- MATIC traded 23% lower than the same time last week.

- Wallets holding between 1,000 to 10 million coins increased sharply over the week.

The crypto market remained soaked in red, as Bitcoin [BTC] and most leading altcoins failed to counter downside volatility.

Not an exception, MATIC, suffered as well, dropping nearly 4% in the last 24 hours, according to CoinMarketCap.

The native token of popular layer-2 (L2) network Polygon was trading at $0.71 as of this writing, 23% lower than the same time last week.

Opportunity to stockpile some more?

Typically, such sharp corrections in a bull market are not viewed with an overtly negative sentiment, for they allow seasoned market players to accumulate coins at lower prices.

On-chain tracker Lookonchain drew attention to one such whale who utilized the downside to fill up their bags.

Among various altcoins, MATIC featured prominently, with nearly 2 million of them getting scooped up by the wealthy investor.

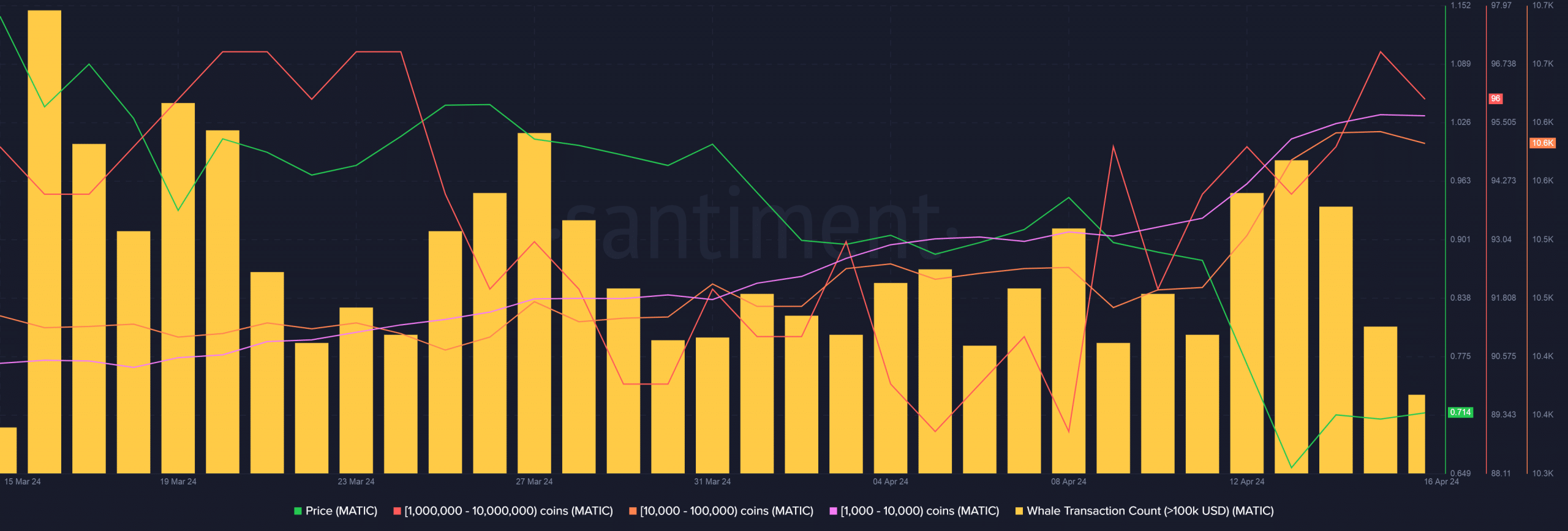

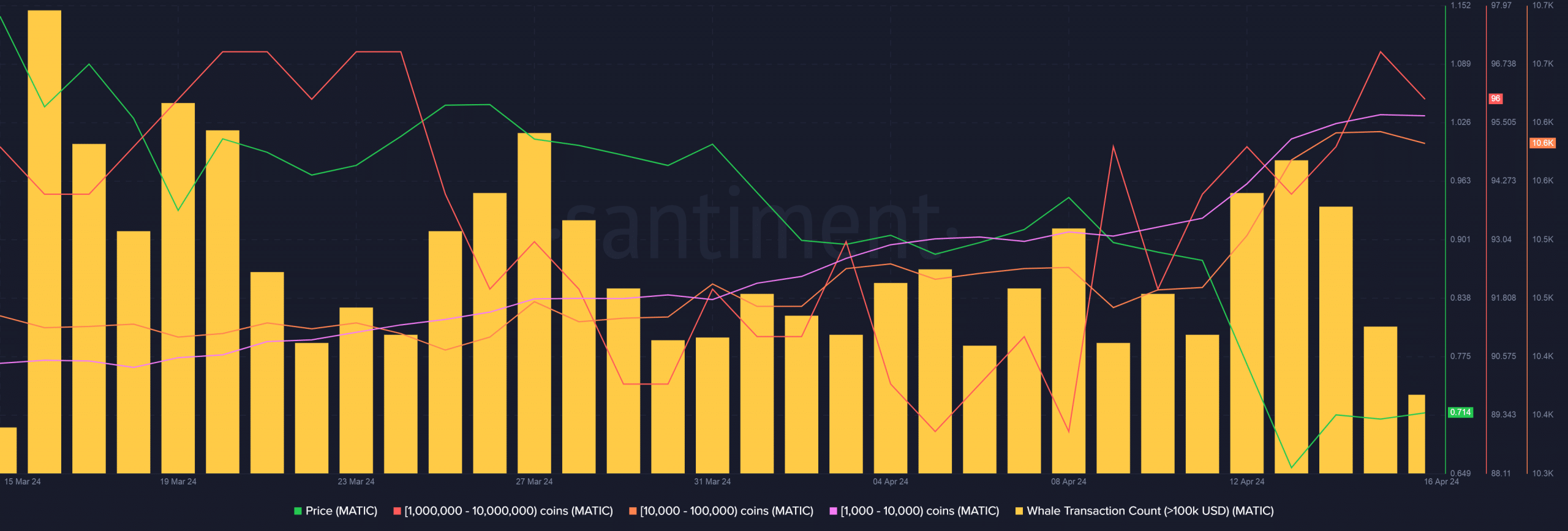

But this was not just a one-off incident. Using Santiment’s data, AMBCrypto noticed a noticeable uptick in holdings of whale cohorts.

The number of wallets holding between 1,000 to 10 million coins increased sharply over the week. At the same time, large transactions, worth more than $100,000, increased significantly.

This indicated that whales were indeed buying MATIC’s dip.

Source: Santiment

Whales confident of MATIC’s rebound?

The motivation to accumulate was rooted in their bullish expectations from MATIC.

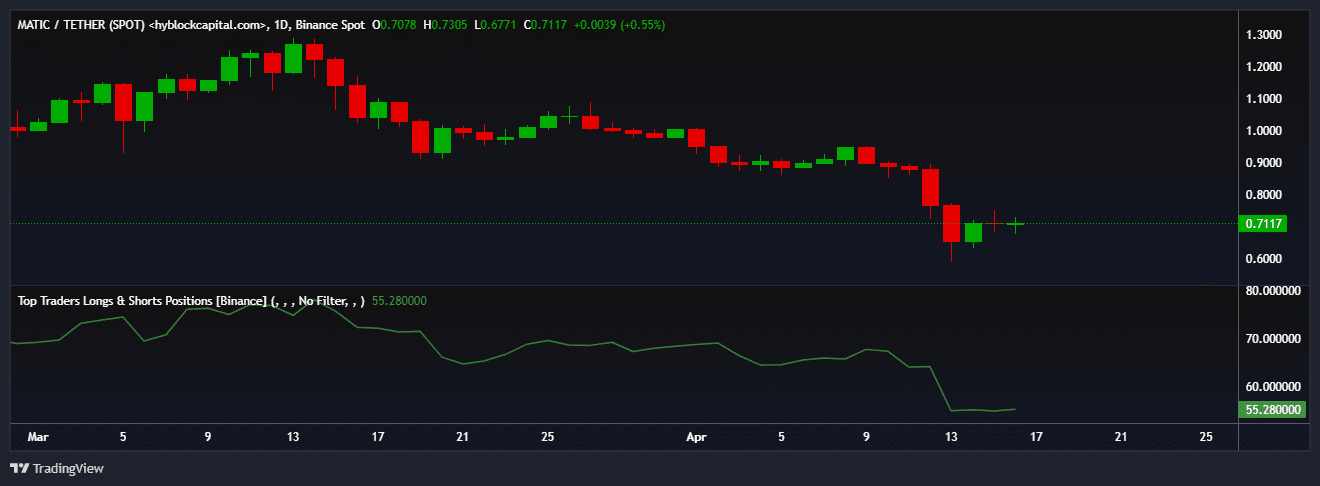

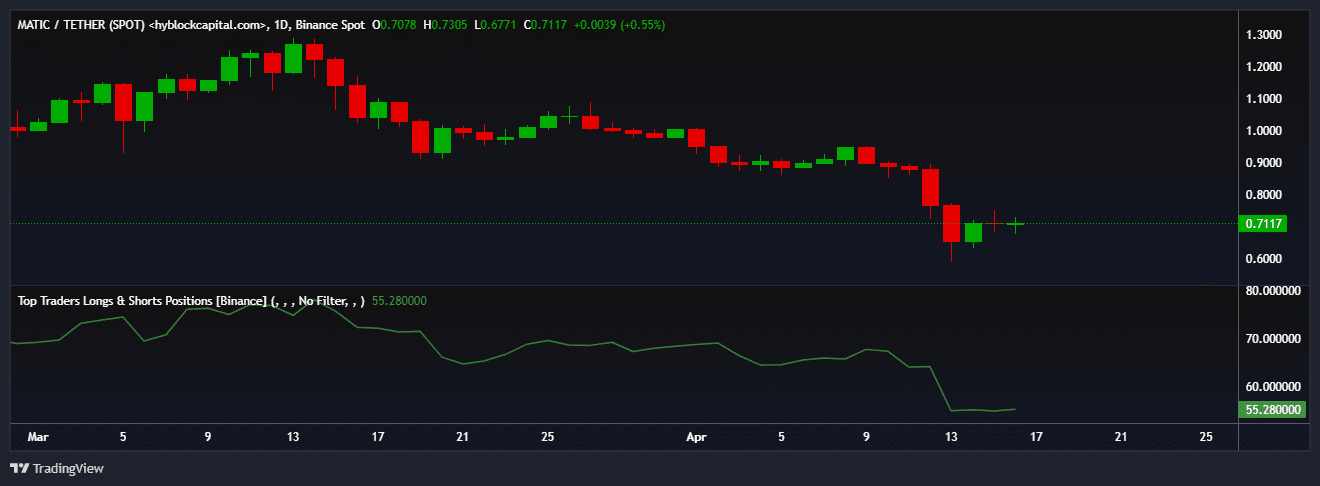

Despite a notable drop, nearly 55% of all whale positions for MATIC on Binance were long as of this writing, according to AMBCrypto’s analysis of Hyblock Capital’s data.

This suggested that they were confident of a rebound in the short term.

Source: Hyblock Capital

Is your portfolio green? Check out the MATIC Profit Calculator

Negative commentary dominates

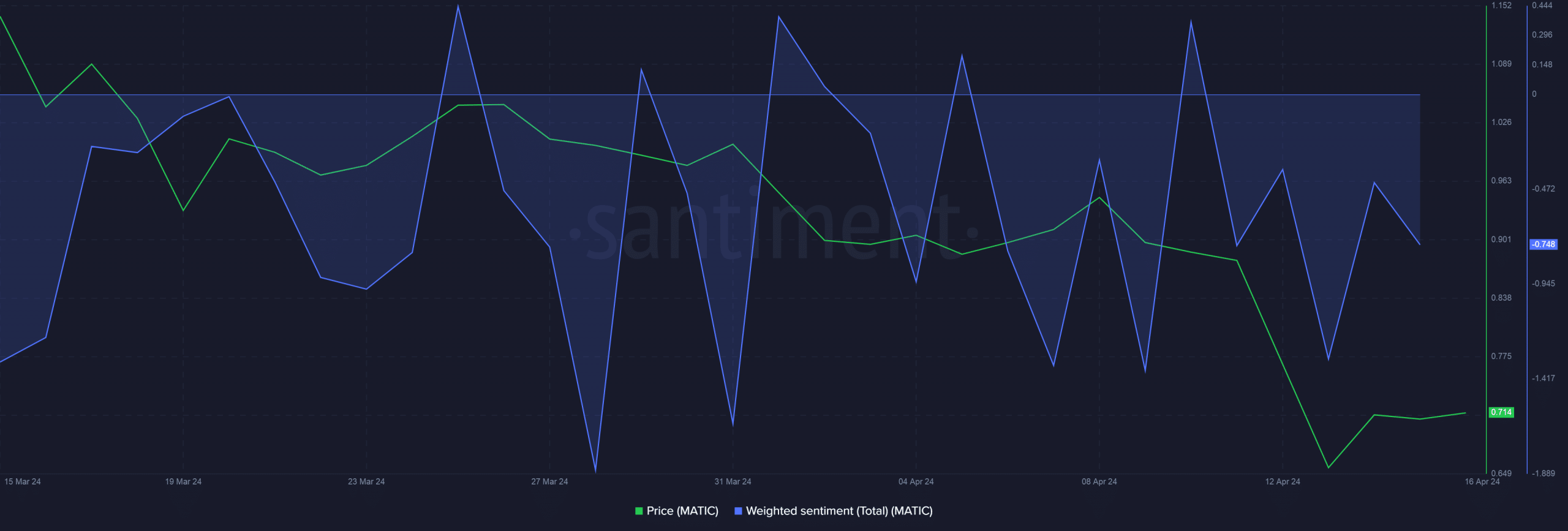

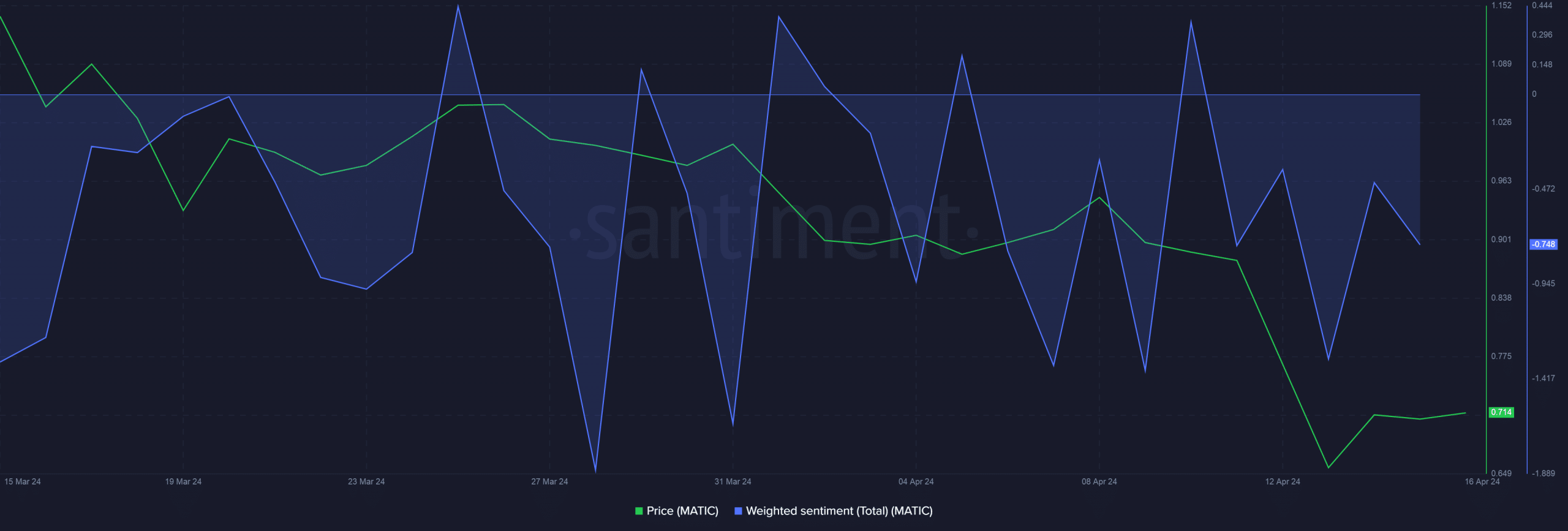

However, the price slump contributed to increased negative commentary around the coin, as evidenced by the negative Weighted Sentiment indicator.

Typically, such bearish takes could influence retail investors’ participation, as the latter are persuaded by discussions, particularly on social media.

Source: Santiment

- MATIC traded 23% lower than the same time last week.

- Wallets holding between 1,000 to 10 million coins increased sharply over the week.

The crypto market remained soaked in red, as Bitcoin [BTC] and most leading altcoins failed to counter downside volatility.

Not an exception, MATIC, suffered as well, dropping nearly 4% in the last 24 hours, according to CoinMarketCap.

The native token of popular layer-2 (L2) network Polygon was trading at $0.71 as of this writing, 23% lower than the same time last week.

Opportunity to stockpile some more?

Typically, such sharp corrections in a bull market are not viewed with an overtly negative sentiment, for they allow seasoned market players to accumulate coins at lower prices.

On-chain tracker Lookonchain drew attention to one such whale who utilized the downside to fill up their bags.

Among various altcoins, MATIC featured prominently, with nearly 2 million of them getting scooped up by the wealthy investor.

But this was not just a one-off incident. Using Santiment’s data, AMBCrypto noticed a noticeable uptick in holdings of whale cohorts.

The number of wallets holding between 1,000 to 10 million coins increased sharply over the week. At the same time, large transactions, worth more than $100,000, increased significantly.

This indicated that whales were indeed buying MATIC’s dip.

Source: Santiment

Whales confident of MATIC’s rebound?

The motivation to accumulate was rooted in their bullish expectations from MATIC.

Despite a notable drop, nearly 55% of all whale positions for MATIC on Binance were long as of this writing, according to AMBCrypto’s analysis of Hyblock Capital’s data.

This suggested that they were confident of a rebound in the short term.

Source: Hyblock Capital

Is your portfolio green? Check out the MATIC Profit Calculator

Negative commentary dominates

However, the price slump contributed to increased negative commentary around the coin, as evidenced by the negative Weighted Sentiment indicator.

Typically, such bearish takes could influence retail investors’ participation, as the latter are persuaded by discussions, particularly on social media.

Source: Santiment

can i buy clomiphene without prescription zei: get generic clomiphene for sale buying clomid no prescription where to buy cheap clomid price where to get cheap clomid without dr prescription generic clomiphene pill generic clomiphene without prescription

This is the tolerant of post I turn up helpful.

azithromycin 500mg for sale – buy generic tinidazole metronidazole for sale

buy rybelsus sale – cyproheptadine ca buy periactin 4 mg pill

order motilium without prescription – buy cyclobenzaprine online flexeril without prescription

order inderal 10mg online cheap – purchase inderal for sale brand methotrexate 2.5mg

augmentin 625mg oral – https://atbioinfo.com/ ampicillin without prescription

buy esomeprazole no prescription – anexa mate nexium generic

cheap warfarin – cou mamide cozaar drug

buy mobic for sale – relieve pain buy mobic sale

order prednisone 20mg generic – https://apreplson.com/ deltasone 10mg without prescription

cheap erectile dysfunction pills online – https://fastedtotake.com/ causes of ed

buy fluconazole 200mg without prescription – order forcan online diflucan order

cenforce us – cenforce rs cenforce online buy

cialis recreational use – pregnancy category for tadalafil cialis patent expiration 2016

order zantac 300mg online cheap – buy zantac 300mg sale ranitidine oral

where can i buy cialis – cialis by mail buy cialis with american express

Greetings! Very useful par‘nesis within this article! It’s the little changes which will make the largest changes. Thanks a a quantity towards sharing! https://gnolvade.com/

viagra women sale online – https://strongvpls.com/# 50 off viagra coupon

This is the stripe of serenity I enjoy reading. https://ursxdol.com/cenforce-100-200-mg-ed/

The reconditeness in this serving is exceptional. gabapentin 600mg canada

Thanks on sharing. It’s first quality. https://prohnrg.com/product/lisinopril-5-mg/

I couldn’t turn down commenting. Well written! https://aranitidine.com/fr/sibelium/