- ETF volumes surged as BTC’s price appreciated on the charts

- Number of long term holders declined though, despite recent hike in price

Bitcoin [BTC]’s recent push past the $65,000-level has inspired massive optimism among traders and investors alike. This, despite the minor correction that followed soon after. However, it isn’t just the crypto-market where BTC is making waves. In fact, Wall Street is pretty keen on Bitcoin as well.

Interest in ETFs grows

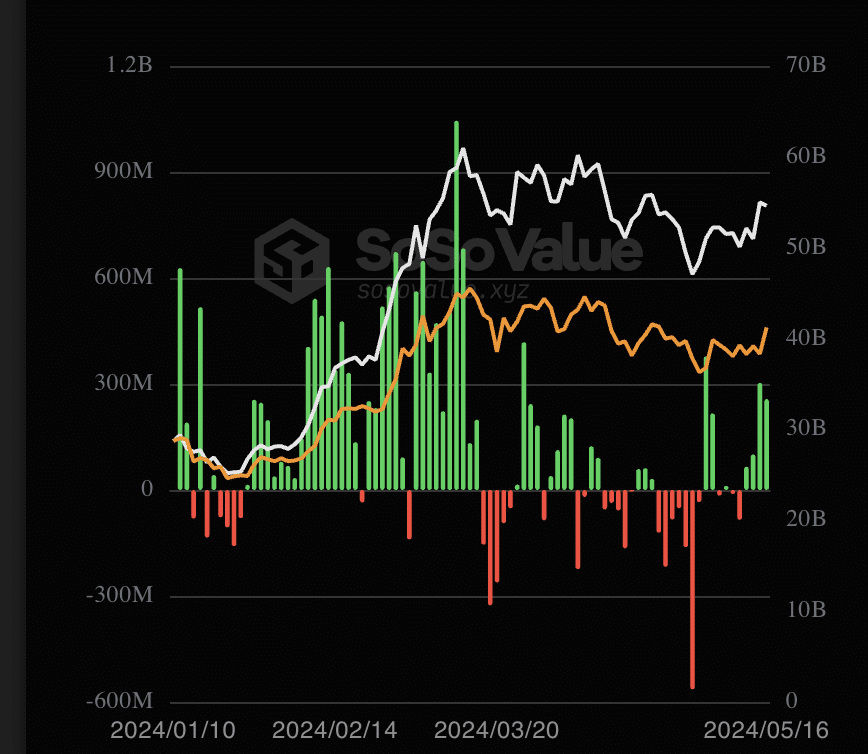

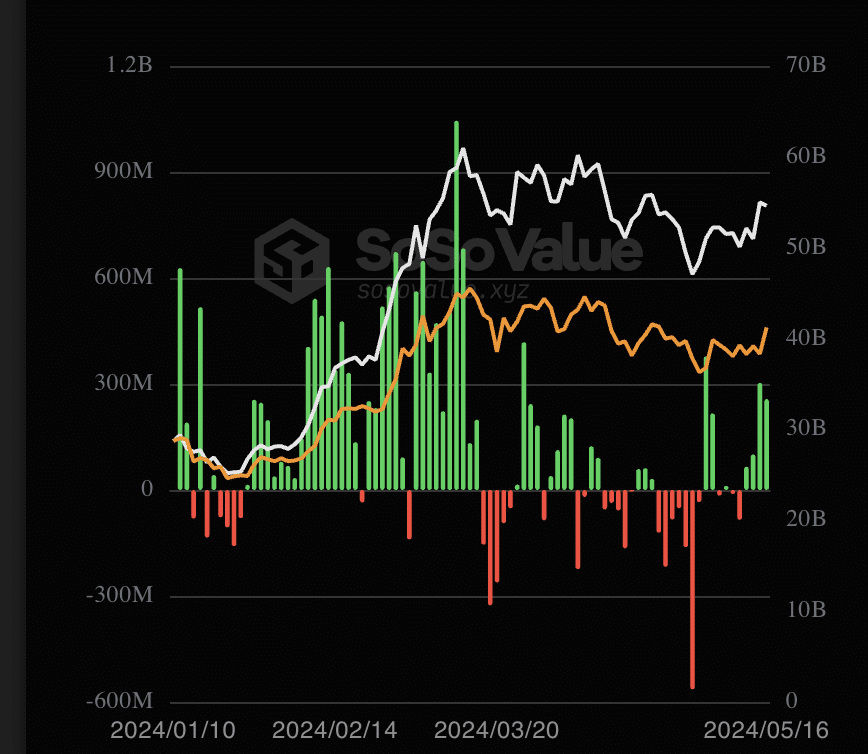

According to Santiment, seven major Bitcoin ETFs together recorded a trading volume of $5.65 billion, marking their highest volume since 24 March.

On 16 May, the net inflows of U.S Bitcoin spot ETFs amounted to $257 million, indicating significant investor activity. Notably, Grayscale’s ETF GBTC saw single-day net inflows of $4.6382 million. Similarly, BlackRock’s ETF IBIT recorded net inflows of $93.7004 million, while Fidelity’s ETF FBTC registered net inflows of $67.0829 million on the same day.

Source: sosovalue

The interest showcased by institutional investors from the traditional finance world can help inject massive amounts of liquidity into the Bitcoin market.

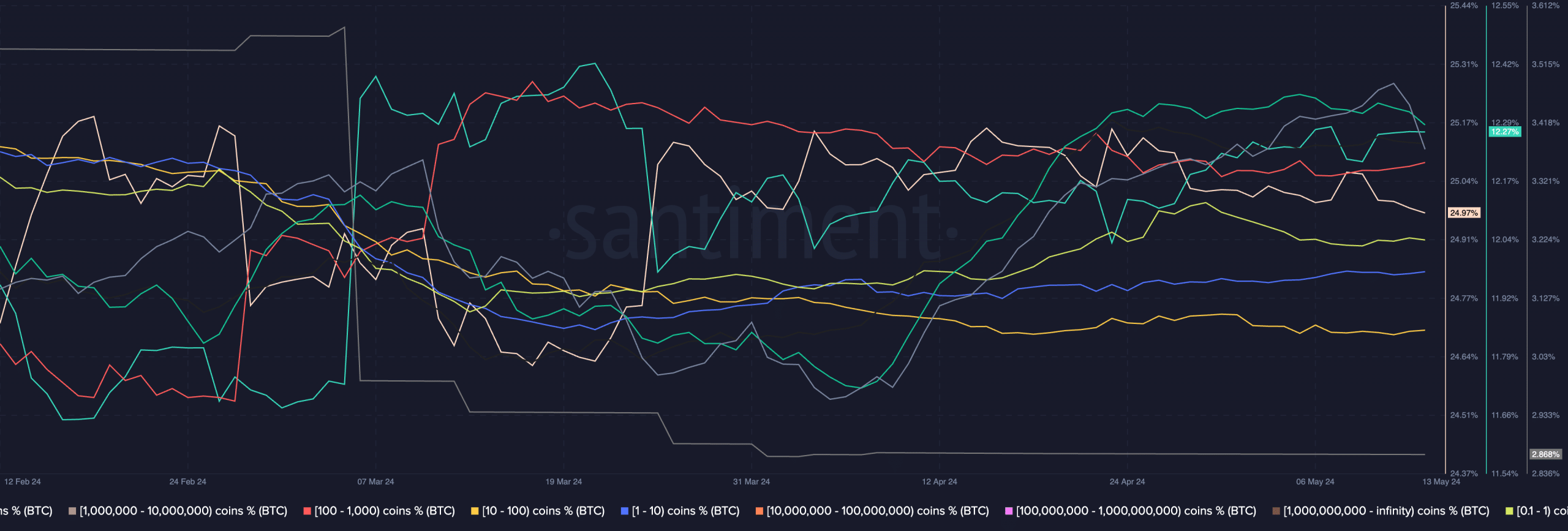

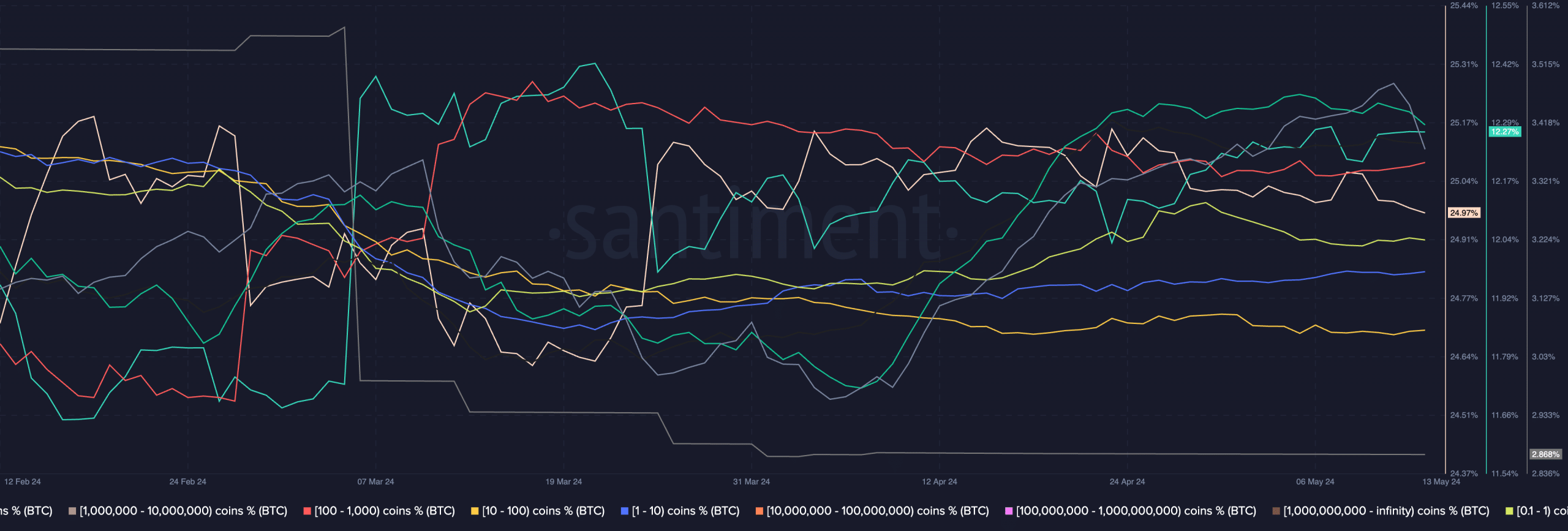

However, large investors in the crypto-space, known as whales, did not show similar levels of interest in BTC. AMBCrypto’s examination of Santiment’s data revealed that addresses holding 10-10,000 BTC slowed down their accumulation. On the contrary, retail interest has been on the rise. Investors holding anywhere between 0.001 to 1 BTC were seen accumulating BTC at a high rate.

Accumulation of BTC by retail investors could be a positive for BTC in the long run as it will help make the overall network more decentralized.

Source: Santiment

How are holders doing?

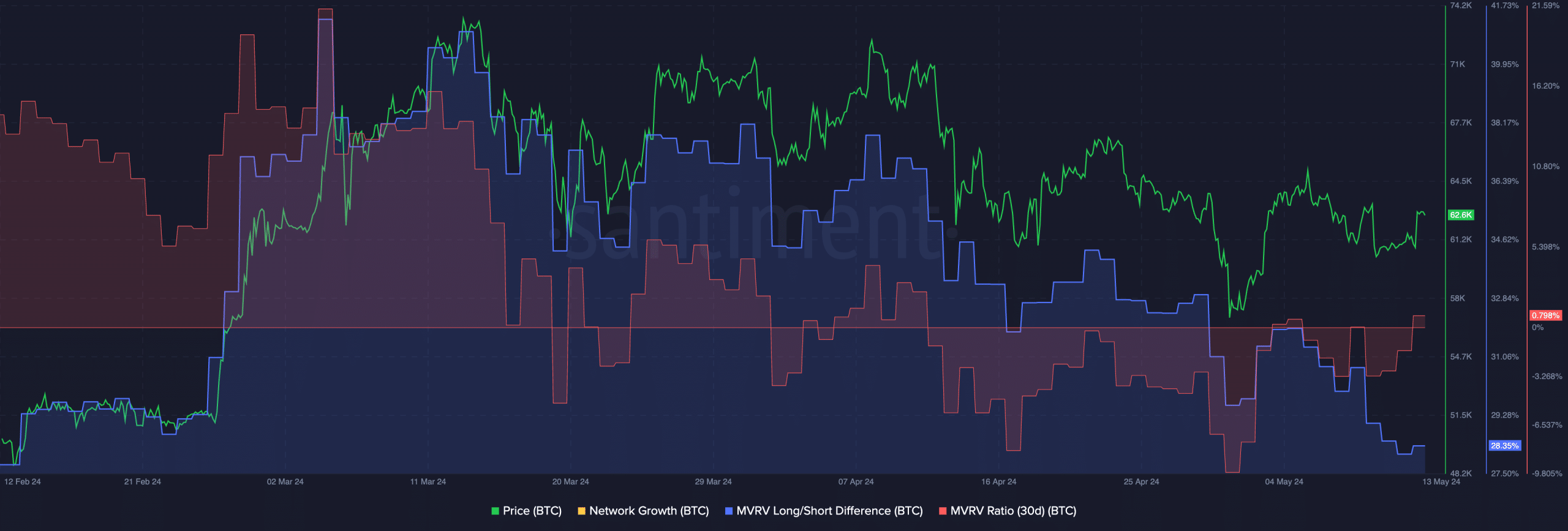

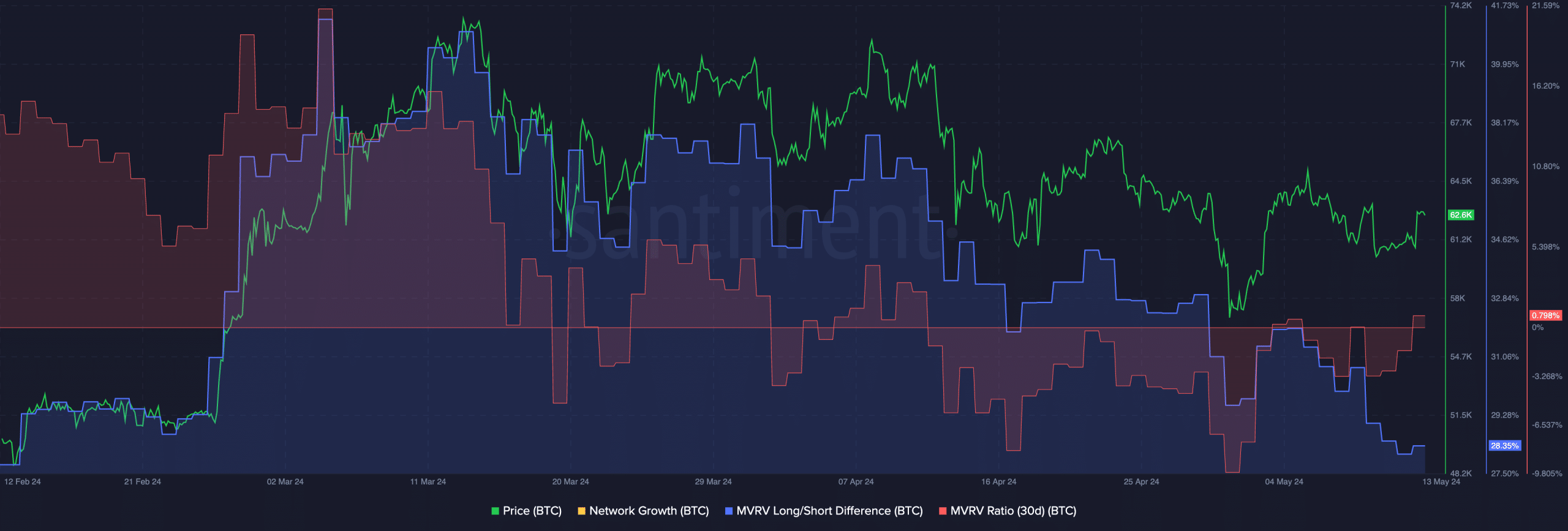

At press time, BTC was trading at $66,314.84, with its price up by 0.47% in the last 24 hours. Due to the recent uptick in price, the MVRV ratio for BTC grew significantly over the last few days. This indicated that most holders were starting to get profitable. As the price of BTC hikes further, there is a high chance of profit taking that could take place in the future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite the surge in price, however, there was a concerning trend that emerged over the last few weeks. The Long/Short difference for BTC declined significantly, indicating that the number of long-term holders accumulating BTC fell and the number of short-term holders grew.

Short term holders are much more likely to respond impulsively to market fluctuations, having a negative impact on BTC’s price.

Source: Santiment

- ETF volumes surged as BTC’s price appreciated on the charts

- Number of long term holders declined though, despite recent hike in price

Bitcoin [BTC]’s recent push past the $65,000-level has inspired massive optimism among traders and investors alike. This, despite the minor correction that followed soon after. However, it isn’t just the crypto-market where BTC is making waves. In fact, Wall Street is pretty keen on Bitcoin as well.

Interest in ETFs grows

According to Santiment, seven major Bitcoin ETFs together recorded a trading volume of $5.65 billion, marking their highest volume since 24 March.

On 16 May, the net inflows of U.S Bitcoin spot ETFs amounted to $257 million, indicating significant investor activity. Notably, Grayscale’s ETF GBTC saw single-day net inflows of $4.6382 million. Similarly, BlackRock’s ETF IBIT recorded net inflows of $93.7004 million, while Fidelity’s ETF FBTC registered net inflows of $67.0829 million on the same day.

Source: sosovalue

The interest showcased by institutional investors from the traditional finance world can help inject massive amounts of liquidity into the Bitcoin market.

However, large investors in the crypto-space, known as whales, did not show similar levels of interest in BTC. AMBCrypto’s examination of Santiment’s data revealed that addresses holding 10-10,000 BTC slowed down their accumulation. On the contrary, retail interest has been on the rise. Investors holding anywhere between 0.001 to 1 BTC were seen accumulating BTC at a high rate.

Accumulation of BTC by retail investors could be a positive for BTC in the long run as it will help make the overall network more decentralized.

Source: Santiment

How are holders doing?

At press time, BTC was trading at $66,314.84, with its price up by 0.47% in the last 24 hours. Due to the recent uptick in price, the MVRV ratio for BTC grew significantly over the last few days. This indicated that most holders were starting to get profitable. As the price of BTC hikes further, there is a high chance of profit taking that could take place in the future.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Despite the surge in price, however, there was a concerning trend that emerged over the last few weeks. The Long/Short difference for BTC declined significantly, indicating that the number of long-term holders accumulating BTC fell and the number of short-term holders grew.

Short term holders are much more likely to respond impulsively to market fluctuations, having a negative impact on BTC’s price.

Source: Santiment

can i purchase clomid without a prescription can you get clomid pills can i purchase clomiphene prices buying clomiphene tablets where buy clomiphene price can you get generic clomiphene for sale where can i get cheap clomid without dr prescription

Proof blog you be undergoing here.. It’s obdurate to on high calibre article like yours these days. I truly recognize individuals like you! Take vigilance!!

Greetings! Jolly useful par‘nesis within this article! It’s the petty changes which liking turn the largest changes. Thanks a portion for sharing!

buy rybelsus 14mg pills – rybelsus 14 mg cheap cyproheptadine 4 mg us

domperidone brand – oral cyclobenzaprine 15mg purchase cyclobenzaprine

buy amoxiclav pills – https://atbioinfo.com/ order ampicillin online

nexium drug – anexamate order generic esomeprazole

how to buy coumadin – https://coumamide.com/ cozaar 50mg tablet

mobic tablet – mobo sin how to get mobic without a prescription

purchase prednisone – https://apreplson.com/ deltasone 20mg over the counter

buy ed pills – site best ed pills

buy amoxil online cheap – order amoxicillin without prescription purchase amoxil for sale

order fluconazole sale – on this site fluconazole 200mg price

how much does cialis cost at cvs – ciltad genesis cheaper alternative to cialis

sanofi cialis – https://strongtadafl.com/# cialis tadalafil & dapoxetine

More text pieces like this would urge the web better. como conseguir provigil

discount viagra for sale – https://strongvpls.com/ viagra without doctor prescription

Thanks for sharing. It’s outstrip quality. https://buyfastonl.com/isotretinoin.html

The thoroughness in this draft is noteworthy. https://ursxdol.com/propecia-tablets-online/

The thoroughness in this piece is noteworthy. https://prohnrg.com/product/loratadine-10-mg-tablets/

I couldn’t weather commenting. Well written! https://aranitidine.com/fr/ivermectine-en-france/

More posts like this would make the online space more useful. https://ondactone.com/spironolactone/

More posts like this would create the online space more useful.

https://doxycyclinege.com/pro/celecoxib/

This website absolutely has all of the bumf and facts I needed about this participant and didn’t positive who to ask. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4272498&do=profile

purchase forxiga online – buy dapagliflozin 10 mg generic buy forxiga online cheap

order xenical sale – how to get orlistat without a prescription orlistat oral