- Ethereum’s price falls by 10% post-ETF launch, contrary to bullish predictions.

- Factors like market corrections and external economic pressures contribute to the downturn

In recent developments, Ethereum [ETH] price has witnessed a notable downturn, dipping by nearly 10% within the past 24 hours, and currently standing at $3,164.

This decline strikes as particularly significant given its timing—right after the launch of the highly anticipated spot Ethereum ETFs, which many had expected to catalyze a bullish trend for ETH.

Although this is just the beginning of the live trading of these ETH financial products, 10x Research, a Digital Asset Research for Traders and Institutions has given some notable factors on why Ethereum is plunging despite their launch.

Why the sudden drop?

Despite the optimism that surrounded the initial trading of these ETFs, the response has not lived up to expectations.

According to insights from 10x Research, the rapid dissipation of the initial excitement around the Ethereum ETFs has led to a classic “sell-the-news” scenario.

This phenomenon isn’t new to the cryptocurrency market; similar trends were observed in past significant events within the digital assets space, including multiple instances throughout 2017, 2021, and earlier in 2024.

10x Research points out that the timing of the ETF launch may have exacerbated the situation.

It coincided not only with the distribution of Bitcoin from the long-standing Mt. Gox case but also with a broader market downturn influenced by poor performances in the U.S. tech sector.

Companies like Alphabet and Tesla have seen notable sell-offs, contributing to a cautious or bearish outlook across investment spaces due to weakened consumer spending forecasts.

Furthermore, the impact of these factors appears to be more pronounced for Ethereum.

Ahead of the ETF’s launch, 10x Research already marked Ethereum as overbought, suggesting that the market was ripe for a correction. This perspective seems to have been validated by the recent price movements, which saw Ethereum struggling even as significant capital flowed into the new ETFs.

Ethereum ETF inflows and price drop impact

Despite the downturn in spot prices, the Ethereum ETFs have attracted considerable attention from investors. On their first day of trading, these funds collectively garnered net inflows of around $106 million.

Leading the charge was BlackRock’s iShares Ethereum Trust ETF, which alone pulled in $266.5 million. Close on its heels was the Bitwise Ethereum ETF, with $204 million in inflows, and the Fidelity Ethereum Fund, which attracted $71 million.

However, not all funds experienced positive inflows. The Grayscale Ethereum Trust, transitioning into an ETF, saw significant outflows totaling $484 million—markedly higher than the initial outflows experienced by its Bitcoin counterpart earlier in the year.

Meanwhile, as the market digests the new developments and adjusts to the influx of ETF products, Ethereum’s price volatility has left many traders facing substantial losses.

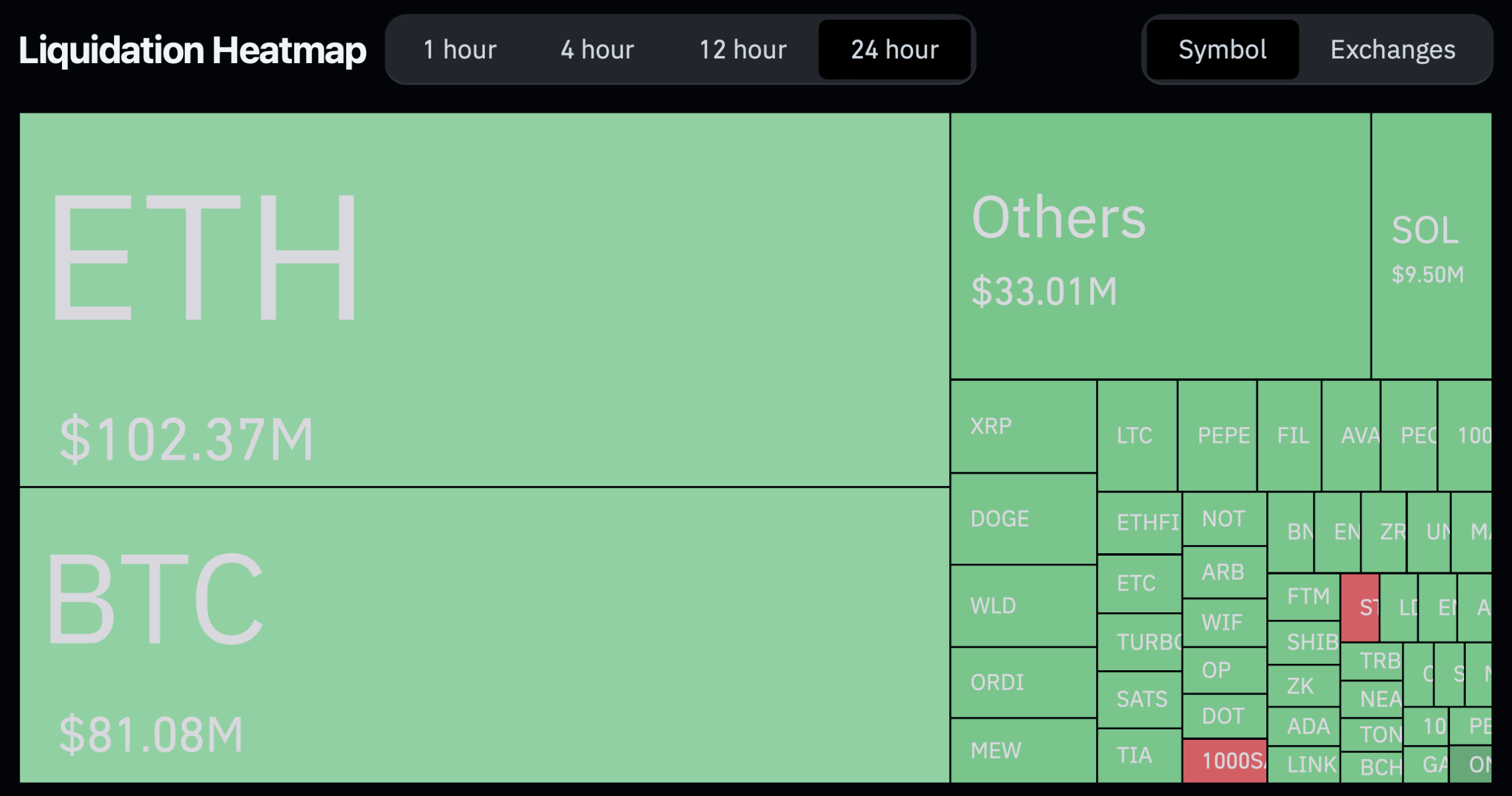

Source: Coinglass

Over the past day, a whopping 73,119 traders were liquidated, with Ethereum-related liquidations accounting for $102.37 million.

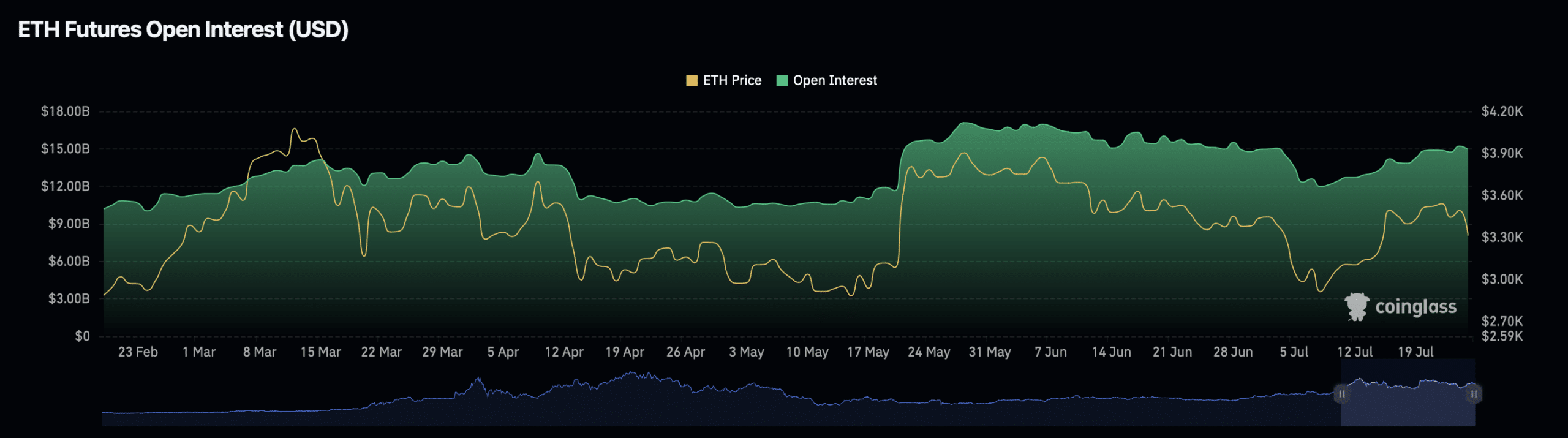

This has also influenced Ethereum’s open interest, which has seen a decline of nearly 5%, standing at $14.32 billion, with the volume decreasing by 3.92%.

Source: Coinglass

- Ethereum’s price falls by 10% post-ETF launch, contrary to bullish predictions.

- Factors like market corrections and external economic pressures contribute to the downturn

In recent developments, Ethereum [ETH] price has witnessed a notable downturn, dipping by nearly 10% within the past 24 hours, and currently standing at $3,164.

This decline strikes as particularly significant given its timing—right after the launch of the highly anticipated spot Ethereum ETFs, which many had expected to catalyze a bullish trend for ETH.

Although this is just the beginning of the live trading of these ETH financial products, 10x Research, a Digital Asset Research for Traders and Institutions has given some notable factors on why Ethereum is plunging despite their launch.

Why the sudden drop?

Despite the optimism that surrounded the initial trading of these ETFs, the response has not lived up to expectations.

According to insights from 10x Research, the rapid dissipation of the initial excitement around the Ethereum ETFs has led to a classic “sell-the-news” scenario.

This phenomenon isn’t new to the cryptocurrency market; similar trends were observed in past significant events within the digital assets space, including multiple instances throughout 2017, 2021, and earlier in 2024.

10x Research points out that the timing of the ETF launch may have exacerbated the situation.

It coincided not only with the distribution of Bitcoin from the long-standing Mt. Gox case but also with a broader market downturn influenced by poor performances in the U.S. tech sector.

Companies like Alphabet and Tesla have seen notable sell-offs, contributing to a cautious or bearish outlook across investment spaces due to weakened consumer spending forecasts.

Furthermore, the impact of these factors appears to be more pronounced for Ethereum.

Ahead of the ETF’s launch, 10x Research already marked Ethereum as overbought, suggesting that the market was ripe for a correction. This perspective seems to have been validated by the recent price movements, which saw Ethereum struggling even as significant capital flowed into the new ETFs.

Ethereum ETF inflows and price drop impact

Despite the downturn in spot prices, the Ethereum ETFs have attracted considerable attention from investors. On their first day of trading, these funds collectively garnered net inflows of around $106 million.

Leading the charge was BlackRock’s iShares Ethereum Trust ETF, which alone pulled in $266.5 million. Close on its heels was the Bitwise Ethereum ETF, with $204 million in inflows, and the Fidelity Ethereum Fund, which attracted $71 million.

However, not all funds experienced positive inflows. The Grayscale Ethereum Trust, transitioning into an ETF, saw significant outflows totaling $484 million—markedly higher than the initial outflows experienced by its Bitcoin counterpart earlier in the year.

Meanwhile, as the market digests the new developments and adjusts to the influx of ETF products, Ethereum’s price volatility has left many traders facing substantial losses.

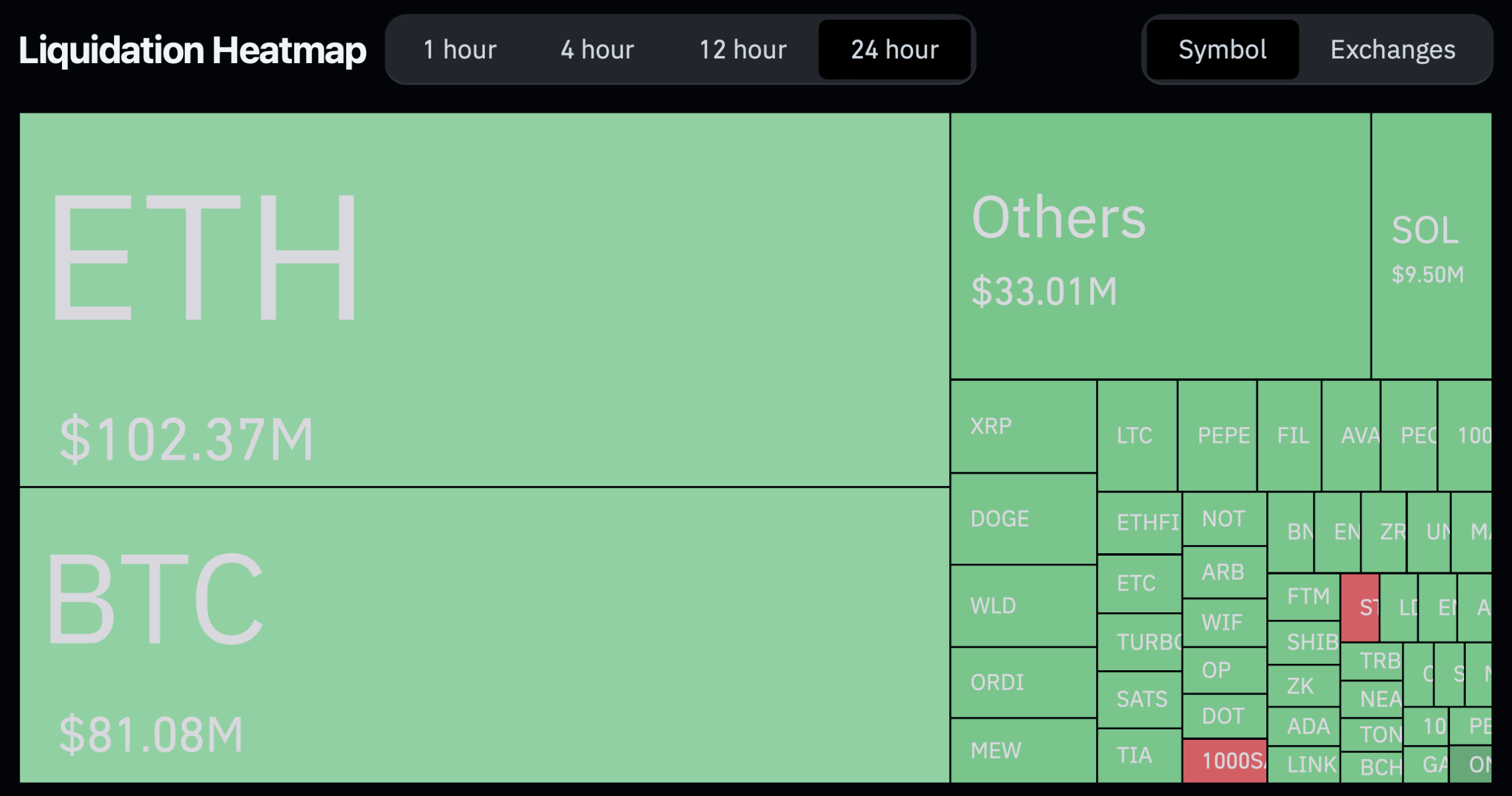

Source: Coinglass

Over the past day, a whopping 73,119 traders were liquidated, with Ethereum-related liquidations accounting for $102.37 million.

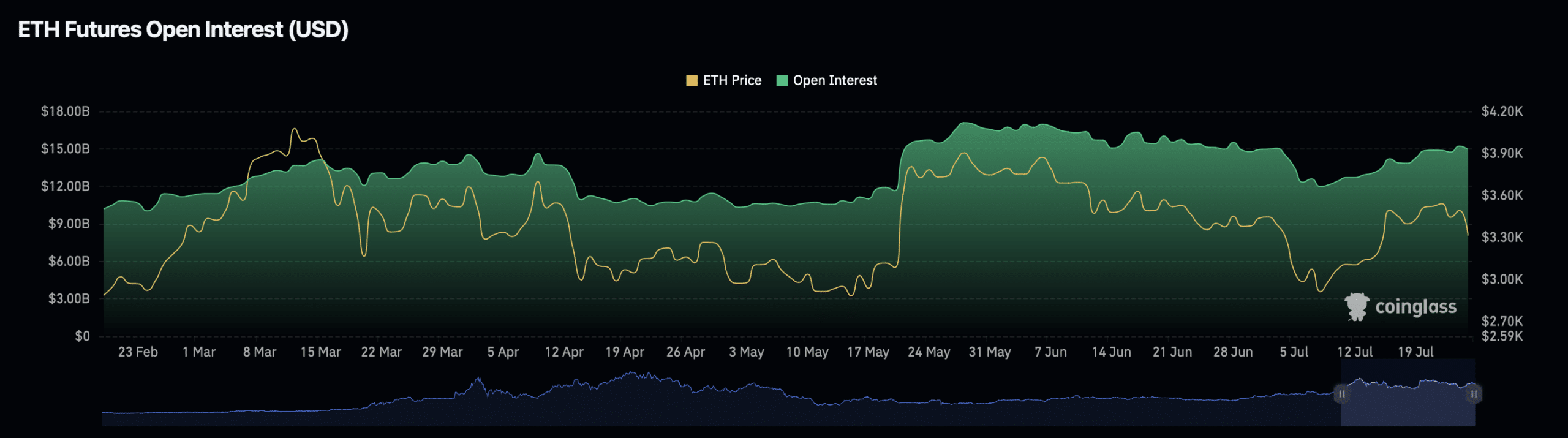

This has also influenced Ethereum’s open interest, which has seen a decline of nearly 5%, standing at $14.32 billion, with the volume decreasing by 3.92%.

Source: Coinglass

Wonderful web site Lots of useful info here Im sending it to a few friends ans additionally sharing in delicious And obviously thanks to your effort

clomiphene challenge test where buy clomid buy generic clomiphene pill cost clomiphene prices how to buy cheap clomiphene no prescription how to get generic clomid price buy cheap clomid no prescription

I couldn’t hold back commenting. Adequately written!

Thanks for sharing. It’s first quality.

azithromycin 250mg cheap – buy metronidazole 400mg oral flagyl 400mg

order rybelsus 14mg online – purchase cyproheptadine generic cyproheptadine generic

motilium drug – order flexeril generic buy flexeril pills

buy inderal online cheap – buy generic propranolol online generic methotrexate

amoxicillin oral – cheap ipratropium combivent cheap

cost zithromax 250mg – buy bystolic without a prescription bystolic 5mg for sale

buy clavulanate medication – https://atbioinfo.com/ order ampicillin for sale

oral esomeprazole 20mg – anexa mate esomeprazole pills

coumadin 5mg usa – https://coumamide.com/ buy losartan 25mg for sale

purchase mobic generic – moboxsin order meloxicam 7.5mg for sale

deltasone online order – aprep lson prednisone oral

buy erectile dysfunction drugs – best male ed pills buy generic ed pills online

purchase amoxicillin – order amoxil pill buy amoxil without a prescription

fluconazole 200mg generic – https://gpdifluca.com/# order generic forcan

order cenforce online – https://cenforcers.com/# order cenforce 100mg pills

mambo 36 tadalafil 20 mg reviews – ciltad genesis tadalafil generic cialis 20mg

zantac 300mg cost – https://aranitidine.com/ zantac drug

This is the kind of writing I in fact appreciate. prednisolona que es y para que sirve

viagra 50 mg price walgreens – order generic viagra uk viagra vs cialis

More posts like this would create the online elbow-room more useful. https://ursxdol.com/sildenafil-50-mg-in/

Greetings! Jolly serviceable suggestion within this article! It’s the scarcely changes which wish espy the largest changes. Thanks a a quantity in the direction of sharing! https://prohnrg.com/product/orlistat-pills-di/

Thanks towards putting this up. It’s well done. https://aranitidine.com/fr/en_france_xenical/

With thanks. Loads of erudition! https://ondactone.com/product/domperidone/

Palatable blog you procure here.. It’s intricate to assign high status writing like yours these days. I truly appreciate individuals like you! Withstand vigilance!!

buy maxolon pill

The vividness in this ruined is exceptional. http://www.potthof-engelskirchen.de/out.php?link=https://faithful-raccoon-qpl4dn.mystrikingly.com/

Thanks recompense sharing. It’s outstrip quality. http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4702

dapagliflozin 10mg pill – dapagliflozin 10 mg uk dapagliflozin pill

purchase orlistat pill – https://asacostat.com/ purchase orlistat for sale