- The member’s holdings accounted for 6.4% of the total circulating supply.

- Just about 4% of the total supply is needed to get a vote in favor of “yes.”

Uniswap [UNI] holders were taken for a ride in the past two days.

After a 77% spike on a proposal to overhaul the protocol’s governance system, the decentralized exchange token sharply corrected by 15% in the last 24 hours, data from CoinMarketCap showed.

Nonetheless, the sharp uptick sent UNI to a 2-year high, taking its monthly gains to nearly 80%. The focus now shifts to the proposal and the odds of it getting ratified by the community.

Amidst the speculations, an interesting bit of information was supplied by the on-chain data tracker Lookonchain.

A decisive advantage

A community member was found to be having a disproportionate influence on Uniswap’s on-chain governance.

The member had possession of 64 million UNI tokens, accounting for 6.4% of the total circulating supply. They then distributed this amount across 31 different wallets.

With around 4% of the total supply needed to get a vote in the favor of “yes” for the proposal, these wallets could decisively impact the outcome of the governance vote.

This scenario invited fierce criticism as users questioned the very ethos of decentralization that underpins on-chain governance mechanisms.

Whales continue to accumulate despite correction

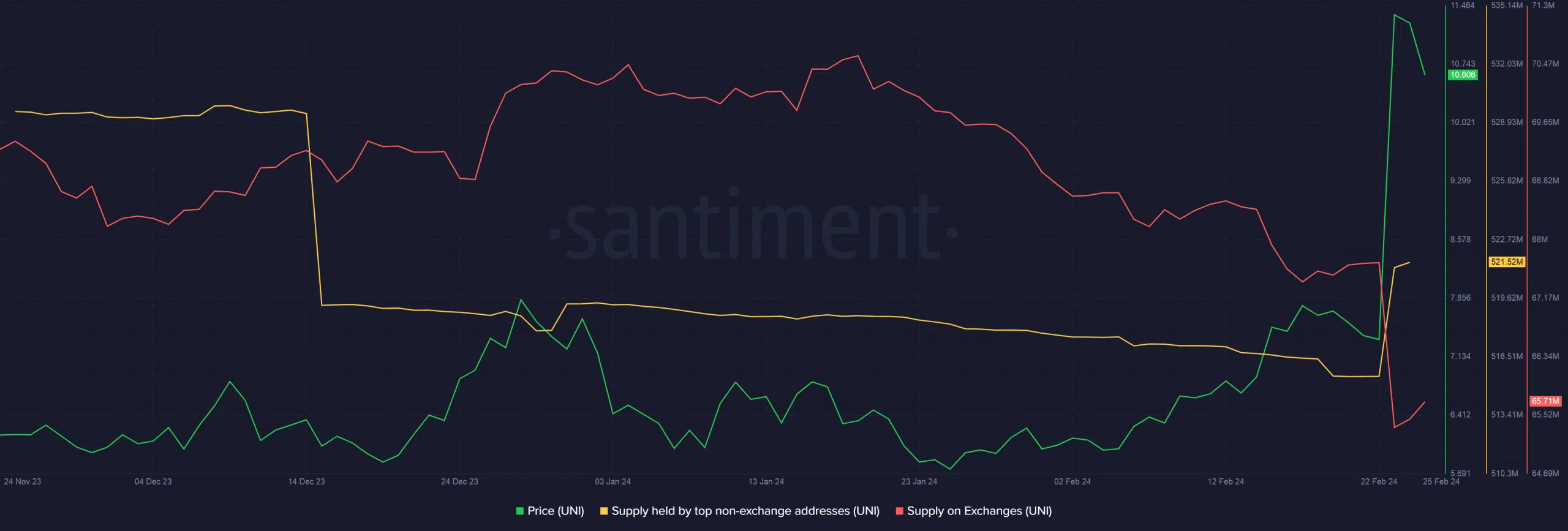

Turning attention back to UNI, the price correction was accompanied by an increase in exchange supply, as per AMBCrypto’s assessment of Santiment’s data. This implied that holders liquidated their tokens for gains.

On the brighter side, UNI whales continued to accumulate, as seen by a slight increase in supply held by top non-exchange wallets. This suggested that whales were confident of further upsides in the coming days.

UNI’s Open Interest at record highs

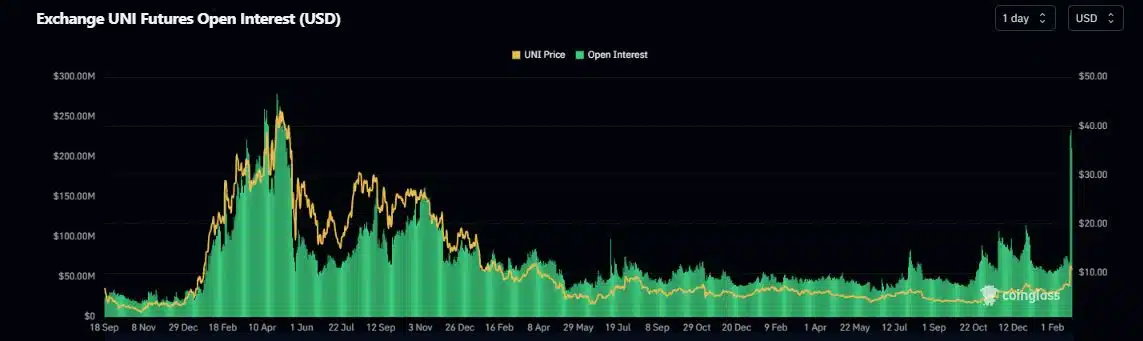

The price explosion also created a flutter in UNI’s derivatives market, spurring a threefold increase in Open Interest (OI), as per AMBCrypto’s scrutiny of Coinglass’ data.

Realistic or not, here’s UNI’s market cap in BTC’s terms

At about $209 million, the money locked into UNI futures contracts was at the highest level since May 2021.

However, the recent pullback altered the sentiment somewhat as the number of bearish short positions for UNI exceeded bullish longs, as seen by the Longs/Shorts Ratio chart.

- The member’s holdings accounted for 6.4% of the total circulating supply.

- Just about 4% of the total supply is needed to get a vote in favor of “yes.”

Uniswap [UNI] holders were taken for a ride in the past two days.

After a 77% spike on a proposal to overhaul the protocol’s governance system, the decentralized exchange token sharply corrected by 15% in the last 24 hours, data from CoinMarketCap showed.

Nonetheless, the sharp uptick sent UNI to a 2-year high, taking its monthly gains to nearly 80%. The focus now shifts to the proposal and the odds of it getting ratified by the community.

Amidst the speculations, an interesting bit of information was supplied by the on-chain data tracker Lookonchain.

A decisive advantage

A community member was found to be having a disproportionate influence on Uniswap’s on-chain governance.

The member had possession of 64 million UNI tokens, accounting for 6.4% of the total circulating supply. They then distributed this amount across 31 different wallets.

With around 4% of the total supply needed to get a vote in the favor of “yes” for the proposal, these wallets could decisively impact the outcome of the governance vote.

This scenario invited fierce criticism as users questioned the very ethos of decentralization that underpins on-chain governance mechanisms.

Whales continue to accumulate despite correction

Turning attention back to UNI, the price correction was accompanied by an increase in exchange supply, as per AMBCrypto’s assessment of Santiment’s data. This implied that holders liquidated their tokens for gains.

On the brighter side, UNI whales continued to accumulate, as seen by a slight increase in supply held by top non-exchange wallets. This suggested that whales were confident of further upsides in the coming days.

UNI’s Open Interest at record highs

The price explosion also created a flutter in UNI’s derivatives market, spurring a threefold increase in Open Interest (OI), as per AMBCrypto’s scrutiny of Coinglass’ data.

Realistic or not, here’s UNI’s market cap in BTC’s terms

At about $209 million, the money locked into UNI futures contracts was at the highest level since May 2021.

However, the recent pullback altered the sentiment somewhat as the number of bearish short positions for UNI exceeded bullish longs, as seen by the Longs/Shorts Ratio chart.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

how to buy cheap clomid no prescription where can i get generic clomid no prescription clomid prescription cost clomiphene generic brand clomid tablets clomiphene tablets price in pakistan can you get clomiphene for sale

This is the kind of enter I recoup helpful.

The thoroughness in this break down is noteworthy.

buy generic zithromax for sale – order metronidazole online cheap order flagyl 200mg online cheap

rybelsus 14mg without prescription – order semaglutide for sale order periactin 4 mg pill

motilium 10mg drug – cyclobenzaprine ca cyclobenzaprine order online

augmentin over the counter – https://atbioinfo.com/ buy generic ampicillin

nexium for sale – https://anexamate.com/ buy nexium online cheap

how to get warfarin without a prescription – https://coumamide.com/ losartan 25mg us

buy mobic 15mg for sale – https://moboxsin.com/ buy mobic 15mg pills

prednisone uk – aprep lson deltasone over the counter

pills for ed – site buy ed pills cheap

amoxicillin over the counter – https://combamoxi.com/ buy amoxil pills for sale

buy diflucan 100mg online cheap – order diflucan 100mg pill buy generic fluconazole online

purchase cenforce generic – https://cenforcers.com/# buy cenforce 50mg generic

cialis australia online shopping – https://ciltadgn.com/ trusted online store to buy cialis

generic cialis tadalafil 20 mg from india – https://strongtadafl.com/ canadian pharmacy cialis brand

zantac price – https://aranitidine.com/ ranitidine 150mg uk

order viagra ireland – strongvpls mail order viagra legitimate

The thoroughness in this draft is noteworthy. https://gnolvade.com/

Thanks an eye to sharing. It’s top quality. buy azithromycin 500mg online

Greetings! Utter gainful par‘nesis within this article! It’s the scarcely changes which choice turn the largest changes. Thanks a portion towards sharing! https://ursxdol.com/propecia-tablets-online/

Thanks towards putting this up. It’s understandably done. https://prohnrg.com/product/metoprolol-25-mg-tablets/

Greetings! Extremely gainful par‘nesis within this article! It’s the crumb changes which wish make the largest changes. Thanks a quantity in the direction of sharing! cialis professional generique prix

More posts like this would force the blogosphere more useful. https://ondactone.com/simvastatin/

More posts like this would add up to the online play more useful.

coumadin for sale online

I’ll certainly bring to review more. http://3ak.cn/home.php?mod=space&uid=229259

order dapagliflozin 10 mg online cheap – https://janozin.com/# buy dapagliflozin without prescription