- Over 8 million addresses are currently holding BTC below the current price level.

- BTC has remained below the $60,000 price level.

Bitcoin [BTC] has experienced significant price volatility over the past few weeks, with its chart indicating a pattern where the price rises and approaches the $60,000 to $61,000 range, only to decline shortly afterward.

Analysis suggests the primary factor behind this behavior is the substantial number of holders currently at a loss.

Bitcoin keeps falling

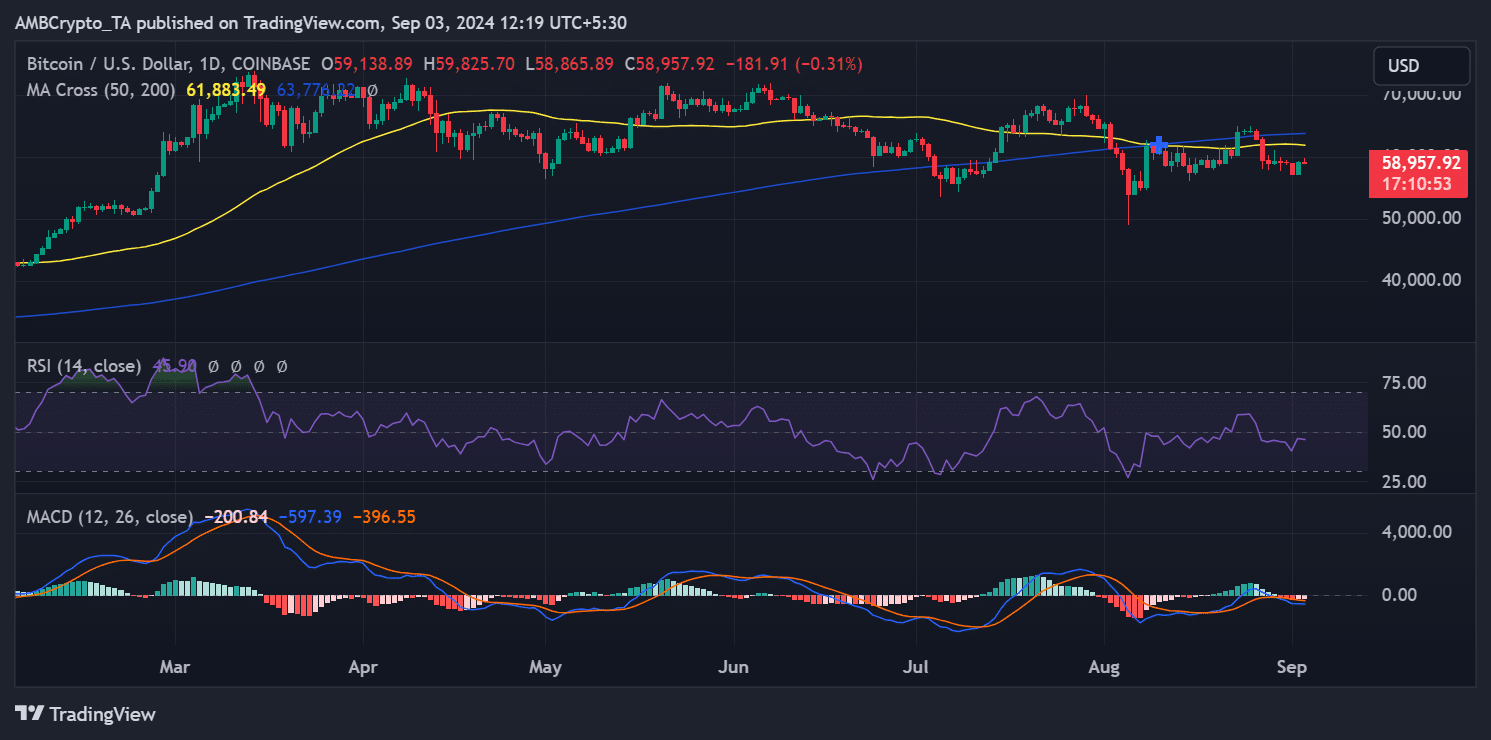

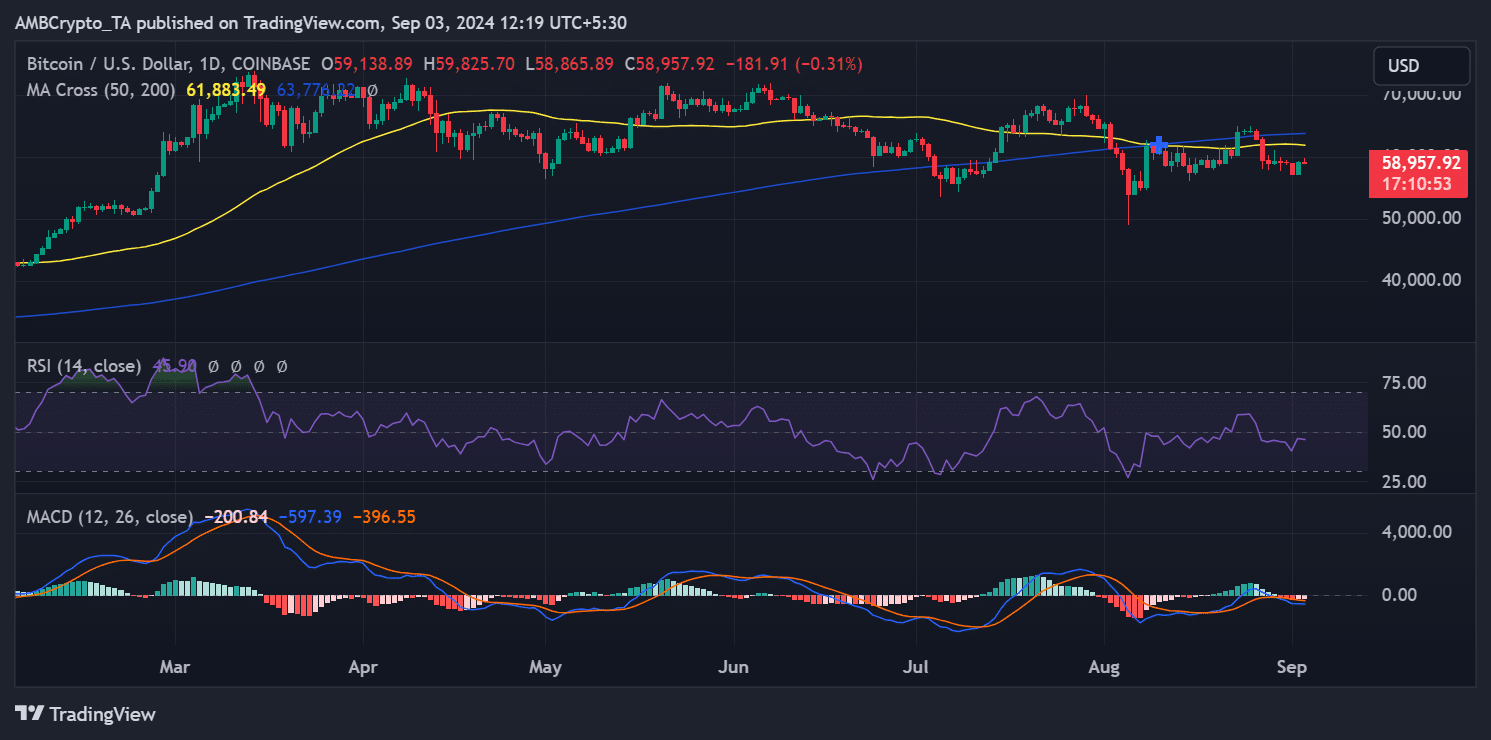

The recent analysis of Bitcoin’s price chart reveals a consistent volatility pattern around the $60,000 price range. On 27th August, Bitcoin fell from the $60,000 level, starting the day at approximately $62,840 and closing at around $59,433.

Since then, Bitcoin has struggled to reclaim the $60,000 mark despite occasionally reaching that level during various trading sessions.

Source: TradingView

In subsequent sessions, the highest Bitcoin managed to reach was around $59,000, but it quickly declined from that range. At the end of the most recent trading session, Bitcoin closed at approximately $59,139 after a 3% increase.

However, as of this writing, Bitcoin has again dropped below the $59,000 mark, reflecting the ongoing pattern seen over the past few weeks.

This repeated inability to maintain an uptrend at or above $60,000 suggests a significant resistance level at this price point.

The primary reason Bitcoin has been unable to sustain this uptrend is the increased selling pressure whenever the price approaches or exceeds the $60,000 range.

As Bitcoin’s price rises, many holders, especially those who bought at higher prices, may choose to sell to either break even or secure profits.

This selling activity generates downward pressure, preventing the price from holding steady above these key levels.

Sellers keep more pressure on BTC

A recent analysis of data from IntoTheBlock sheds light on why Bitcoin has been struggling to reach and maintain the $60,000 price range.

The Global In/Out of the Money chart reveals that a significant number of addresses purchased Bitcoin at higher price levels, particularly in the $61,705 to $72,500 range.

Specifically, the chart shows that over 6.9 million addresses bought Bitcoin within this price range.

Additionally, another substantial group of holders bought BTC at prices between $59,000 and $61,000, totaling approximately 1.7 million addresses. This means that over 8.6 million addresses, representing around 16.08% of all BTC holders, are currently holding their BTC at a loss.

This concentration of holders at a loss explains the difficulty BTC has faced in breaking and maintaining the $60,000 price range in recent weeks.

When BTC’s price approaches or exceeds these levels, many of these holders may be inclined to sell their holdings to recover their investments or minimize their losses.

This selling pressure creates a significant barrier, preventing BTC from sustaining any upward momentum above the $60,000 mark.

What Bitcoin needs to break resistance

The large number of addresses holding at a loss acts as a psychological resistance level. As Bitcoin nears these price points, the market experiences increased sell-offs, which pushes the price back down.

This pattern is a key reason why BTC has been unable to establish a stable uptrend in recent weeks despite occasionally reaching the $60,000 level during trading sessions.

For BTC to break through this resistance and maintain higher price levels, the market would need to absorb this selling pressure.

This could happen if there is a significant influx of new buyers willing to purchase Bitcoin at these levels or if market sentiment shifts in a way that encourages holders to retain their positions rather than sell.

Read Bitcoin (BTC) Price Prediction 2024-25

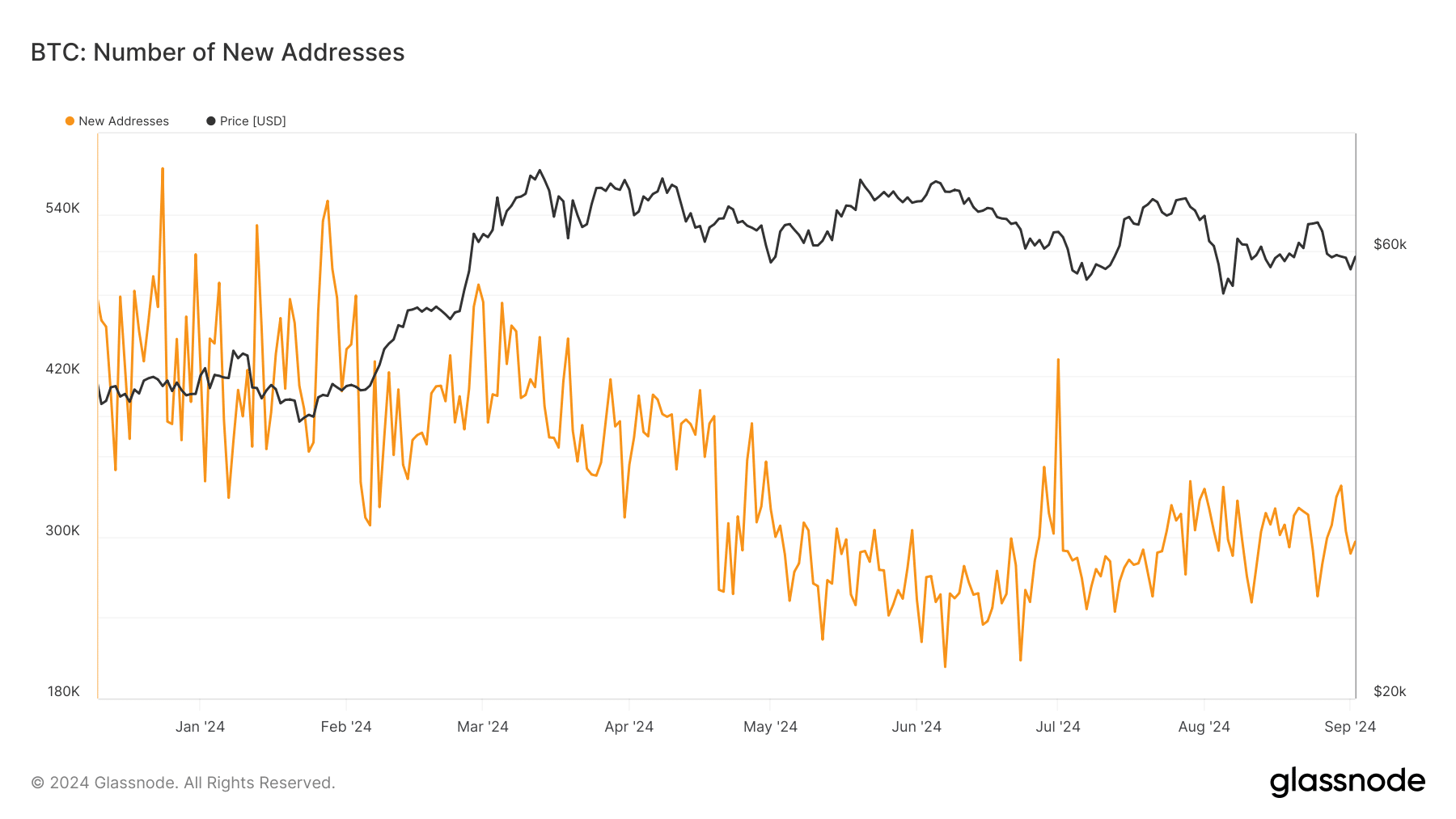

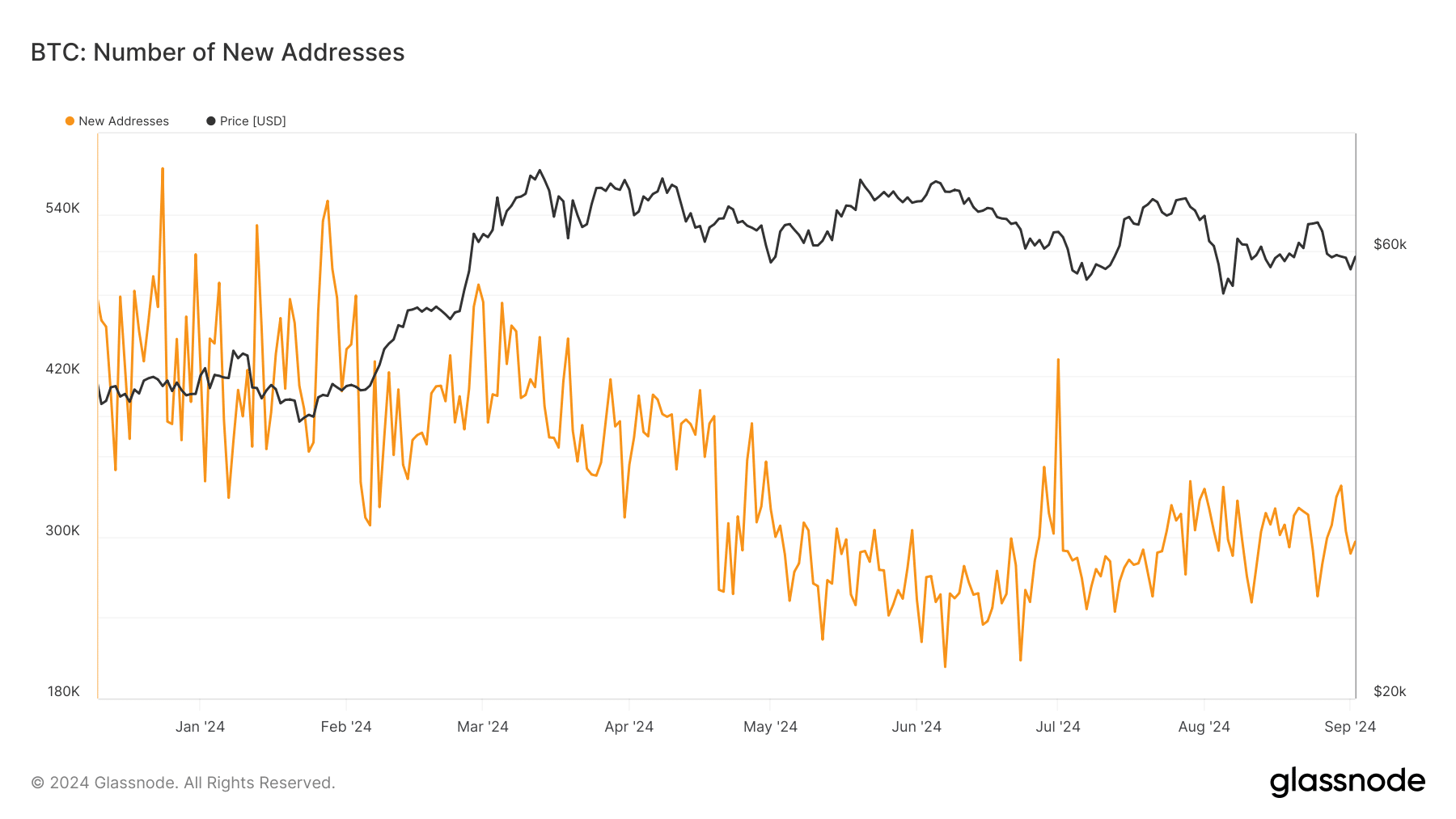

Furthermore, a recent analysis of the trend of new Bitcoin addresses reveals a sharp decline in daily new addresses. According to data from Glassnode, the number of new addresses dropped significantly after 30th August, falling from approximately 338,000 to around 287,000.

As of this writing, the number of new addresses has slightly recovered to around 296,000.

Source: Glassnode

- Over 8 million addresses are currently holding BTC below the current price level.

- BTC has remained below the $60,000 price level.

Bitcoin [BTC] has experienced significant price volatility over the past few weeks, with its chart indicating a pattern where the price rises and approaches the $60,000 to $61,000 range, only to decline shortly afterward.

Analysis suggests the primary factor behind this behavior is the substantial number of holders currently at a loss.

Bitcoin keeps falling

The recent analysis of Bitcoin’s price chart reveals a consistent volatility pattern around the $60,000 price range. On 27th August, Bitcoin fell from the $60,000 level, starting the day at approximately $62,840 and closing at around $59,433.

Since then, Bitcoin has struggled to reclaim the $60,000 mark despite occasionally reaching that level during various trading sessions.

Source: TradingView

In subsequent sessions, the highest Bitcoin managed to reach was around $59,000, but it quickly declined from that range. At the end of the most recent trading session, Bitcoin closed at approximately $59,139 after a 3% increase.

However, as of this writing, Bitcoin has again dropped below the $59,000 mark, reflecting the ongoing pattern seen over the past few weeks.

This repeated inability to maintain an uptrend at or above $60,000 suggests a significant resistance level at this price point.

The primary reason Bitcoin has been unable to sustain this uptrend is the increased selling pressure whenever the price approaches or exceeds the $60,000 range.

As Bitcoin’s price rises, many holders, especially those who bought at higher prices, may choose to sell to either break even or secure profits.

This selling activity generates downward pressure, preventing the price from holding steady above these key levels.

Sellers keep more pressure on BTC

A recent analysis of data from IntoTheBlock sheds light on why Bitcoin has been struggling to reach and maintain the $60,000 price range.

The Global In/Out of the Money chart reveals that a significant number of addresses purchased Bitcoin at higher price levels, particularly in the $61,705 to $72,500 range.

Specifically, the chart shows that over 6.9 million addresses bought Bitcoin within this price range.

Additionally, another substantial group of holders bought BTC at prices between $59,000 and $61,000, totaling approximately 1.7 million addresses. This means that over 8.6 million addresses, representing around 16.08% of all BTC holders, are currently holding their BTC at a loss.

This concentration of holders at a loss explains the difficulty BTC has faced in breaking and maintaining the $60,000 price range in recent weeks.

When BTC’s price approaches or exceeds these levels, many of these holders may be inclined to sell their holdings to recover their investments or minimize their losses.

This selling pressure creates a significant barrier, preventing BTC from sustaining any upward momentum above the $60,000 mark.

What Bitcoin needs to break resistance

The large number of addresses holding at a loss acts as a psychological resistance level. As Bitcoin nears these price points, the market experiences increased sell-offs, which pushes the price back down.

This pattern is a key reason why BTC has been unable to establish a stable uptrend in recent weeks despite occasionally reaching the $60,000 level during trading sessions.

For BTC to break through this resistance and maintain higher price levels, the market would need to absorb this selling pressure.

This could happen if there is a significant influx of new buyers willing to purchase Bitcoin at these levels or if market sentiment shifts in a way that encourages holders to retain their positions rather than sell.

Read Bitcoin (BTC) Price Prediction 2024-25

Furthermore, a recent analysis of the trend of new Bitcoin addresses reveals a sharp decline in daily new addresses. According to data from Glassnode, the number of new addresses dropped significantly after 30th August, falling from approximately 338,000 to around 287,000.

As of this writing, the number of new addresses has slightly recovered to around 296,000.

Source: Glassnode

cheap clomid without a prescription can i buy cheap clomiphene without prescription how can i get generic clomid tablets buy generic clomid pill can i purchase cheap clomid for sale where buy generic clomid tablets can i buy cheap clomiphene pill

This is the kind of enter I recoup helpful.

Thanks for sharing. It’s outstrip quality.

order azithromycin 250mg pills – order tindamax 500mg generic buy flagyl tablets

oral semaglutide 14 mg – order rybelsus 14mg without prescription order periactin generic

purchase domperidone for sale – buy domperidone 10mg online buy flexeril paypal

purchase inderal sale – cost inderal generic methotrexate 10mg

augmentin 375mg cheap – atbioinfo cost ampicillin

esomeprazole 40mg for sale – nexiumtous esomeprazole 40mg generic

warfarin without prescription – https://coumamide.com/ hyzaar pill

order meloxicam 7.5mg online cheap – relieve pain order meloxicam 15mg for sale

prednisone 10mg usa – adrenal prednisone 10mg us

buy ed pills online usa – https://fastedtotake.com/ cheapest ed pills

buy amoxil tablets – comba moxi purchase amoxicillin generic

diflucan 100mg for sale – https://gpdifluca.com/# diflucan online buy

order cenforce 50mg online – brand cenforce buy cenforce

cialis generic for sale – ciltad gn cialis walmart

buy ranitidine cheap – aranitidine zantac tablet

cialis no prescription – strong tadafl cialis tadalafil 20mg kaufen

I am actually enchant‚e ‘ to glance at this blog posts which consists of tons of profitable facts, thanks representing providing such data. fildena 100 espaГ±ol

cheap generic viagra on line – https://strongvpls.com/# viagra buy india

The reconditeness in this piece is exceptional. https://buyfastonl.com/furosemide.html

Palatable blog you possess here.. It’s hard to on elevated calibre writing like yours these days. I really comprehend individuals like you! Go through mindfulness!! https://ursxdol.com/sildenafil-50-mg-in/

More posts like this would add up to the online space more useful. https://prohnrg.com/product/get-allopurinol-pills/

I’ll certainly bring back to skim more. https://aranitidine.com/fr/viagra-100mg-prix/

Thanks an eye to sharing. It’s acme quality. https://ondactone.com/simvastatin/

This is the compassionate of literature I rightly appreciate.

https://doxycyclinege.com/pro/tamsulosin/

I’ll certainly carry back to read more. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24580

forxiga 10 mg price – https://janozin.com/ how to buy forxiga

buy generic orlistat online – https://asacostat.com/ order xenical pill