- The crypto market maintained its over $2 trillion capitalization.

- Anticipation about the FOMC and CPI reports have contributed to the crypto decline.

The crypto market has experienced a massive decline in the last 24 hours, with millions of dollars wiped off the market capitalization.

The declines in Bitcoin [BTC] and Ethereum [ETH] have played a significant role in this downturn.

More specifically, the upcoming U.S. Federal Open Market Committee (FOMC) meeting and Consumer Price Index (CPI) reports have contributed largely to the decline of the two biggest crypto assets.

The reason why crypto is down today

AMBCrypto’s analysis of the crypto market capitalization on CoinMarketCap showed a significant decline in the last few days.

In the past 48 hours, the market cap has dropped from over $2.5 trillion to around $2.47 trillion as of this writing.

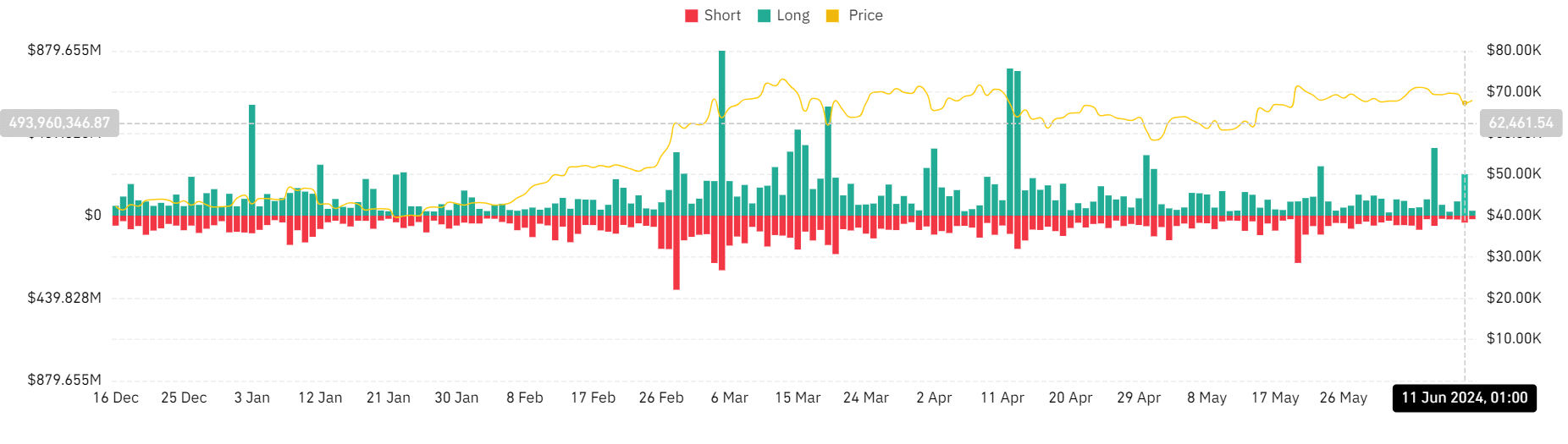

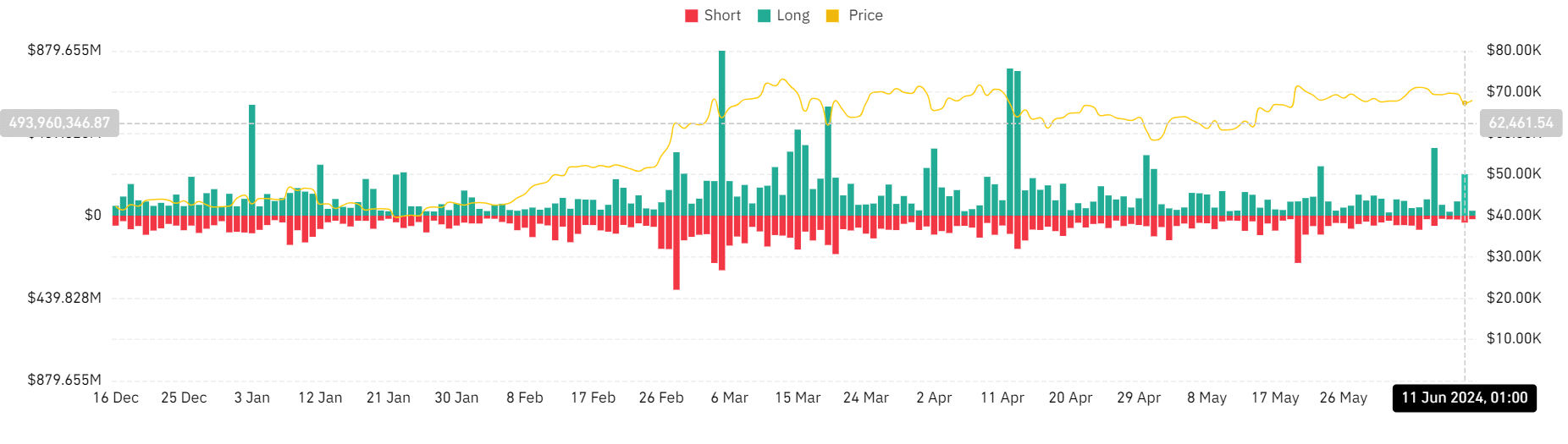

Also, the liquidation chart on Coinglass showed that crypto liquidations on the 11th of June were quite significant. The chart indicated that long positions experienced more liquidations than short ones as prices sharply declined.

Source: Coinglass

Long liquidation volume was over $221 million, while the short liquidation volume was around $37 million.

Bitcoin, Ethereum lead market dip

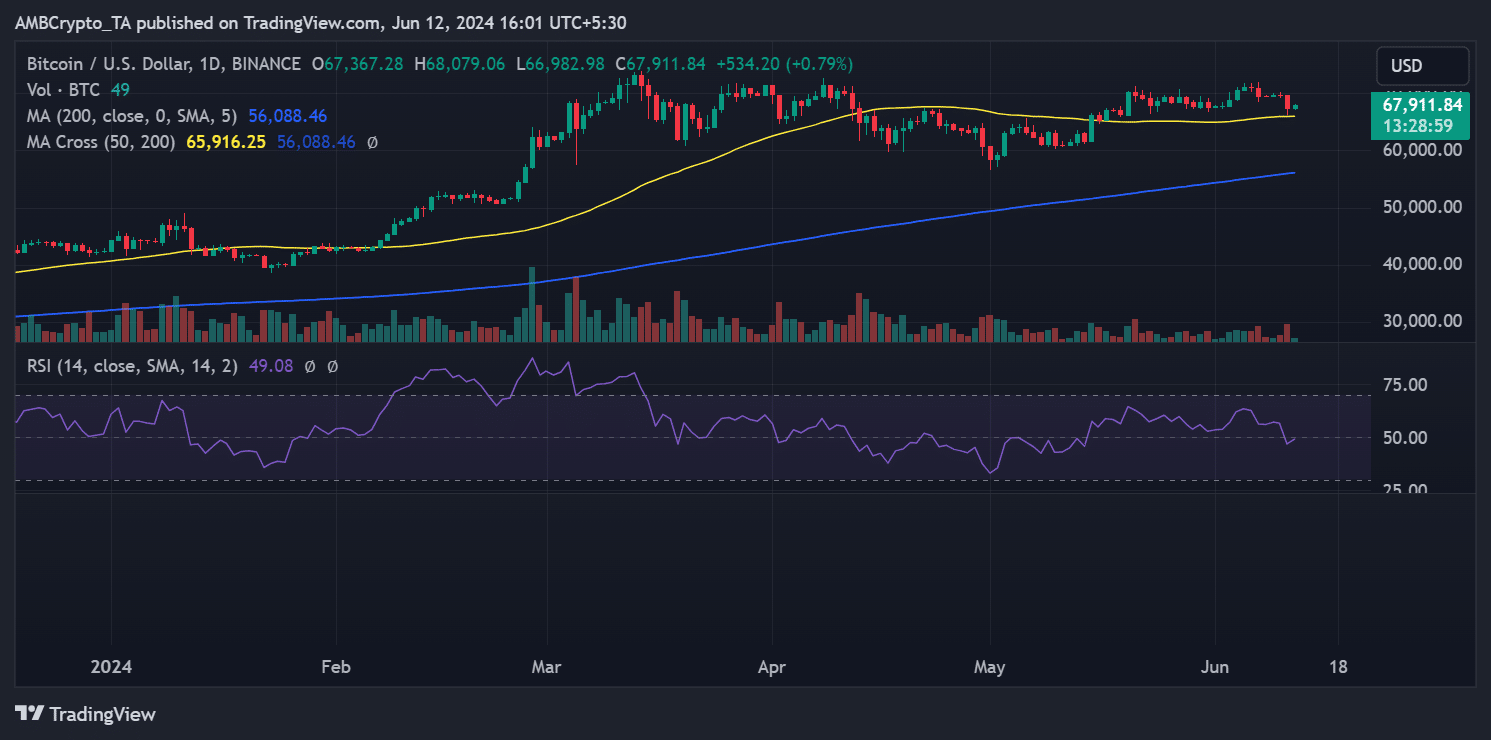

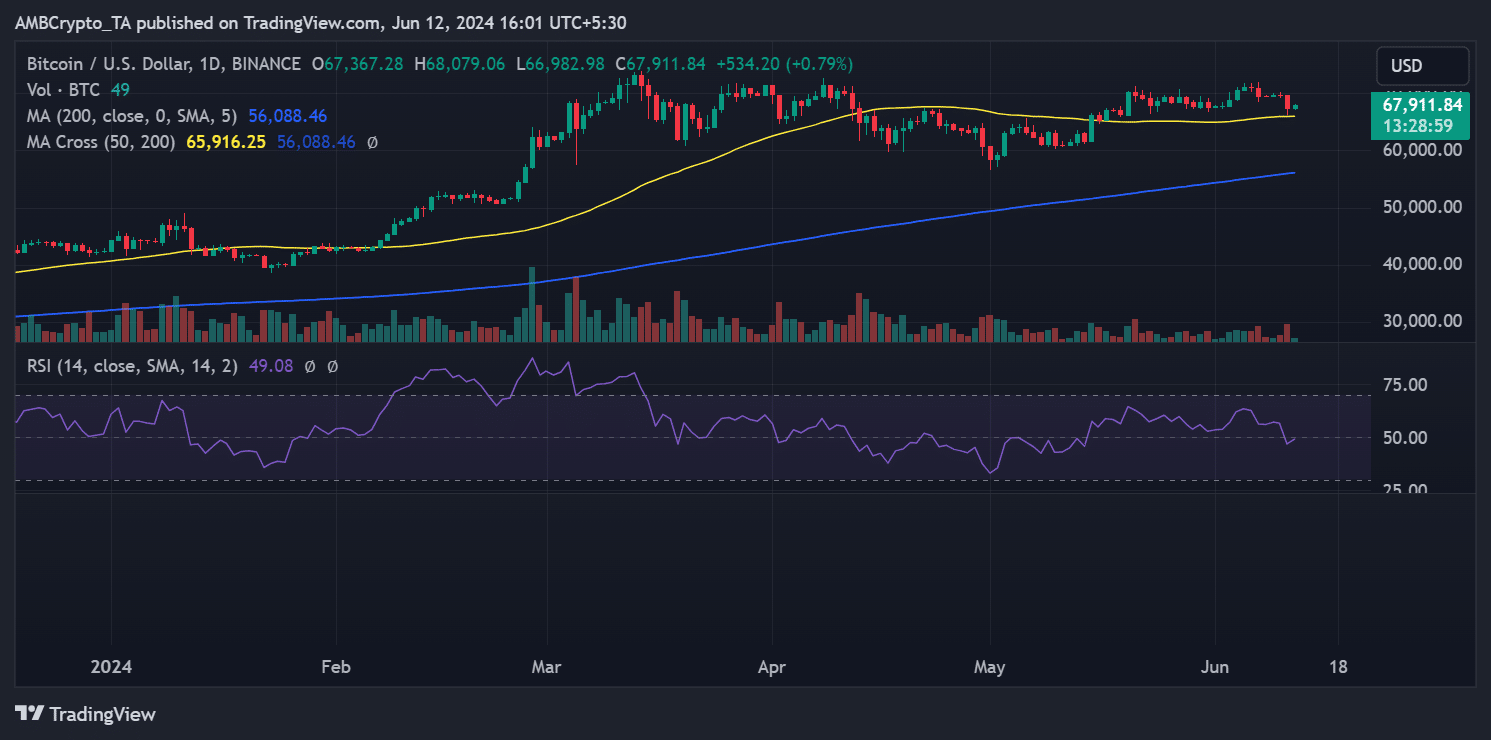

Looking at Bitcoin on a daily timeframe showed, AMBCrypto saw that on the 11th of June, it declined by over 3%. The chart indicated that this drop decreased its price to around $67,377.

BTC’s liquidation chart revealed that this decline led to over $66 million in liquidation volume.

Source: TradingView

Specifically, long liquidations accounted for over $52 million, while short liquidations were over $14 million.

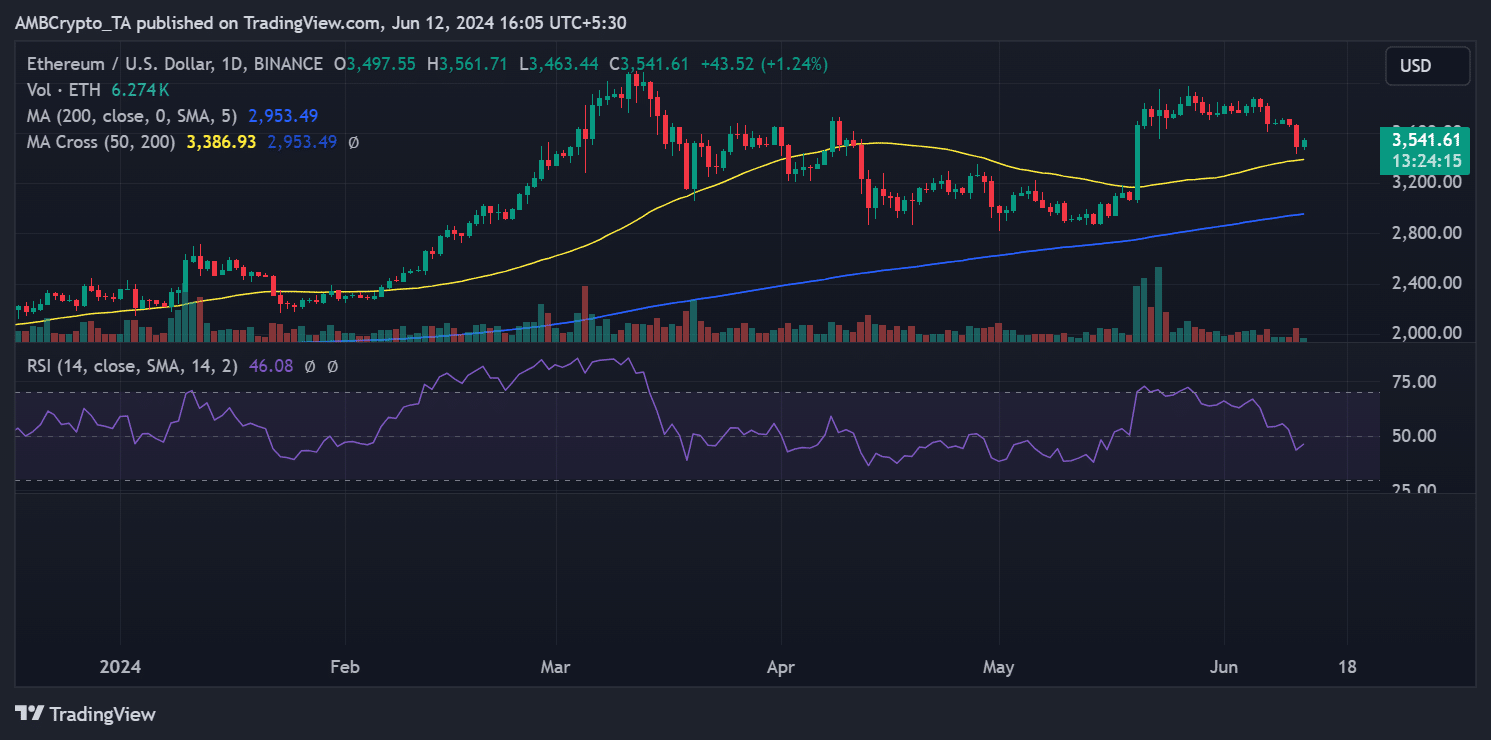

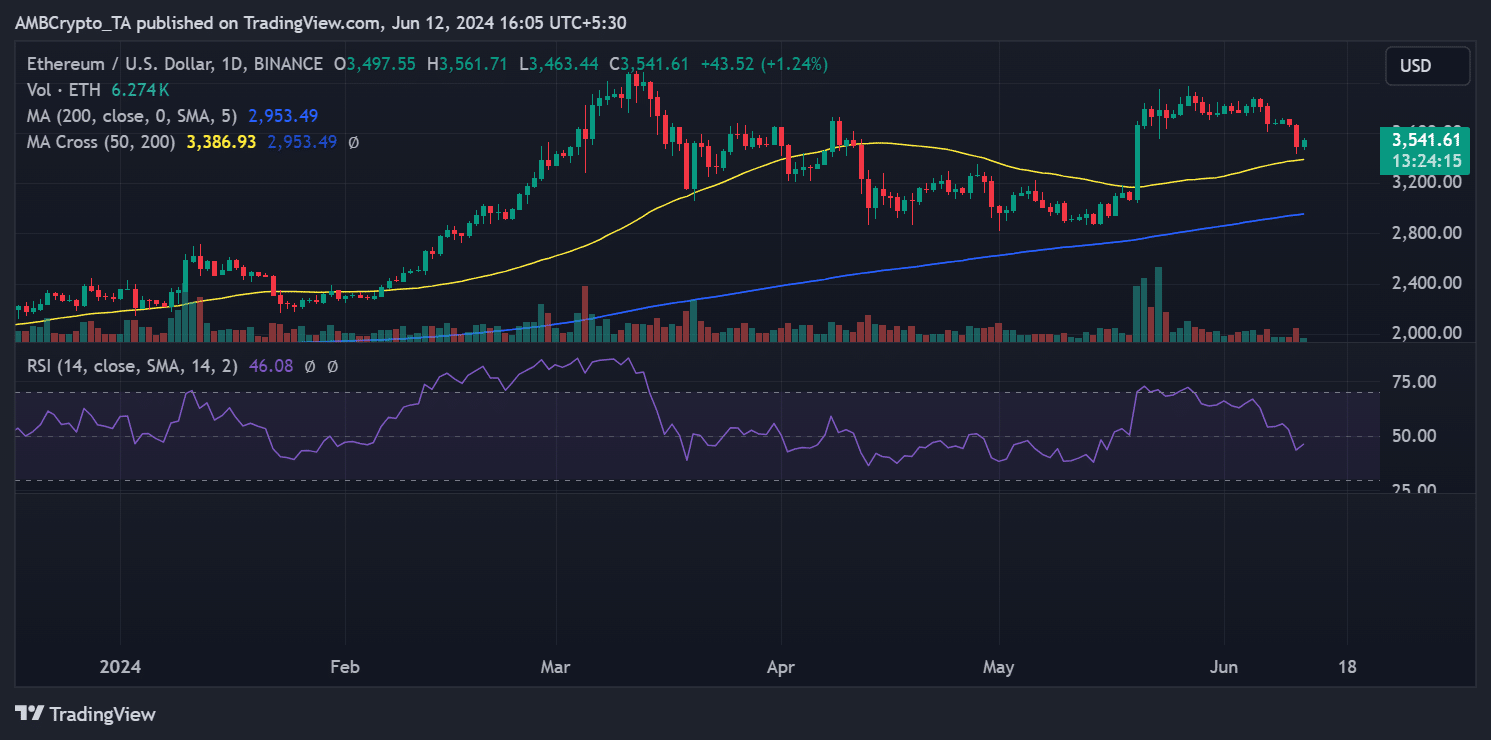

Ethereum, in the same timeframe, showed an almost 4.6% decline as its price fell to around $3,500. The liquidation chart showed that over $69 million was liquidated due to the decline.

Of this, long liquidations accounted for around $62 million, while short liquidations were over $7 million.

Source: TradingView

CPI and FOMC causing panic

Historically, when the Consumer Price Index (CPI) data is released or the Federal Open Market Committee (FOMC) adjusts interest rates, the crypto market often experiences significant fluctuations.

This is because investors adjust their risk exposure in response to these economic indicators. Typically, a rise in CPI correlates with a drop in Bitcoin’s price.

Is your portfolio green? Check out the BTC Profit Calculator

Increases in essential goods reduce the amount of disposable income people have, leading to decreased investment in crypto.

The FOMC is anticipated to maintain the current interest rates between 5.25% and 5.50%. Meanwhile, the CPI is expected to show a modest increase, staying within the range of 0.1% to 0.3%.

- The crypto market maintained its over $2 trillion capitalization.

- Anticipation about the FOMC and CPI reports have contributed to the crypto decline.

The crypto market has experienced a massive decline in the last 24 hours, with millions of dollars wiped off the market capitalization.

The declines in Bitcoin [BTC] and Ethereum [ETH] have played a significant role in this downturn.

More specifically, the upcoming U.S. Federal Open Market Committee (FOMC) meeting and Consumer Price Index (CPI) reports have contributed largely to the decline of the two biggest crypto assets.

The reason why crypto is down today

AMBCrypto’s analysis of the crypto market capitalization on CoinMarketCap showed a significant decline in the last few days.

In the past 48 hours, the market cap has dropped from over $2.5 trillion to around $2.47 trillion as of this writing.

Also, the liquidation chart on Coinglass showed that crypto liquidations on the 11th of June were quite significant. The chart indicated that long positions experienced more liquidations than short ones as prices sharply declined.

Source: Coinglass

Long liquidation volume was over $221 million, while the short liquidation volume was around $37 million.

Bitcoin, Ethereum lead market dip

Looking at Bitcoin on a daily timeframe showed, AMBCrypto saw that on the 11th of June, it declined by over 3%. The chart indicated that this drop decreased its price to around $67,377.

BTC’s liquidation chart revealed that this decline led to over $66 million in liquidation volume.

Source: TradingView

Specifically, long liquidations accounted for over $52 million, while short liquidations were over $14 million.

Ethereum, in the same timeframe, showed an almost 4.6% decline as its price fell to around $3,500. The liquidation chart showed that over $69 million was liquidated due to the decline.

Of this, long liquidations accounted for around $62 million, while short liquidations were over $7 million.

Source: TradingView

CPI and FOMC causing panic

Historically, when the Consumer Price Index (CPI) data is released or the Federal Open Market Committee (FOMC) adjusts interest rates, the crypto market often experiences significant fluctuations.

This is because investors adjust their risk exposure in response to these economic indicators. Typically, a rise in CPI correlates with a drop in Bitcoin’s price.

Is your portfolio green? Check out the BTC Profit Calculator

Increases in essential goods reduce the amount of disposable income people have, leading to decreased investment in crypto.

The FOMC is anticipated to maintain the current interest rates between 5.25% and 5.50%. Meanwhile, the CPI is expected to show a modest increase, staying within the range of 0.1% to 0.3%.

can i purchase generic clomiphene online where buy cheap clomiphene price clomid usa can i order clomid without a prescription cost of generic clomiphene without a prescription clomiphene sale can i buy clomid without dr prescription

This website positively has all of the low-down and facts I needed about this participant and didn’t know who to ask.

I’ll certainly bring to review more.

cost azithromycin 500mg – buy generic floxin over the counter order metronidazole 400mg generic

order semaglutide 14mg sale – semaglutide 14mg usa periactin 4 mg for sale

order motilium 10mg online – buy tetracycline 500mg generic flexeril price

augmentin buy online – at bio info order ampicillin online

buy nexium sale – nexium to us esomeprazole pills

buy coumadin online cheap – https://coumamide.com/ losartan where to buy

buy generic mobic over the counter – relieve pain buy meloxicam 7.5mg pill

order prednisone 40mg without prescription – adrenal order generic deltasone 40mg

top rated ed pills – erectile dysfunction medicines the blue pill ed

buy amoxicillin without a prescription – https://combamoxi.com/ amoxicillin cheap

order diflucan 100mg without prescription – https://gpdifluca.com/ diflucan over the counter

cenforce 50mg generic – https://cenforcers.com/# cenforce online buy

cialis none prescription – https://ciltadgn.com/ tadalafil buy online canada

pregnancy category for tadalafil – https://strongtadafl.com/ cialis how to use

buy zantac – aranitidine buy ranitidine generic

buy 50 mg viagra online – buy cheap viagra in the uk cost of 50mg viagra

More posts like this would make the online play more useful. https://gnolvade.com/

Greetings! Extremely serviceable par‘nesis within this article! It’s the scarcely changes which choice obtain the largest changes. Thanks a lot towards sharing! https://ursxdol.com/provigil-gn-pill-cnt/

This website exceedingly has all of the tidings and facts I needed adjacent to this participant and didn’t identify who to ask. https://prohnrg.com/product/diltiazem-online/

More posts like this would make the online elbow-room more useful. https://aranitidine.com/fr/viagra-100mg-prix/

I am actually happy to glance at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://ondactone.com/spironolactone/

This is the kind of post I find helpful.

inderal pills

Proof blog you be undergoing here.. It’s severely to assign elevated quality writing like yours these days. I really appreciate individuals like you! Take vigilance!! http://www.gtcm.info/home.php?mod=space&uid=1157024

order generic dapagliflozin 10mg – https://janozin.com/ order dapagliflozin 10 mg online

buy generic orlistat – https://asacostat.com/# xenical uk