- Increased demand for the Ethereum network has led to a surge in burn rate.

- This has brought about a decline in the coin’s circulating supply.

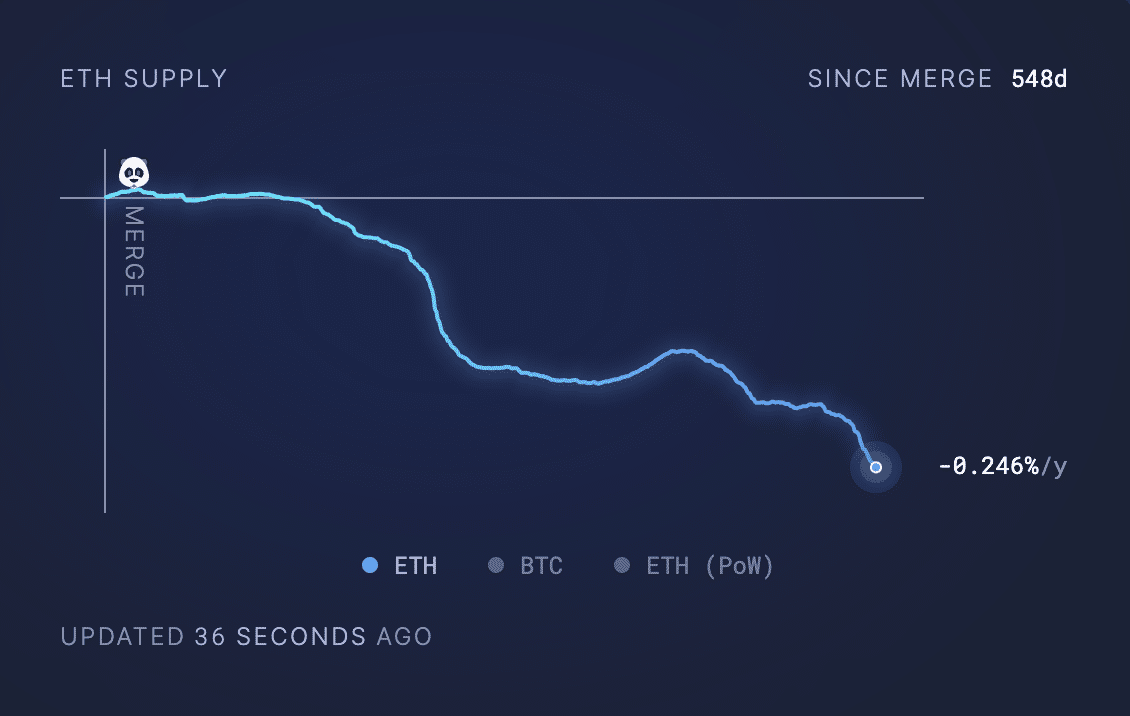

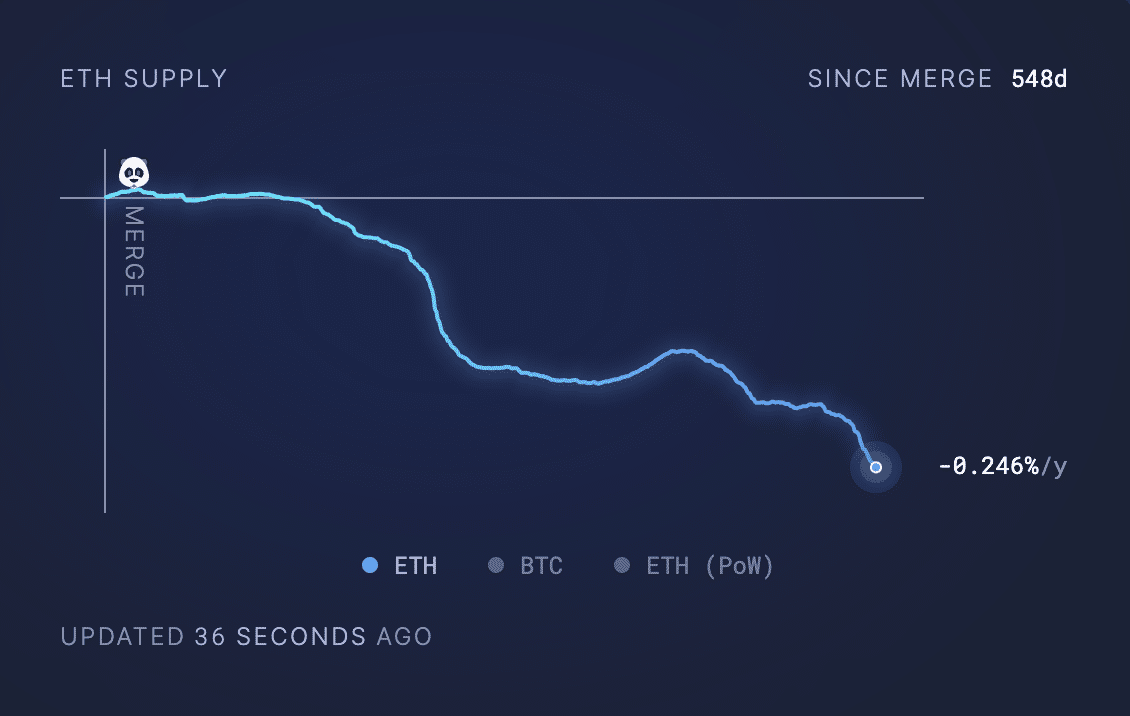

Ethereum’s [ETH] circulating supply has fallen to a new post-merge low, according to data from Ultrasound.money.

In the last month, 86,219 ETH worth around $300 million at the altcoin’s press time price has been removed from circulation in the last 30 days.

The decline in ETH’s circulating supply showed that the Proof-of-Stake (PoS) network has seen an uptick in demand and use, causing its burn rate to increase.

AMBCrypto previously reported that the daily count of new addresses created on the Ethereum network recently surpassed 116,000, a year-to-date (YTD) high.

This signaled a surge in user activity on the Layer 1 (L1) network.

At press time, ETH’s circulating supply totaled 120.07 million ETH, the lowest level in 548 days since the network transitioned from Proof-of-Work (PoW), in an event popularly referred to as “The Merge.”

Source: Ultrasound.money

Ecosystem performance in the last month

An assessment of Ethereum’s decentralized finance (DeFi) ecosystem revealed an uptick in total value locked (TVL) in the last month.

According to DefiLlama’s data, Ethereum’s TVL was $51 billion at press time, rising by 21% in the 30 days. During that period, Lido Finance, the leading protocol on the chain, saw its TVL increase by 27%.

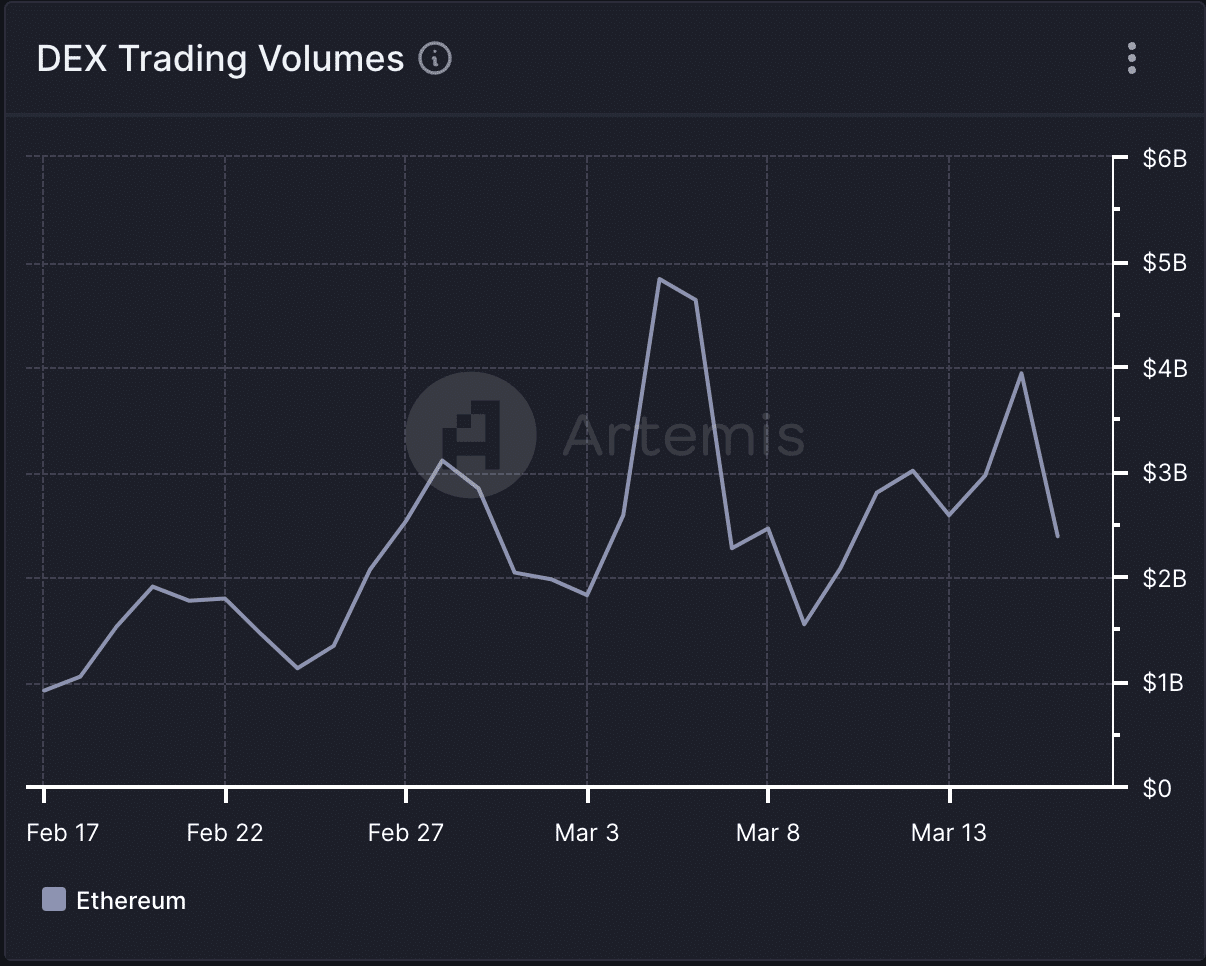

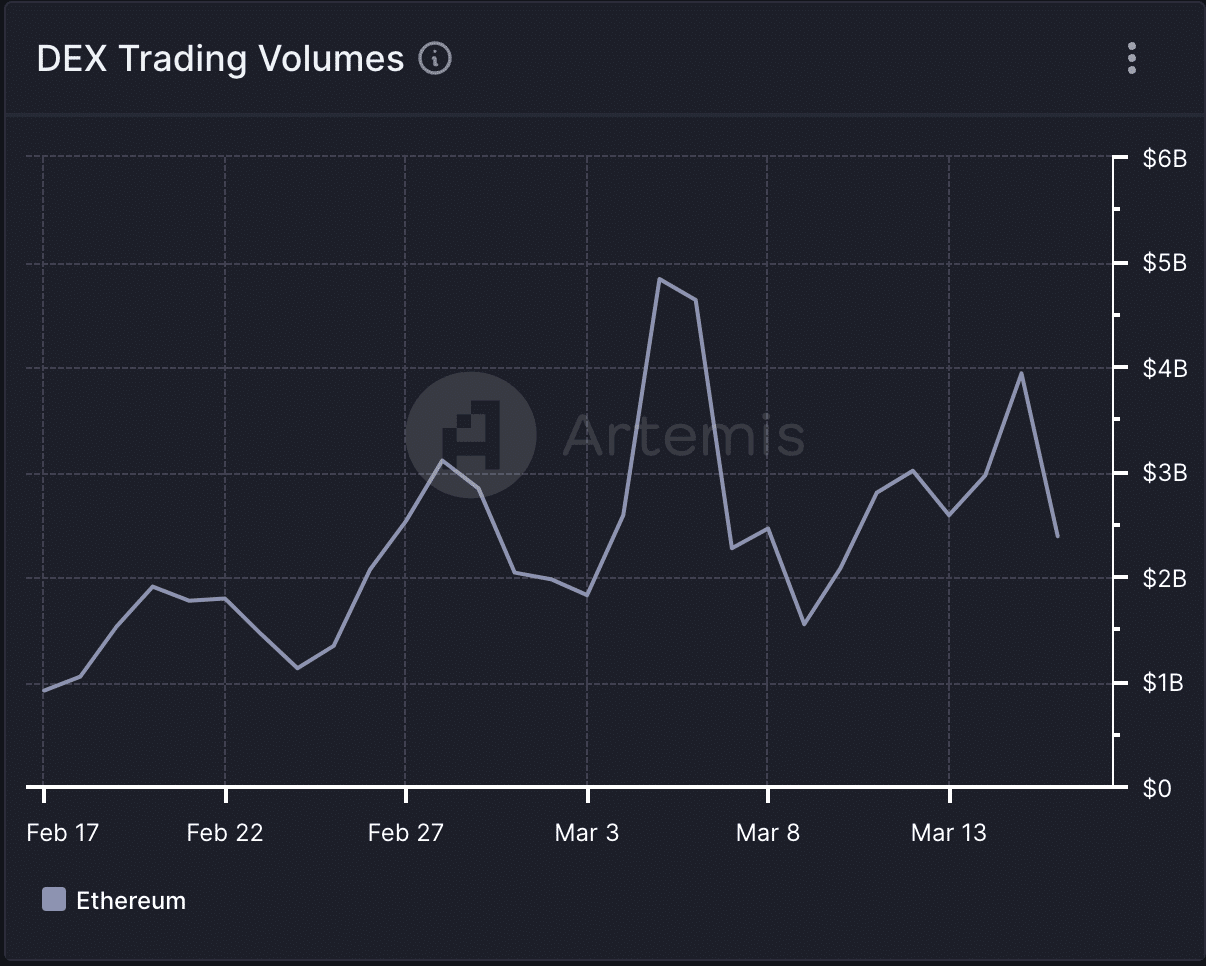

Amid the recent rally in the altcoin market, Ethereum witnessed a spike in its decentralized exchange (DEX) trade volumes in the last month.

According to data from Artemis’, the daily trading volume across the DEXes housed within Ethereum has risen by 161% in the past 30 days.

Source: Artemis

Regarding the network’s non-fungible token (NFT) sector, it also witnessed growth in the last month.

According to data from CryptoSlam, NFT sales volume totaled $617 million in the past 30 days, registering a 17% rally.

This spike in trading volume occurred despite the 57% decrease in the number of NFT sales transactions completed during that period.

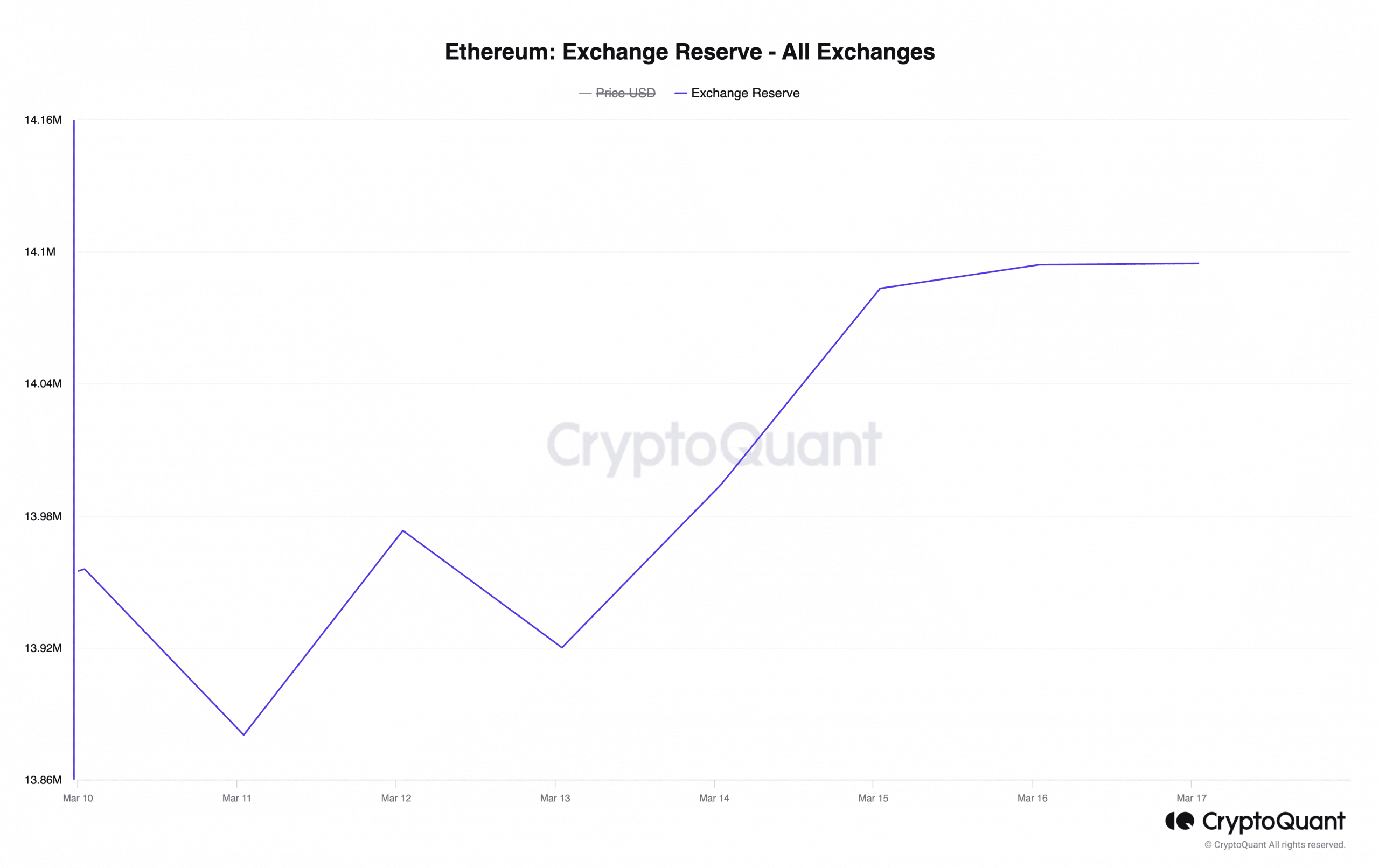

Exchange reserve climbs to a one-month high

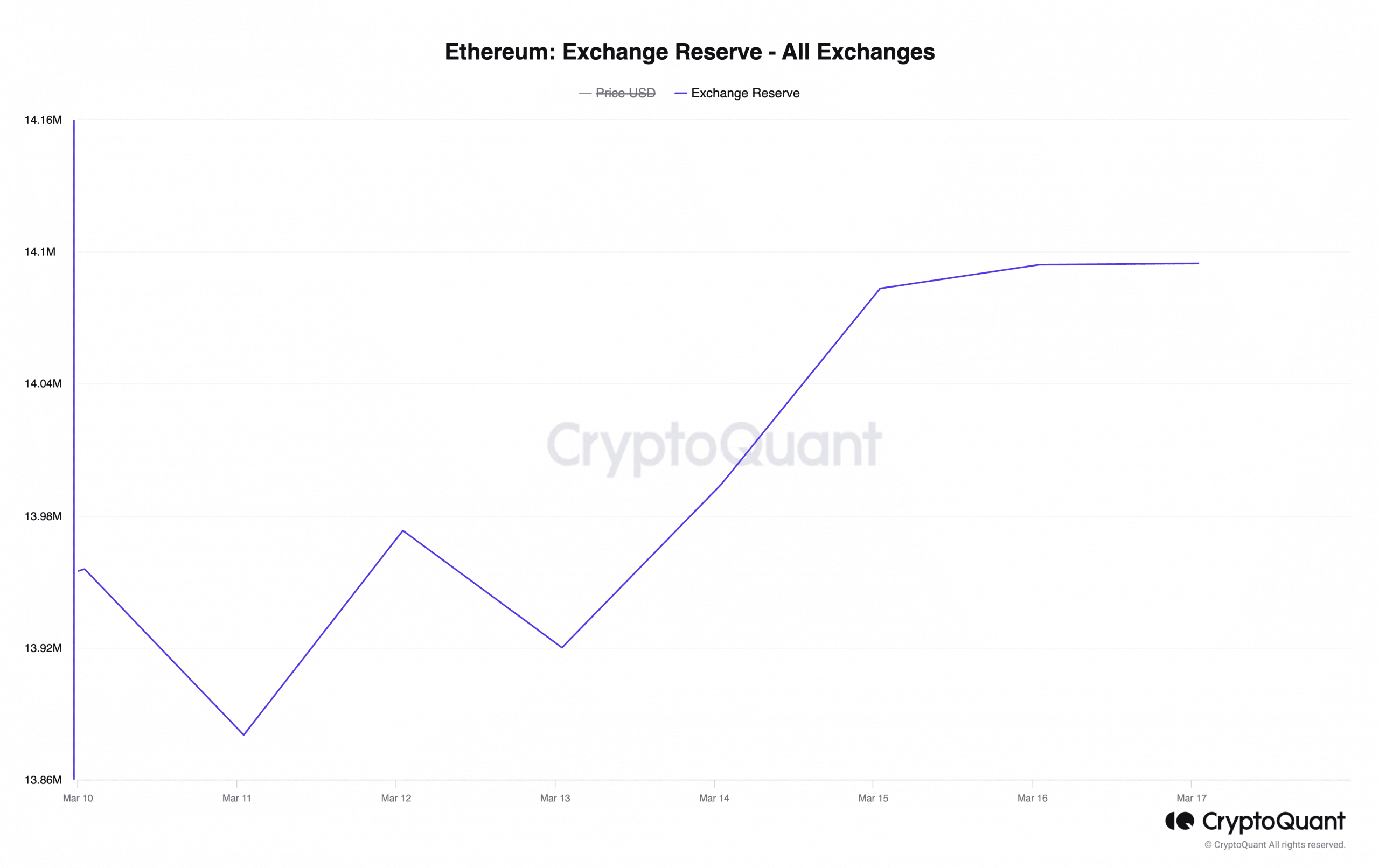

As the crypto market becomes significantly overheated, with the crypto fear & greed index indicating a marked increase in greedy sentiment, sell-offs of ETH have surged.

How much are 1,10,100 ETHs worth today?

This has resulted in a spike in ETH’s supply on exchanges. Per CryptoQuant’s data, ETH’s exchange reserve was 14.1 million at press time, its highest level in the last month.

Source: CryptoQuant

When an asset’s exchange reserve climbs this way, it suggests an increase in selling pressure.

- Increased demand for the Ethereum network has led to a surge in burn rate.

- This has brought about a decline in the coin’s circulating supply.

Ethereum’s [ETH] circulating supply has fallen to a new post-merge low, according to data from Ultrasound.money.

In the last month, 86,219 ETH worth around $300 million at the altcoin’s press time price has been removed from circulation in the last 30 days.

The decline in ETH’s circulating supply showed that the Proof-of-Stake (PoS) network has seen an uptick in demand and use, causing its burn rate to increase.

AMBCrypto previously reported that the daily count of new addresses created on the Ethereum network recently surpassed 116,000, a year-to-date (YTD) high.

This signaled a surge in user activity on the Layer 1 (L1) network.

At press time, ETH’s circulating supply totaled 120.07 million ETH, the lowest level in 548 days since the network transitioned from Proof-of-Work (PoW), in an event popularly referred to as “The Merge.”

Source: Ultrasound.money

Ecosystem performance in the last month

An assessment of Ethereum’s decentralized finance (DeFi) ecosystem revealed an uptick in total value locked (TVL) in the last month.

According to DefiLlama’s data, Ethereum’s TVL was $51 billion at press time, rising by 21% in the 30 days. During that period, Lido Finance, the leading protocol on the chain, saw its TVL increase by 27%.

Amid the recent rally in the altcoin market, Ethereum witnessed a spike in its decentralized exchange (DEX) trade volumes in the last month.

According to data from Artemis’, the daily trading volume across the DEXes housed within Ethereum has risen by 161% in the past 30 days.

Source: Artemis

Regarding the network’s non-fungible token (NFT) sector, it also witnessed growth in the last month.

According to data from CryptoSlam, NFT sales volume totaled $617 million in the past 30 days, registering a 17% rally.

This spike in trading volume occurred despite the 57% decrease in the number of NFT sales transactions completed during that period.

Exchange reserve climbs to a one-month high

As the crypto market becomes significantly overheated, with the crypto fear & greed index indicating a marked increase in greedy sentiment, sell-offs of ETH have surged.

How much are 1,10,100 ETHs worth today?

This has resulted in a spike in ETH’s supply on exchanges. Per CryptoQuant’s data, ETH’s exchange reserve was 14.1 million at press time, its highest level in the last month.

Source: CryptoQuant

When an asset’s exchange reserve climbs this way, it suggests an increase in selling pressure.

how to buy clomid without dr prescription where can i get cheap clomid pill where can i get cheap clomid pill where can i buy generic clomid price clomid prices cost cheap clomiphene online can i get clomiphene pills

This is the kind of glad I take advantage of reading.

Palatable blog you possess here.. It’s hard to espy elevated worth writing like yours these days. I honestly appreciate individuals like you! Take mindfulness!!

zithromax pills – order tetracycline 250mg sale purchase metronidazole pills

rybelsus 14 mg tablet – periactin 4 mg brand periactin medication

order motilium 10mg online – buy cyclobenzaprine without prescription order cyclobenzaprine 15mg for sale

amoxiclav online order – atbioinfo.com purchase ampicillin generic

buy esomeprazole generic – anexa mate how to buy esomeprazole

warfarin 5mg generic – cou mamide buy generic hyzaar online

meloxicam for sale online – https://moboxsin.com/ brand mobic

deltasone 20mg pill – https://apreplson.com/ purchase prednisone generic

order generic amoxicillin – combamoxi order amoxicillin pills

where can i buy forcan – https://gpdifluca.com/ cheap diflucan 100mg

order cenforce generic – this buy cenforce 100mg online cheap