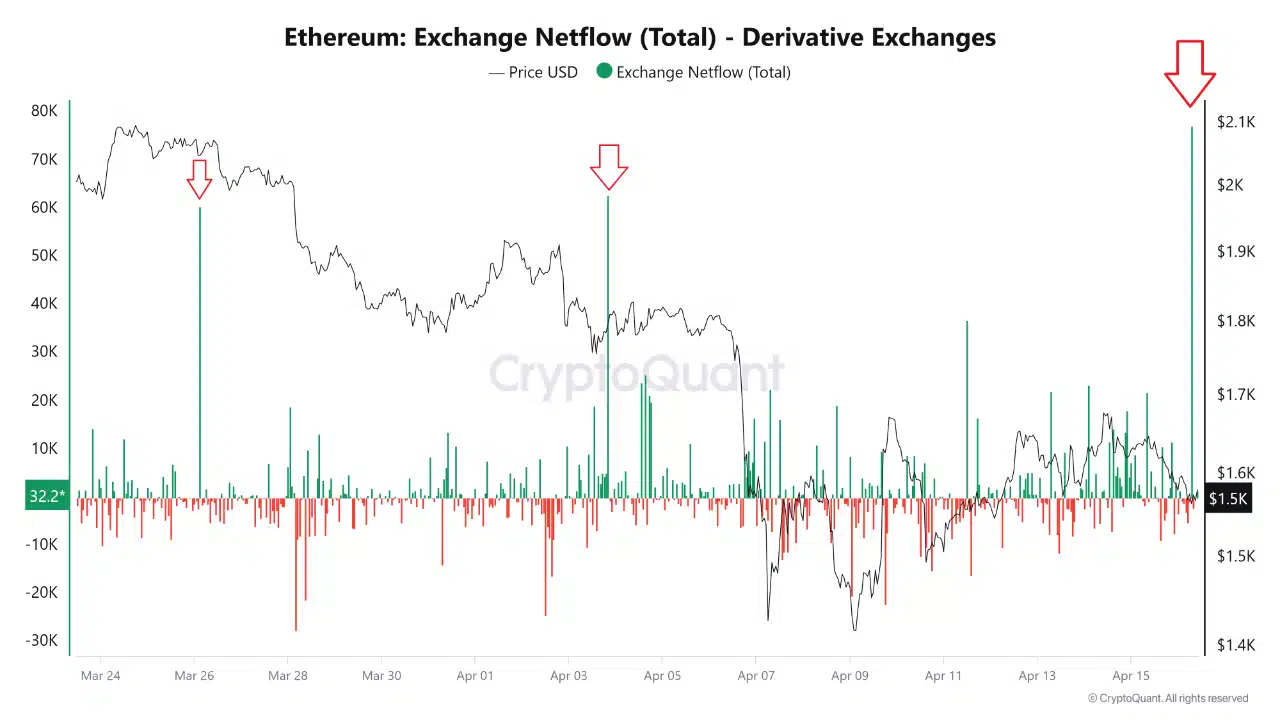

A massive move: 77K ETH hits derivatives

On the 16th of April, over 77,000 ETH flooded into derivative exchanges — Ethereum’s largest single-day net inflow in months.

This makes the previous spikes of 65K ETH on the 26th of March and 60K ETH on the 3rd of April look like chump change.

Source: Cryptoquant

The sudden surge, shown clearly in the chart, represents a significant increase in supply entering markets typically used for leverage, hedging, or speculation.

Crucially, Ethereum’s price hovered around $1.5K during the inflow — its lowest level since late 2023 — indicating that this movement isn’t driven by euphoria, but likely caution.

With markets still rattled by uncertainty, such a scale of inflow suggests institutional players are repositioning — and potentially preparing for more downside.

Bearish repeats

Ethereum’s latest spike in derivatives inflow mirrors two prior events — the 26th of March and the 3rd of April — both of which preceded notable price declines.

These inflows correlate with rising bearish sentiment, as traders move ETH to derivative platforms to open shorts or protective hedges.

The pattern is clear: large ETH inflows cause market retreats. What’s different now is the scale and context.

This week’s surge follows China’s retaliatory tariffs, which have sparked a broader risk-off sentiment across global markets.

If history repeats, ETH could see further weakness; but if macro conditions stabilize, this inflow might mark capitulation at the bottom, not a prelude to more pain.

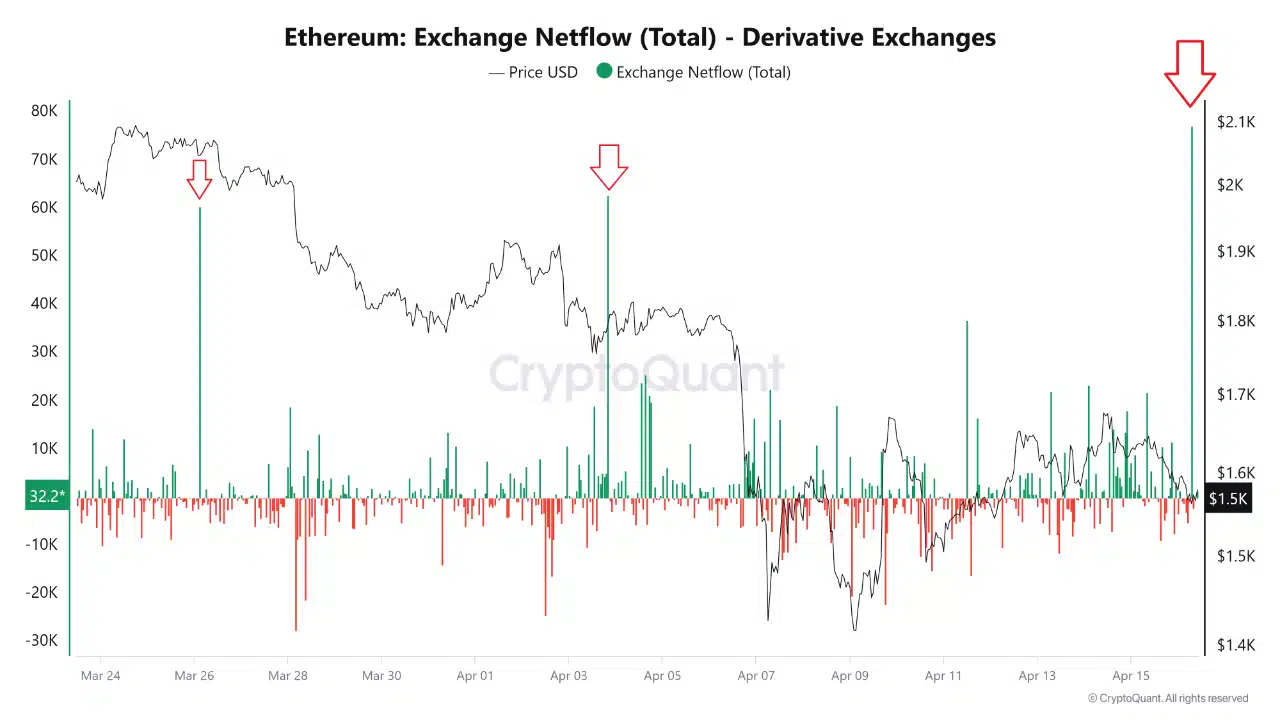

A massive move: 77K ETH hits derivatives

On the 16th of April, over 77,000 ETH flooded into derivative exchanges — Ethereum’s largest single-day net inflow in months.

This makes the previous spikes of 65K ETH on the 26th of March and 60K ETH on the 3rd of April look like chump change.

Source: Cryptoquant

The sudden surge, shown clearly in the chart, represents a significant increase in supply entering markets typically used for leverage, hedging, or speculation.

Crucially, Ethereum’s price hovered around $1.5K during the inflow — its lowest level since late 2023 — indicating that this movement isn’t driven by euphoria, but likely caution.

With markets still rattled by uncertainty, such a scale of inflow suggests institutional players are repositioning — and potentially preparing for more downside.

Bearish repeats

Ethereum’s latest spike in derivatives inflow mirrors two prior events — the 26th of March and the 3rd of April — both of which preceded notable price declines.

These inflows correlate with rising bearish sentiment, as traders move ETH to derivative platforms to open shorts or protective hedges.

The pattern is clear: large ETH inflows cause market retreats. What’s different now is the scale and context.

This week’s surge follows China’s retaliatory tariffs, which have sparked a broader risk-off sentiment across global markets.

If history repeats, ETH could see further weakness; but if macro conditions stabilize, this inflow might mark capitulation at the bottom, not a prelude to more pain.

where to buy generic clomiphene tablets can you get clomid prices where to buy cheap clomid tablets clomiphene generico how to get clomiphene tablets generic clomid online can you buy generic clomiphene without rx

My partner and I absolutely love your blog and find almost all of your post’s to be what precisely I’m looking for. Do you offer guest writers to write content available for you? I wouldn’t mind writing a post or elaborating on a lot of the subjects you write concerning here. Again, awesome web log!

Thanks on putting this up. It’s well done.

I couldn’t resist commenting. Warmly written!

azithromycin 500mg tablet – ciplox 500mg canada metronidazole 200mg brand

I’ve been exploring for a little bit for any high-quality articles or blog posts on this sort of area . Exploring in Yahoo I at last stumbled upon this web site. Reading this information So i’m happy to convey that I have an incredibly good uncanny feeling I discovered exactly what I needed. I most certainly will make certain to do not forget this site and give it a look regularly.

purchase motilium generic – purchase motilium online brand flexeril

amei este site. Pra saber mais detalhes acesse o site e descubra mais. Todas as informações contidas são informações relevantes e únicos. Tudo que você precisa saber está está lá.

buy clavulanate pills – https://atbioinfo.com/ order ampicillin online

buy esomeprazole without prescription – anexamate nexium capsules

coumadin 5mg pill – coumamide.com buy losartan pills for sale

Great write-up, I¦m regular visitor of one¦s blog, maintain up the nice operate, and It is going to be a regular visitor for a lengthy time.

mobic 15mg pills – https://moboxsin.com/ mobic uk

order prednisone 10mg – aprep lson deltasone 40mg cost

buy ed pills usa – fast ed to take best ed pills

order amoxicillin – buy amoxil tablets buy amoxicillin pills

diflucan 100mg sale – https://gpdifluca.com/# order fluconazole 200mg online

escitalopram us – lexapro online order lexapro 20mg pill

cenforce 50mg cheap – https://cenforcers.com/# order cenforce sale

tadalafil daily use – https://ciltadgn.com/# cialis 20mg side effects

order generic cialis online 20 mg 20 pills – https://strongtadafl.com/ tadalafil with latairis

zantac 150mg over the counter – zantac 300mg without prescription order zantac 150mg generic

generic viagra sale online – https://strongvpls.com/ how to order generic viagra

More posts like this would prosper the blogosphere more useful. buy generic furosemide over the counter

This is a theme which is in to my heart… Diverse thanks! Unerringly where can I upon the phone details for questions? https://ursxdol.com/propecia-tablets-online/

I’ll certainly return to be familiar with more. https://prohnrg.com/product/cytotec-online/

F*ckin¦ awesome things here. I am very satisfied to look your article. Thanks a lot and i’m taking a look forward to touch you. Will you kindly drop me a mail?

This is the kind of content I enjoy reading. kamagra utilisation

Greetings! Extremely productive par‘nesis within this article! It’s the petty changes which liking make the largest changes. Thanks a lot towards sharing! https://ondactone.com/spironolactone/

More articles like this would make the blogosphere richer.

can i buy generic flexeril without insurance

With thanks. Loads of expertise! http://bbs.dubu.cn/home.php?mod=space&uid=395580

Absolutely pent content, thanks for selective information.

I¦ve recently started a web site, the information you provide on this web site has helped me tremendously. Thanks for all of your time & work.

I got what you intend, thankyou for posting.Woh I am glad to find this website through google. “You must pray that the way be long, full of adventures and experiences.” by Constantine Peter Cavafy.

Thank you for sharing superb informations. Your web-site is so cool. I’m impressed by the details that you’ve on this blog. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my pal, ROCK! I found just the info I already searched everywhere and just couldn’t come across. What an ideal site.

Please let me know if you’re looking for a article author for your weblog. You have some really great articles and I think I would be a good asset. If you ever want to take some of the load off, I’d really like to write some articles for your blog in exchange for a link back to mine. Please send me an e-mail if interested. Regards!

Some times its a pain in the ass to read what people wrote but this internet site is rattling user pleasant! .

I like this web site because so much useful material on here : D.

I really appreciate this post. I have been looking everywhere for this! Thank goodness I found it on Bing. You’ve made my day! Thank you again!

dapagliflozin 10 mg drug – https://janozin.com/# order forxiga 10mg sale

Good web site! I truly love how it is easy on my eyes and the data are well written. I’m wondering how I could be notified whenever a new post has been made. I’ve subscribed to your RSS which must do the trick! Have a nice day!

buy xenical sale – buy orlistat online orlistat 60mg sale