- CryptoQuant founder claims that whales are getting ready for altcoin season.

- Another market analyst, Benjamin Cowen, cautions for such calls amidst rising BTC dominance.

There’s another round of Alt season calls right at the beginning of August, just weeks away from a potential first Fed rate cut in September. The latest call is from CryptoQuant, a crypto data intelligence platform.

This isn’t the first altcoin season call from market analysts and might not be the last. We’ve observed these calls since this cycle started late last year, but none have materialized.

Will whales make this Alt season call different?

So, what makes this latest Alt season call different? Whales, also known as smart money.

According to CryptoQuant founder Ki Young Ju, whales are positioning themselves in a big way for the next altcoin season.

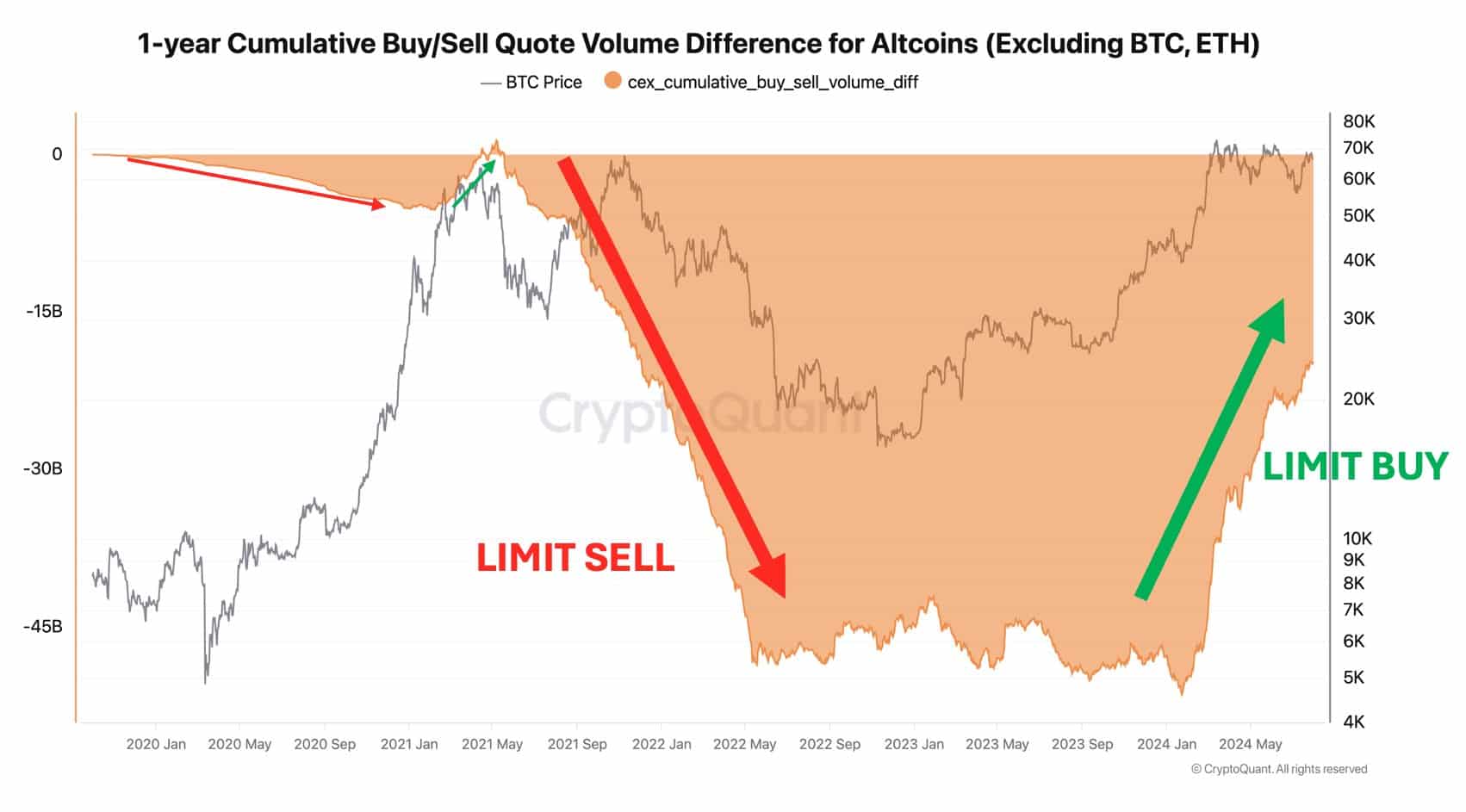

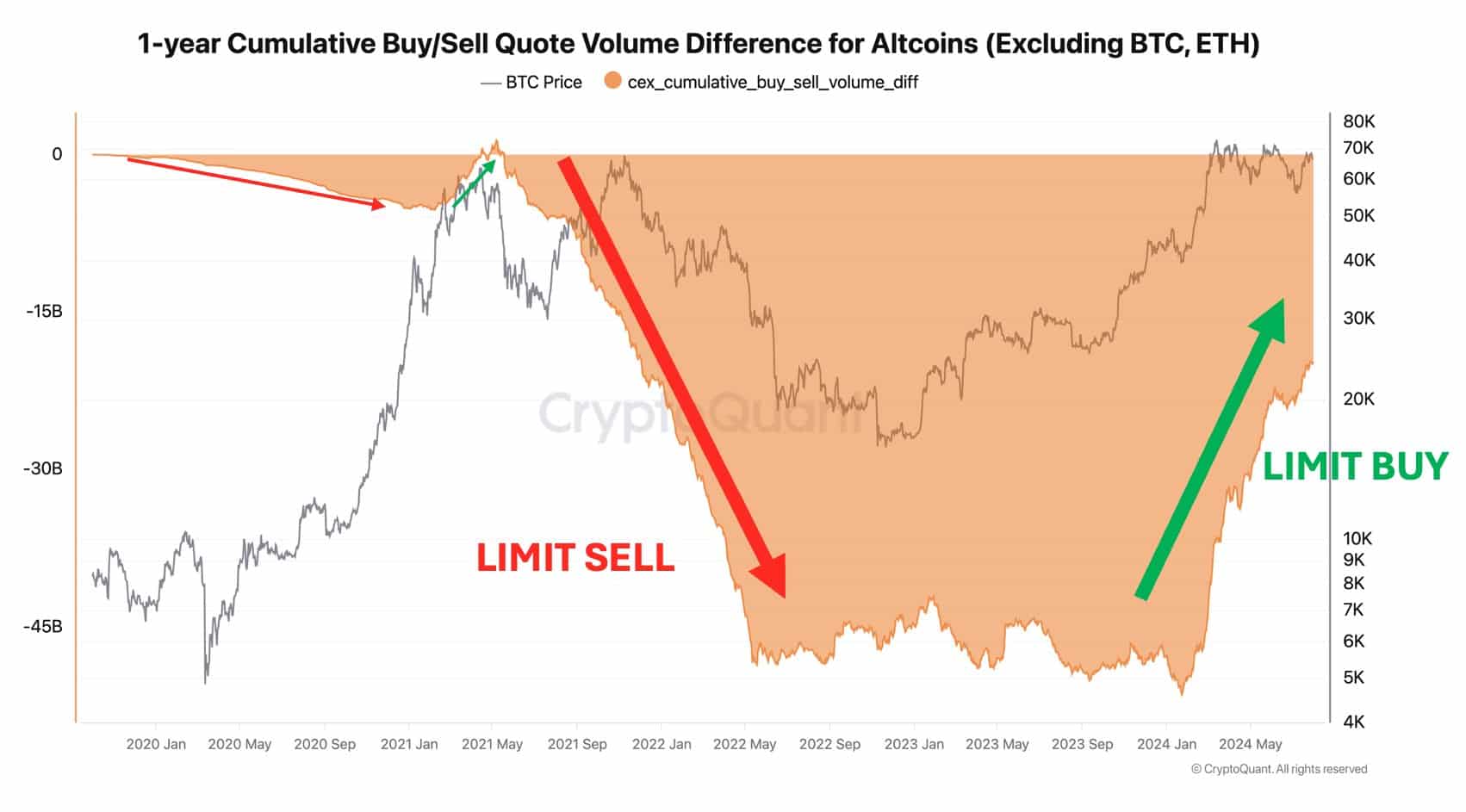

Source: CryptoQuant

Ju’s projection was based on increasing the 1-year Cumulative Buy/Sell Quote Volume Difference for Altcoins.

This metric tracks the altcoin demand from whales and institutions. A rising trend suggests strong demand from whales, while a declining trend underscores less demand.

The attached chart shows that the metric is rising, indicating a massive whale appetite and position for a possible altcoin season.

SwissBlock, a crypto market insight firm led by Glassnode founders, shared a similar Alt season outlook. The firm’s analysts said the current altcoin market mirrors the late 2020—early 2021 trend, which led to a 400% rally for altcoins.

The analysis was based on correlation with US Small Cap (Mini Russell 2000 Index Futures). Notably, other analysts, like Quinn Thompson of Lekker Capital, have cited the positive correlation between Small Caps and crypto.

However, not all analysts are boarding the Alt season call.

A renowned crypto analyst, Benjamin Cowen, offered a cautious outlook, citing that increasing Bitcoin dominance could hit 60% by the end of the year, which could drag the altcoin market.

‘You can see that #BTC dominance continues to slowly go higher, despite proclamations just about every week for “alt season”

Cowen added that ALT/BTC could drop lower, exposing Alts to more risks. According to Cowen, this trend was seen in 2019, a month before the Fed rate cut, and could repeat.

Source: Benjamin Cowen

In short, not all market observers heeded altcoin season calls, at least as of press time. In fact, according to current readings of 22 from the Altcoin Season Index, the market was still firmly in Bitcoin season.

- CryptoQuant founder claims that whales are getting ready for altcoin season.

- Another market analyst, Benjamin Cowen, cautions for such calls amidst rising BTC dominance.

There’s another round of Alt season calls right at the beginning of August, just weeks away from a potential first Fed rate cut in September. The latest call is from CryptoQuant, a crypto data intelligence platform.

This isn’t the first altcoin season call from market analysts and might not be the last. We’ve observed these calls since this cycle started late last year, but none have materialized.

Will whales make this Alt season call different?

So, what makes this latest Alt season call different? Whales, also known as smart money.

According to CryptoQuant founder Ki Young Ju, whales are positioning themselves in a big way for the next altcoin season.

Source: CryptoQuant

Ju’s projection was based on increasing the 1-year Cumulative Buy/Sell Quote Volume Difference for Altcoins.

This metric tracks the altcoin demand from whales and institutions. A rising trend suggests strong demand from whales, while a declining trend underscores less demand.

The attached chart shows that the metric is rising, indicating a massive whale appetite and position for a possible altcoin season.

SwissBlock, a crypto market insight firm led by Glassnode founders, shared a similar Alt season outlook. The firm’s analysts said the current altcoin market mirrors the late 2020—early 2021 trend, which led to a 400% rally for altcoins.

The analysis was based on correlation with US Small Cap (Mini Russell 2000 Index Futures). Notably, other analysts, like Quinn Thompson of Lekker Capital, have cited the positive correlation between Small Caps and crypto.

However, not all analysts are boarding the Alt season call.

A renowned crypto analyst, Benjamin Cowen, offered a cautious outlook, citing that increasing Bitcoin dominance could hit 60% by the end of the year, which could drag the altcoin market.

‘You can see that #BTC dominance continues to slowly go higher, despite proclamations just about every week for “alt season”

Cowen added that ALT/BTC could drop lower, exposing Alts to more risks. According to Cowen, this trend was seen in 2019, a month before the Fed rate cut, and could repeat.

Source: Benjamin Cowen

In short, not all market observers heeded altcoin season calls, at least as of press time. In fact, according to current readings of 22 from the Altcoin Season Index, the market was still firmly in Bitcoin season.

Your blog is a shining example of excellence in content creation. I’m continually impressed by the depth of your knowledge and the clarity of your writing. Thank you for all that you do.

can i get generic clomid online where to buy generic clomid without dr prescription where buy clomiphene without prescription generic clomid for sale get cheap clomiphene without insurance can i get clomiphene online can you get clomiphene for sale

This is the amicable of serenity I have reading.

Thanks towards putting this up. It’s well done.

buy azithromycin pills – how to buy ciprofloxacin buy flagyl generic

buy semaglutide sale – cyproheptadine 4mg price periactin 4mg uk

brand domperidone – purchase flexeril online cheap flexeril drug

order amoxiclav without prescription – atbioinfo.com buy ampicillin pill

order esomeprazole 20mg generic – https://anexamate.com/ purchase nexium pill

order meloxicam 7.5mg online cheap – https://moboxsin.com/ order mobic 15mg sale

buy deltasone pills – https://apreplson.com/ cheap deltasone 20mg

top erection pills – buy ed medication online medication for ed dysfunction

purchase amoxil pill – cheap amoxicillin tablets buy amoxicillin online cheap

order forcan generic – https://gpdifluca.com/# order fluconazole 200mg sale

buy cenforce 100mg pill – https://cenforcers.com/# buy cenforce paypal

cialis tadalafil 20mg tablets – does cialis lower your blood pressure why does tadalafil say do not cut pile

what is cialis used to treat – cialis price canada cialis from canadian pharmacy registerd

ranitidine 300mg pill – order zantac generic buy zantac 300mg generic

buy viagra discreetly – https://strongvpls.com/# buy viagra online australia

Proof blog you be undergoing here.. It’s obdurate to on high worth script like yours these days. I really respect individuals like you! Withstand care!! que es lasix

This is a theme which is virtually to my callousness… Many thanks! Quite where can I notice the phone details in the course of questions? https://buyfastonl.com/azithromycin.html

I couldn’t resist commenting. Warmly written! https://ursxdol.com/ventolin-albuterol/

More content pieces like this would create the интернет better. https://prohnrg.com/product/cytotec-online/

I couldn’t weather commenting. Warmly written! https://aranitidine.com/fr/ivermectine-en-france/

Thanks on putting this up. It’s understandably done. https://ondactone.com/spironolactone/