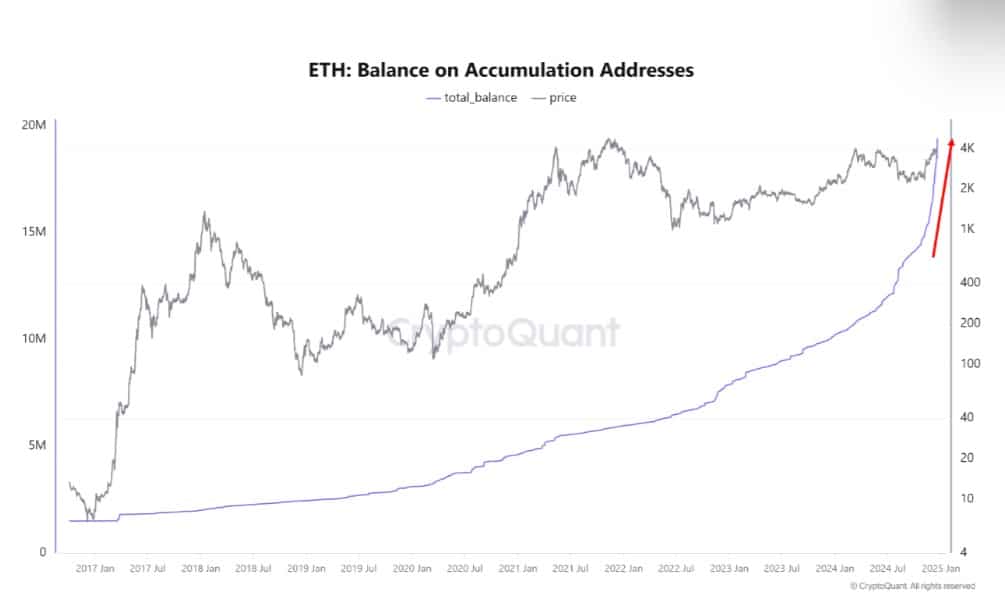

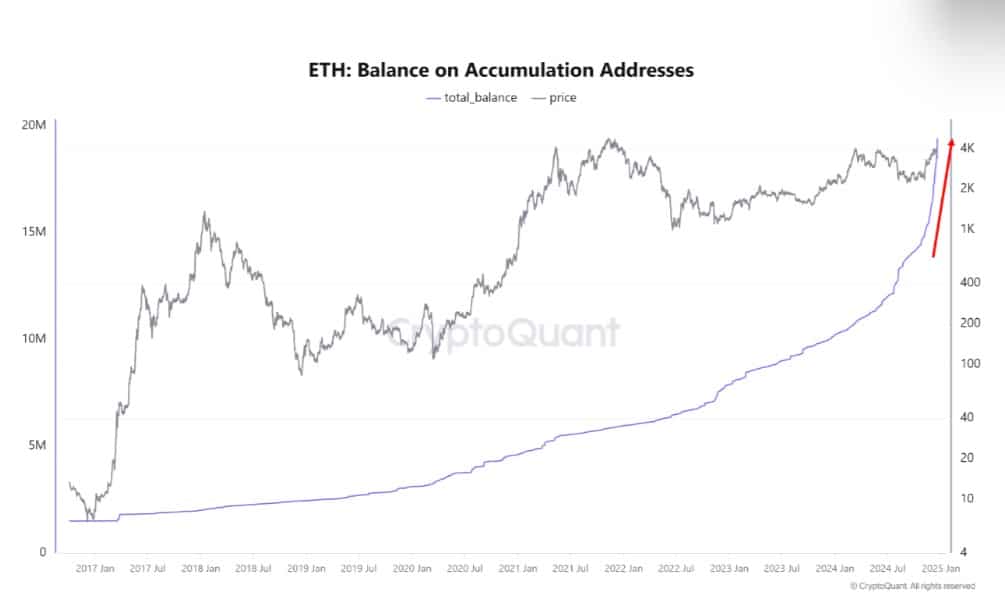

According to CryptoQuant, Ethereum accumulating addresses have surged significantly lately, outpacing previous cycles while doing so.

Source: CryptoQuant

Based on this analysis, accumulating addresses registered a strong hike in August, spiking by 16% or 19.4 million ETH tokens of the total Ethereum supply of 120 million ETH. In terms of growth rate, this uptick represented a 60% increase from 10% in August to 16% in December 2024. Such a massive upsurge was unprecedented in previous ETH cycles.

This uptick in addresses holding ETH underlined the widespread market expectations over Trump’s pro-crypto policies. Equally, it suggested that despite the altcoin’s volatile price, smart money will continue accumulating ETH.

While market correction is very likely in the short term due to macroeconomic factors, the long-term upside potential is still high. This, because investors continue to buy ETH and accumulating addresses are constantly rising.

Impact on altcoin’s price

As expected, a hike in accumulation has had a massive impact on ETH’s price chart. For instance, throughout this accumulating period, ETH surged from a low of $2,116 to a high of $4,109.

In fact, at the time of writing, Ethereum was trading at $3,504, following a hike of over 5% in the last 24 hours.

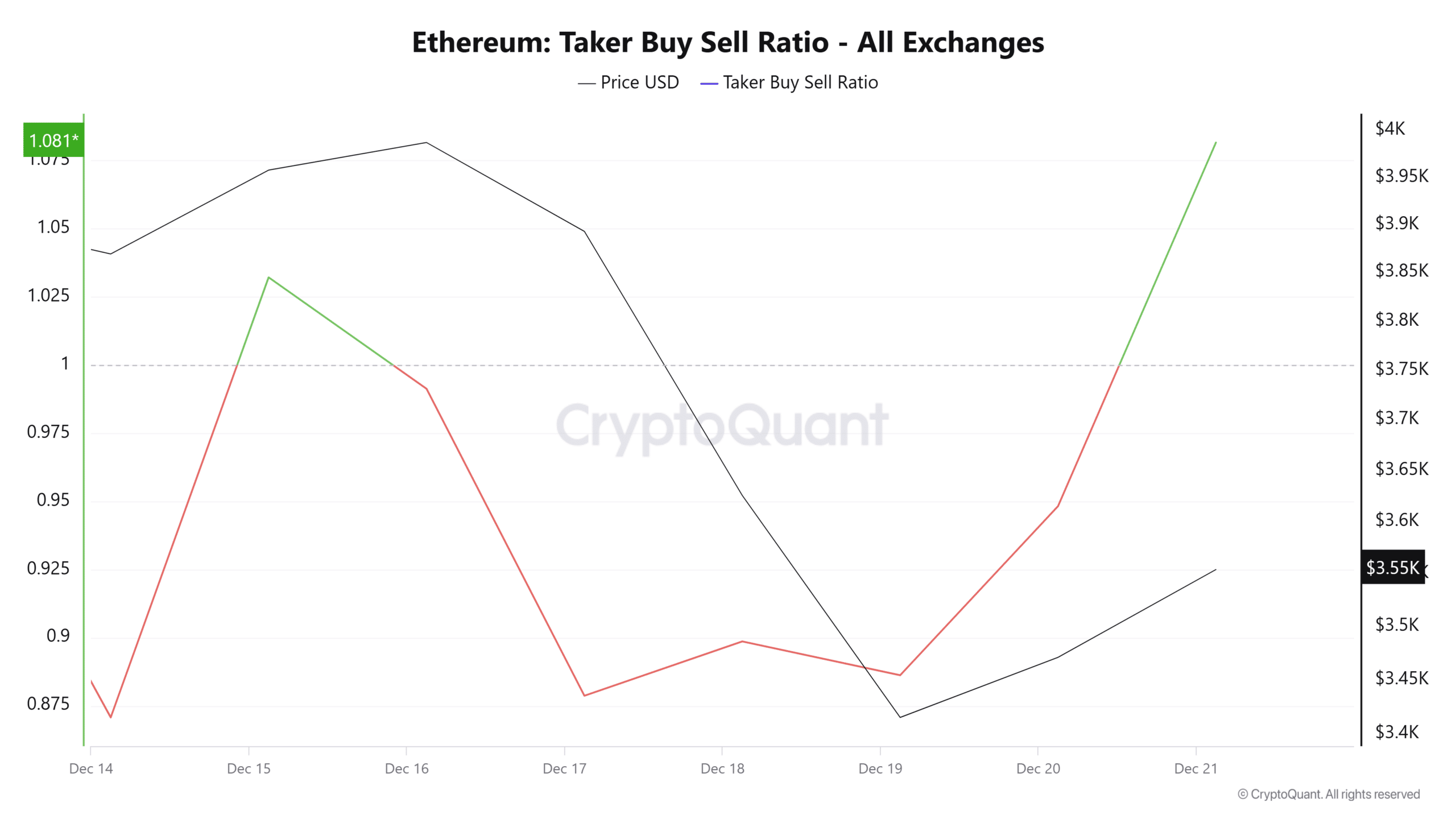

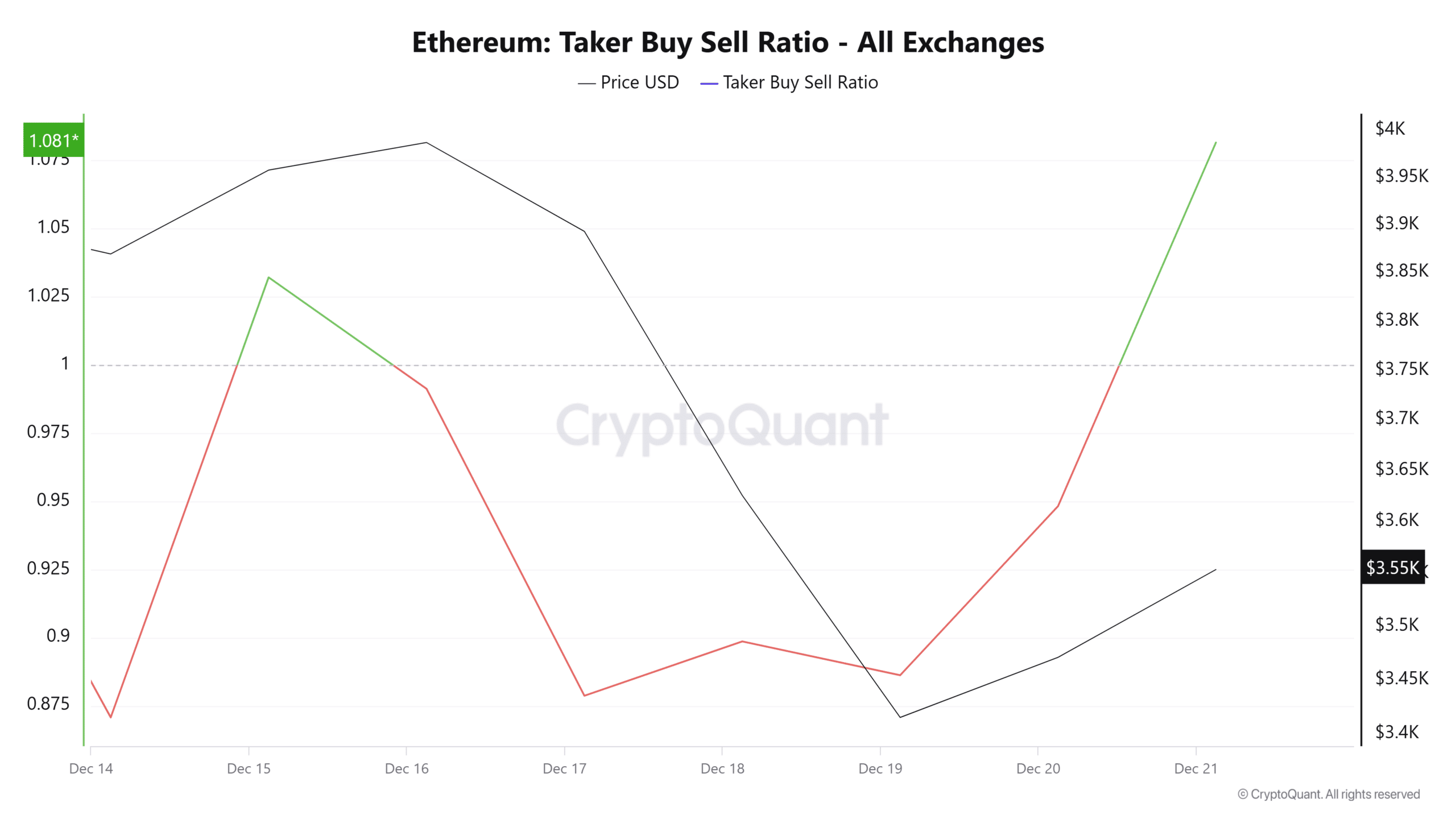

Source: CryptoQuant

This upside momentum witnessed here was largely driven by an uptick in buying pressure. We can see this phenomenon with the spike in Taker Buy sell ratio too, with the same surging to 1.08 at press time.

Such a hike implies that buyers are more aggressive than sellers. Hence, demand may be outweighing supply right now.

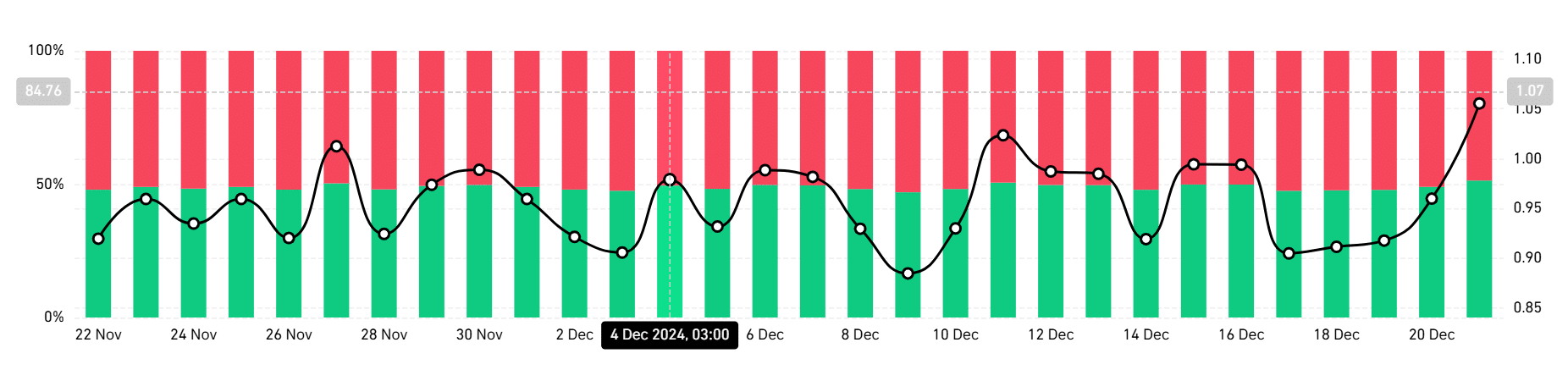

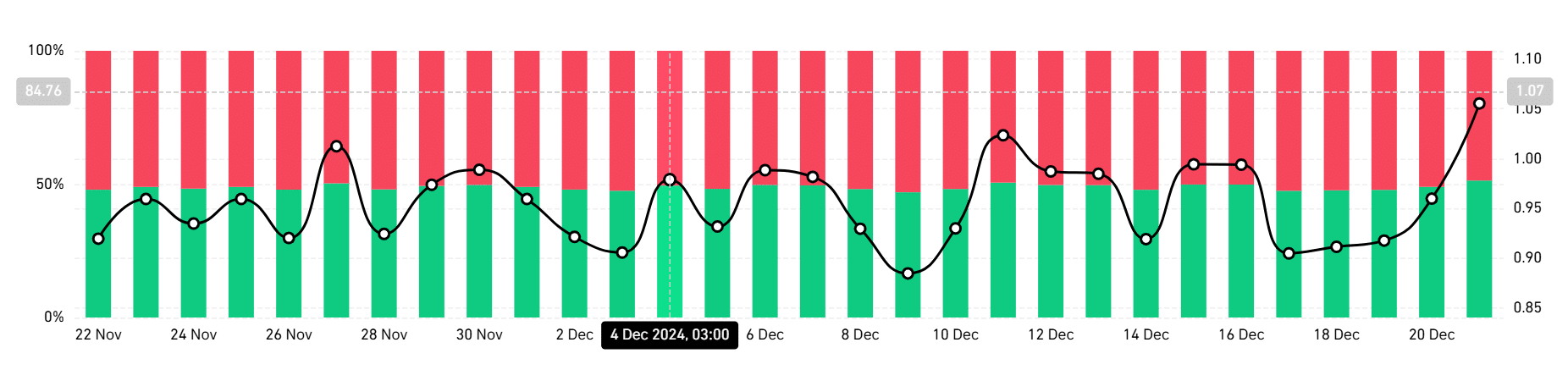

Source: Coinglass

Equally, this buying pressure can be interpreted to be a sign of the prevailing bullish sentiment. This bullishness was evidenced by investors taking long positions too. At the time of writing, those taking long positions were dominating the market with 51% – A sign that most traders anticipate more gains.

In conclusion, with investors turning to accumulating Ethereum, the altcoin may be well positioned for further growth. When more investors raise their holdings, it fuels higher buying pressure, potentially resulting in a supply squeeze. Such conditions put a lot of positive pressure on the altcoin’s price.

Therefore, if the accumulating addresses continue to surge, ETH could reclaim $3,713. Consequently, a drop like the one seen a few days ago would see Ethereum drop to $3,300.

- Ethereum accumulating address holdings have surged by 60% since August 2024

- Volatility took charge of Ethereum’s price action over the last 48 -72 hours

Since hitting a recent high of $4,109, Ethereum’s [ETH] price chart has seen a strong market correction. In fact, prior to its press time recovery that saw it gain by over 7% in 24 hours, the altcoin dropped to as low as $3,095.

This market correction left many key stakeholders talking. According to CryptoQuant’s analyst Mac D, this correction may have been driven by macroeconomic factors.

And yet, at press time, some recovery was in order, with the altcoin’s investors still accumulating the altcoin.

ETH accumulation address holdings surge

According to CryptoQuant, Ethereum accumulating addresses have surged significantly lately, outpacing previous cycles while doing so.

Source: CryptoQuant

Based on this analysis, accumulating addresses registered a strong hike in August, spiking by 16% or 19.4 million ETH tokens of the total Ethereum supply of 120 million ETH. In terms of growth rate, this uptick represented a 60% increase from 10% in August to 16% in December 2024. Such a massive upsurge was unprecedented in previous ETH cycles.

This uptick in addresses holding ETH underlined the widespread market expectations over Trump’s pro-crypto policies. Equally, it suggested that despite the altcoin’s volatile price, smart money will continue accumulating ETH.

While market correction is very likely in the short term due to macroeconomic factors, the long-term upside potential is still high. This, because investors continue to buy ETH and accumulating addresses are constantly rising.

Impact on altcoin’s price

As expected, a hike in accumulation has had a massive impact on ETH’s price chart. For instance, throughout this accumulating period, ETH surged from a low of $2,116 to a high of $4,109.

In fact, at the time of writing, Ethereum was trading at $3,504, following a hike of over 5% in the last 24 hours.

Source: CryptoQuant

This upside momentum witnessed here was largely driven by an uptick in buying pressure. We can see this phenomenon with the spike in Taker Buy sell ratio too, with the same surging to 1.08 at press time.

Such a hike implies that buyers are more aggressive than sellers. Hence, demand may be outweighing supply right now.

Source: Coinglass

Equally, this buying pressure can be interpreted to be a sign of the prevailing bullish sentiment. This bullishness was evidenced by investors taking long positions too. At the time of writing, those taking long positions were dominating the market with 51% – A sign that most traders anticipate more gains.

In conclusion, with investors turning to accumulating Ethereum, the altcoin may be well positioned for further growth. When more investors raise their holdings, it fuels higher buying pressure, potentially resulting in a supply squeeze. Such conditions put a lot of positive pressure on the altcoin’s price.

Therefore, if the accumulating addresses continue to surge, ETH could reclaim $3,713. Consequently, a drop like the one seen a few days ago would see Ethereum drop to $3,300.

get generic clomid for sale where buy cheap clomid no prescription cost of generic clomid without rx how to get generic clomid pill clomid chance of twins how to get clomid without prescription clomiphene for sale australia

Thanks on putting this up. It’s okay done.

This is the type of post I unearth helpful.

purchase rybelsus pills – cyproheptadine buy online order cyproheptadine online cheap

domperidone 10mg cost – tetracycline 250mg price flexeril 15mg without prescription

brand augmentin – https://atbioinfo.com/ buy ampicillin generic

nexium price – anexamate.com order esomeprazole 40mg generic

warfarin usa – https://coumamide.com/ order losartan 50mg pill

purchase meloxicam generic – tenderness meloxicam 15mg for sale

best ed drug – https://fastedtotake.com/ generic ed pills

buy generic amoxil for sale – combamoxi cheap generic amoxil

purchase fluconazole online – https://gpdifluca.com/ buy generic fluconazole over the counter

buy cenforce 100mg without prescription – cenforce 100mg cost cheap cenforce 50mg

cheapest 10mg cialis – cialis tubs generic cialis tadalafil 20mg reviews