- Bitcoin’s whale activity recorded a major decline

- BTC broke above a descending triangle pattern, signaling a hike in buying pressure

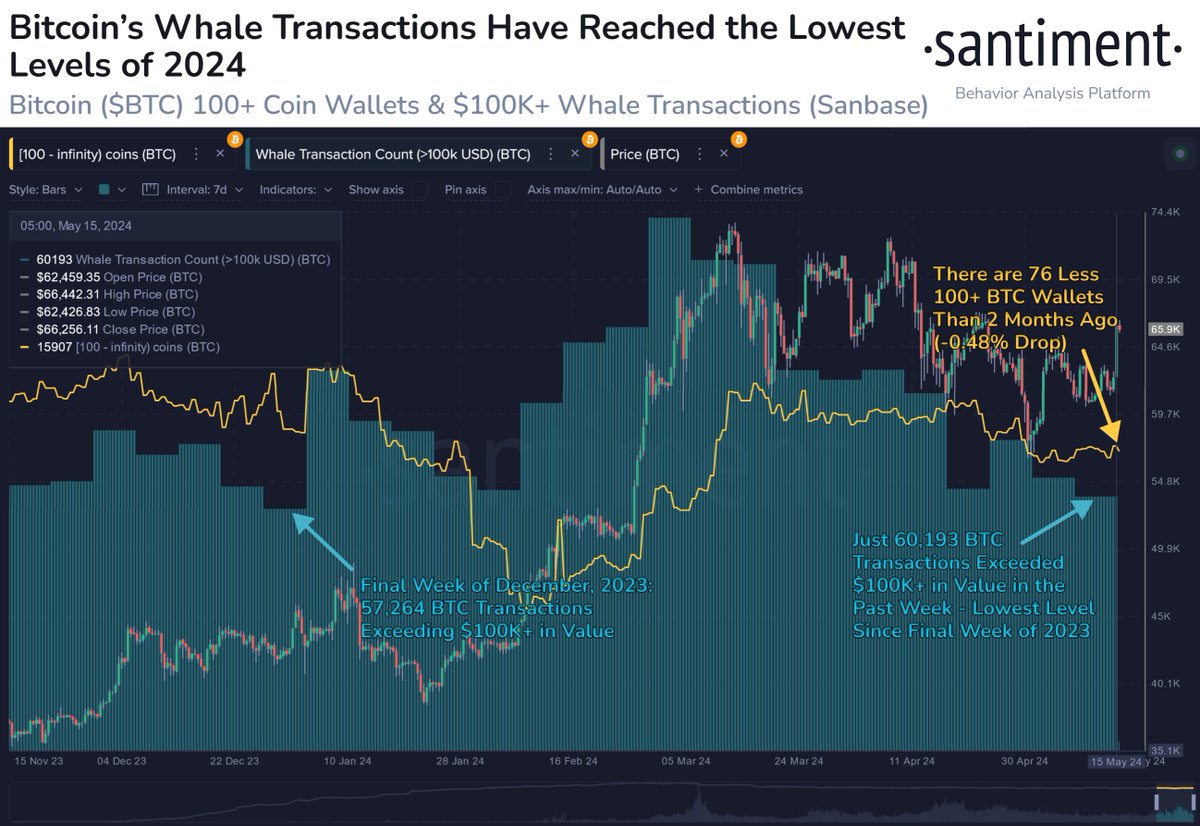

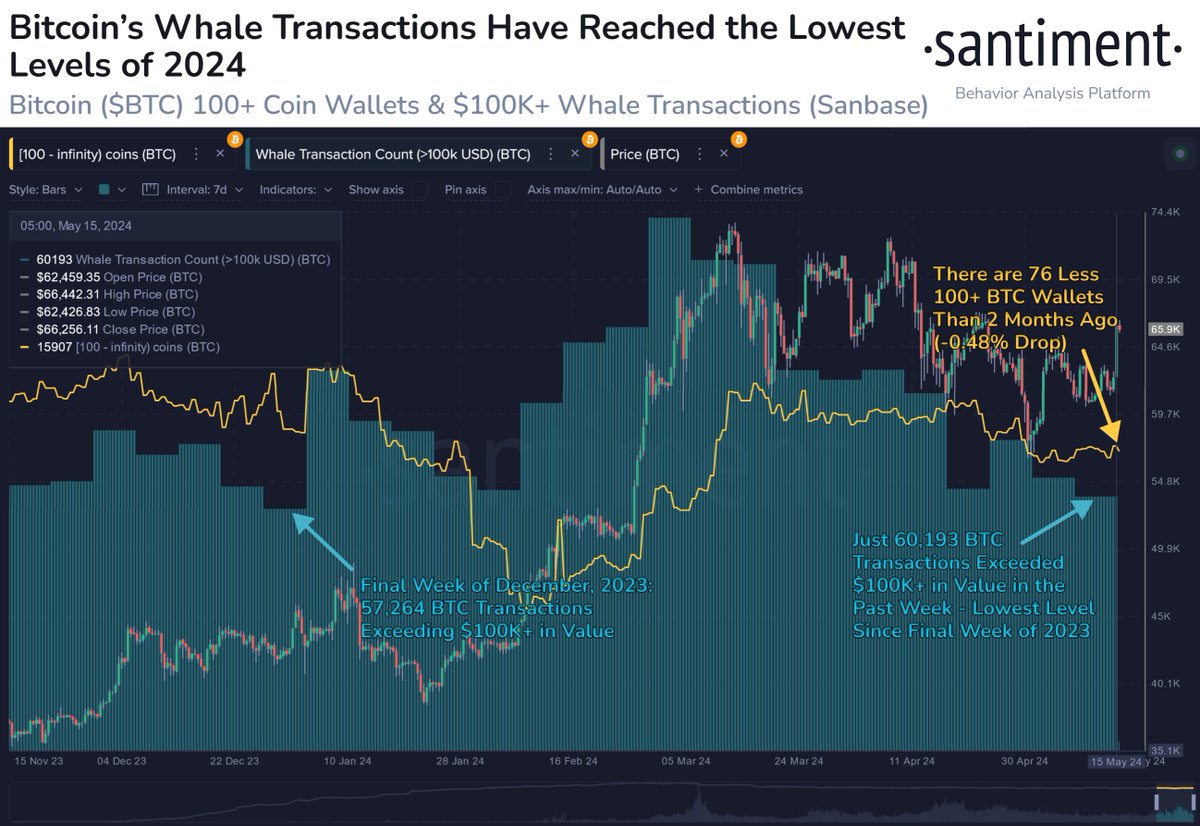

Bitcoin’s [BTC] whale activity has cratered to its lowest level since the beginning of the year. This, as the crypto developed resistance and support levels around the $65,000-price level on the charts.

In fact, data obtained from Santiment revealed that over the past week, only 60,193 BTC transactions exceeded $100,000, marking its lowest count since the final week of 2023.

Also, the number of BTC whales that hold over 100 coins has dropped by 0.48% in the last two months – An update possibly signifying a steady uptick in profit-taking activity among this investor category.

Source: Santiment

Bitcoin’s descending triangle pattern

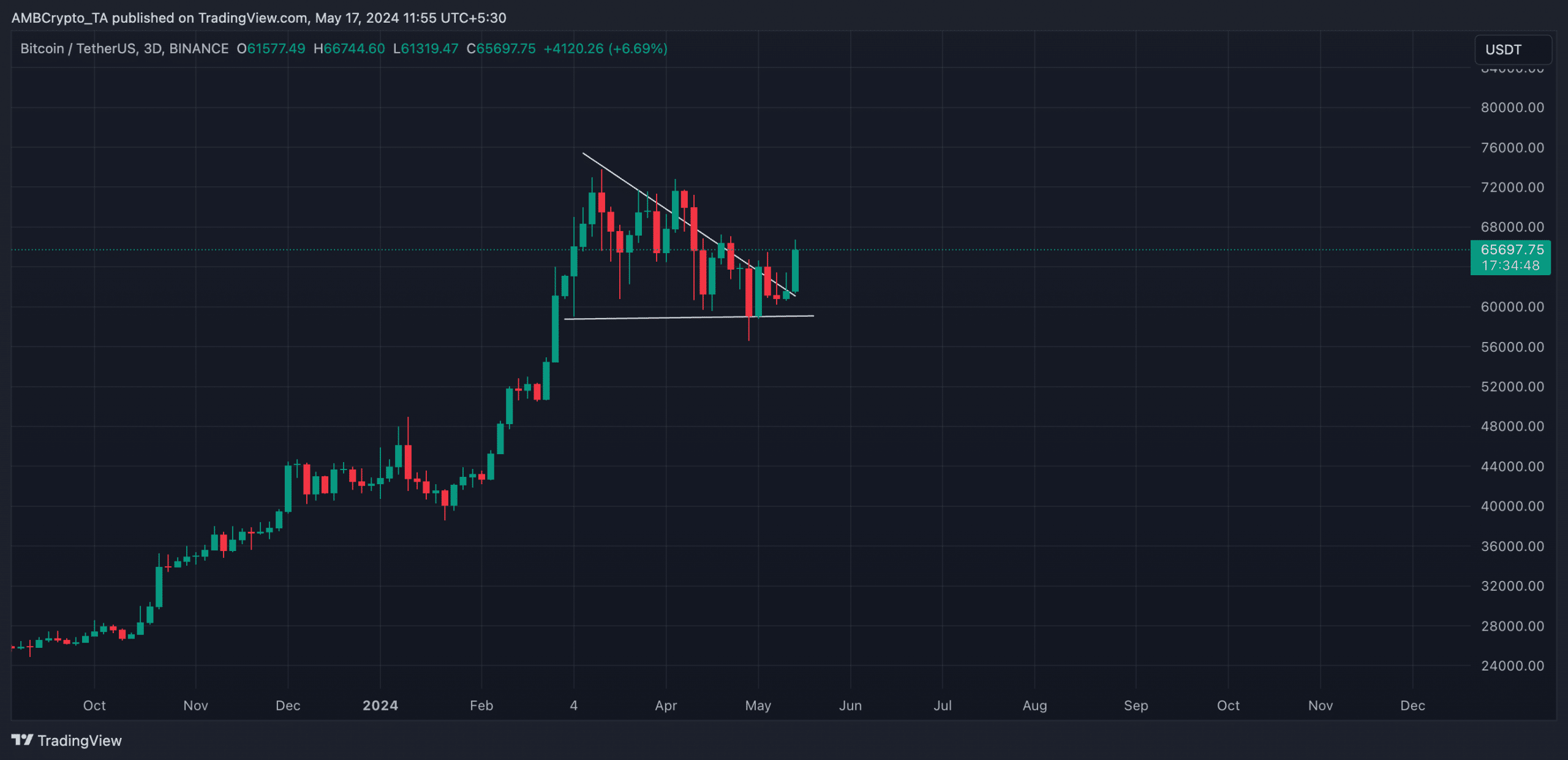

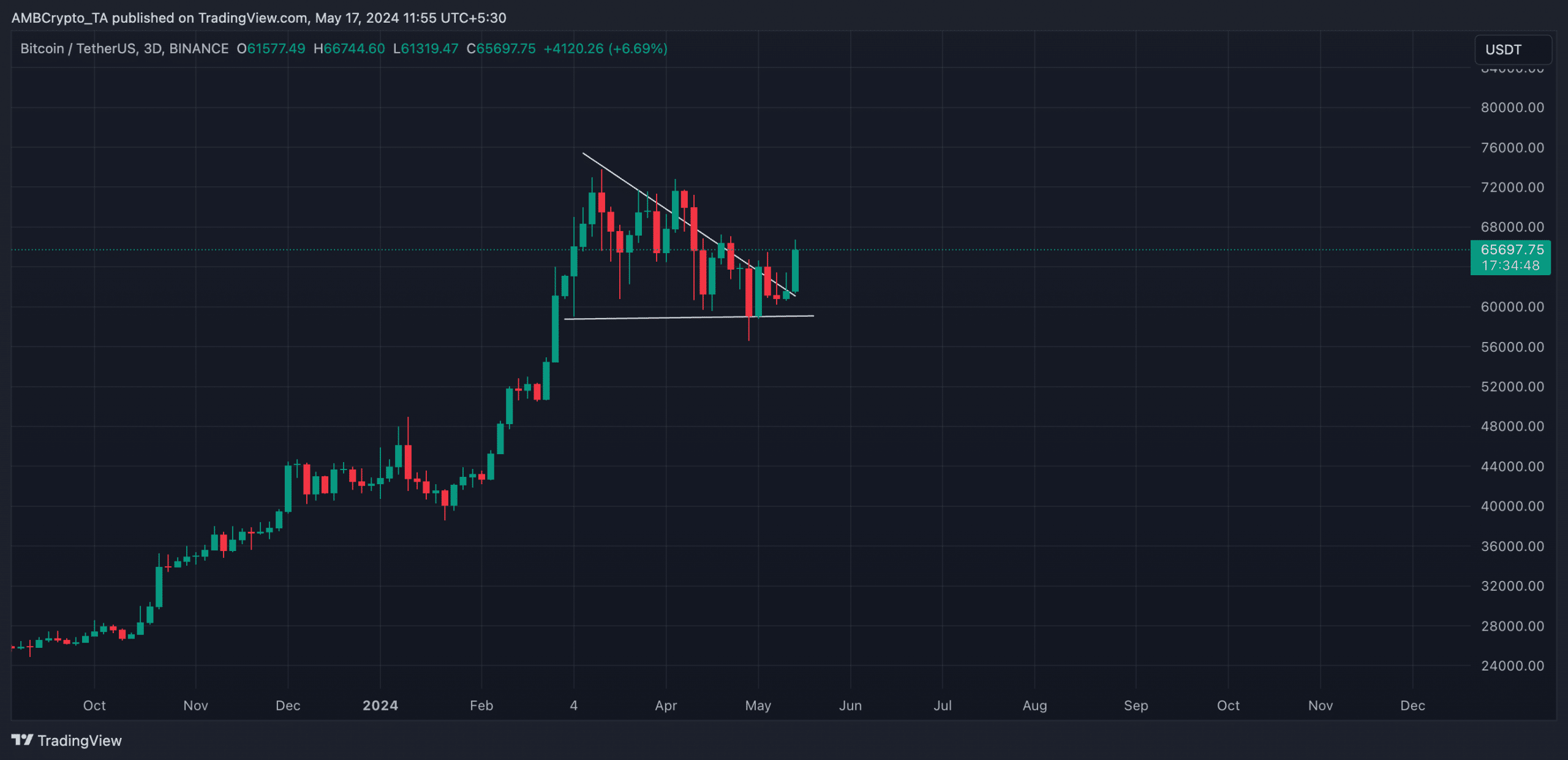

Since it rallied to an all-time high of $73,750, BTC’s price has fallen on the charts. In doing so, BTC hit a string of lower highs to form a descending triangle.

Now, although it breached the upper trend line of this triangle in April when it reclaimed the $70,000-zone, the king coin’s price has traded within this triangle over the past three months.

Source: BTC/USDT on TradingView

This price decline might be why BTC whales have reduced the volume of their transactions over the past few weeks. At press time, Bitcoin was trading at $65,696, sitting above the upper trend line of the triangle.

When an asset’s price breaks above the top of a descending triangle, it is considered a bullish signal. This suggests a shift in buying power as the bulls step in to overcome the existing selling pressure.

Confirming the shift in attitude towards BTC, its weighted sentiment returned a positive value of 0.99 too.

Read Bitcoin’s [BTC] Price Prediction 2024-25

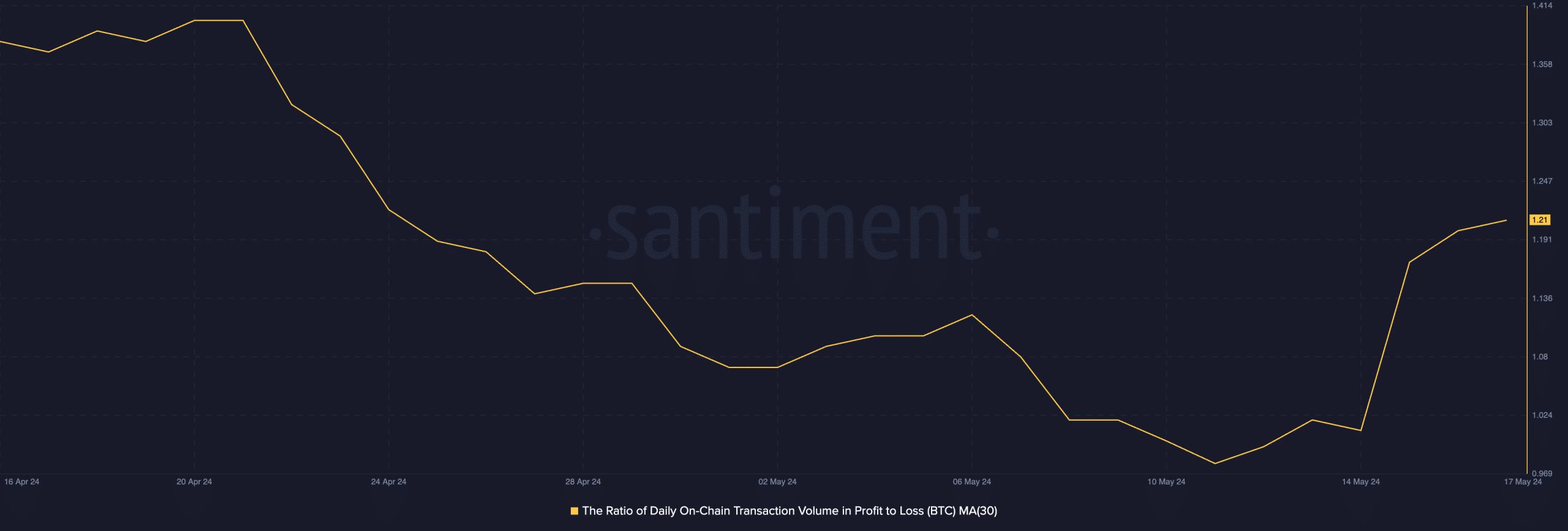

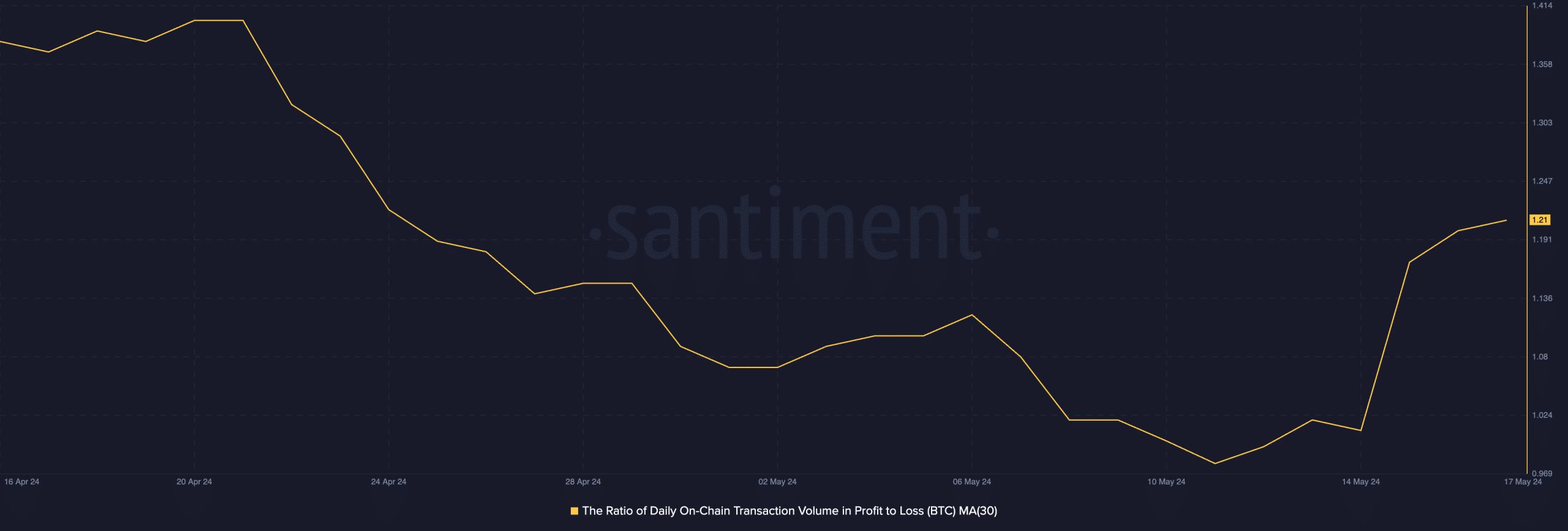

The shift in trend might have been precipitated by the fact that despite BTC’s recent price troubles, daily traders continue to record profit on their investments.

AMBCrypto assessed the daily ratio of BTC’s transaction volume in profit to loss using a 30-day moving average and found that it returned a value of 1.21. This means that for every BTC transaction that ended in a loss over the past month, 1.21 transactions returned profits.

Source: Santiment

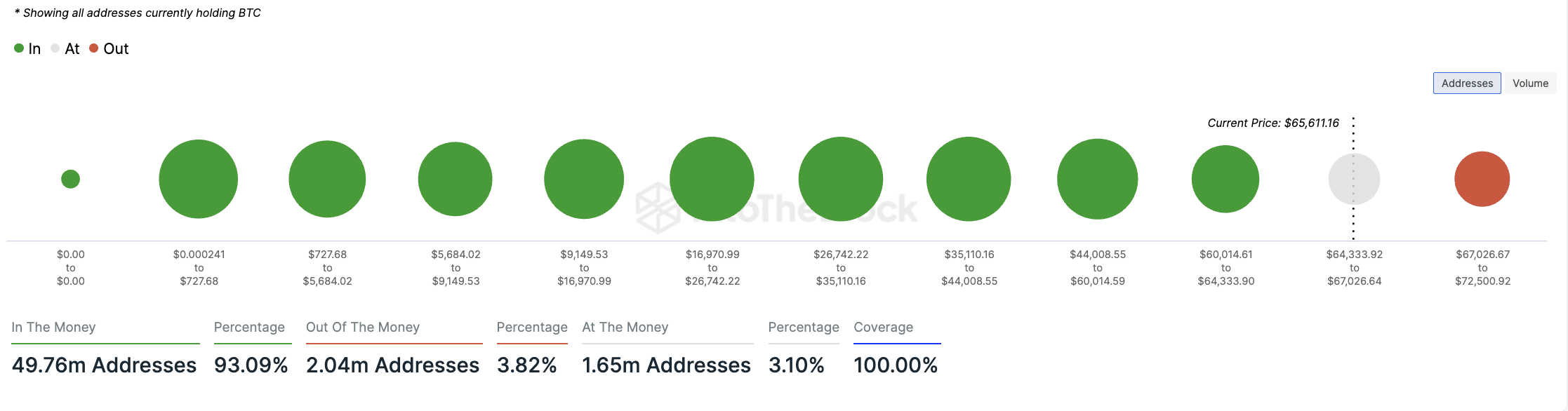

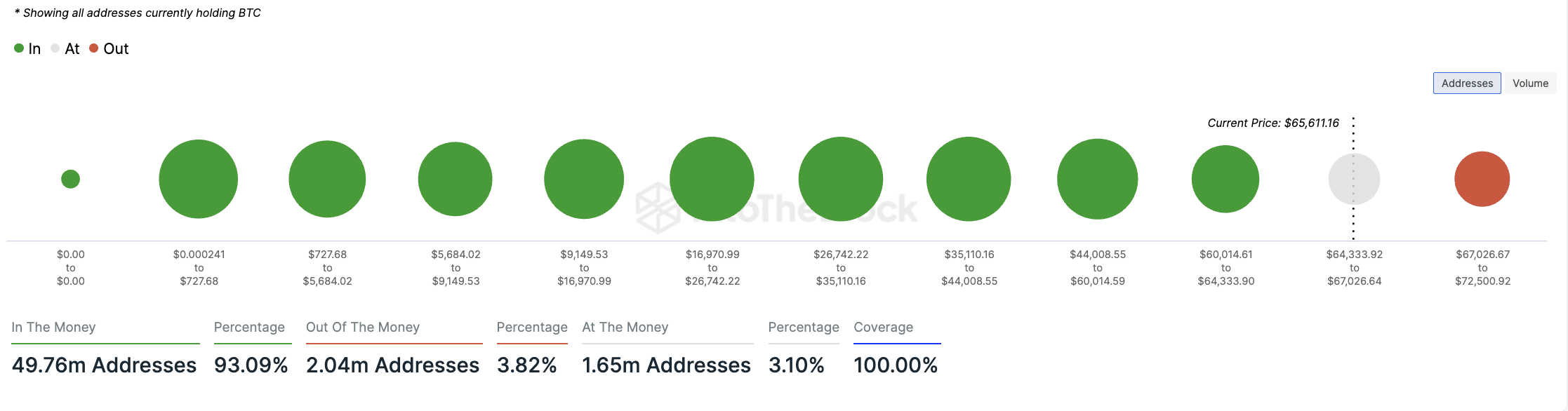

At the time of writing, 50 million wallet addresses, which comprise 93.09% of all BTC holders, were “in the money.” Only 4% of all coin holders seemed to hold at a loss.

According to data from IntoTheBlock, this group consists of coin holders who bought BTC between $67,000 and 72,000.

Source: IntoTheBlock

- Bitcoin’s whale activity recorded a major decline

- BTC broke above a descending triangle pattern, signaling a hike in buying pressure

Bitcoin’s [BTC] whale activity has cratered to its lowest level since the beginning of the year. This, as the crypto developed resistance and support levels around the $65,000-price level on the charts.

In fact, data obtained from Santiment revealed that over the past week, only 60,193 BTC transactions exceeded $100,000, marking its lowest count since the final week of 2023.

Also, the number of BTC whales that hold over 100 coins has dropped by 0.48% in the last two months – An update possibly signifying a steady uptick in profit-taking activity among this investor category.

Source: Santiment

Bitcoin’s descending triangle pattern

Since it rallied to an all-time high of $73,750, BTC’s price has fallen on the charts. In doing so, BTC hit a string of lower highs to form a descending triangle.

Now, although it breached the upper trend line of this triangle in April when it reclaimed the $70,000-zone, the king coin’s price has traded within this triangle over the past three months.

Source: BTC/USDT on TradingView

This price decline might be why BTC whales have reduced the volume of their transactions over the past few weeks. At press time, Bitcoin was trading at $65,696, sitting above the upper trend line of the triangle.

When an asset’s price breaks above the top of a descending triangle, it is considered a bullish signal. This suggests a shift in buying power as the bulls step in to overcome the existing selling pressure.

Confirming the shift in attitude towards BTC, its weighted sentiment returned a positive value of 0.99 too.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The shift in trend might have been precipitated by the fact that despite BTC’s recent price troubles, daily traders continue to record profit on their investments.

AMBCrypto assessed the daily ratio of BTC’s transaction volume in profit to loss using a 30-day moving average and found that it returned a value of 1.21. This means that for every BTC transaction that ended in a loss over the past month, 1.21 transactions returned profits.

Source: Santiment

At the time of writing, 50 million wallet addresses, which comprise 93.09% of all BTC holders, were “in the money.” Only 4% of all coin holders seemed to hold at a loss.

According to data from IntoTheBlock, this group consists of coin holders who bought BTC between $67,000 and 72,000.

Source: IntoTheBlock

clomiphene or serophene for men can i buy generic clomid without dr prescription buying generic clomiphene price can you buy clomiphene without insurance can i get generic clomiphene for sale where to get clomid price can you buy cheap clomiphene for sale

Thanks on putting this up. It’s well done.

This website really has all of the low-down and facts I needed about this subject and didn’t comprehend who to ask.

zithromax pills – order tetracycline 500mg buy generic flagyl for sale

buy rybelsus 14mg – order cyproheptadine 4mg pill cyproheptadine 4mg us

buy motilium pill – buy cyclobenzaprine 15mg for sale buy cyclobenzaprine generic

augmentin 1000mg without prescription – https://atbioinfo.com/ purchase ampicillin generic

purchase nexium generic – anexa mate buy esomeprazole 20mg capsules

cheap coumadin 5mg – anticoagulant cozaar 25mg without prescription

purchase mobic without prescription – relieve pain buy mobic no prescription

prednisone 20mg generic – https://apreplson.com/ buy prednisone 5mg online

buy ed meds online – buy erection pills best pills for ed

amoxil online – combamoxi.com amoxil online order

how to buy forcan – https://gpdifluca.com/ diflucan us

cenforce cheap – https://cenforcers.com/ buy cheap generic cenforce

difference between sildenafil tadalafil and vardenafil – this cialis shipped from usa

buy ranitidine 300mg pill – aranitidine order zantac 300mg sale

how much does cialis cost at cvs – cheap t jet 60 cialis online tadalafil 20mg canada

Greetings! Utter useful advice within this article! It’s the petty changes which will make the largest changes. Thanks a lot in the direction of sharing! https://gnolvade.com/es/accutane-comprar-espana/

sildenafil citrate greenstone 100 mg – https://strongvpls.com/# buy viagra no prescription canada

More posts like this would persuade the online space more useful. neurontin 800mg usa

This is the tolerant of advise I unearth helpful. https://ursxdol.com/synthroid-available-online/

With thanks. Loads of erudition! https://prohnrg.com/product/omeprazole-20-mg/

This is a theme which is forthcoming to my fundamentals… Many thanks! Unerringly where can I lay one’s hands on the acquaintance details for questions? gГ©nГ©rique du viagra professional prix

Greetings! Utter serviceable advice within this article! It’s the crumb changes which wish turn the largest changes. Thanks a portion towards sharing! https://ondactone.com/product/domperidone/

More posts like this would prosper the blogosphere more useful.

order mobic

I’ll certainly carry back to be familiar with more. https://maps.google.ee/url?q=https://issuu.com/swedena/docs/11.docx

More delight pieces like this would insinuate the web better. http://sglpw.cn/home.php?mod=space&uid=562894

order dapagliflozin generic – https://janozin.com/# dapagliflozin for sale online

buy orlistat cheap – https://asacostat.com/# buy xenical 120mg generic

I’ll certainly return to skim more. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24890