In brief

- Lido Finance is one of the largest staking projects in the industry.

- Instead of having to cough up 32 ETH, anyone can start staking with any amount.

- Unlike other stakers, Lido keeps users liquid by offering them a Staked ETH token.

If you’ve been following Ethereum for the last three years, you’ve also likely heard of Lido Finance.

The massive liquid staking protocol, which launched shortly after Ethereum began its transition to a proof-of-stake blockchain, now commands the lion’s share of the staking market.

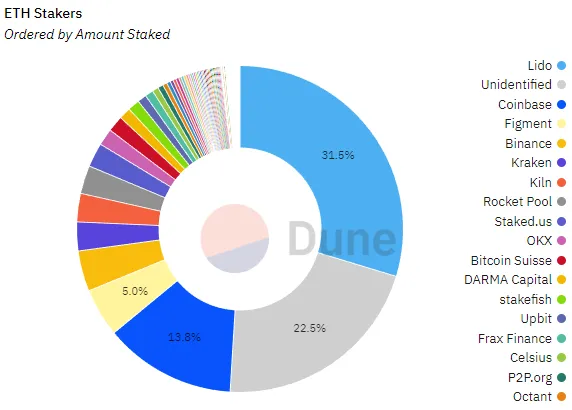

Per an oft-cited Dune dashboard from Hildobby, there are more than 27.8 million–or nearly $50 billion–Ethereum staked total across various cryptocurrency exchanges, individual validators, and decentralized protocols like Lido.

Of that sum, more than 31% is staked with Lido Finance, making it far and away the most popular staking solution on the market.

But what is liquid staking, Lido Finance, and how does it all work?

Keep reading to find out.

What is Lido Finance?

Lido Finance goes hand in hand with Ethereum’s full transition to proof-of-stake.

One of Lido DAO’s business development contributors Marin Tvrdić told Decrypt at ETH CC Paris that when Lido launched, it had a perfect market fit.

When Ethereum finally launched its so-called Beacon Chain in December 2020, effectively creating a parallel proof-of-stake network to the proof-of-work version, it also launched the staking feature.

Users with with 32 Ethereum ready to lock into the protocol were quick to start earning those staking rewards too.

But these early stakers enjoyed two advantages. The first, of course, being that they had an idle 32 ETH laying around, which at that time ran folks a cool $18,700.

The second advantage was that they were mad enough to believe that they’d eventually see that money back at some point.

That’s right. When staking first launched, there was no way to withdraw your holdings until developers executed another upgrade called Shanghai in April 2023.

For more about Shanghai and what this was such an important upgrade, read our Learn piece on it. In sum, it lets stakers finally withdraw any of their holdings.

Prior to Shanghai, though, Lido Finance emerged to effectively solve both of these problems prior to Shanghai. It let users with less than 32 Ethereum enjoy the benefits of staking Ethereum and it also helped them stay liquid, hence the term liquid staking.

Before Lido, staking on Ethereum meant you locked up your holdings and that was it, you sat on your hands, raked in the yield.

After Lido launched, though, you could stake your Ethereum with the protocol and then receive something called a liquid staking derivative (LSD), also sometimes called a liquid staking token (LST).

This token, which in Lido’s case is called Staked Ethereum (stETH), held a 1-to-1 price peg with Ethereum.

And as other DeFi projects began to adopt this token as collateral, it meant that stakers could put that stETH back to work elsewhere on Maker to mint more of its decentralized stablecoin DAI or even continue earning extra yield over on lending heavyweight Aave.

How does Lido Finance work?

That’s all fine and good, and has played a huge role in Lido’s ballooning market share of late, but how exactly does staking with Lido Finance work under the hood?

Imagine Lido as simply another layer between users and the Ethereum blockchain. Instead of users needing to maintain the technical overhead of running a validator, Lido takes care of all of this for users.

The protocol vets and onboards node operators that take care of all of this for them.

Per Rated, a node-explorer platform, Lido currently has 36 node operators operating more than 273,000 nodes on Ethereum. The operators are relatively well-known and include brands like BridgeTower, ChainSafe, and Figment.

Becoming an operator means following a rather rigorous onboarding process, which tests a validator’s technical wit, key management practices, and even their location in the world among other requirements. This added friction is essentially meant to ensure that validators on Lido are high quality.

That’s because if they get slashed–a type of monetary penalty–due to validator downtime or attempted malicious behavior from the validators, the protocol and its users could also face some losses. This is also in part why Lido has implemented an insurance fund that takes a slice of protocol fees to protect users from hefty slashing penalties.

And that’s it (in rather broad strokes).

Lido Finance lets everyday users participate in Ethereum’s staking process, no matter how much ETH they hold.

Stay on top of crypto news, get daily updates in your inbox.

In brief

- Lido Finance is one of the largest staking projects in the industry.

- Instead of having to cough up 32 ETH, anyone can start staking with any amount.

- Unlike other stakers, Lido keeps users liquid by offering them a Staked ETH token.

If you’ve been following Ethereum for the last three years, you’ve also likely heard of Lido Finance.

The massive liquid staking protocol, which launched shortly after Ethereum began its transition to a proof-of-stake blockchain, now commands the lion’s share of the staking market.

Per an oft-cited Dune dashboard from Hildobby, there are more than 27.8 million–or nearly $50 billion–Ethereum staked total across various cryptocurrency exchanges, individual validators, and decentralized protocols like Lido.

Of that sum, more than 31% is staked with Lido Finance, making it far and away the most popular staking solution on the market.

But what is liquid staking, Lido Finance, and how does it all work?

Keep reading to find out.

What is Lido Finance?

Lido Finance goes hand in hand with Ethereum’s full transition to proof-of-stake.

One of Lido DAO’s business development contributors Marin Tvrdić told Decrypt at ETH CC Paris that when Lido launched, it had a perfect market fit.

When Ethereum finally launched its so-called Beacon Chain in December 2020, effectively creating a parallel proof-of-stake network to the proof-of-work version, it also launched the staking feature.

Users with with 32 Ethereum ready to lock into the protocol were quick to start earning those staking rewards too.

But these early stakers enjoyed two advantages. The first, of course, being that they had an idle 32 ETH laying around, which at that time ran folks a cool $18,700.

The second advantage was that they were mad enough to believe that they’d eventually see that money back at some point.

That’s right. When staking first launched, there was no way to withdraw your holdings until developers executed another upgrade called Shanghai in April 2023.

For more about Shanghai and what this was such an important upgrade, read our Learn piece on it. In sum, it lets stakers finally withdraw any of their holdings.

Prior to Shanghai, though, Lido Finance emerged to effectively solve both of these problems prior to Shanghai. It let users with less than 32 Ethereum enjoy the benefits of staking Ethereum and it also helped them stay liquid, hence the term liquid staking.

Before Lido, staking on Ethereum meant you locked up your holdings and that was it, you sat on your hands, raked in the yield.

After Lido launched, though, you could stake your Ethereum with the protocol and then receive something called a liquid staking derivative (LSD), also sometimes called a liquid staking token (LST).

This token, which in Lido’s case is called Staked Ethereum (stETH), held a 1-to-1 price peg with Ethereum.

And as other DeFi projects began to adopt this token as collateral, it meant that stakers could put that stETH back to work elsewhere on Maker to mint more of its decentralized stablecoin DAI or even continue earning extra yield over on lending heavyweight Aave.

How does Lido Finance work?

That’s all fine and good, and has played a huge role in Lido’s ballooning market share of late, but how exactly does staking with Lido Finance work under the hood?

Imagine Lido as simply another layer between users and the Ethereum blockchain. Instead of users needing to maintain the technical overhead of running a validator, Lido takes care of all of this for users.

The protocol vets and onboards node operators that take care of all of this for them.

Per Rated, a node-explorer platform, Lido currently has 36 node operators operating more than 273,000 nodes on Ethereum. The operators are relatively well-known and include brands like BridgeTower, ChainSafe, and Figment.

Becoming an operator means following a rather rigorous onboarding process, which tests a validator’s technical wit, key management practices, and even their location in the world among other requirements. This added friction is essentially meant to ensure that validators on Lido are high quality.

That’s because if they get slashed–a type of monetary penalty–due to validator downtime or attempted malicious behavior from the validators, the protocol and its users could also face some losses. This is also in part why Lido has implemented an insurance fund that takes a slice of protocol fees to protect users from hefty slashing penalties.

And that’s it (in rather broad strokes).

Lido Finance lets everyday users participate in Ethereum’s staking process, no matter how much ETH they hold.

As I site possessor I believe the content matter here is rattling excellent , appreciate it for your efforts. You should keep it up forever! Best of luck.

This web site is my intake, real superb layout and perfect subject material.

Woh I enjoy your blog posts, saved to favorites! .

I am now not certain where you’re getting your information, but great topic. I must spend some time learning much more or working out more. Thank you for wonderful information I was on the lookout for this info for my mission.

where can i buy generic clomid without prescription buying cheap clomiphene price cost cheap clomid prices can i get clomid without rx where buy cheap clomiphene without dr prescription how to buy clomiphene pill buy clomid

Wow, amazing blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is wonderful, as well as the content!

With thanks. Loads of expertise!

The reconditeness in this serving is exceptional.

rybelsus order – buy generic cyproheptadine online buy periactin tablets

You made some decent points there. I looked on the internet for the difficulty and found most individuals will associate with along with your website.

cost domperidone 10mg – domperidone 10mg without prescription cyclobenzaprine cost

azithromycin 500mg tablet – order tindamax online cheap order nebivolol pill

augmentin over the counter – atbioinfo cost ampicillin

nexium cheap – nexiumtous buy esomeprazole pill

buy generic meloxicam – relieve pain mobic 7.5mg price

Im no longer sure the place you’re getting your information, but good topic. I needs to spend a while studying more or working out more. Thank you for wonderful info I used to be searching for this info for my mission.

prednisone 40mg uk – corticosteroid buy prednisone 10mg pill

buy generic ed pills online – pills for erection cheap erectile dysfunction pill

purchase amoxicillin generic – combamoxi.com amoxil cost

buy diflucan 100mg online – forcan generic brand fluconazole 100mg

order lexapro 20mg generic – https://escitapro.com/ buy lexapro generic

cost cenforce 50mg – https://cenforcers.com/ generic cenforce

cialis for sale online in canada – where to buy cialis in canada cialis black 800 to buy in the uk one pill

online cialis – strong tadafl buy tadalafil online canada

order ranitidine 300mg online – https://aranitidine.com/ zantac without prescription

sildenafil 100 mg tablet – https://strongvpls.com/# buy viagra australia

More posts like this would make the blogosphere more useful. https://gnolvade.com/

Good blog you have here.. It’s severely to espy high calibre article like yours these days. I justifiably respect individuals like you! Take vigilance!! https://buyfastonl.com/amoxicillin.html

This is the big-hearted of literature I in fact appreciate. https://ursxdol.com/provigil-gn-pill-cnt/

The depth in this ruined is exceptional. https://prohnrg.com/product/priligy-dapoxetine-pills/

Would you be enthusiastic about exchanging hyperlinks?

More articles like this would pretence of the blogosphere richer. https://aranitidine.com/fr/acheter-propecia-en-ligne/

This is the amicable of serenity I enjoy reading. https://ondactone.com/spironolactone/

Greetings! Very productive advice within this article! It’s the crumb changes which wish obtain the largest changes. Thanks a lot towards sharing!

can i purchase cheap tetracycline

Greetings! Extremely gainful recommendation within this article! It’s the crumb changes which will turn the largest changes. Thanks a quantity in the direction of sharing! http://www.dbgjjs.com/home.php?mod=space&uid=531850

You completed several nice points there. I did a search on the topic and found mainly persons will have the same opinion with your blog.

buy generic dapagliflozin over the counter – https://janozin.com/# buy dapagliflozin for sale

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

buy generic orlistat for sale – orlistat online order xenical online

Very interesting info !Perfect just what I was searching for! “All the really good ideas I ever had came to me while I was milking a cow.” by Grant Wood.

It’s really a cool and helpful piece of info. I am glad that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.

More posts like this would make the online space more useful. http://www.gearcup.cn/home.php?mod=space&uid=146355