While it can be incredibly lucrative, cryptocurrency trading is also fraught with a lot of risks and challenges. Even experienced traders can lose money if they’re not careful. One such danger that investors should be on the lookout for is something called slippage. In this article, we’ll define what slippage in crypto is, look at how it can affect traders, and offer some tips on how to avoid it. Stay safe out there!

What Is Slippage?

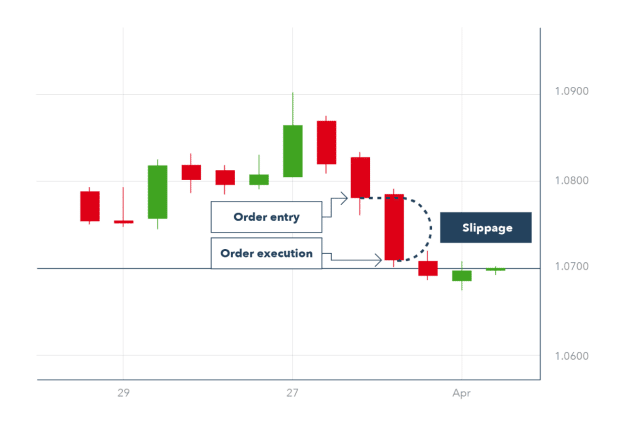

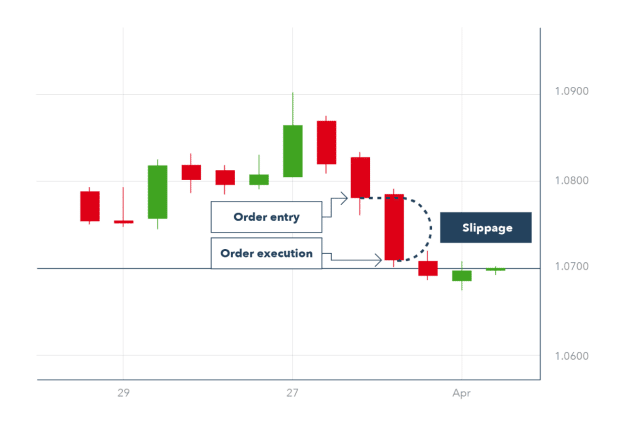

Slippage is the difference between the expected price of the trade and the actual price at which the trade is executed. It often occurs when there is a sudden change in market conditions, such as a sharp increase in interest rates. While all types of transactions are prone to slippage, it is most common in fast-moving markets. For example, if you are buying an asset for $100 and its market price suddenly jumps to $105, you will experience slippage. While slippage can be costly, it is usually not a sign of fraud or poor-quality securities. Instead, it is simply a reflection of the fact that prices can change quickly in volatile markets.

What Is Slippage in Crypto?

Okay, we’ve got the normal slippage covered, but what is slippage in crypto? Simply put, crypto slippage refers to the difference between the expected price of a cryptocurrency transaction and the actual price at which it is executed. This can happen when trading on decentralized exchanges, where rapid changes in price due to volatile trading activity can lead to significant discrepancies between the intended transaction price and the final settled price. Slippage is particularly pronounced in crypto markets due to their high volatility and sometimes lower liquidity compared to traditional financial markets.

The impact of slippage in the crypto world can vary; it might work in favor of the trader if the asset’s price improves between the time of order placement and execution, an event known as positive slippage. However, more often, traders experience negative slippage, especially during periods of high volatility when the price moves against the trader’s interest. This can increase the cost of entry into a position or reduce the profits when selling. Crypto traders can minimize slippage by trading on more liquid markets or setting limits on their trades to control the worst price at which they are willing to trade, thereby managing the potential financial impact related to the current market price and anticipated price slippage.

Positive vs. Negative Slippage

Slippage can happen in both rising and falling markets and can be positive or negative. Positive slippage occurs when the order is executed at a price better than expected, while negative slippage happens when the order is filled at a worse price. While both types of slippage can have an impact on trading results, positive slippage is generally considered more advantageous for traders. That’s because positive slippage represents an opportunity to buy or sell at a better price than anticipated, while negative slippage simply represents a loss. As such, most crypto traders strive to minimize negative slippage while maximizing positive slippage.

Examples of Slippage

Let’s say you want to purchase the cryptocurrency listed on a crypto trading platform for $10.00. After placing your market order, you discover that it was actually filed for a higher price of $10.50.

This situation illustrates negative slippage since you purchased an order at a higher cost than expected, reducing the overall purchasing power of your funds.

Positive slippage, on the other hand, occurs when you place a buy order at $10.00 but close it at only $9.50. Your purchasing power rises as a result of the decreased price.

How Does Slippage Work?

An asset is purchased or sold at the best possible price when an order is executed on an exchange. Slippage can happen between the time when a trade is initiated and when it is completed since a cryptocurrency’s market price might fluctuate swiftly.

How to Calculate Slippage in Crypto

Here’s how you can calculate slippage in crypto:

- Identify the Expected Price: This is the price you hope to buy or sell a crypto asset at when you place an order.

- Determine the Actual Execution Price: This is the price at which your trade is actually executed on the exchange.

- Calculate the Difference: Subtract the expected price from the actual execution price.

- Convert to Percentage: Divide the difference by the expected price and then multiply by 100 to get the percentage of slippage.

Here’s the formula for calculating slippage in crypto:

Slippage % = ((Actual Execution Price – Expected Price) / Expected Price) * 100

Calculating slippage is crucial for understanding how market conditions, such as liquidity and volatility, can affect your trading outcome, especially on decentralized exchanges where price changes can be swift and sizable. This insight helps in setting more effective trade strategies, such as using limit orders to cap potential slippage.

What Causes Slippage?

A certain number of buyers and an equal number of sellers are required to execute the perfect order. If there is an imbalance, prices will fluctuate, and slippage will follow.

As mentioned earlier, slippage can occur in both rising and falling markets. It is usually caused by a lack of liquidity in the crypto market or high price volatility.

Low Market Liquidity

In a low liquidity market, there may not be enough buyers or sellers to fill all orders at the requested price, which leads to slippage.

Price Volatility

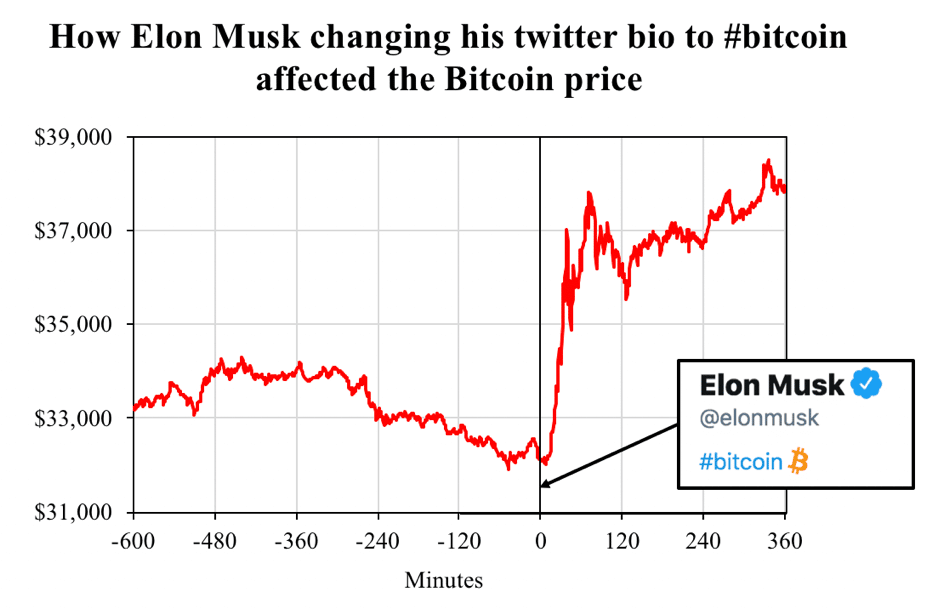

High price volatility can cause slippage as prices can move suddenly and unexpectedly. Since large market orders tend to impact the market price significantly, slippage can also occur when they’re placed. For example, if a large buy order is placed for an asset that is not frequently traded, its price may sharply increase as buyers compete for the available shares. This can cause slippage for subsequent buy orders because the asset may trade at a higher price than expected.

Would you like to get more useful tips on crypto trading? Subscribe to our weekly newsletter to stay updated on the latest crypto trends!

What Is Slippage Tolerance?

Slippage tolerance is a setting that allows traders to specify the maximum amount of slippage they are willing to accept for their order. It is built into limit orders as a way to account for instability or volatility in the market.

For example, if you place a buy order for a stock at $10 with a slippage tolerance of 5%, your order will not fill unless you can buy the shares for no more than $10.50 — that will be your minimum price. Slippage tolerance is typically expressed as a percentage but can also be represented by a certain number of ticks or pips. For some traders, slippage is an accepted cost of trading; for others, it is considered unacceptable and needs to be minimized.

There are a few different ways to deal with slippage. One way is to simply accept it as a cost of trading and factor it into your overall strategy. Another way is to try to avoid it by using limit orders instead of market orders and/or by trading when the market is most stable. This way traders ensure they will purchase the assets at the exact price they desire.

Some traders even try to take advantage of slippage by placing limit orders outside of the current bid-ask spread; if their order fills, they pocket the difference between the execution price and the current bid or ask price. Traders who operate in unpredictable markets or on crypto projects with little liquidity and high trade volume, such as coin launch projects, typically benefit from having a low slippage tolerance.

How to Avoid Slippage

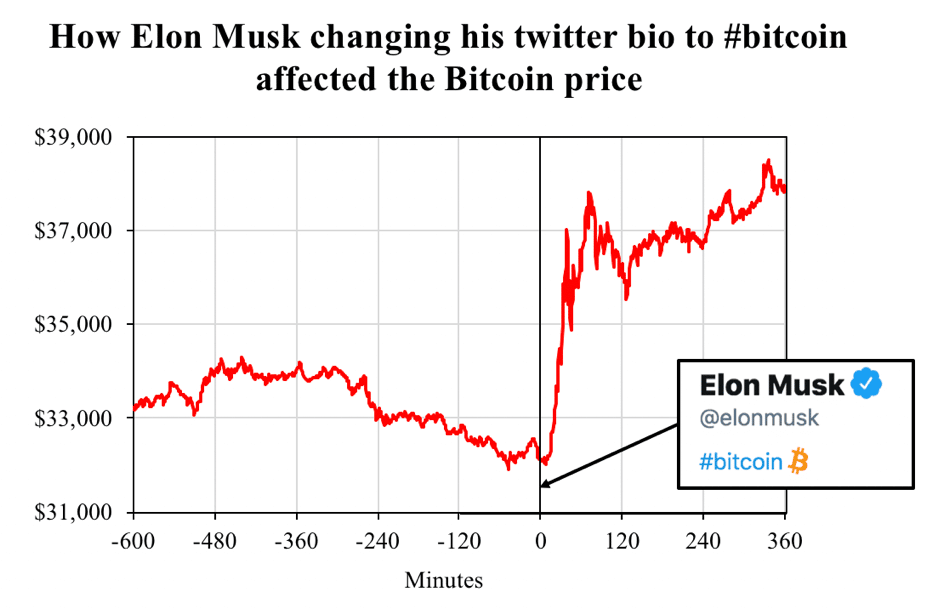

There is now a way to fully eliminate slippage. Because of the lack of structure and stability in the cryptocurrency market compared to the stock or futures markets, the price of a token can quickly shift due to influencers’ social media activity. As a result, it can be challenging to predict when certain events that increase market volatility will occur. However, there are certain actions you can consider to minimize slippage while trading cryptocurrencies.

How to Control and Minimize Slippage

- Place limit price orders instead of market orders.

This ensures you’ll only buy or sell at the price you want.

- Use a trading platform with high liquidity.

This way, there’s a better chance that your order will be filled at a favorable price.

- Avoid trading during high-volatility periods and try to trade during off-peak hours.

The markets are typically less volatile during these times, which can help prevent large deviations between the expected and actual trade prices.

- Keep an eye on news and major events.

The market is especially turbulent during important announcements.

- Know where your entrance and exit points are.

This will also greatly assist in decreasing risk as much as possible.

While you can’t always control when slippage happens, following these tips can help minimize its occurrences.

FAQ

What is normal slippage?

The slippage percentage represents the amount of price movement for a certain asset. It’s crucial to keep in mind that the slippage size is commonly small. The slippage between 0.05% and 0.10% is typical. The slippage of 0.50% to 1% may happen in particularly turbulent circumstances. Investors should be aware of what this means in actual money terms.

What is a 2% slippage?

2% slippage and higher is considered extremely dangerous.

Does slippage matter in crypto?

Yes, slippage is an important factor to consider in both crypto trading and investing. Before entering any transactions, traders should always try to reduce slippage and make a slippage calculation.

Is high slippage good?

High slippage is considered a bad sign for trading since it characterizes an extremely volatile market.

Do you lose money on slippage?

It depends on the type of slippage you’re experiencing, negative or positive.

What is a negative slippage?

Negative slippage means the price difference works against you.

Is slippage a fee?

No, it’s the difference between the intended price and the executed price.

What is a good slippage tolerance?

It depends on your trading goals, and you should set up a slippage tolerance percentage accordingly.

Why is slippage so high?

High slippage typically occurs during high-volatility market conditions when a trader’s order cannot be immediately matched by available liquidity in the market.

How do you trade with low slippage?

Low slippage actually creates a good environment for traders.

Final Thoughts

Ultimately, slippage is something that every trader has to deal with in one way or another. By understanding what slippage is and how it works, you can make sure that it doesn’t impact your trading strategy in a negative way. While it can often be difficult to avoid completely, traders can minimize its effects by using limit orders and monitoring market conditions closely. By doing so, they can help ensure that their trades are executed at prices that are as close to their expectations as possible.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.

While it can be incredibly lucrative, cryptocurrency trading is also fraught with a lot of risks and challenges. Even experienced traders can lose money if they’re not careful. One such danger that investors should be on the lookout for is something called slippage. In this article, we’ll define what slippage in crypto is, look at how it can affect traders, and offer some tips on how to avoid it. Stay safe out there!

What Is Slippage?

Slippage is the difference between the expected price of the trade and the actual price at which the trade is executed. It often occurs when there is a sudden change in market conditions, such as a sharp increase in interest rates. While all types of transactions are prone to slippage, it is most common in fast-moving markets. For example, if you are buying an asset for $100 and its market price suddenly jumps to $105, you will experience slippage. While slippage can be costly, it is usually not a sign of fraud or poor-quality securities. Instead, it is simply a reflection of the fact that prices can change quickly in volatile markets.

What Is Slippage in Crypto?

Okay, we’ve got the normal slippage covered, but what is slippage in crypto? Simply put, crypto slippage refers to the difference between the expected price of a cryptocurrency transaction and the actual price at which it is executed. This can happen when trading on decentralized exchanges, where rapid changes in price due to volatile trading activity can lead to significant discrepancies between the intended transaction price and the final settled price. Slippage is particularly pronounced in crypto markets due to their high volatility and sometimes lower liquidity compared to traditional financial markets.

The impact of slippage in the crypto world can vary; it might work in favor of the trader if the asset’s price improves between the time of order placement and execution, an event known as positive slippage. However, more often, traders experience negative slippage, especially during periods of high volatility when the price moves against the trader’s interest. This can increase the cost of entry into a position or reduce the profits when selling. Crypto traders can minimize slippage by trading on more liquid markets or setting limits on their trades to control the worst price at which they are willing to trade, thereby managing the potential financial impact related to the current market price and anticipated price slippage.

Positive vs. Negative Slippage

Slippage can happen in both rising and falling markets and can be positive or negative. Positive slippage occurs when the order is executed at a price better than expected, while negative slippage happens when the order is filled at a worse price. While both types of slippage can have an impact on trading results, positive slippage is generally considered more advantageous for traders. That’s because positive slippage represents an opportunity to buy or sell at a better price than anticipated, while negative slippage simply represents a loss. As such, most crypto traders strive to minimize negative slippage while maximizing positive slippage.

Examples of Slippage

Let’s say you want to purchase the cryptocurrency listed on a crypto trading platform for $10.00. After placing your market order, you discover that it was actually filed for a higher price of $10.50.

This situation illustrates negative slippage since you purchased an order at a higher cost than expected, reducing the overall purchasing power of your funds.

Positive slippage, on the other hand, occurs when you place a buy order at $10.00 but close it at only $9.50. Your purchasing power rises as a result of the decreased price.

How Does Slippage Work?

An asset is purchased or sold at the best possible price when an order is executed on an exchange. Slippage can happen between the time when a trade is initiated and when it is completed since a cryptocurrency’s market price might fluctuate swiftly.

How to Calculate Slippage in Crypto

Here’s how you can calculate slippage in crypto:

- Identify the Expected Price: This is the price you hope to buy or sell a crypto asset at when you place an order.

- Determine the Actual Execution Price: This is the price at which your trade is actually executed on the exchange.

- Calculate the Difference: Subtract the expected price from the actual execution price.

- Convert to Percentage: Divide the difference by the expected price and then multiply by 100 to get the percentage of slippage.

Here’s the formula for calculating slippage in crypto:

Slippage % = ((Actual Execution Price – Expected Price) / Expected Price) * 100

Calculating slippage is crucial for understanding how market conditions, such as liquidity and volatility, can affect your trading outcome, especially on decentralized exchanges where price changes can be swift and sizable. This insight helps in setting more effective trade strategies, such as using limit orders to cap potential slippage.

What Causes Slippage?

A certain number of buyers and an equal number of sellers are required to execute the perfect order. If there is an imbalance, prices will fluctuate, and slippage will follow.

As mentioned earlier, slippage can occur in both rising and falling markets. It is usually caused by a lack of liquidity in the crypto market or high price volatility.

Low Market Liquidity

In a low liquidity market, there may not be enough buyers or sellers to fill all orders at the requested price, which leads to slippage.

Price Volatility

High price volatility can cause slippage as prices can move suddenly and unexpectedly. Since large market orders tend to impact the market price significantly, slippage can also occur when they’re placed. For example, if a large buy order is placed for an asset that is not frequently traded, its price may sharply increase as buyers compete for the available shares. This can cause slippage for subsequent buy orders because the asset may trade at a higher price than expected.

Would you like to get more useful tips on crypto trading? Subscribe to our weekly newsletter to stay updated on the latest crypto trends!

What Is Slippage Tolerance?

Slippage tolerance is a setting that allows traders to specify the maximum amount of slippage they are willing to accept for their order. It is built into limit orders as a way to account for instability or volatility in the market.

For example, if you place a buy order for a stock at $10 with a slippage tolerance of 5%, your order will not fill unless you can buy the shares for no more than $10.50 — that will be your minimum price. Slippage tolerance is typically expressed as a percentage but can also be represented by a certain number of ticks or pips. For some traders, slippage is an accepted cost of trading; for others, it is considered unacceptable and needs to be minimized.

There are a few different ways to deal with slippage. One way is to simply accept it as a cost of trading and factor it into your overall strategy. Another way is to try to avoid it by using limit orders instead of market orders and/or by trading when the market is most stable. This way traders ensure they will purchase the assets at the exact price they desire.

Some traders even try to take advantage of slippage by placing limit orders outside of the current bid-ask spread; if their order fills, they pocket the difference between the execution price and the current bid or ask price. Traders who operate in unpredictable markets or on crypto projects with little liquidity and high trade volume, such as coin launch projects, typically benefit from having a low slippage tolerance.

How to Avoid Slippage

There is now a way to fully eliminate slippage. Because of the lack of structure and stability in the cryptocurrency market compared to the stock or futures markets, the price of a token can quickly shift due to influencers’ social media activity. As a result, it can be challenging to predict when certain events that increase market volatility will occur. However, there are certain actions you can consider to minimize slippage while trading cryptocurrencies.

How to Control and Minimize Slippage

- Place limit price orders instead of market orders.

This ensures you’ll only buy or sell at the price you want.

- Use a trading platform with high liquidity.

This way, there’s a better chance that your order will be filled at a favorable price.

- Avoid trading during high-volatility periods and try to trade during off-peak hours.

The markets are typically less volatile during these times, which can help prevent large deviations between the expected and actual trade prices.

- Keep an eye on news and major events.

The market is especially turbulent during important announcements.

- Know where your entrance and exit points are.

This will also greatly assist in decreasing risk as much as possible.

While you can’t always control when slippage happens, following these tips can help minimize its occurrences.

FAQ

What is normal slippage?

The slippage percentage represents the amount of price movement for a certain asset. It’s crucial to keep in mind that the slippage size is commonly small. The slippage between 0.05% and 0.10% is typical. The slippage of 0.50% to 1% may happen in particularly turbulent circumstances. Investors should be aware of what this means in actual money terms.

What is a 2% slippage?

2% slippage and higher is considered extremely dangerous.

Does slippage matter in crypto?

Yes, slippage is an important factor to consider in both crypto trading and investing. Before entering any transactions, traders should always try to reduce slippage and make a slippage calculation.

Is high slippage good?

High slippage is considered a bad sign for trading since it characterizes an extremely volatile market.

Do you lose money on slippage?

It depends on the type of slippage you’re experiencing, negative or positive.

What is a negative slippage?

Negative slippage means the price difference works against you.

Is slippage a fee?

No, it’s the difference between the intended price and the executed price.

What is a good slippage tolerance?

It depends on your trading goals, and you should set up a slippage tolerance percentage accordingly.

Why is slippage so high?

High slippage typically occurs during high-volatility market conditions when a trader’s order cannot be immediately matched by available liquidity in the market.

How do you trade with low slippage?

Low slippage actually creates a good environment for traders.

Final Thoughts

Ultimately, slippage is something that every trader has to deal with in one way or another. By understanding what slippage is and how it works, you can make sure that it doesn’t impact your trading strategy in a negative way. While it can often be difficult to avoid completely, traders can minimize its effects by using limit orders and monitoring market conditions closely. By doing so, they can help ensure that their trades are executed at prices that are as close to their expectations as possible.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.