- The number of Bitcoins transferred by miners to exchanges hit a 5-month high a day before the approvals.

- Hashprice fell considerably as Bitcoin prices dropped.

Bitcoin [BTC] sharply corrected two days after the spot ETFs were officially cleared for trading, falling as much as 7% from the levels seen immediately after the approval.

Over the weekend, the king coin meandered in the $42,000 region, according to CoinMarketCap.

Much of the downside pressure was sparked by outflows of Bitcoin from the Grayscale Bitcoin Trust (GBTC).

Note that the fund was converted into a spot ETF, allowing for the redemption of Bitcoins, which were locked up indefinitely in the previous structure.

However, one cohort of Bitcoin holders, perhaps, saw this pullback coming and accordingly executed their strategies.

Did miners see the pullback coming?

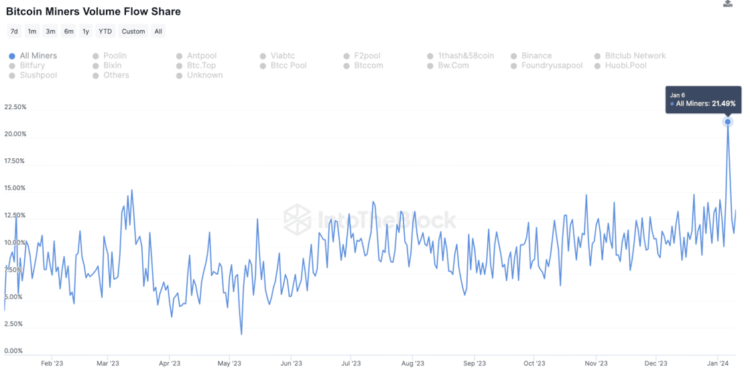

According to on-chain analytics firm IntoTheBlock, Bitcoin miners’ share of on-chain trading volume spiked drastically in the days leading to the ETF approvals.

In fact, the on-chain volume was the highest in more than four years.

Source: IntoTheBlock

Miners to exchange flow spiked

To cross-verify this data, AMBCrypto turned to another popular on-chain analytics tool, CryptoQuant.

Indeed, the number of Bitcoins transferred by miners to exchanges hit a 5-month high on the 10th of January, a day before the approvals. Moreover, the Miner to Exchange Flow was on an uptrend beginning the 7th of June.

Source: CryptoQuant

Was it a wise decision?

Miners, as we all know, frequently liquidate their holdings to cover costs incurred in setting up mining infrastructure. There are higher chances of these events happening when BTC is rising and offering better returns to the miners.

Take note that BTC gained significant bullish momentum before the approvals, pumping up to 60% in the previous three months.

Miners may have therefore seen the retracement coming and decided to lock in gains before it was too late.

Hashprice, considered an important barometer of miners’ profitability, fell considerably as Bitcoin prices dropped, AMBCrypto noticed using the HashRate Index data.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Hence, in retrospect, the miners’ choice to liquidate appeared to be well-thought-out.

Source: Hashrate Index

Due to Bitcoin’s bull rally, miners’ earnings have lifted to levels not seen since the peak bull market of 2021. After a prolonged and punishing bear market, miners couldn’t have hoped for anything better.

Source: CryptoQuant

- The number of Bitcoins transferred by miners to exchanges hit a 5-month high a day before the approvals.

- Hashprice fell considerably as Bitcoin prices dropped.

Bitcoin [BTC] sharply corrected two days after the spot ETFs were officially cleared for trading, falling as much as 7% from the levels seen immediately after the approval.

Over the weekend, the king coin meandered in the $42,000 region, according to CoinMarketCap.

Much of the downside pressure was sparked by outflows of Bitcoin from the Grayscale Bitcoin Trust (GBTC).

Note that the fund was converted into a spot ETF, allowing for the redemption of Bitcoins, which were locked up indefinitely in the previous structure.

However, one cohort of Bitcoin holders, perhaps, saw this pullback coming and accordingly executed their strategies.

Did miners see the pullback coming?

According to on-chain analytics firm IntoTheBlock, Bitcoin miners’ share of on-chain trading volume spiked drastically in the days leading to the ETF approvals.

In fact, the on-chain volume was the highest in more than four years.

Source: IntoTheBlock

Miners to exchange flow spiked

To cross-verify this data, AMBCrypto turned to another popular on-chain analytics tool, CryptoQuant.

Indeed, the number of Bitcoins transferred by miners to exchanges hit a 5-month high on the 10th of January, a day before the approvals. Moreover, the Miner to Exchange Flow was on an uptrend beginning the 7th of June.

Source: CryptoQuant

Was it a wise decision?

Miners, as we all know, frequently liquidate their holdings to cover costs incurred in setting up mining infrastructure. There are higher chances of these events happening when BTC is rising and offering better returns to the miners.

Take note that BTC gained significant bullish momentum before the approvals, pumping up to 60% in the previous three months.

Miners may have therefore seen the retracement coming and decided to lock in gains before it was too late.

Hashprice, considered an important barometer of miners’ profitability, fell considerably as Bitcoin prices dropped, AMBCrypto noticed using the HashRate Index data.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Hence, in retrospect, the miners’ choice to liquidate appeared to be well-thought-out.

Source: Hashrate Index

Due to Bitcoin’s bull rally, miners’ earnings have lifted to levels not seen since the peak bull market of 2021. After a prolonged and punishing bear market, miners couldn’t have hoped for anything better.

Source: CryptoQuant

can i order cheap clomid pills can i buy clomiphene tablets where can i buy generic clomid without dr prescription how to get clomiphene no prescription cost of generic clomid without rx buying generic clomiphene order generic clomid pills

Greetings! Jolly useful par‘nesis within this article! It’s the crumb changes which choice espy the largest changes. Thanks a lot for sharing!

More delight pieces like this would urge the интернет better.

order zithromax 500mg online cheap – azithromycin 250mg ca order metronidazole pill

motilium canada – buy tetracycline 250mg for sale where to buy cyclobenzaprine without a prescription

augmentin pills – https://atbioinfo.com/ ampicillin uk

purchase nexium – anexa mate buy esomeprazole 40mg capsules

buy warfarin online cheap – https://coumamide.com/ order cozaar generic

mobic price – https://moboxsin.com/ buy meloxicam 15mg online

prednisone 40mg ca – https://apreplson.com/ order deltasone sale

buy ed pills usa – fast ed to take buy erectile dysfunction drugs

order amoxicillin pills – https://combamoxi.com/ how to buy amoxicillin

buy fluconazole 100mg pill – fluconazole 200mg usa order fluconazole 100mg generic

brand cenforce 100mg – https://cenforcers.com/# cenforce ca

is generic tadalafil as good as cialis – click evolution peptides tadalafil

zantac 300mg over the counter – purchase ranitidine without prescription ranitidine online order

best time to take cialis 5mg – cialis tadalafil 20 mg cialis 20 mg duration

viagra buy london – sildenafil 50 mg cost buy viagra with a mastercard

More posts like this would bring about the blogosphere more useful. https://ursxdol.com/azithromycin-pill-online/

I’ll certainly return to review more. https://prohnrg.com/product/acyclovir-pills/

Facts blog you have here.. It’s intricate to on strong quality article like yours these days. I truly recognize individuals like you! Go through vigilance!! https://aranitidine.com/fr/acheter-propecia-en-ligne/